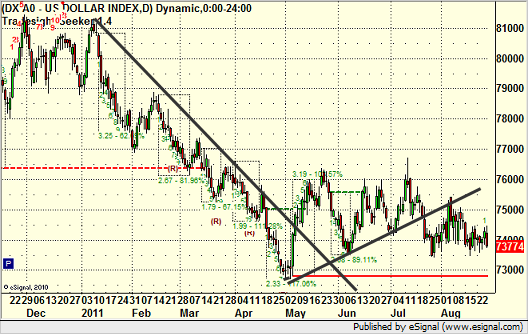

So, let’s discuss the US Dollar Index. From a broader perspective, we stuck in what I call the “back side of a wedge,” which is denoted on this 9-month daily chart by the break of both the intermediate and short term trendlines:

Meanwhile, despite everything that is going on in the world today, which people constantly tell me should be moving the forex market right now, there is a reality that I think some people like to try to ignore. August really is a time where the big money players, specifically out of Europe, take a break. It’s almost always the slowest, most meandering month of the year. Only one year out of the last decade was this not the case. When you think about it from that perspective, let’s zoom in on the more recent chart data over the last four months or so:

First of all, clearly, we’re in a pretty narrow range now for FOUR MONTHS. That is an important note to make. At some point, when we break this either way, things will get going. But, specifically look at May, June, and July, where I highlighted some decent moves with black trendlines. Those allowed us to make decent money in those months…in fact, pretty good money in some cases.

Now focus specifically on August. No trends for even a week. Lots of back and forth bars. Narrowest range of the four months.

Despite what is going on in the world, you can’t trump one thing. The big money players vacation in August.

From a trading perspective, what this means for us is that I have been half size for most of the month and will continue to do so until ranges improve for a couple of days (at some point after Labor Day) or we break out or down from this four month area on the Dollar Index.