I’ve been getting a lot of questions about market volume and the resulting lack of action in the markets, especially the last month. I’ve written enough pieces on volume in the past that I will skip that here, but I did want to address a few things about the current market and where some of the problems may be. No, I don’t think this is the typically “summer doldrums” where volume drops a bit as kids get out of school and families go on vacation. This is a symptom of several bigger issues that are going on all at once.

Remember that markets don’t like uncertainty, and when we say that, what we usually mean is that they go DOWN when they don’t know what to expect. If this were just about concerns over the European situation (Greece in particular, but Spain and Italy behind), you would think that the market would be heading down sharply ON volume, not floating sideways without volume, so this has to be viewed differently.

There are at least primary factors in play here: Europe, the US budget situation, and Facebook.

Let’s start with the situation at home. We’re seeing the economy slow again. Before I address the European component of this, we know what is causing much of the problem. The lack of a plan by the Federal government, the lack of a budget, of a tax policy that starts to put us back on the track of balancing our books as they were just getting to back in 2000…that is part of what is preventing businesses from hiring and manufacturing. This was discussed in Dimon’s testimony to Congress last week, where he heavily requested that a budget that gives certainty to the business community be put forth not after the election, when we are walking up to the financial cliff again, but before it. Don’t fool yourself. The inability to come to a basic accord, as Congress and the White House always have in the past, to get things back in line is weighing on this recovery. It isn’t about spending or entitlements. It’s about whether our credit is going to get downgraded further next year because we failed to take steps to balance our books. And if there is a component of that that is driven by waiting out the election in hopes that one side or the other pays a political price, that is an extremely high game of chicken to play with this economy in this state.

The second factor is, of course, Europe, and frankly may have a bigger impact on our economy than anything going forward, which could mean that whether we come out of this Great Recession anytime soon is more out of our control than in our control. We are trading partners with Europe, of course. We rely on them to sell us cheap goods where they can produce them cheaper and buy our goods. Trouble and uncertainly slows spending, and that hurts our chance at selling goods abroad. In this case, it also increases the chance of inflationary factors if production in Europe dips not because of a lack of demand for certain goods, but because of currency uncertainty and instability within countries.

So what does this mean for the US? To the extent that the unknown in Europe has been slowing us down, it also plays a role in a general lack of trading volume and market movement here. It’s too big of a bet for major players to sell and assume that things in Europe will go that wrong (although they could), but there is no real incentive to boost long positions in funds. From this perspective, obviously, this weekend’s vote in Greece is a first big step toward seeing what lies beyond the Looking Glass. If this gives us some clarity in the next few days, one way or the other, it is possible that this will be the catalyst to get things moving and volume back…into all markets.

Finally, there is a third factor that hit in the middle of the rest of this nightmare that is so precise in its timing as it relates to the market going flat that it cannot be ignored: Facebook. Here’s a look at FB stock since it came public a few short weeks ago on May 18:

Obviously, a disaster of epic proportions. That’s a lot of money buried in a single stock since it was such a large market cap. That’s a lot of disappointment. That’s a lot of eye-raising concerns about the regulatory framework in which our markets work.

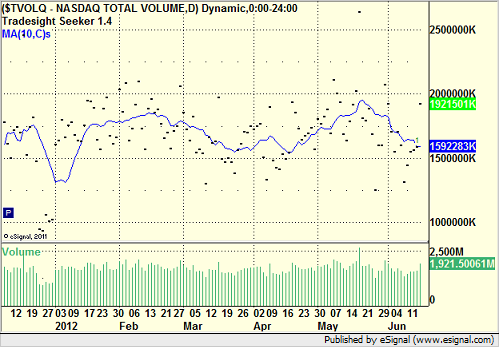

Now, take a look at this chart of daily NASDAQ volume that I put up in the Tradesight Trading Lab this week. I’ve put a 10-day moving average on the chart (blue line). You can see that volume was back on the rise in late April and early May, and we were seeing several days a week of very nice trading activity with consistent moves that led to more than small partials on our trades. But, notice that the moving average peaked and has since dropped very sharply…and the peak day was May 18:

And since then, volume has dropped so quickly that we have brought the moving average to lows of the year.

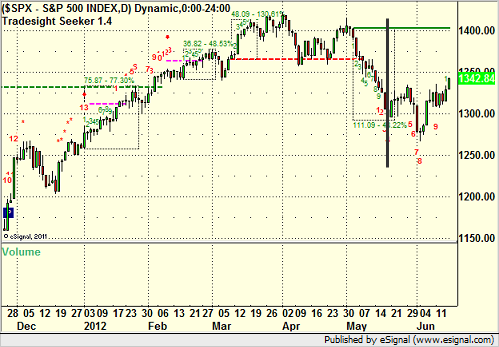

And what has the market done since May 18 when Facebook came public and collapse subsequently, and market volume died with it?

The S&P, with the “Facebook launch date” drawn vertically:

This is more important than you might think. A lot of money came out of hot companies like AAPL and GOOG and AMZN to go into Facebook for a “quick pop,” and it is not stuck. People are disillusioned about how the IPO process works at a time when not many companies are going public. It creates not economic uncertainty, but market annoyance. People are disgusted.

The economy needs a dose of cooperation and common sense from the global leaders to get things going again, and that will lead to volume and activity.

Can Europe either clean itself up quickly or take a direct and fast step to something new? We may find that out this week or soon after.

Can the US government get a budget that includes spending cuts (including to defense, which is where the biggest bloat is), tax reforms (closing of some of the more ridiculous loopholes), and some mild tax increases at the top put together so that the uncertainty can be lifted a bit and businesses can move forward and produce and hire? My concern is that this won’t happen until after the election, which will lead to another market plunge in the coming months that didn’t need to happen.

Can we clean up Facebook? That one is probably a no.

Have a good weekend.