Pretty much as you would expect as we dig into waiting for the Fed. Gapped up and took most of the day to fill on 1.5 billion NASDAQ shares. We were sitting mid-range right into the last few minutes and then slipped down for the close.

Net ticks: -19 ticks.

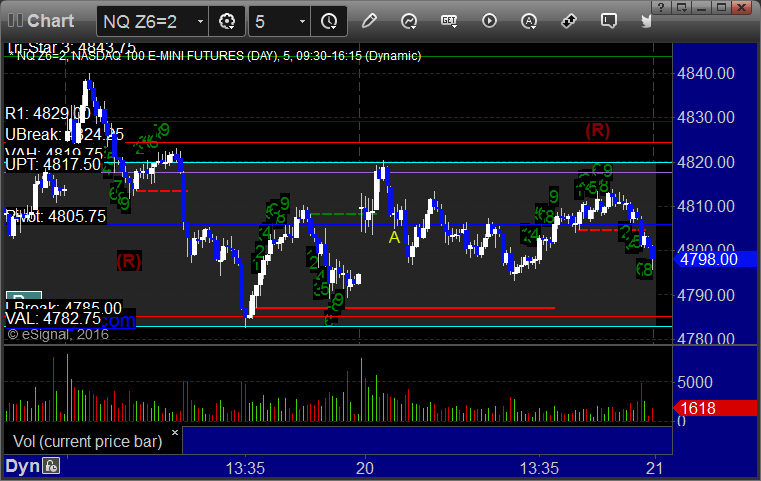

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and stopped. Triggered short at B and worked enough for a partial:

NQ Opening Range Play triggered long at A and just barely stopped unfortunately:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered short at A at 4803.00 and worked enough for a 6 tick partial and stopped the second half over the entry: