A surprisingly light volume day (1.2 billion NASDAQ shares) considering this wasn’t a bank Holiday like last Monday, when we did about the same volume. Opening Range plays netted out gains, but the volume was so low, there was no point in taking additional plays.

Net ticks: +5.5 ticks.

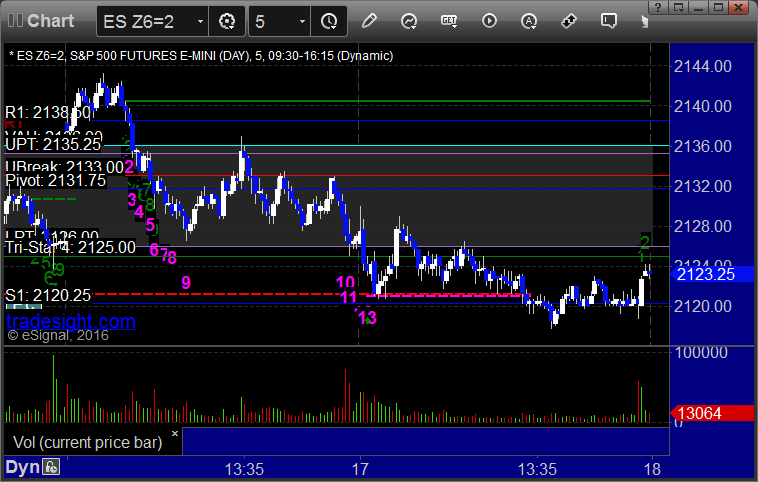

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

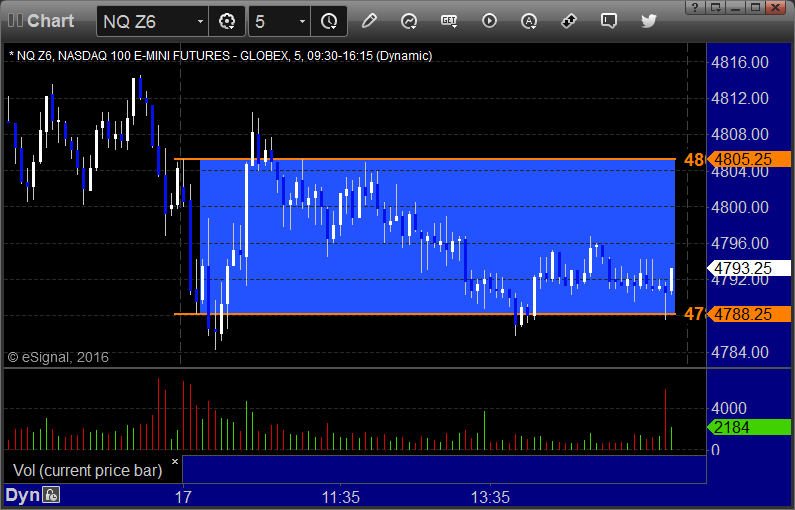

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and stopped, triggered short at B and worked:

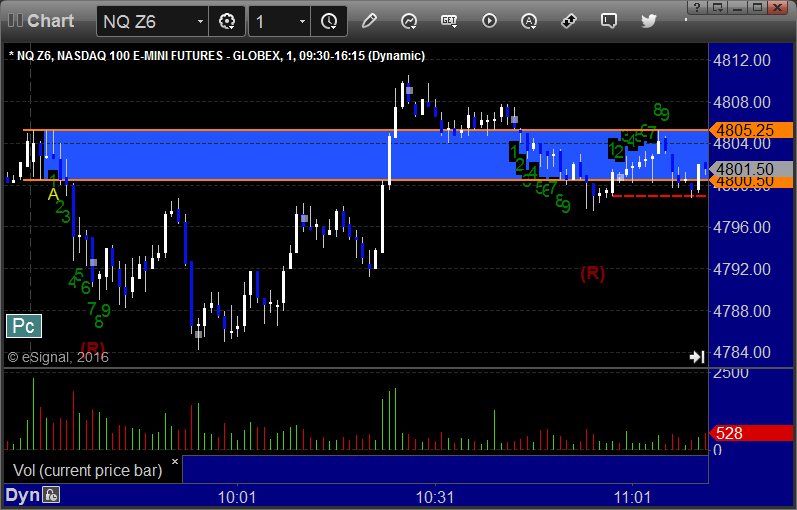

NQ Opening Range Play triggered short at A and worked (Someone asked about taking this trade when we were still long the ES. Remember that one of the rules that we add into the “black and white” system for the OR plays is when we have a gap in the market, if you end up long or short the ES or the NQ, you wouldn’t take the other one if it triggers away from the gap, but you would if it triggers into the gap. Why do we do this? Not because it 100% makes sense, but we know that gaps tend to fill, so the trade in the direction of the gap should statistically be slightly more likely to work than a trade away from the gap, but even that is not 100% true since the gaps could still fill later in the day from either direction. The main point about today was that there literally was no gap at all. We opened dead flat on both the ES and NQ, so that variable wasn’t really there to factor into the trade.):

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: