Let’s take a look at something that we call the “Gap Fill Threshold” levels. The simple version of these calculations is that when a stock or futures contract gaps past them, it becomes much less likely that it will turn around and come back and fill the gap. There are two calculations that we provide each day, one for a gap up (the Upper Gap Fill Threshold, a dashed green line on the following charts) and one for a gap down (the Lower Gap Fill Threshold, a dashed red line on the following charts).

Not only are these crucial for determining if the market has gapped beyond a certain threshold, but the exact numbers themselves can be support or resistance levels.

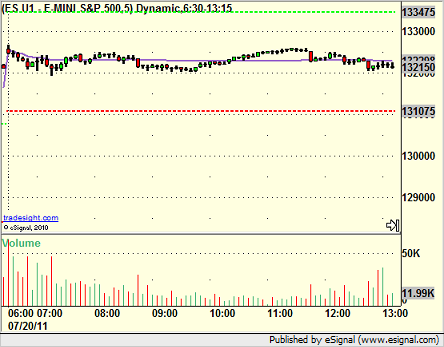

Each of the following four charts are of the ES contract, 5-minute bars, showing each day so far this week (Monday through Thursday) and the LAST bar of the prior day, just so you can see if there was a gap from the prior close to the open.

Let’s have a look at Monday to start, where the ES gapped down under the Lower Gap Fill Threshold (meaning it was less likely to head up and fill the gap); INSERT INTO `wp_posts` (`ID`, `post_author`, `post_date`, `post_date_gmt`, `post_content`, `post_title`, `post_category`, `post_excerpt`, `post_status`, `comment_status`, `ping_status`, `post_password`, `post_name`, `to_ping`, `pinged`, `post_modified`, `post_modified_gmt`, `post_content_filtered`, `post_parent`, `guid`, `menu_order`, `post_type`, `post_mime_type`, `comment_count`) VALUES retested the line exactly, and then went lower and never looked back:

Now Tuesday, where we gapped just over the Upper Gap Fill Threshold and kept going:

Wednesday opened between the GFT levels and never touched either…in fact, a dead flat session in the middle of earnings season:

Thursday, we opened above the Upper GFT, pulled back to touch it exactly, and then turned up, so once again, the market telling us that it probably wasn’t going to fill and then testing the exact level as support:

As you can see, when you get a gap, these GFT levels can give you a lot of information. Commonly, if we get a gap but it is NOT beyond the GFT in that direction, the gap will fill.

As a side note, the GFT levels exist on individual stocks, which we can provide you by request in our Trading Lab. Here is an example today of NFLX, which didn’t gap at all at the open on Thursday, but note how it used the Upper GFT (solid green line here) as resistance early and then the Lower GFT (solid red line here) as the low later in the session:

Had it gapped past either one, the odds are high that it never would have come back.