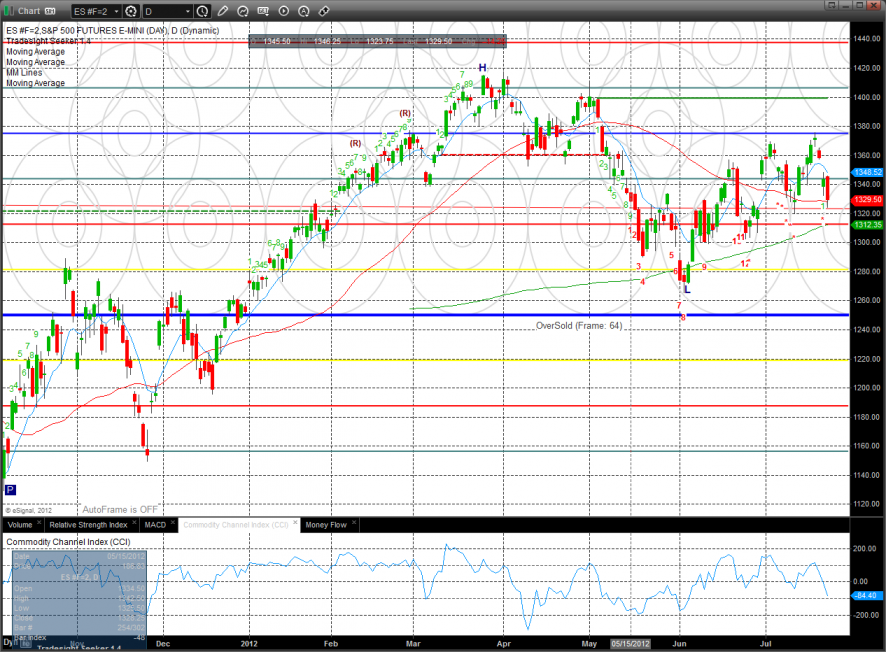

The ES lost 14 on the day which didn’t feel too bad until the prior day’s range was taken out. This left the settlement right at the 50dma with next support at the 200dma.

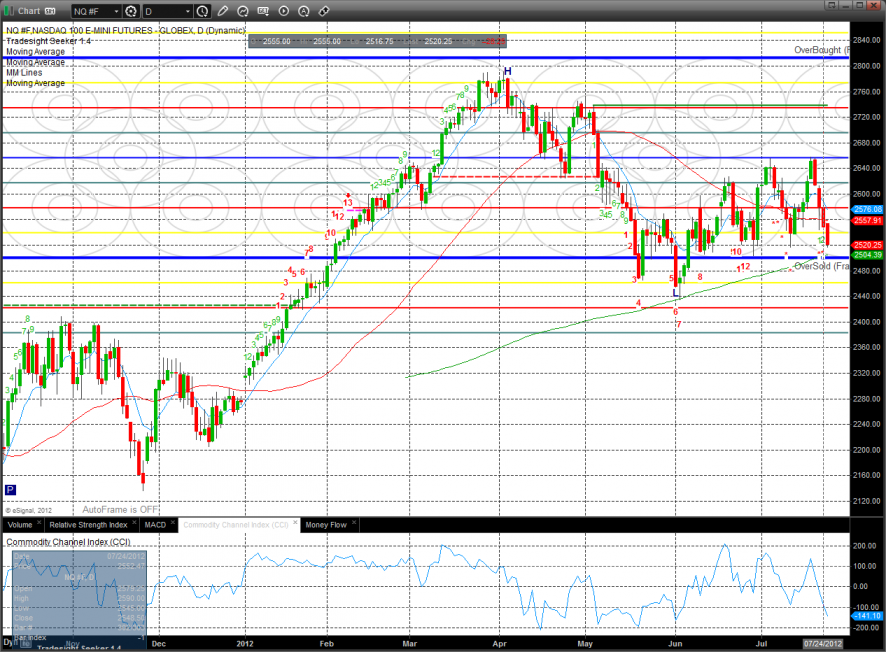

The NQ futures were lower on the day by 31 which was a parity move with the broad market. Price touched but did not break the key 0/8 support level. Keep in mind that IF the 200dma is lost then so will the 200dma. In all of the pullbacks in the current move price, both settlement and lows have been above the 200dma.

The 10-day Trin has used most of the oversold energy and has retreated to the neutral area.

The total put/call ratio remains neutral:

Multi sector daily chart:

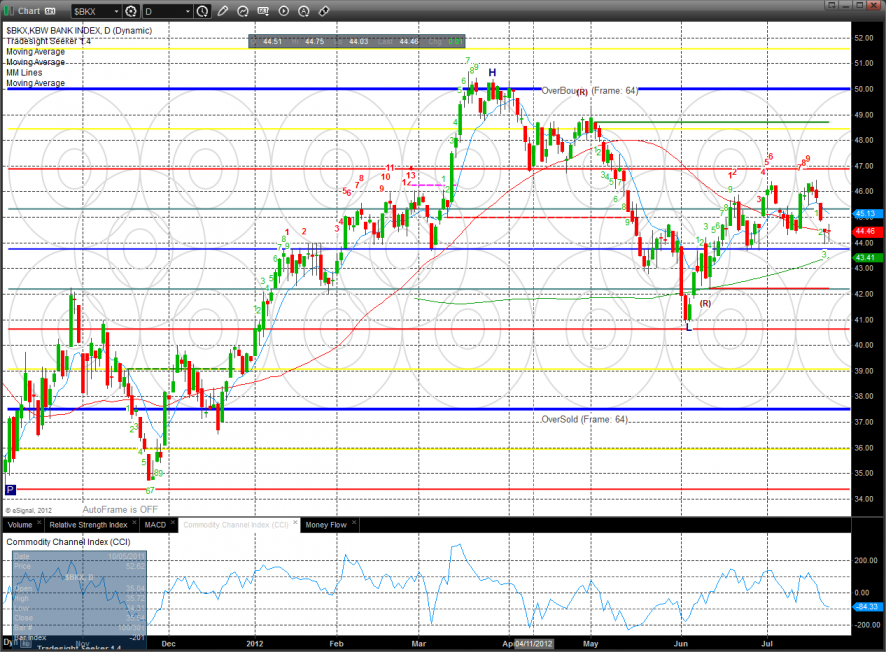

The BKX was the top gun on the day unchanged on the day and right at the 50dma.

The XAU was a good relative performer and did not produce a new low on the move.

The SOX was lower by a small amount and traded inside yesterday’s candle. A break out of the current range should have some punch.

The OSX was weak on the day but was contained within the prior candle, so yet another inside day to be resolved.

The BTK seems to be rolling over. The index was weaker than the broad market and Naz.

Oil:

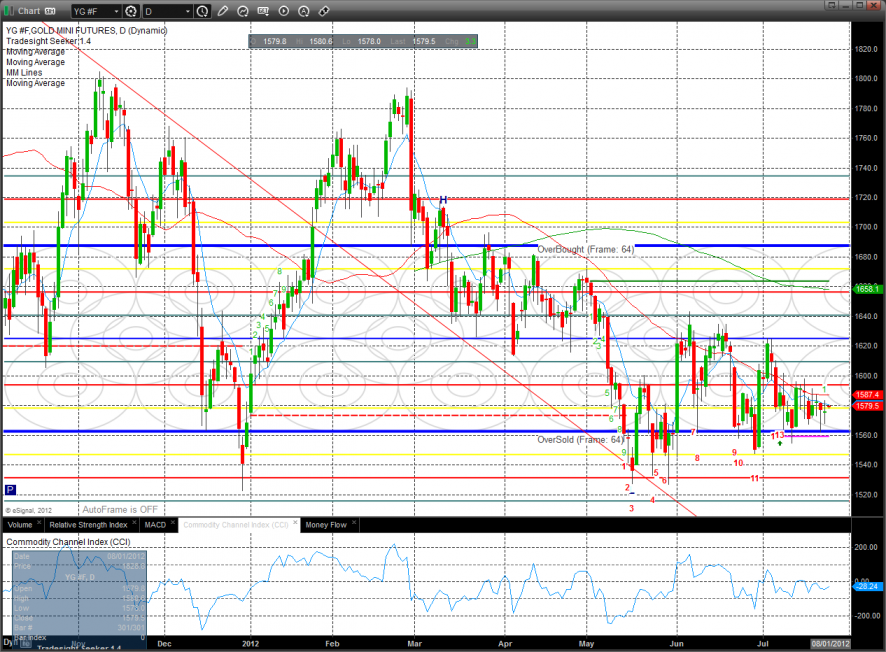

Gold:

Silver: