Two losers early after two nice setups, and a winner after the Fed announcement later in the session. All of it on the ES, see that section below.

Net ticks: -10 ticks.

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

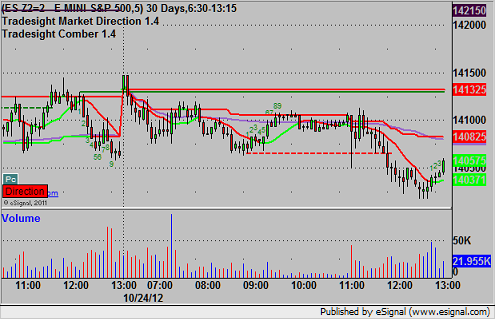

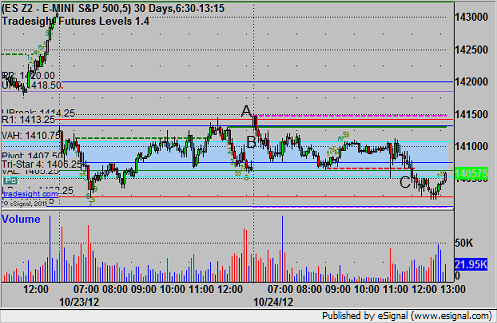

ES:

Triggered long at A at 1414.50 and stopped for 7 ticks. That was an opening bar trade, which I usually don’t do, but it was a nice breakout over yesterday’s action. Triggered short at B after setting the Value Area High at 1410.25, which also stopped for 7 ticks. I didn’t re-enter because it spent 10 minutes in the Value Area, but the re-trigger would have worked. Also triggered short at C at 1404.75 after the Fed, hit first target for six ticks, and closed the final at 1404.25 as it got late in the session:

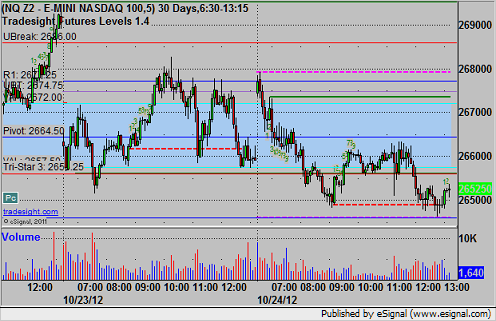

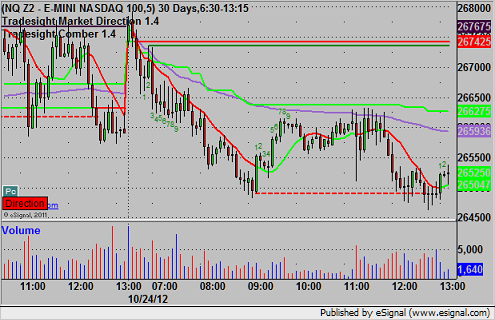

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.