Today in the Markets:

The markets gapped up big on a good CPI number and went a little higher for the session on 5.5 billion NASDAQ shares. This was also likely the options unraveling move.

ES with Levels:

ES with Market Directional:

NQ with Levels:

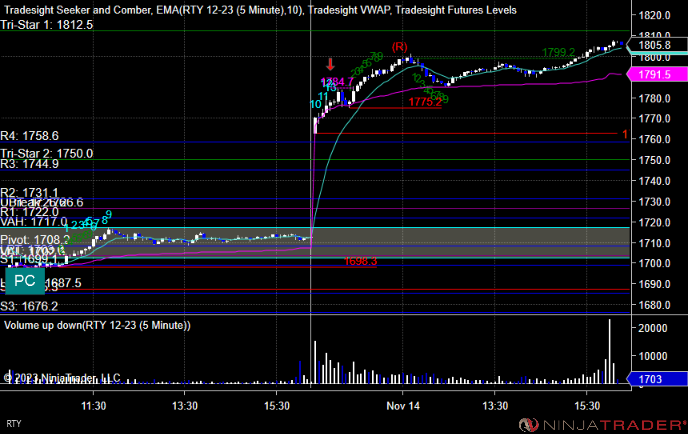

RTY with Levels:

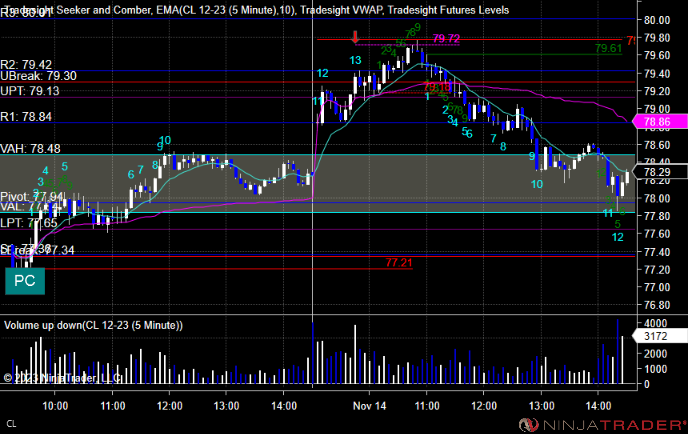

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered long and worked:

Additional Futures Calls:

None.

Results: +14 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered Rich’s CVX triggered long (no market support as the trigger was in the first 5 minutes) and worked:

Rich’s AMAT triggered short (without market support) and did not work:

That’s 0 triggered with market support.