Two winners and a stop out to wrap up the week as options expiration was exactly what we expected…fairly dull with heavy volume early. See ES and NQ sections below.

Net ticks: +5 ticks.

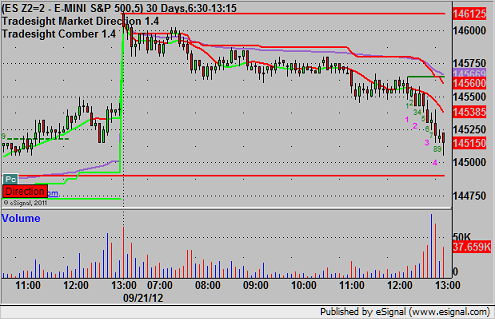

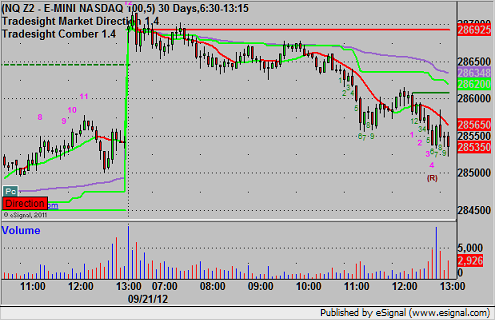

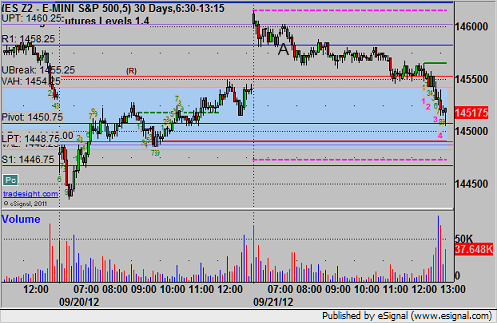

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES:

Mark’s ES short triggered at A at 1457.75, hit first target for six ticks, and the second half stopped over the entry:

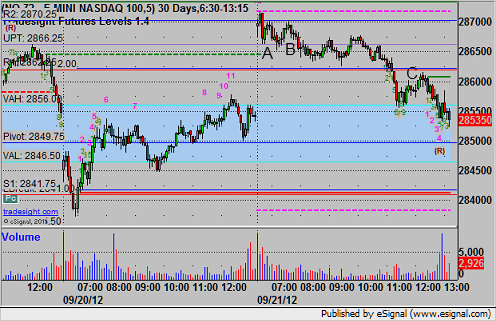

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My short triggered at A at 2866.00 and stopped for 7 ticks, then triggered again at B, hit first target for six ticks, lowered the stop later, and finally stopped at 2859.50 at C: