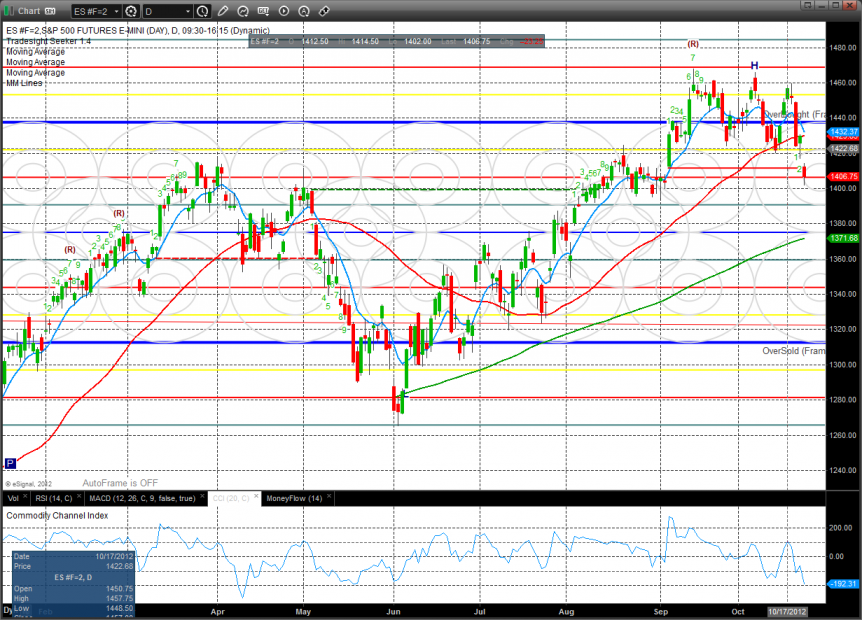

As we talked about yesterday, the small bounce in the ES was relatively meaningless because it did not penetrate the upper half of Friday’s steep decline today’s price action was more notable. Two key things happened because the static trend line was undercut and 9/5/12 breakaway gap was filled. The technical damage already seen in the NDX side of the market is now present in the SPX side.

The NQ was much more contained than the SP side because of the 3 key levels that are converging. The 4/8 Murrey math level, the active static trend line and the 200dma provided support to arrest the slide in the NQ. Although the NQ lost 27 on the day it greatly outperformed the SP side and the Naz should find support enough to either consolidate or put in a short-term reversal here.

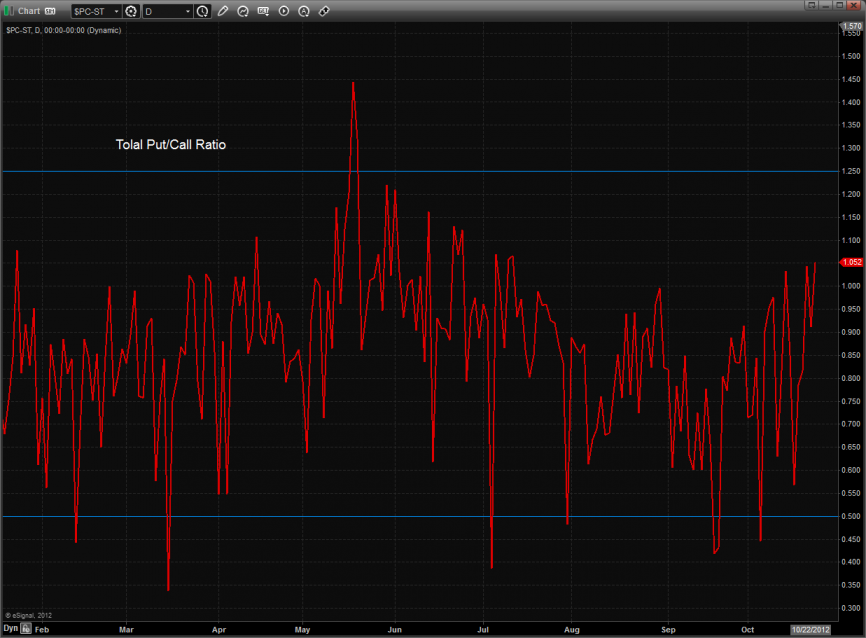

The total put/call ratio has put in a multi month high but didn’t yet record a climatic readaing.

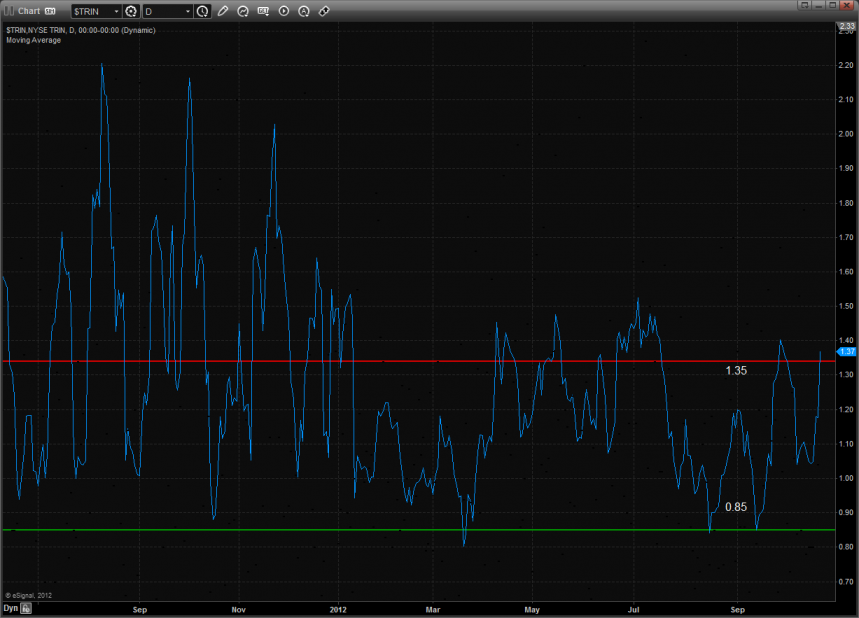

The 10-day Trin is oversold and has upside reversal energy for the overall market.

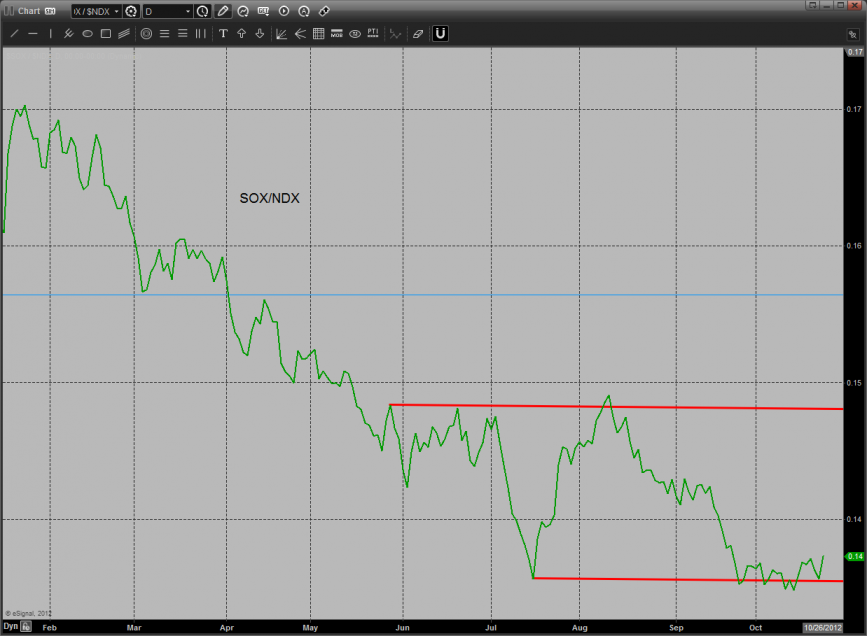

The NDX cross bounced off of a very oversold reading but needs to reclaim the trend channel before there is a new technical development.

The SOX/NDX cross is still hanging onto the prior low and has yet to decisively break. This might be the one bright point for the bulls in the NDX.

The SPX/TLT cross has not recorded a new low which indicates that so far there has been no detectable flight to safety in favor of US treasuries over equities.

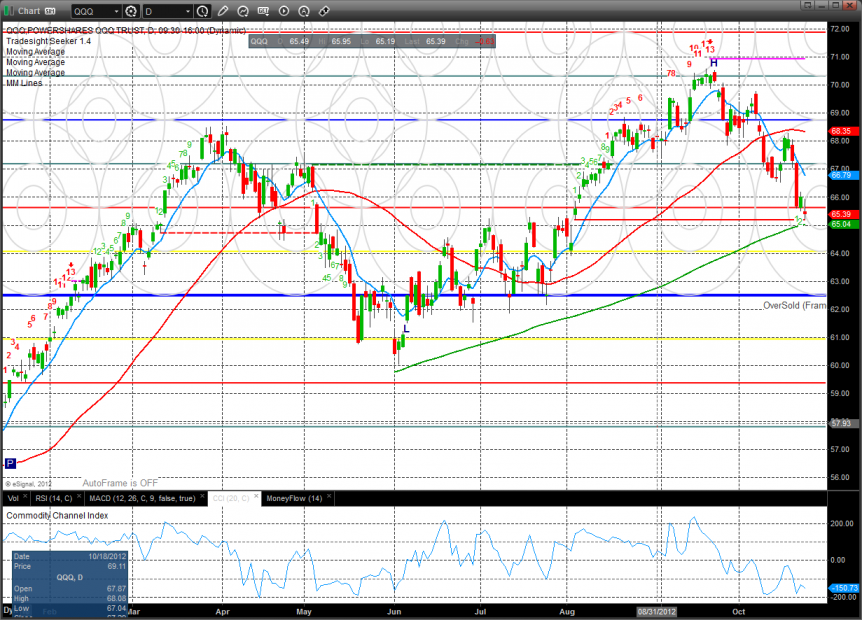

The QQQ’s have declined to the key support area of the static trend line and 200dma. This is a make-or-break area where a loss and a qualified follow through will put a Seeker 9 bar buy setup in motion.

The SOX was the top gun and the only important sector up on the day. Note that in June the 2/8 level was a key area that reversed the trend.

The BKX broke but found support at the 50dma and September low—49 is key support.

The OSX was boxed up and still drawn by the major moving averages.

The BTK was much weaker than the NAZ and has experienced rapid profit taking. Look for key support at the 2/8 Murrey math level where the 200dma comes into play.

The XAU was the last laggard on the day and has key support at the 181 area. Note that the Seeker is 11 days up in the sell countdown.

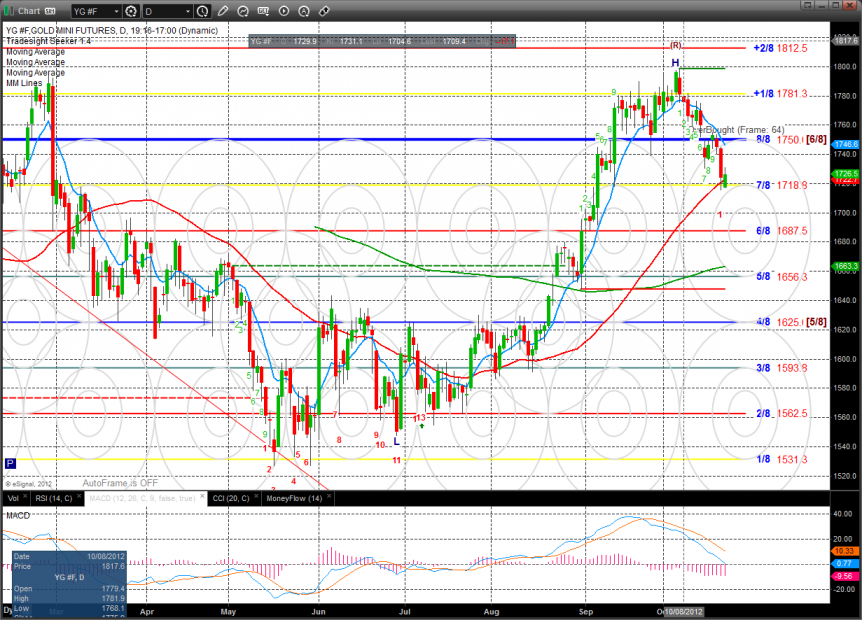

Gold:

Silver:

Oil: