Two calls that both worked nicely, one on the ES, one on the NQ, and one in each direction (long/short) of the market. See both sections below.

Net ticks: +15.5 ticks.

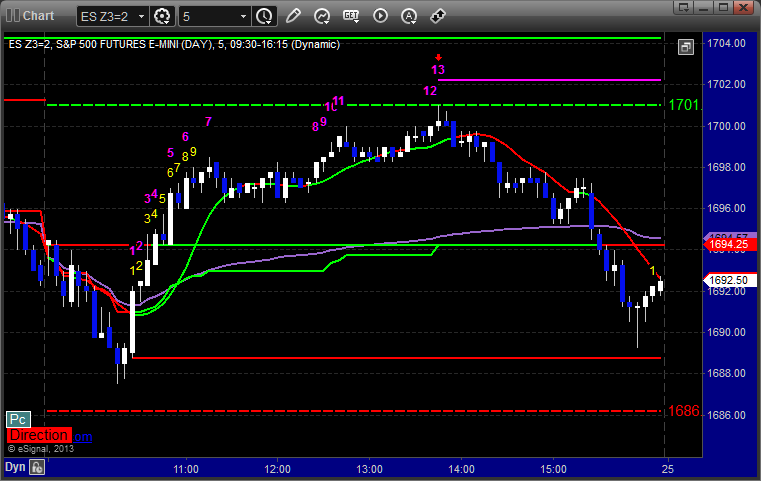

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

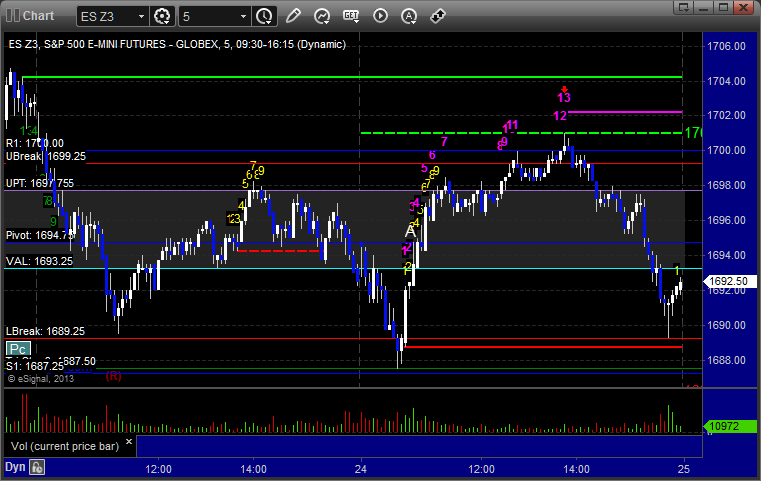

ES:

Mark’s call triggered long at A at 1695.00, hit first target for 6 ticks, and after two stop adjustments, stopped at 1696.25 in the money:

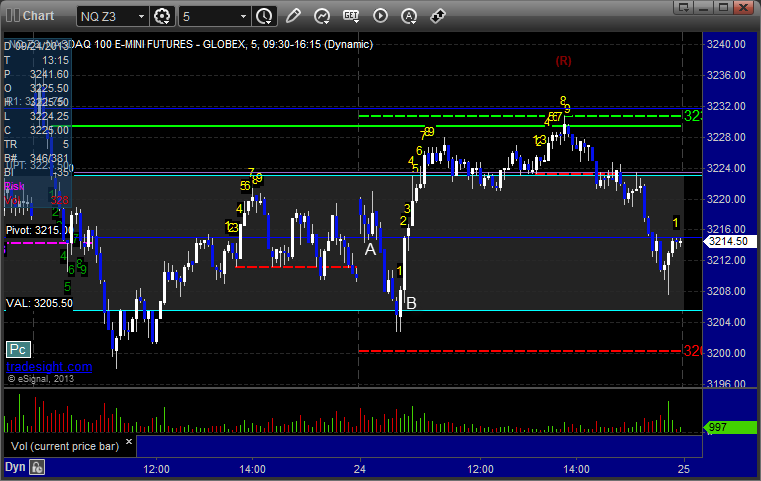

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3214.00, hit first target for 6 ticks, lowered stop a couple of times and stopped the final half well in the money at B at 3207.00: