For today’s Blog commentary lesson/review, we wanted to show off a key play from last night’s action that works about 70-80% of the time on a proper setup, which was the Value Area play on the GBPUSD. The main component here is that the pair started above the Value Area during the European session start (this chart is PST, but you can see volume as to when the European session started). Here is the 5-minute chart. The lines that we care about for this discussion are the light blue (or cyan) Value Area High and Value Area Low:

What you can see is that the pair came down to the Value Area High at A, which provides a short entry and a 70-80% chance that a move to the Value Area Low will occur. In this particular case, based on the prior day’s ranges and the Levels as provided, we crossed 30 pips to the Value Area Low at B perfectly, and there was some initial support around that area.

Value Area plays are extremely easy to spot with the right tools and provide a simple strategy for traders with a basic stop entry and t/p target. Risk level should be half of the Value Area range.

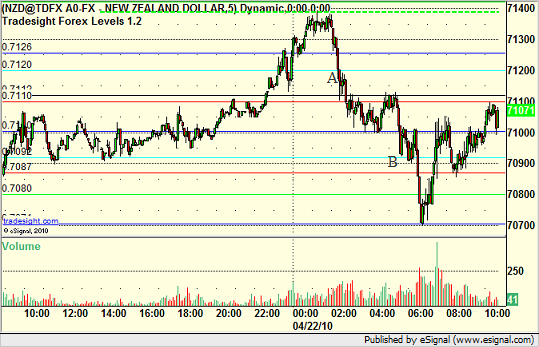

Think that one was just a coincidence? How about the same concept on the NZDUSD last night, which triggered into the Value Area at A and crossed to the VAL at B for a perfect trade:

Note that the NZDUSD stopped right at the VAL at that point TO THE PIP. The market knows these numbers.

Follow us on Twitter or take a trial to our services for greater detail by clicking here.