Tradesight Recap Report for 7/25/24

Today in the Markets:

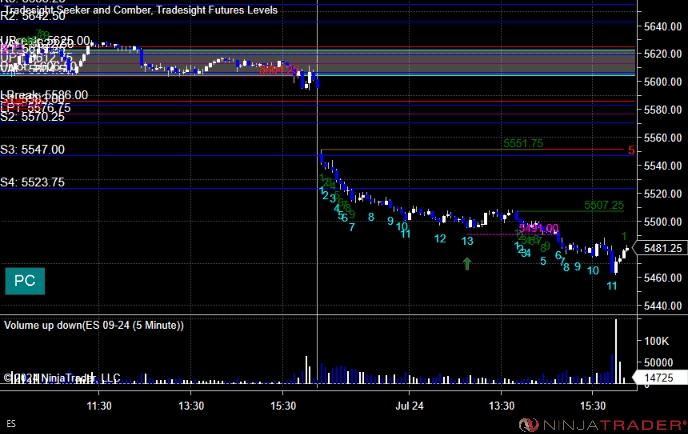

The markets gapped down a couple of points, went lower, then ran up, and the ES got a 13 sell signal, hit the risk line exactly, and dropped to lows of the day on 5.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

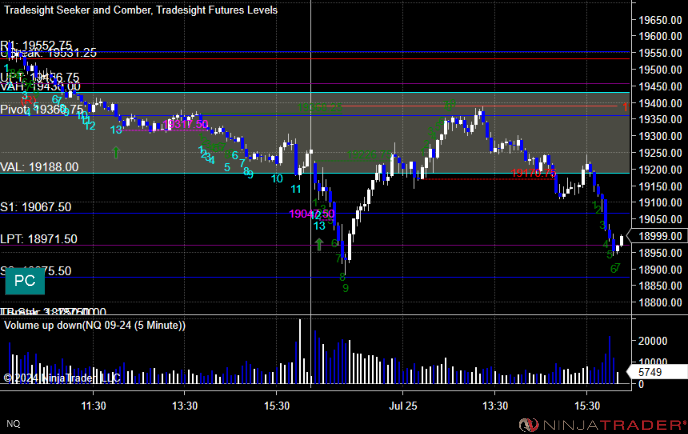

NQ with Levels:

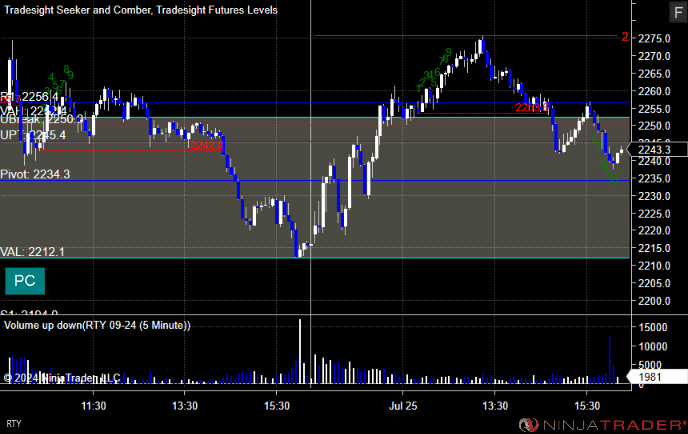

RTY with Levels:

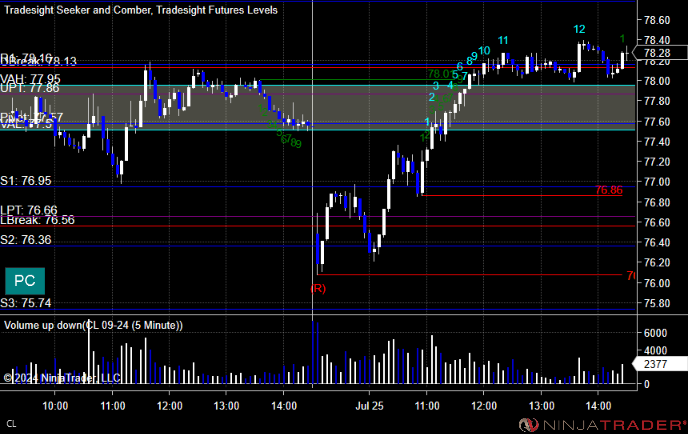

CL with Levels:

GC with Levels:

Futures:

Nothing triggered in range.

ES Opening Range Play, at A was out of range to take short:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

No triggers.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

Tradesight Recap Report for 7/24/24

Today in the Markets:

The markets gapped down big due to earnings and dropped huge on 6.4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

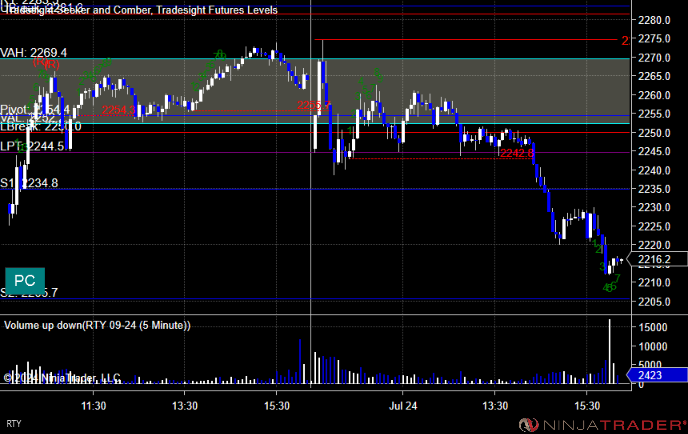

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play:

Additional Futures Calls:

None.

Results: +10 ticks

Stocks:

Two calls triggered. Good day overall.

These are the Tradesight calls that triggered, BA triggered short (with market support) and worked:

Rich's AAPL triggered short (with market support) and worked:

That's 2 triggered with market support, and both worked.

Tradesight Recap Report for 7/23/24

Today in the Markets:

The markets opened flat and did nothing all day on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

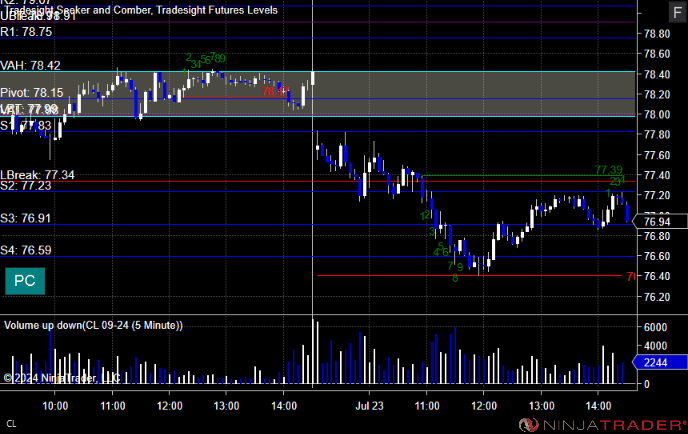

CL with Levels:

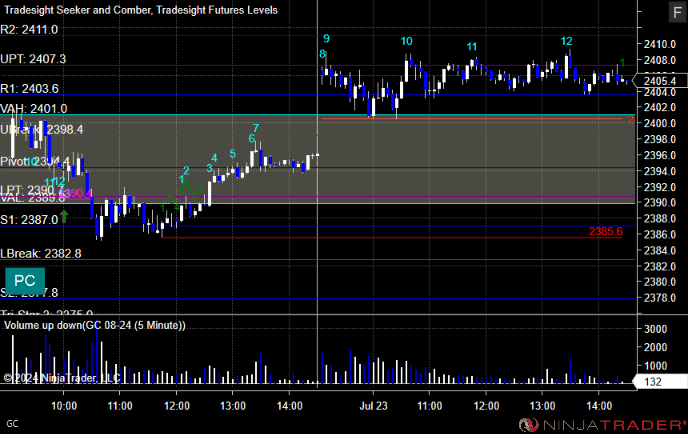

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered short at A and did not work, triggered long at B and worked:

Additional Futures Calls:

None.

Results: -14 ticks

Stocks:

One call triggered,

These are the Tradesight calls that triggered, Rich's LLY triggered long (with market support) and worked enough for a partial:

That's 1 triggered with market support, and it worked.

Tradesight Recap Report for 7/22/24

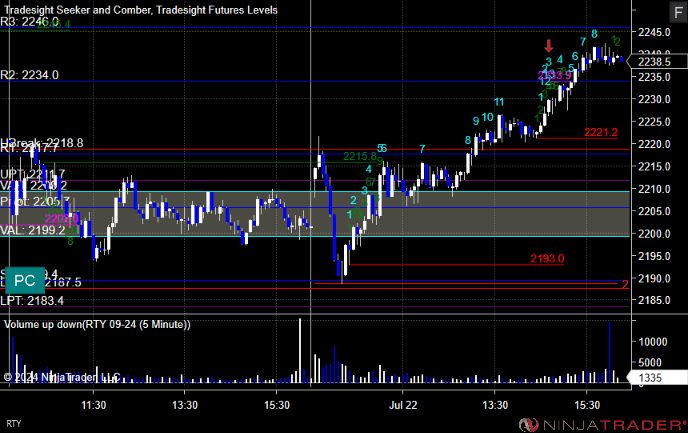

Today in the Markets:

The markets gapped up and played both ways early, never filled the gap, and closed a little higher than where they opened on 5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

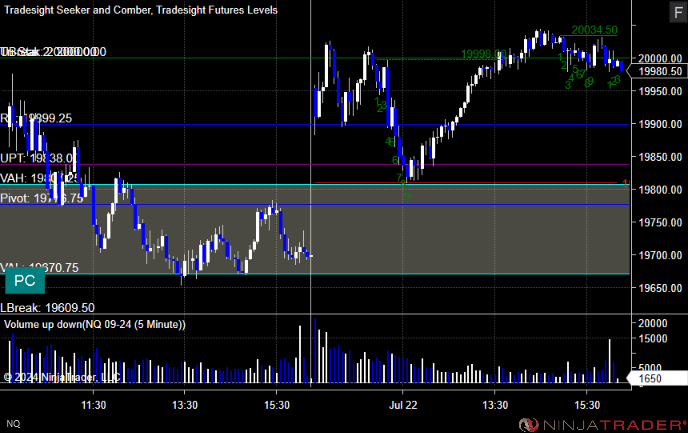

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, long at A was too far out of range to take and short at B was too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered, Rich's EXPE triggered short (with market support) and did not work:

AAPL triggered short (without market support) and worked:

That's 1 triggered with market support, and it did not work.

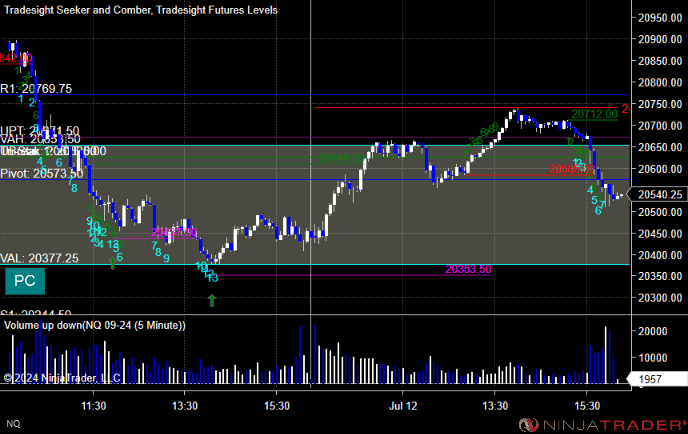

Tradesight Recap Report for 7/12/24

Today in the Markets:

After Thursday's sell-off, the markets recovered most of the loss and the S&P even made new highs at one point on 5.4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered long at A and did not work:

Additional Futures Calls:

None.

Results: -21 ticks

Stocks:

Nada.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

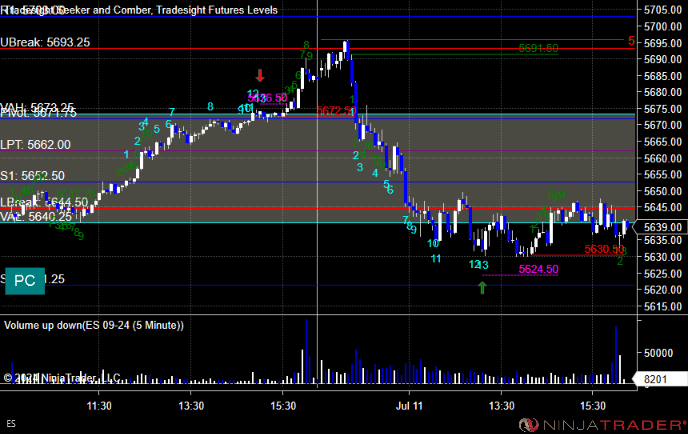

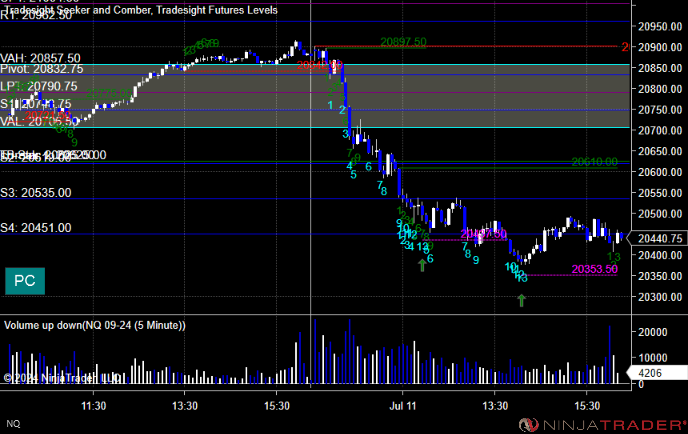

Tradesight Recap Report for 7/11/24

Today in the Markets:

The markets opened flat, tried to go higher, and then sold off sharply with a handful of big stocks taking the hit on 5.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

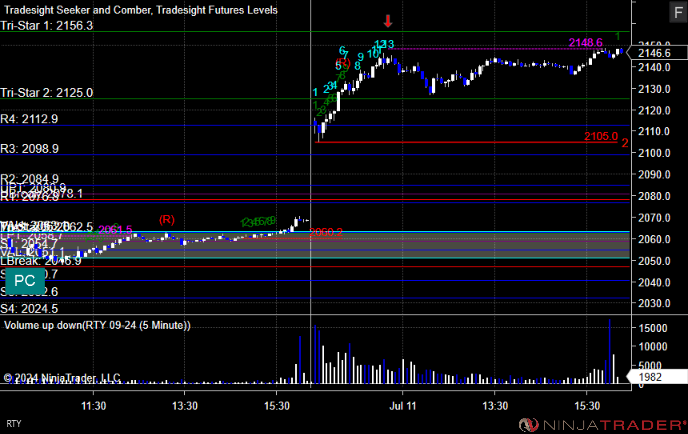

RTY with Levels:

CL with Levels:

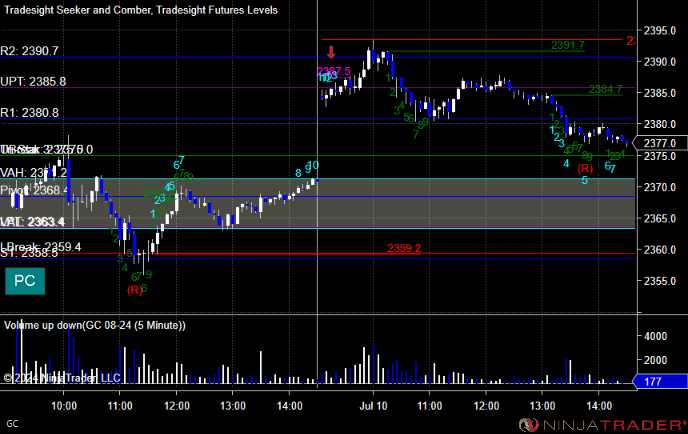

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered short at A and did not work, triggered long at B and did not work:

Additional Futures Calls:

None.

Results: -31 ticks

Stocks:

Nothing triggered as the market sold off in the second half of the day out of the blue.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

Tradesight Recap Report for 7/10/24

Today in the Markets:

The markets gapped up and rallied over lunch and beyond on 5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

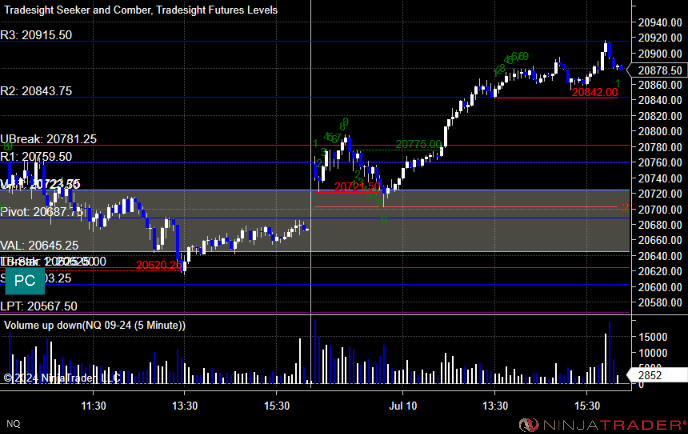

NQ with Levels:

RTY with Levels:

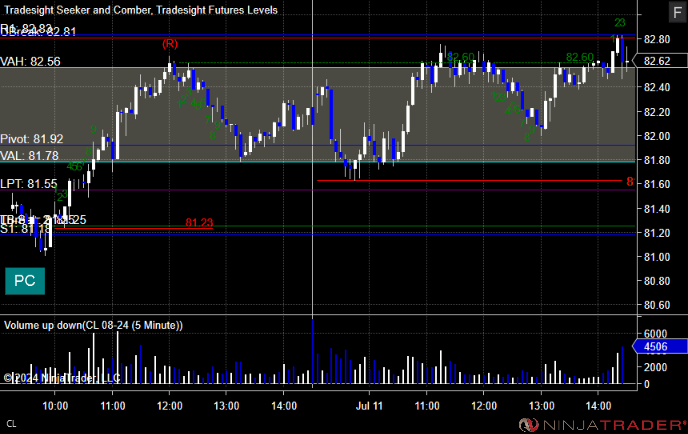

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered short at at A and did not work, triggered long at B and worked:

Additional Futures Calls:

None.

Results: -12 ticks

Stocks:

One call triggered.

These are the Tradesight calls that triggered, FDX triggered short (with market support) and didn't work

That's 1 triggered with market support, and it didn't work..

Tradesight Recap Report for 7/9/24

Today in the Markets:

The markets gapped up a little and took all day to fill. Dead flat again basically on 4.5 billion NASDAQ shares. Zzzzzzzz.

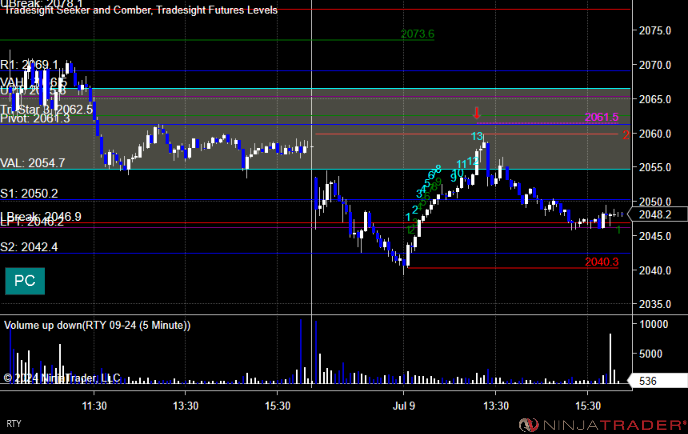

ES with Levels:

ES with Market Directional:

NQ with Levels:

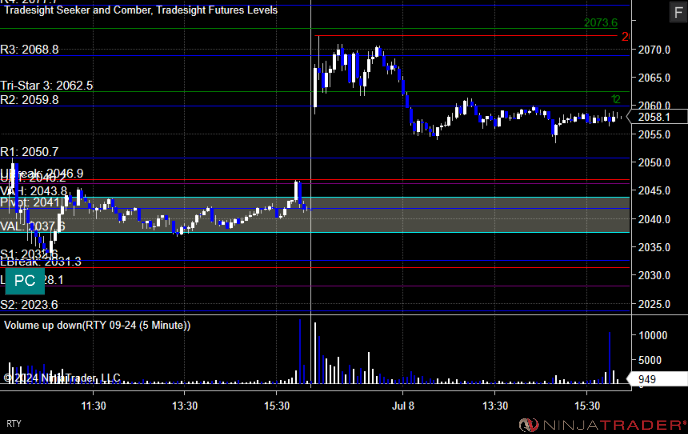

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered long at A and worked:

Additional Futures Calls:

None.

Results: +4 ticks

Stocks:

No calls triggered.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

Tradesight Recap Report for 7/8/24

Today in the Markets:

What a dead flat day on 4.8 billion NASDAQ shares. Horrible.

ES with Levels:

ES with Market Directional:

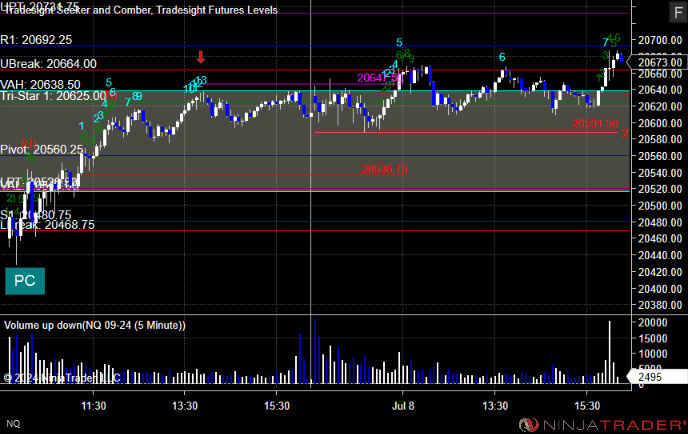

NQ with Levels:

RTY with Levels:

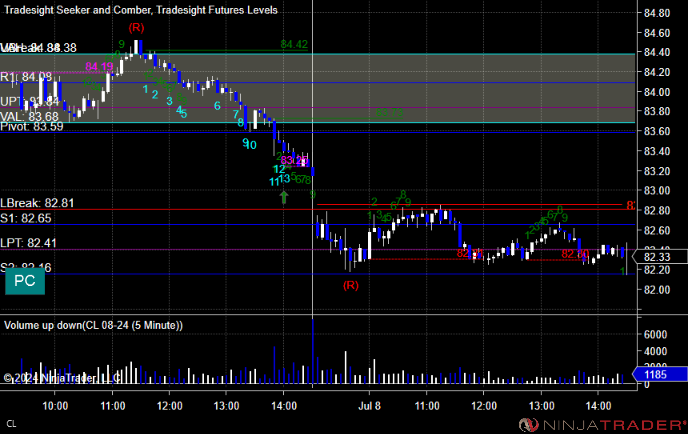

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered long at A and worked enough for a partial:

Additional Futures Calls:

None.

Results: +4 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered, AXP triggered short (with market support) and worked:

LRCX triggered long (without market support) and did not go enough to count:

That's 1 triggered with market support, and it worked.

Tradesight Recap Report for 6/28/24

Today in the Markets:

The markets open flat again, pushed higher, came back, sat in the value area most of the day, and closed slightly negative, following the debate to end the second quarter on 8 billion NASDAQ shares, which is all about end of quarter volume printing.

ES with Levels:

ES with Market Directional:

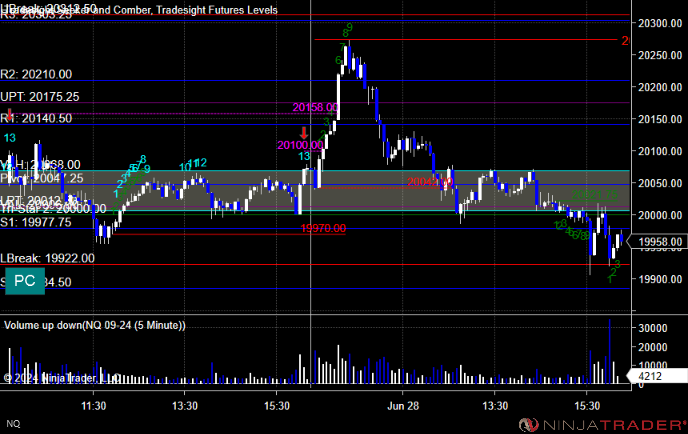

NQ with Levels:

RTY with Levels:

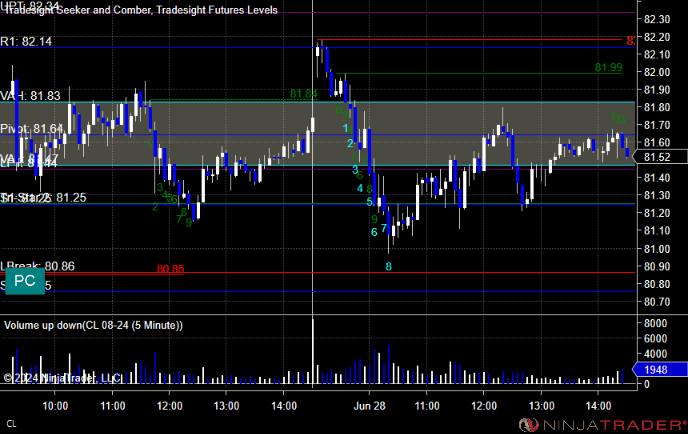

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered long at A and worked:

Additional Futures Calls:

None.

Results: +13 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered, EXPE triggered long (with market support) and did not go enough to count:

WYNN triggered long (with market support) and did not go enough to count:

That's 2 triggered with market support, both did not go enough to count.