Tradesight Recap Report for 1/25/24

Today in the Markets:

The markets gapped up, stayed flat all morning, dipped down after lunch to almost fill the gap on the ES and then came back to inside the opening 5 minute candle like it went nowhere. Again. NASDAQ volume was 4.9 billion shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered short at A and did not work, triggered long at B and worked:

Additional Futures Calls:

None.

Results: -13 ticks

Stocks:

One call triggered.

These are the Tradesight calls that triggered, Rich's NOW triggered short (with market support) and did not go enough to count:

That's 1 triggered with market support, and did not go enough to count.

Tradesight Recap Report for 1/24/24

Today in the Markets:

The markets gapped up pretty big, but then went sideways for many hours and sold off after lunch to fill the gap. NASDAQ volume was 4.9 billion shares.

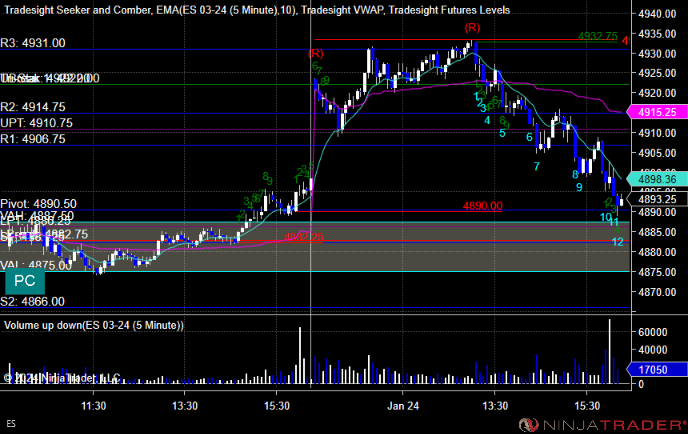

ES with Levels:

ES with Market Directional:

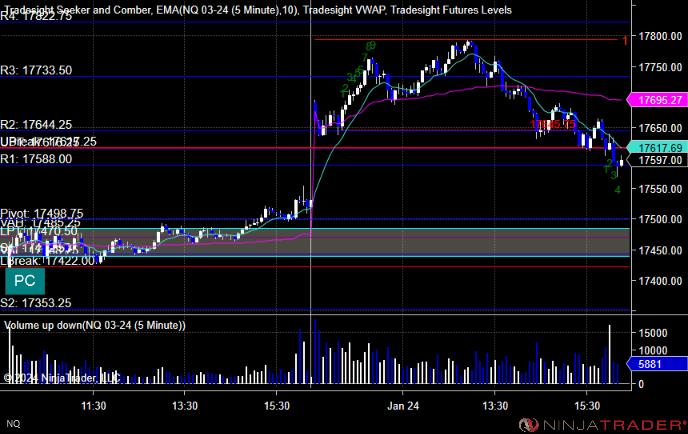

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered short at A and worked:

Additional Futures Calls:

None.

Results: +4 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered, SNOW triggered long (with market support) and worked enough for a partial:

USAC triggered long (with market support) and did not work:

That's 2 triggered with market support, and 1 worked and 1 did not.

Tradesight Recap Report for 1/23/24

Today in the Markets:

The markets continued the very flat action from the prior days last six hours for most of this session and then rallied a little bit in the last hour. NASDAQ volume was 5.1 billion shares.

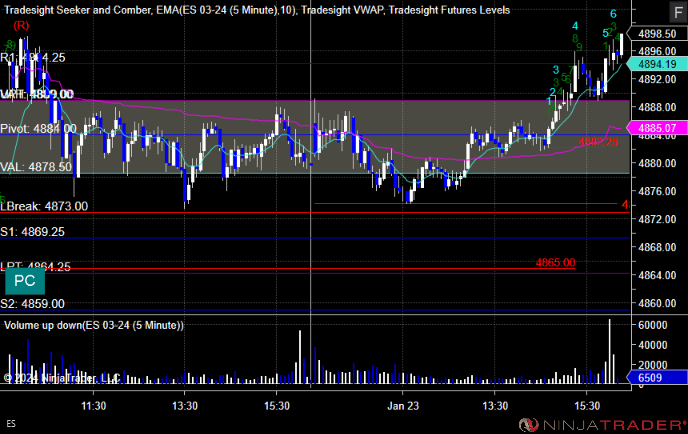

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered and did not work.

ES Opening Range Play, triggered short at A and stopped over the midpoint:

Additional Futures Calls:

None.

Results: -20 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered, Rich's LRCX triggered short (with market support) and did not work:

BHVN, triggered long (triggered in the first five minute candle, therefore no support) and worked enough for a partial:

That's 1 triggered with market support, and it did not work.

Tradesight Recap Report for 1/22/24

Today in the Markets:

The markets gapped up and went about as dead flat as they could after pulling back just a bit. NASDAQ volume was 4.7 billion shares.

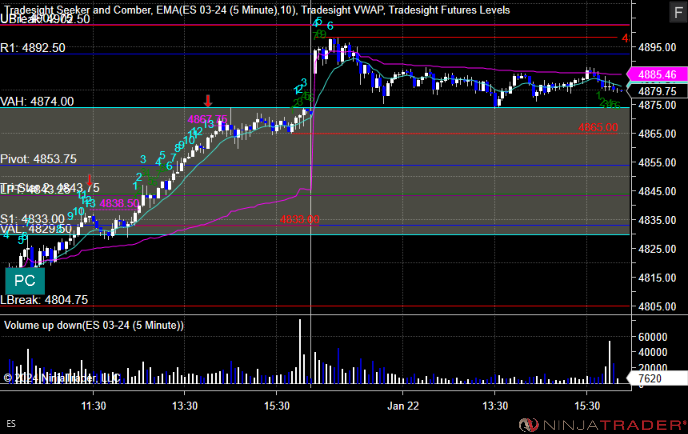

ES with Levels:

ES with Market Directional:

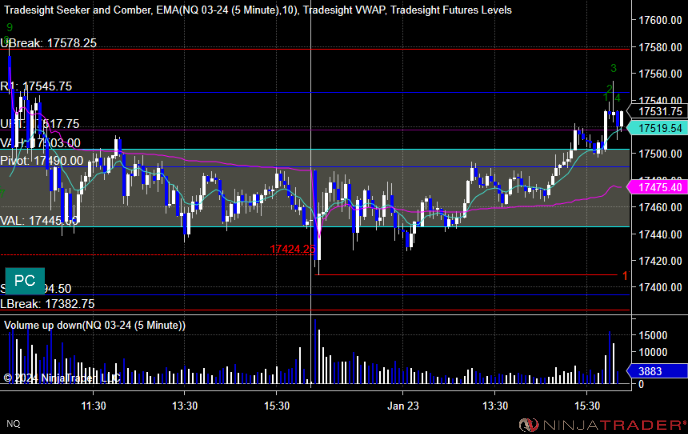

NQ with Levels:

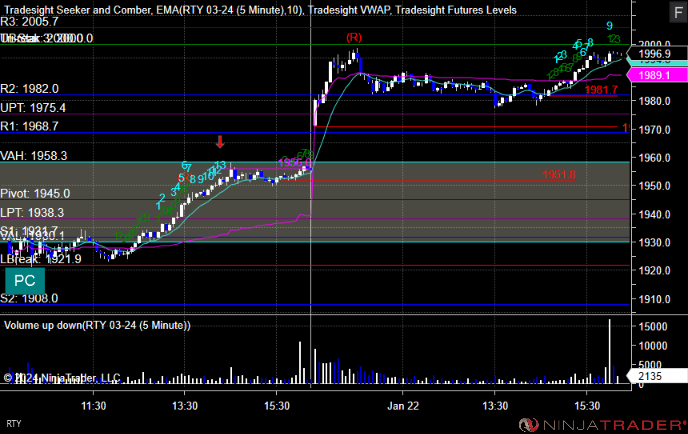

RTY with Levels:

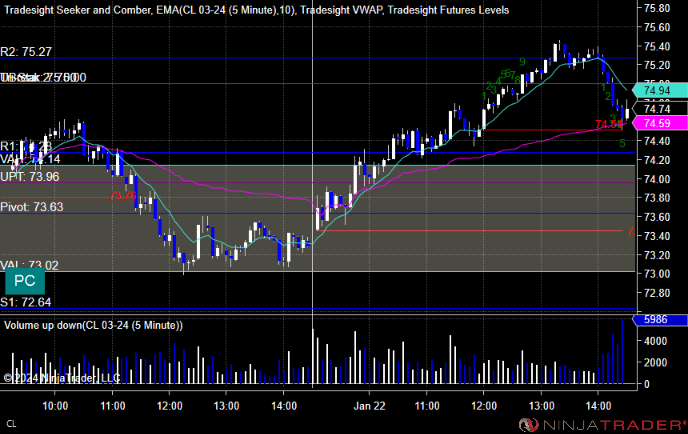

CL with Levels:

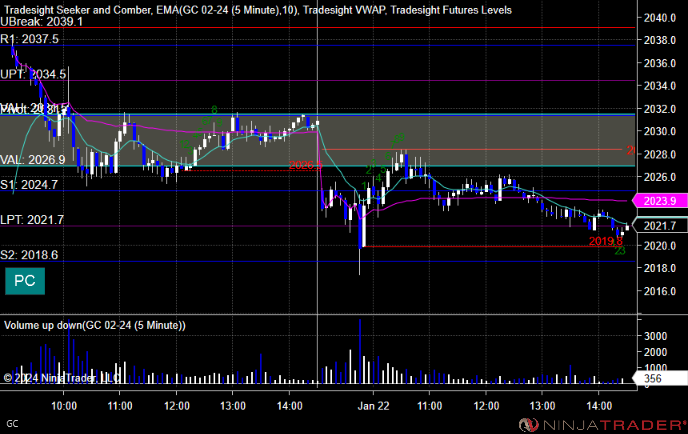

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play:

Additional Futures Calls:

None.

Results: +8 ticks

Stocks:

One call triggered.

These are the Tradesight calls that triggered, Rich's TXN triggered long (no market support due to triggering in the first five minuets) and did not work:

That's 0 triggered with market support.

Tradesight Recap Report for 1/12/24

Today in the Markets:

The markets gapped up decent, then came back and filled the gap, and then closed even after hours of flatness on 4.9 billion NASDAQ shares ahead of the long weekend and with a storm hitting most of the country.

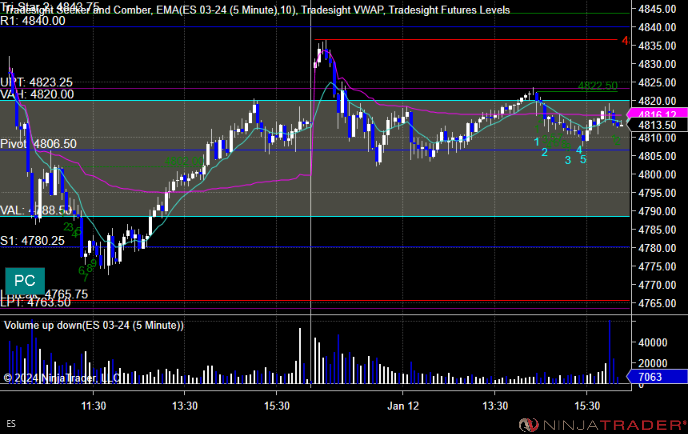

ES with Levels:

ES with Market Directional:

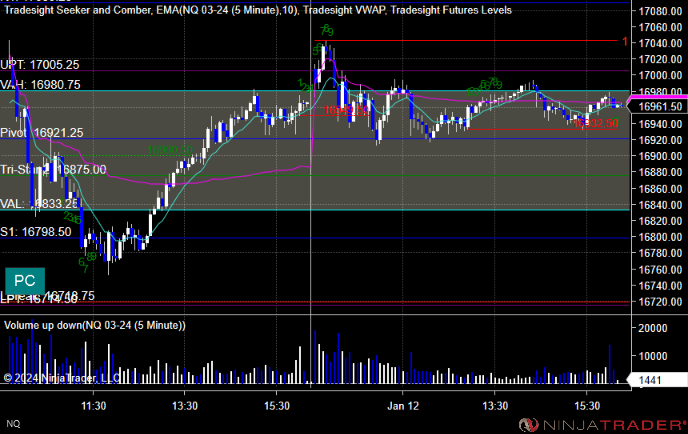

NQ with Levels:

RTY with Levels:

CL with Levels:

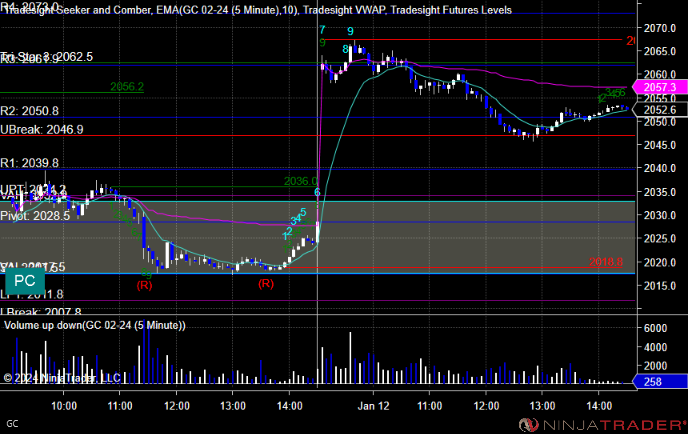

GC with Levels:

Futures:

Two calls triggered. A big, winning day.

ES Opening Range Play:

Additional Futures Calls:

None

Results: +31 ticks

Stocks:

Two calls triggered with a mixed bag to close out the week.

These are the Tradesight calls that triggered, Rich's COIN triggered short (with market support) and worked:

Rich's ROKU triggered short (without market support) and did not work:

That's 1 triggered with market support, and it worked.

Tradesight Recap Report for 1/11/24

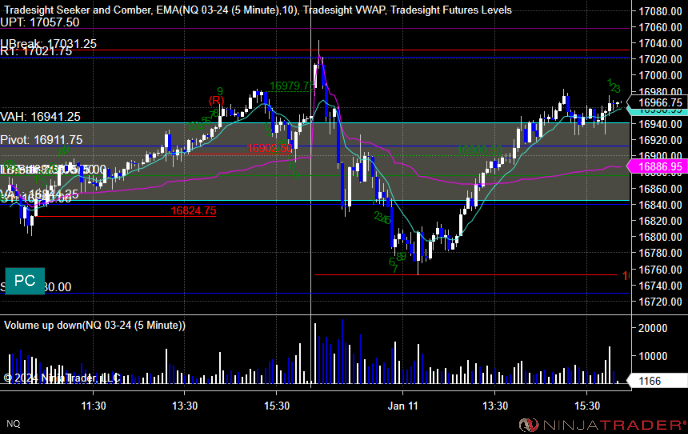

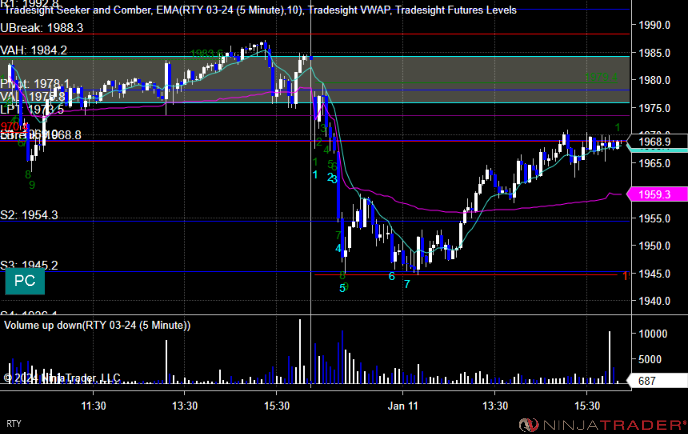

Today in the Markets:

The markets gapped up a little, filled and kept going lower, then reversed in the afternoon to close even on 5.1 billion NASDAQ shares.

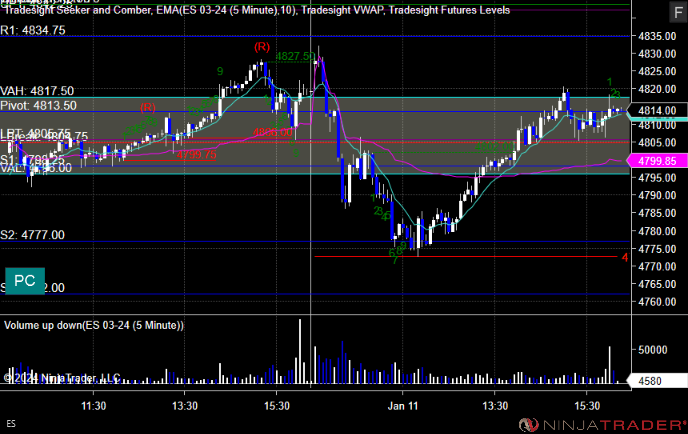

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered short at A, but was too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

One call triggered, and another green day.

These are the Tradesight calls that triggered, Rich's AXP triggered short (with market support) and worked:

That's 1 triggered with market support, and it worked.

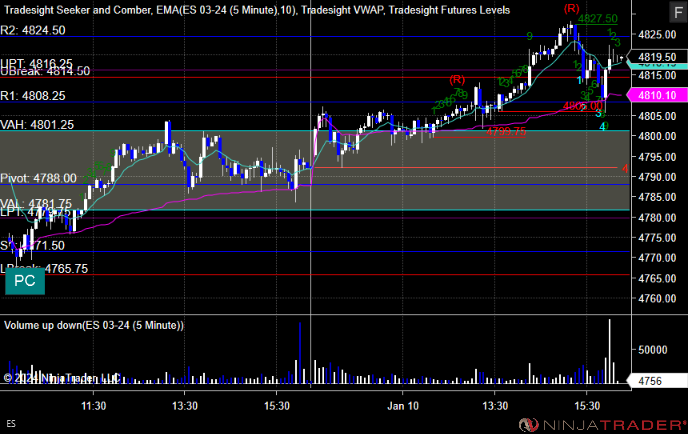

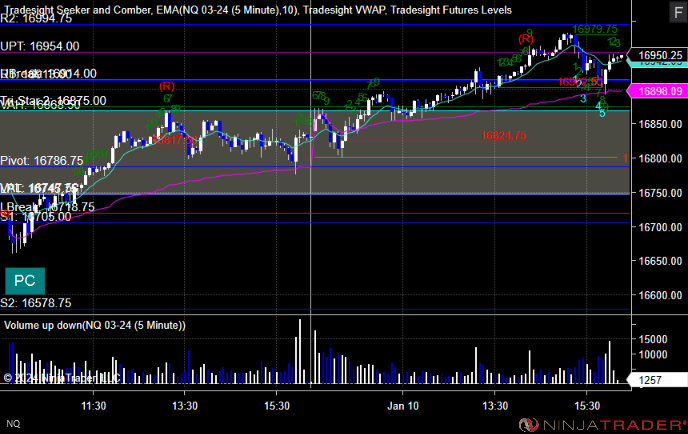

Tradesight Recap Report for 1/10/24

Today in the Markets:

The markets gapped up small, filled very quickly, and then rallied on 5.4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered long at A and worked, triggered short at B and worked:

Additional Futures Calls:

None.

Results: +10 ticks

Stocks:

One call triggered.

These are the Tradesight calls that triggered, Rich's META triggered long (without market support as it triggered in the first five minutes) and worked:

That's 0 triggered with market support.

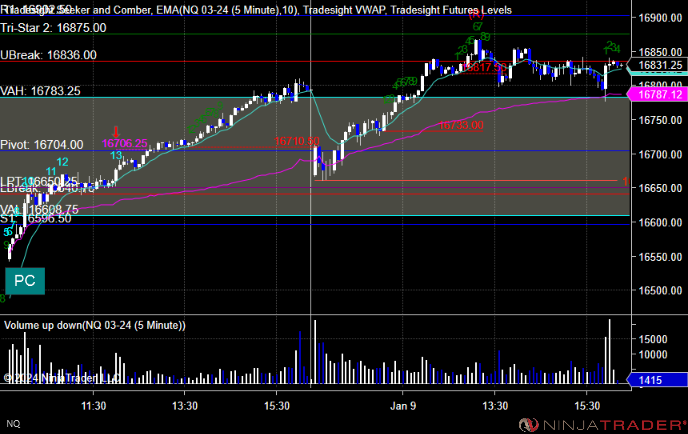

Tradesight Recap Report for 1/9/24

Today in the Markets:

The markets gapped down and filled, and that was it for the session on 4.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered long at A and did not work, triggered short at B, but was too far out of range to take:

Additional Futures Calls:

None.

Results: -14 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered, GS triggered long (with market support) and didn't work:

Rich's NVDA triggered long (with market support) and worked:

That's 2 triggered with market support, and 1 worked and 1 did not.

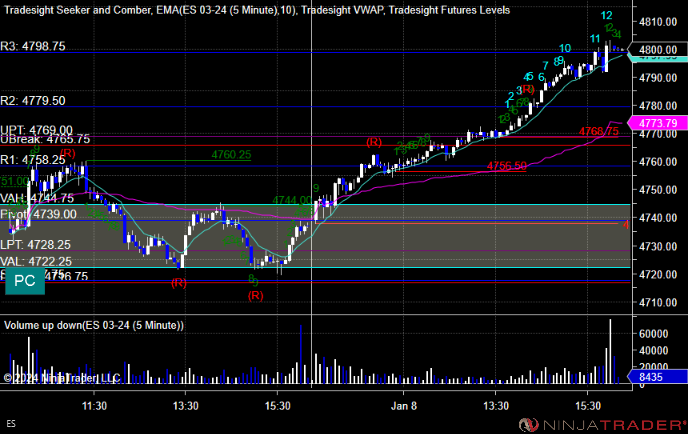

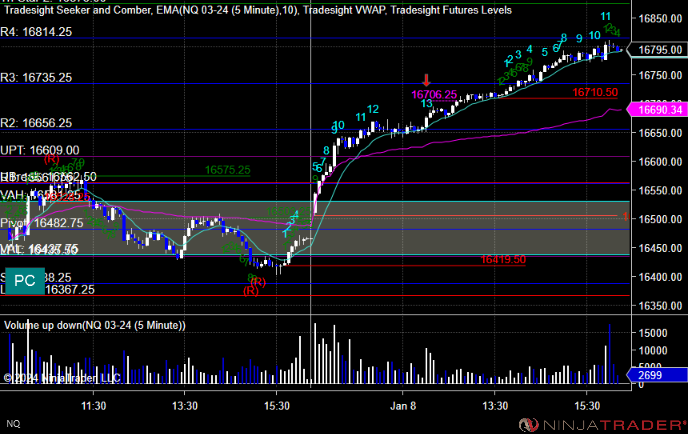

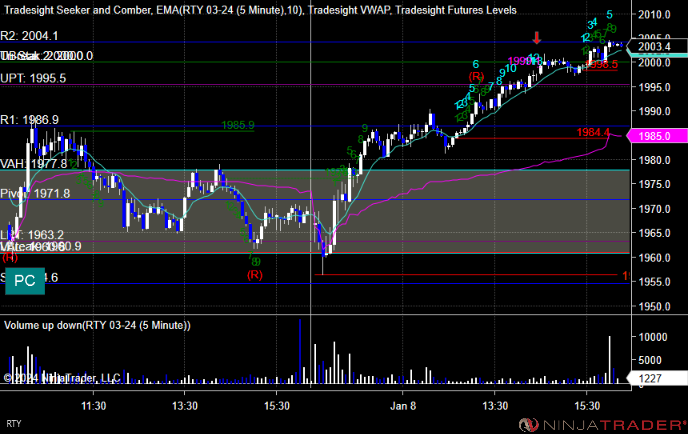

Tradesight Recap Report for 1/8/24

Today in the Markets:

The markets opened flat and rallied for the session on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered long at A and worked:

Additional Futures Calls:

None.

Results: +4 ticks

Stocks:

One call triggered, and it was a very nice winner.

These are the Tradesight calls that triggered, NFLX triggered long (with market support) and worked:

That's 1 triggered with market support, and it worked.

Tradesight Recap Report for 12/29/23

Today in the Markets:

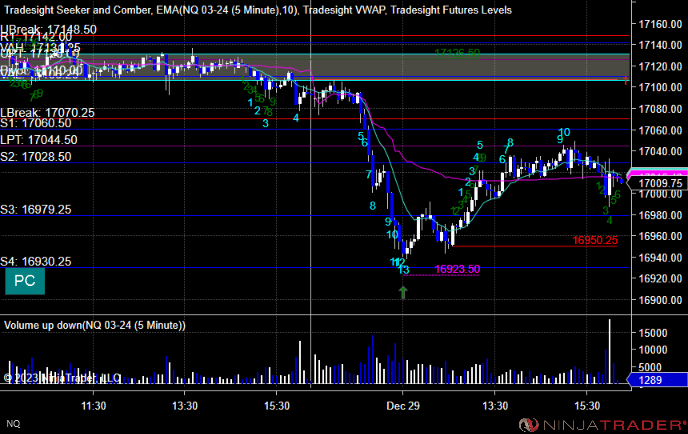

The year is over. Markets opened flat, sold off a bit (probably some big firms prepping for selling in January), then came back most of the way. Note that the low was a 13 buy on the NQ and the reversal high was a 13 sell on the ES.

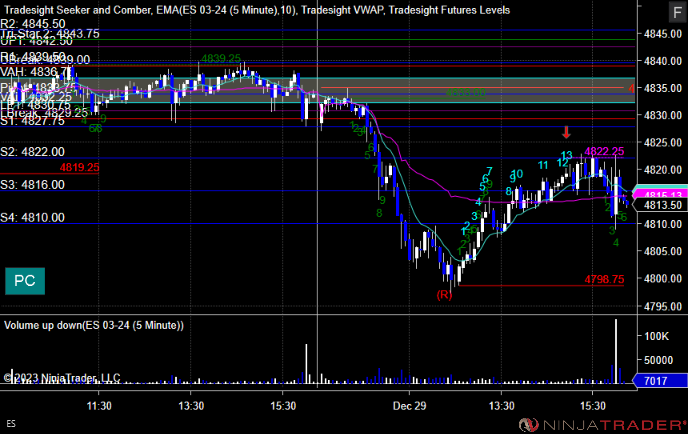

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

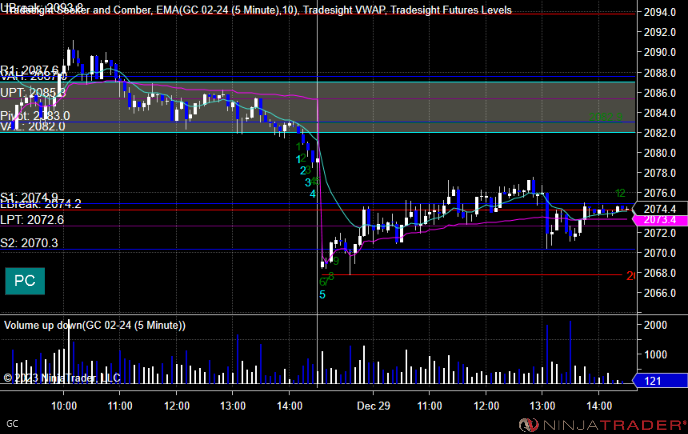

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered long at A and worked:

Additional Futures Calls:

None.

Results: +4 ticks

Stocks:

One call triggered.

These are the Tradesight calls that triggered, Rich's COST triggered short (without market support) and did not go enough to count:

That's 0 triggered with market support.