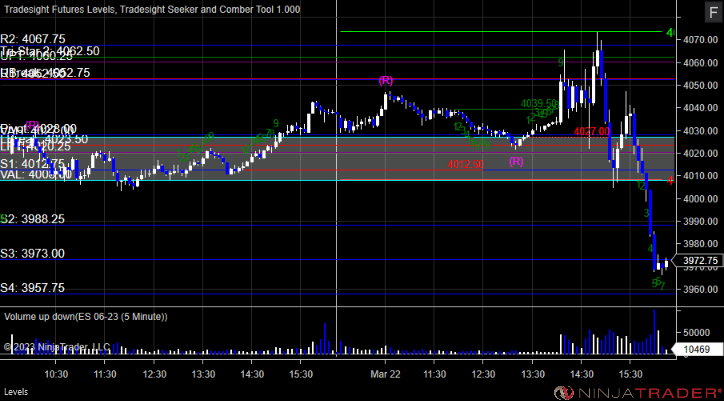

Tradesight Recap Report for 3/22/23

Today in the Markets:

The markets opened flat and did nothing until the Fed announcement, then spiked, then tanked when the Fed said they probably would need to lower rates later in the year.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered short at A and stopped, triggered long at B and worked:

Additional Futures Calls:

None

Results: -0.5 ticks

Stocks:

No calls triggered.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

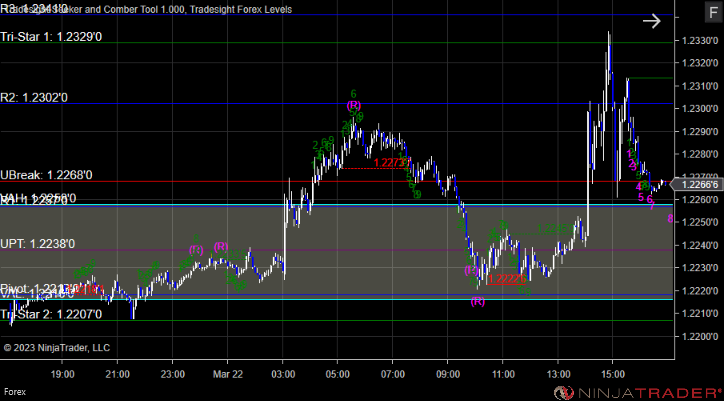

Forex:

No calls made.

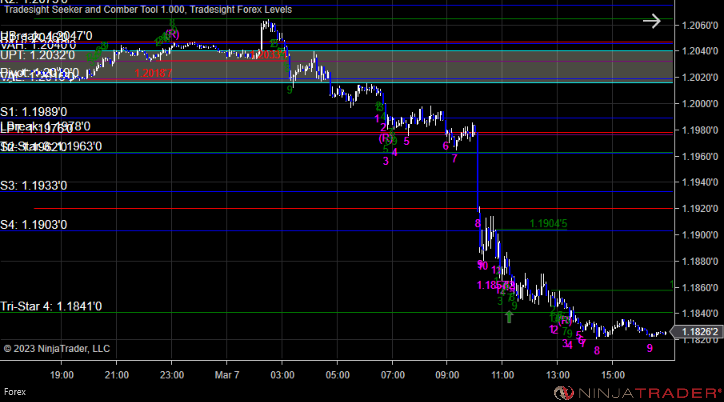

GBPUSD:

Results: +0 pips

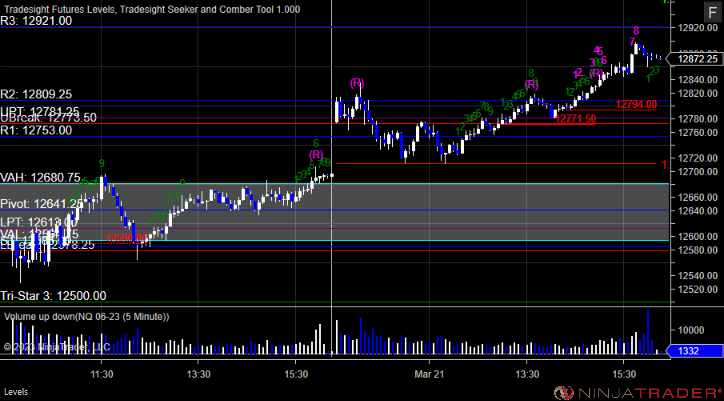

Tradesight Recap Report for 3/21/23

Today in the Markets:

The markets gapped up and went dead flat most of the day as the 2-day Fed meeting starts, then closed a little higher on 4.7 billion NASDAQ shares.

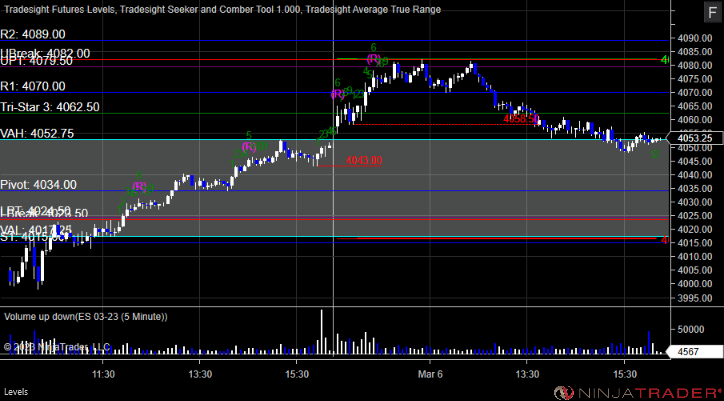

ES with Levels:

ES with Market Directional:

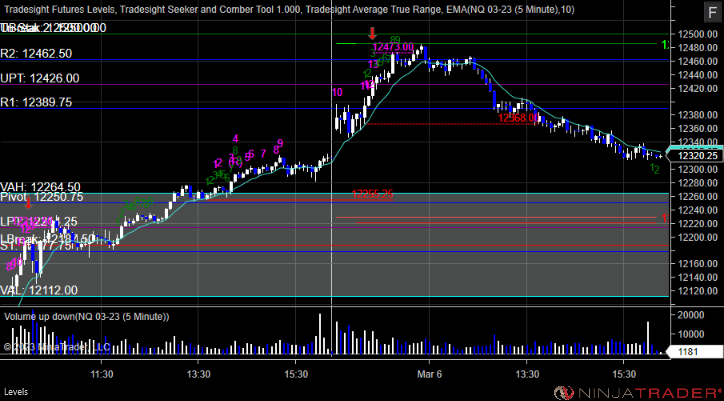

NQ with Levels:

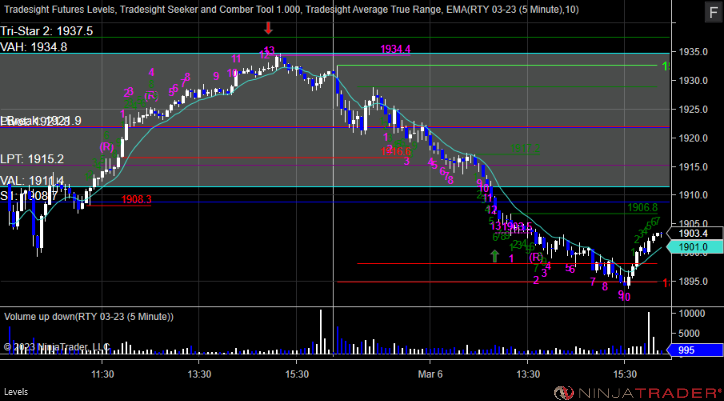

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

No triggers today.

ES Opening Range Play, triggered long at A and short at B, but both were too far out of range to take:

Additional Futures Calls:

None

Results: +0 ticks

Stocks:

Three calls triggered.

These are the Tradesight calls that triggered, Rich's NEM triggered short (with market support) and did not work:

Rich's TSLA triggered long (without market support) and worked:

Rich's AMD triggered long (without market support) and did not work:

That's 1 triggered with market support, and it did not work.

Forex:

No calls today, but we closed the second half of the prior day's trade.

GBPUSD:

Results: +30 pips

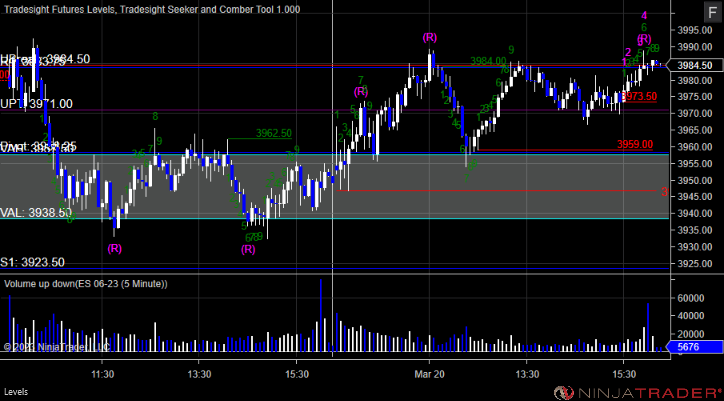

Tradesight Recap Report for 3/20/23

Today in the Markets:

The markets opened flat and then headed higher, came back, and bounced again to close near the highs on 5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

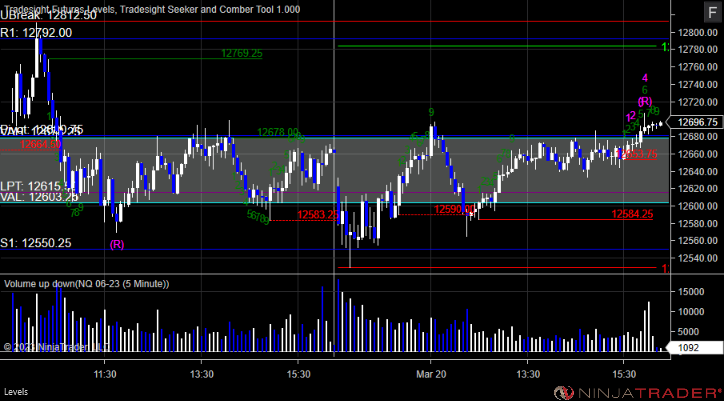

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered long at A and worked enough for a partial and triggered short at B and did not work:

Additional Futures Calls:

None

Results: +4 ticks

Stocks:

Three calls triggered.

These are the Tradesight calls that triggered, AAPL triggered long (with market support) and did not go enough to count:

LULU triggered long (with market support) and did not work:

Rich's DE triggered long late in the session (with market support) and did not go enough to count:

That's 1 triggered with market support, and it did not work.

Forex:

One call triggered.

GBPUSD, triggered long at A and took a partial at B and the balance continues open:

Results: Trade is still going.

Tradesight Recap Report for 3/10/23

Today in the Markets:

Despite some bad news in the world about the SIVB bank situation, the markets went both ways and closed barely lower, but this might be about quarterly futures contract roll.

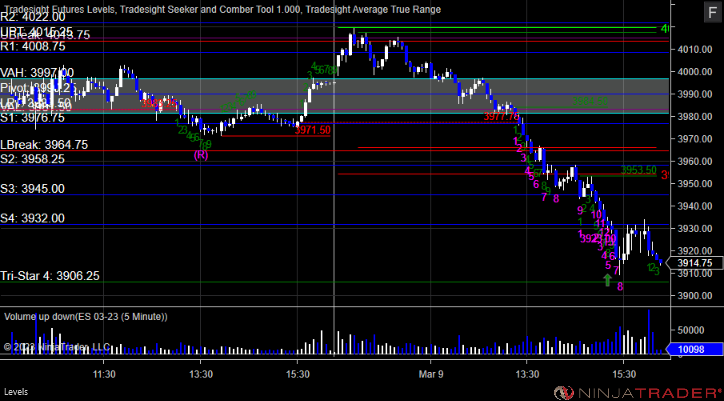

ES with Levels:

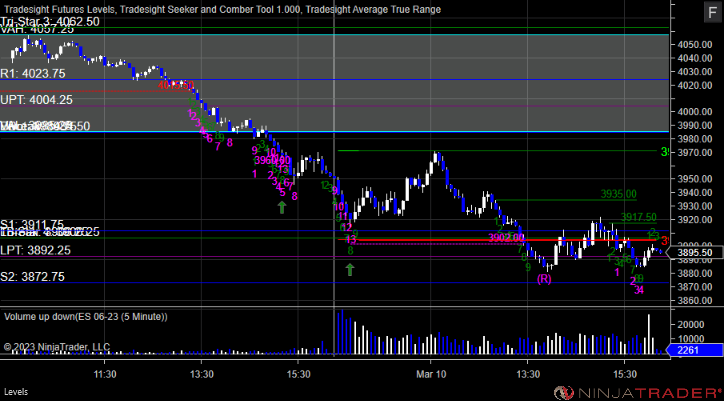

ES with Market Directional:

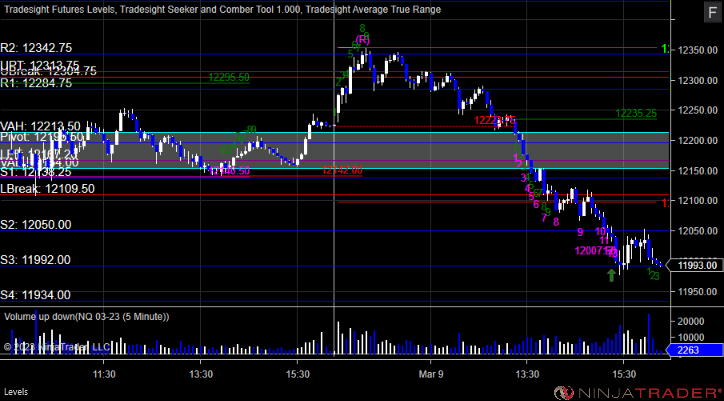

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered short at A and worked enough for a partial:

Additional Futures Calls:

None

Results: +4 ticks

Stocks:

One call triggered.

These are the Tradesight calls that triggered, Rich's FSLR triggered short (with market support) and did not work:

That's 1 triggered with market support, and it did not work.

Forex:

No calls made.

GBPUSD:

Results: +0 pips

Tradesight Recap Report for 3/9/23

Today in the Markets:

The markets gapped up a little, tried to go higher, and then rolled to fill the gap and went lower on 5 billion NASDAQ shares.

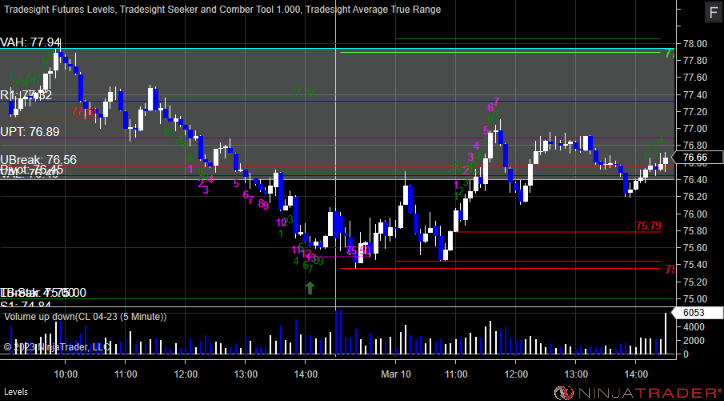

ES with Levels:

ES with Market Directional:

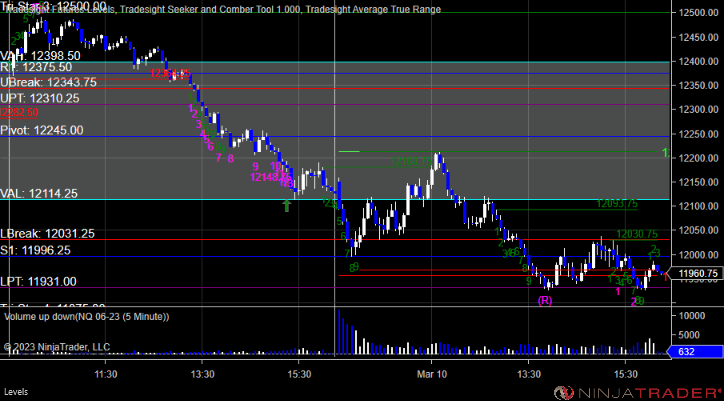

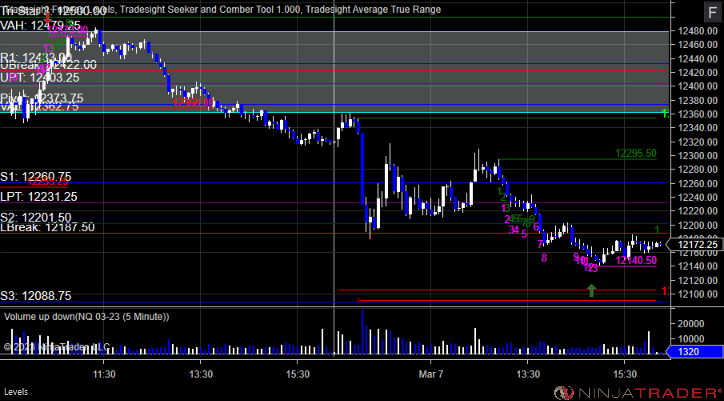

NQ with Levels:

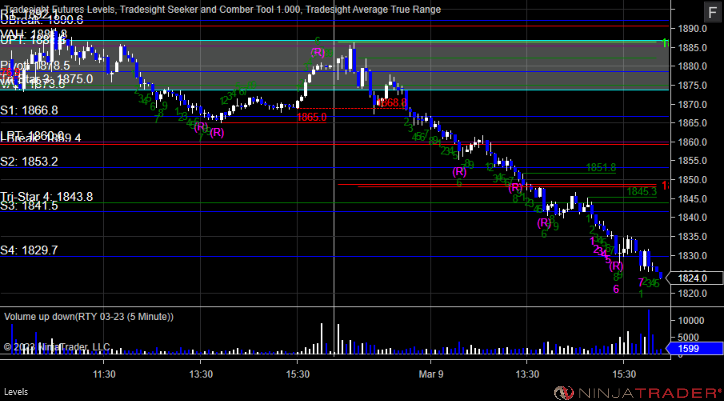

RTY with Levels:

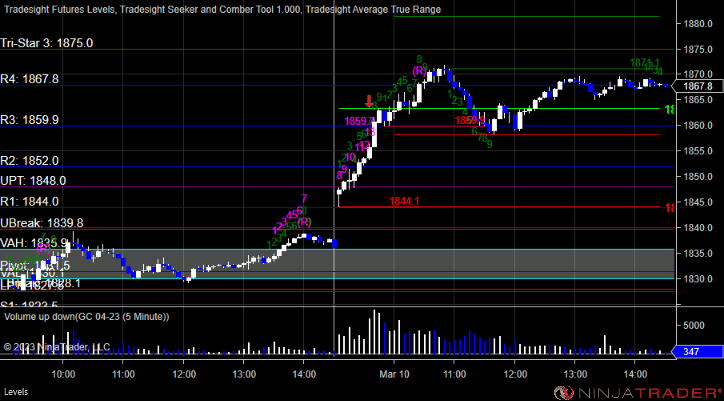

CL with Levels:

GC with Levels:

Futures:

Two triggers today.

ES Opening Range Play triggered long at A and worked enough for a partial, triggered short at B and stopped out:

Additional Futures Calls:

None

Results: -4 ticks

Stocks:

Three triggers for today.

These are the Tradesight calls that triggered, ZM triggered long (with market support) and did not work:

Rich's ETSY triggered long (with market support) and worked:

Rich's SIVB triggered long (with market support) and did not work:

That's 3 triggered with market support, and 1 worked and 2 did not.

Forex:

No calls.

GBPUSD:

Results: +0 pips

Tradesight Recap Report for 3/8/23

Today in the Markets:

Such a dead day as the markets opened flat and closed even on 5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Two triggers.

ES Opening Range Play, triggered short at A enough for a partial and triggered long at B and stopped out under the midpoint:

Additional Futures Calls:

None

Results: -4 ticks

Stocks:

One call triggered on a very dead day in the markets.

These are the Tradesight calls that triggered, Rich's CAT triggered short (with market support and did not go enough to count:

That's 1 triggered with market support, and did not go enough to count.

Forex:

There were two calls, but they did not trigger.

GBPUSD:

Results: +0 pips

Tradesight Recap Report for 3/7/23

Today in the Markets:

The markets opened flat and then slipped on some news and closed down pretty hard.

ES with Levels:

ES with Market Directional:

NQ with Levels:

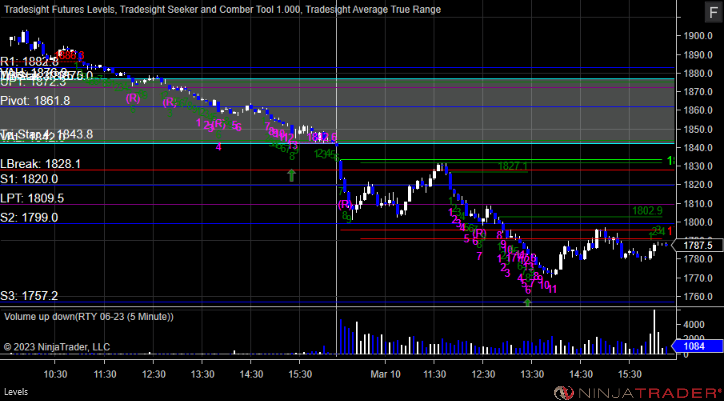

RTY with Levels:

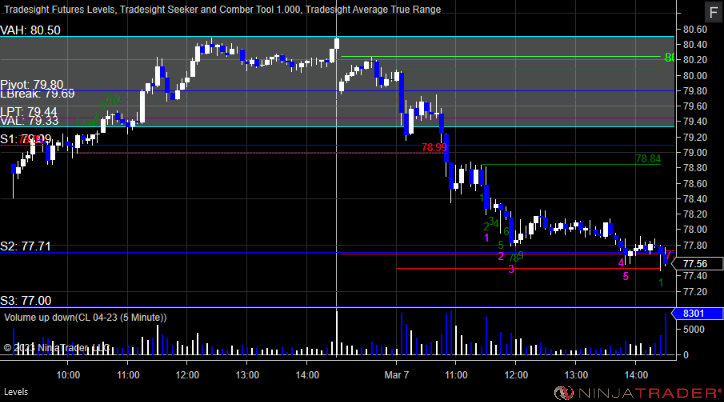

CL with Levels:

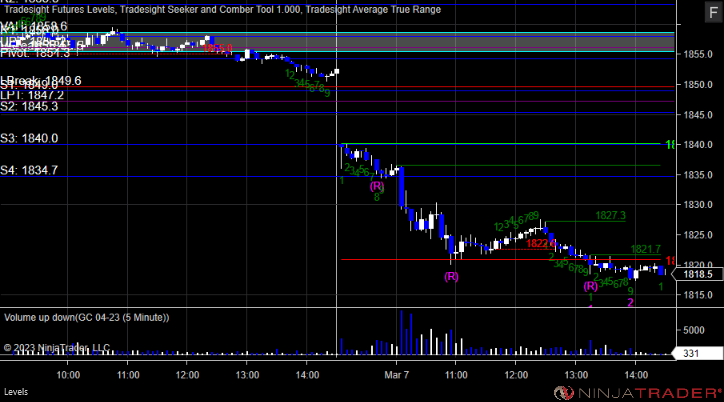

GC with Levels:

Futures:

Two triggers.

ES Opening Range Play, triggered long at A and worked enough for a partial, and triggered short at B for a loss:

Additional Futures Calls:

None

Results: -4 ticks

Stocks:

Many calls triggered.

These are the Tradesight calls that triggered, GS triggered short (with market support) and worked:

Rich's COST triggered long (with market support) and worked enough for a partial:

Rich's SNAP triggered long (with market support) and worked enough for a partial:

Rich's WYNN triggered short (with market support) and worked:

That's 4 triggers with market support, and 4 worked.

Forex:

No calls made

GBPUSD:

Results: +0 pips

Tradesight Recap Report for 3/6/23

Today in the Markets:

The markets gapped up, went higher, stalled out right at the UBreak level, and then came back and filled the gap on 4.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

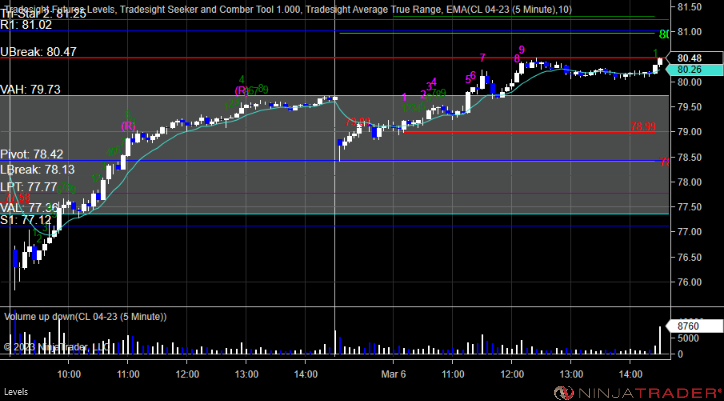

CL with Levels:

GC with Levels:

Futures:

One small winner.

ES Opening Range Play, Triggered long at A and the balance stopped out for a small winner:

Additional Futures Calls:

None

Results: +4 ticks

Stocks:

Several calls posted, but none of them triggered so not much of a day.

These are the Tradesight calls that triggered:

None

That's 0 triggered with market support.

Forex:

No calls were made.

GBPUSD:

Results: +0 pips

Tradesight Recap Report for 2/24/23

Today in the Markets:

The markets gapped down, and once again, did very little from the on 4.4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked enough for a partial, Triggered short at B and was too far to take:

Additional Futures Calls:

None

Results: +4 ticks

GBPUSD, no calls:

Results: +0 pips

One call.

These are the Tradesight calls that triggered, Rich's SPOT triggered short (with market support) and did not work:

Tradesight Recap Report for 2/23/23

Today in the Markets:

Another day that opened flat and dipped and came back on 4.6 billion NASDAQ shares.

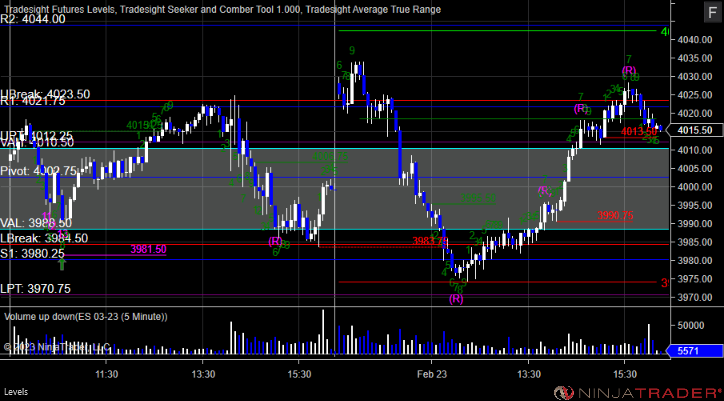

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and short at B, both worked enough for a partial:

Additional Futures Calls:

None

Results: +8 ticks

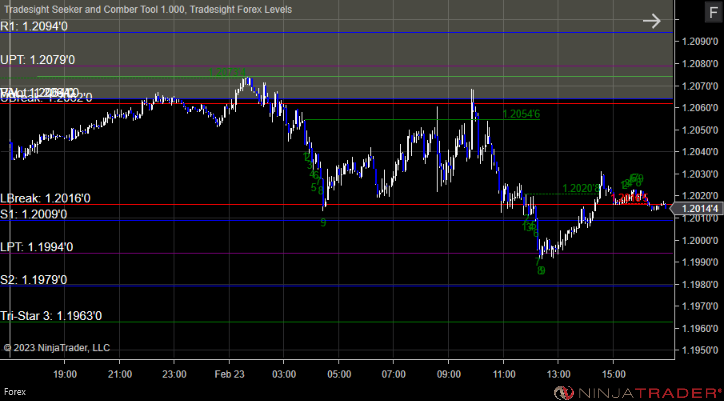

GBPUSD:

Results: +0 pips

Two calls.

These are the Tradesight calls that triggered, BYND triggered long (with market support) and did not work:

Rich's NFLX triggered short (with market support) and worked: