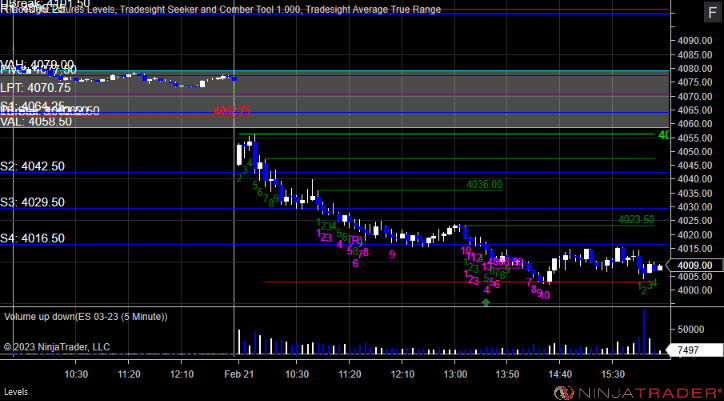

Tradesight Recap Report for 2/21/23

Today in the Markets:

First day back from options expiration and a long weekend, so wasn't super exciting. We gapped down and went lower on 5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered long at A and triggered short at B, but too far out of range to take:

Additional Futures Calls:

None

Results: +0 ticks

GBPUSD:

Results: +0 pips

Just a couple of calls on the first day back and they worked.

These are the Tradesight calls that triggered, Rich's META triggered long (with market support) and worked:

Rich's WDC triggered short (with market support) and worked:

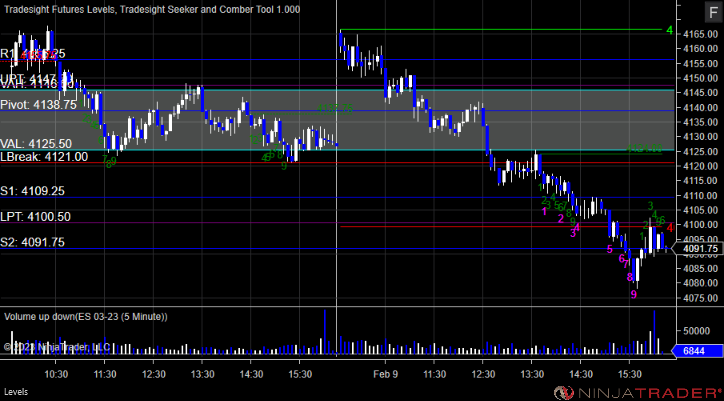

Tradesight Recap Report for 2/10/23

Today in the Markets:

What a dull end of the week. The markets literally did nothing on 4.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered long at A and short at B, but too far out of range to take:

Additional Futures Calls:

None

Results: + 0 ticks

GBPUSD, triggered short at A with 1.2036 target, closed for end of week for a small gain:

Results: +20 pips

Two trades triggered on a very boring session.

These are the Tradesight calls that triggered, Rich's ETSY triggered short (with market support) and worked:

Rich's NOW triggered long (with market support) and did not work:

Tradesight Recap Report for 2/9/23

Today in the Markets:

The markets gapped up and sold off all day on 5.7 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered short at A and worked enough for a partial:

Additional Futures Calls:

None

Results: +4 ticks

GBPUSD:

Results: +0 pips

A good day in the markets, which finally showed some solid action to the downside after a couple of days of not much happening.

These are the Tradesight calls that triggered, INTU triggered short (with market support) and worked:

NVDA triggered short (with market support) and worked enough for a partial:

Rich's AFRM triggered short (with market support) and worked:

Rich's WYNN triggered short (with market support) and worked enough for a partial:

Rich's FSLR triggered long (with market support) and did not work:

Rich's AXP triggered long (without market support) and worked enough for a partial:

Tradesight Recap Report for 2/8/23

Today in the Markets:

The markets gapped down a little, stayed flat for two hours, went a little lower ahead of lunch, and then went dead flat for the rest of the day on 5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered long at A and worked for a nice win:

Additional Futures Calls:

None

Results: +16 ticks

GBPUSD, triggered long at A and stopped:

Results: -25 pips

Not much to do with the triggers on a day that ended up being fairly dead.

These are the Tradesight calls that triggered, Rich's GS triggered long (with market support) and did not go enough to count:

Rich's UBER triggered short (without market support) and worked:

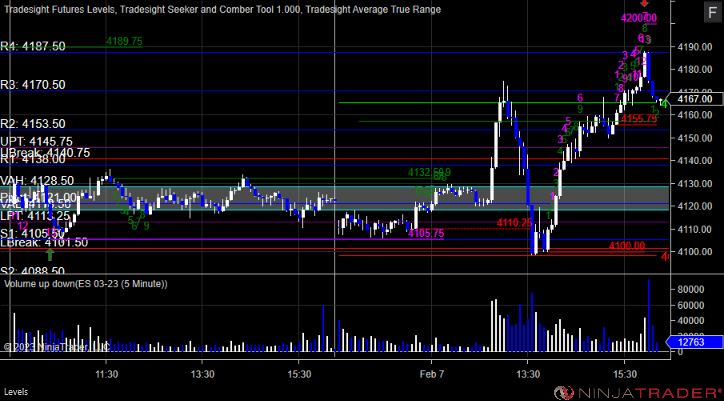

Tradesight Recap Report for 2/7/23

Today in the Markets:

The markets gapped down a little and went dead flat again into lunch, then jumped on Powell's comments, then retreated to lows, then went back up for the rest of the day on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered long at A and worked enough for a partial:

Additional Futures Calls:

None.

Results: +4 ticks

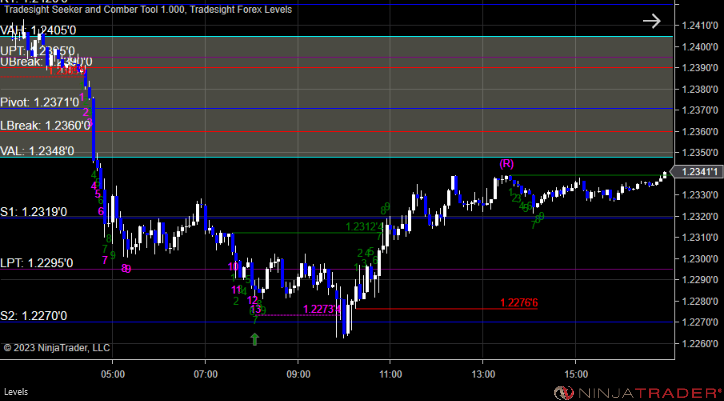

GBPUSD triggered short at A, hit the first target at B, stopped second half at C, triggered at D and stopped:

Results: +15 pips

Despite a flat start and then three news-driven moves, we had a couple of nice winners for the session.

These are the Tradesight calls that triggered, Rich's MSFT triggered long (with market support) and worked enough for a partial:

Rich's COIN triggered short (with market support) and worked:

Rich's AI triggered short (without market support) and worked:

Tradesight Recap Report for 2/6/23

Today in the Markets:

The markets gapped down a little and literally went as dead flat as we have seen in a while on 5.5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered short at A, but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

GBPUSD, triggered short under the LBreak and stopped:

Results: -25 pips

Seriously, what a waste of a day, but we still had a nice winner.

These are the Tradesight calls that triggered, Rich's JWN triggered short (with market support) and worked:

Rich's PXD triggered short (with market support) and did not move either way to count:

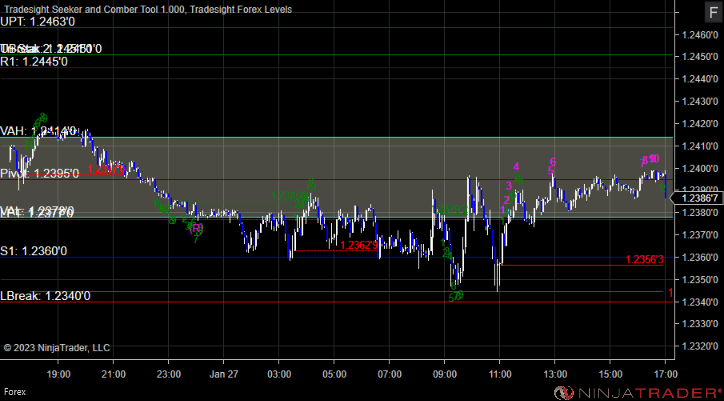

Tradesight Recap Report for 1/27/23

Today in the Markets:

The markets gapped down small, filled and moved around to nowhere early, then rallied and pulled back late for a small gain on 4.8 billion NASDAQ shares.

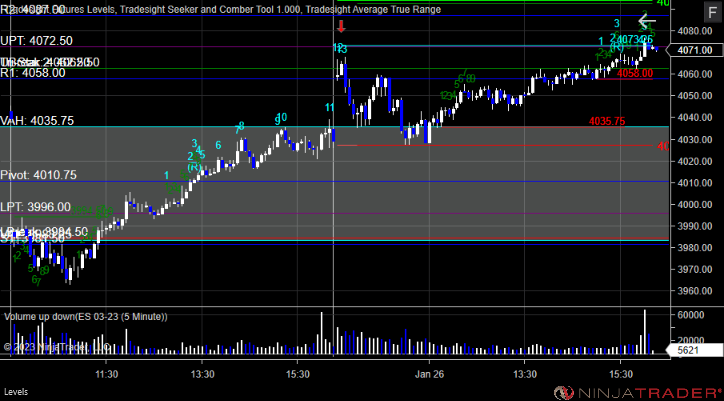

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

Additional Futures Calls:

None.

Results: +21 ticks

GBPUSD:

Results: +0 pips

No calls for the session.

These are the Tradesight calls that triggered:

Tradesight Recap Report for 1/26/23

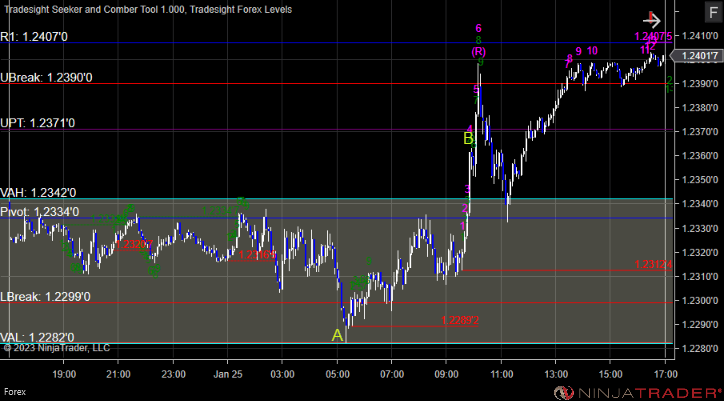

Today in the Markets:

The markets gapped up, filled, and then kind of drifted higher on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

A loser for the session. We came in carrying a trade from the prior day and that worked.

GBPUSD triggered short at A and stopped:

Results: +10 pips

A winner but without market support.

These are the Tradesight calls that triggered, Rich's MRK triggered short (without market support) and worked:

Tradesight Recap Report for 1/25/23

Today in the Markets:

The markets gapped down, but it was useless because they spent the whole day rallying to fill the gap and go nowhere on 5.1 billion NASDAQ shares.

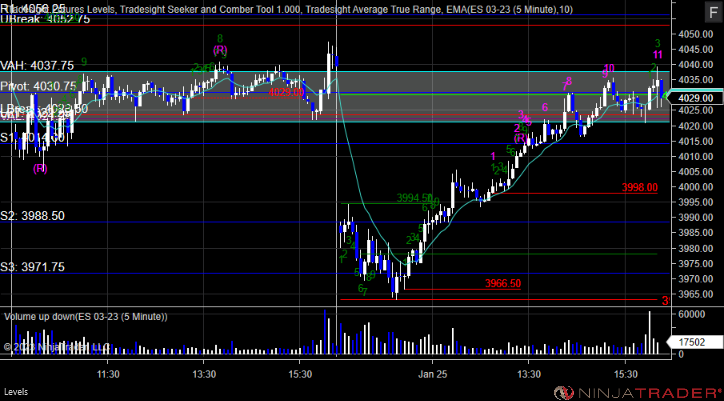

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and long at B, both too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

GBPUSD triggered short at A and stopped, triggered long at B and is still going:

Results: -25 pips plus the other trade is still going

Stocks:

Not much of a day again.

These are the Tradesight calls that triggered, COIN triggered long (with market support) and did not work, but did work later:

Tradesight Recap Report for 1/24/23

Today in the Markets:

What a horrible day. A small gap down and filled and then went dead flat for the session on 5.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and stopped, triggered short at B (not labeled) and stopped:

Additional Futures Calls:

None.

Results: -32 ticks

GBPUSD:

Results: +0 pips

Nothing triggered on a day flat day.

These are the Tradesight calls that triggered: