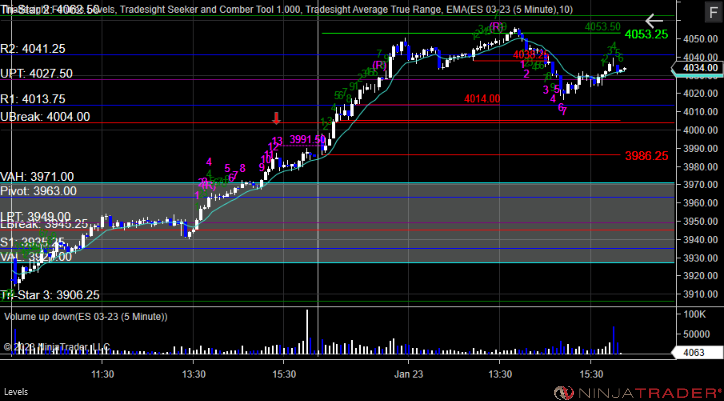

Tradesight Recap Report for 1/23/23

Today in the Markets:

The markets opened close to flat and pushed up a bit for an hour on 6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A but too far out of range to take under the current rules:

Additional Futures Calls:

None.

Results: +0 ticks

GBPUSD triggered long at A and stopped, triggered short at B and stopped.:

Results: -50 pips

A green day despite not much.

These are the Tradesight calls that triggered, Rich's MU triggered long (with market support) and worked:

Rich's LLY triggered short (without market support) and did not go enough to count:

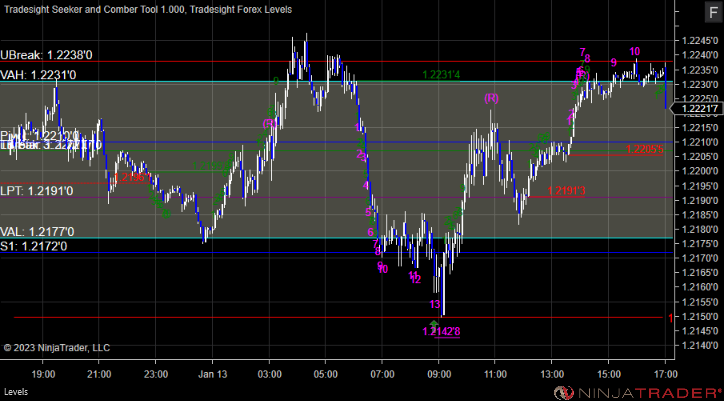

Tradesight Recap Report for 1/13/23

Today in the Markets:

The markets gapped down, then filled and closed slightly positive ahead of the long weekend on 4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and stopped, triggered long at B but too far out of range to take:

Additional Futures Calls:

None.

Results: -13 ticks

GBPUSD:

Results: +0 pips

No calls ahead of the long weekend that triggered.

These are the Tradesight calls that triggered:

None.

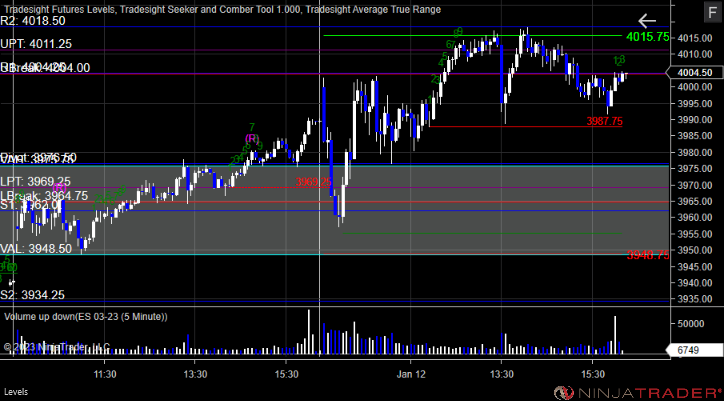

Tradesight Recap Report for 1/12/23

Today in the Markets:

A mostly dead day after an early gap up and sell off that recovered. NASDAQ volume was 4.5 billion shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

GBPUSD:

Results: +0 pips

Not a very exciting day and our first red day of the year.

These are the Tradesight calls that triggered, Rich's SPOT triggered short (with market support) and did not work:

Rich's FSLR triggered long (with market support) and did not work:

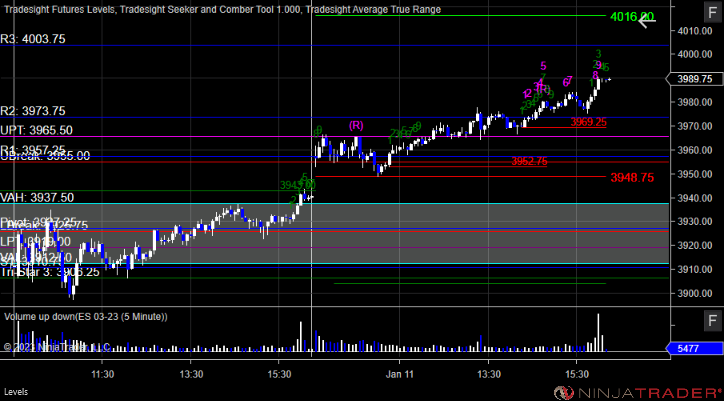

Tradesight Recap Report for 1/11/23

Today in the Markets:

We gapped up and went flat until after lunch, then drifted higher a bit on 4.3 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take, triggered long at B and stopped under the midpoint:

Additional Futures Calls:

None.

Results: -13 ticks

GBPUSD triggered short at A and stopped:

Results: -25 pips

A mixed but green day again in the markets.

These are the Tradesight calls that triggered, Rich's TSLA triggered long (with market support) and worked:

Rich's JPM triggered long (with market support) and worked a little:

Rich's META triggered long (with market support) and did not work:

That’s 3 triggers with market support, 2 of them worked and 1 didn’t.

Tradesight Recap Report for 1/10/23

Today in the Markets:

The markets opened flat and wiggled both ways, then closed near highs on 4.7 billion NASDAQ shares.

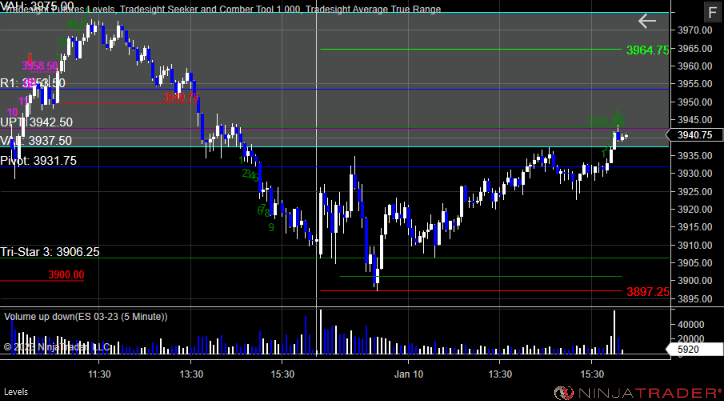

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

GBPUSD triggered short at A and stopped:

Results: -25 pips

Another green session. 6 for 6 so far this year.

These are the Tradesight calls that triggered, Rich's AVGO triggered short (with market support) and worked:

Tradesight Recap Report for 1/9/23

Today in the Markets:

The markets gapped up, pushed a little higher, and then slowly eroded back to even on 4.3 billion NASDAQ shares.

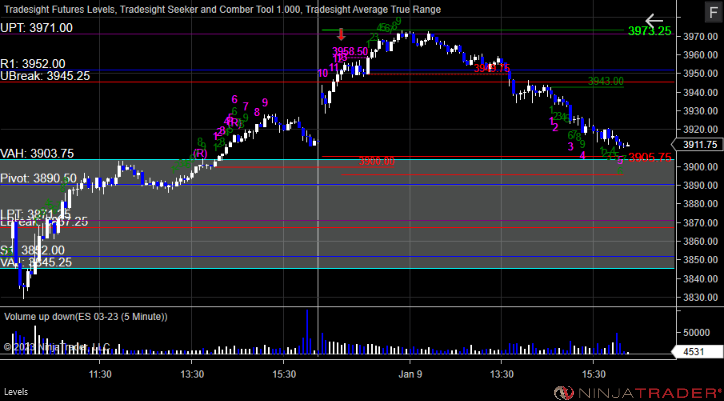

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A but too far out of range to take, triggered short at B and worked enough for a partial:

Additional Futures Calls:

None.

Results: -4 ticks

GBPUSD triggered long at A and stopped. There was no trigger at B:

Results: -25 pips

Nice to be back to work again. Lots of great trades.

These are the Tradesight calls that triggered, NVDA triggered long (with market support) and worked:

Rich's AAPL triggered long (with market support) and worked:

Rich's AMD triggered long (with market support) and worked:

Rich's HUM triggered short (with market support) and worked enough for a partial:

Rich's MU triggered long (with market support) and did not work:

Tradesight Recap Report for 12/30/22

Today in the Markets:

Tradesight was closed for end of year, but the markets gapped down, went flat, and rallied to almost even for the session on 4.5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A but too far out of range to take, triggered short at B and worked:

Additional Futures Calls:

None.

Results: +19 ticks

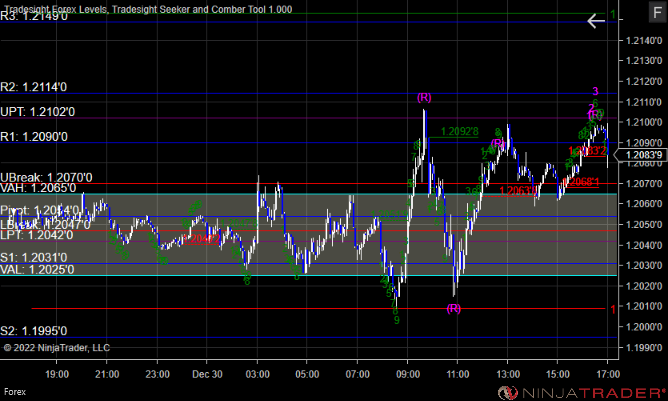

GBPUSD:

Results: +0 pips

Tradesight Recap Report for 12/29/22

Today in the Markets:

The markets recovered the downward move from the day before on 3.6 billion NASDAQ shares. Not too many people around.

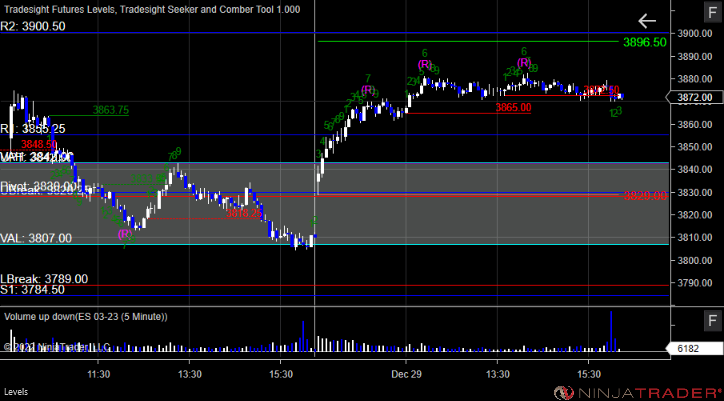

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

Additional Futures Calls:

None.

Results: +25 ticks

Results: -25 pips

No calls. Tradesight is done for the year.

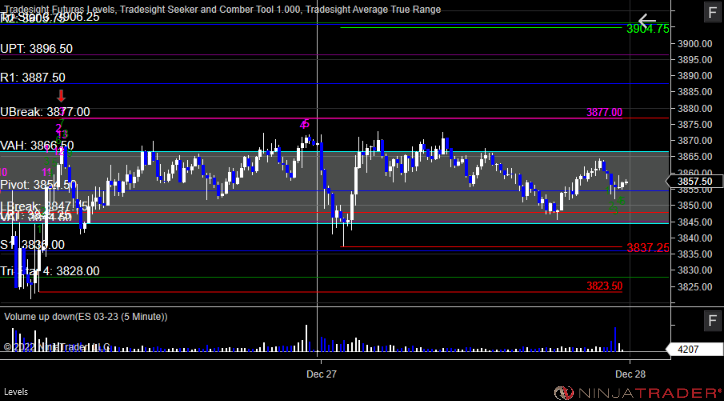

Tradesight Recap Report for 12/28/22

Today in the Markets:

Markets slipped back a bit, probably showing us the biggest move of the week on 4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and short at B, both too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

GBPUSD triggered long at A and stopped, there was no trigger at B:

Results: -25 pips

Nothing triggered, not much to call.

Tradesight Recap Report for 12/27/22

Today in the Markets:

We expect a dead week for the end of the year, and so far, that's what we are getting. Literally didn't do anything to start the short week.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

GBPUSD:

Results: pips

Nothing triggered, not much called. Expect that most of the week.