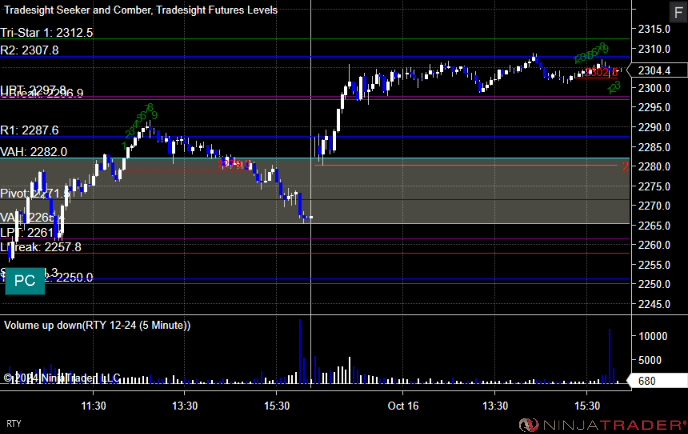

Tradesight Recap Report for 10/16/24

Today in the Markets:

The markets opened flat and headed up on 5.1 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered short at A and did not work, long at B was too far out of range:

Additional Futures Calls:

None.

Results: -17 ticks

Stocks:

No triggers on the session.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

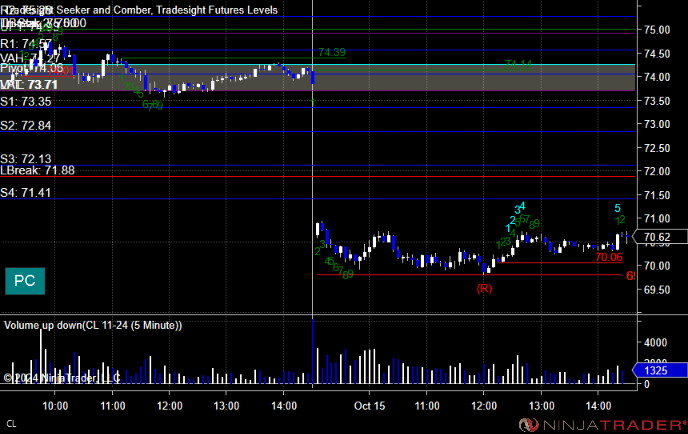

Tradesight Recap Report for 10/15/24

Today in the Markets:

The markets opened flat and then sold off on 4.9 billion NASDAQ shares, giving back the prior day's gains.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered at A and worked:

Additional Futures Calls:

None.

Results: +4 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered, NFLX triggered short (with market support) and did not work:

MRK triggered long (without market support) and worked:

That's 1 triggered with market support, and it did not work.

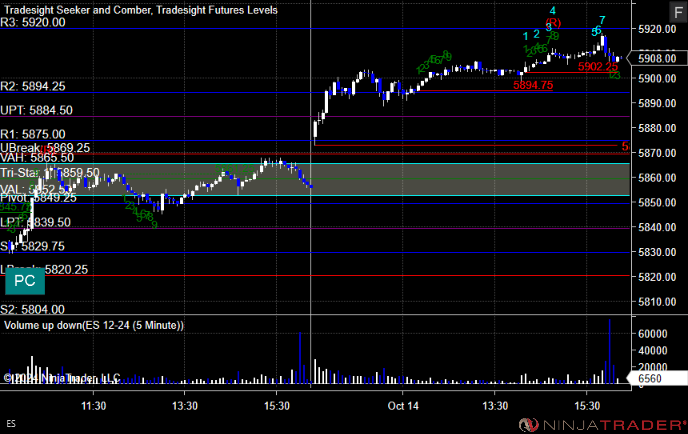

Tradesight Recap Report for 10/14/24

Today in the Markets:

The markets gapped up and rallied to new highs on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered long at A and worked:

Additional Futures Calls:

None.

Results: +13 ticks

Stocks:

No triggers for the session after the gap.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

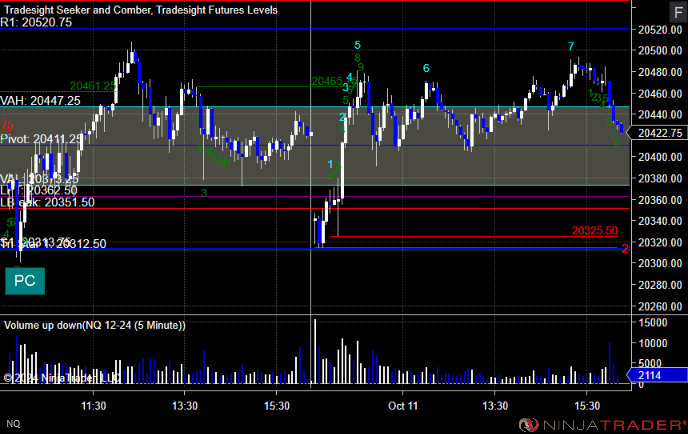

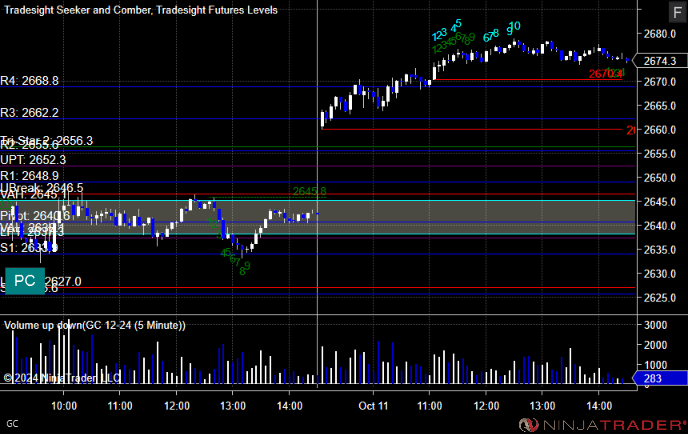

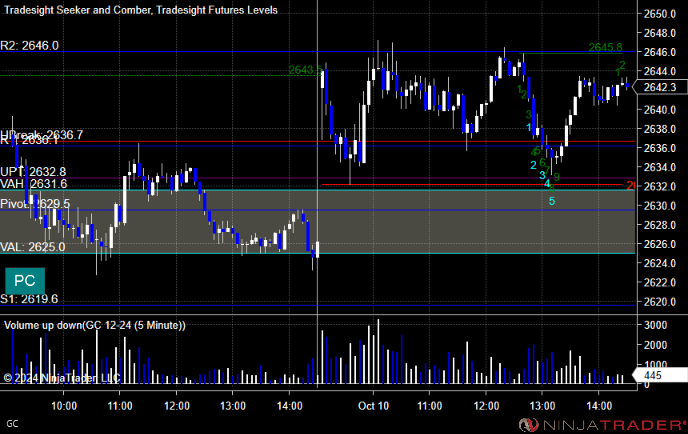

Tradesight Recap Report for 10/11/24

Today in the Markets:

The markets opened flat and rallied again but were dead flat after the first hour on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Nothing triggered in range.

ES Opening Range Play, at A was out of range to take long:

Additional Futures Calls:

None.

Results:

Stocks:

Just nothing.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

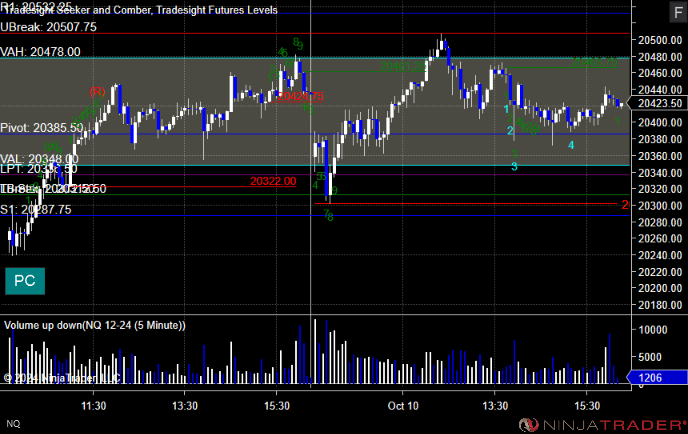

Tradesight Recap Report for 10/10/24

Today in the Markets:

The markets gapped down a little and closed where they opened on 5 billion NASDAQ shares. Such junk,

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered short at A and worked, triggered long at B and did not work:

Additional Futures Calls:

None.

Results: -13 ticks

Stocks:

Two calls triggered and worked.

These are the Tradesight calls that triggered, ABNB triggered short (with market support) and worked:

Rich's TSLA triggered short (with market support) and worked:

That's 2 triggered with market support, and both worked.

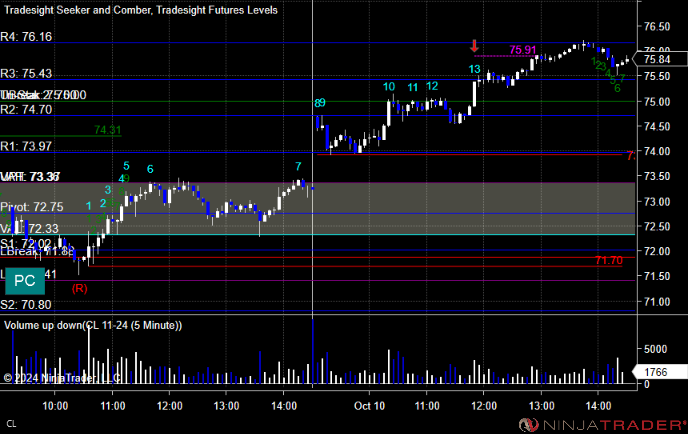

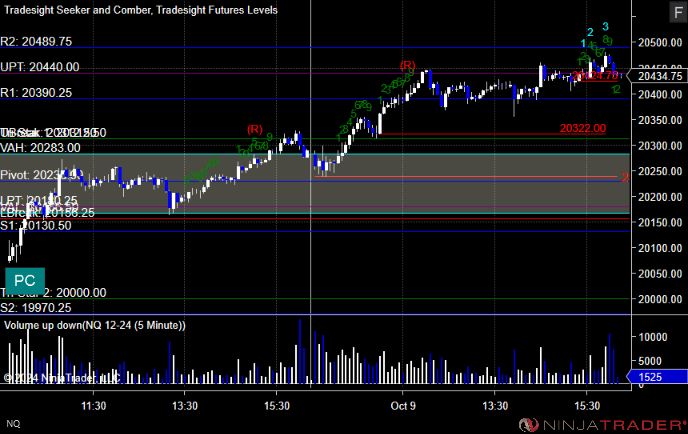

Tradesight Recap Report for 10/9/24

Today in the Markets:

The markets opened flat and headed up early and then went flat for hours on 4.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered short at A and did not work, triggered long at B and worked:

Additional Futures Calls:

None.

Results: -10 ticks

Stocks:

Nothing triggered.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

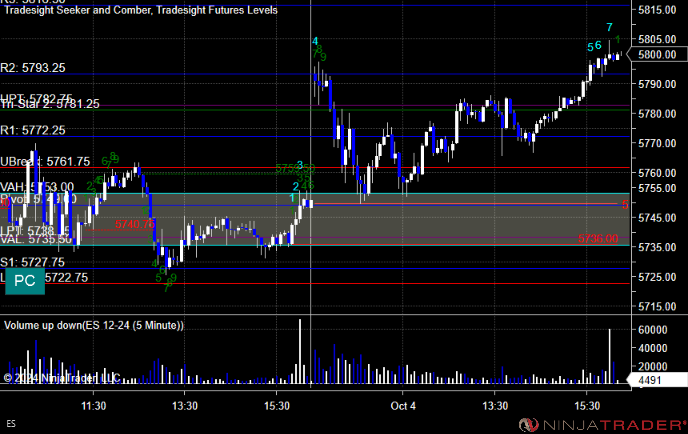

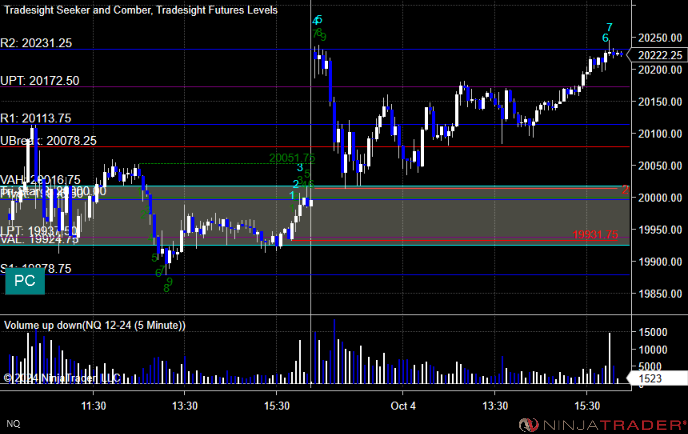

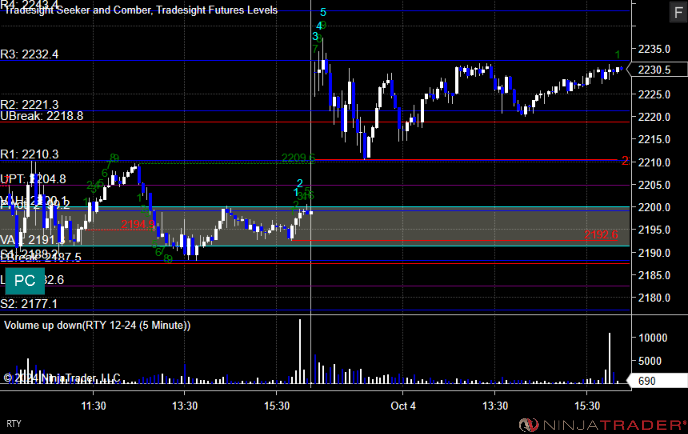

Tradesight Recap Report for 10/4/24

Today in the Markets:

The markets gapped up pretty big, and then came all the way back to fill the gap exactly, and then rally back over the course of several hours to close where they opened once again, on 4.7 billion NASDAQ shares, which is light volume.

ES with Levels:

ES with Market Directional:

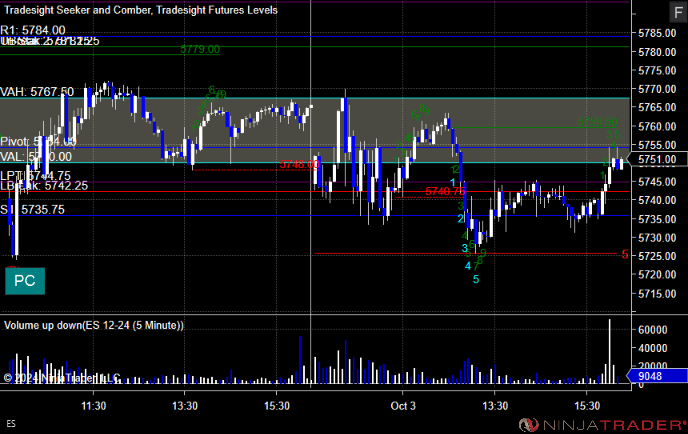

NQ with Levels:

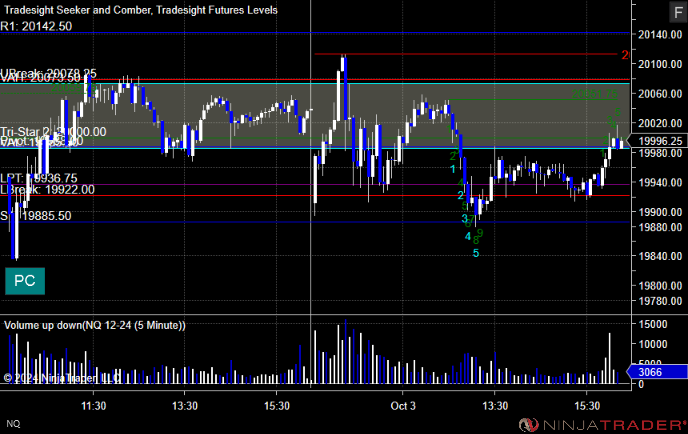

RTY with Levels:

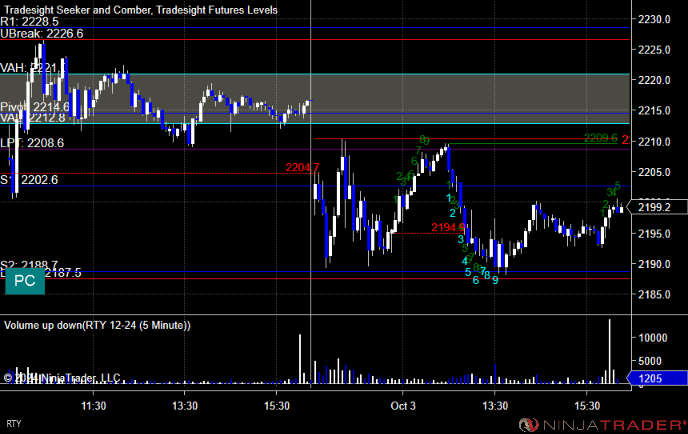

CL with Levels:

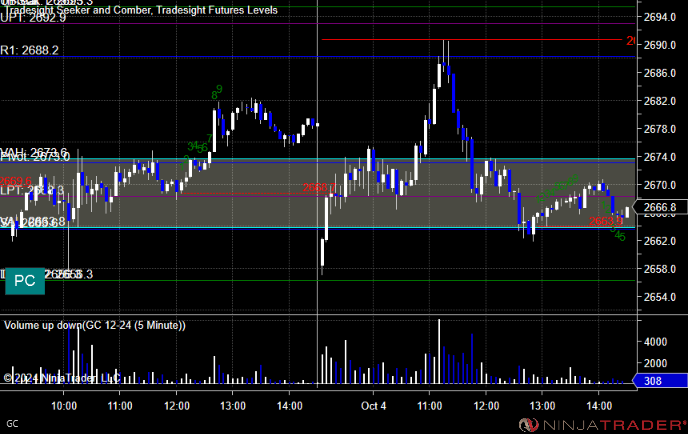

GC with Levels:

Futures:

Nothing triggered in range.

ES Opening Range Play, at A was out of range to take short:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered, AMD triggered long (with market support) and worked:

LLY triggered short (with market support) and did not work:

That's 2 triggered with market support, 1 worked and 1 did not.

Tradesight Recap Report for 10/3/24

Today in the Markets:

The markets gap down a little bit and then filled the gap quickly and then wiggled both ways and ended up closing about where they opened on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered at A and worked, triggered at B and did not work:

Additional Futures Calls:

None.

Results: -7 ticks

Stocks:

Another day without triggers in a dead market.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

Tradesight Recap Report for 10/2/24

Today in the Markets:

The market's gap down filled the gap in about an hour and a half, and then sat flat for the rest of the day on 4.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

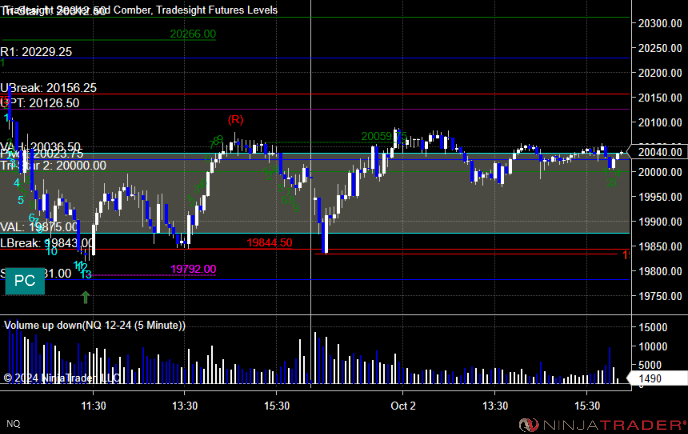

NQ with Levels:

RTY with Levels:

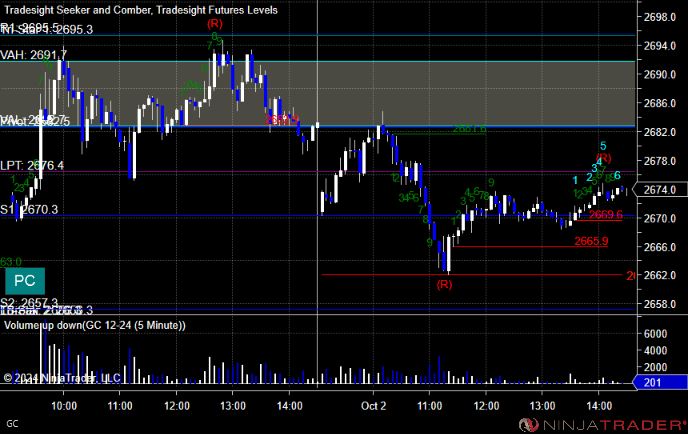

CL with Levels:

GC with Levels:

Futures:

Nothing triggered in range.

ES Opening Range Play, at A was out of range to take short and at B was out of range to take long:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

One call triggered.

These are the Tradesight calls that triggered, Rich's AAPL triggered short (with market support) and did not work:

That's 1 triggered with market support, and it did not work.

Tradesight Recap Report for 10/1/24

Today in the Markets:

The markets open flat and sold off quickly and then. bounced around for the next six hours on 5.2 billion NASDAQ shares.

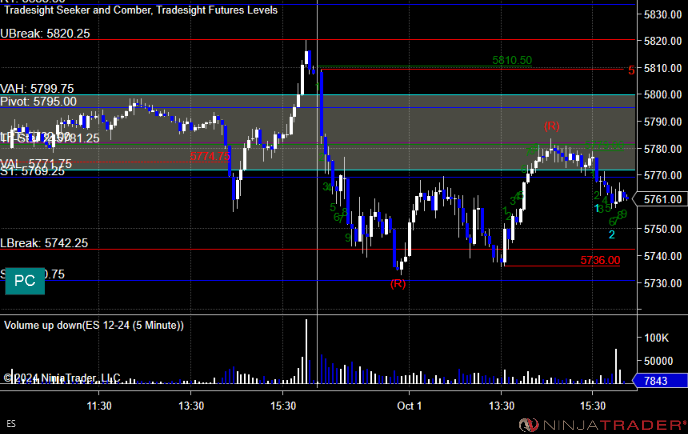

ES with Levels:

ES with Market Directional:

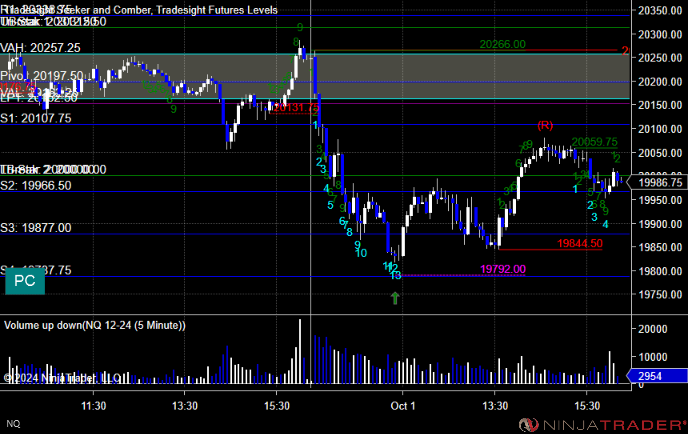

NQ with Levels:

RTY with Levels:

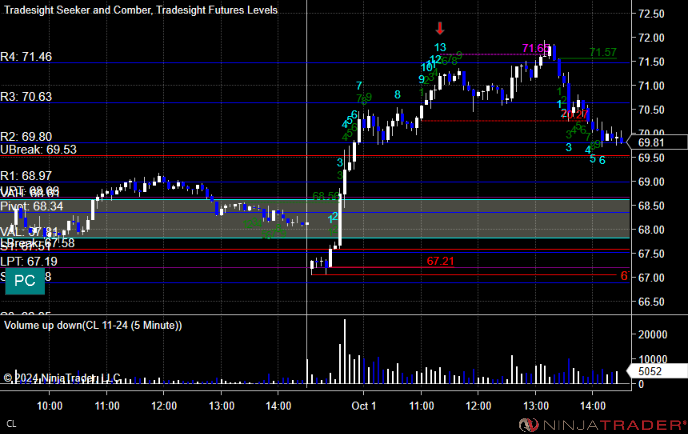

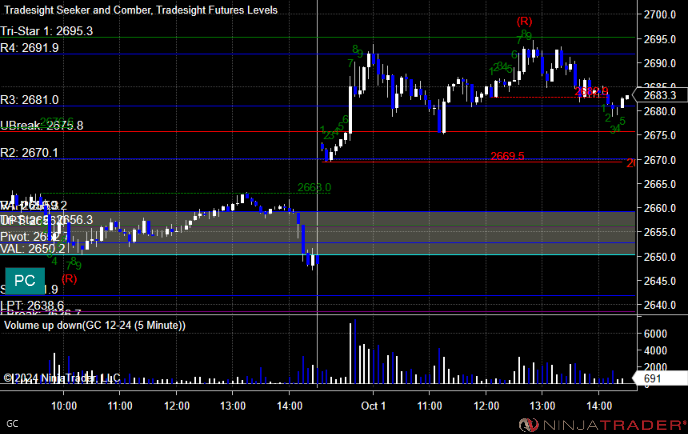

CL with Levels:

GC with Levels:

Futures:

No calls triggered.

ES Opening Range Play, One call triggered short at A but too far out of range.

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered, EBAY triggered long (without market support) and worked:

Rich's RDDT triggered short (with market support) and did not work:

That's 1 triggered with market support, and it did not work.