Tradesight Recap Report for 9/20/24

Today in the Markets:

The market's gapped down and went lower than came back, filled the gap and closed slightly negative on the session on 7.0 billion NASDAQ shares because of options expiration.

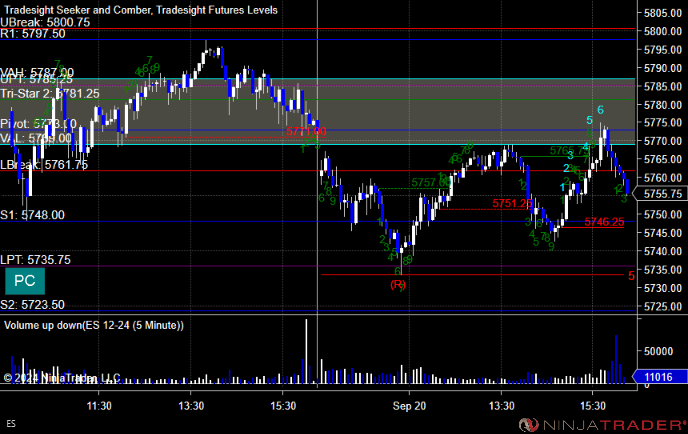

ES with Levels:

ES with Market Directional:

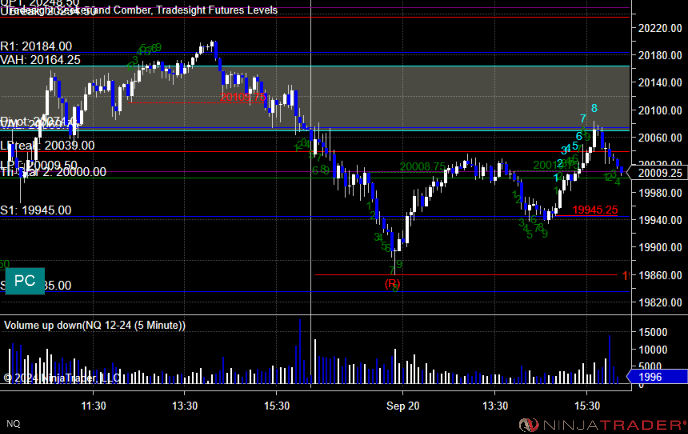

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered long at A and worked, triggered short at B and did not work:

Additional Futures Calls:

None.

Results: -10 ticks

Stocks:

Nothing triggered on a dead day for options expiration.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

Tradesight Recap Report for 9/19/24

Today in the Markets:

The markets gapped up and went dead flat after the Fed on 7 billion NASDAQ shares.

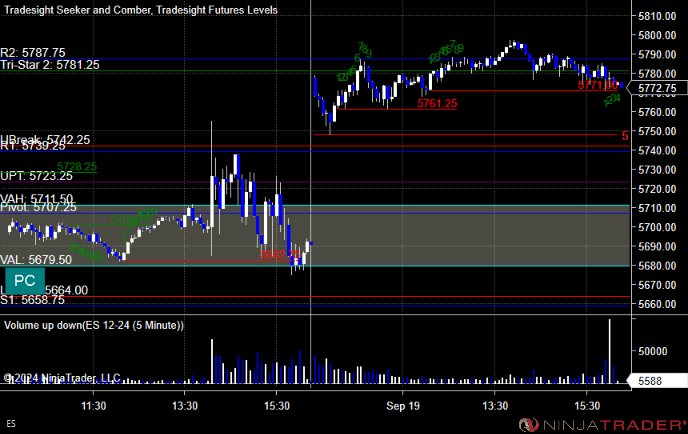

ES with Levels:

ES with Market Directional:

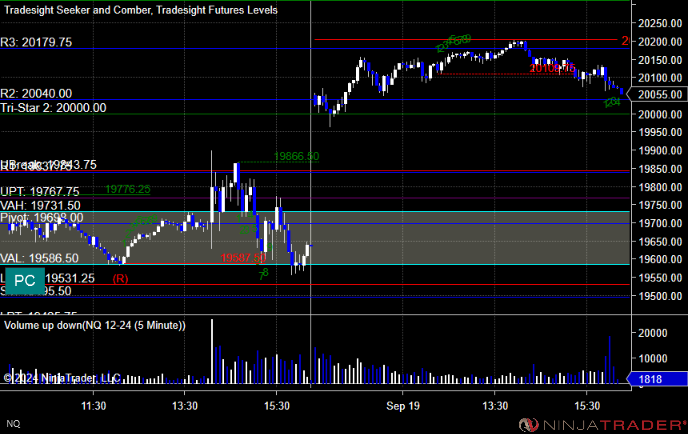

NQ with Levels:

RTY with Levels:

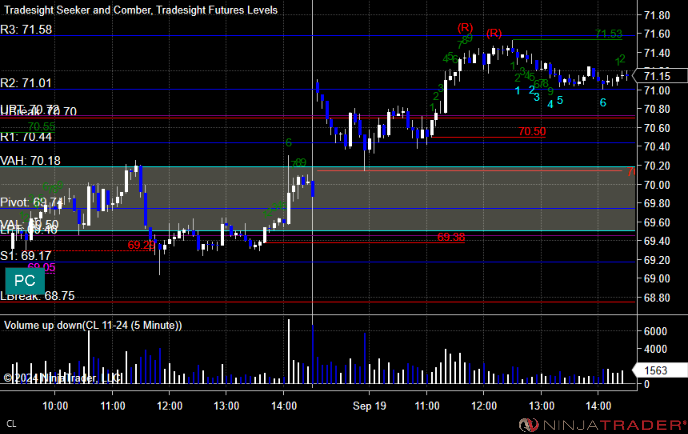

CL with Levels:

GC with Levels:

Futures:

No calls triggered.

ES Opening Range Play, triggered short at A but too far out of range:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

Three calls triggered.

These are the Tradesight calls that triggered COIN triggered short (with market support) and did not work:

NFLX triggered long (with market support) and did not work:

ANET triggered long (without market support) and did not work:

That's 2 triggered with market support, and both did not work.

Tradesight Recap Report for 9/18/24

Today in the Markets:

The markets opened flats and didn't do anything all day until the Fed announcement then spiked up and came back and closed at the low of the value area on 5.5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

No calls triggered.

ES Opening Range Play, triggered long at A but too far out of range:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

Nothing triggered.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

Tradesight Recap Report for 9/17/24

Today in the Markets:

The markets gapped up, trying to go higher, and then came back and filled the gap and closed almost even on 5.1 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

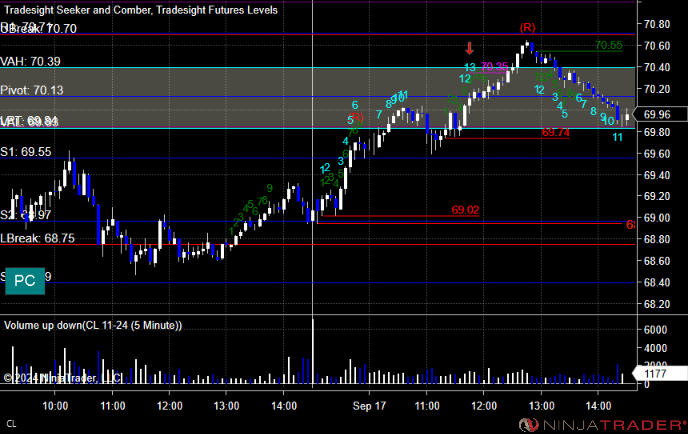

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered long at A and did not work, triggered short at B and did not work:

Additional Futures Calls:

None.

Results: -32 ticks

Stocks:

Three calls triggered.

These are the Tradesight calls that triggered, MU triggered long (with market support) and did not work:

TXN triggered short (with market support) and did not work:

HOOD triggered long (without market support) and did not go enough to count:

That's 2 triggered with market support, 0 worked and 2 did not.

Tradesight Recap Report for 9/16/24

Today in the Markets:

The market's open flat, tried to go higher, tried to go lower and closed, barely positive on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

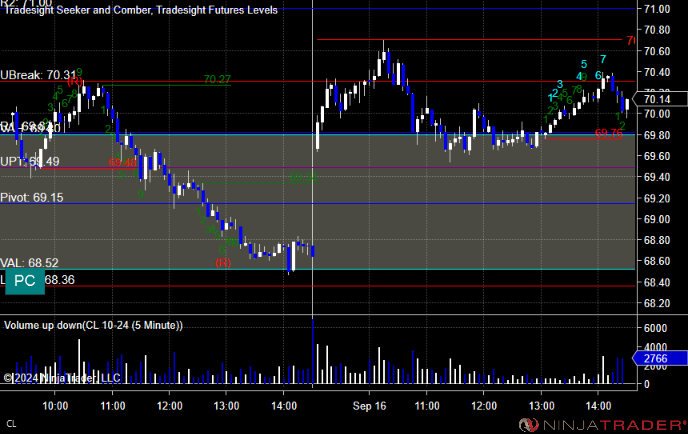

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered short at A but too far out of range, triggered long at B and worked:

Additional Futures Calls:

None.

Results: +6 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered, HUM triggered short (with market support) and worked:

TXN triggered short (with market support) and worked:

That's 2 triggered with market support, both worked.

Tradesight Recap Report for 9/6/24

Today in the Markets:

The markets open flat and sold off on a Friday on 5.1 billion NASDAQ shares.

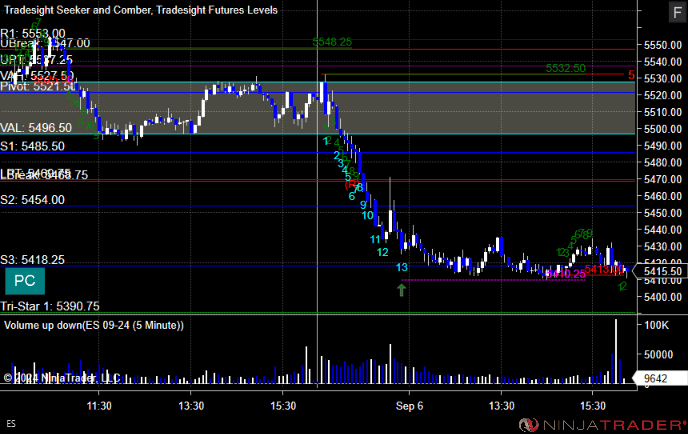

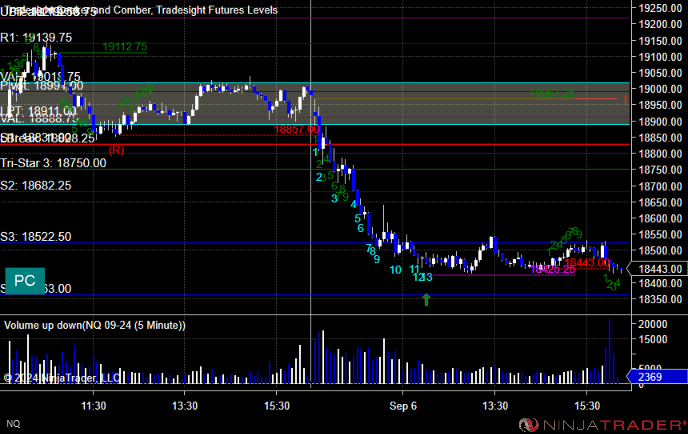

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

No calls triggered.

ES Opening Range Play, triggered short at A but too far out of range:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

Nothing to do here. No triggers.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

Tradesight Recap Report for 9/5/24

Today in the Markets:

The markets opened basically flat, pushed higher and then pulled back, made new lows for the day, and then came back up to even and closed slightly lower on 5.2 billion NASDAQ shares.

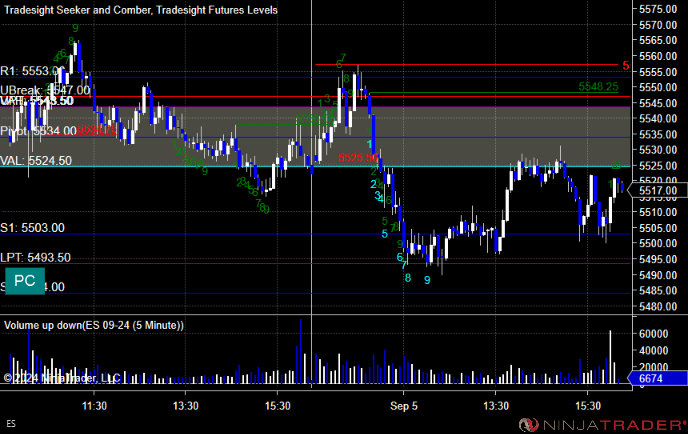

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered short at A and did not work, triggered long at B and worked enough for a partial:

Additional Futures Calls:

None.

Results: -16 ticks

Stocks:

Three calls triggered.

These are the Tradesight calls that triggered, META triggered long (with market support) and did not work:

HUM triggered short (without market support) and worked:

Rich's FAS triggered short (direction not needed for an ETF) and worked:

That's 2 triggered with market support, 1 worked and 1 did not.

Tradesight Recap Report for 9/4/24

Today in the Markets:

A dead flat day with the markets opening down a couple of points filling and then going sideways for the rest of the session on 4.9 billion NASDAQ shares.

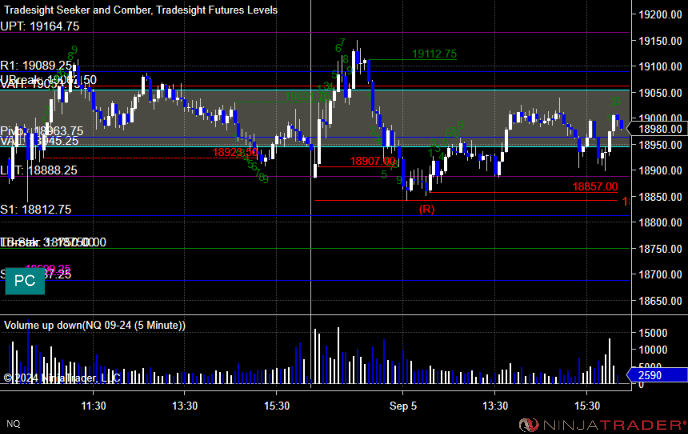

ES with Levels:

ES with Market Directional:

NQ with Levels:

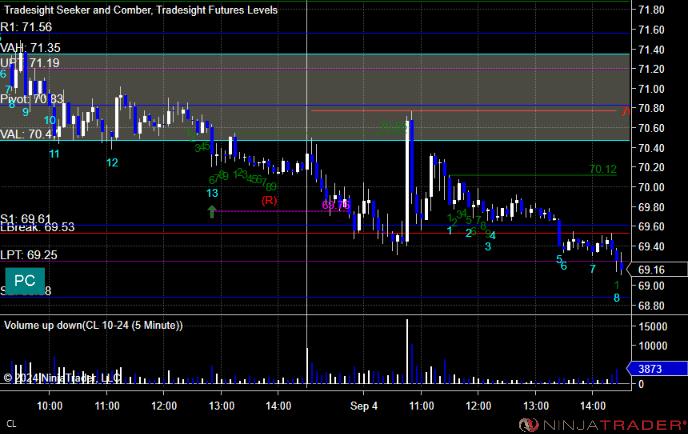

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered long at A and worked:

Additional Futures Calls:

None.

Results: +12 ticks

Stocks:

One call triggered.

These are the Tradesight calls that triggered, Rich's SLB triggered short (without market support) and worked:

That's 0 triggered with market support.

Tradesight Recap Report for 9/3/24

Today in the Markets:

The markets gapped down and then went lower and closed near the lows of the day on 5.4 billion NASDAQ shares.

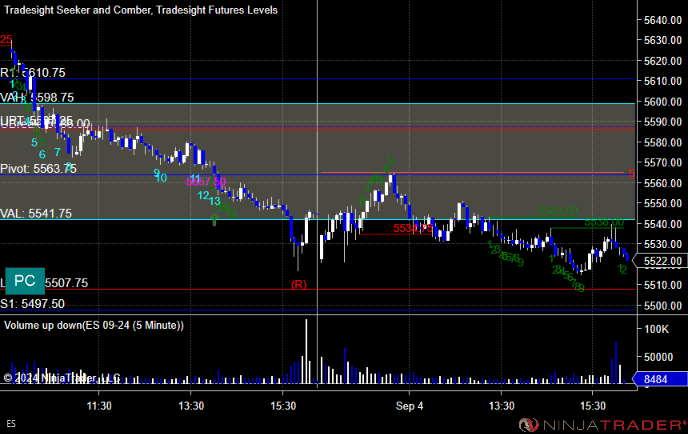

ES with Levels:

ES with Market Directional:

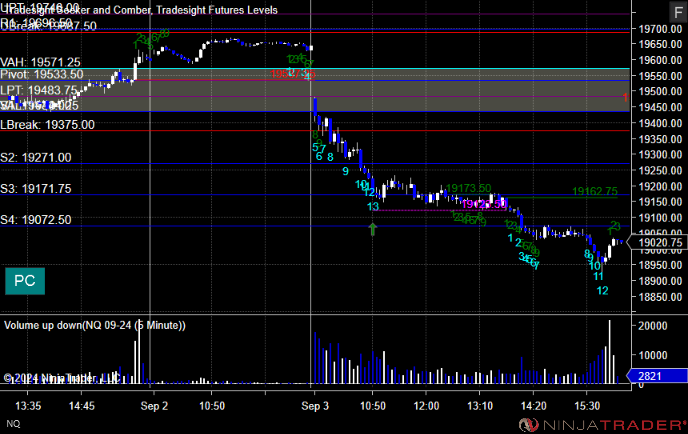

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

No calls triggered.

ES Opening Range Play, triggered short at A but too far out of range:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

No stock trades triggered which is not unusual on the first day back from a long weekend.

These are the Tradesight calls that triggered:

None

That's 0 triggered with market support.

Tradesight Recap Report for 8/23/24

Today in the Markets:

The markets gapped up, pushed higher, came back, pushed higher again, came back, almost filled the gap, and then closed above where they opened on 5.1 billion NASDAQ shares.

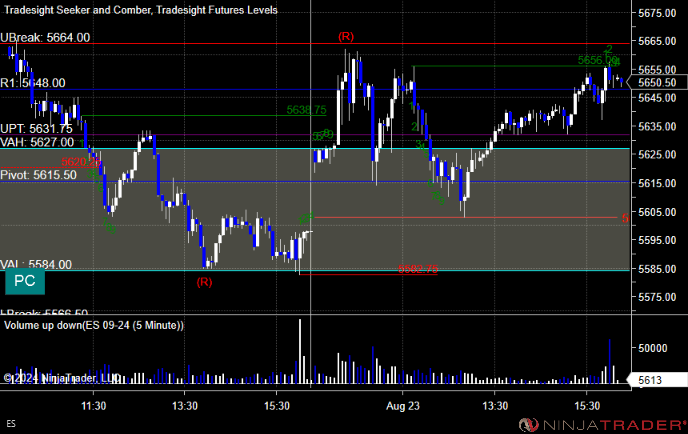

ES with Levels:

ES with Market Directional:

NQ with Levels:

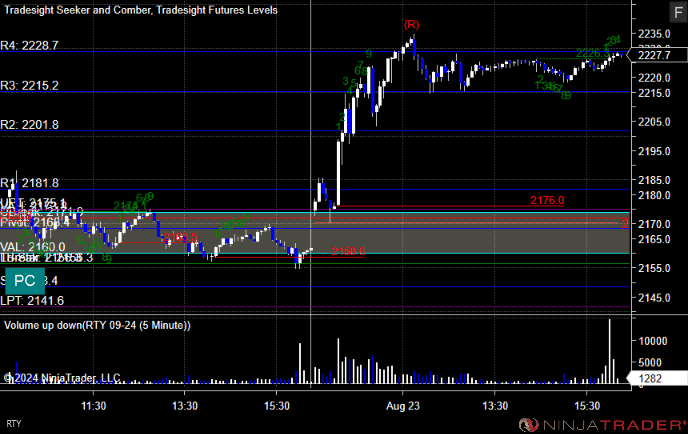

RTY with Levels:

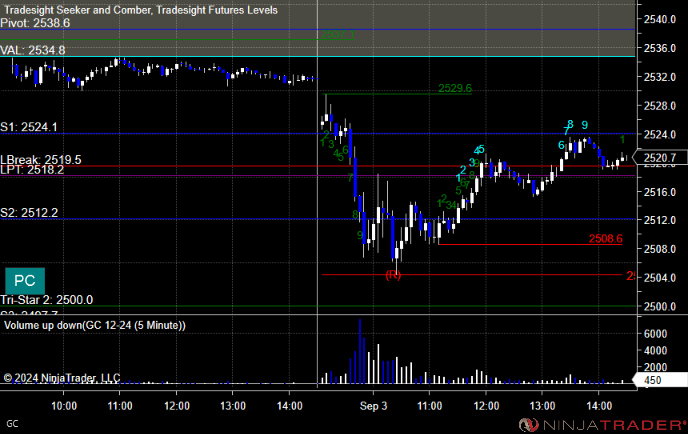

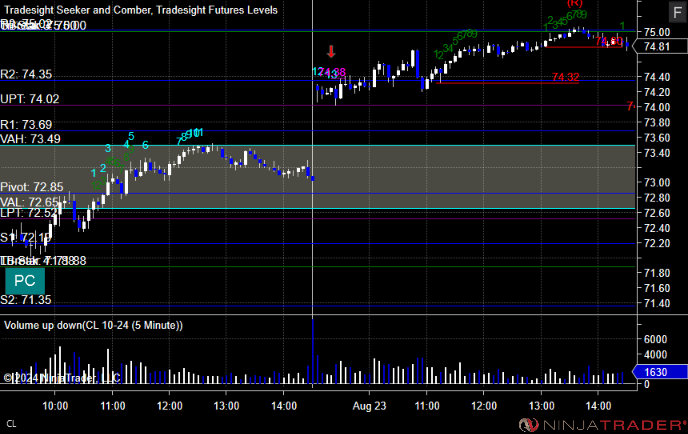

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered long at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

Nothing triggered again.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.