Tradesight Recap Report for 6/28/24

Today in the Markets:

The markets open flat again, pushed higher, came back, sat in the value area most of the day, and closed slightly negative, following the debate to end the second quarter on 8 billion NASDAQ shares, which is all about end of quarter volume printing.

ES with Levels:

ES with Market Directional:

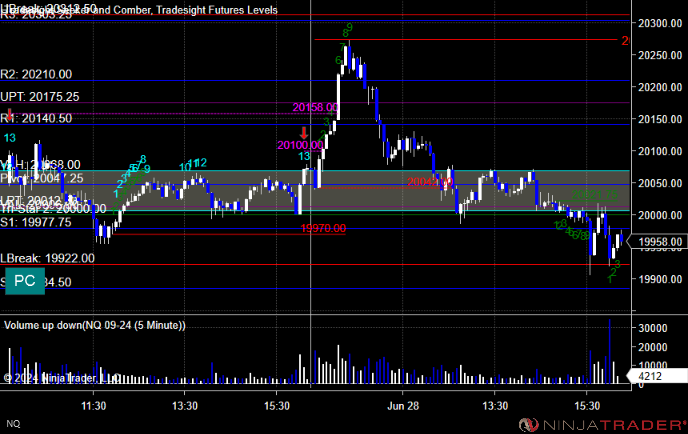

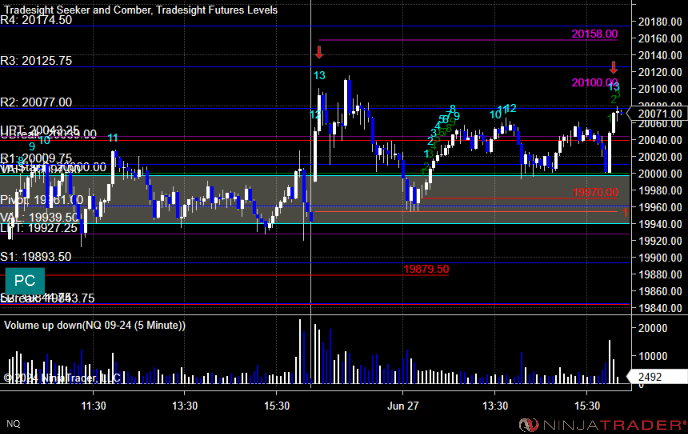

NQ with Levels:

RTY with Levels:

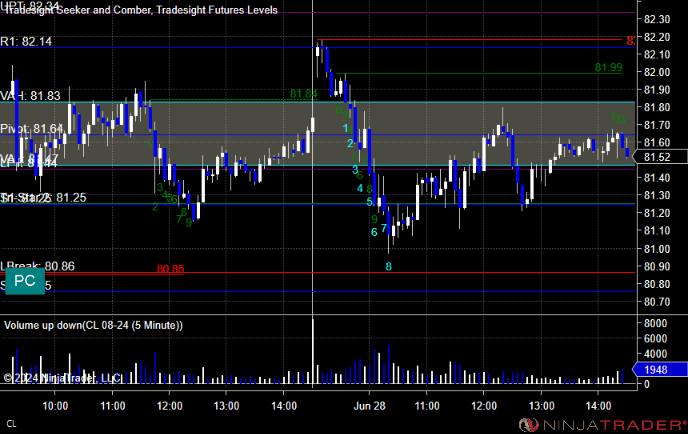

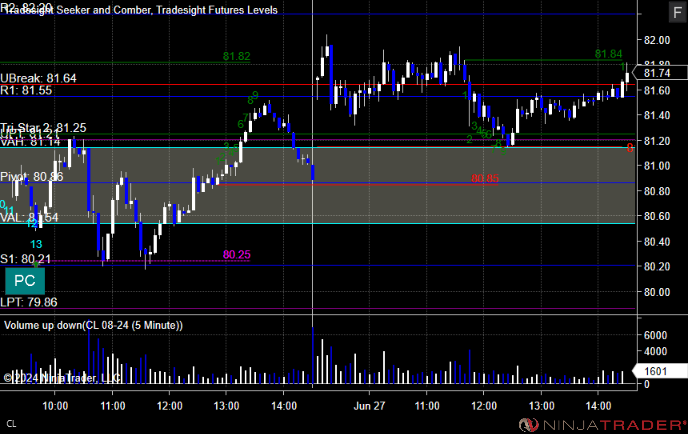

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered long at A and worked:

Additional Futures Calls:

None.

Results: +13 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered, EXPE triggered long (with market support) and did not go enough to count:

WYNN triggered long (with market support) and did not go enough to count:

That's 2 triggered with market support, both did not go enough to count.

Tradesight Recap Report for 6/27/24

Today in the Markets:

As we head into the end of the second quarter, we're getting exactly what we expected. The markets opened flat and basically stayed flat all day and then closed slightly positive on the last minute push on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered long at A and worked:

Additional Futures Calls:

None.

Results: +14 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered, WDAY triggered long (with market support) and worked:

Craig's PINS triggered short (with market support) and worked:

That's 2 triggered with market support, and they both worked.

Tradesight Recap Report for 6/26/24

Today in the Markets:

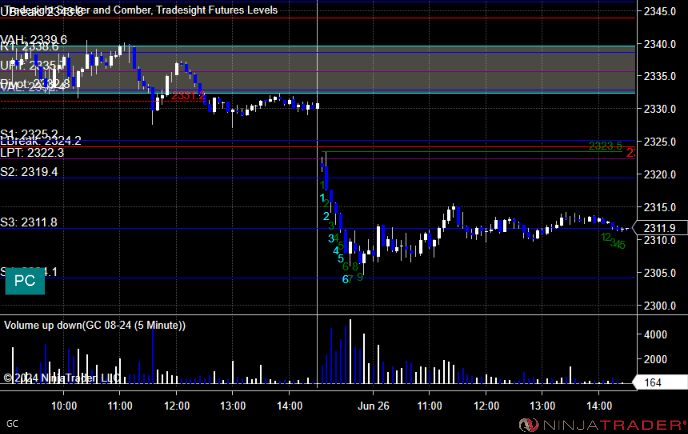

The markets had a tiny gap down, which it filled with in the first hour Then it drifted back lower, came back up and sat flat for the rest of the day, closing basically even on 4.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered long at A and did not work:

Additional Futures Calls:

None.

Results: -16 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered, Rich's AVGO triggered long (with market support) and did not work:

Rich's QCOM triggered short (without market support) and worked:

That's 1 triggered with market support, and it did not work.

Tradesight Recap Report for 6/25/24

Today in the Markets:

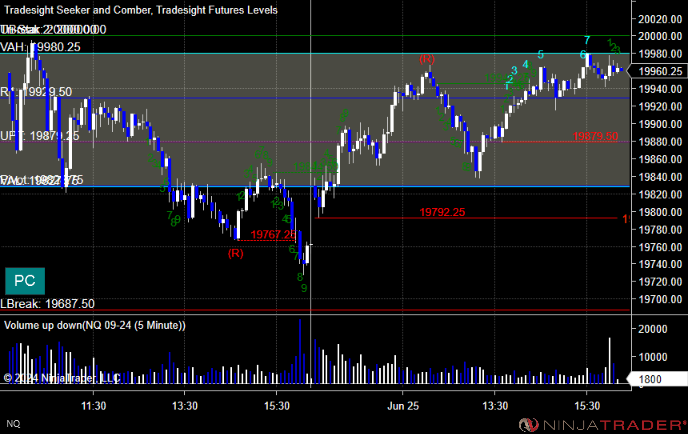

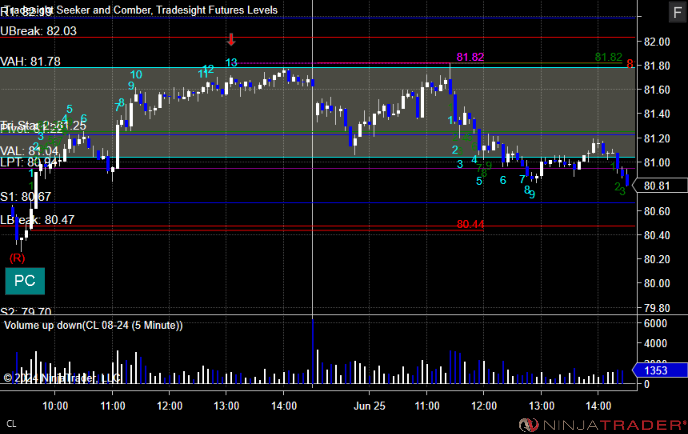

The markets opened flat basically again with a tiny gap U, and then filled it right over lunch after being flat for hours, and then lifted slightly into the close. NASDAQ volume was 5.1 billion shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered short at A and did not work, triggered long at B and did not work:

Additional Futures Calls:

None.

Results: -32 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered, Rich's GOOGL triggered long (with market support) and worked:

Rich's MRVL triggered short (without market support as it triggered in the first five minute candle) and worked:

That's 1 triggered with market support, and it worked.

Tradesight Recap Report for 6/24/24

Today in the Markets:

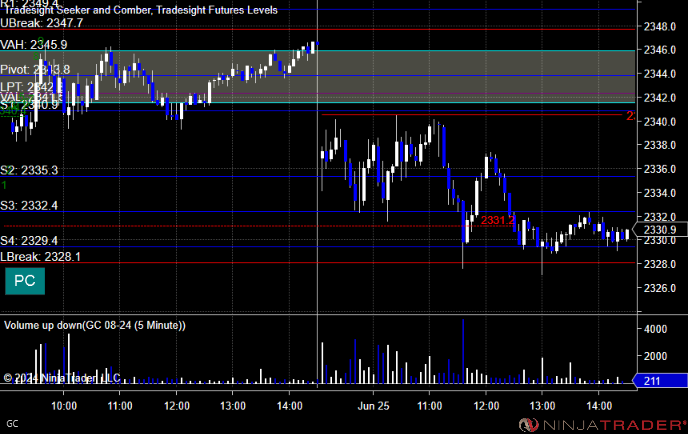

The markets open flat and then popped up a bit, came back over lunch to even sat there until the last 15 minutes of the day on 4.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

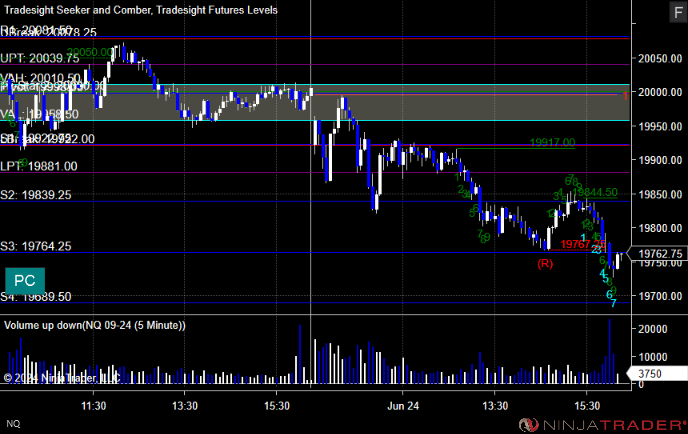

NQ with Levels:

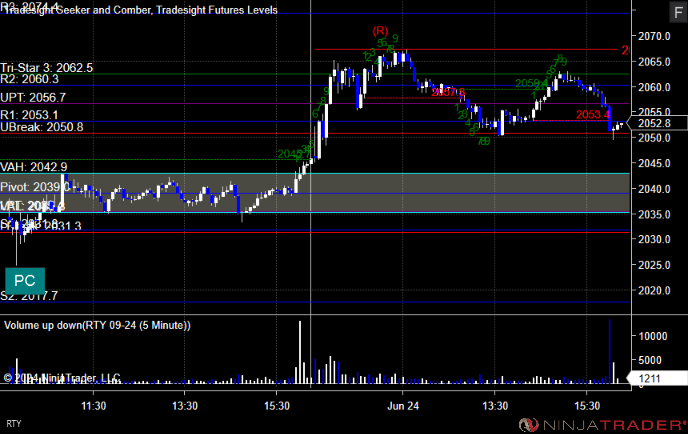

RTY with Levels:

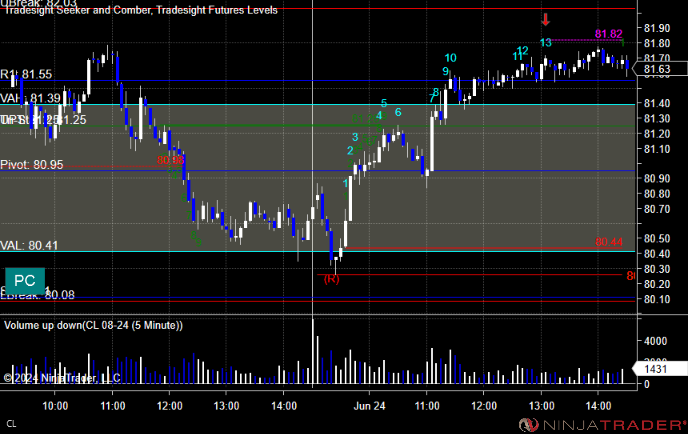

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered long at A and did not work, triggered short at B and worked:

Additional Futures Calls:

None.

Results: -13 ticks

Stocks:

Five calls triggered.

These are the Tradesight calls that triggered, META triggered short (with market support) and worked:

SPOT triggered short (with market support) and did not go enough to count:

Rich's SNOW triggered short (with market support) and did not go enough to count:

HD triggered short (without market support) and worked:

Rich's ADBE triggered long (without market support as it triggered in the first five minute candle) and did not work:

That's 3 triggered with market support, 1 worked and 2 did not go enough to count.

Tradesight Recap Report for 6/14/24

Today in the Markets:

Markets gapped down and eventually slowly filled on 4.7 billion nasdaq shares as we head into the week of Juneteenth.

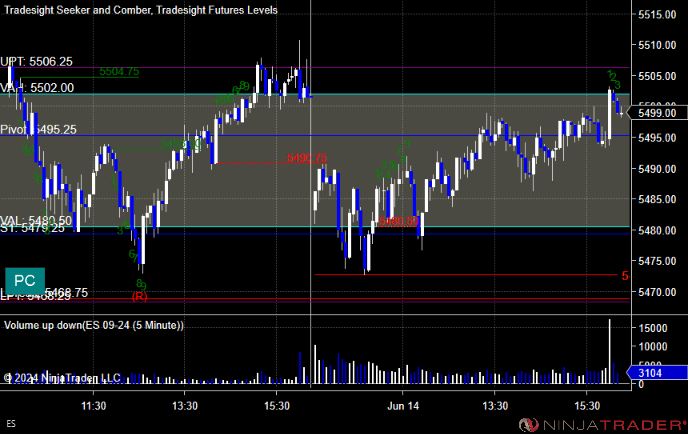

ES with Levels:

ES with Market Directional:

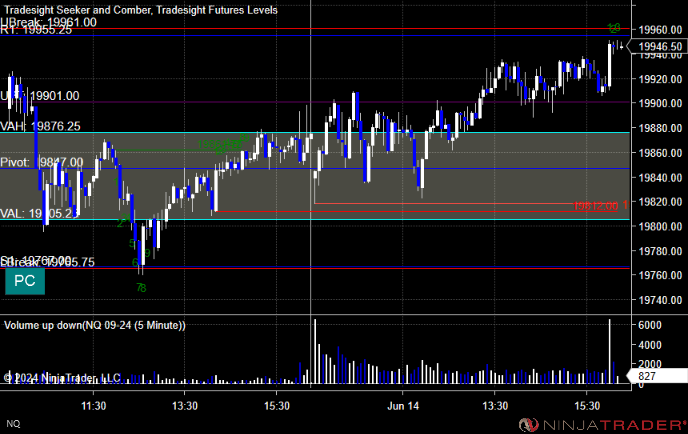

NQ with Levels:

RTY with Levels:

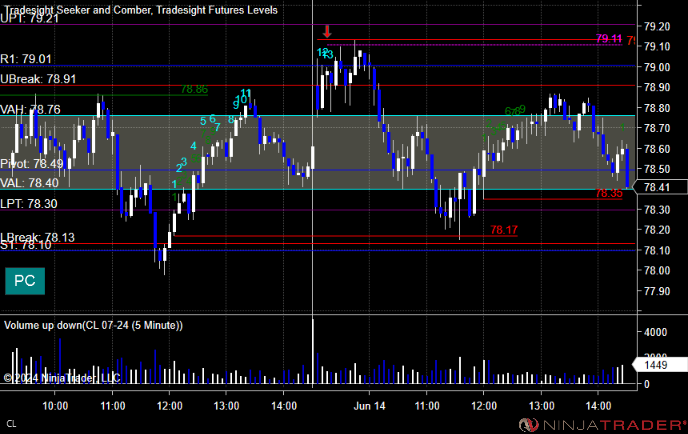

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered long at A and worked, triggered short at B and did not work:

Additional Futures Calls:

None.

Results: -7 ticks

Stocks:

One call triggered.

These are the Tradesight calls that triggered, SHOP triggered long (with market support) and worked:

That's 1 triggered with market support, and it worked.

Tradesight Recap Report for 6/13/24

Today in the Markets:

The markets gapped up a bit after the Fed and filled and then closed just above even. Still boring on 4.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

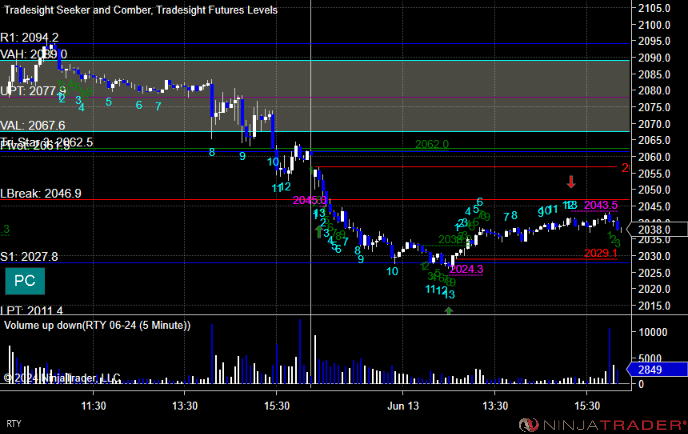

RTY with Levels:

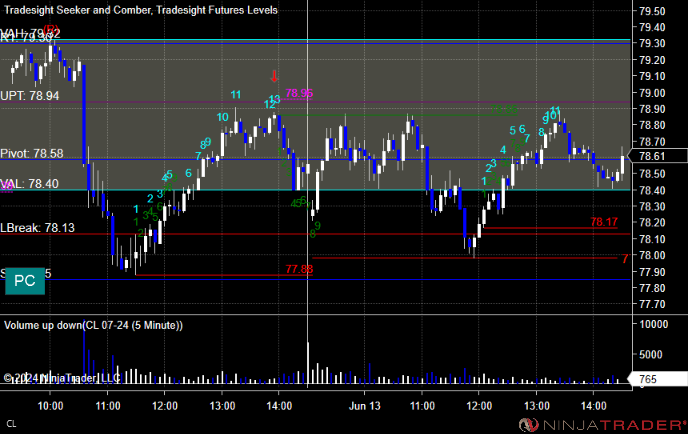

CL with Levels:

GC with Levels:

Futures:

One call triggered. A small winner.

ES Opening Range Play, triggered short at A and worked:

Additional Futures Calls:

None.

Results: +4 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered, Rich's FCX triggered short (with market support) and worked:

Rich's CAT triggered short (with market support) and worked:

That's 2 triggered with market support, 1 worked and 1 did not work.

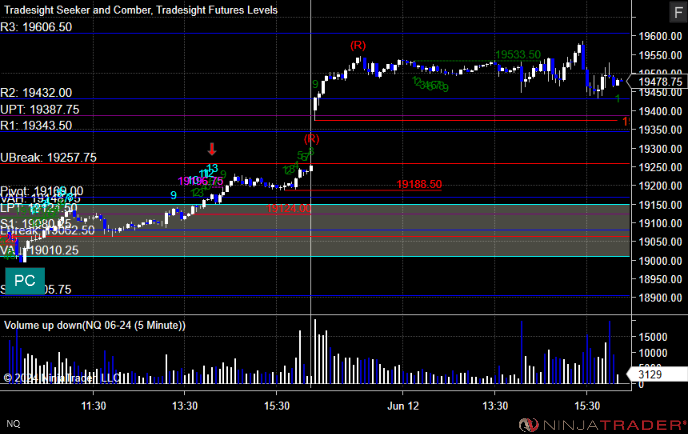

Tradesight Recap Report for 6/12/24

Today in the Markets:

The markets gapped up and went dead flat and didn't even shake on the Fed announcement. The CPI was more important. NASDAQ volume was 5.2 billion shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered. Another strong day for futures.

ES Opening Range Play, triggered long at A and worked:

Additional Futures Calls:

None.

Results: +21 ticks

Stocks:

Nothing to do ahead of the Fed or after. No shocker.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

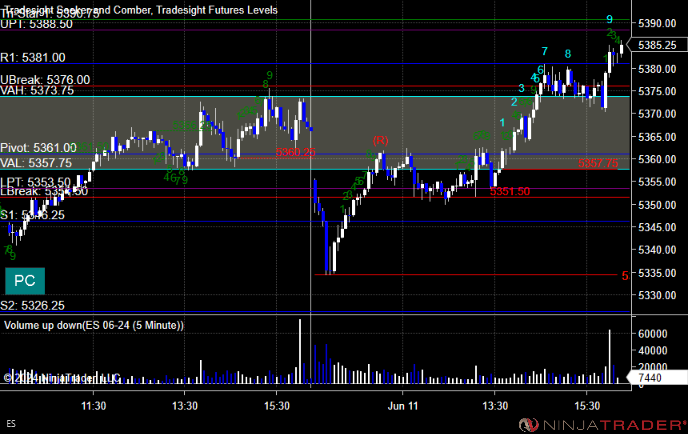

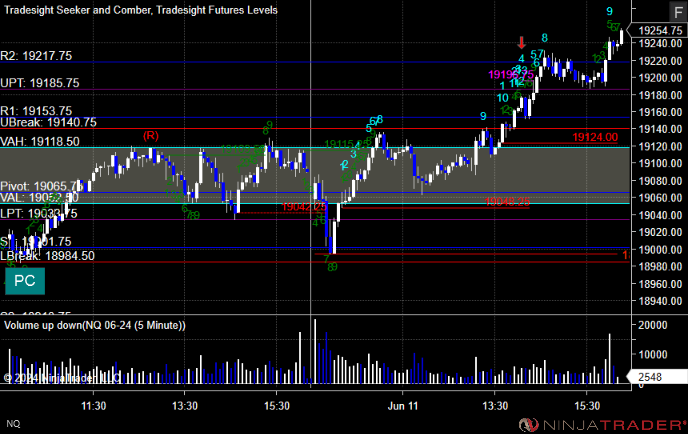

Tradesight Recap Report for 6/11/24

Today in the Markets:

Same as yesterday. The markets gapped down, filled the gap during lunch, and closed slightly green, but there's just nothing here ahead of the Fed on 4.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered short at A and worked:

Additional Futures Calls:

None.

Results: +22

Stocks:

Three calls triggered.

These are the Tradesight calls that triggered, Rich's AVGO triggered long (with market support) and worked:

Rich's META triggered long (without market support) and did not work:

Rich's SHOP triggered long (without market support due to triggering in the first five minute candle) and did not work:

That's 1 triggered with market support, and it worked.

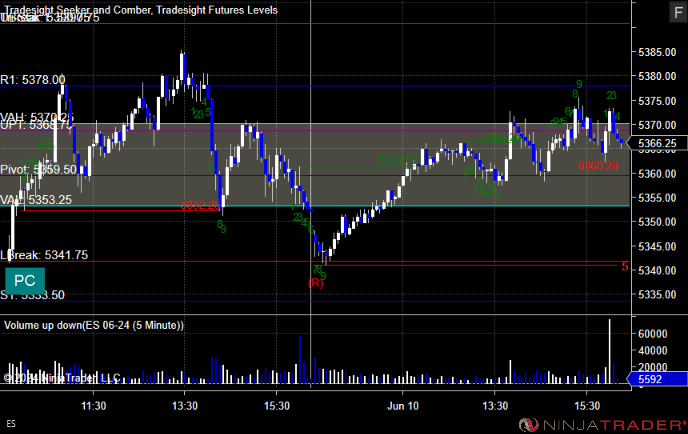

Tradesight Recap Report for 6/10/24

Today in the Markets:

The markets gapped down and filled the gap ahead of lunch and then stuck in the Value Area on 4.7 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

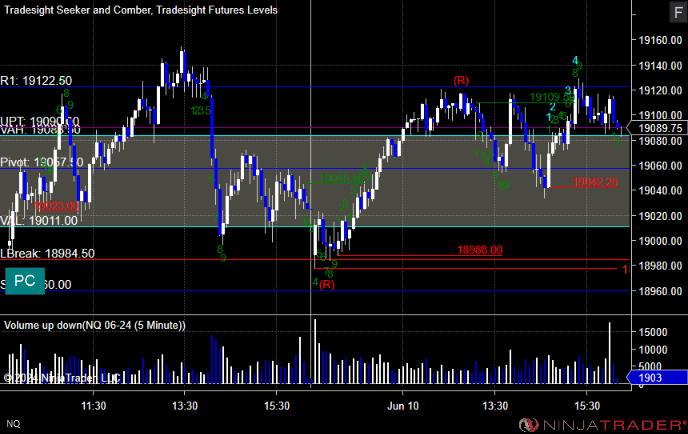

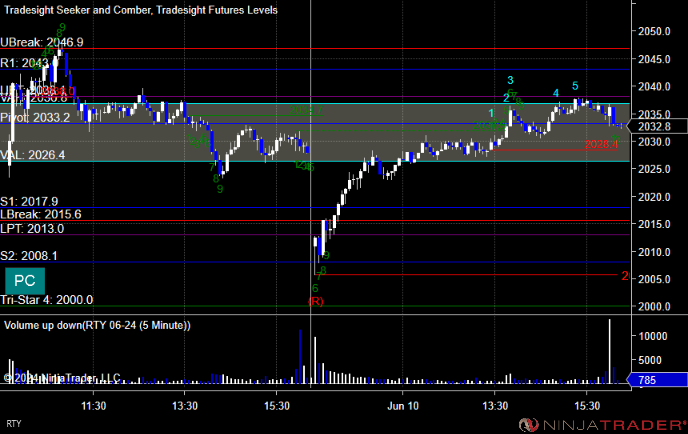

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Two calls triggered.

ES Opening Range Play, triggered short at A and did not work, triggered long at B and worked:

Additional Futures Calls:

None.

Results: -12 ticks

Stocks:

Boring. Still not going anywhere.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.