Tradesight Recap Report for 7/31/24

Today in the Markets:

Margaret's gapped up and held the gains actually went higher on 6.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

CL with Levels:

ZN with Levels:

Futures:

No real triggers based on the fact that the opening range was too wide.

ES Opening Range Play, triggered short at A but too far out of range to take, triggered long at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

Again, not much of a day in terms of triggers.

These are the Tradesight calls that triggered, FSLR PT play triggered short (without market support) and worked :

MSFT PT play triggered short (with market support) but didn't work:

That's 1 trigger with market support, and it did not work.

Tradesight Recap Report for 7/30/24

Today in the Markets:

The market's gapped up and then sold off a bit, recovered late and then sold off on earnings after the bell on 5.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

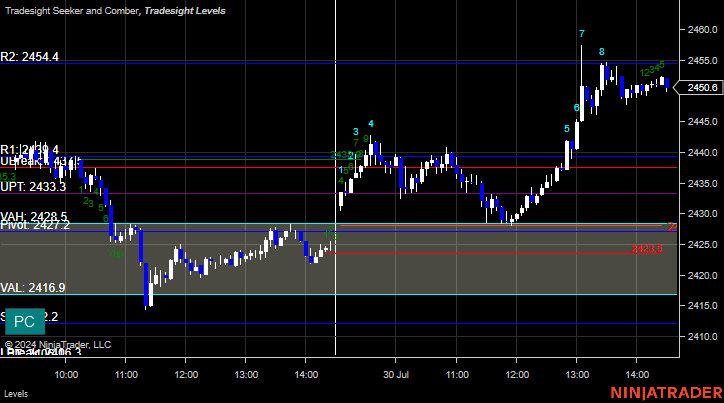

NQ with Levels:

RTY with Levels:

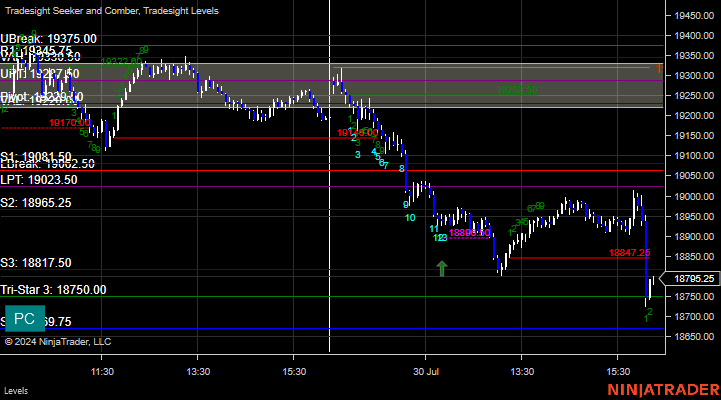

YM with Levels:

CL with Levels:

GC with Levels:

Futures:

Not a very exciting day in futures.

ES Opening Range Play, triggered long at A and worked enough for a partial. Triggered short at B and stopped above the midpoint:

Additional Futures Calls:

None.

Results: -14 ticks

Stocks:

These are the Tradesight calls that triggered, BIIB PT play triggered short (with market support) but didn't go enough to count:

EBAY PT play triggered long (without market support) and didn't work:

FSLR PPT play triggered short (with market support) and worked:

That's 2 triggers with market support, 1 didn't do anything and 1 did not work.

Tradesight Recap Report for 7/29/24

Today in the Markets:

The markets opened flat and did nothing on 5.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

GC with Levels:

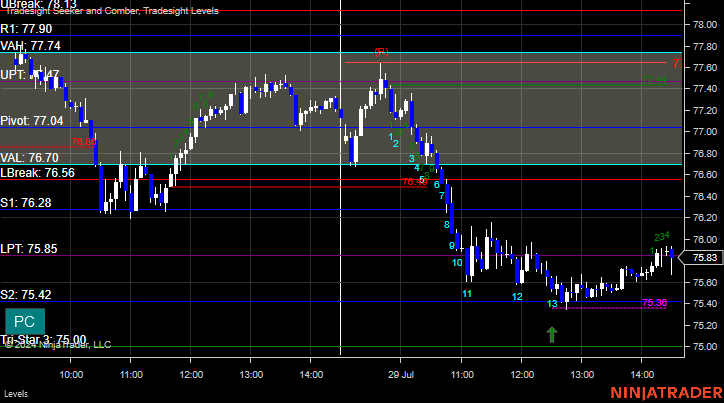

CL with Levels:

Futures:

Main trades did not trigger.

ES Opening Range Play, triggered long at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

Not a very exciting day.

These are the Tradesight calls that triggered, AMZN PT play triggered long (without market support) and didn't work:

Rich's NVDA triggered long (with market support) but didn't work:

That's 1 trigger with market support, and it did not work.

Tradesight Recap Report for 7/18/24

Today in the Markets:

The markets capped up a little bit and tried to hold on for about an hour, then filled the gap, bounced around a bit and sold off ahead of lunch and even more in the afternoon on 6 billion NASDAQ shares.

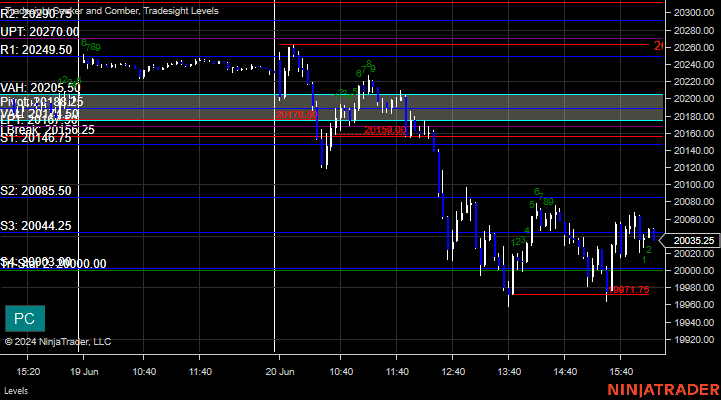

ES with Levels:

ES with Market Directional:

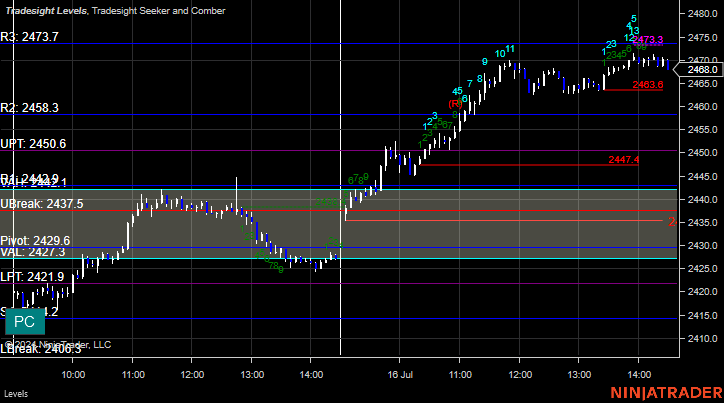

NQ with Levels:

RTY with Levels:

6B with Levels:

CL with Levels:

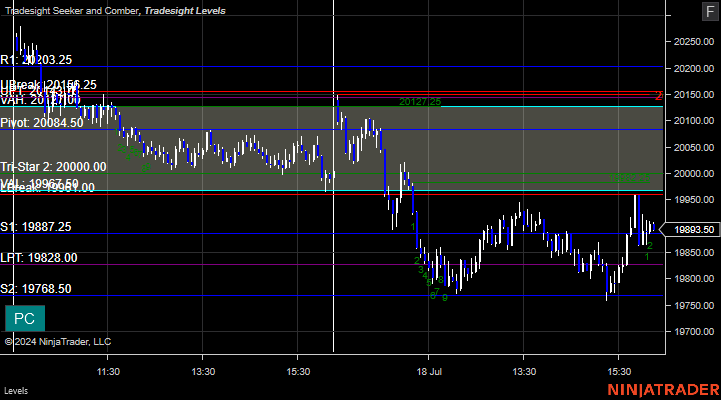

YM with Levels:

Futures:

A mixed bag that didn't add up to anything in the futures.

ES Opening Range Play, triggered long at A and stopped under the midpoint. Triggered short at B and worked enough for a partial:

Additional Futures Calls:

None.

Results: -10 ticks.

Stocks:

Not much here to be concerned about out as the market sold off again.

These are the Tradesight calls that triggered, Rich's QCOM triggered short (with market support) and stopped. Worked the second time if you took it again (with market support):

His CAT triggered long (without market support) and worked:

META PT play triggered long (without market support) and worked a little:

Rich's META triggered too late in the session (without market support) and didn't work:

His DIS triggered long (with market support) but didn't work:

That's 2 triggers with market support, neither worked.

Tradesight Recap Report for 7/17/24

Today in the Markets:

On some bad semiconductor news, the markets gap down huge, tried to rally for a few minutes and then sold off for the rest of the day on 5.9 billion NASDAQ shares.

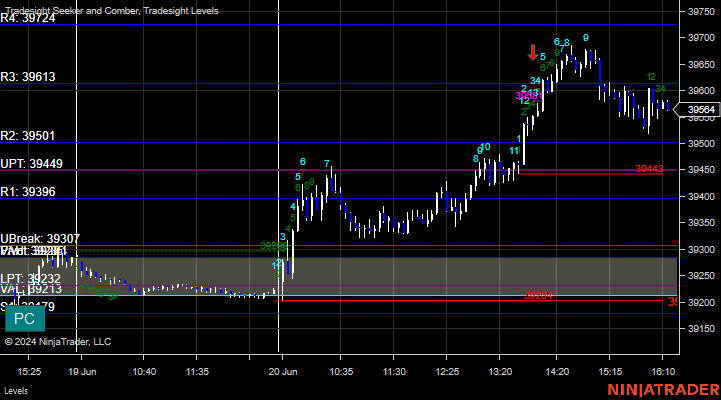

ES with Levels:

ES with Market Directional:

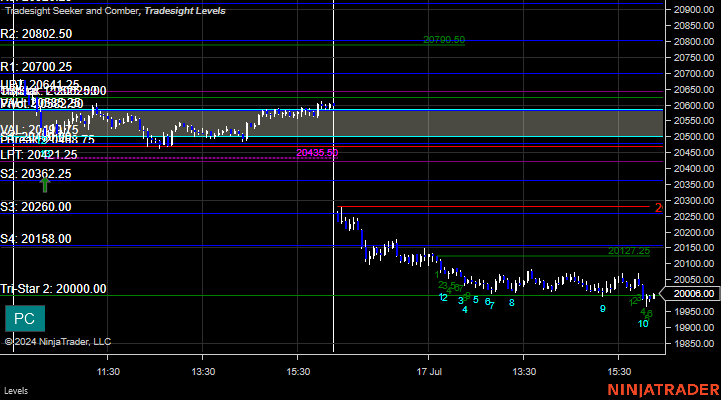

NQ with Levels:

RTY with Levels:

YM with Levels:

GC with Levels:

CL with Levels:

Futures:

Two winners for the session in futures.

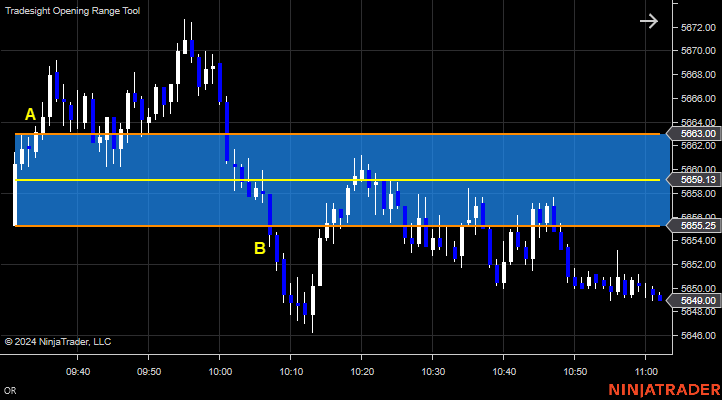

ES Opening Range Play,, triggered long at A and worked. Triggered short at B and worked:

Additional Futures Calls:

None.

Results: +14 ticks.

Stocks:

With the gap nothing really triggered.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Tradesight Recap Report for 7/16/24

Today in the Markets:

Once again, the markets gapped up a little bit, tried to pull back and fill the gap, didn't really do anything, and then after lunch rallied a couple points on 5.1 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

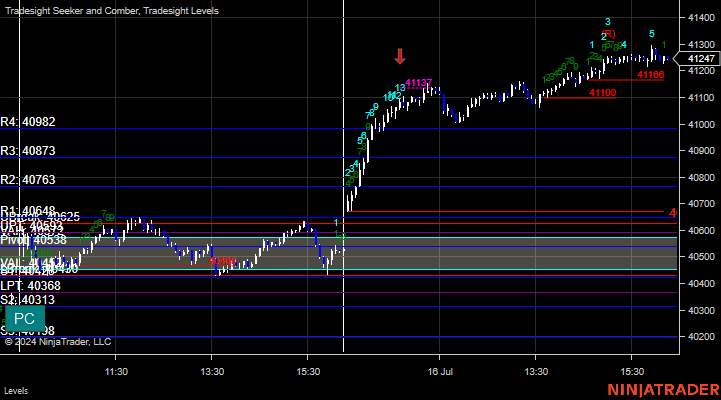

NQ with Levels:

RTY with Levels:

YM with Levels:

GC with Levels:

6B with Levels:

Futures:

A winner and a loser for basically not much.

ES Opening Range Play, triggered long at A and stopped under the midpoint. Triggered short at B and worked:

Additional Futures Calls:

None.

Results: -4 ticks

Stocks:

Another green day with one trigger.

These are the Tradesight calls that triggered, Rich's NVDA triggered short (with market support) and worked :

That's 1 trigger with market support, and it worked.

Tradesight Recap Report for 7/15/24

Today in the Markets:

The markets gapped up a little bit and pushed higher, but then came right back and filled the gap and closed up a couple points on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

CL with Levels:

GC with Levels:

Futures:

Two small winners for the session.

ES Opening Range Play, triggered long at A and worked enough for a partial. Triggered short at B and worked enough for a partial.:

Additional Futures Calls:

None.

Results: +8 ticks.

Stocks:

A green day even if it wasn't exciting.

These are the Tradesight calls that triggered, UNH PT play triggered short (without market support) and worked:

Rich's FDX triggered long (with market support) and worked:

That's 1 trigger with market support and it worked.

Tradesight Recap Report for 6/21/24

Today in the Markets:

Markets gapped down a little bit and were dead flat as expected on 5.2 billion NASDAQ shares.

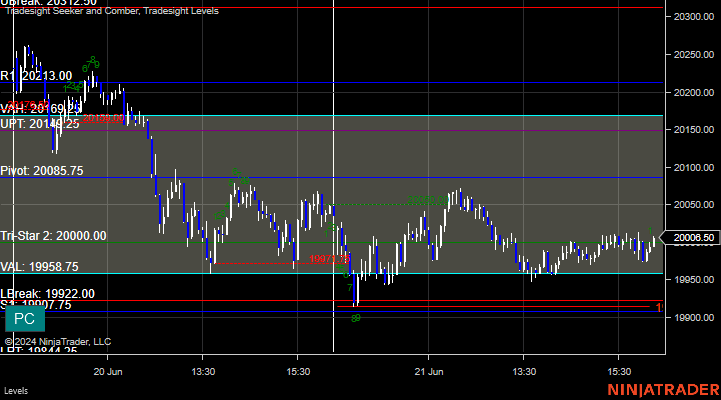

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

CL with Levels:

GC with Levels:

Futures:

The site gained for the session on the futures.

ES Opening Range Play, triggered long at A and worked enough for a partial. Triggered short at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +4 ticks.

Stocks:

Sometimes a perfect setup doesn't work, and that's what happened today.

These are the Tradesight calls that triggered, AMZN PT play triggered long (with market support) but didn't work:

That's 1 trigger with market support, and it did not work.

Tradesight Recap Report for 6/20/24

Today in the Markets:

The markets gapped up a little bit after the holiday, and then filled the gap and went lower and then came back and really did nothing on 4.7 billion NASDAQ shares.

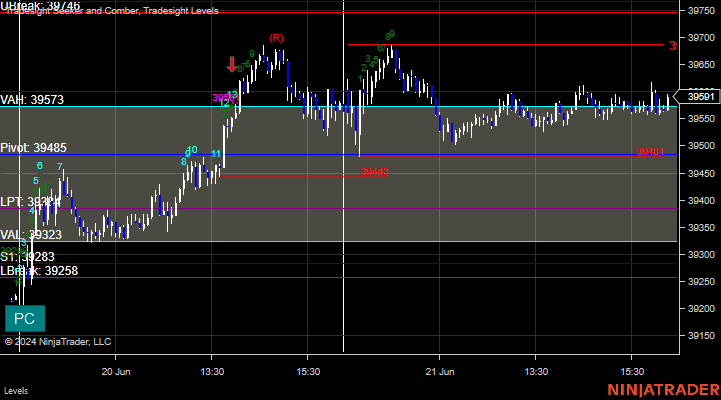

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

GC with Levels:

ZB with Levels:

Futures:

Another nice winner in futures.

ES Opening Range Play, triggered long at A worked. Triggered short at B and worked:

Additional Futures Calls:

None.

Results: +13 ticks,

Stocks:

Add another nice winner on the stock side, even though there wasn't much to do.

These are the Tradesight calls that triggered, Rich's QCOM triggered short (with market support) and worked:

That's 1 trigger with market support, and it worked.

Tradesight Recap Report for 6/18/24

Today in the Markets:

So with Juneteenth in the middle of the week, as expected, this was very flat, very uncomfortable because of the holiday. And nothing happened at all on 4.6 billion Nasdaq shares.

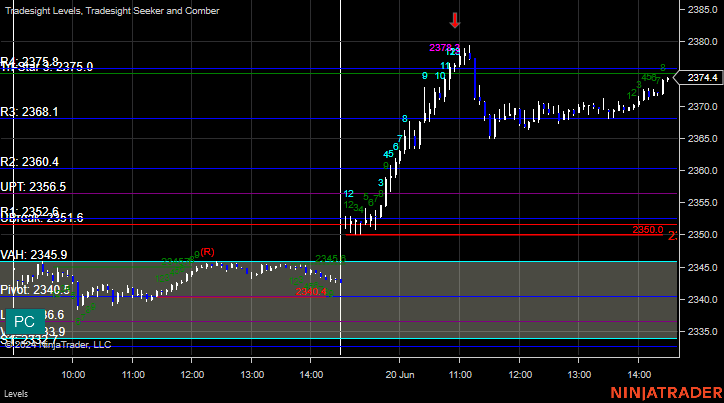

ES with Levels:

ES with Market Directional:

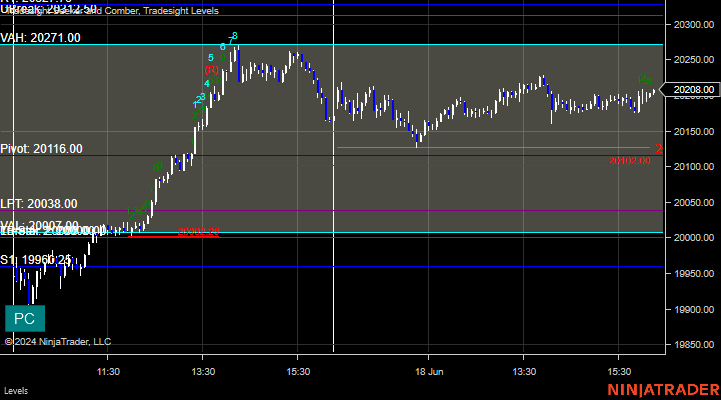

NQ with Levels:

RTY with Levels:

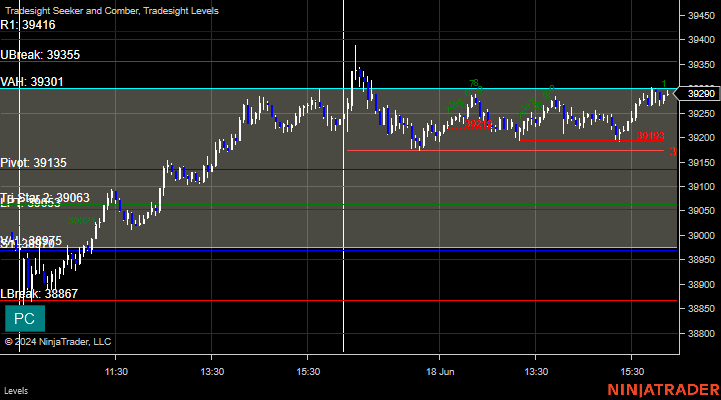

YM with Levels:

6B with Levels:

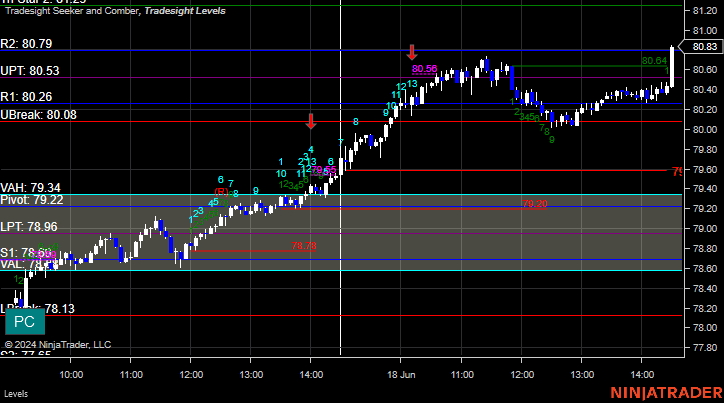

CL with Levels:

Futures:

A decent winner for the session in futures.

ES Opening Range Play, triggered long at A and worked:

Additional Futures Calls:

None.

Results: +12 ticks.

Stocks:

With a flat day, there was no point in trading stocks.

These are the Tradesight calls that triggered, Rich's ABNB triggered long (with market support) but didn't work:

That's 1 trigger with market support, and it did not work.