Tradesight Recap Report for 4/11/23

Today in the Markets:

A dead day in the market completely on 4.7 billion NASDAQ shares.

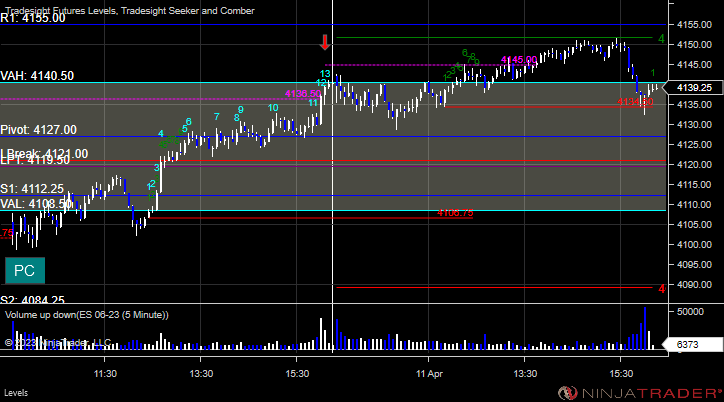

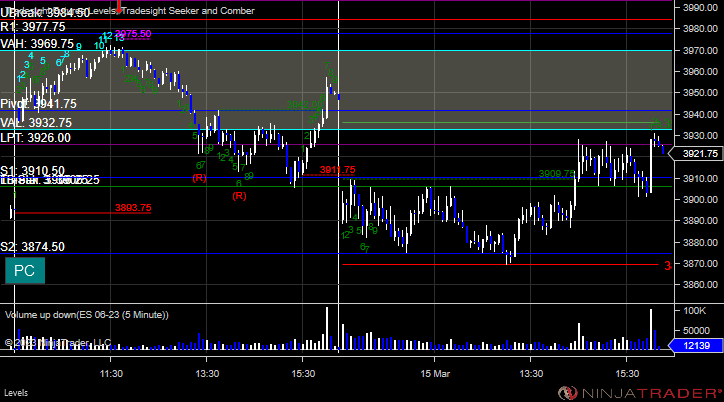

ES with Levels:

ES with Market Directional:

NQ with Levels:

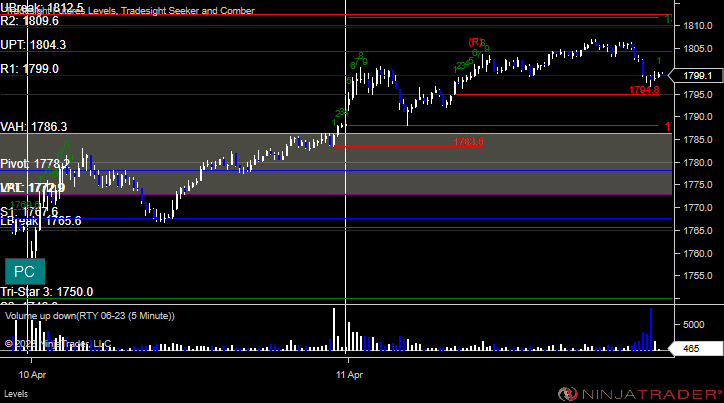

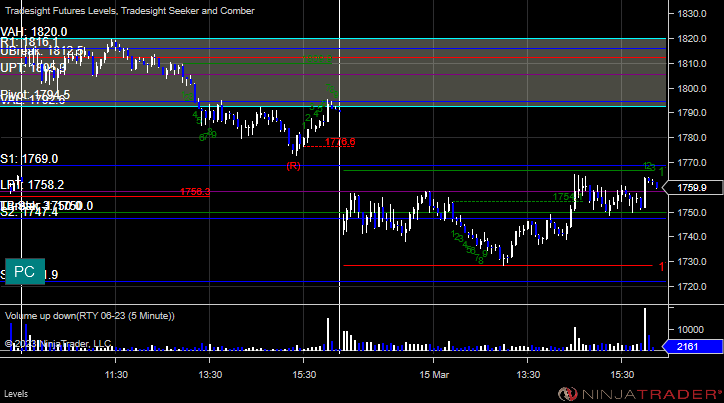

RTY with Levels:

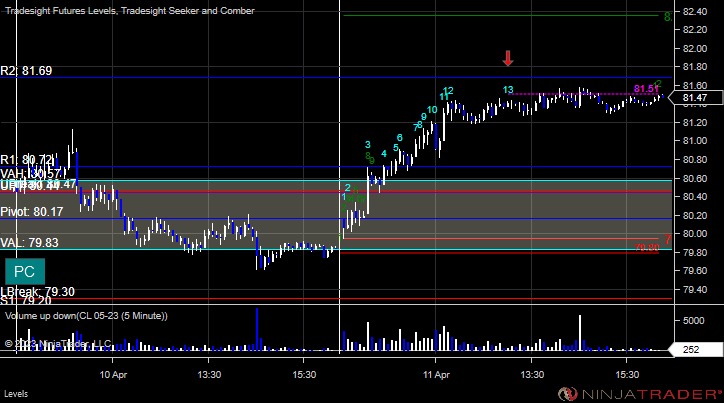

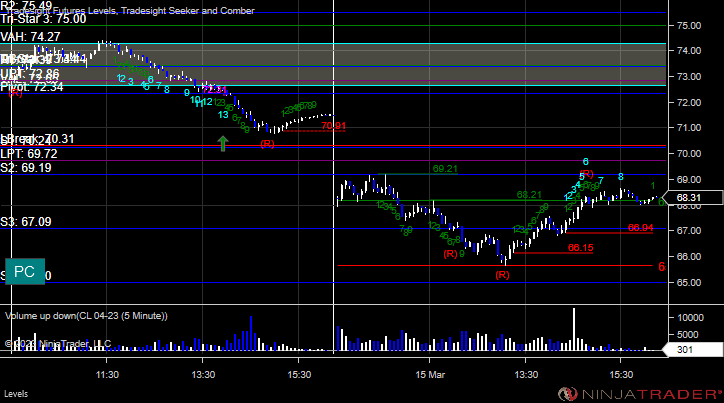

CL with Levels:

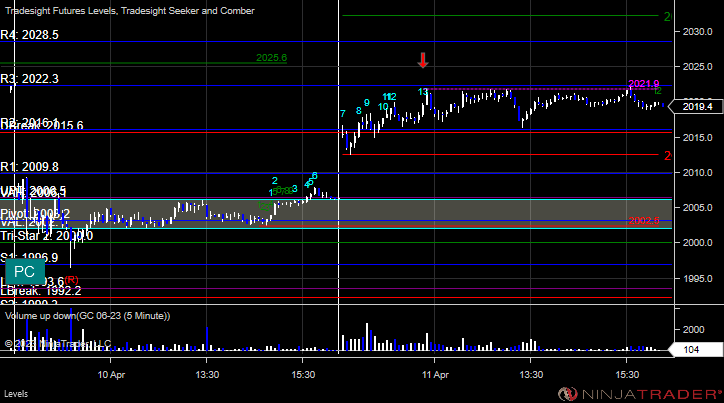

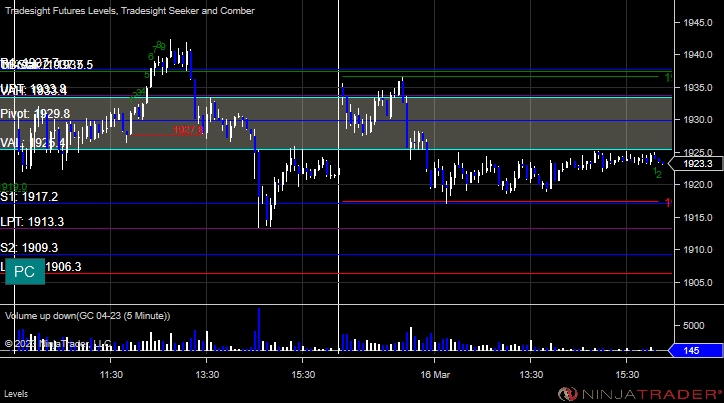

GC with Levels:

Futures:

A winner for the session.

ES Opening Range Play, triggered short at A and worked enough for a partial (shy of the stop loss by a tick) :

Additional Futures Calls:

None.

Results: +4 ticks.

Stocks:

Not much to do when the market doesn't move.

These are the Tradesight calls that triggered, Rich's TSCO triggered long (with market support) and didn't work:

His PXD triggered short (with market support) but didn't work:

That's 2 triggers with market support, but none worked.

Forex:

No triggers.

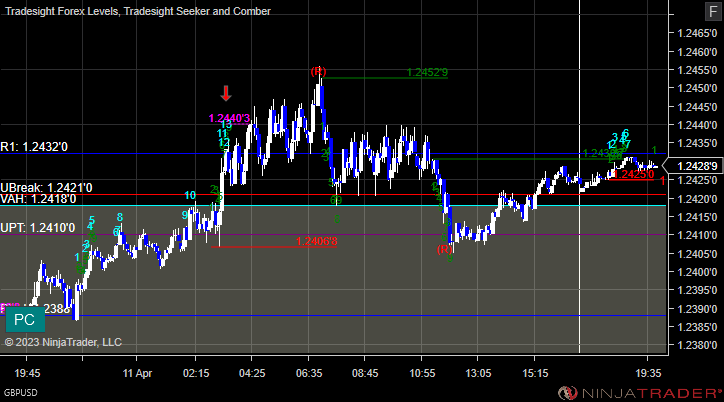

GBPUSD:

Results: +0

Tradesight Recap Report for 4/10/23

Today in the Markets:

The markets gapped down and spent the day crawling back up to fill the gap on 5.2 billion NASDAQ shares.

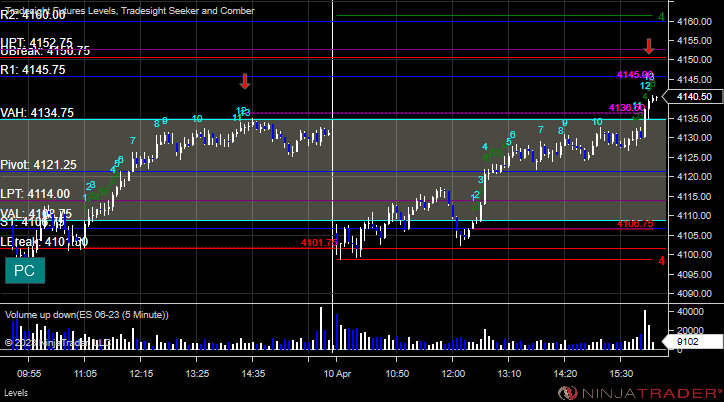

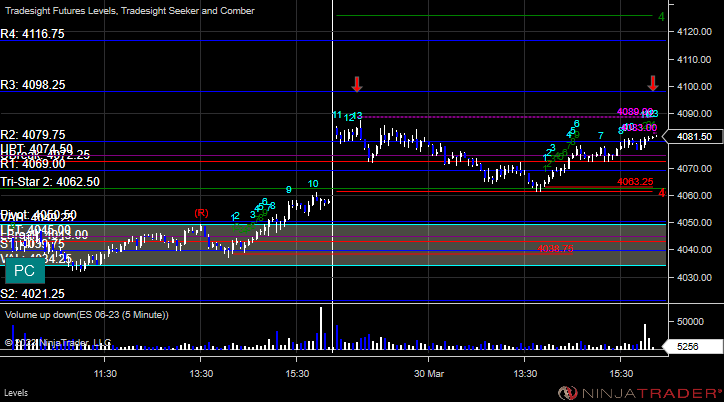

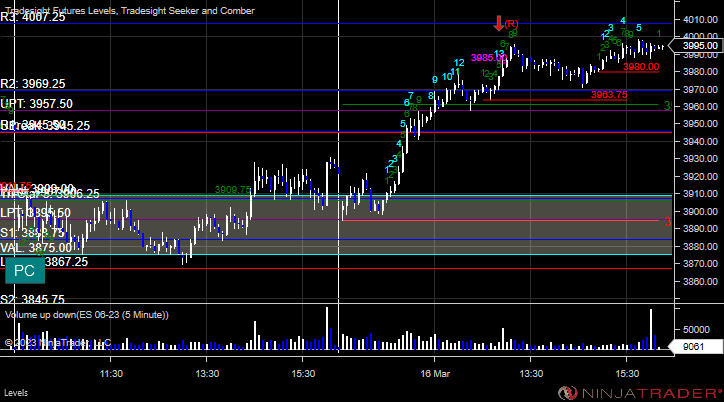

ES with Levels:

ES with Market Directional:

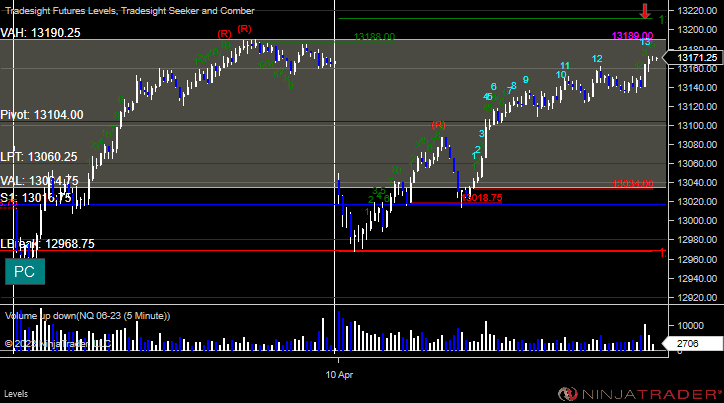

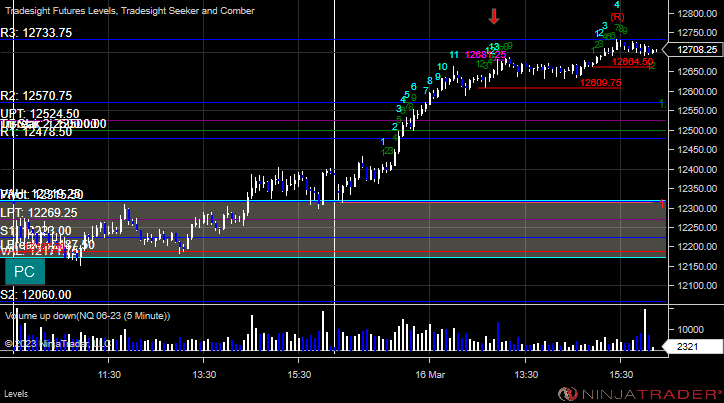

NQ with Levels:

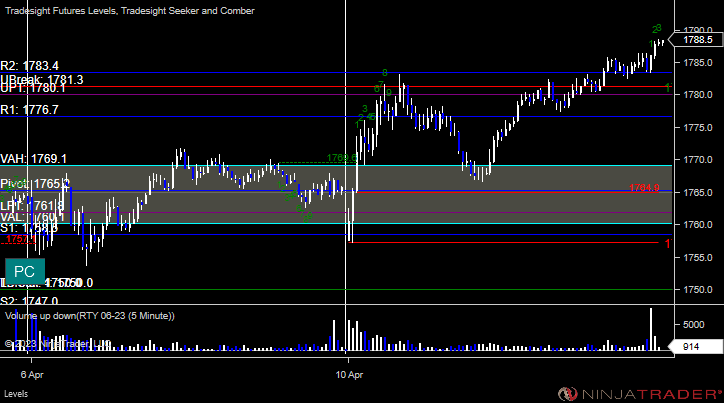

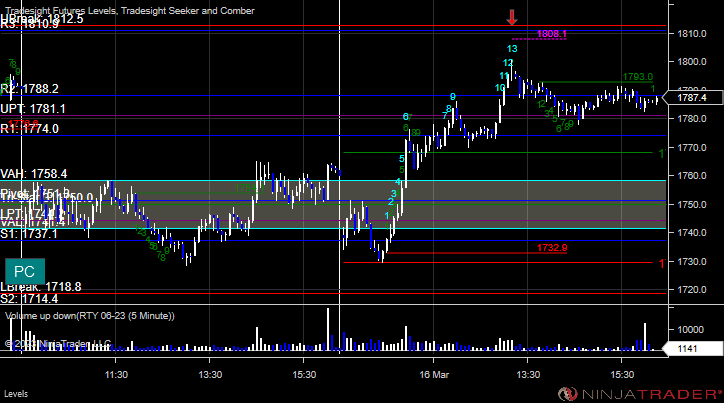

RTY with Levels:

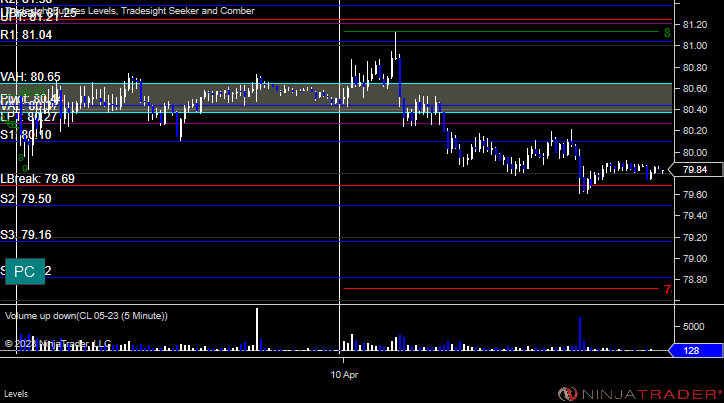

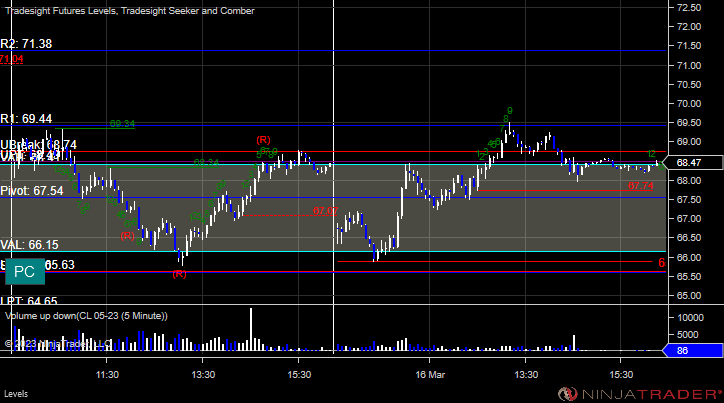

CL with Levels:

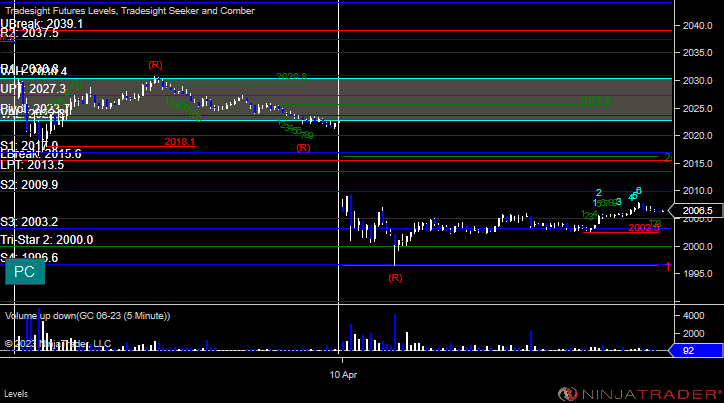

GC with Levels:

Futures:

A loser and a winner for the session.

ES Opening Range Play, triggered short at A but stopped over the midpoint (just one tick shy from the partial). Triggered long at B and worked enough for a partial:

Additional Futures Calls:

None.

Results: -14

Stocks:

A mixed bag for the session in stocks.

These are the Tradesight calls that triggered, GS PT play triggered long (with market support) but didn't go enough either way to count:

Rich's AMAT triggered long (with market support) and worked:

Rich's TSLA triggered short (with market support) but didn't work:

That's 3 triggered with market support, 1 worked, 1 did not, and 1 didn't do anything.

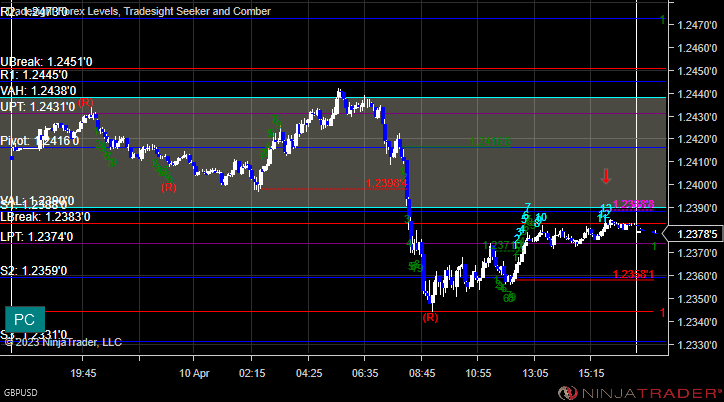

Forex:

No calls for the session.

GBPUSD:

Results: +0

Tradesight Recap Report for 3/31/23

Today in the Markets:

A bit of a better day late, but a weird end to a not-very-eventful week.

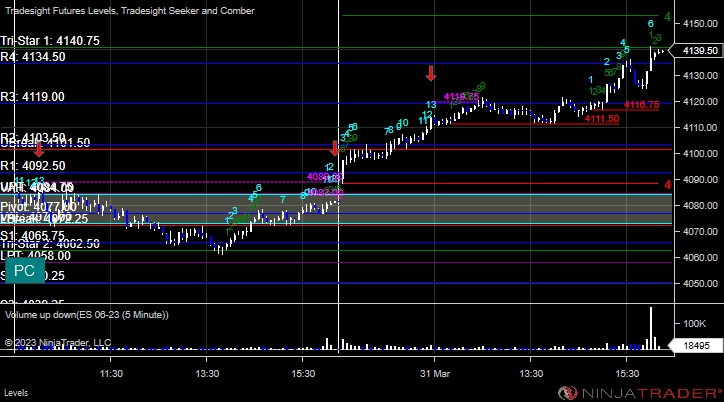

ES with Levels:

ES with Market Directional:

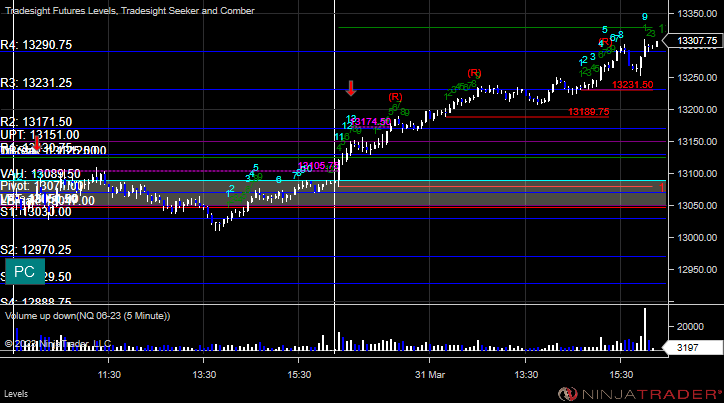

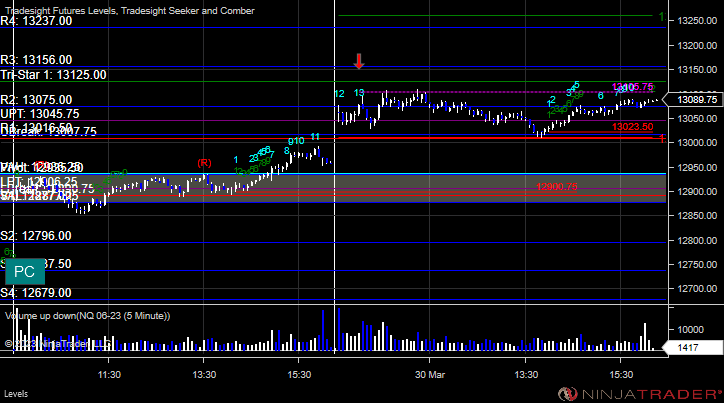

NQ with Levels:

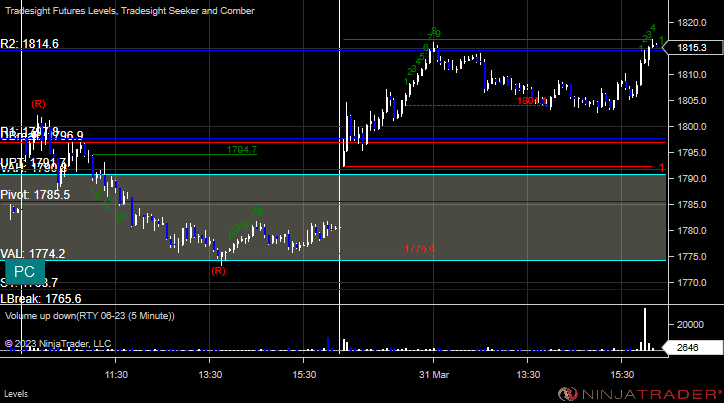

RTY with Levels:

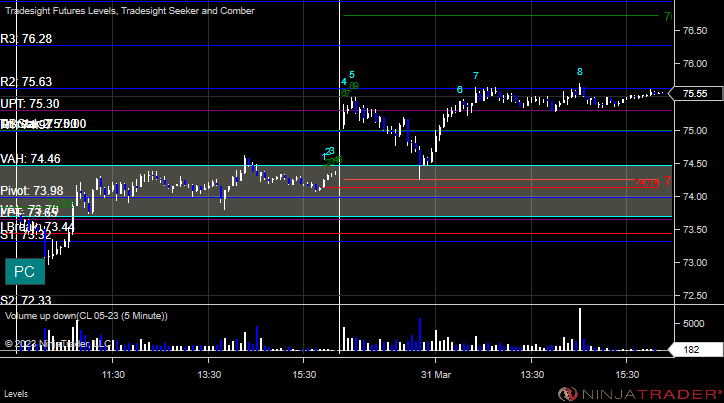

CL with Levels:

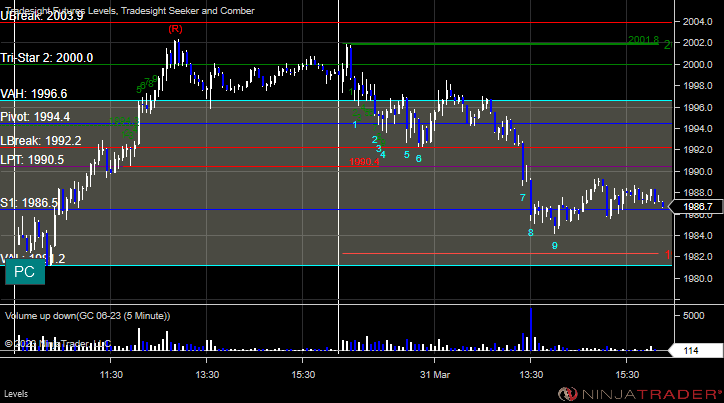

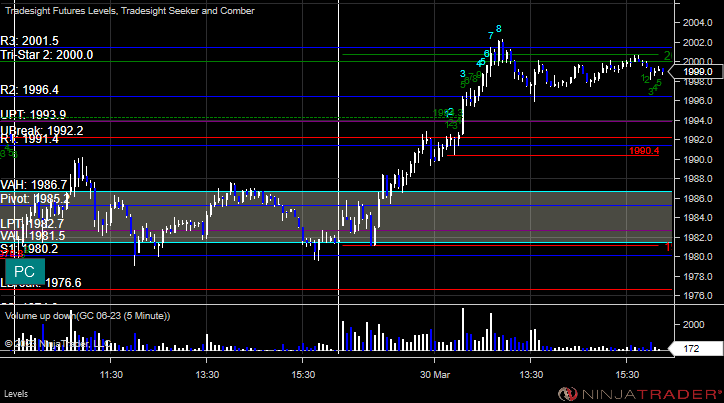

GC with Levels:

Futures:

ES Opening Range Play, triggered long at A and worked enough for a partial:

Additional Futures Calls:

None.

Results: +4 ticks.

Stocks: Nothing triggered. Again.

These are the Tradesight calls that triggered:

Nada.

That's 0 triggers with market support.

Forex: No calls for the session.

Too boring again.

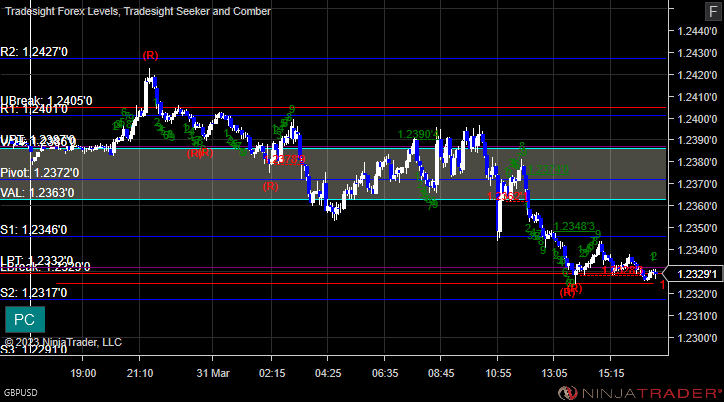

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 3/30/23

Today in the Markets:

Yet another dead flat day. Nothing else to say. A gap and then sit.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Another dull day leads to nothing.

ES Opening Range Play, triggered short at A and stopped:

Additional Futures Calls:

None.

Results: -13 ticks.

Stocks:

Not much triggered on the fourth dead day of the week.

These are the Tradesight calls that triggered, Rich's AMZN triggered long (without market support) and didn't work.:

That's 0 triggers with market support.

Forex:

Not much here again.

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 3/29/23

Today in the Markets:

Evidently this is just going to be a boring week. We gapped up and went flat until a slight drift up late in the day.

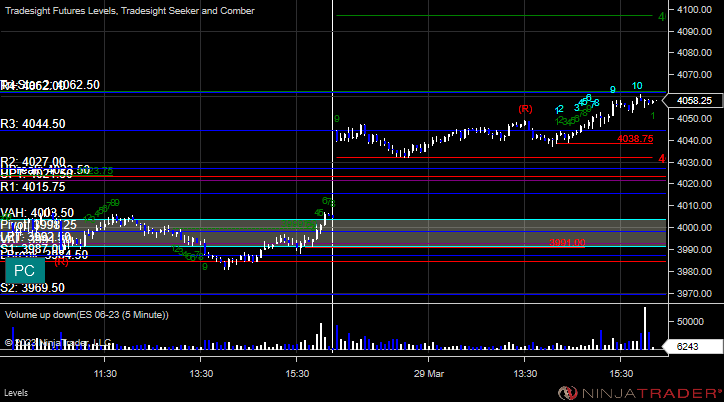

ES with Levels:

ES with Market Directional:

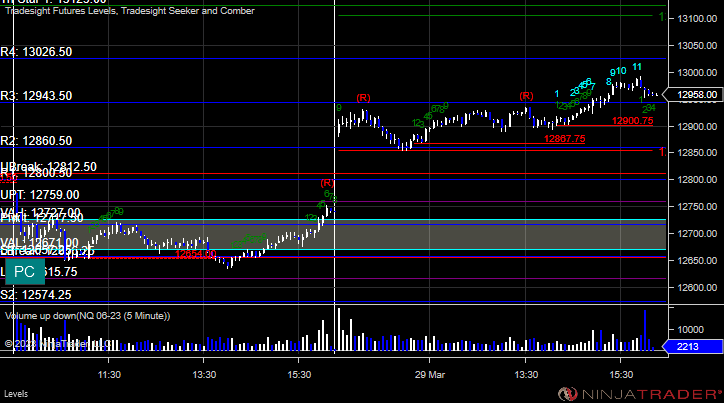

NQ with Levels:

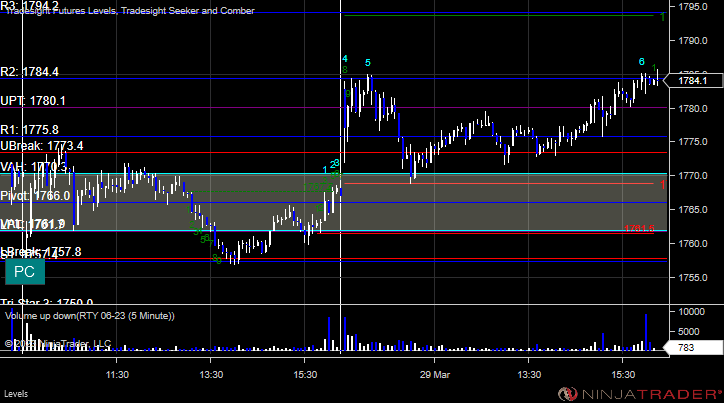

RTY with Levels:

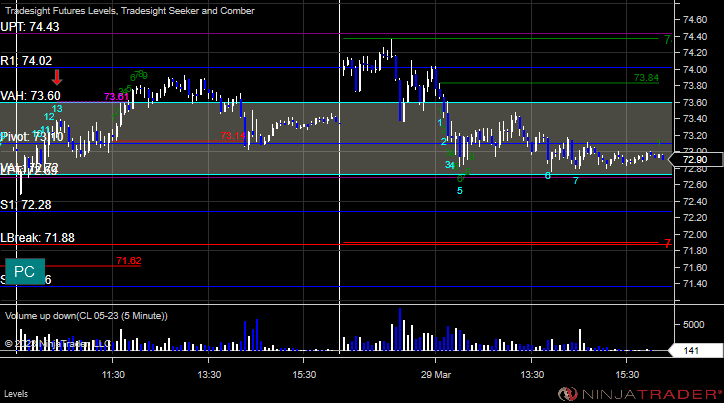

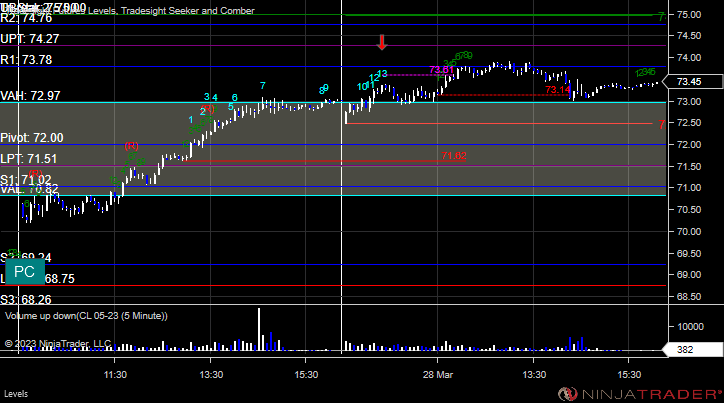

CL with Levels:

GC with Levels:

Futures:

Two winners for the session despite the dull action.

ES Opening Range Play, triggered long at A and worked enough for a partial. Triggered short at B and worked enough for a partial:

Additional Futures Calls:

None.

Results: +8 ticks.

Stocks:

This market is so dead, nothing triggered. Sigh.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Forex:

No action at all.

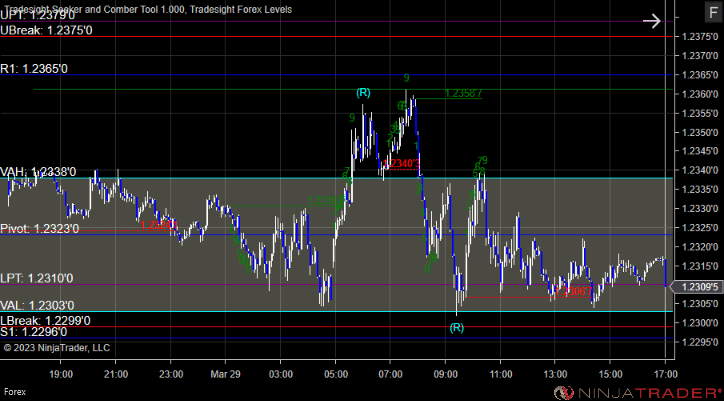

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 3/28/23

Today in the Markets:

The markets gapped down slightly and closed where they opened. Another very boring session.

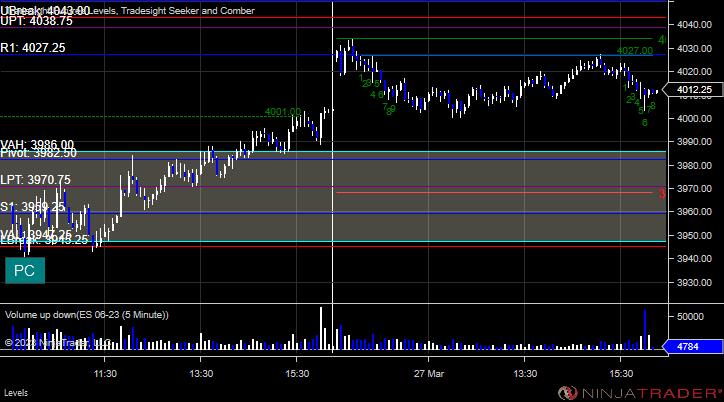

ES with Levels:

ES with Market Directional:

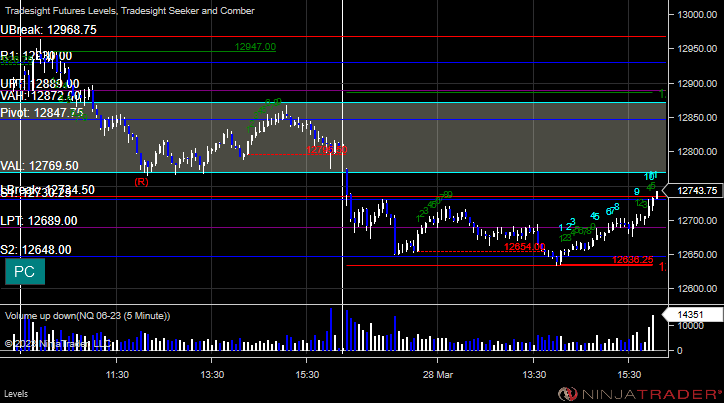

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Nothing exciting here.

ES Opening Range Play, triggered short at A and worked enough for a partial. Triggered long at B and stopped:

Additional Futures Calls:

None.

Results: -12 ticks.

Stocks:

Another dead day in the markets leads to no action.

These are the Tradesight calls that triggered, BIDU triggered short (without market support) but didn't work:

BIIB triggered long (with market support) but didn't work:

That's 1 triggered with market support and it did not work.

Forex:

Nothing triggered.

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 3/27/23

Today in the Markets:

The markets gapped up and basically sat flat all day on 5.2 billion NASDAQ shares. Not very exciting.

ES with Levels:

ES with Market Directional:

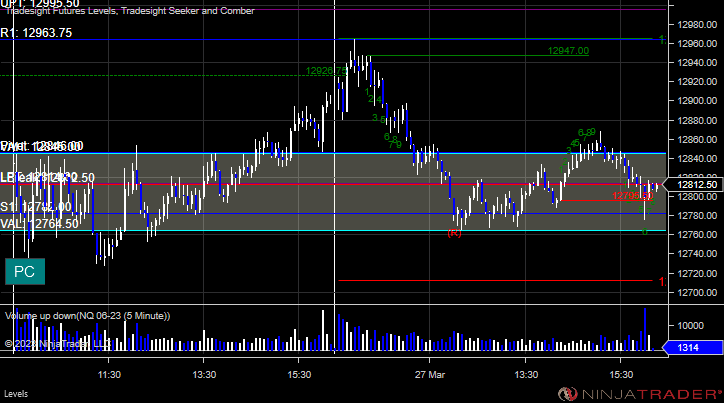

NQ with Levels:

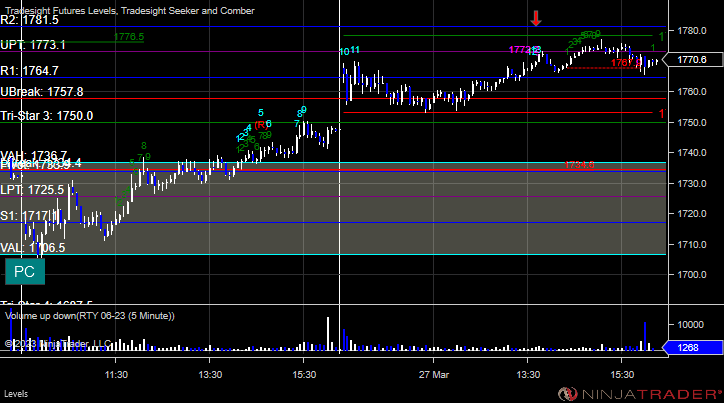

RTY with Levels:

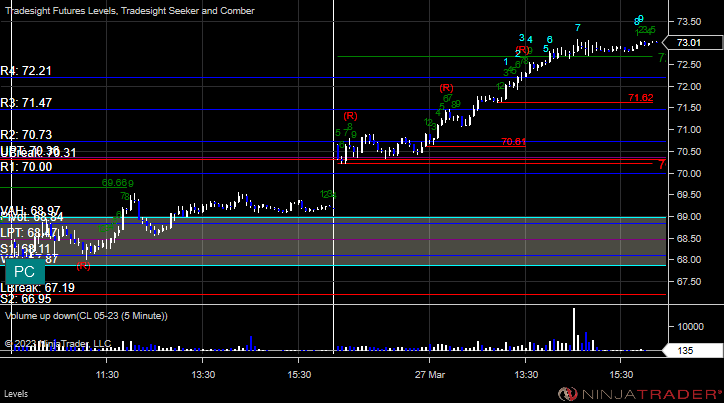

CL with Levels:

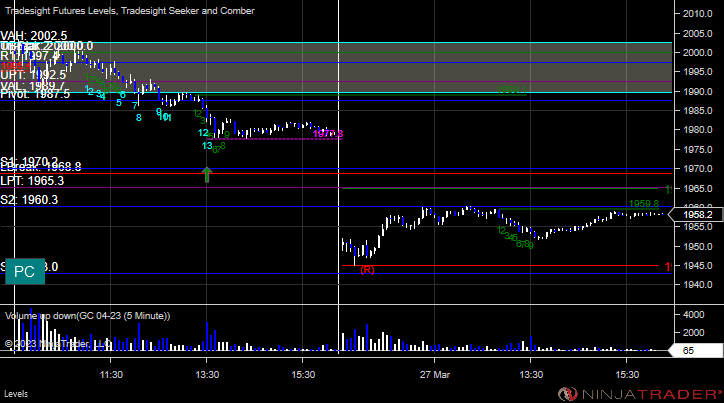

GC with Levels:

Futures:

Two winners for the session.

ES Opening Range Play, triggered long at A and worked enough for a partial. Triggered short at B and worked:

Additional Futures Calls:

None.

Results: +10 ticks.

Stocks:

Just too flat of a session to get anything going.

These are the Tradesight calls that triggered, GOOGL triggered long (with market support) but didn't work:

ABNB triggered long (with market support) but didn't work:

That's 2 triggered with market support, and none of them worked.

Forex:

No calls.

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 3/17/23

Today in the Markets:

As expected, not much action for triple expiration. We closed slightly lower and barely up for the week on 6.3 billion NASDAQ shares.

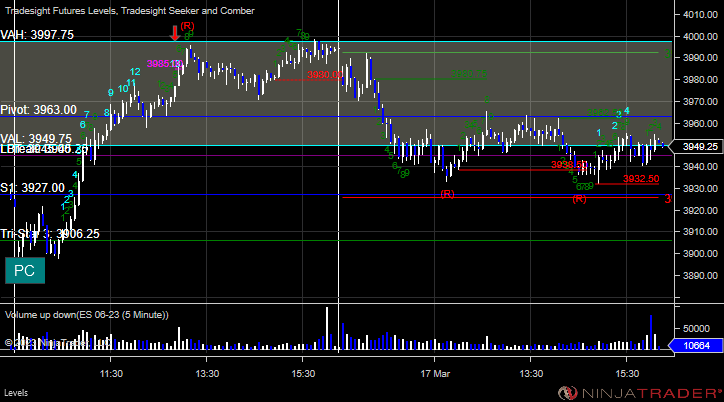

ES with Levels:

ES with Market Directional:

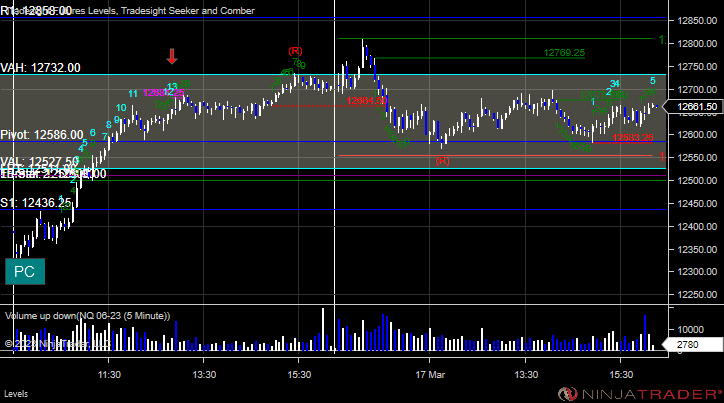

NQ with Levels:

RTY with Levels:

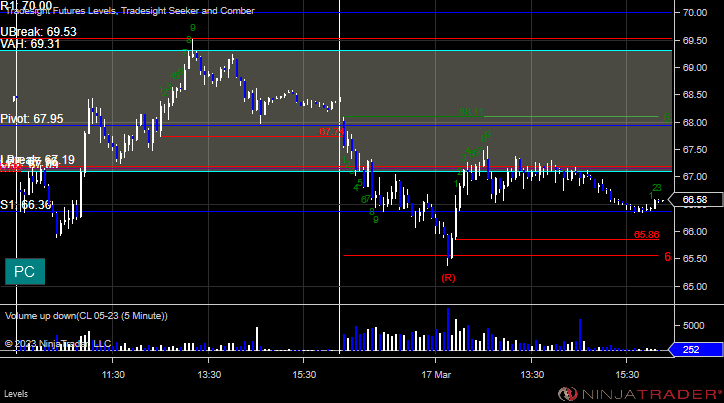

CL with Levels:

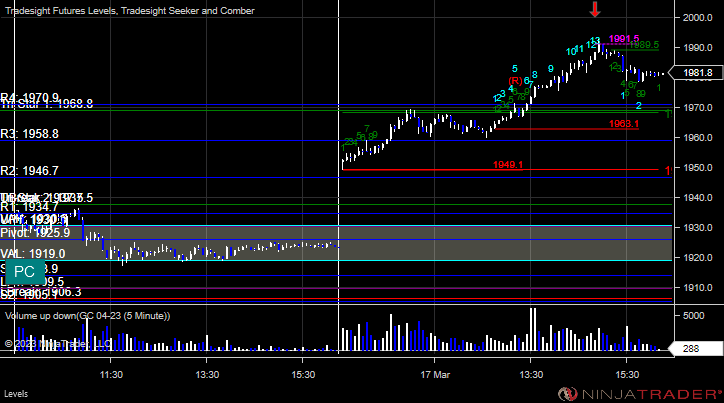

GC with Levels:

Futures:

A small winner to close the week.

ES Opening Range Play triggered short at A but too far out of range to take. Triggered long at B and worked enough for a partial:

Additional Futures Calls:

None.

Results: +4 ticks.

Stocks:

Another green day despite the lack of action.

These are the Tradesight calls that triggered, Rich's PT play triggered short (with market support) and worked enough for a partial:

His NVDA triggered long (with market support) but didn't work:

His GS triggered short (with market support) and worked enough for a partial by the end of the day:

That's 3 triggered with market support, 2 worked and 1 did not.

Forex:

None.

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 3/16/23

Today in the Markets:

The markets gapped down small and then rallied, likely giving us the options unravel move, on 5.3 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

One loser for the session.

ES Opening Range Play, triggered short at A and stopped. Triggered long at B but too far out of range to take:

Additional Futures Calls:

None.

Results: -16 ticks.

Stocks:

A nice winner for the session again.

These are the Tradesight calls that triggered, Rich's AMZN triggered long (with market support) and worked big:

That's 1 triggered with market support, and it worked.

Forex:

None.

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 3/15/23

Today in the Markets:

Yet another generally flat day after a gap down. NASDAQ volume was 4.7 billion shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

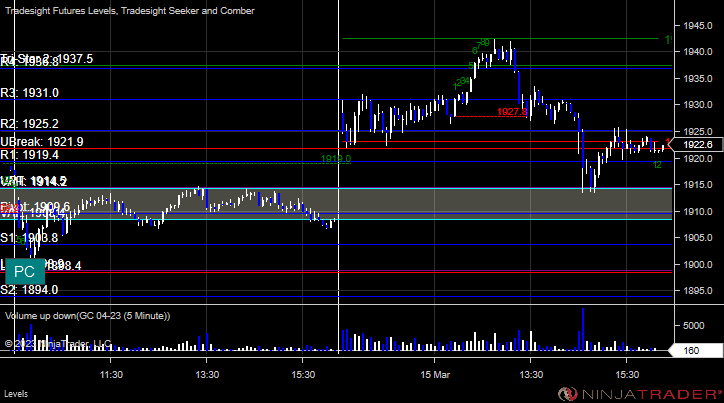

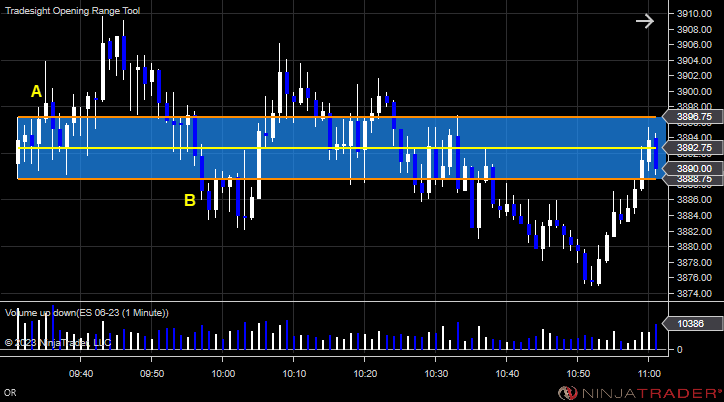

GC with Levels:

Futures:

Another day without trades in range.

ES Opening Range Play, triggered long at A but too far out of range to take. Triggered short at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

Despite the boring market, we had a nice day in stock trading.

These are the Tradesight calls that triggered, Rich's JPM triggered short (with market support) and worked enough for a partial:

His CVX triggered short (with market support) and worked enough for a partial:

His META triggered long (with market support) and didn't work:

His OXY triggered short (without market support due to first 5-min) and didn't work:

His GOOGL triggered long (with market support) and worked:

That's 4 triggered with market support, 3 worked and 1 did not.

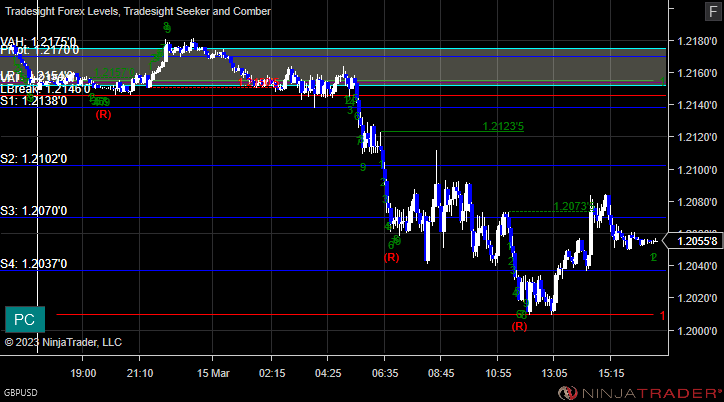

Forex:

Nothing triggered.

GBPUSD:

Results: +0 pips.