Tradesight Recap Report for 6/21/23

Today in the Markets:

The markets gapped down, eventually filled in the afternoon, then closed again where they opened on 5.1 billion NASDAQ shares.

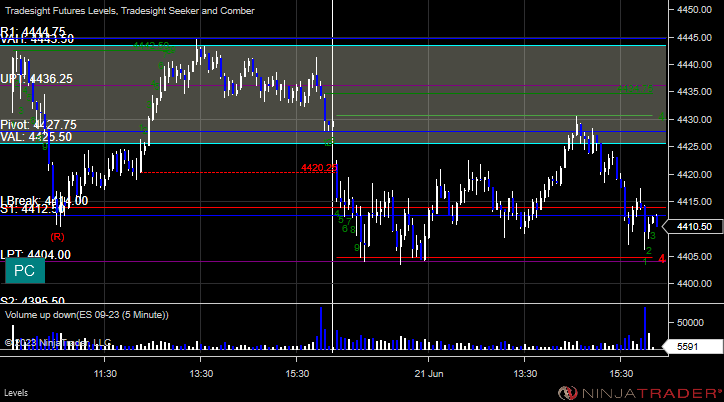

ES with Levels:

ES with Market Directional:

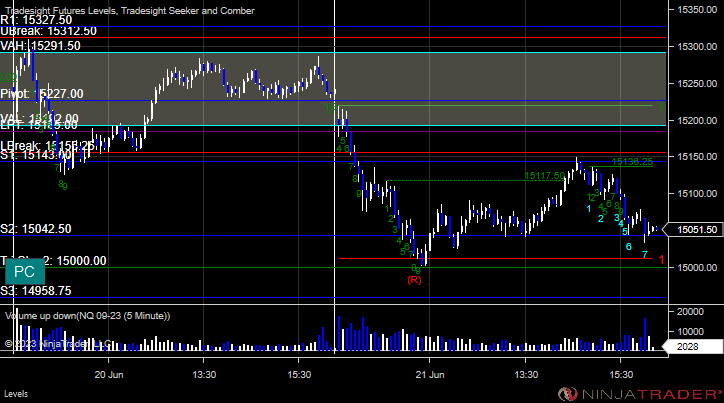

NQ with Levels:

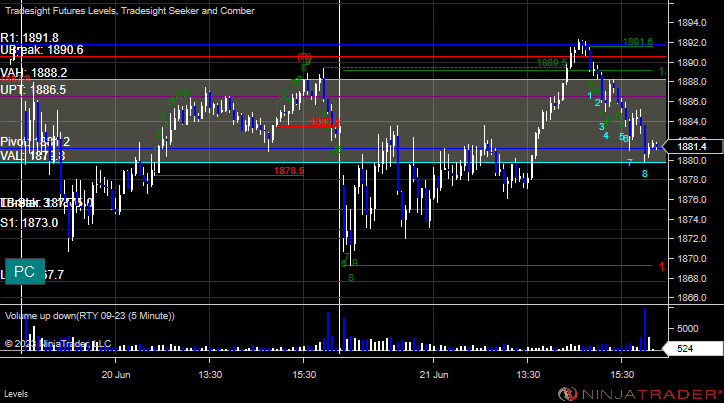

RTY with Levels:

CL with Levels:

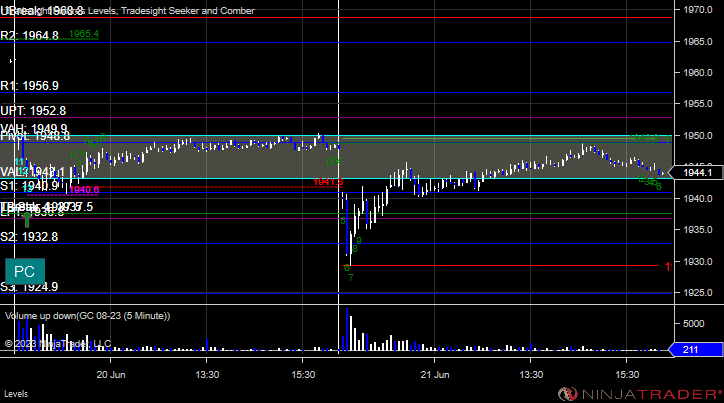

GC with Levels:

Futures:

A small winner for the session.

ES Opening Range Play, triggered short at A and worked enough for a partial:

Additional Futures Calls: +4 ticks

Results:

Stocks:

A couple of winners including a nice one.

These are the Tradesight calls that triggered, Rich's SPOT triggered long (without market support) and didn't work:

His FSLR triggered short (with market support) but didn't work:

His NOW triggered short (with market support) and worked great:

That's 2 triggers with market support, 1 worked and 1 did not.

Forex: No calls for the session:

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 6/20/23

Today in the Markets:

After the Monday Juneteenth Holiday, the markets gapped down and closed where they opened on 4.9 billion NASDAQ shares.

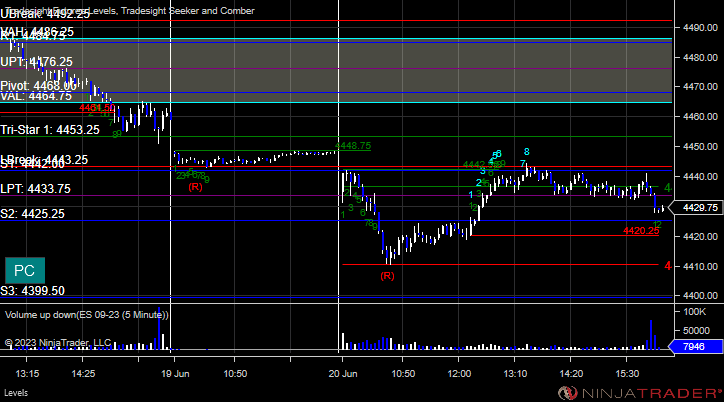

ES with Levels:

ES with Market Directional:

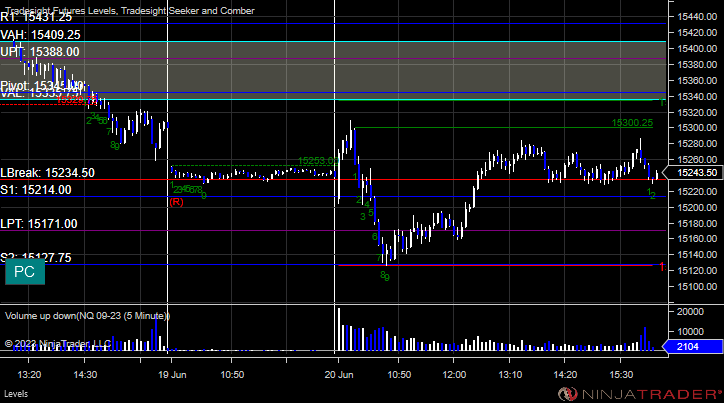

NQ with Levels:

RTY with Levels:

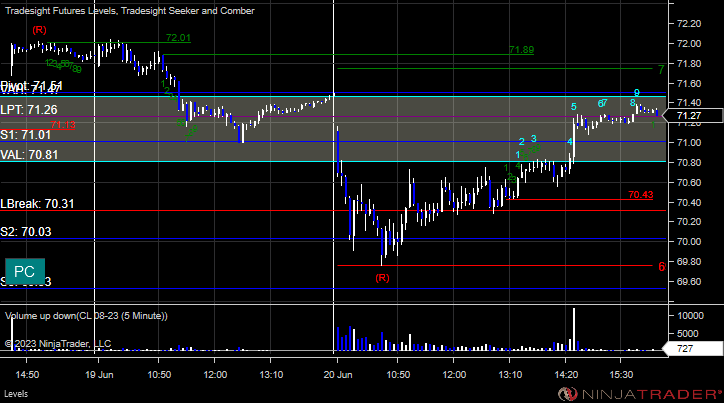

CL with Levels:

GC with Levels:

Futures:

Not much of a day in futures despite an early winner.

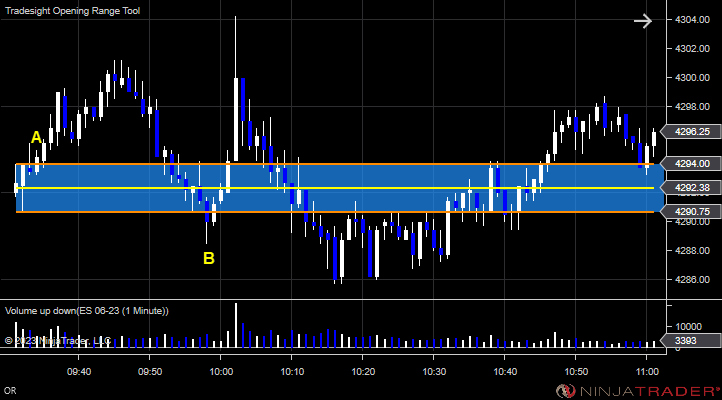

ES Opening Range Play, triggered long at A and worked, triggered short at B and stopped above the mid-point:

Additional Futures Calls, ES triggered long above lBreak and stopped for 7 ticks stop loss:

Results - 23 ticks:

Stocks:

Not much to do on a dead day in the markets.

These are the Tradesight calls that triggered, NFLX PT play triggered long (with market support) but didn't work:

That's 1 trigger with market support, and it didn't work.

Forex: No calls for the session.

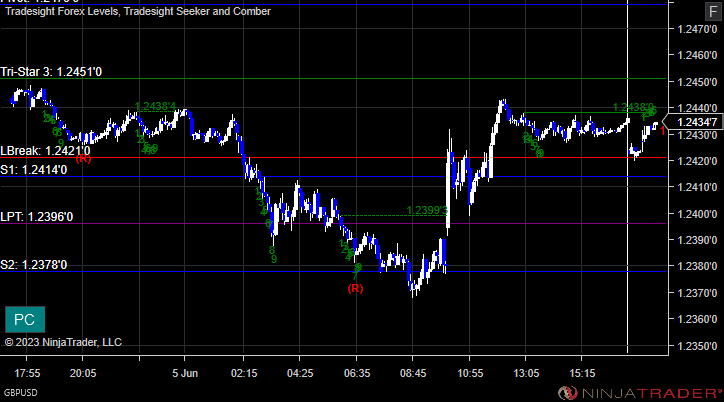

GBPUSD:

Results: 0 pips.

Tradesight Recap Report for 6/9/23

Today in the Markets:

The markets gapped up and pushed up a little higher as we start trading the September futures contracts. As usual, that leads to a dull day, and we drifted back to fill the gap and went flat.

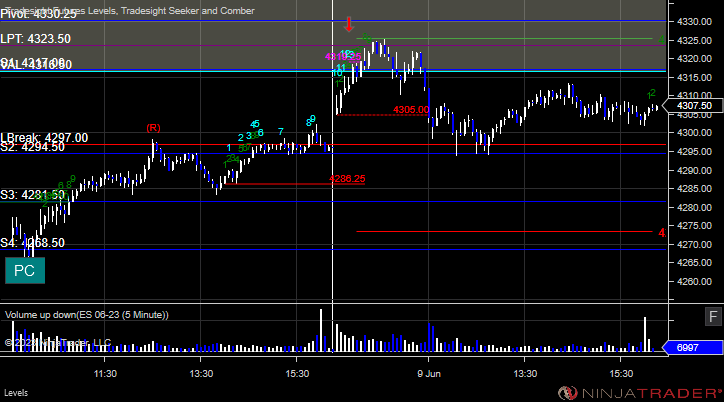

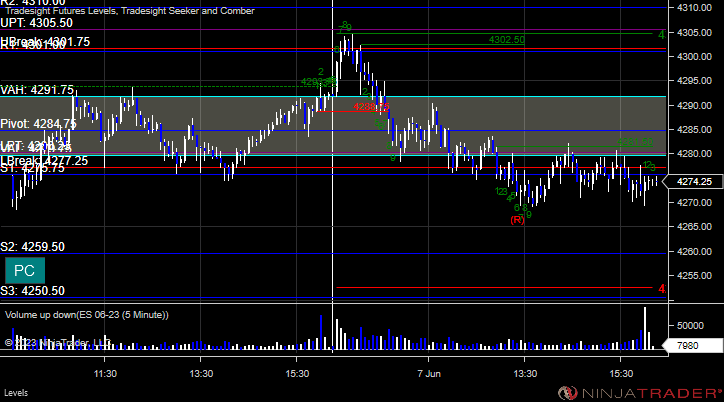

ES with Levels:

ES with Market Directional:

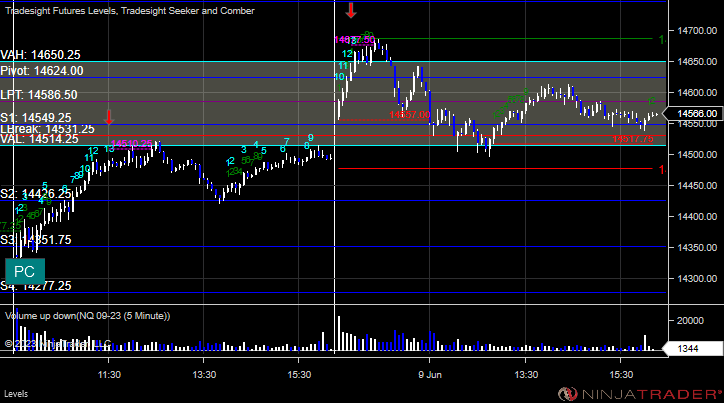

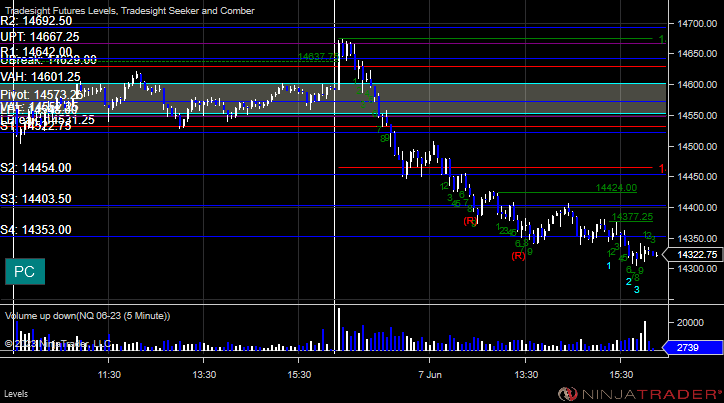

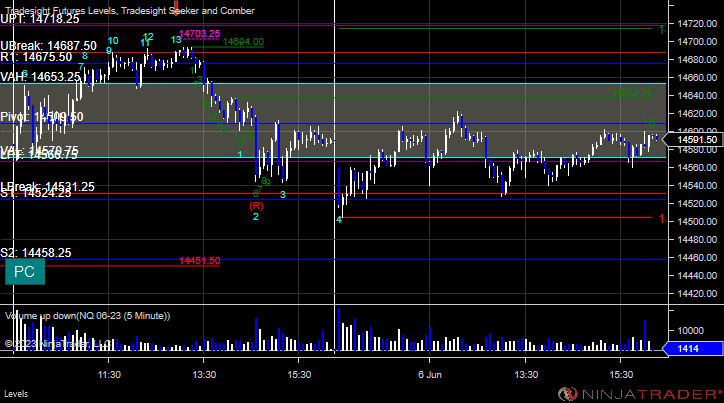

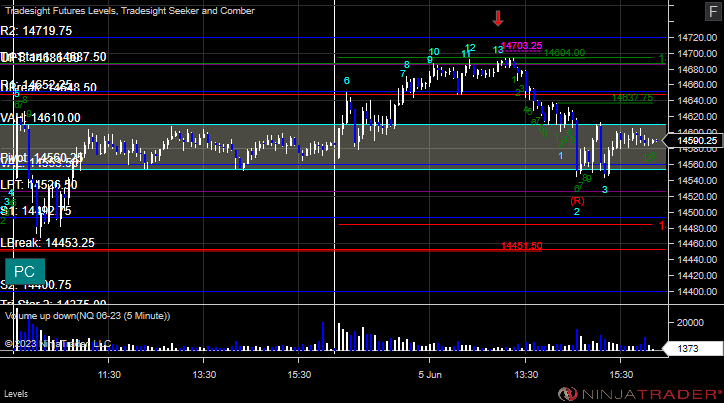

NQ with Levels:

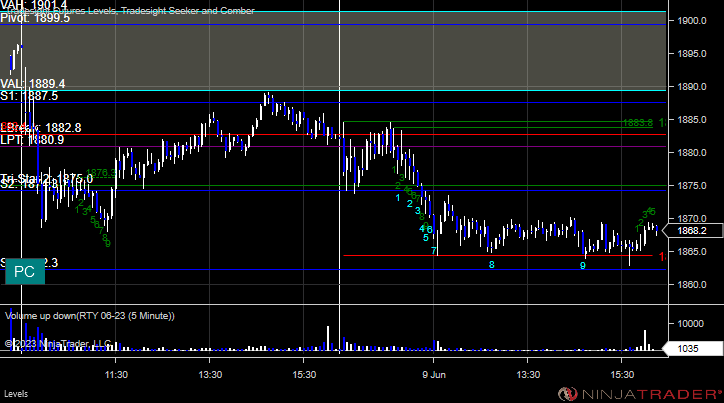

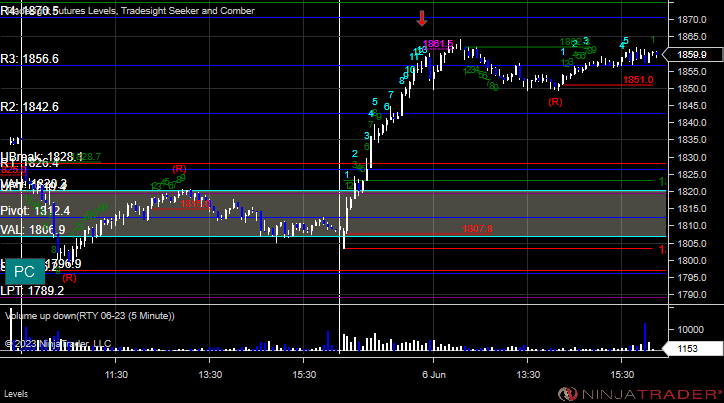

RTY with Levels:

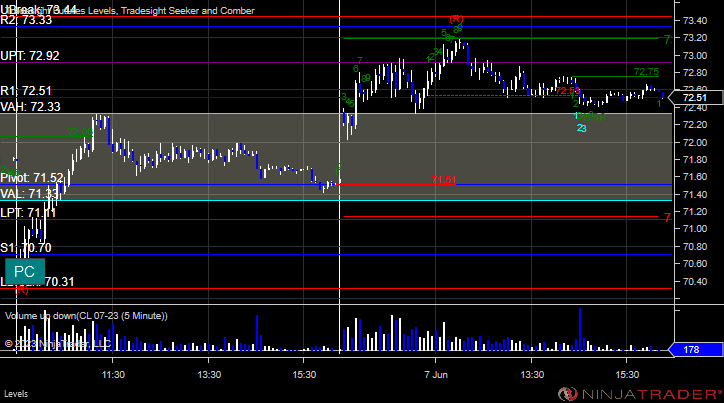

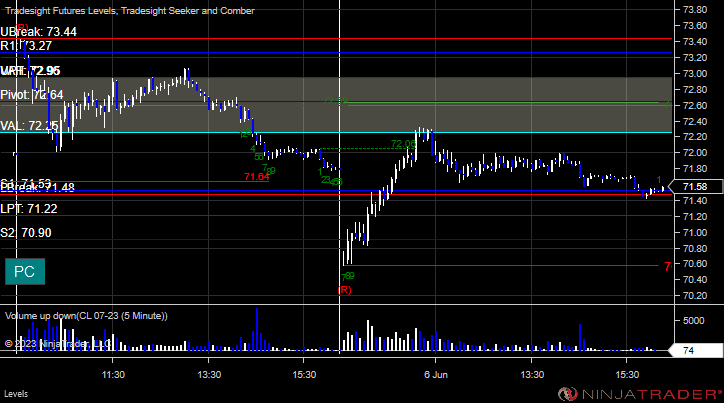

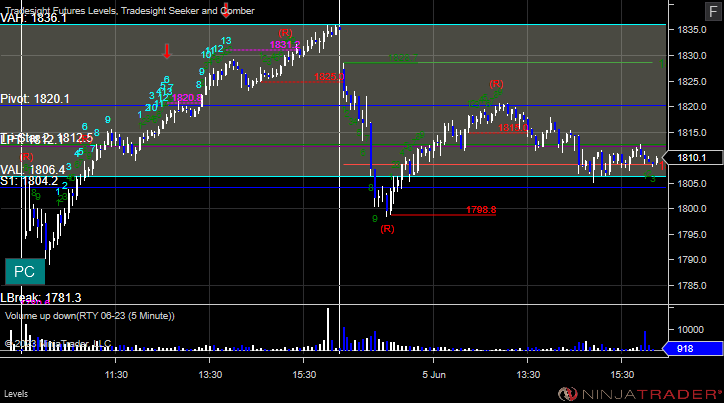

CL with Levels:

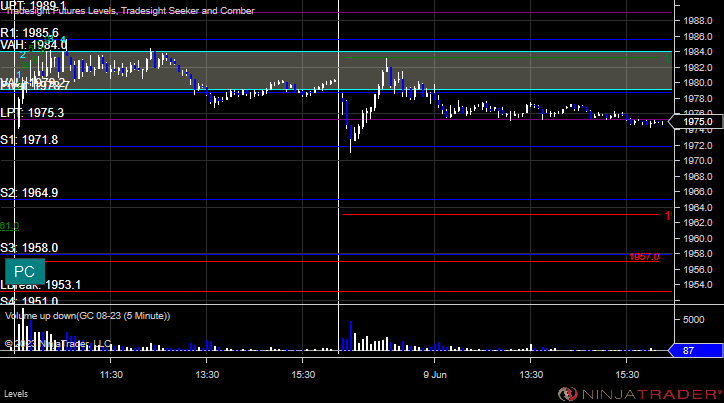

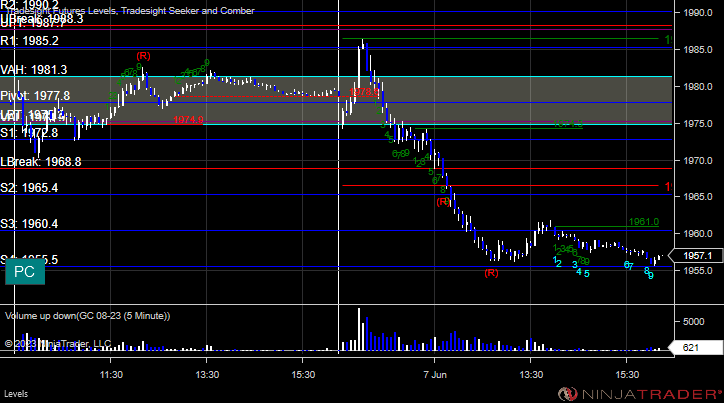

GC with Levels:

Futures:

A nice winner for the session.

ES Opening Range Play, triggered long at A and worked:

Additional Futures Calls:

None.

Results: +13 ticks.

Stocks: No calls for the session. Not usually worth it on the first day of futures contract roll.

That's 0 triggers with market support.

Forex: No calls for the session. We closed out the second half of the prior day's play in the money.

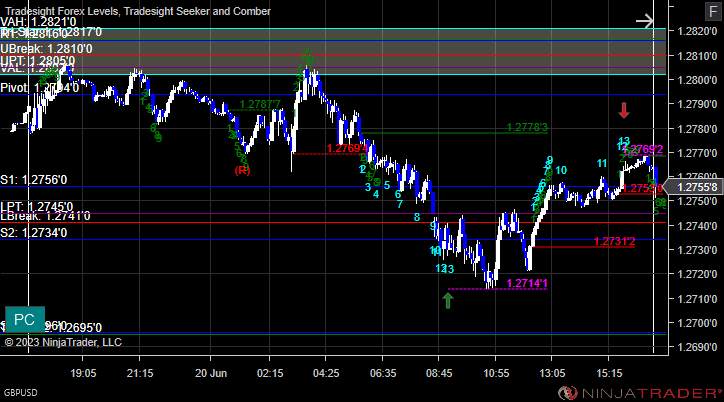

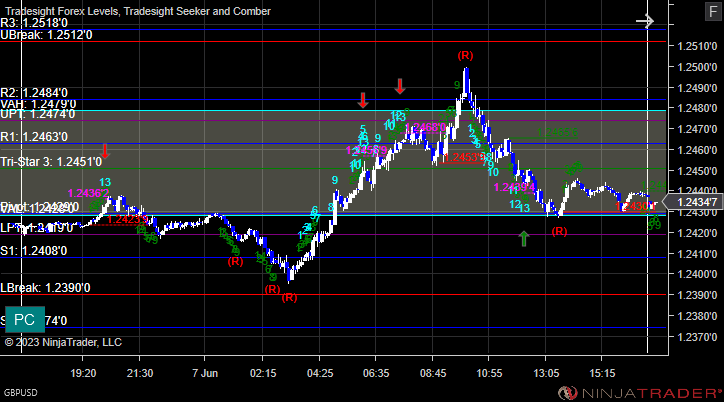

GBPUSD:

Results: +25 pips.

Tradesight Recap Report for 6/8/23

Today in the Markets:

The markets gapped down and went lower as we start to roll to the September futures contracts. We made our way back up to the open on 5.1 billion NASDAQ shares.

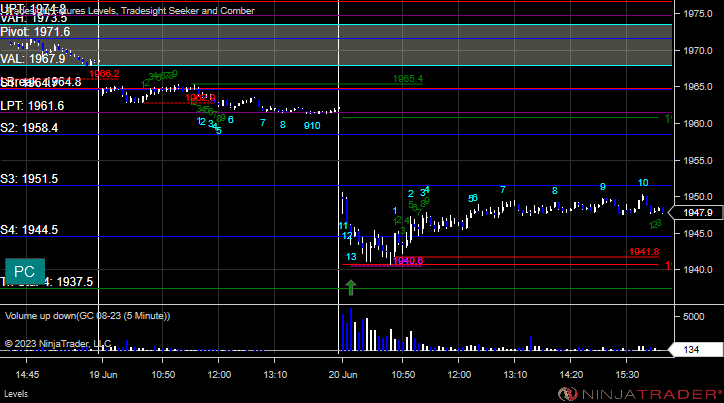

ES with Levels:

ES with Market Directional:

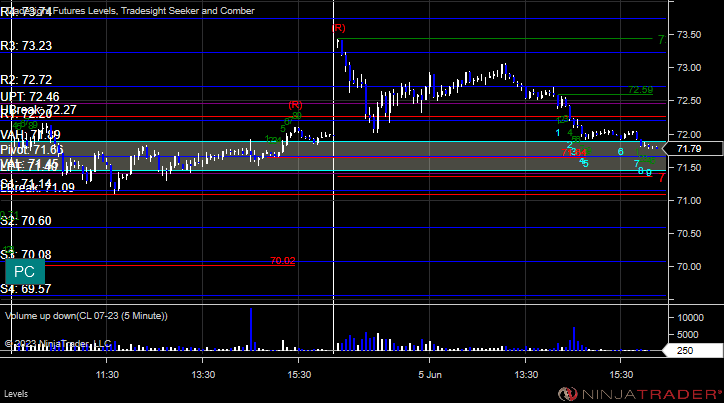

NQ with Levels:

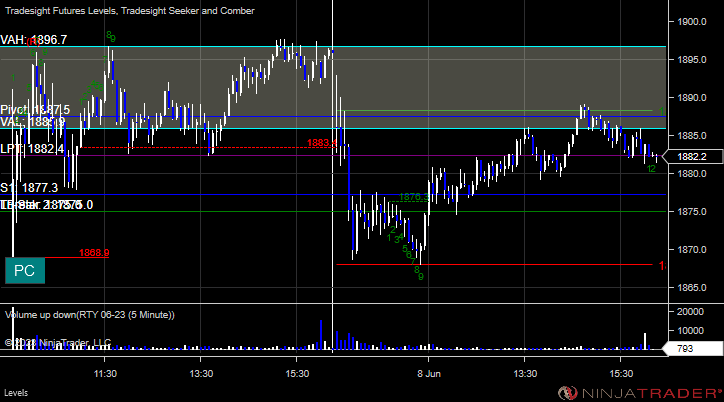

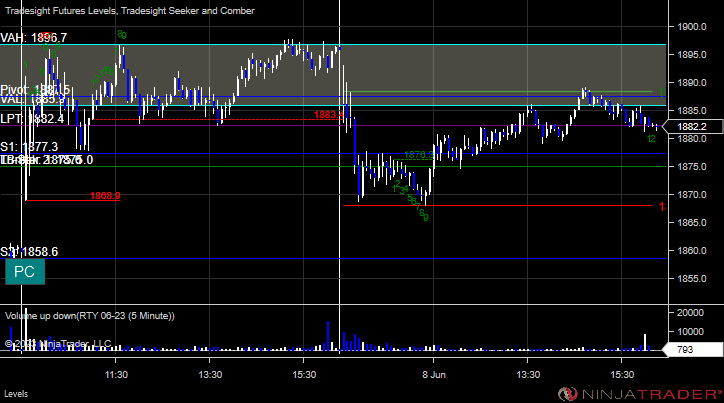

RTY with Levels:

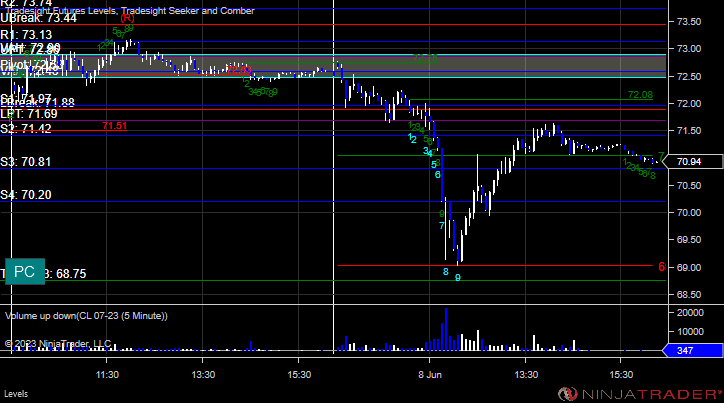

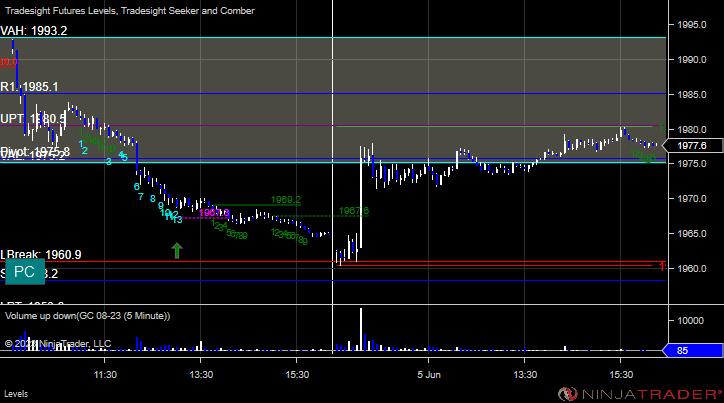

CL with Levels:

GC with Levels:

Futures:

A winner and a loser.

ES Opening Range Play, triggered long at A and stopped under midpoint. Triggered short at B and worked enough for a partial:

Additional Futures Calls:

None.

Results: -11 ticks.

Stocks:

A loser for the session. Not too many triggers again.

These are the Tradesight calls that triggered, Rich's FSLR triggered short (with market support) but didn't work:

That's 1 trigger with market support, and it did not.

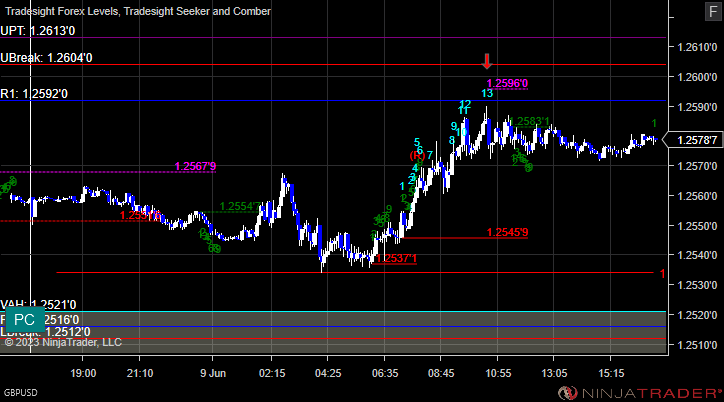

Forex:

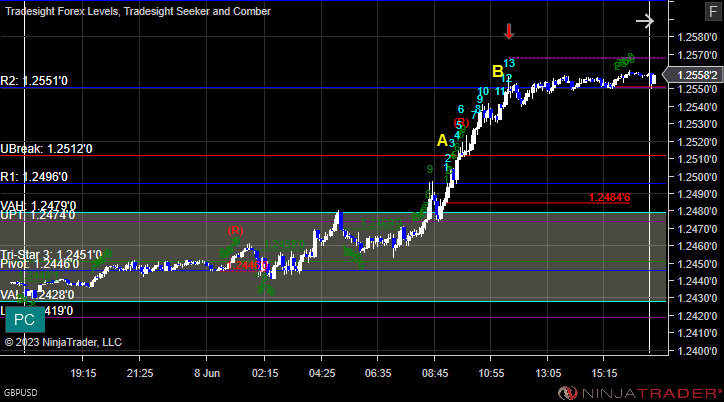

A winner (still going) for the session.

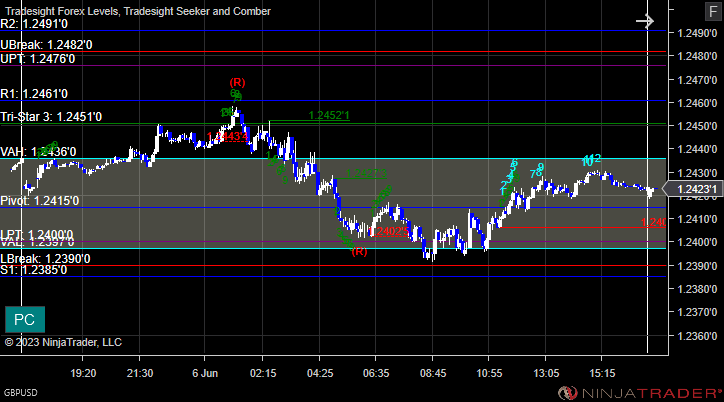

GBPUSD, triggered long at A, hit its first target at B, now holding the second half with a stop one pip under uBreak (1.2512):

Results: Trade still not over.

Tradesight Recap Report for 6/7/23

Today in the Markets:

A small gap up that filled and drifted lower, mostly staying inside of the prior day's range on 5.1 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

A small winner for the session.

ES Opening Range Play, triggered long at A and worked enough for a partial:

Additional Futures Calls:

None.

Results: +4 ticks.

Stocks:

Again, not much of a session, but we had a winner.

These are the Tradesight calls that triggered, Rich's FSLR triggered short (without market support) and didn't work:

His WDAY triggered short (with market support) and worked:

That's 1 trigger with market support, and it worked.

Forex: No calls for the session.

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 6/6/23

Today in the Markets:

The markets gapped down slightly, filled, and sat in the Value Area on 4.9 billion NASDAQ shares.

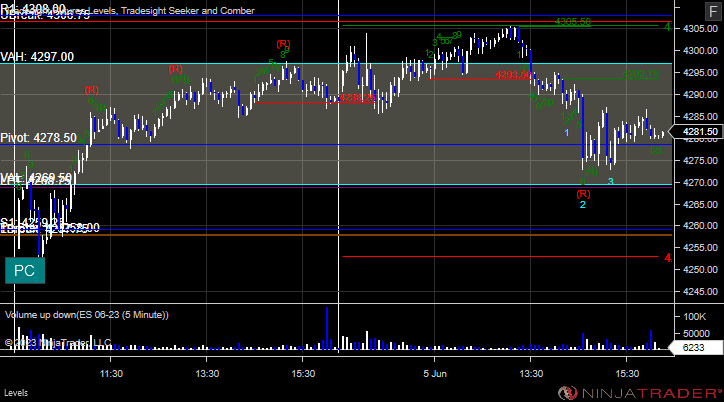

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

A winner and a loser for the session.

ES Opening Range Play, triggered short at A and worked enough for a partial. Triggered long at B and stopped under the midpoint:

Additional Futures Calls: None.

Results: -8 ticks.

Stocks:

Not a very exciting session for triggers.

These are the Tradesight calls that triggered, LULU triggered short (without market support) but didn't go enough either way to count:

That's 0 triggers with market support.

Forex: A flat session.

GBPUSD: 2 calls, none triggered:

Results: +0 pips.

Tradesight Recap Report for 6/5/23

Today in the Markets:

The markets opened fairly flat, drifted higher, and then sold off a bit in the afternoon on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

A mixed bag after a nice winner.

ES Opening Range Play, triggered long at A and worked. Triggered short at B and stopped:

Additional Futures Calls: None.

Results: -11 ticks

Stocks:

Lots of calls but not much triggered.

These are the Tradesight calls that triggered, Rich's NFLX triggered long (without market support) and worked:

That's 0 triggers with market support.

Forex: No calls for the session.

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 5/26/23

Today in the Markets:

The markets gapped up and pushed higher for an hour and then went flat on 5.1 billion NASDAQ shares.

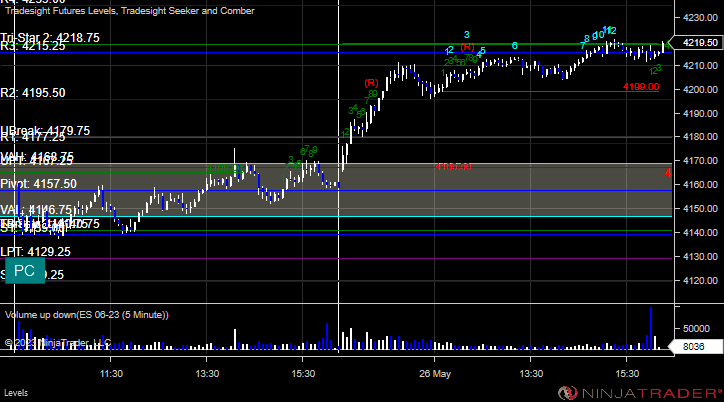

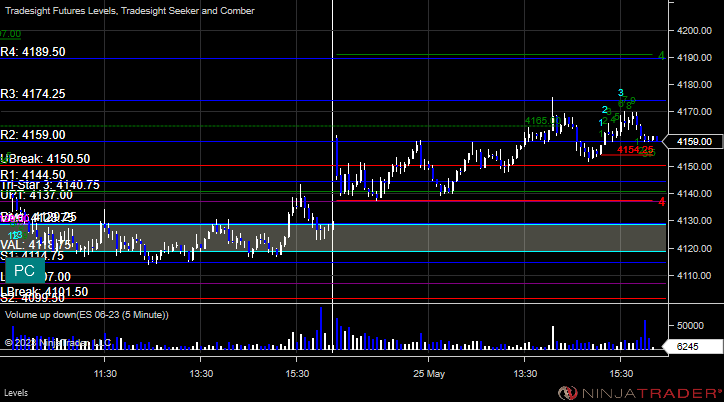

ES with Levels:

ES with Market Directional:

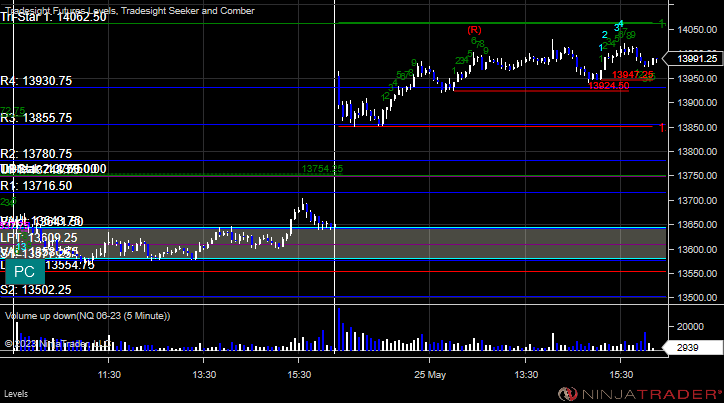

NQ with Levels:

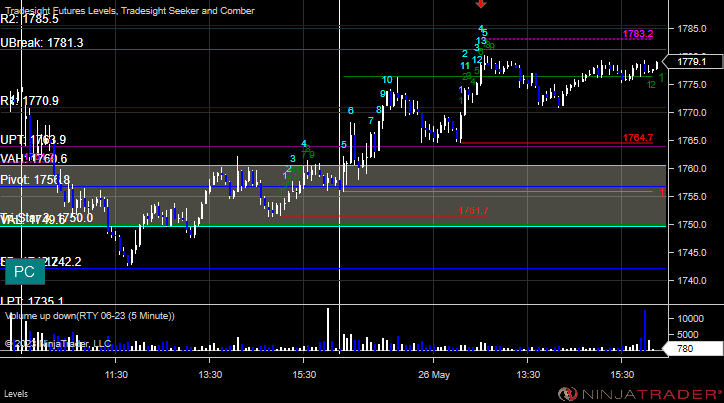

RTY with Levels:

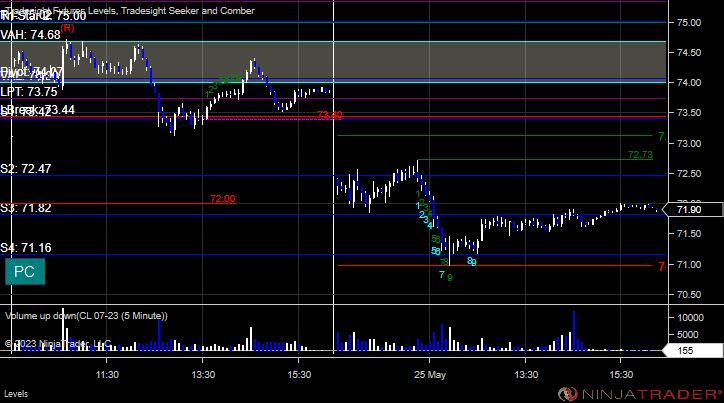

CL with Levels:

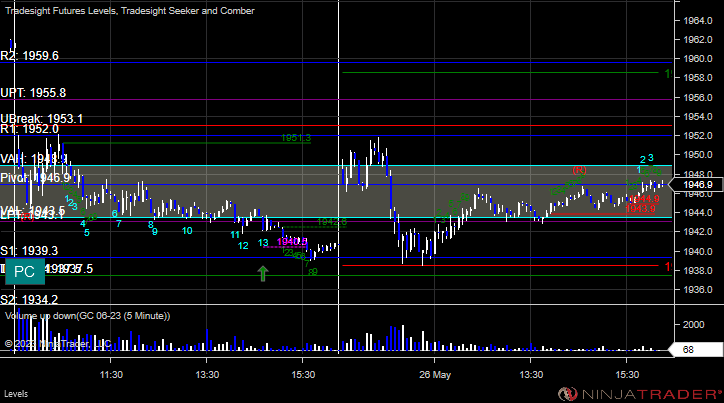

GC with Levels:

Futures:

A winner.

ES Opening Range Play, triggered long at A and it worked:

Additional Futures Calls:

None.

Results: +4 ticks.

Stocks:

A winner for the session.

These are the Tradesight calls that triggered, Rich's CRM triggered long (with market support) and it worked:

That's 1 trigger with market support, and it worked.

Forex: No calls for the session.

GBPUSD:

Results: 0 pips.

Tradesight Recap Report for 5/25/23

Today in the Markets:

The markets gapped up and took all day to drift higher on 5 billion NASDAQ shares.

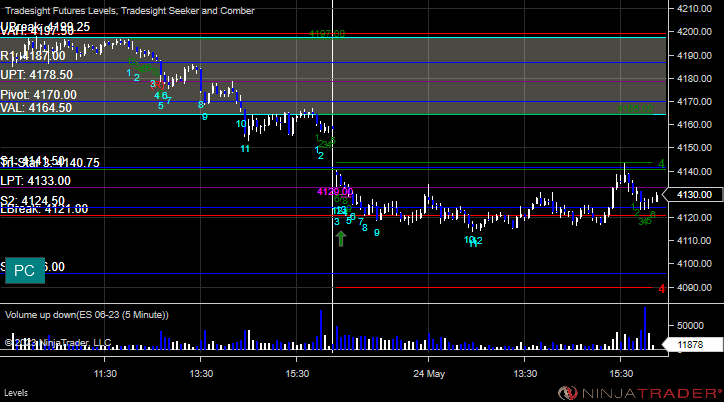

ES with Levels:

ES with Market Directional:

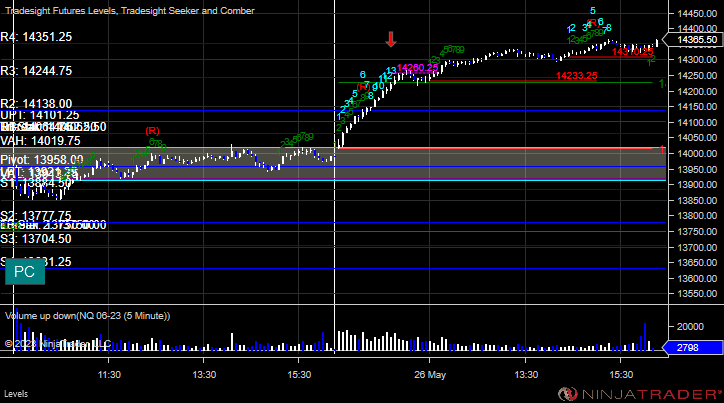

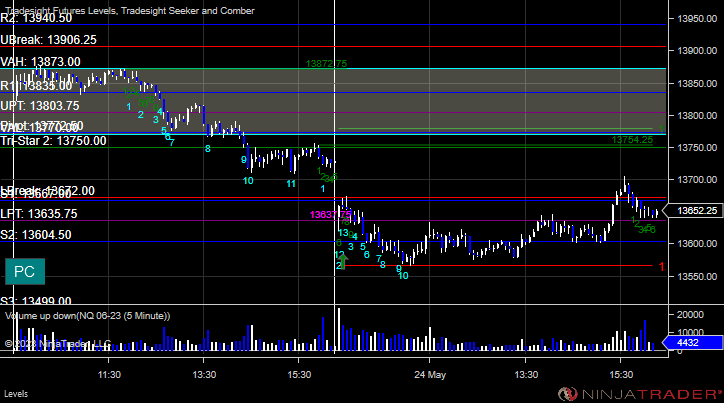

NQ with Levels:

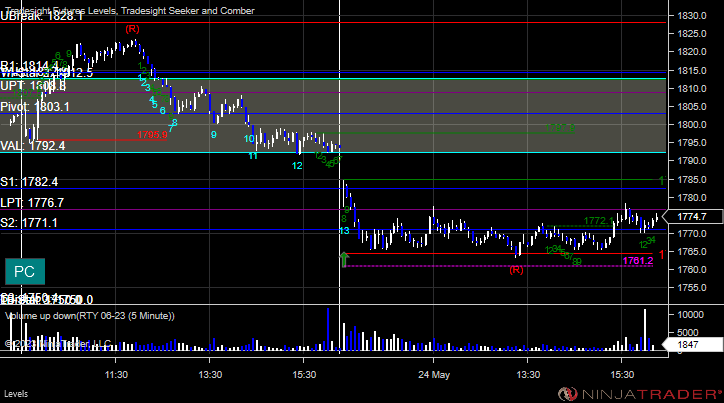

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Nothing here.

ES Opening Range Play, triggered short at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +00 ticks.

Stocks:

A mixed bag for the session.

These are the Tradesight calls that triggered, Rich's LLY triggered short (with market support) but didn't work:

His GILD triggered short (with market support) and worked:

His TGT triggered short (with market support) but didn't work:

That's 3 triggers with market support, 1 worked and 2 did not.

Forex: No calls for the session.

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 5/24/23

Today in the Markets:

The markets gapped down and went dead flat again on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

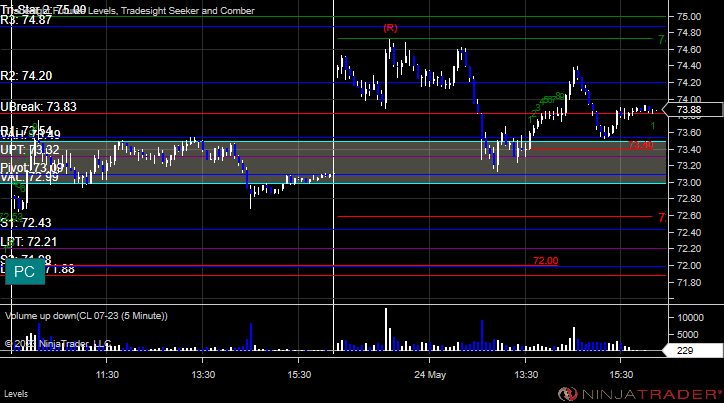

CL with Levels:

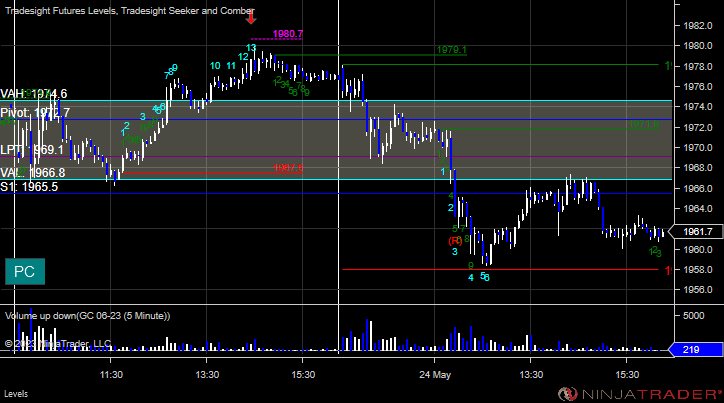

GC with Levels:

Futures:

A nice winner for the session.

ES Opening Range Play, triggered short at A and worked:

Additional Futures Calls:

None.

Results: +26 ticks

Stocks:

Nothing major happened.

These are the Tradesight calls that triggered, Rich's MA triggered short (with market support) but didn't work:

His AI triggered short (with market support) but didn't work.

That's 2 triggers with market support, and neither worked.

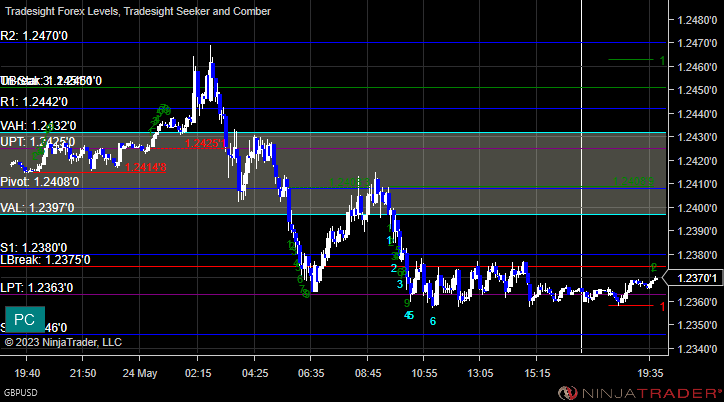

Forex: No calls for the session.

GBPUSD:

Results: 0 pips.