Tradesight Recap Report for 5/23/23

Today in the Markets:

The markets gapped down and headed lower, although they stayed in the range of the last several weeks, on 4.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

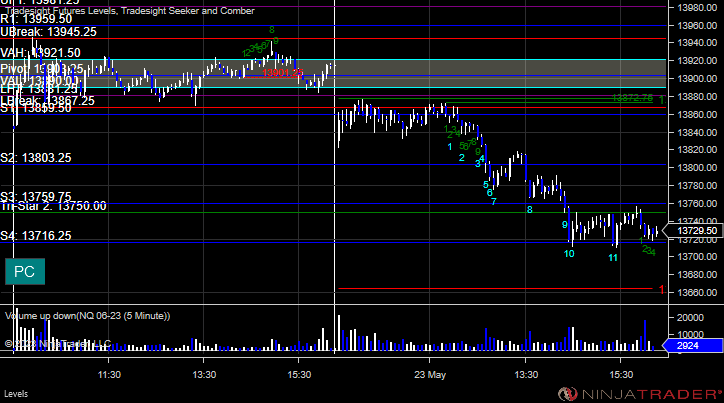

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

A winner for the session.

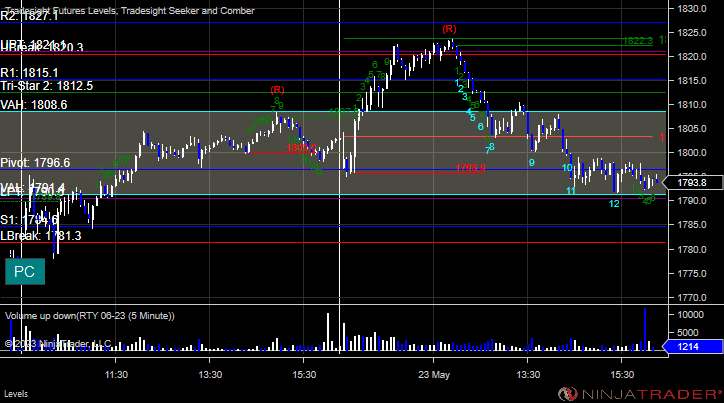

ES Opening Range Play, triggered long at A and worked:

Additional Futures Calls: None.

Results: +8 ticks

Stocks:

Nothing that mattered besides two winners.

These are the Tradesight calls that triggered, Rich's AMAT triggered short (without market support) and worked:

His MSFT triggered short (without market support) and worked big:

That's 0 triggers with market support.

Forex: No calls for the session.

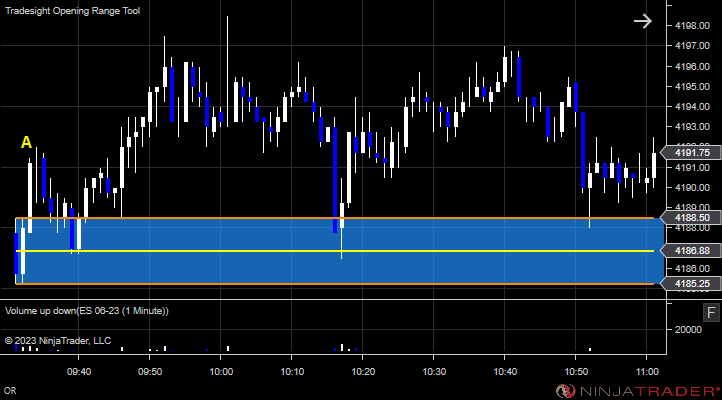

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 5/22/23

Today in the Markets:

Just a waste of time. Dead flat.

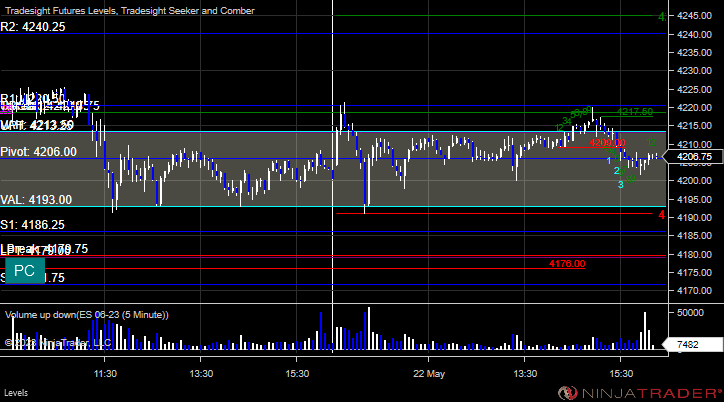

ES with Levels:

ES with Market Directional:

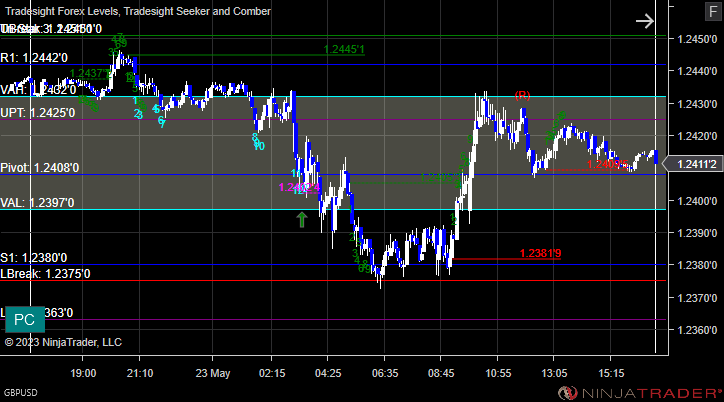

NQ with Levels:

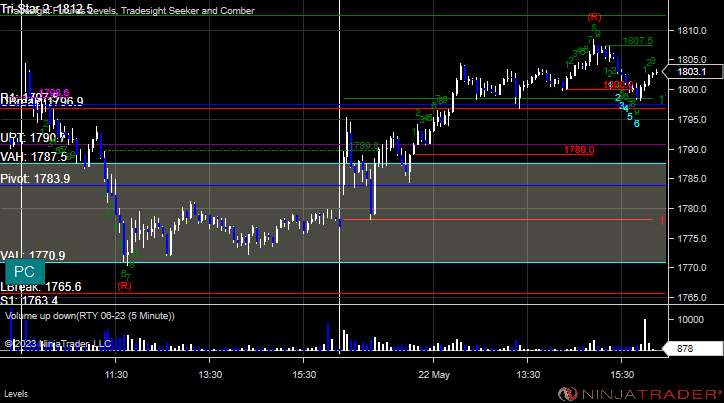

RTY with Levels:

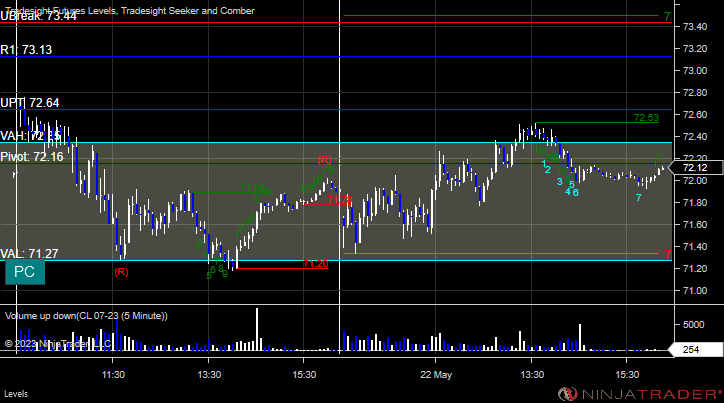

CL with Levels:

GC with Levels:

Futures:

No trades on a dead day in the markets.

ES Opening Range Play, triggered long at A but too far out of range to take. Triggered short at B and also too far out of range to take:

Additional Futures Calls: None.

Results: +0 ticks

Stocks:

A winner and a loser for the session.

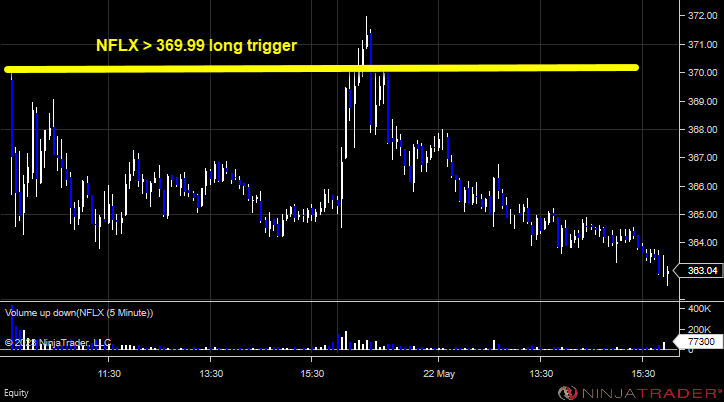

These are the Tradesight calls that triggered, Rich's NFLX triggered long (with market support) but didn't work:

CROX triggered short (with market support) and worked:

That's 2 triggers with market support, 1 worked and 1 did not.

Forex: No calls for the session.

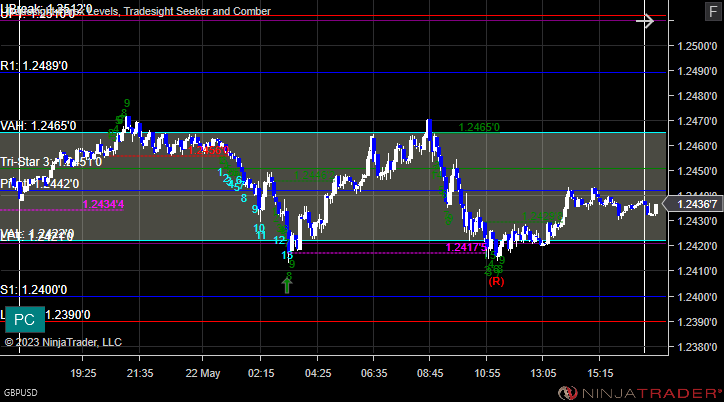

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 5/12/23

Today in the Markets:

The markets gapped up on news and sold off and then...closed about even...AGAIN. Not exciting. The world is waiting for the debt ceiling situation to be resolved.

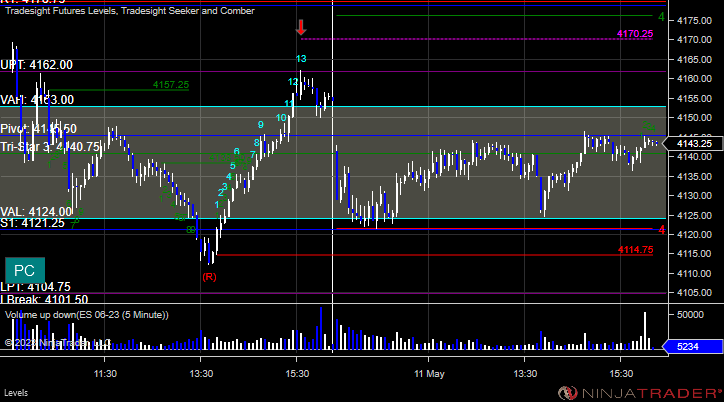

ES with Levels:

ES with Market Directional:

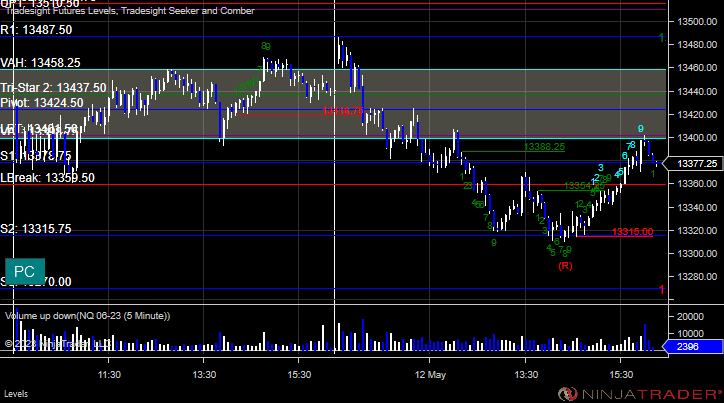

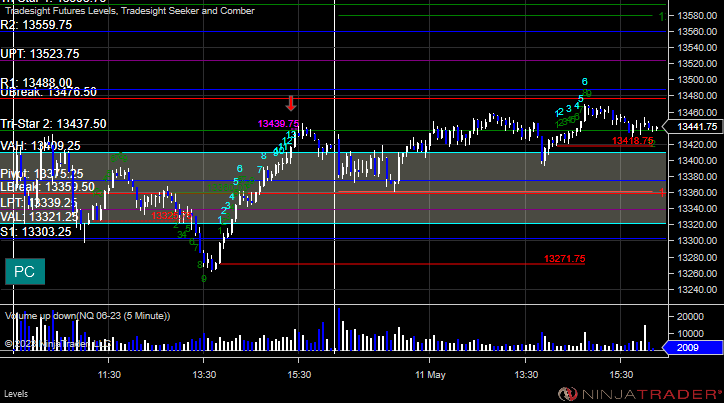

NQ with Levels:

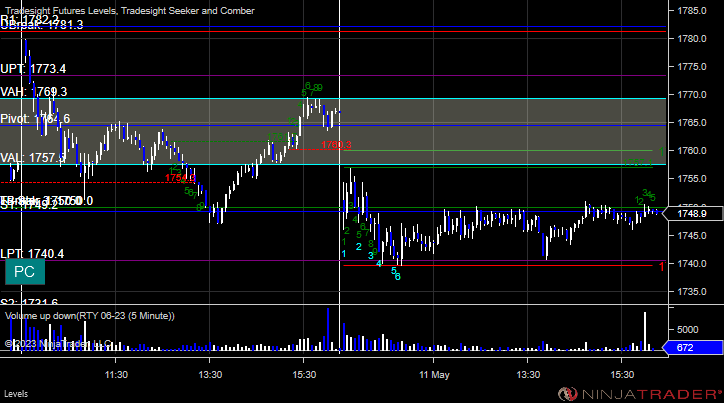

RTY with Levels:

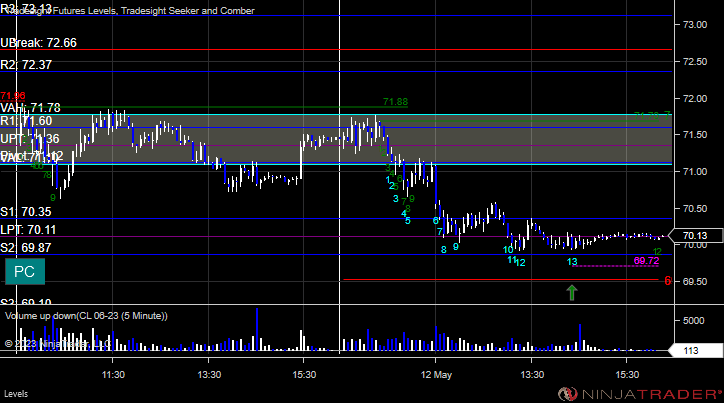

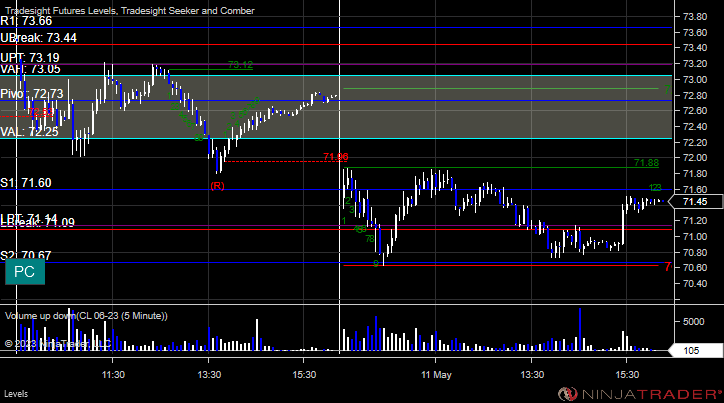

CL with Levels:

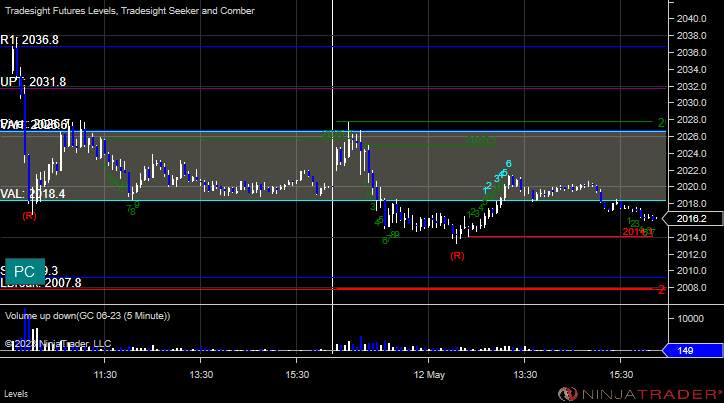

GC with Levels:

Futures:

Two losers for the session.

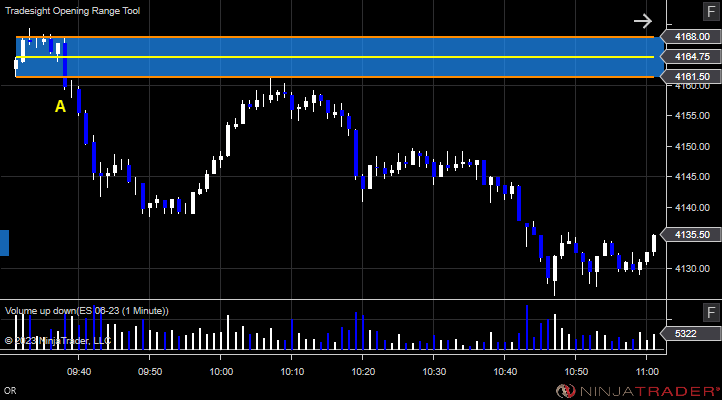

ES Opening Range Play, triggered long at A and stopped, triggered short at B and stopped:

Additional Futures Calls: None.

Results: -25 ticks

Stocks:

No reason to make calls here.

These are the Tradesight calls that triggered: None.

That's 0 triggers.

Forex: No calls for the session.

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 5/11/23

Today in the Markets:

We just can't do anything. We gapped down small and sat flat all day but made some money.

ES with Levels:

ES with Market Directional:

NQ with Levels:

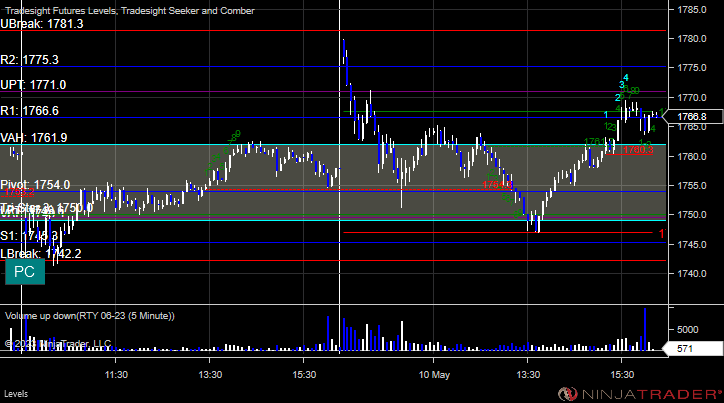

RTY with Levels:

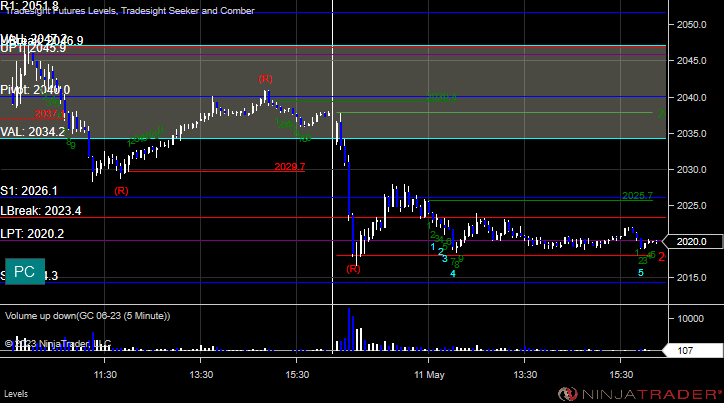

CL with Levels:

GC with Levels:

Futures:

Nothing here.

ES Opening Range Play, triggered short at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

A green day at least given how flat this remains.

These are the Tradesight calls that triggered, Rich's WDC triggered short (with market support) but didn't work:

PT play COIN triggered short (with market support) and worked:

Rich's ETSY triggered long (barely with market support) and worked:

His ADBE triggered short (with market support) but didn't go enough either way to count:

That's 4 triggers with market support, 2 worked, 1 did not, and 1 didn't do anything.

Forex: No calls for the session.

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 5/10/23

Today in the Markets:

Well, that was a bit interesting but still amounted to nothing. We gapped up and sold off and filled and closed barely green for the session on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

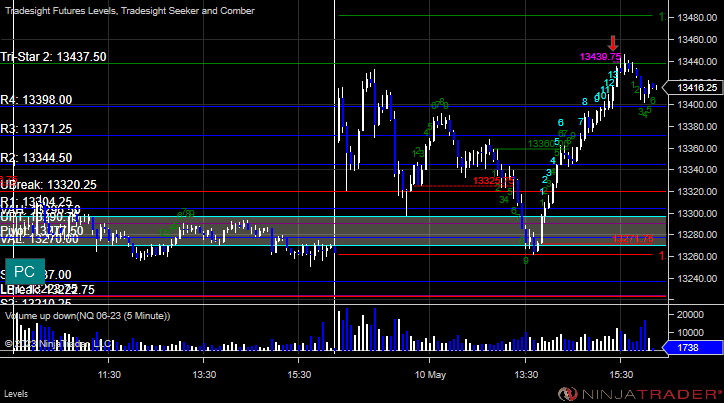

NQ with Levels:

RTY with Levels:

CL with Levels:

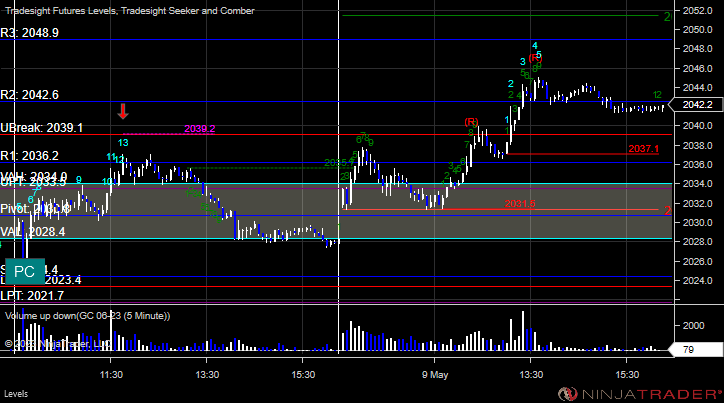

GC with Levels:

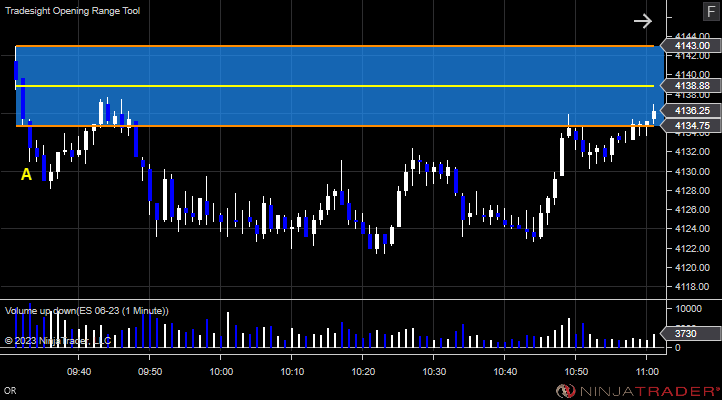

Futures:

A nice winner for the day.

ES Opening Range Play, triggered short at A and worked big:

Additional Futures Calls:

None.

Results: +40 ticks

Stocks:

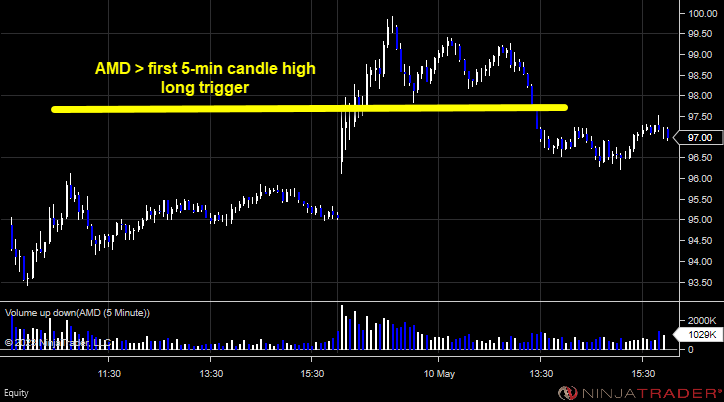

A decent day.

These are the Tradesight calls that triggered, Rich's NFLX triggered long (without market support) but didn't work:

His AMD triggered long (without market support) and worked:

His GDX triggered short (with market support) and worked:

That's 1 trigger with market support, and it worked.

Forex: No calls for the session.

There remains no point in Forex.

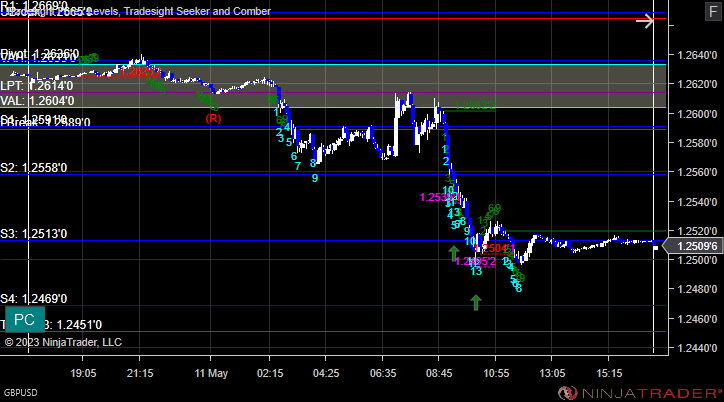

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 5/9/23

Today in the Markets:

This is crazy. So we gapped down a little and then just went dead flat again on 4.8 billion NASDAQ shares.

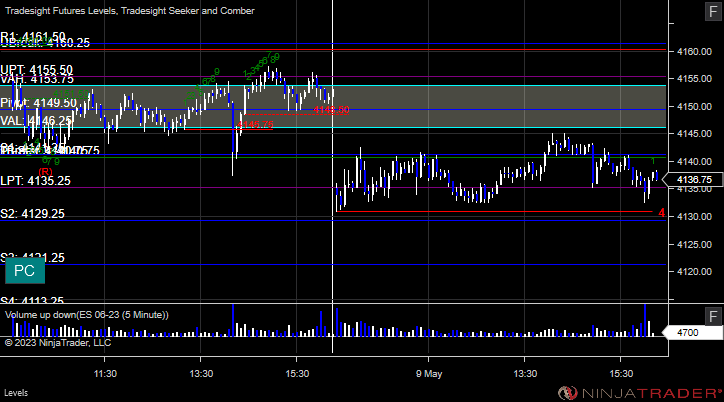

ES with Levels:

ES with Market Directional:

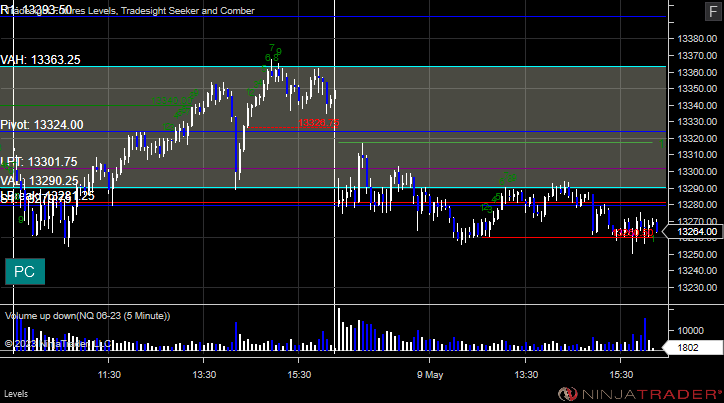

NQ with Levels:

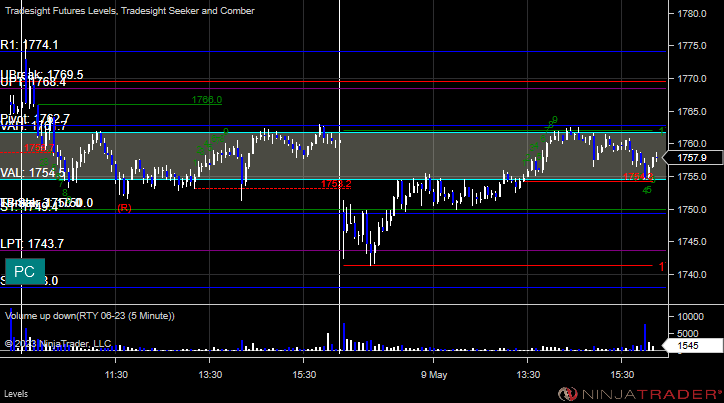

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

A winner and a loser on a flat day in the markets.

ES Opening Range Play, triggered short at A and stopped above the OR high, triggered long at B and worked:

Additional Futures Calls:

None.

Results: -10 ticks.

Stocks:

So horrible. No action, only 1 trigger.

These are the Tradesight calls that triggered, Rich's LRCX triggered short (with market support) but didn't go enough either way to count:

That's 0 triggers with market support.

Forex: No calls for the session.

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 5/8/23

Today in the Markets:

Wow, what a flat opening and flat day with nothing to do on 4.9 billion NASDAQ shares. This is nuts.

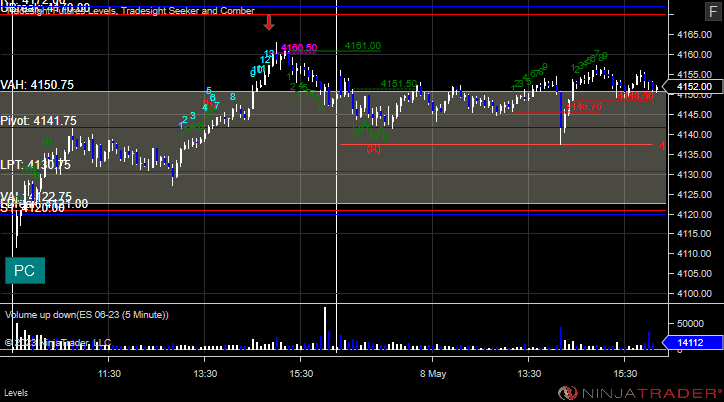

ES with Levels:

ES with Market Directional:

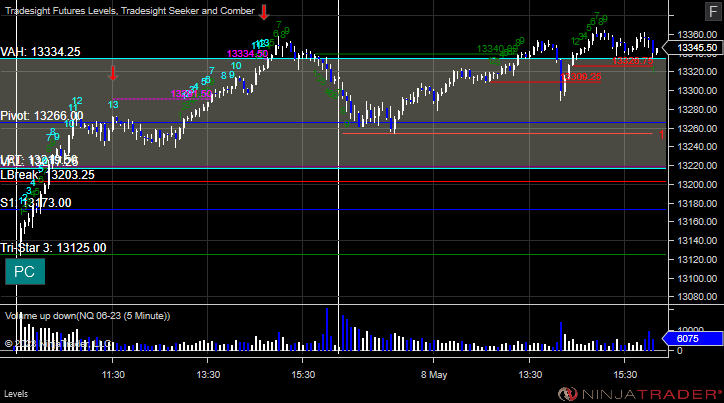

NQ with Levels:

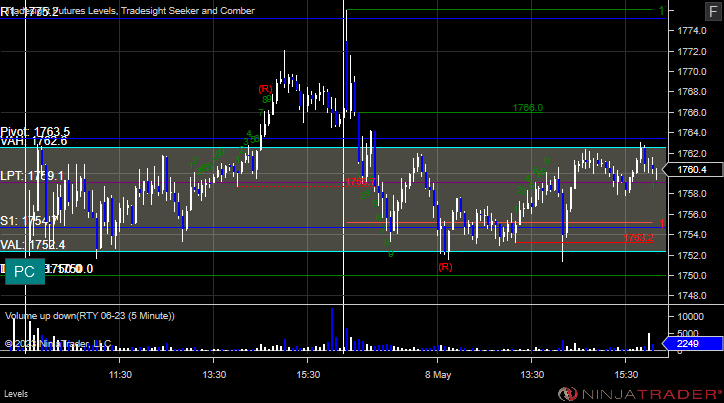

RTY with Levels:

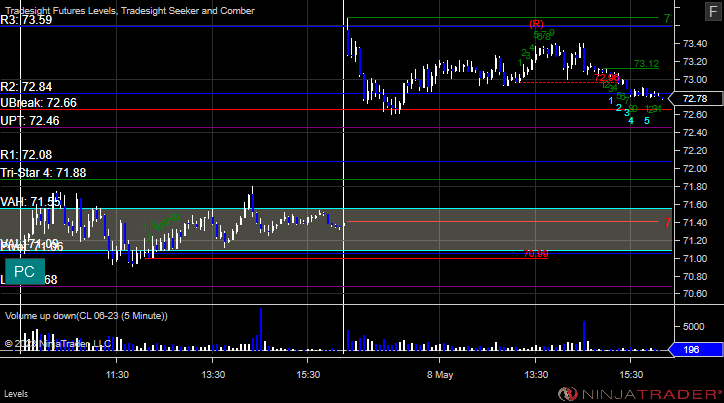

CL with Levels:

GC with Levels:

Futures:

A loser for the session.

ES Opening Range Play, triggered short at A and stopped:

Additional Futures Calls:

None.

Results: -14 ticks

Stocks:

What a flat day. Nothing triggered.

These are the Tradesight calls that triggered: No calls for the session.

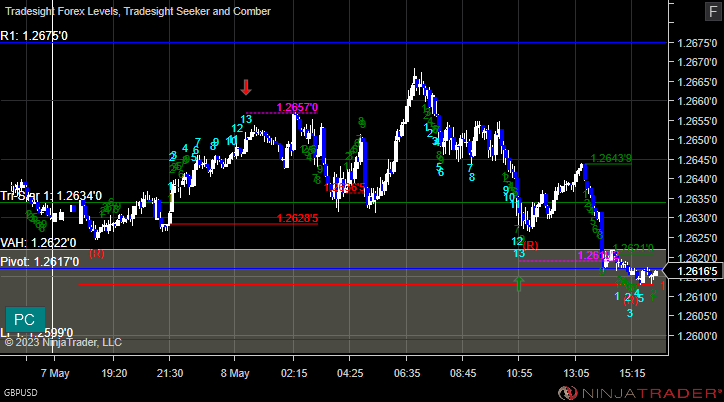

Forex: No calls for the session. What's the point?

GBPUSD:

Results: +0 pips

Tradesight Recap Report for 5/1/23

Today in the Markets:

Another dead day that closed where it opened on little movement on 4.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

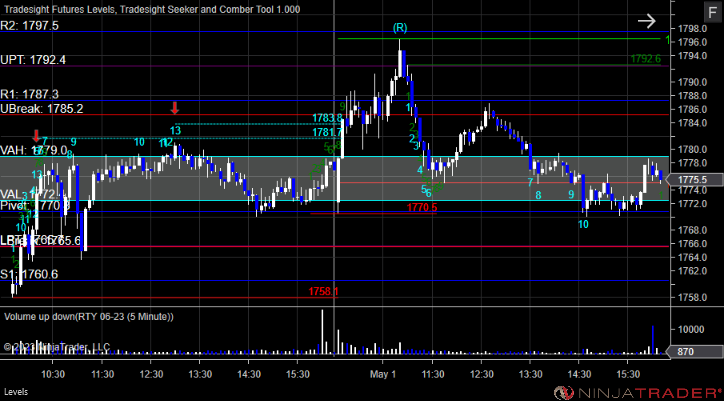

RTY with Levels:

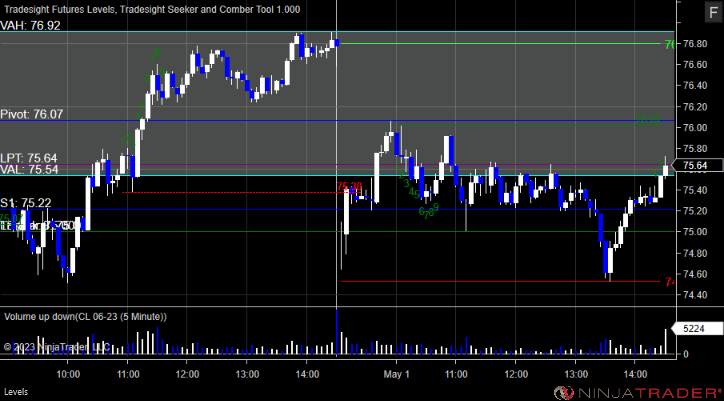

CL with Levels:

GC with Levels:

Futures:

One call triggered.

ES Opening Range Play, triggered long at A, but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

Four calls triggered.

These are the Tradesight calls that triggered, WYNN triggered long (with market support) and did not work:

Rich's DVN triggered long (with market support) and worked:

Rich's EOG triggered long (with market support) and worked enough for a partial:

Rich's SCHW triggered long (with market support) and did not work:

That's 4 triggers with market support, and 2 worked and 2 did not.

Forex:

No calls made.

GBPUSD:

Results: +0 pips

Tradesight Recap Report for 4/28/23

Today in the Markets:

A mostly dead day with a slight drift up on 5.0 billion NASDAQ shares.

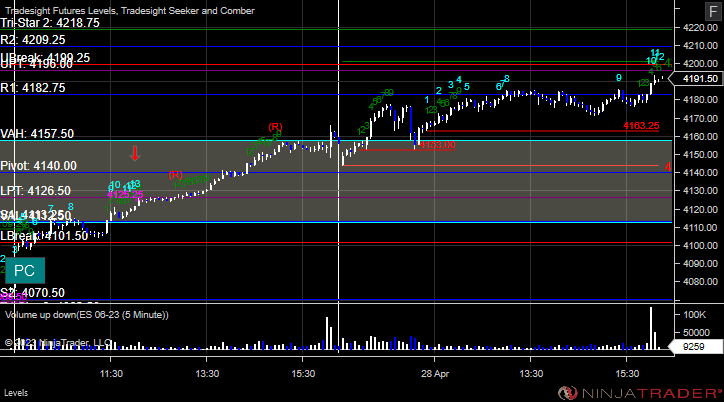

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

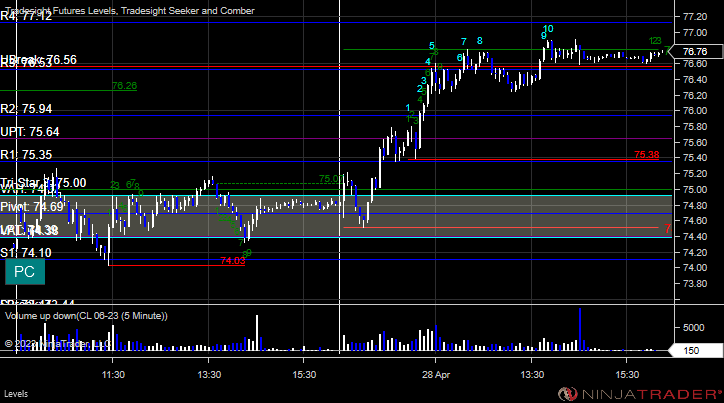

CL with Levels:

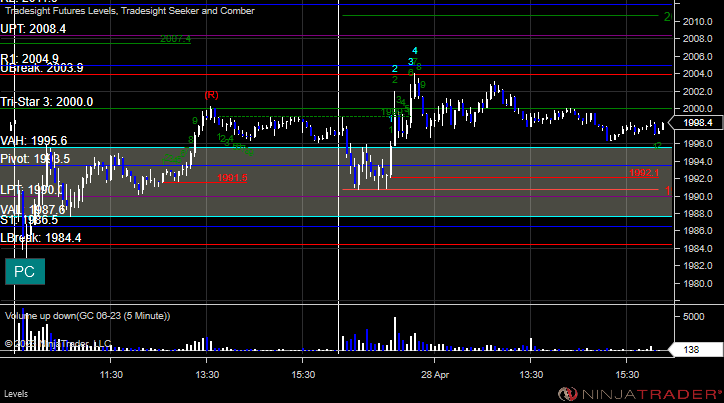

GC with Levels:

Futures:

A winner again for the session.

ES Opening Range Play, triggered long at A and worked:

Additional Futures Calls:

None.

Results: +5 ticks.

Stocks:

Literally nothing to call for end of month Friday.

These are the Tradesight calls that triggered:

No calls for the session.

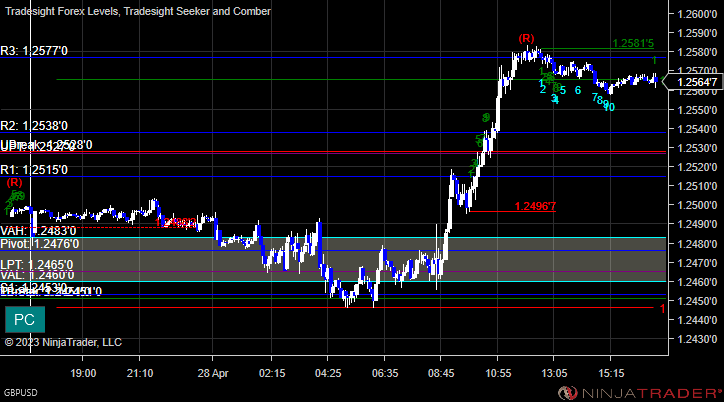

Forex:

No calls.

GBPUSD:

Results: +0 pips.

Tradesight Recap Report for 4/27/23

Today in the Markets:

And now we gap up instead and push higher back into the range of the last two weeks on 5.1 billion NASDAQ shares.

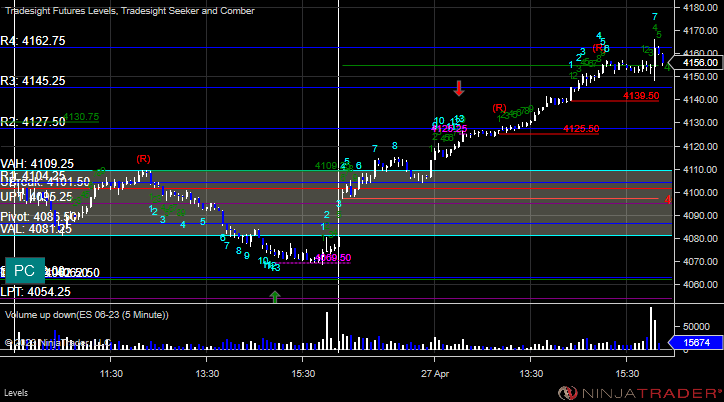

ES with Levels:

ES with Market Directional:

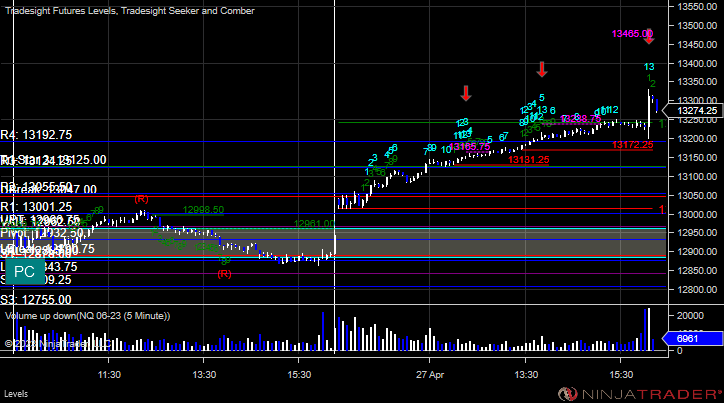

NQ with Levels:

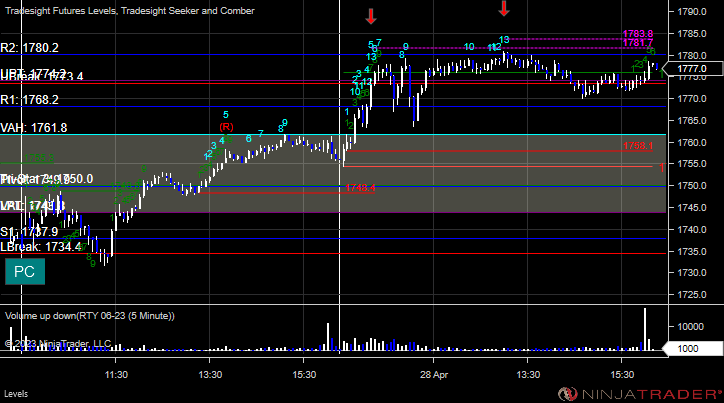

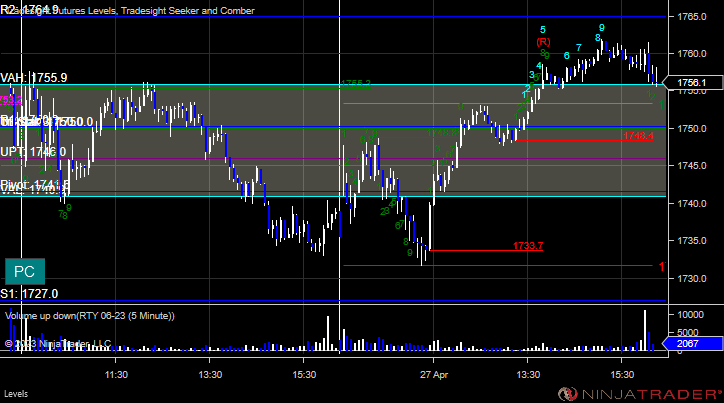

RTY with Levels:

CL with Levels:

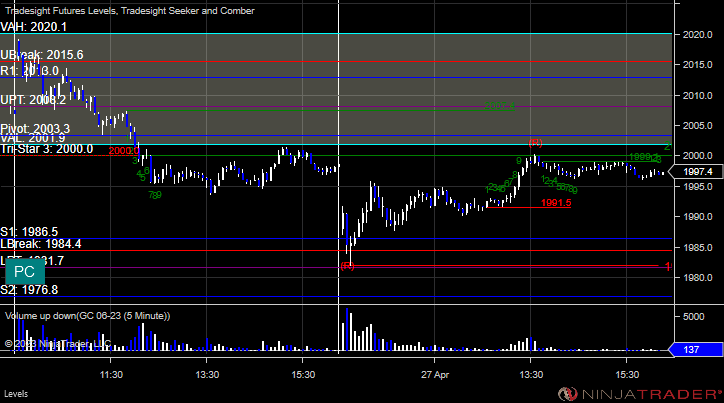

GC with Levels:

Futures:

A winner for the session again.

ES Opening Range Play, triggered long at A and worked:

Additional Futures Calls:

None.

Results: +4 ticks.

Stocks:

Lot of triggers without market support, but one key winner that had it.

These are the Tradesight calls that triggered, Rich's DE triggered short (without market support) and didn't work :

His DVN triggered short (without market support) and didn't work:

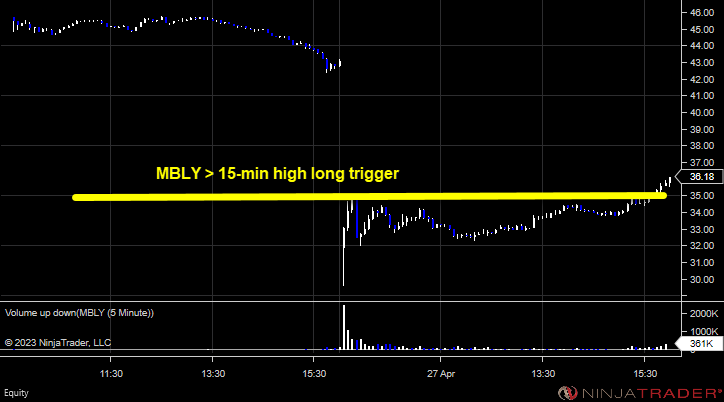

His MBLY triggered long (with market support) and worked:

His LLY triggered short (without market support) but didn't work:

That's 1 trigger with market support, and it worked.

Forex:

No action at all.

GBPUSD:

Results: +0 pips.