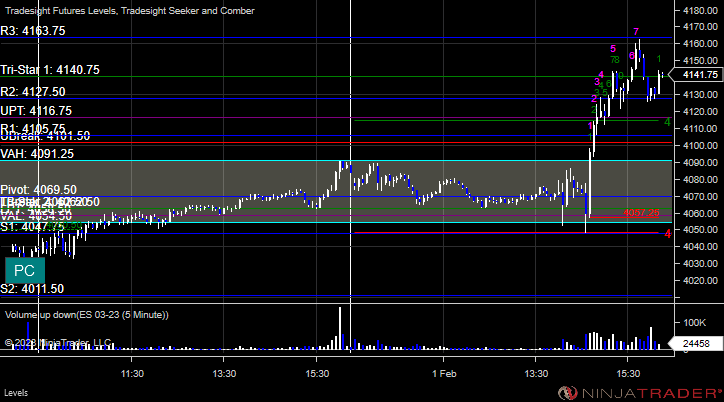

Tradesight Recap Report for 2/1/23

Today in the Markets:

The markets were dead flat until the Fed, then spiked on the Press Conference on 5.1 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered short at A and stopped, triggered long at B and stopped:

Additional Futures Calls:

Results: -28 ticks

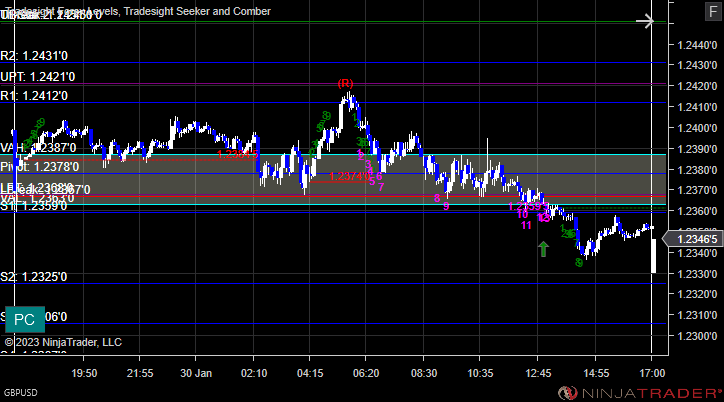

GBPUSD, triggered short at A and stopped. Triggered long at B, hit the first target and now still holding the second half with stop under the entry:

Results: -25 pips plus a trade that is still going

Stocks:

Nothing triggered on a day that was mostly flat until the Fed.

That’s 0 triggers with market support.

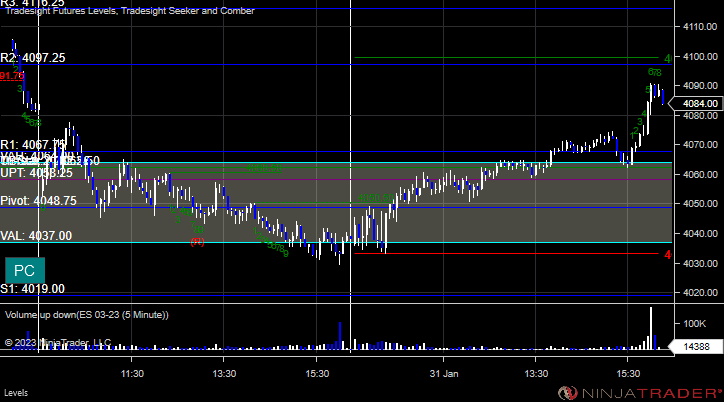

Tradesight Recap Report for 1/31/23

Today in the Markets:

We had a flat opening and basically drifted through most of the session in the Value Area and inside of the prior day's range until a very late move as we wait for the Fed.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered long at A and stopped under the midpoint, triggered short at B and stopped above the midpoint:

Additional Futures Calls:

None.

Results: -30 ticks

GBPUSD, triggered short at A and stopped:

Results: -25 pips

A winner for the session on a mostly dead day.

These are the Tradesight calls that triggered, Rich's CAT triggered short (with market support) and worked:

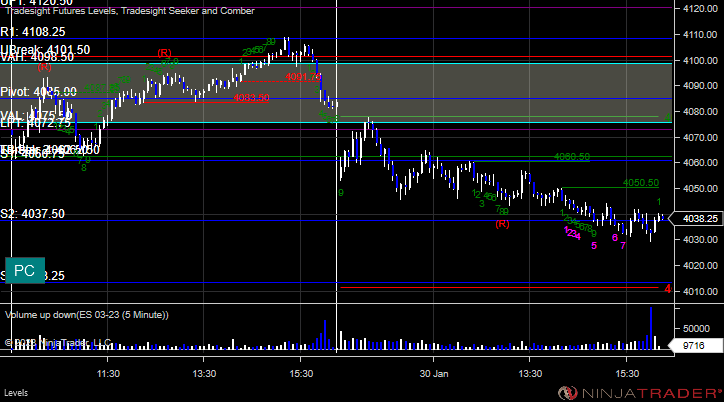

Tradesight Recap Report for 1/30/23

Today in the Markets:

The markets gapped down, almost filled, then drifted lower in a boring way on 4.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered long at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

GBPUSD:

Results: +0 pips

What a dull session.

These are the Tradesight calls that triggered, Rich's AXP triggered long (with market support) but didn't work:

His LLY triggered short (with market support) but didn't go enough either way to count:

That’s 2 triggers with market support, 1 of them didn't work and 1 didn’t go enough to count.

Tradesight Recap Report for 1/20/23

Today in the Markets:

The markets opened flat and drifted higher for options expiration Friday on 6 billion NASDAQ shares (boosted by the options expiration).

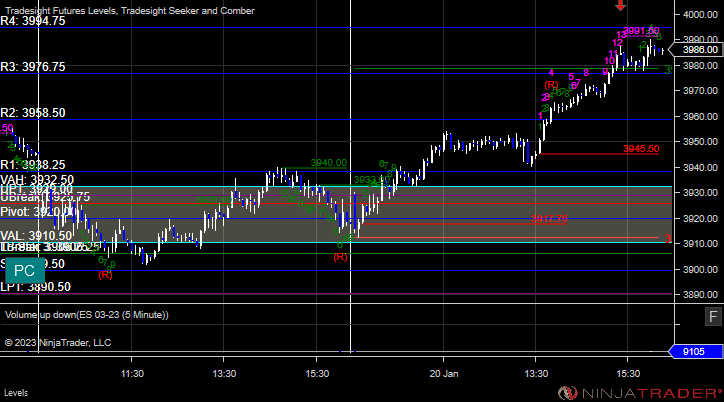

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take. Triggered long at B and worked:

Additional Futures Calls:

None.

Results: +10 ticks

GBPUSD, triggered short at A and stopped:

Results: -25 pips

Not much here again for options expiration.

These are the Tradesight calls that triggered, Rich's ENPH triggered short (with market support) and it didn't work:

Tradesight Recap Report for 1/19/23

Today in the Markets:

The markets gapped down a little and went dead flat for the session on 4.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked enough for a partial. Triggered short at B and worked enough for a partial:

Additional Futures Calls:

Results: +8 ticks

GBPUSD:

Results: +0 pips

Another flat session with not much to do.

These are the Tradesight calls that triggered, Rich's BA triggered short (with market support) and didn't work:

Tradesight Recap Report for 1/18/23

Today in the Markets:

The markets gapped up, filled, and then sold off after about 90 minutes on 5.3 billion NASDAQ shares. Looks like that was the options unraveling move.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered short at A but too far out of range to take. Triggered long at B and worked enough for a partial:

Additional Futures Calls:

None.

Results: +4 ticks

GBPUSD:

Results: +0 pips

Not much of a day.

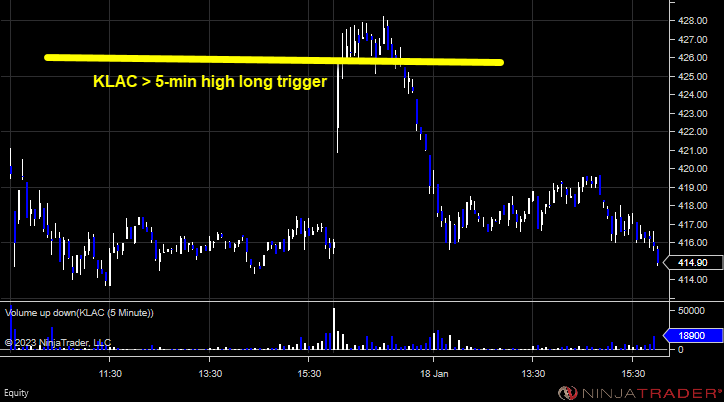

These are the Tradesight calls that triggered, Rich's META triggered long (with market support) but didn't work:

His KLAC triggered long (without market support) and didn't work:

Tradesight Recap Report for 1/17/23

Today in the Markets:

The markets gapped up small, pushed up, filled, and then went dead flat all day on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered short at A (avoided getting stopped out by a tick) and worked. Triggered long at B and worked:

Additional Futures Calls:

None

Results: +31 ticks

Forex:

GBPUSD, triggered long at A and stopped:

Results: -25 pips

A mostly flat day with the early headfake that went nowhere.

These are the Tradesight calls that triggered, Rich's FSLR triggered long (with market support) and didn't work:

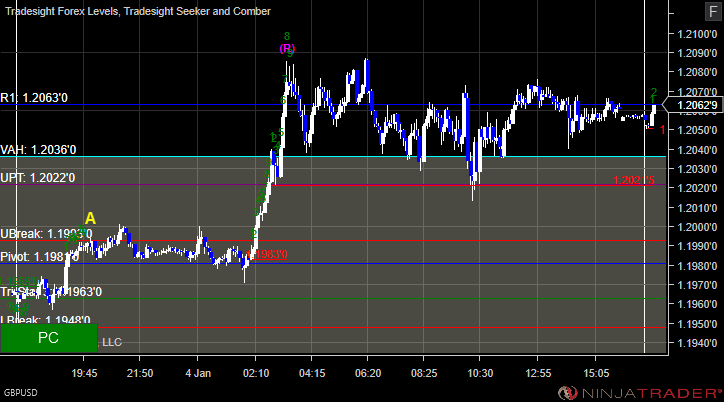

Tradesight Recap Report for 1/6/23

Today in the Markets:

Finally, some movement out of the range that we have been stuck in for two weeks on 4.5 billion NASDAQ shares.

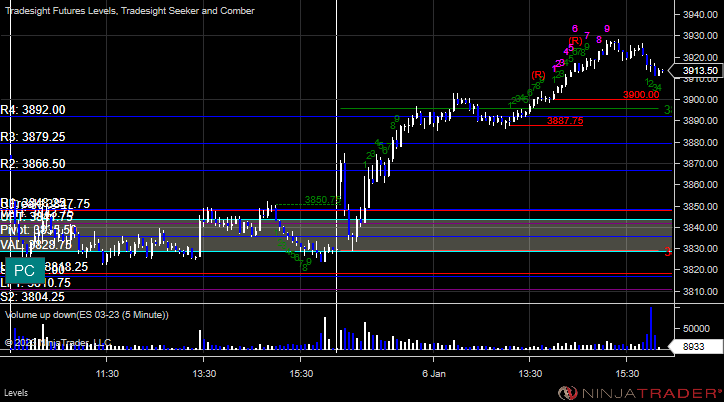

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered long at A but too far out of range to take. Triggered short at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

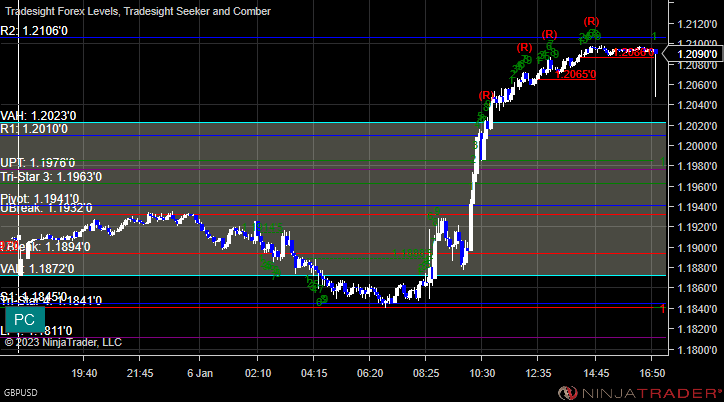

GBPUSD, stopped the second half of the prior day's trade:

Results: +45 pips

Another nice trade, and 4 green days to start 2023.

These are the Tradesight calls that triggered, Rich's CAT triggered long (with market support) and worked nicely:

Tradesight Recap Report for 1/5/23

Today in the Markets:

A little gap down and then just flat. 2023 has officially started out a dud.

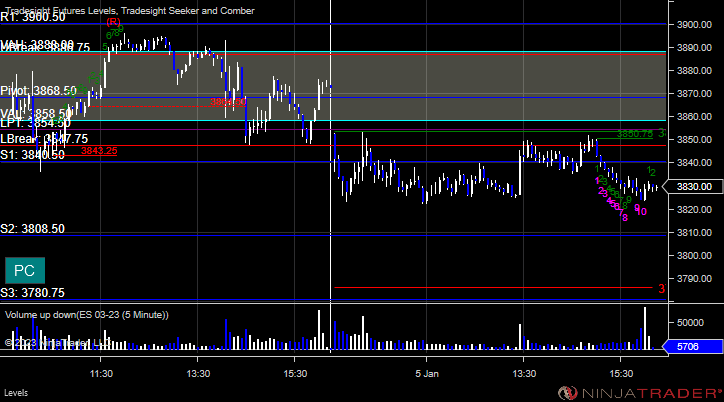

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered short at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

GBPUSD, triggered short at A, hit first target at S2, still holding second half:

Results: Trade is still going

Another green day despite a dull market.

These are the Tradesight calls that triggered, Rich's DE triggered short (with market support) and worked:

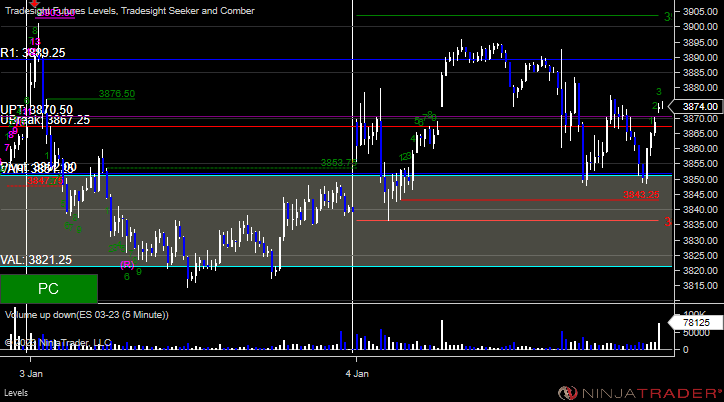

Tradesight Recap Report for 1/4/23

Today in the Markets:

Things are just not getting moving in 2023. Another flat session on 4.3 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered short at A but too far out of range to take. Triggered long at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

GBPUSD, triggered long at A and stopped:

Results: -25 pips

A minor green session. Hard to do much with the markets so flat.

These are the Tradesight calls that triggered, Rich's NTES triggered short (without market support) and didn't work:

His BA triggered long (without market support) and worked:

SHOP triggered short (with market support) and worked enough for a partial: