Tradesight Recap Report for 3/1/23

Today in the Markets:

The markets opened flat, wiggled both ways, and closed slightly lower on 4.9 billion NASDAQ shares.

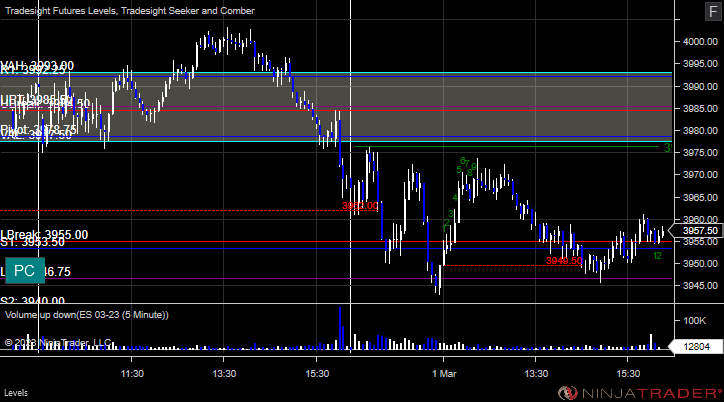

ES with Levels:

ES with Market Directional:

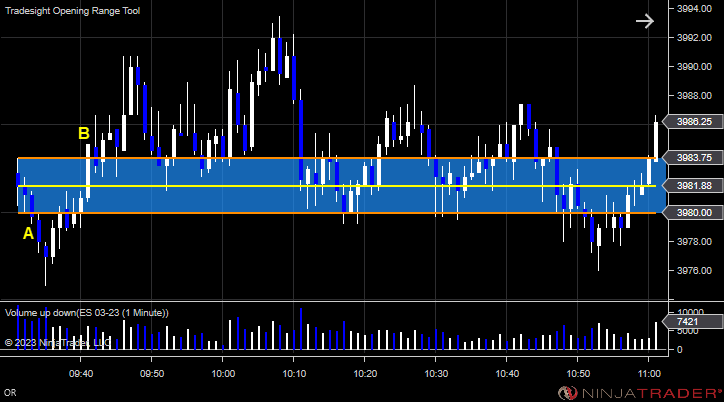

Futures:

ES Opening Range Play, triggered long at A but too far out of range to take. Triggered short at B and worked:

Additional Futures Calls:

None.

Results: +19 ticks

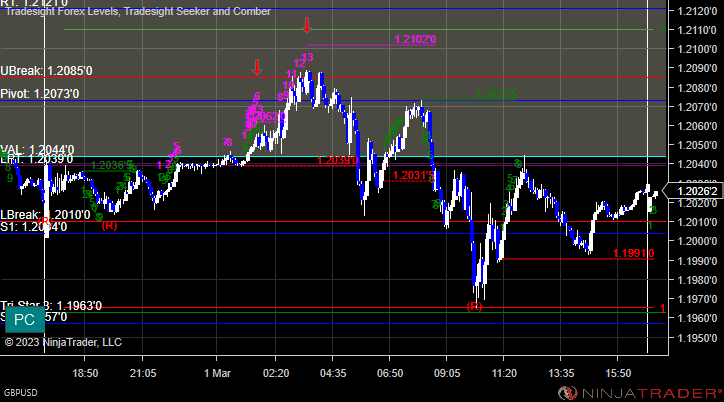

GBPUSD:

Results: +0 pips

A winner for the session.

These are the Tradesight calls that triggered, BABA triggered short (with market support) and worked:

TSLA triggered short (with market support) and worked enough for a partial:

WYNN triggered long (without market support) but didn't go enough either way to count:

Tradesight Recap Report for 2/28/23

Today in the Markets:

The markets opened down just a little and were flat all day until a sell-off in the last 30 minutes on 5.3 billion NASDAQ shares.

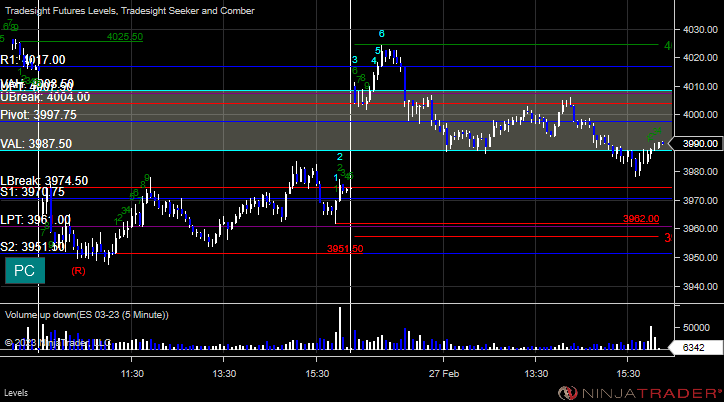

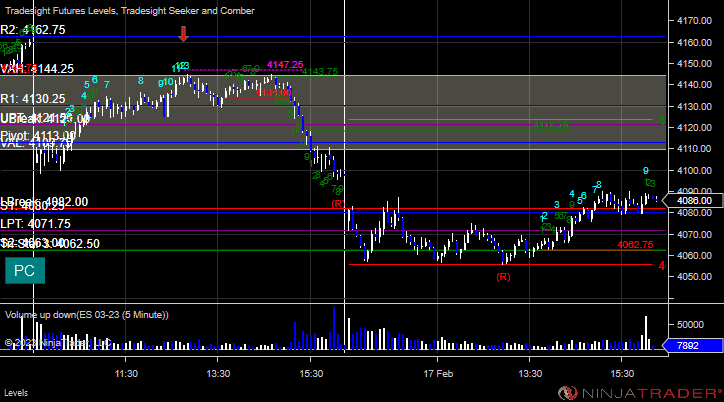

ES with Levels:

ES with Market Directional:

Futures:

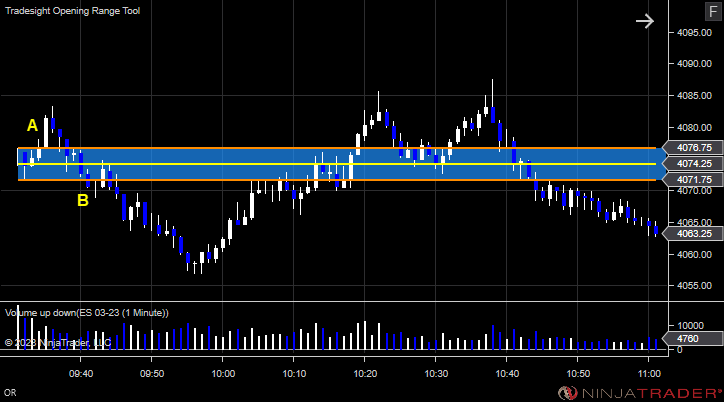

ES Opening Range Play, triggered short at A and worked. Triggered long at B and worked:

Additional Futures Calls, ES triggered short under LBreak and worked:

Results: +16 ticks

GBPUSD, triggered long at A and worked enough for a partial:

Results: +45 pips

Another green day with one loser.

These are the Tradesight calls that triggered, Rich's META triggered long (with market support) and worked:

GS triggered short (without market support) and worked:

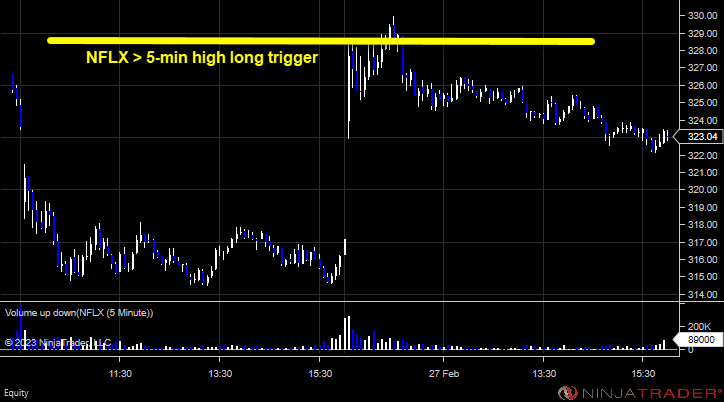

NFLX triggered long (with market support) and didn't work:

Tradesight Recap Report for 2/27/23

Today in the Markets:

The markets gapped up and slowly drifted back to almost fill the gaps on 4.5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered short at A but too far out of range to take. Triggered long at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

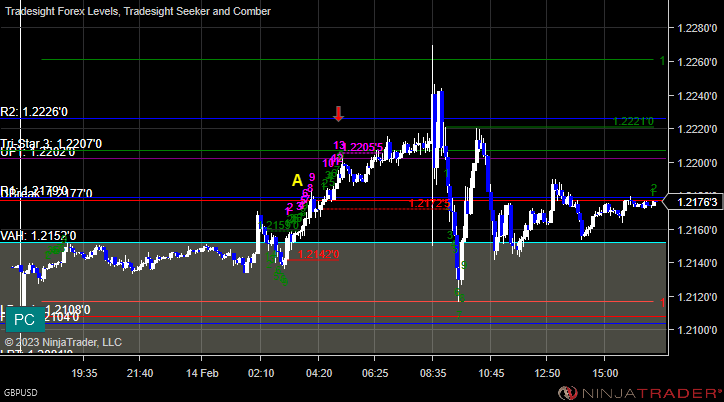

GBPUSD, triggered long at A and hit the first target at B for a 45 pips partial. Holding the second half with a stop under R1:

Results: Trade is still going

Stocks:

A mixed bag on a day that wasn't very exciting.

These are the Tradesight calls that triggered, Rich's TSLA triggered long (with market support) and worked:

His NFLX triggered long (with market support) and didn't work:

Tradesight Recap Report for 2/17/23

Today in the Markets:

For options expiration, not much happened. We gapped down and went flat on 4.9 billion shares, which is weak for options expiration.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered long at A and worked, triggered short at B and worked:

Additional Futures Calls:

None.

Results: +23 ticks

Results: -25 pips

A winner for options expiration.

These are the Tradesight calls that triggered, Rich's ABNB triggered short (with market support) and worked:

Tradesight Recap Report for 2/16/23

Today in the Markets:

Again, we gapped down, almost filled, but then sold off late on 5.1 billion NASDAQ shares.

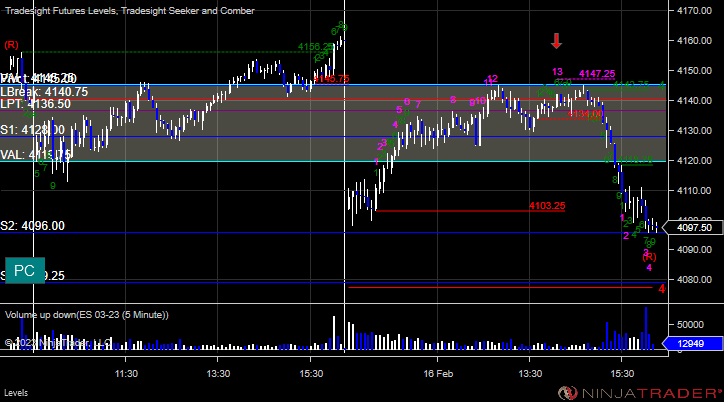

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered short at A and worked enough for a partial. Triggered long at B and stopped:

Additional Futures Calls:

None.

Results: -16 ticks

Results: +0 pips

A mixed day.

These are the Tradesight calls that triggered, Rich's SHOP triggered short (without market support) and worked:

His ABNB triggered long (with market support) and worked:

His QQQ triggered long (ETF so no market support needed) and didn't work:

Tradesight Recap Report for 2/15/23

Today in the Markets:

A repeat of the last session, we gapped down small and closed even on 5.1 billion NASDAQ shares.

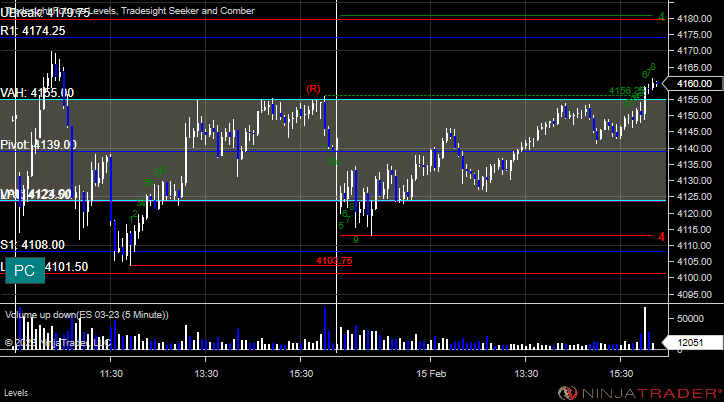

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered long at A and worked enough for a partial. Triggered short at B and stopped:

Additional Futures Calls:

None.

Results: -16 ticks

Results: +0 pips

A good day despite how flat it was.

These are the Tradesight calls that triggered, Rich's NSC triggered short (without market support) and worked enough for a partial:

His LYFT triggered long (with market support) and worked:

His DVN triggered short (with market support) and worked:

His SPOT triggered long (with market support) and didn't go enough to count:

Tradesight Recap Report for 2/14/23

Today in the Markets:

The markets gapped down, filled and went higher, then settled back and closed even on 5.1 billion NASDAQ shares.

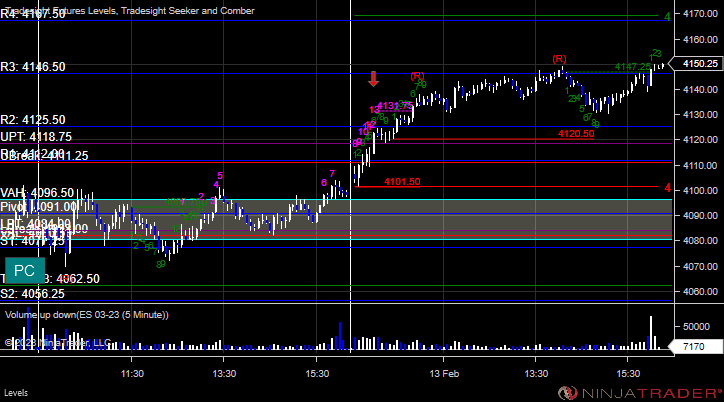

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered long at A but too far out of range to take:

Additional Futures Calls, triggered long above Pivot (4134.25) and worked big:

Results: +64 ticks

Results: -25 pips

Two solid winners for the session.

These are the Tradesight calls that triggered, Rich's NVDA triggered long (with market support) and worked:

His COIN triggered long (with market support) and worked:

Tradesight Recap Report for 2/13/23

Today in the Markets:

The markets gapped up a little, drifted higher for 90 minutes, and then went flat for the rest of the day on 4.7 billion NASDAQ shares.

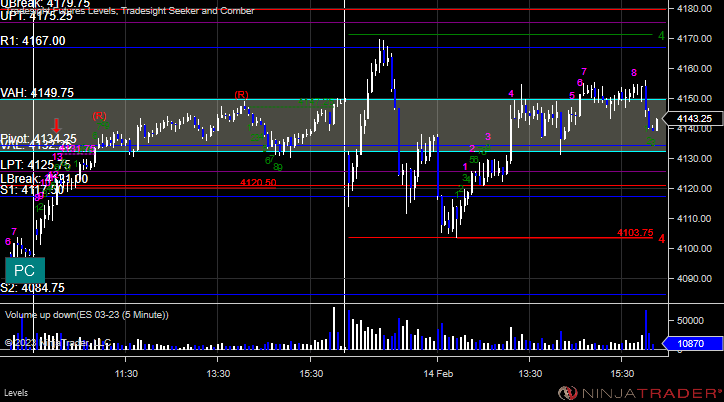

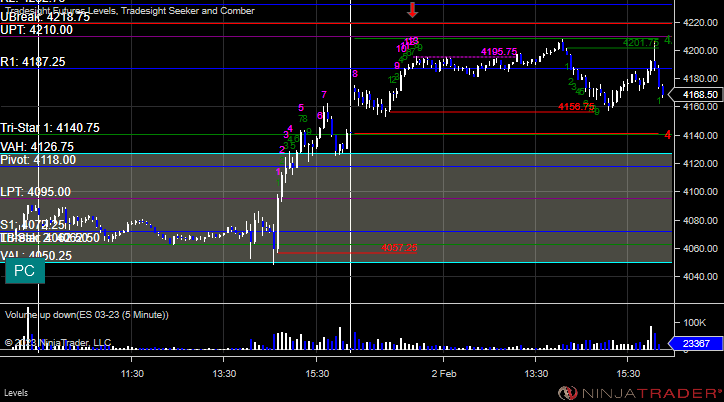

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered short at A and stopped above the midpoint. Triggered long at B and worked enough for a partial:

Additional Futures Calls:

None.

Results: -10 ticks

Results: +0 pips

A couple of green trades for the session.

These are the Tradesight calls that triggered, Rich's COST triggered long (with market support) and worked enough for a partial at the end of the day:

His AI triggered short (without market support) and worked:

Tradesight Recap Report for 2/3/23

Today in the Markets:

Again, not much of a day as we gapped down a bit, filled, and then closed where we opened on 4.8 billion NASDAQ shares.

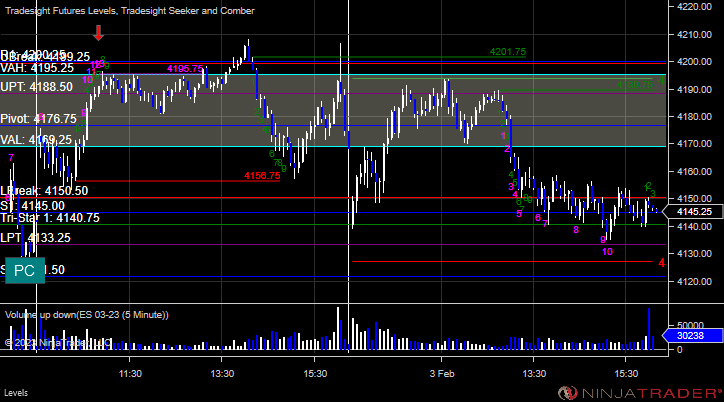

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered long at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

Forex:

GBPUSD:

Results: +0 pips

Another slow day but the one trade that triggered didn't work.

These are the Tradesight calls that triggered, Rich's AMZN triggered long (with market support) and didn't work:

Tradesight Recap Report for 2/2/23

Today in the Markets:

The markets gapped up a bit, and basically did nothing all day on 4.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, triggered short at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks

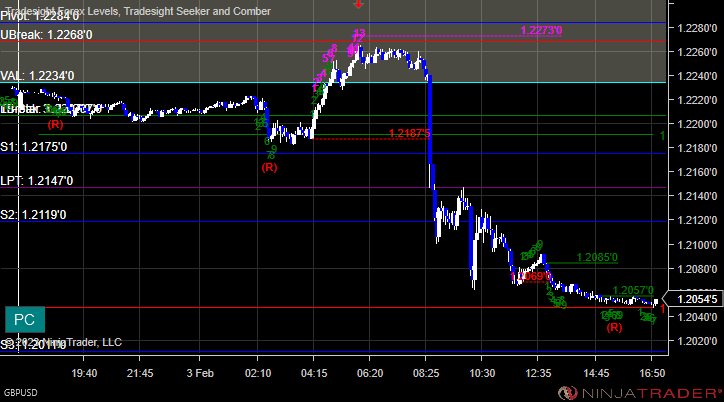

GBPUSD, triggered short at A and stopped:

Results: +10 pips

With the Fed behind us, we had some nice winners for the session.

These are the Tradesight calls that triggered, Rich's AMGN triggered short (with market support) and worked enough for a partial:

His FDX triggered long (with market support) and worked:

His COIN triggered short (with market support) and worked enough for a partial: