Tradesight Recap Report for 10/10/22

Today in the Markets:

The markets opened flat, wiggled both ways, and closed about flat on 4.4 billion NASDAQ shares.

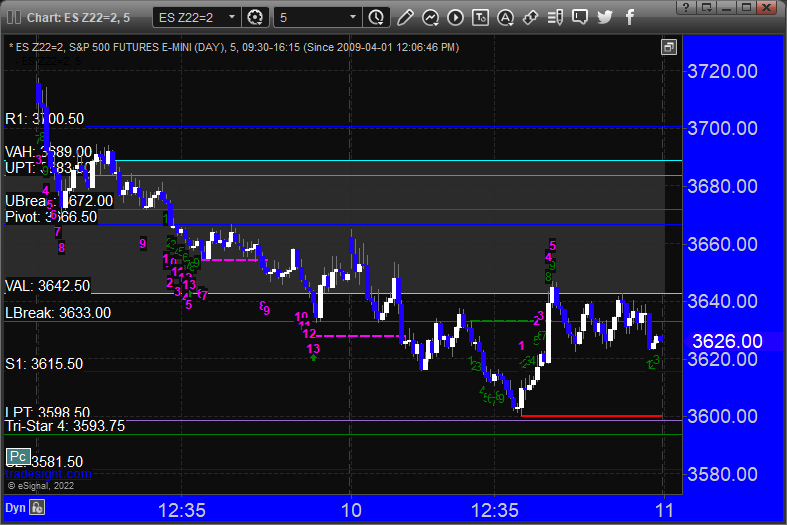

ES with Levels:

ES with Market Directional:

Futures:

Triggered short at A but too far out of range to take:

Additional Futures Calls:

None

Results: +0 ticks

Triggered short at A and stopped:

Results: -25 pips

These are the Tradesight calls that triggered:

COST triggered short (with market support) and didn't work:

INTU triggered short (with market support) and worked:

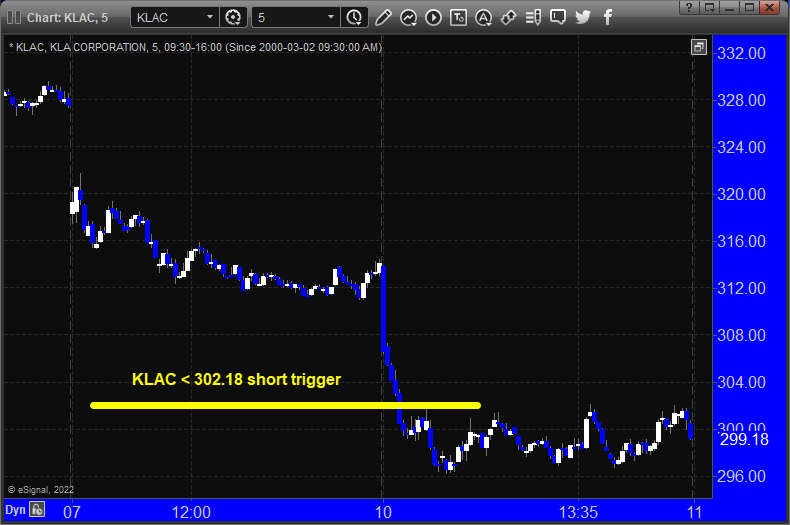

KLAC triggered short (with market support) and worked:

NVDA triggered short (with market support) and worked:

Tradesight Recap Report for 9/30/22

Today in the Markets:

The markets gapped down small, filled, went higher, then came back and closed negative on 4.6 billion NASDAQ shares for end of quarter.

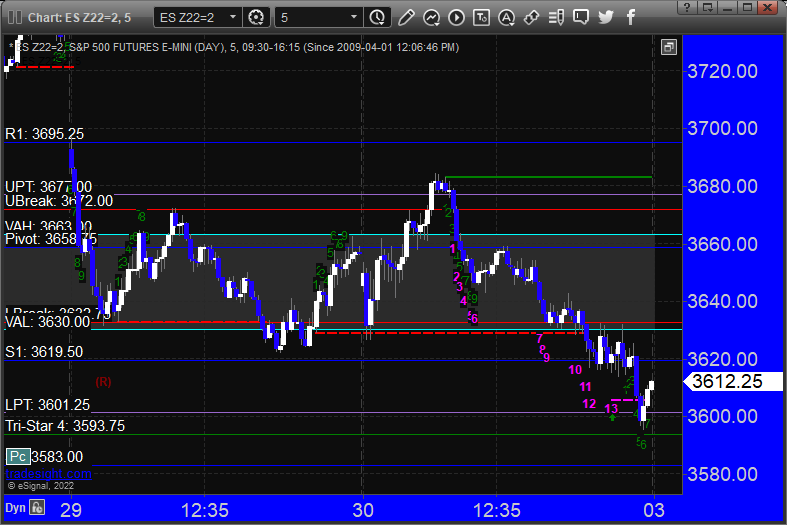

ES with Levels:

ES with Market Directional:

Futures:

Triggered short at A but too far out of range to take. Triggered long at B but too far out of range to take:

Additional Futures Calls:

None

Results: +0 ticks

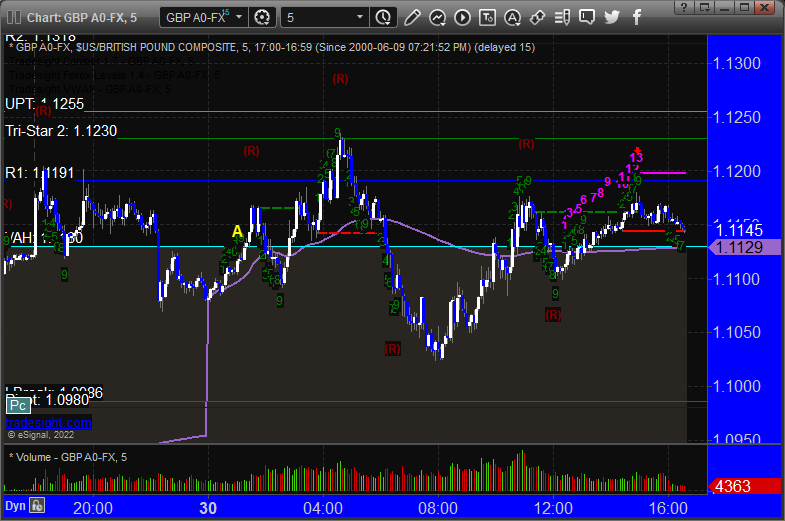

GBPUSD:

Triggered long at A and stopped.

Results: +15 pips

No calls triggered for the end of the quarter.

That's zero triggers with market support.

Tradesight Recap Report for 9/29/22

Today in the Markets:

The markets gapped down quite a bit and shot lower for 30 minutes and that was about it for the day on 4.5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play:

Triggered short at A but too far out of range to take.

Additional Futures Calls:

None

Results: +0 ticks

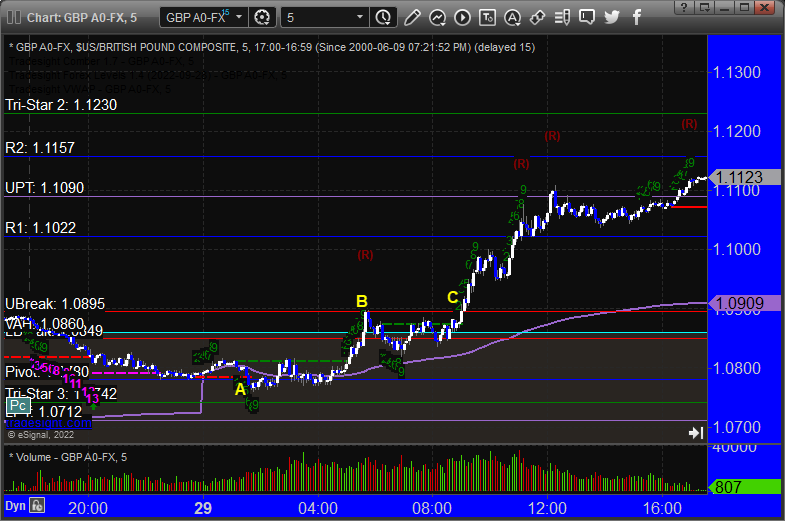

GBPUSD:

Triggered short at A and stopped, one leg of three triggered long at B and stopped. The whole trade triggered at C, hit the first target at R1 (1.1022). Now holding the second half under R1.

Results: -25 pips (second trade still going)

Stocks: No calls triggered.

That's zero triggers with market support.

Tradesight Recap Report for 9/28/22

Today in the Markets:

The markets opened flat and headed up on 4.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play:

Triggered short at A and long at B, but both were too far out of range to take:c

Additional Futures Calls:

None

Results: +0 ticks

GBPUSD:

Triggered short at A (under VAL), hit the first target at LBreak. Closed the second half above entry. Triggered long at 1.0743, hit the first target at UPT, closed second half under the entry.

Results: +40 pips

A great day!

These are the Tradesight calls that triggered:

META PT-play triggered (with market support) above 136.95 and worked big.

SHOP PT play triggered long (with market support) and worked.

Tradesight Recap Report for 9/27/22

Today in the Markets:

The markets gapped up, filled, and went flat and closed almost flat on 4.4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play:

Triggered long at A but too far out of range to take. Triggered short at B but too far out of range to take.

Additional Futures Calls:

None

Results: +0 ticks

Results: +0 pips

That’s 0 triggers with market support.

Tradesight Recap Report for 9/26/22

Today in the Markets:

The markets gapped down small, filled the gap and went a bit higher, then reversed to lows at the Value Area Low and came back to the midpoint before the close on 4.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A but too far out of range to take:

Additional Futures Calls:

None

Results: +0 ticks

GBPUSD triggered short at A and hit the first target at B, closed second half above entry:

Results: +10 pips

Ended up being a boring day. Nothing triggered.

No calls triggered.

Tradesight Recap Report for 9/16/22

Today in the Markets:

The markets gapped down on Fedex news and projections and then went flat most of the day and inched up a bit late for triple expiration on 7.2 billion NASDAQ shares (mostly triple expiration volume).

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play:

Triggered short at A and worked. Triggered long later at B but too far out of range to take.

Additional Futures Calls:

None

Results: +4 ticks

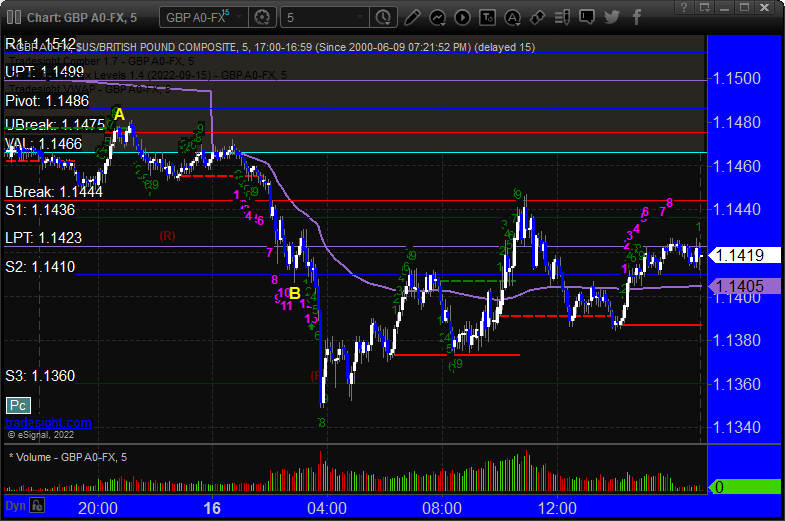

Two stop-outs in GBP/USD. Triggered long at A and stopped. Triggered short at B and stopped. The short trade worked on the retrigger.

Results: -50 pips

Not much to do

These are the Tradesight calls that triggered, Rich's CSX triggered short (with market support) and didn't work:

His VXX triggered long (ETF, so no market support needed) and didn't do enough to count:

Tradesight Recap Report for 9/15/22

Today in the Markets:

The markets gapped down a little and filled and that was most of the day until late when we swept the lows on 4.1 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and stopped, triggered long at B but too far out of range to take:

Additional Futures Calls:

None

Results: -18 ticks

GBPUSD:

Triggered short at A and stopped

Results: -25 pips

A better day in stocks as we head into options expiration.

These are the Tradesight calls that triggered:

Rich's AAPL triggered short (with market support) and worked enough for a partial.

META triggered long (with market support) and didn't work.

DIS triggered long (with market support) and worked enough for a partial.

AMAT triggered short (with market support) and worked.

Tradesight Recap Report for 9/14/22

Today in the Markets:

The markets opened flat and stayed totally dead all day on 4.4 billion NASDAQ shares..

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play both the short and the long triggered too far out of range to take:

Additional Futures Calls:

None

Results: +0 ticks

GBPUSD:

Results: +0 pips

Nothing worth doing.

No triggers.

Tradesight Recap Report for 9/13/22

Today in the Markets:

Well unfortunately, the markets gapped down big and ruined my plan, and continued to sell off sharply on 4.6 billion NASDAQ shares after the inflation number.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and stopped under the midpoint, triggered short at B but too far out of range to take:

Additional Futures Calls:

None

Results: -20 ticks

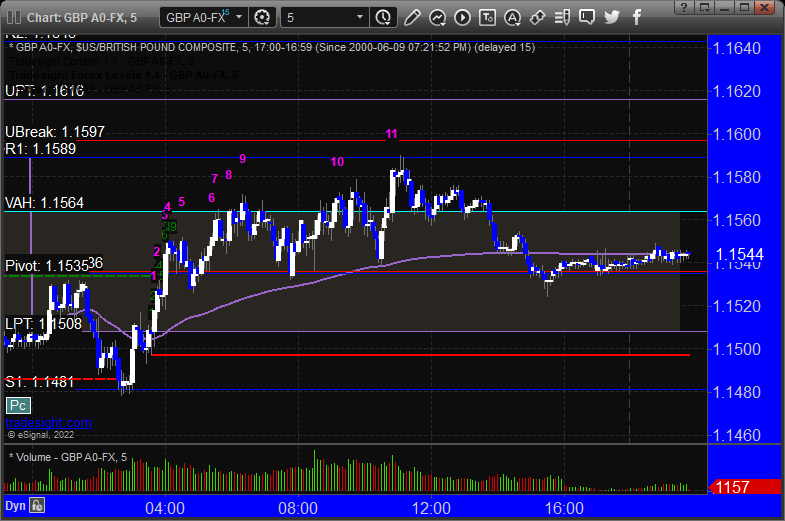

GBPUSD:

Triggered long at A and stopped. Triggered short at B and worked. Still holding the second half with a stop above S4 (1.1557)

Results: -25 pips and the other trade is still going.

Again, not much of a day with the big gap.

These are the Tradesight calls that triggered:

Rich's ORCL triggered long (without market support) and worked.