Tradesight Recap Report for 1/3/25

Today in the Markets:

The markets gapped up and drifted higher on 6.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

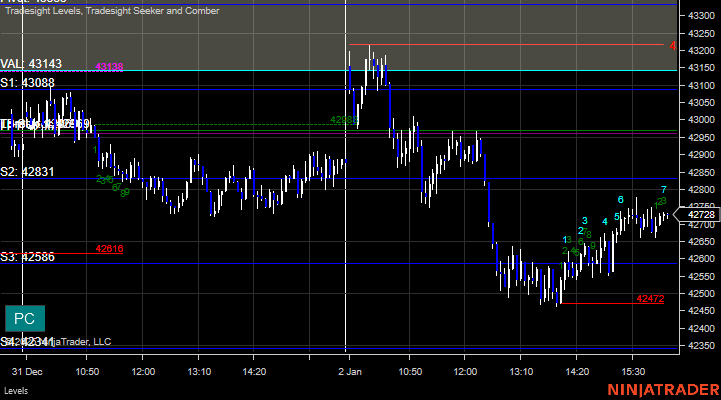

YM with Levels:

CL with Levels:

ZB with Levels:

Futures:

No valid triggers the whole week.

ES Opening Range Play, triggered long at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

No calls, we were off for the Holiday.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Tradesight Recap Report for 1/2/25

Today in the Markets:

To start the year (with a two day week after New Year's) the markets gapped up, filled, and then sold off a bit on 6.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

ZB with Levels:

CL with Levels:

Futures:

Again, no valid triggers.

ES Opening Range Play, triggered short at A but too far out of range to take. Triggered long at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

Nothing triggered.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Tradesight Recap Report for 12/31/24

Today in the Markets:

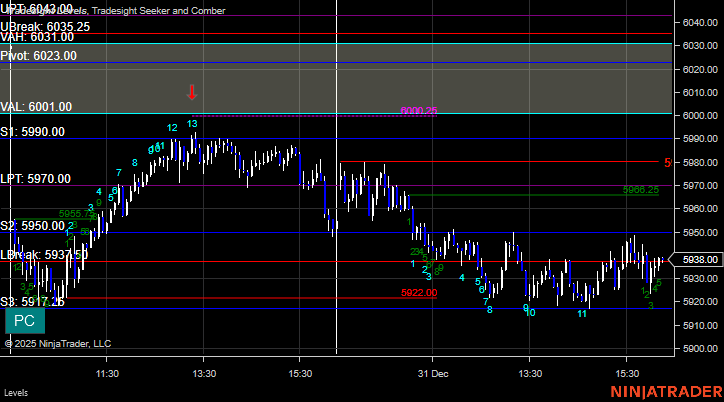

The year ends as it usually does, on a boring note, with the market drifting lower on 6.5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

ZN with Levels:

GC with Levels:

Futures:

No valid triggers again.

ES Opening Range Play, triggered long at A but too far out of range to take, triggered short at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

We took the day off.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Tradesight Recap Report for 12/30/24

Today in the Markets:

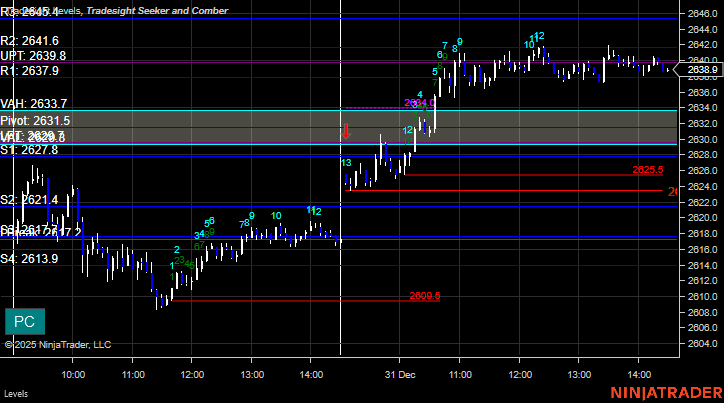

We are wrapping up the year and the markets gapped down and rallied a bit on 6.5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

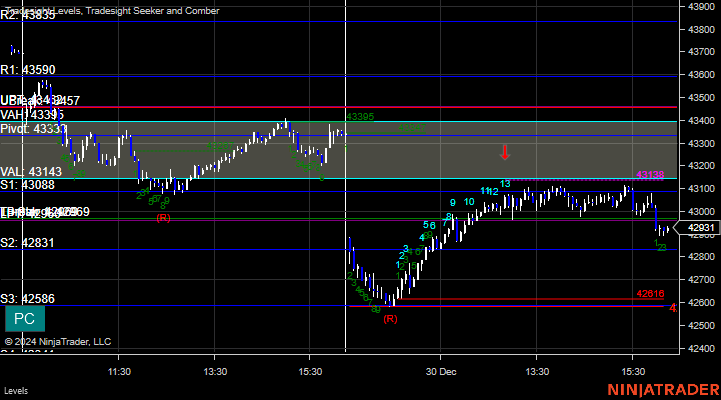

YM with Levels:

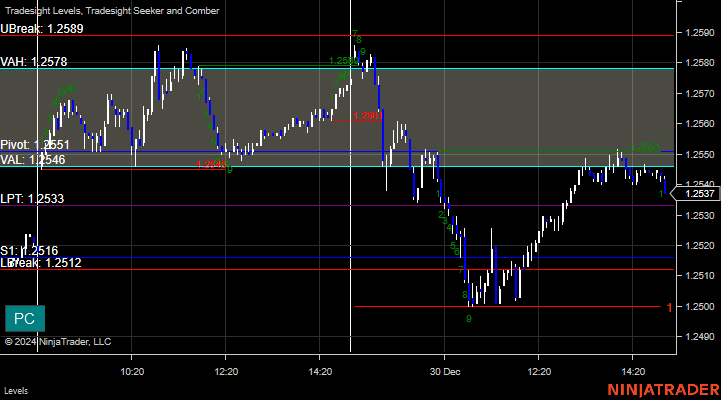

6B with Levels:

GC with Levels:

Futures:

No valid triggers.

ES Opening Range Play, triggered short at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

No calls.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Tradesight Recap Report for 12/27/24

Today in the Markets:

The markets gapped down and sold off more than expected on 6.3 billion NASDAQ shares to close out the Holiday week.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

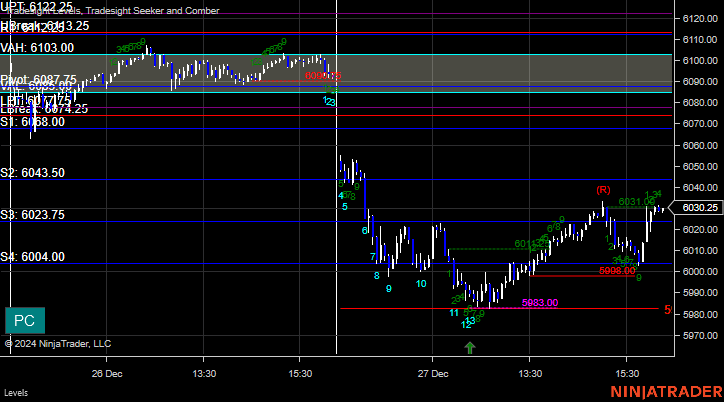

YM with Levels:

CL with Levels:

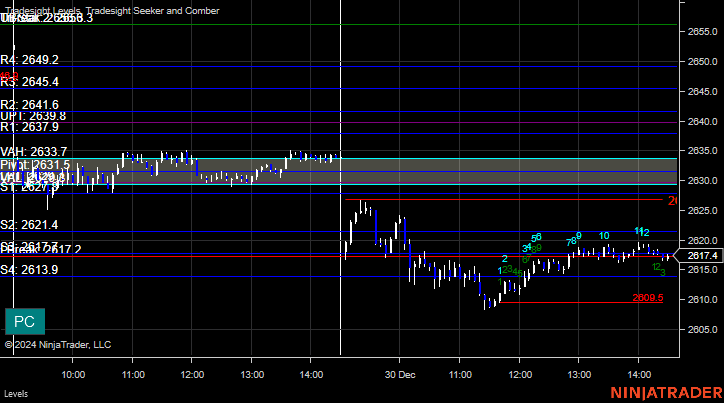

GC with Levels:

Futures:

A winner for the session.

ES Opening Range Play, triggered shot at A and worked enough for a partial:

Additional Futures Calls:

None.

Results: +4 ticks.

Stocks:

No calls over the Holidays.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Tradesight Recap Report for 12/20/24

Today in the Markets:

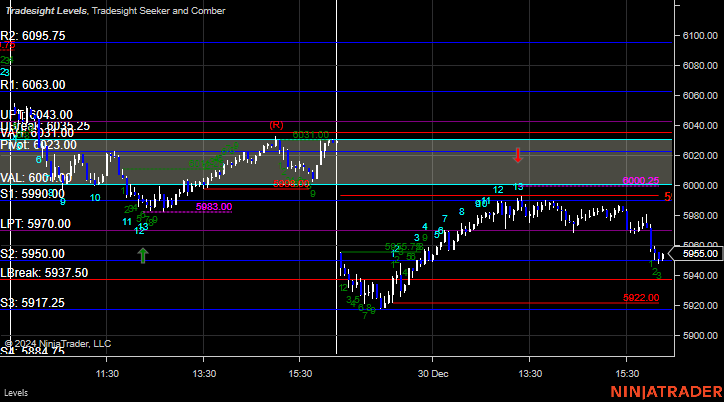

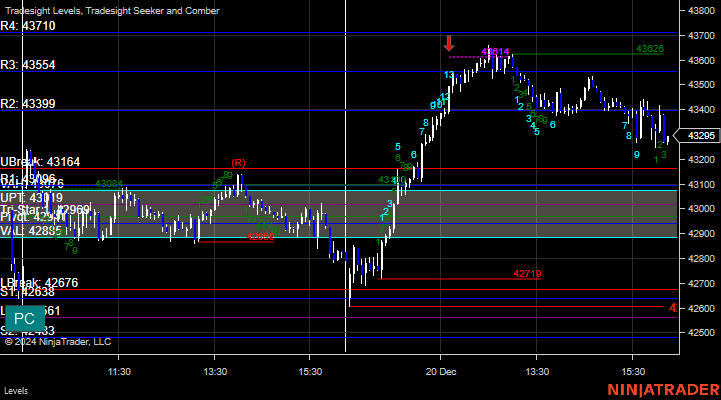

The markets opened down a few points and rallied as we head into Christmas week on 5.5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

GC with Levels:

CL with Levels:

Futures:

Nothing here.

ES Opening Range Play, triggered long at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

No point.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Tradesight Recap Report for 12/18/24

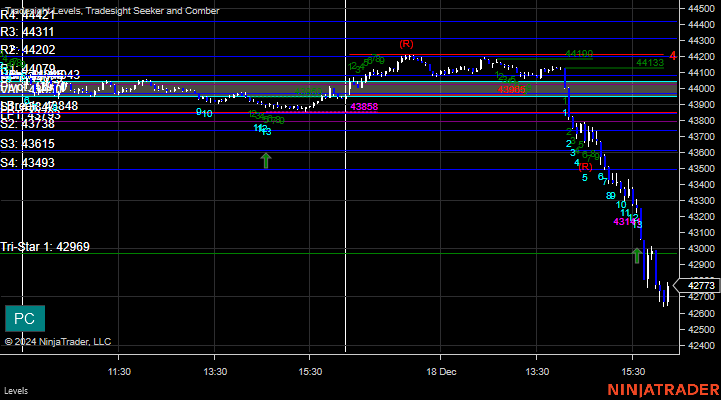

Today in the Markets:

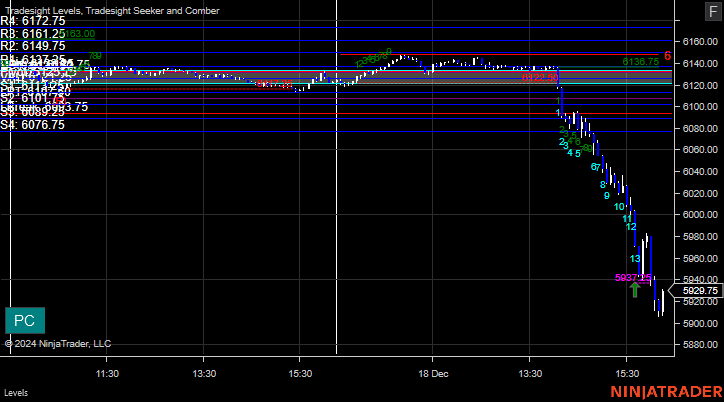

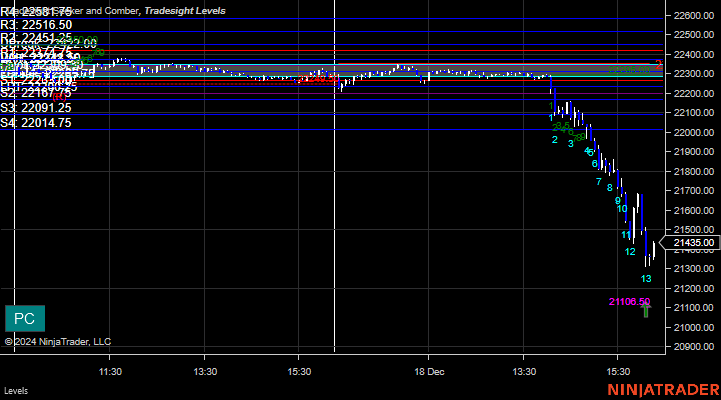

A flat opening for the Fed but then we sold off hard after the announcement on 6.5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

GC with Levels:

ZB with Levels:

Futures:

A loser and a winner.

ES Opening Range Play, triggered short at A and stopped above the midpoint. Triggered long at B and worked:

Additional Futures Calls:

None.

Results: -12 ticks.

Stocks:

No triggers.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

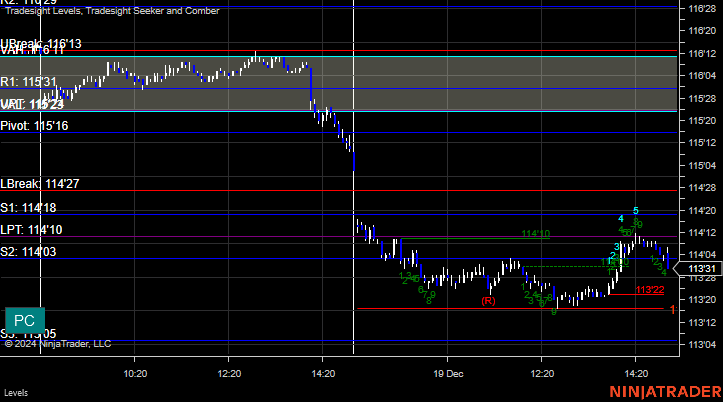

Tradesight Recap Report for 12/19/24

Today in the Markets:

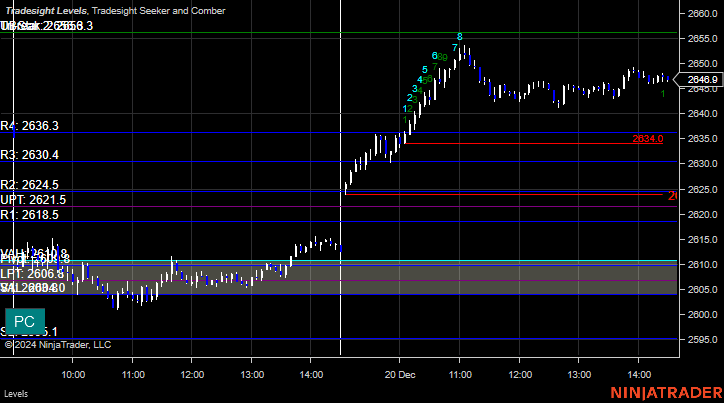

The markets gapped up and basically slowly drifted back to even for the session on 5.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

CL with Levels:

ZB with Levels:

Futures:

No valid triggers.

ES Opening Range Play, triggered long at A but too far out of range to take. Triggered short at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

Nothing triggered.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

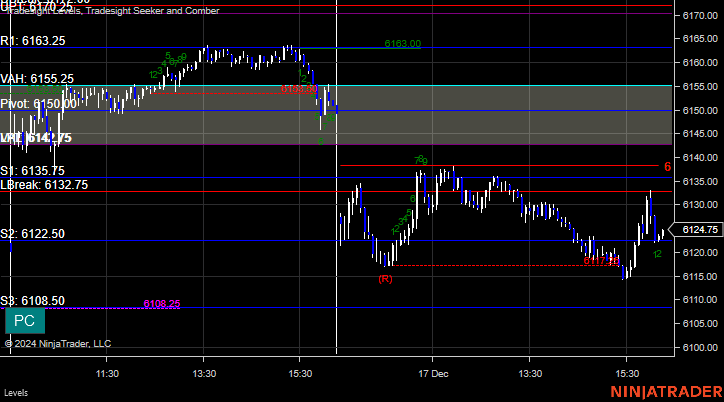

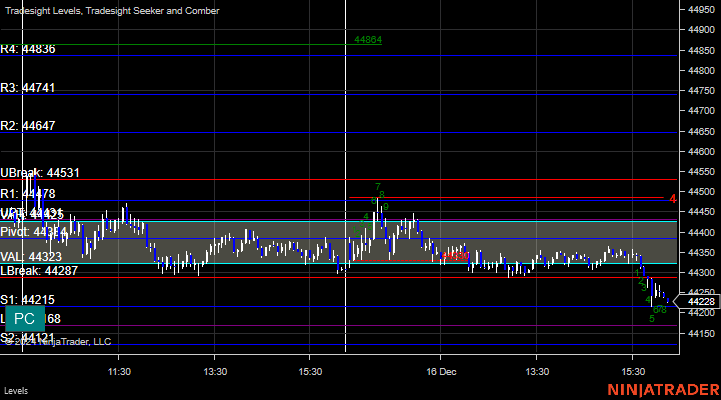

Tradesight Recap Report for 12/17/24

Today in the Markets:

The markets gapped down and closed where they opened on 6.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

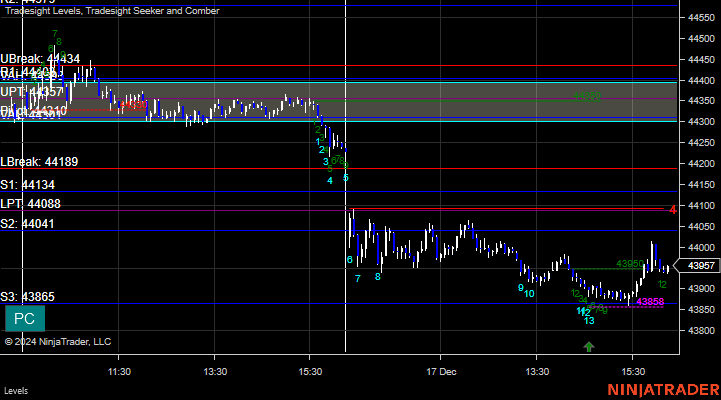

YM with Levels:

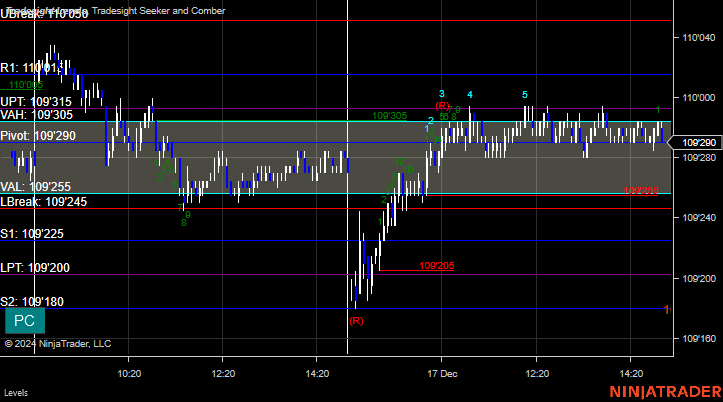

ZN with Levels:

6B with Levels:

Futures:

Nothing here.

ES Opening Range Play, triggered long at A and stopped. Triggered short at B and worked enough for a partial:

Additional Futures Calls:

None.

Results: -10 ticks.

Stocks:

Two nice winners on the session.

These are the Tradesight calls that triggered, Rich's NVDA triggered long (with market support) and worked:

HUM PT play triggered short (with market support) and worked big:

That's 2 triggers with market support, they both worked.

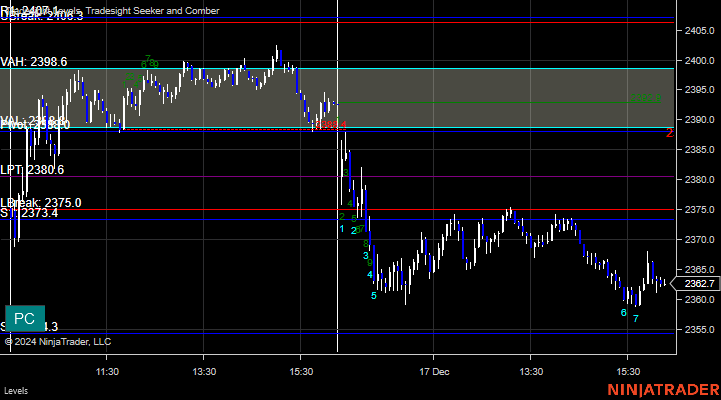

Tradesight Recap Report for 12/16/24

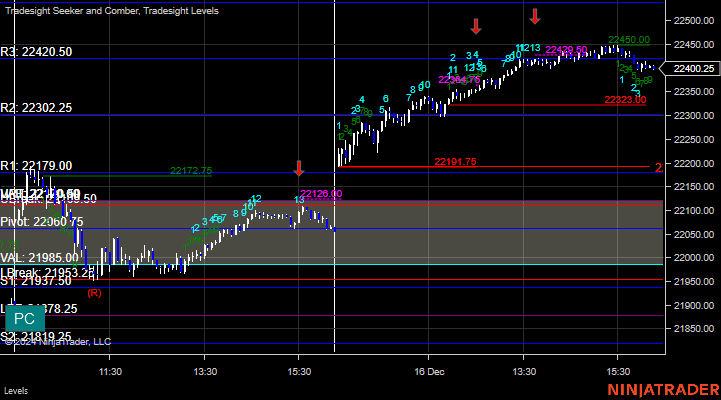

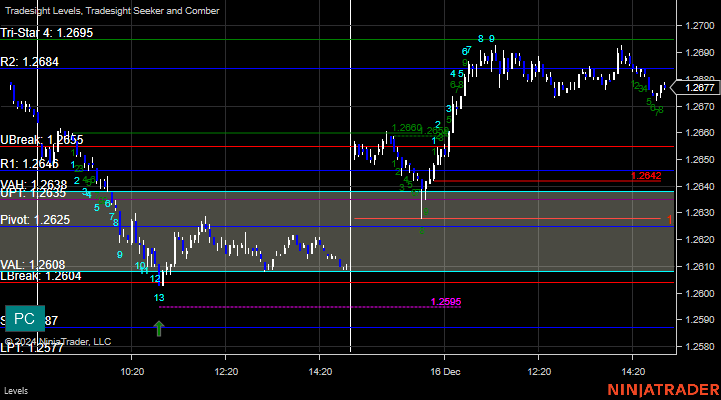

Today in the Markets:

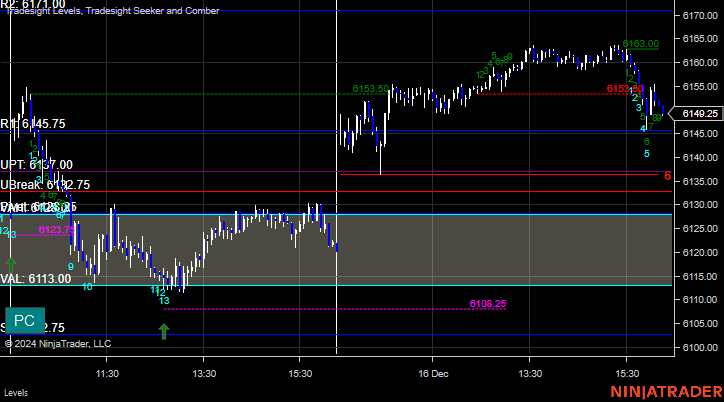

The markets gapped up and closed where they opened on 6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

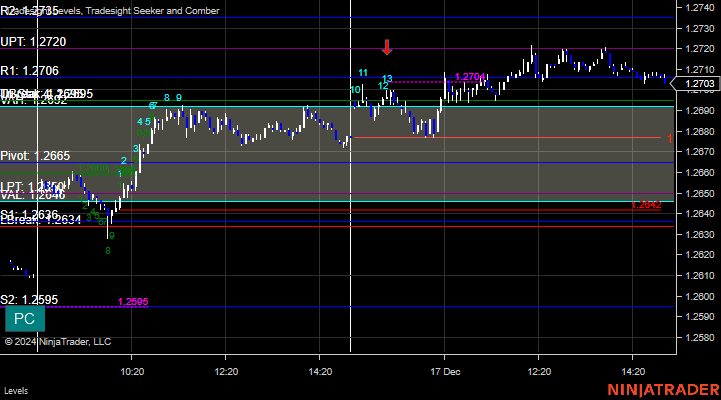

6B with Levels:

YM with Levels:

ZB with Levels:

Futures:

Two losers for the session.

ES Opening Range Play, triggered short at A and stopped. Triggered long at B and stopped:

Additional Futures Calls:

None.

Results: -30 ticks.

Stocks:

A small winner.

These are the Tradesight calls that triggered, AAPL PT play triggered long (with market support) and worked a little:

That's 1 trigger with market support, and it worked.