Tradesight Recap Report for 1/31/25

Today in the Markets:

The markets gapped up, went higher, then rolled and plunged on 7.1 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

CL with Levels:

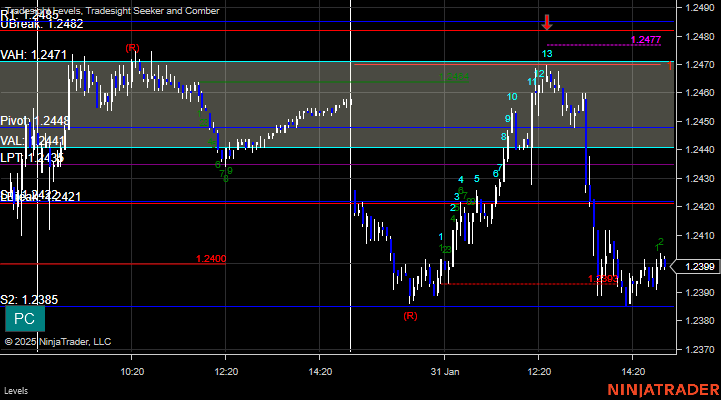

6B with Levels:

Futures:

A winner and a loser for the session.

ES Opening Range Play, triggered short at A and worked enough for a partial. Triggered long at B and stopped under the midpoint:

Additional Futures Calls:

None.

Results: -9 ticks.

Stocks:

A flat trade.

These are the Tradesight calls that triggered, GOOGL PT play triggered long (with market support) but didn't go enough either way to count:

That's 1 triggered with market support, and it didn't do anything.

Tradesight Recap Report for 1/30/25

Today in the Markets:

The markets gapped up, filled the gap, then rose and topped out on a 13 sell signal, then plunged on 6.7 billion NASDAQ shares.

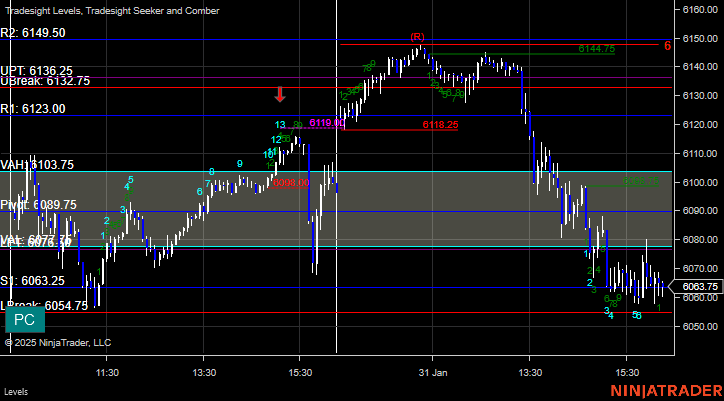

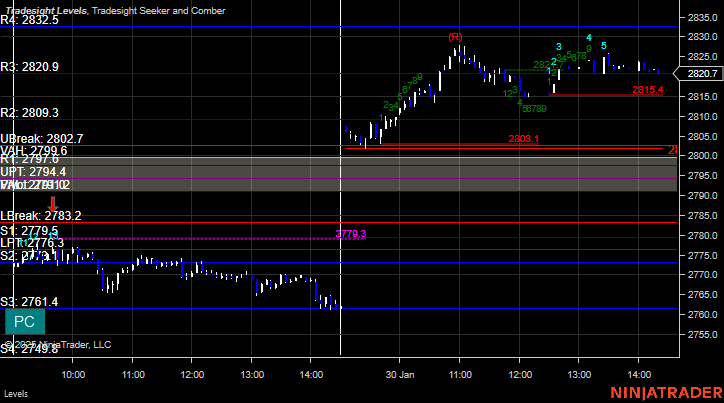

ES with Levels:

ES with Market Directional:

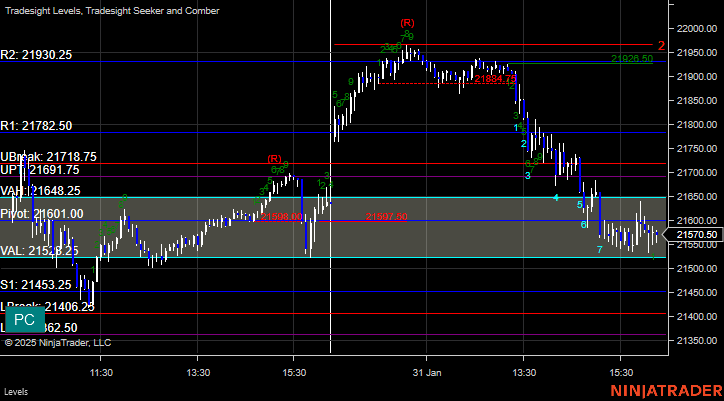

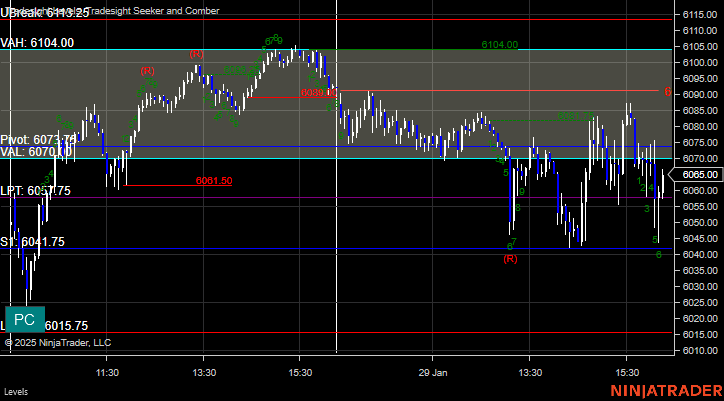

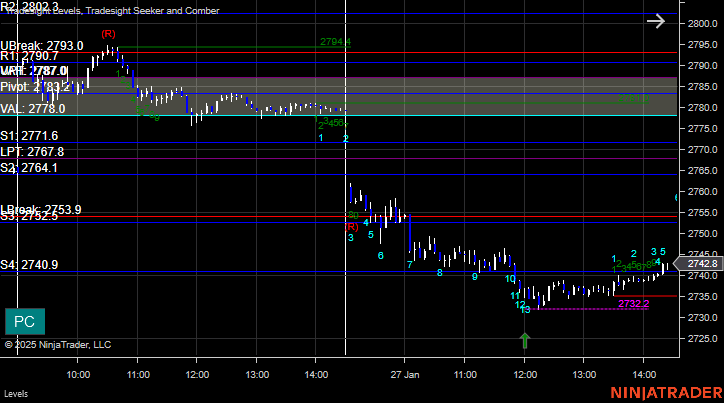

NQ with Levels:

RTY with Levels:

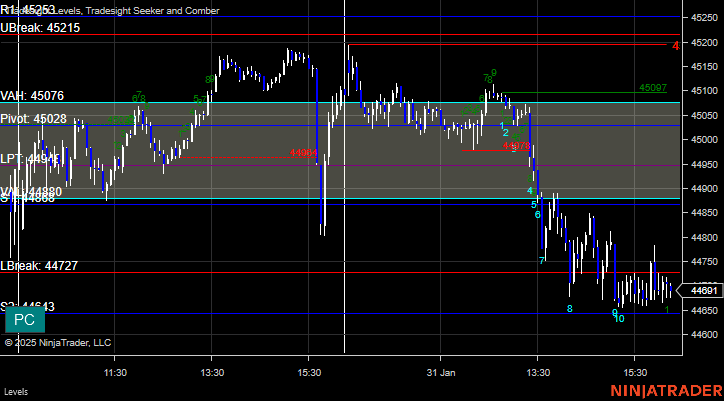

YM with Levels:

GC with Levels:

CL with Levels:

Futures:

Two small winners.

ES Opening Range Play, triggered short at A and worked enough for a partial. Triggered long at B and worked enough for a partial:

Additional Futures Calls:

None.

Results: +8 ticks.

Stocks:

A green trade for the session.

These are the Tradesight calls that triggered, AMZN PT play triggered short (with market support) and worked:

That's 1 triggered with market support, and it worked.

Tradesight Recap Report for 1/29/25

Today in the Markets:

The markets opened flat and bounced around lower on 6.4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

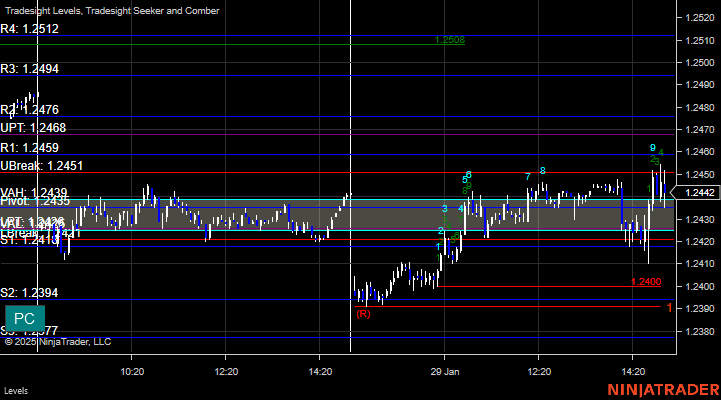

6B with Levels:

ZB with Levels:

Futures:

A winner for the session.

ES Opening Range Play, triggered short at A and worked enough for a partial:

Additional Futures Calls:

None.

Results: +4 ticks.

Stocks:

No triggers.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Tradesight Recap Report for 1/27/25

Today in the Markets:

The markets gapped down big and went flat most of the day, closing at the highs of the range on 7.1 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

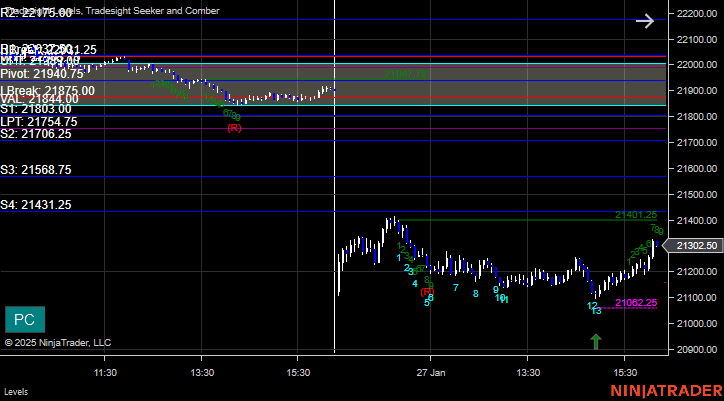

NQ with Levels:

RTY with Levels:

YM with Levels:

CL with Levels:

GC with Levels:

Futures:

No triggers.

ES Opening Range Play, triggered long at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

No triggers in the flat range.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

Tradesight Recap Report for 1/28/25

Today in the Markets:

The markets opened flat, dipped, and then rose on 6.4 billion NASDAQ shares.

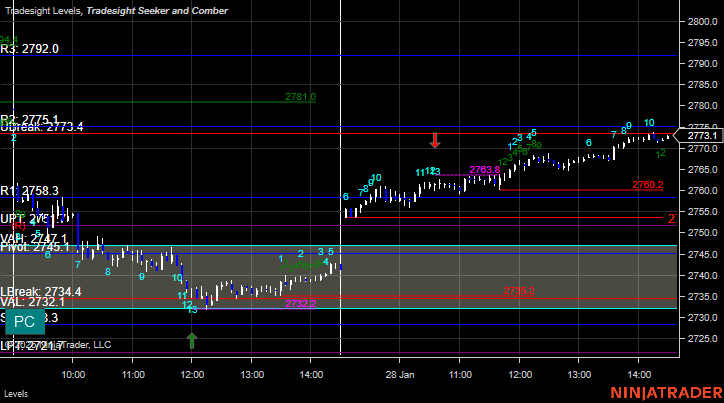

ES with Levels:

ES with Market Directional:

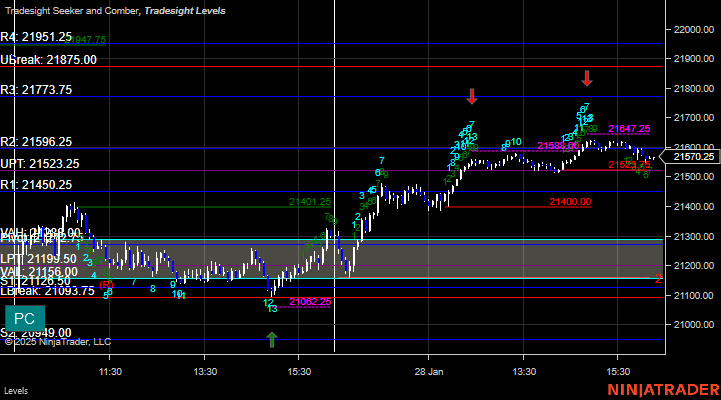

NQ with Levels:

RTY with Levels:

YM with Levels:

CL with Levels:

GC with Levels:

Futures:

No triggers.

ES Opening Range Play, triggered short at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

A winner if you took it.

These are the Tradesight calls that triggered, UBER PT play triggered short (without market support) and it worked:

That's 0 triggers with market support, and it worked.

Tradesight Recap Report for 1/17/25

Today in the Markets:

The markets gapped up, pushed higher, and then came back to the starting point on 6.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

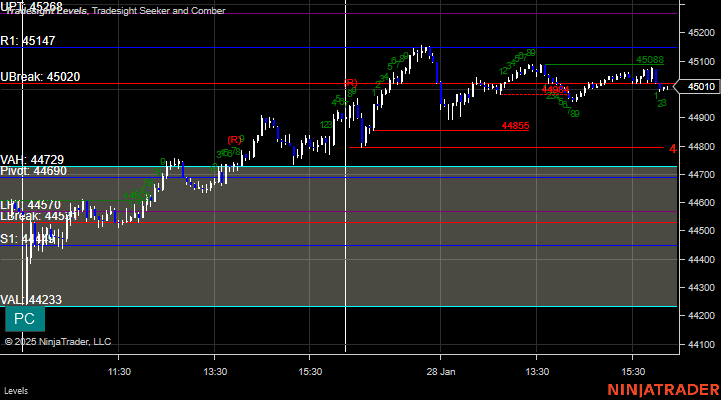

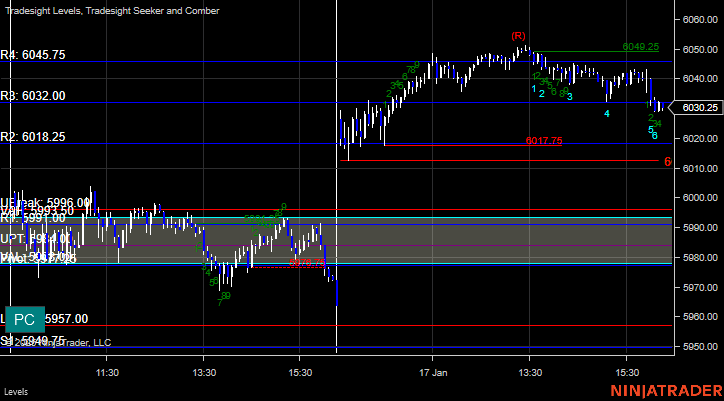

NQ with Levels:

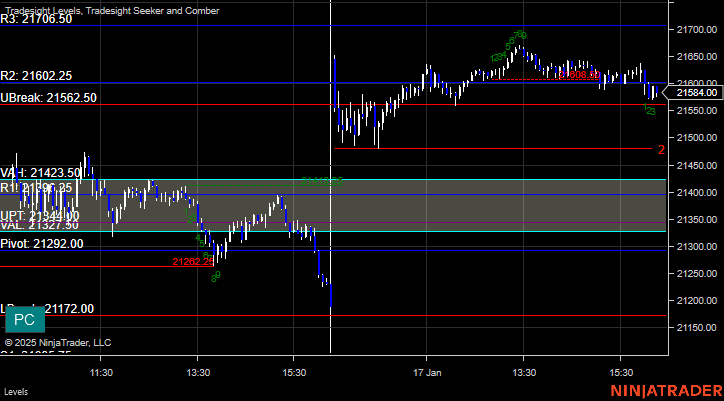

RTY with Levels:

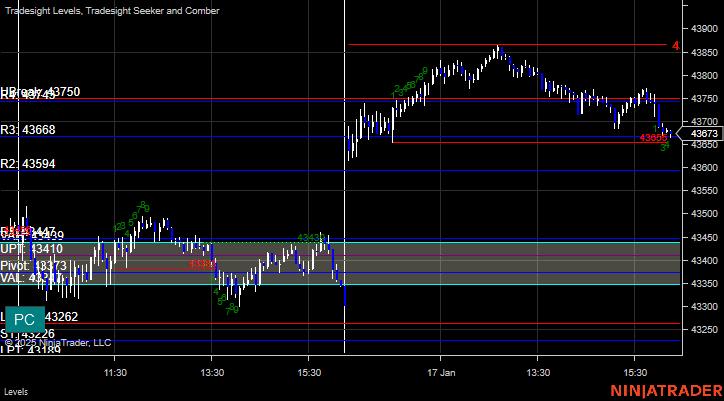

YM with Levels:

CL with Levels:

GC with Levels:

Futures:

No triggers.

ES Opening Range Play, triggered short at A but too far out of range to take. triggered long at B but too far out of range to take.:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

A nice winner for the session.

These are the Tradesight calls that triggered, Rich's TSLA triggered long (with market support) and worked:

That's 1 trigger with market support, and it worked.

Tradesight Recap Report for 1/16/25

Today in the Markets:

The markets gapped up a little, filled, bounced around mostly flat, and then sold off at the close on 7.2 billion NASDAQ shares.

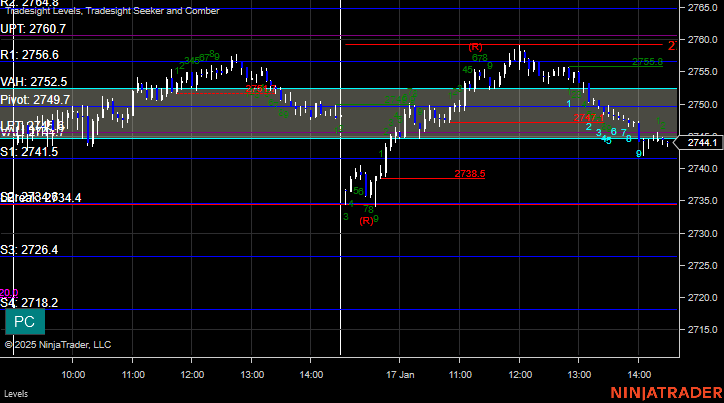

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

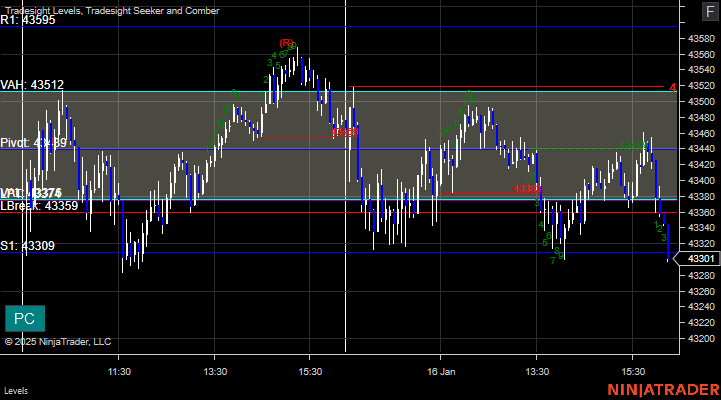

YM with Levels:

CL with Levels:

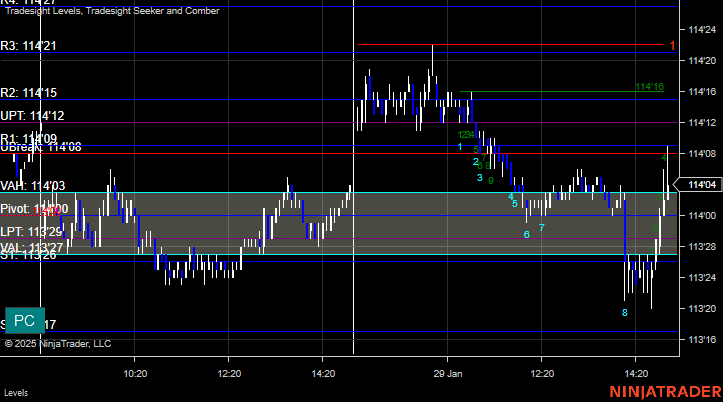

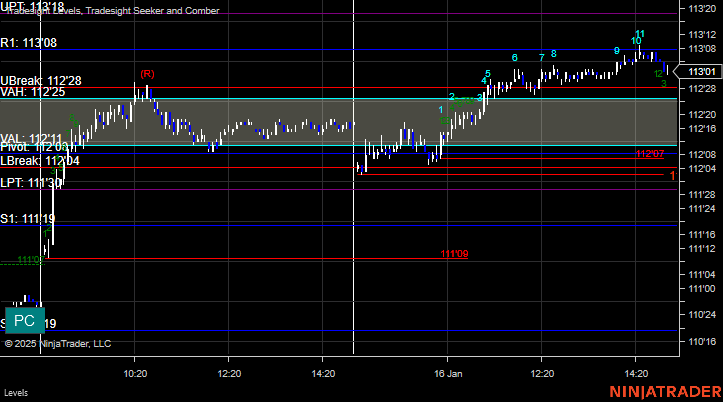

ZB with Levels:

Futures:

No valid triggers.

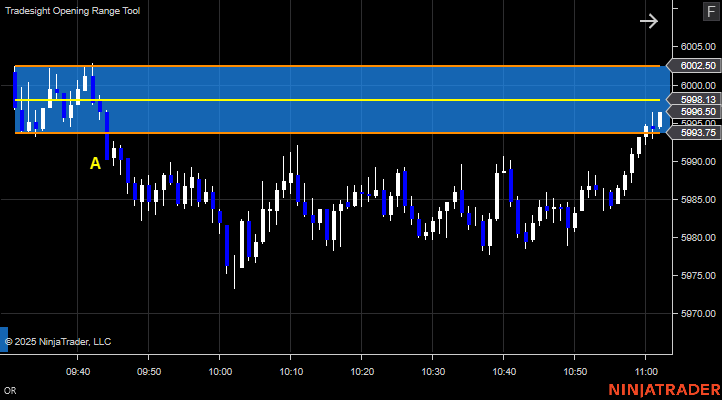

ES Opening Range Play, triggered short at A but too far out of range to take::

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

Not much here.

These are the Tradesight calls that triggered, NEM PT play triggered long (with market support) but didn't work:

AI PT play triggered long (barely with market support) but didn't work:

QCOM PT play triggered short (with market support) and worked a little:

That's 3 triggered with market support, 1 worked a little and 2 did not.

Tradesight Recap Report for 1/15/25

Today in the Markets:

The markets gapped up and then stayed mostly flat on 7 billion NASDAQ shares.

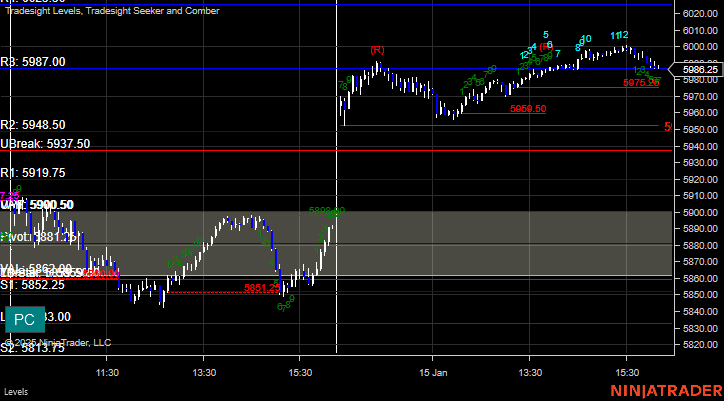

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

CL with Levels:

ZB with Levels:

Futures:

No valid triggers again.

ES Opening Range Play, triggered long at A but too far out of range to take. Triggered short at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +0ticks.

Stocks:

No triggers.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Tradesight Recap Report for 1/14/25

Today in the Markets:

The markets gapped up, filled, and then bounced around and closed a couple of points positive on 6.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

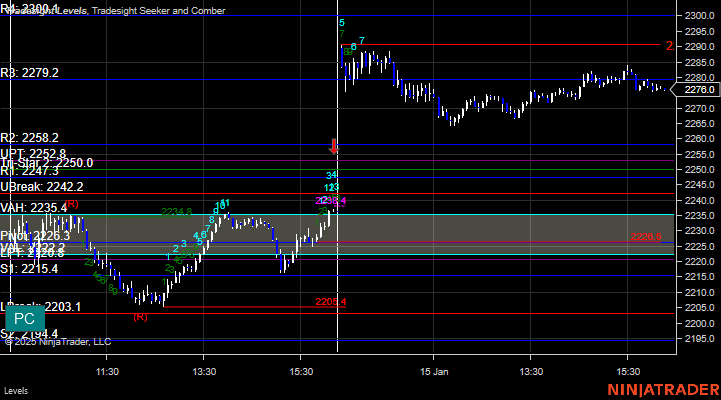

NQ with Levels:

RTY with Levels:

YM with Levels:

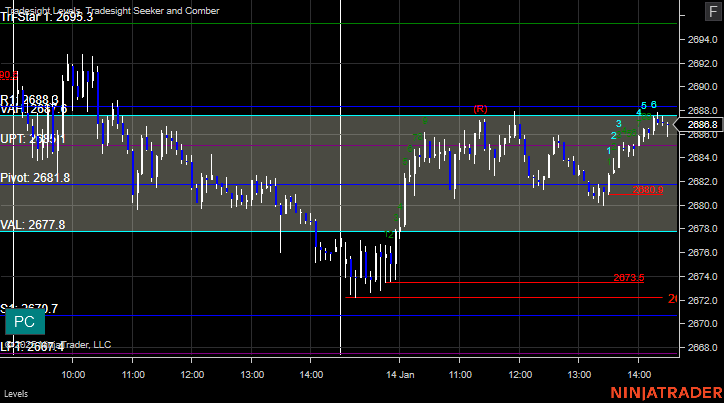

GC with Levels:

CL with Levels:

Futures:

No valid triggers yet again.

ES Opening Range Play, triggered short at A but too far out of range to take. Triggered long at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

No triggers.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Tradesight Recap Report for 1/13/25

Today in the Markets:

The markets gapped down and inched up to fill the gap on 6.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

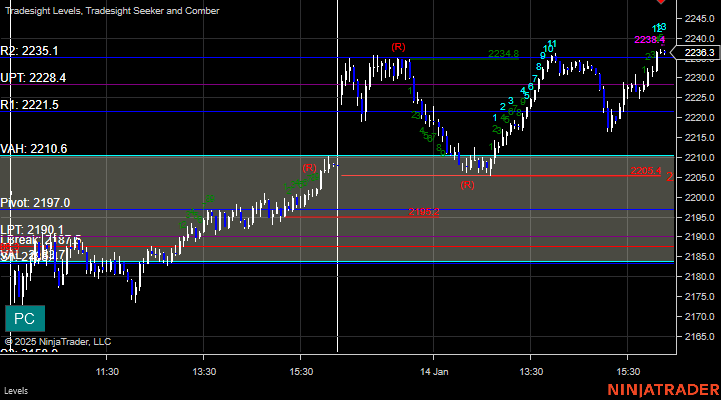

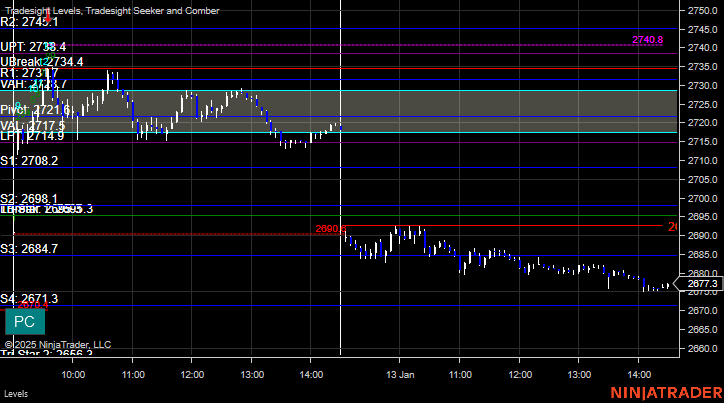

NQ with Levels:

RTY with Levels:

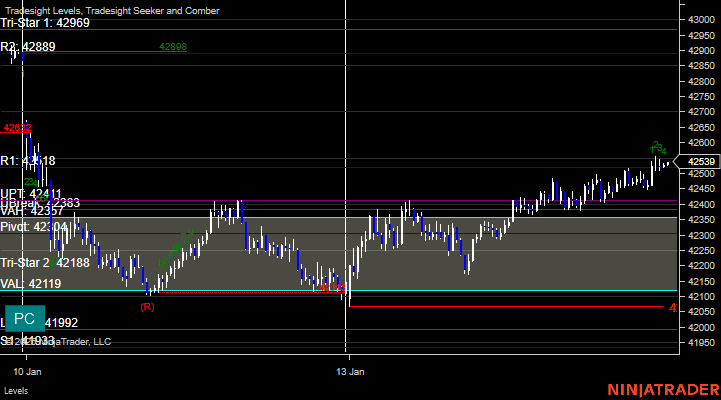

YM with Levels:

CL with Levels:

GC with Levels:

Futures:

No valid triggers.

ES Opening Range Play, triggered long at A but too far out of range to take:

Additional Futures Calls:

None.

Results: +0 ticks.

Stocks:

A solid winner for the session.

These are the Tradesight calls that triggered, ARIS triggered long (with market support) and worked:

ROKU PT play triggered short (with market support) but didn't go enough to count:

META PT play triggered long (with market support) but didn't go enough to count:

Rich's AMZN triggered short (without market support) and didn't work:

His AMD triggered short (without market support) and didn't work:

That's 3 triggered with market support, 1 worked and 2 did not move much either way.