Tradesight Recap Report for 6/17/24

Today in the Markets:

The market's open flat for the strange week with Juneteenth in the middle of the week, then rallied on 4.9 billion Nasdaq shared.

ES with Levels:

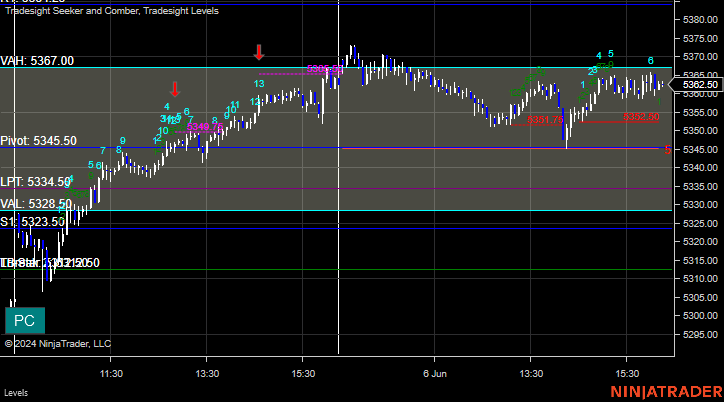

ES with Market Directional:

NQ with Levels:

RTY with Levels:

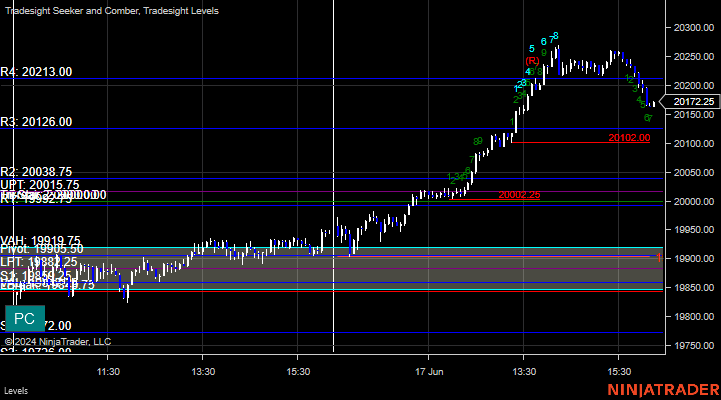

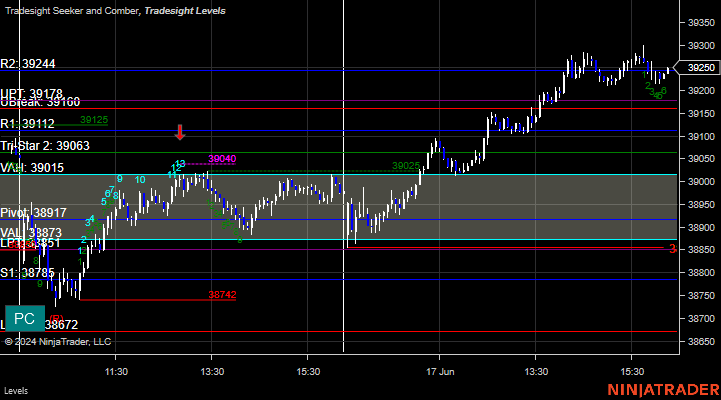

YM with Levels:

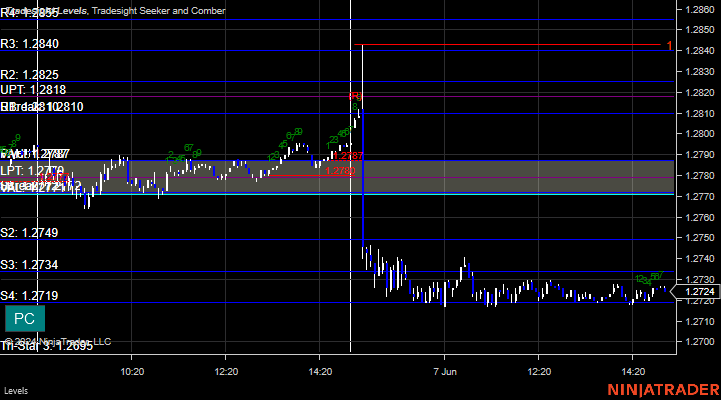

6B with Levels:

CL with Levels:

Futures:

Mixed results on the futures calls didn't add up to anything that mattered.

ES Opening Range Play, triggered short at A and stopped. Triggered long at B and worked enough for a partial:

Additional Futures Calls:

None.

Results: -9 ticks.

Stocks:

Big day on the stock called it triggered.

These are the Tradesight calls that triggered, Rich's LRCX triggered long (with market support) and worked big:

That's 1 trigger with market support, and it worked.

Tradesight Recap Report for 6/7/24

Today in the Markets:

The markets gap down filled the gap, trying to go higher, and ended up closing negative by a little bit on 4.7 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

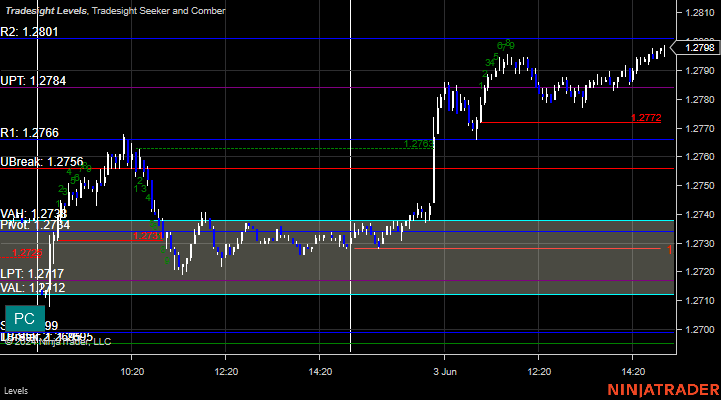

6B with Levels:

GC with Levels:

Futures:

The opening range was too wide for anything to trigger, so we had no features called officially.

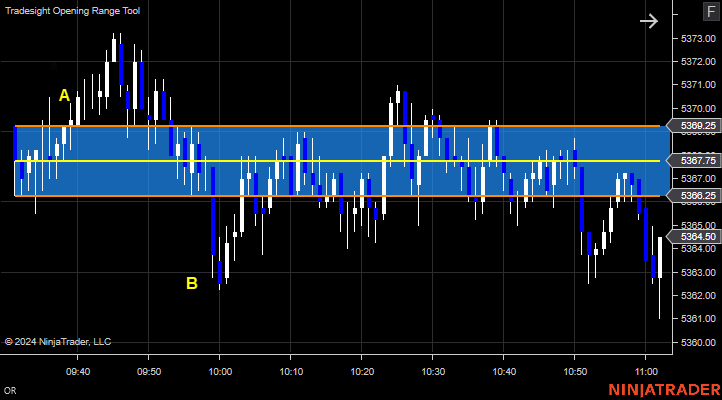

ES Opening Range Play, triggered short at A but too far out of range to take. Triggered long at B but too far out of range to take. :

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

Once again, no triggers on the stock side because it was so flat.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Tradesight Recap Report for 6/6/24

Today in the Markets:

The market opened up just a couple of ticks, and was dead flat all day. What a waste of a day on 4.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

GC with Levels:

CL with Levels:

Futures:

Not much of a day for futures.

ES Opening Range Play, triggered long at A and worked. Triggered short at B and stopped above the midpoint:

Additional Futures Calls:

None.

Results: -11 ticks.

Stocks:

The day was so flat that none of our stock calls triggered.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Tradesight Recap Report for 6/5/24

Today in the Markets:

The markets gapped up a little bit trying to fill the gap and didn't quite do it and then rallied for the big day on 5.4 billion NASDAQ shares.

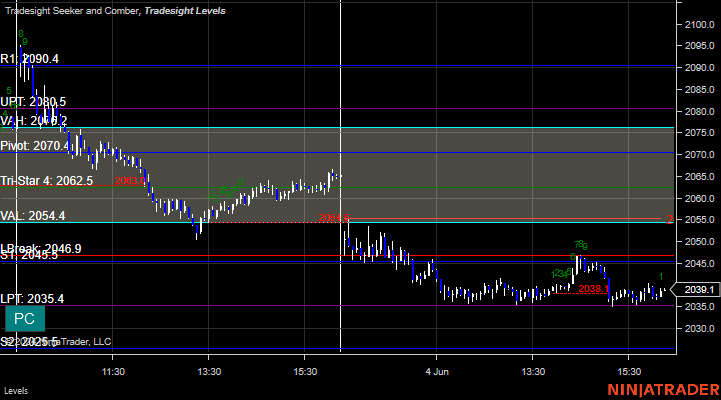

ES with Levels:

ES with Market Directional:

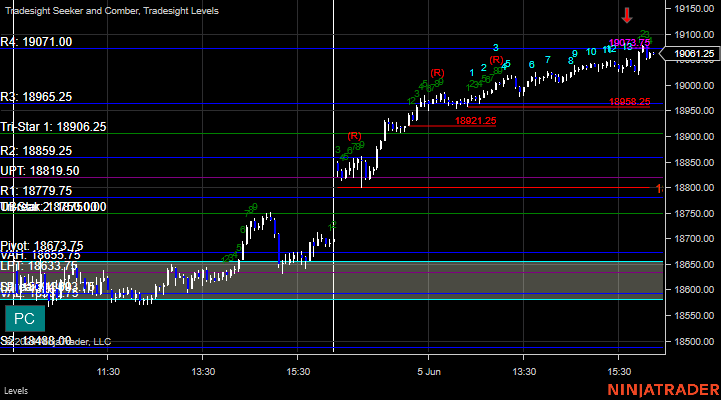

NQ with Levels:

RTY with Levels:

YM with Levels:

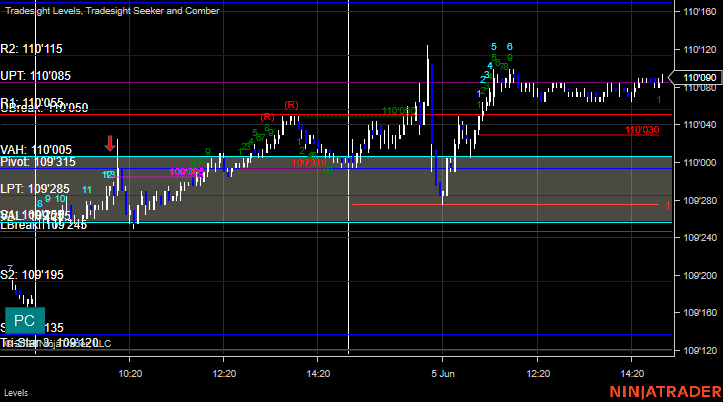

ZN with Levels:

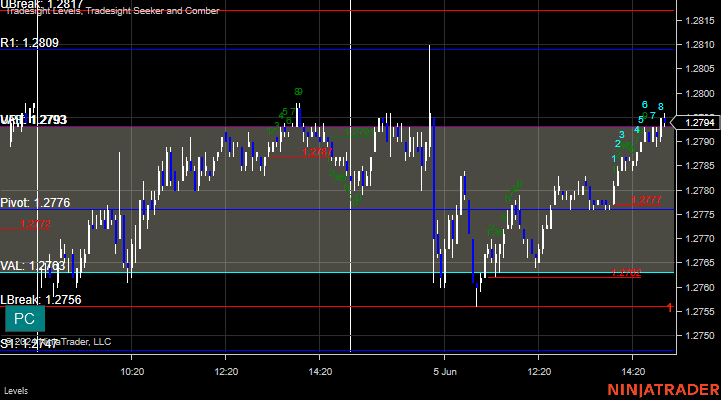

6B with Levels:

Futures:

A small winner for the session.

ES Opening Range Play, triggered short at A and worked :

Additional Futures Calls:

None.

Results: +7 ticks.

Stocks:

We have a winner and a small loser for the stock side.

These are the Tradesight calls that triggered.

Rich's COIN triggered long (with market support) but didn't work:

His USB triggered short (with market support) and worked enough for a partial:

That's 2 triggers with market support, 1 worked and 1 did not work.

Tradesight Recap Report for 6/4/24

Today in the Markets:

The markets gap down a little bit, eventually filled and then closed about even once again on 5.1 billion in NASDAQ shares.

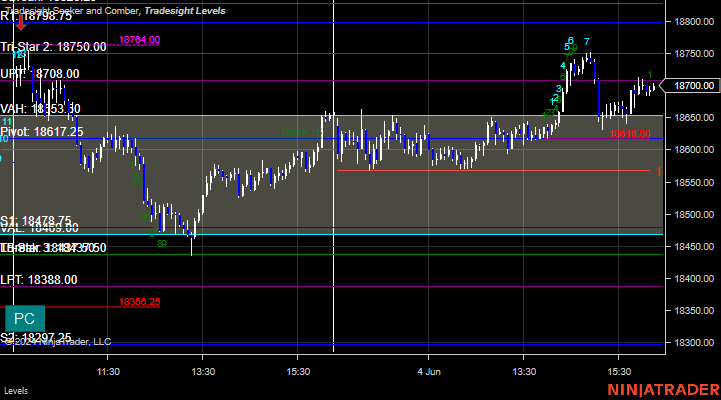

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

6B with Levels:

ZB with Levels:

Futures:

We had a small winner in the futures.

ES Opening Range Play, triggered short at A and worked enough for a partial. Triggered long at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +4 ticks.

Stocks:

We had a small winner on the stock side. Hard to come up with too many calls when the market isn't moving.

These are the Tradesight calls that triggered, Rich's LYFT triggered short (without market support) and worked a little:

That's 0 triggers with market support.

Tradesight Recap Report for 6/3/24

Today in the Markets:

Markets gapped up small came back filled went a little bit lower and then closed about even on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

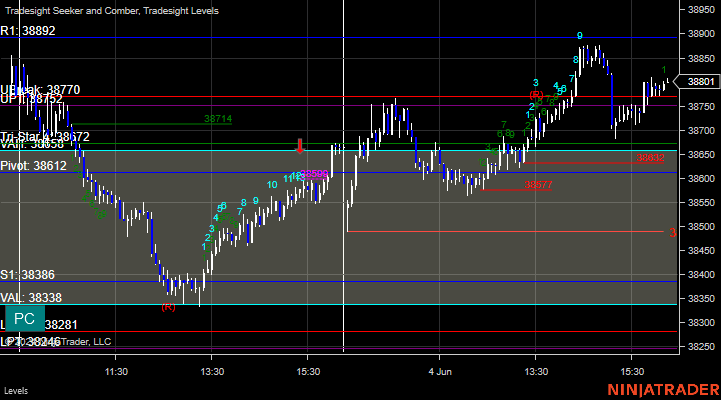

YM with Levels:

6B with Levels:

CL with Levels:

Futures:

One winner on the future side that made decent money.

ES Opening Range Play, triggered short at A and worked:

Additional Futures Calls:

None.

Results: +13 ticks.

Stocks:

None of our calls triggered on the stock side.

These are the Tradesight calls that triggered:

None.

That's 0 triggers with market support.

Tradesight Recap Report for 5/24/24

Today in the Markets:

The markets gapped up the ES hit the Value Area high on a 13 sell signal and then that was it for the day as everybody headed out for the long weekend.

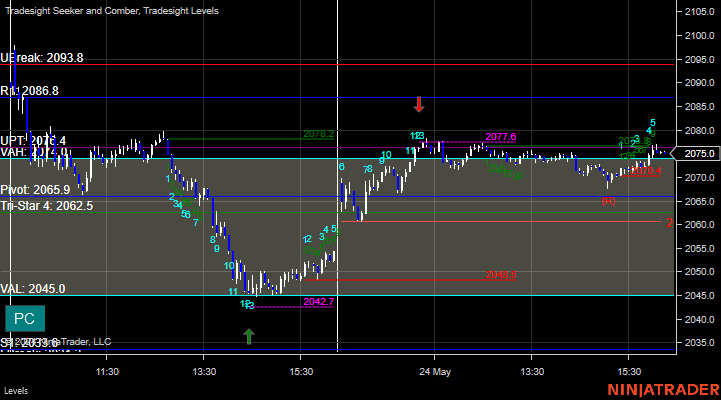

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

CL with Levels:

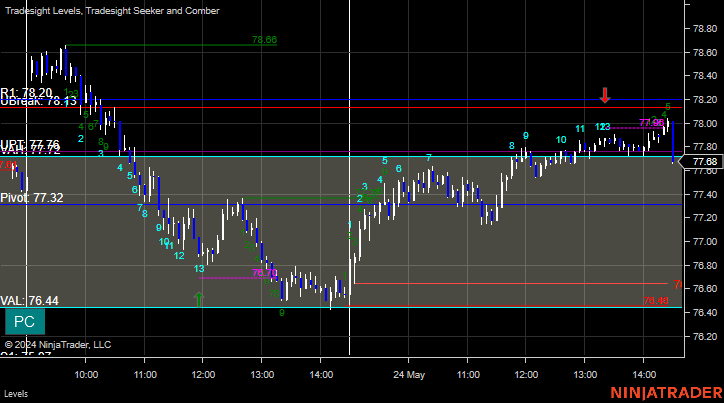

6B with Levels:

Futures:

Not much of a session as expected.

ES Opening Range Play, triggered long at A and stopped under the midpoint. Triggered short at B and worked:

Additional Futures Calls:

None.

Results: -7 ticks.

Stocks:

One big gapper winner if you were ready to go.

These are the Tradesight calls that triggered, Rich's FSLR triggered long (without market support due to first 5-minute) and worked big:

That's 0 triggers with market support.

Tradesight Recap Report for 5/23/24

Today in the Markets:

The markets gapped up, filled the gaps, then went flat until the afternoon and sold off hard with a really bad A/D ratio on 7.7 billion NASDAQ shares. Nothing positive there but tomorrow is a Friday leading into a long weekend.

ES with Levels:

ES with Market Directional:

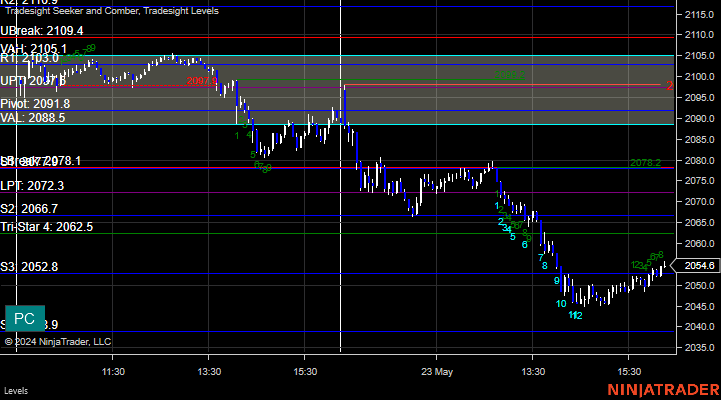

NQ with Levels:

RTY with Levels:

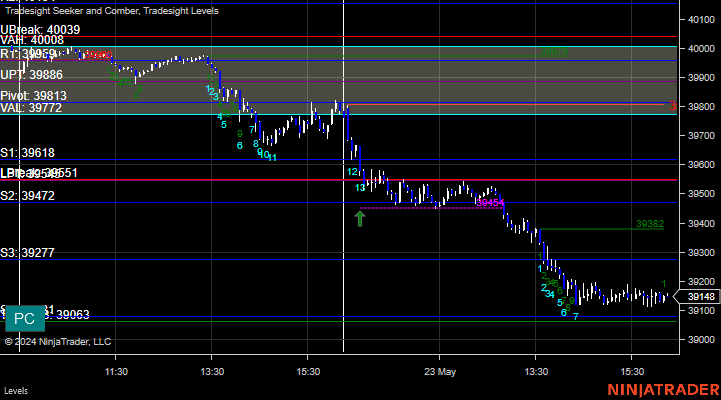

YM with Levels:

CL with Levels:

GC with Levels:

Futures:

No triggers.

ES Opening Range Play, triggered short at A but too far out of range to take:

Additional Futures Calls, NQ VA play call triggered short, worked enough for a partial and stopped the second half above entry:

Results: +5 ticks.

Stocks:

Super nice day overall for stocks.

These are the Tradesight calls that triggered, Rich's RDDT triggered short (with market support) and worked:

BABA PT play triggered short (with market support) and worked:

KLAC PT play triggered short (with market support) and worked:

Rich's PYPL triggered short (with market support) and worked a little:

That's 4 triggers with market support, and they all worked.

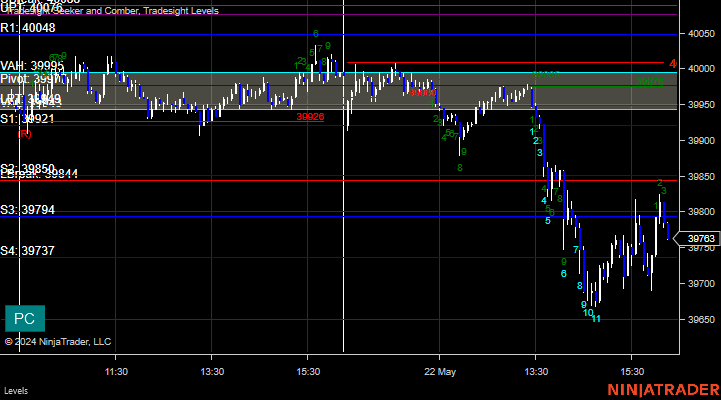

Tradesight Recap Report for 5/22/24

Today in the Markets:

The market's gapped down very small and filled quickly, and then went flat for hours before dipping hard in the afternoon and coming all the way back ahead of the Nvidia announcement of a stock split. NASDAQ volume was 7 billion shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

ZB with Levels:

GC with Levels:

Futures:

A winner for the session again.

ES Opening Range Play, triggered long at A and worked:

Additional Futures Calls:

None.

Results: +6 ticks.

Stocks:

Not much of a day for the calls in stocks.

These are the Tradesight calls that triggered, COST triggered long (with market support) but didn't go enough to count:

ROKU PT play triggered long (with market support) but didn't go enough to count:

INTU triggered long (no market support due to first 5-minute) and didn't work:

That's 2 triggers with market support, neither went enough either way to count.

Tradesight Recap Report for 5/21/24

Today in the Markets:

The markets gapped down a little, filled, and went flat most of the day until a late rally on 6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

YM with Levels:

GC with Levels:

CL with Levels:

Futures:

A small winner for the session.

ES Opening Range Play, triggered long at A and worked enough for a partial:

Additional Futures Calls:

None.

Results: +4 ticks.

Stocks:

A slightly green day.

These are the Tradesight calls that triggered, Rich's BA triggered short (without market support) and didn't work:

COST PT play triggered long (with market support) and worked a little:

That's 1 trigger with market support, and it worked.