Futures Calls Recap for 8/29/16

An extremely dull session on 1.3 billion NASDAQ shares. It's going to be a slow week. Opening Ranges at least worked great.

Net ticks: +17.5 ticks.

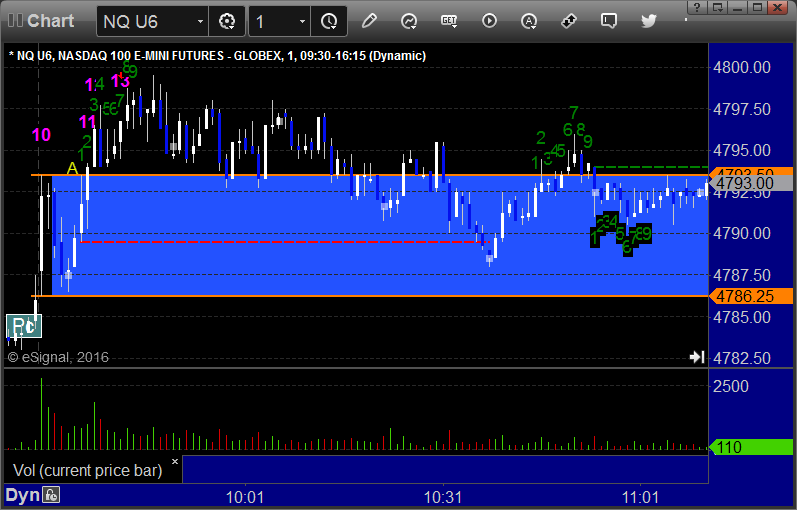

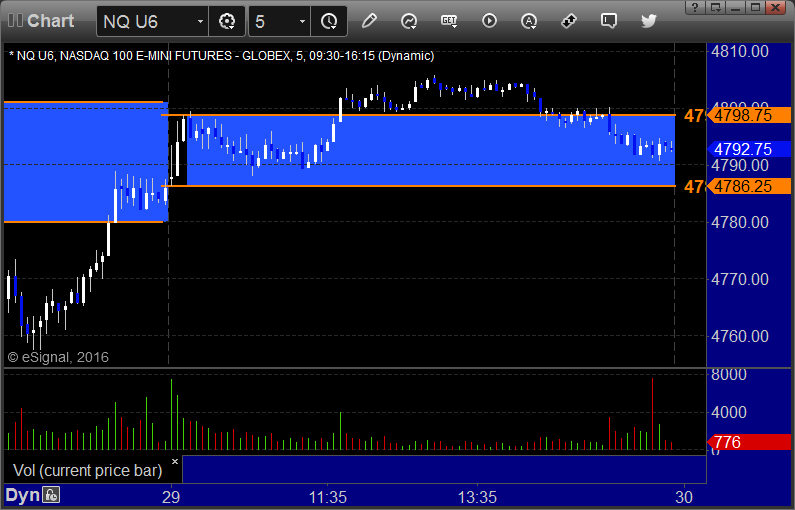

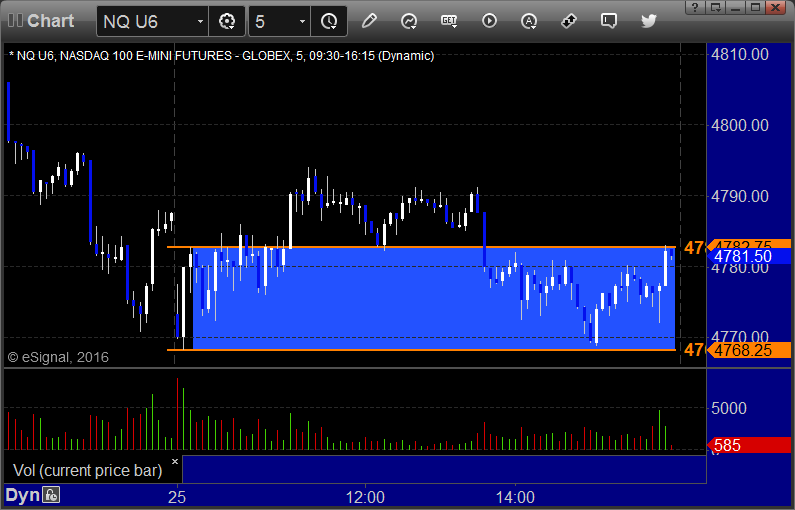

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 8/29/16

A boring session again. Probably going to be a slow week until Labor Day.

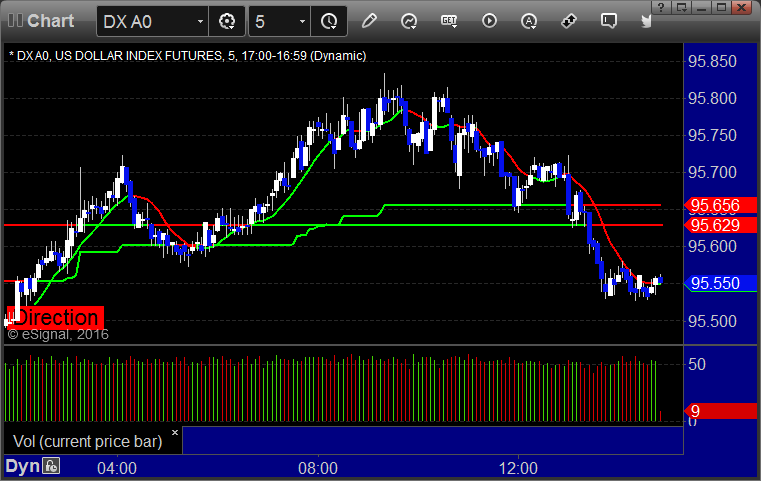

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A and eventually stopped:

Stock Picks Recap for 8/26/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, MCHP triggered long (with market support) and worked enough for a partial:

In total, that's 1 trade triggering with market support, it worked.

Futures Calls Recap for 8/26/16

The markets bounced around a bit on Yellen's comments and even sold off a decent amount ahead of lunch, but then recovered in the afternoon and closed around even on 1.4 billion NASDAQ shares. One more week...

Net ticks: +13.5 ticks.

There was actually some volatility in the markets due to Janet Yellen's speech in the morning, but in the end, we closed around even on 1.4 billion NASDAQ shares. One week to go...

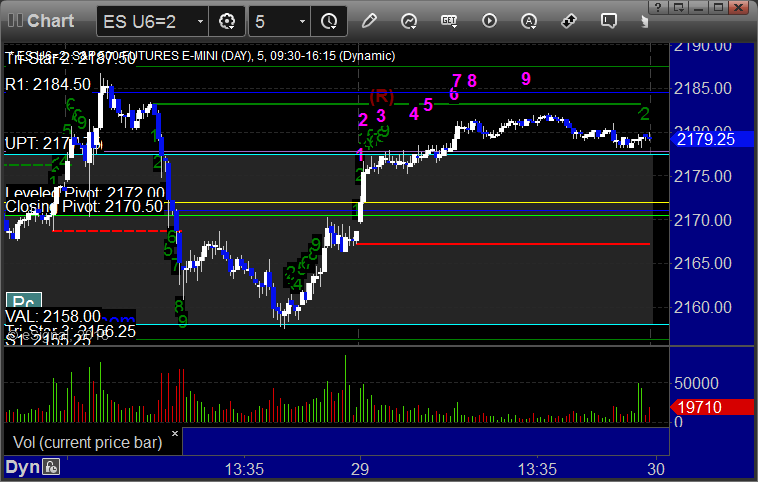

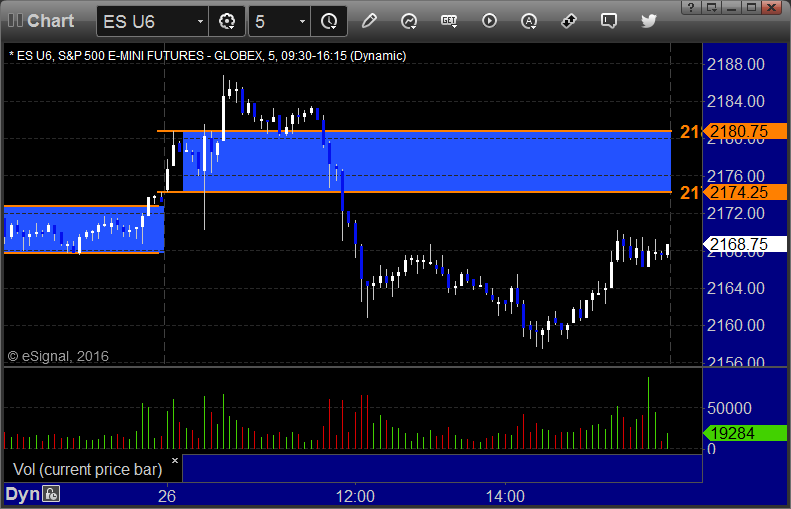

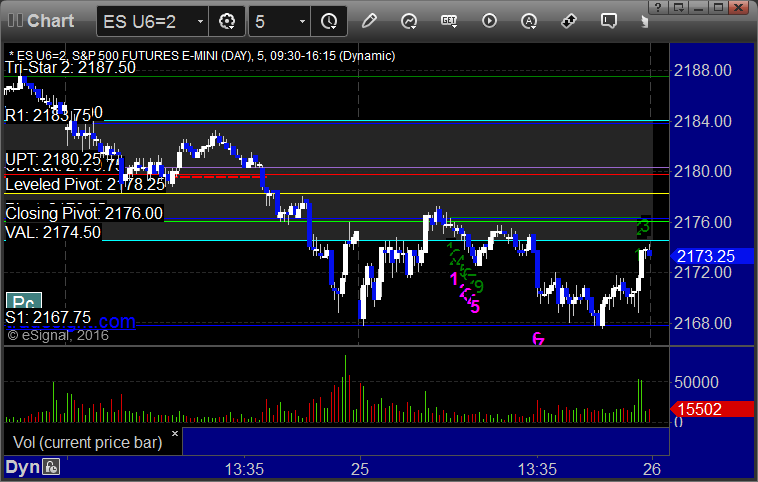

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked, I did not take the short:

NQ Opening Range Play triggered long at A and worked, I did not take the short:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

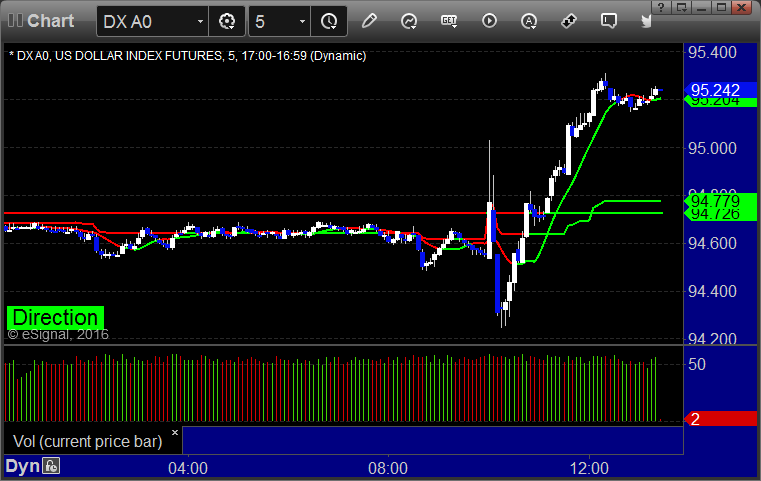

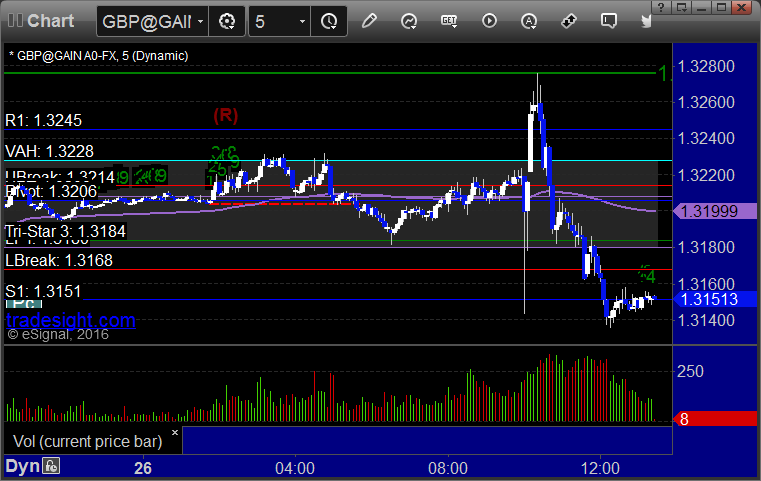

Forex Calls Recap for 8/26/16

Nothing triggered overnight. If you still had the orders in for Yellen's comments, then the GBPUSD spiked both ways.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

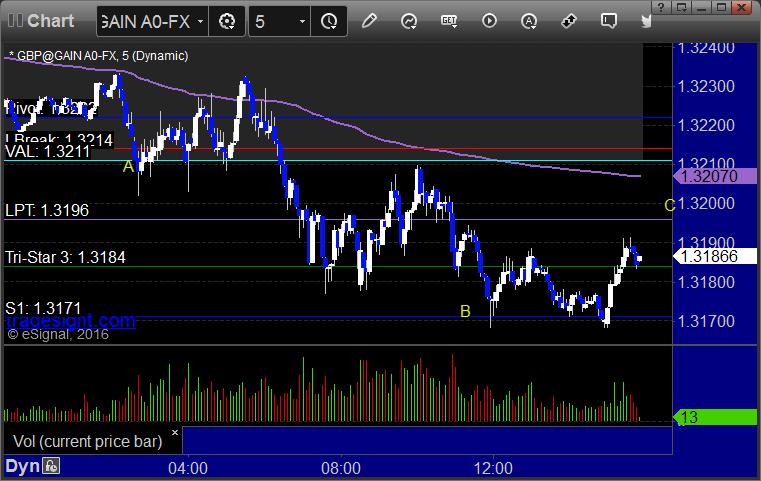

GBPUSD:

Stock Picks Recap for 8/25/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Mark's WDAY triggered short (with market support) and worked:

Nothing else triggered.

In total, that's 1 trade triggering with market support, and it worked.

Futures Calls Recap for 8/25/16

This is the boring session that the prior one managed to slightly avoid. Where volume picked up in the afternoon Wednesday (strangely), it did not here, so nothing happened and NASDAQ volume was only 1.3 billion shares. Tomorrow should not be any more interesting. Opening Range plays didn't work out net with no one around.

Net ticks: -16 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and stopped, triggered long at B and worked:

NQ Opening Range Play triggered short at A and stopped, triggered long at B and even tually worked enough for a partial, did not stop out because we use half point ticks on NQ:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 8/25/16

A winner and a loser for the session in the GBPUSD. See that section below. EURUSD stuck in a 30 pips range again. Ouch.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Our long triggered early off the left of this chart and stopped. Short triggered at A, hit first target at B, still holding second half with a stop over C:

Stock Picks Recap for 8/24/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NBIX triggered long (without market support) and worked enough for a partial:

DVAX triggered long (without market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's WYNN triggered short (with market support) and didn't work initially, worked later:

His VRX triggered long (without market support) and worked:

His FB triggered short (with market support) and worked:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not. Ironically, the three that triggered without market support worked. Very unusual.

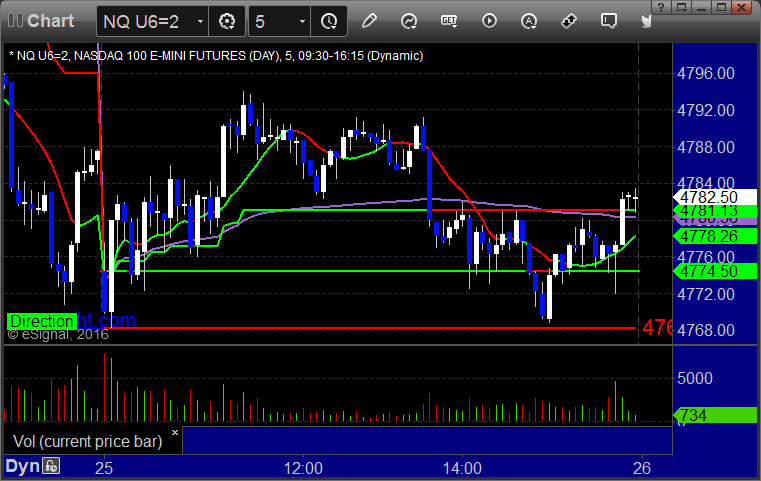

Futures Calls Recap for 8/24/16

Another super-boring flat session with a slow drift down in the afternoon on a weak 1.3 billion NASDAQ shares, basically the lightest of the year.

Net ticks: -27 ticks.

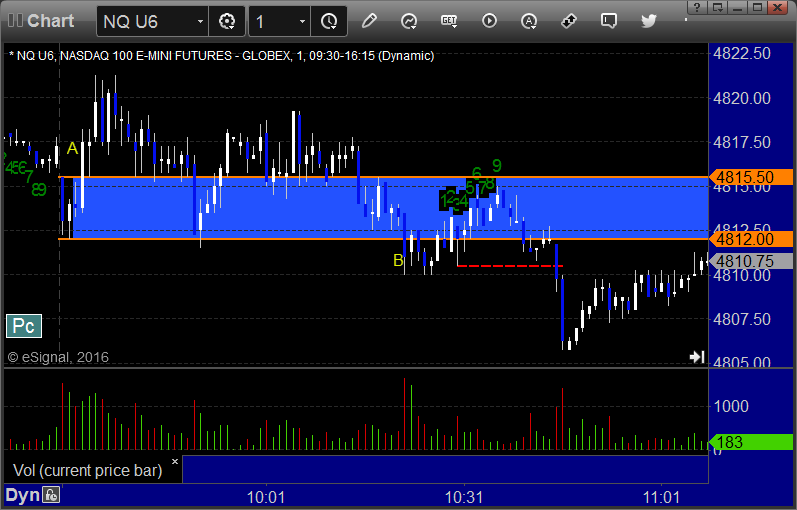

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and stopped, triggered short at B and stopped:

NQ Opening Range Play triggered long at A, missed the first official target by half a tick, triggered short at B and I ended up closing it for 3 ticks out of boredom:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: