Forex Calls Recap for 8/24/16

We closed out two trades from the prior two sessions in the money, then had a new stop out, and then a new winner. See GBPUSD section below.

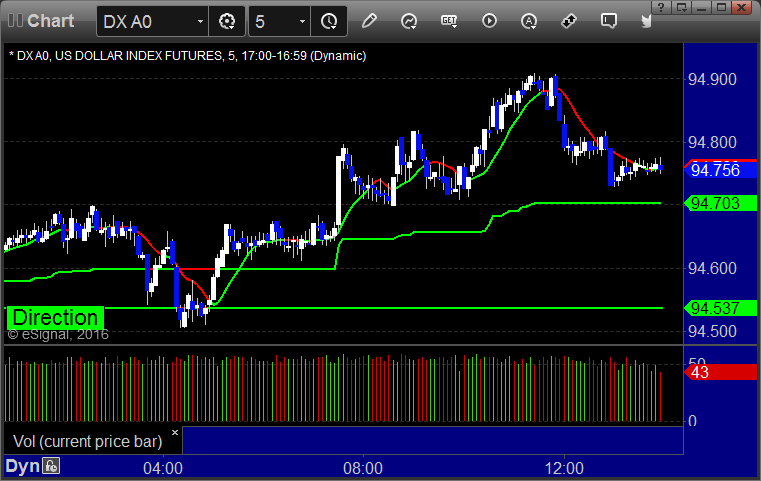

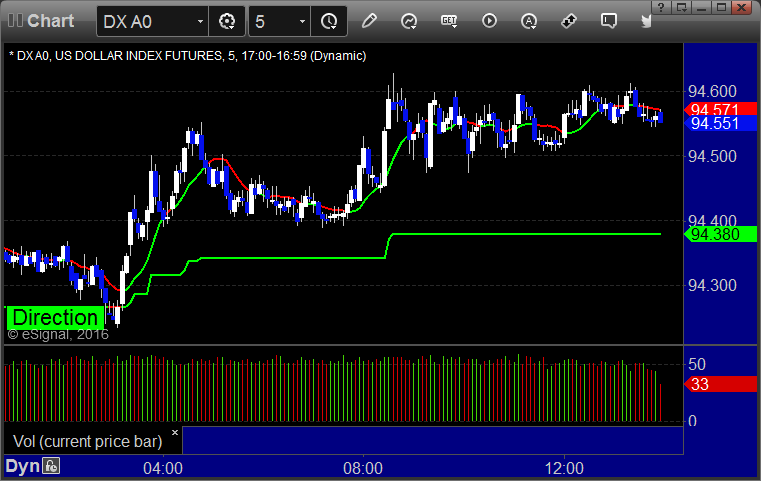

Here's a look at the US Dollar Index intraday with our market directional lines:

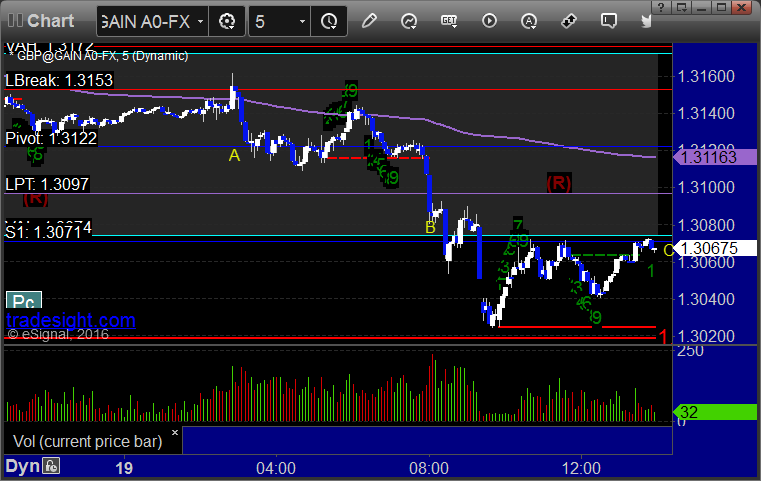

GBPUSD:

New trades triggered short at far left of chart and stopped, then long at A, hit first target at B, closed second half under entry:

Stock Picks Recap for 8/23/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NKTR triggered long (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, NTAP triggered long (with market support) and worked enough for a partial, I closed it slightly in the money:

CELG triggered long (with market support) and worked:

Rich's AMZN triggered long (with market support) and worked enough for a partial:

His AMBA triggered long (without market support) and didn't work:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Futures Calls Recap for 8/23/16

The light volume continues to mean that we shouldn't bother making additional calls as the Levels are barely being touched and largely ignored. Markets gapped up and were dead flat for hours, eventually starting a slow drift down but never covering more than half of average daily range on 1.3 billion NASDAQ shares.

Net ticks: +8 ticks.

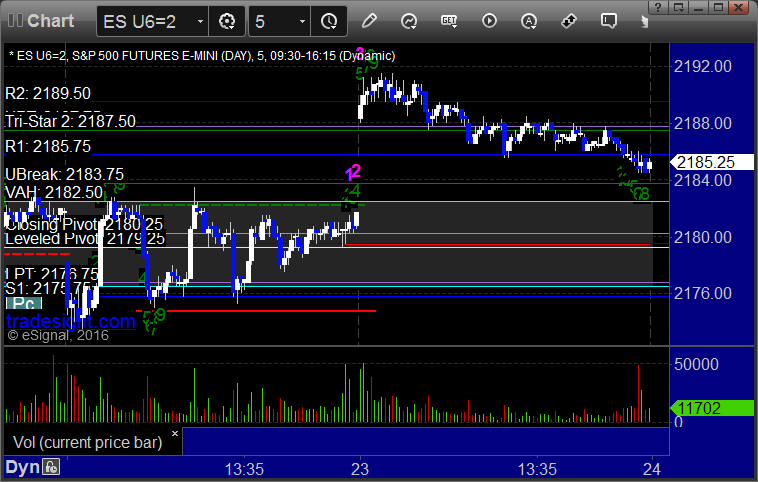

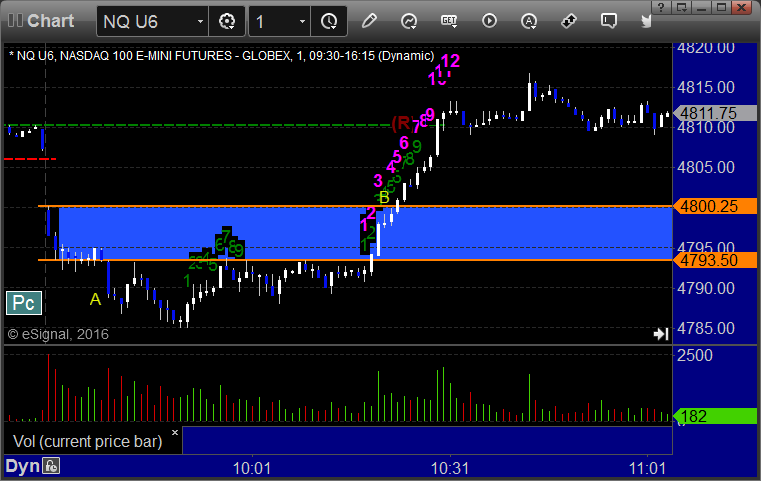

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

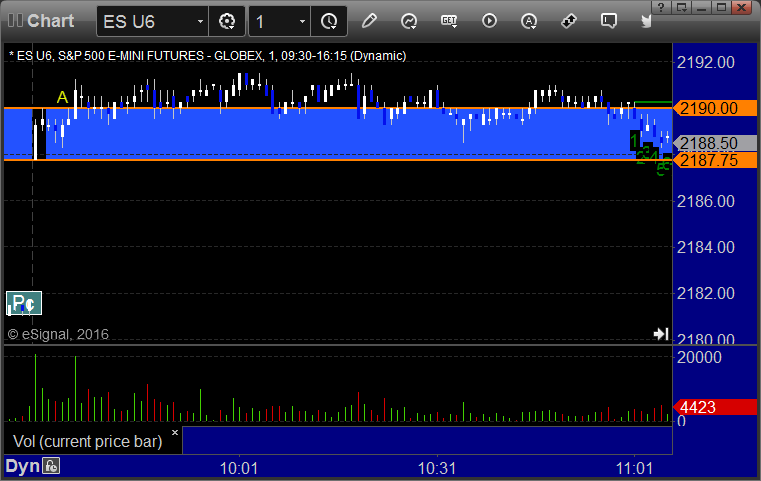

ES Opening Range Play triggered long at A and I eventually closed it for a 2 tick gain after it went nowhere for so long:

NQ Opening Range Play triggered long at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 8/23/16

We came into the session long the second half of the prior day's GBPUSD, and that never stopped, so we are now over 100 pips in the money there. New GBPUSD triggered long and worked. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

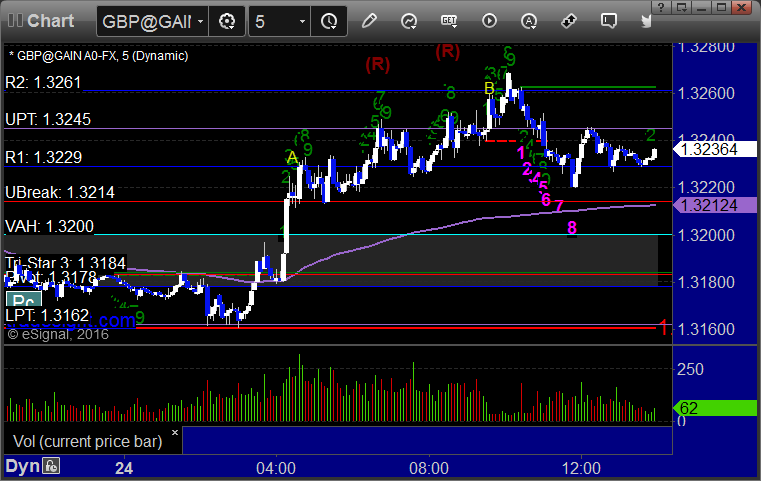

GBPUSD:

We were long from the prior session still. New trade triggered long at A, hit first target at B, still holding second half of both with a stop under yellow line:

Stock Picks Recap for 8/22/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, PCLN triggered short (with market support) and worked enough for a partial (I know most people don't trade that stock because it is so expensive, but it was a nice pattern):

AVGO triggered long (with market support) and worked:

VRSN triggered long (with market support) and didn't work:

GILD triggered long (with market support) and didn't work:

Rich's VRX triggered long (with market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

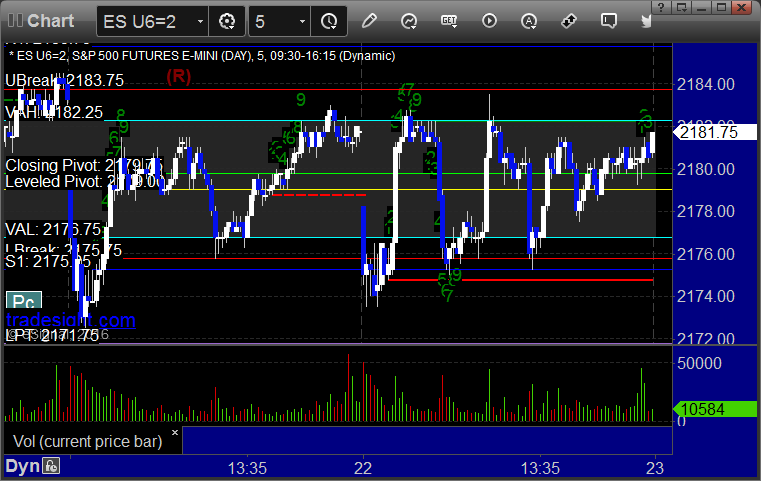

Futures Calls Recap for 8/22/16

Weird looking day. The markets gapped down and pushed lower, then reversed sharply to fill the gaps, then dipped sharply back to lows (still in narrow range), then bounced back up to even, then flat-lined on the midpoint. Still, we traded a very slightly-better-than-last-week 1.4 billion NASDAQ shares and went nowhere on half of average daily range. Opening Range plays were net winners, see that section below.

Net ticks: +6 ticks.

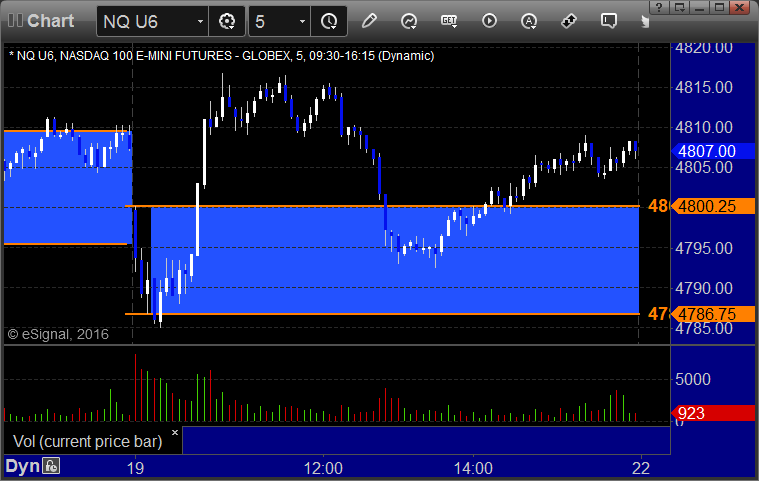

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and I used the midpoint on the short entries because they were away from the gaps and the ORs were a little wider than we had seen in a while, triggered long at B and worked:

NQ Opening Range Play triggered short at A and I used the midpoint on the short entries because they were away from the gaps and the ORs were a little wider than we had seen in a while, triggered long at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

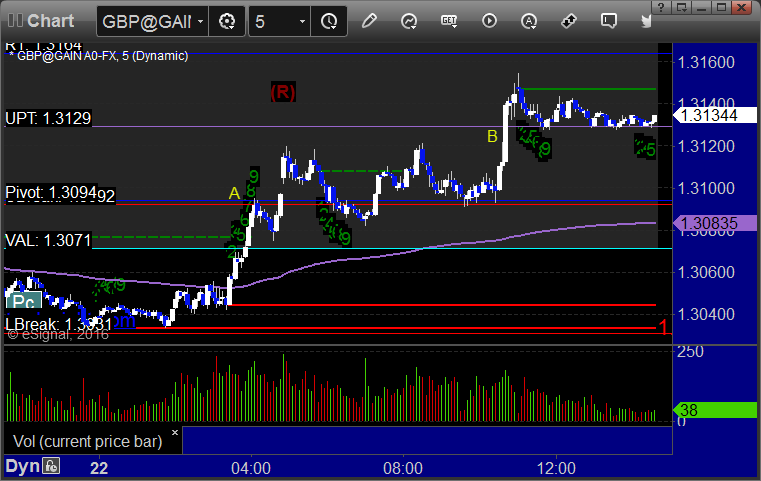

Forex Calls Recap for 8/22/16

A winner to start the week. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, still holding second half with a stop at 1.3120:

Stock Picks Recap for 8/19/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls for August expiration Friday.

From the Messenger/Tradesight_st Twitter Feed, WYNN triggered short (with market support) and worked:

In total, that's 1 trade triggering with market support, it worked.

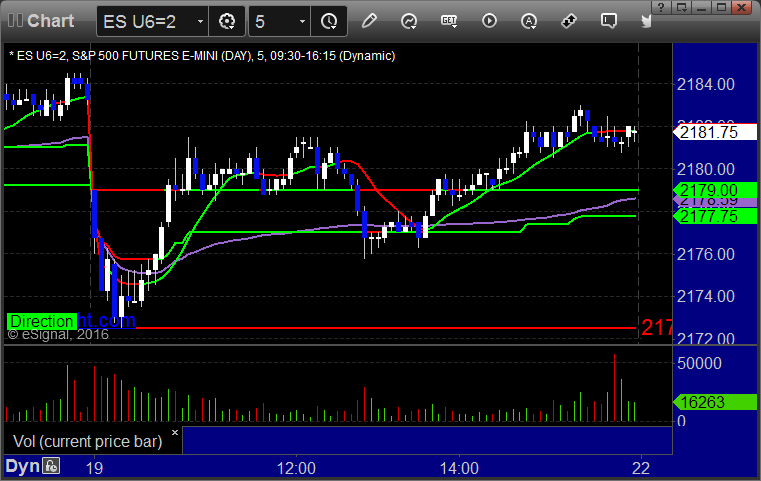

Futures Calls Recap for 8/19/16

The markets gapped down, pushed lower initially, flattened out for 40 minutes, then turned up to fill the gaps on light volume of 1.7 billion NASDAQ shares (light for an options expiration Friday).

Net ticks: +25.5 ticks.

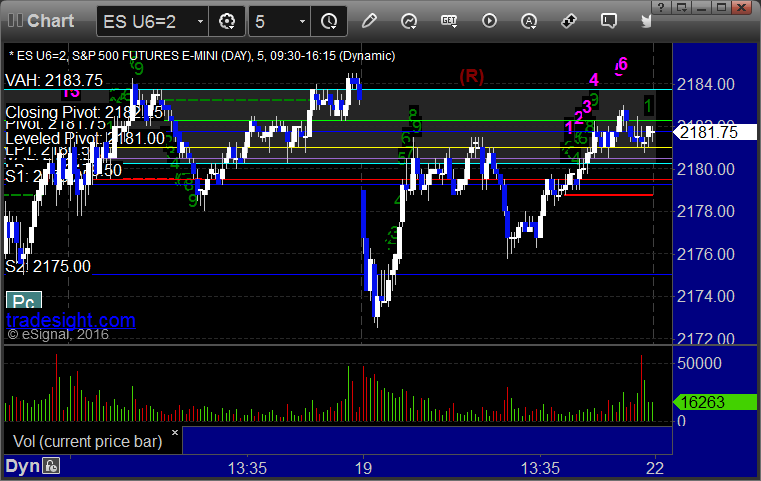

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked, the long triggered too late:

NQ Opening Range Play triggered short at A and worked, triggered long at B and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 8/19/16

Stopped out of the second half of the prior session's GBPUSD trade in the money, and then a new winner. See that section below. Almost to Labor Day!

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

GBPUSD:

Triggered short at A, just missed stopping out, and hit first target at B, closed second half at C for end of week: