Stock Picks Recap for 8/18/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ARWR gapped over, unfortunately.

ANGI triggered long (without market support do to opening 5 minutes) and worked (although it was way thinner than I would have expected):

From the Messenger/Tradesight_st Twitter Feed, Rich's VRX triggered short (with market support) and didn't work initially, worked later:

Rich's OIH triggered long (ETF, so no market support needed) and worked:

His WUBA triggered short (with market support) and didn't work:

GILD triggered long (with market support) but I posted to close it around even after a period of time:

Rich's BIDU triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

Futures Calls Recap for 8/18/16

The markets opened flat and didn't do much all day as expected. The ES was stuck in a horrible 6-point range on 1.4 billion NASDAQ shares.

Net ticks: -25 ticks.

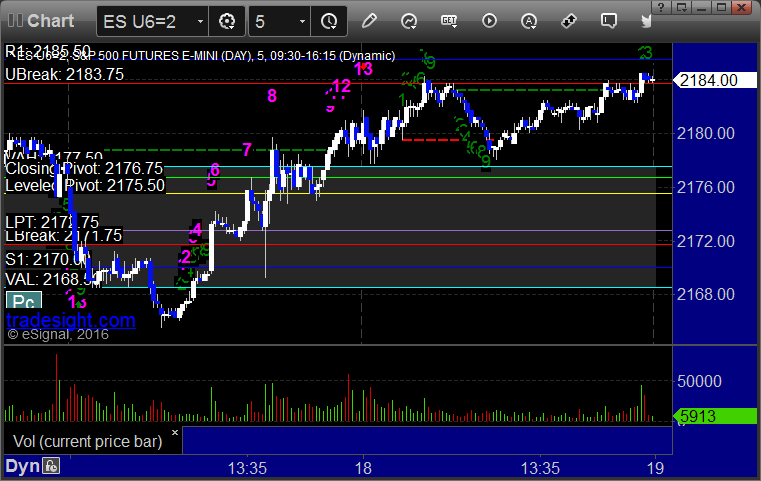

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn't work, we used the midpoint for the stop:

NQ Opening Range Play triggered short at A and didn't work, we used the midpoint for the stop, triggered long at B and eventually closed for a 2 tick loss out of boredom:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 8/18/16

Another nice winner (still holding second half) on the GBPUSD, although we still remain half size for summer doldrums. Look how thin it was on the news move up. Wow.

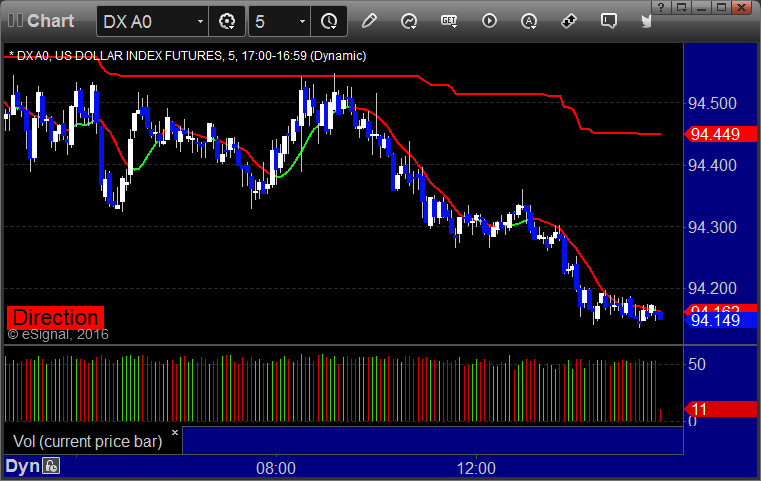

Here's a look at the US Dollar Index intraday with our market directional lines:

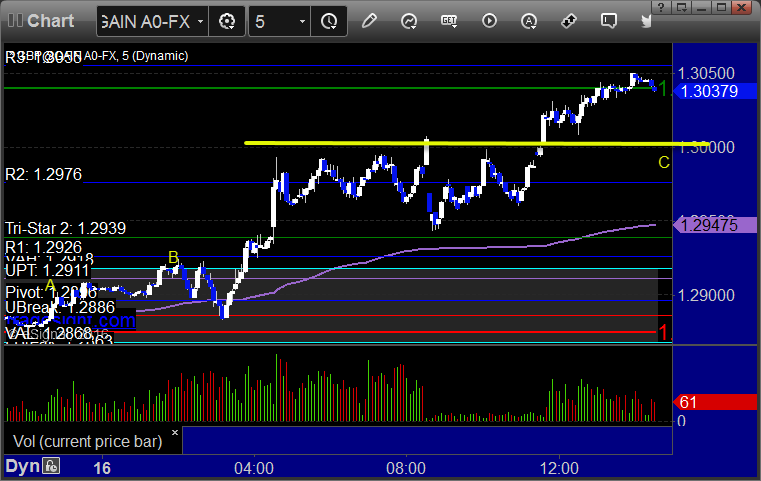

GBPUSD:

Triggered long at A, hit first target at B on the news, still holding second half with a stop at C:

Stock Picks Recap for 8/17/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CCOI triggered short (without market support) and didn't do enough to matter either way:

From the Messenger/Tradesight_st Twitter Feed, Rich's FSLR triggered short (without market support) and didn't go enough in either direction to count:

Amazingly, tons of other calls, nothing triggered again in dull action.

In total, that's 0 trades triggering with market support, so nothing to track for the first time this year.

Futures Calls Recap for 8/17/16

The markets opened down a little and pushed lower, then went flat, came back over lunch to fill the small gap, and closed slightly higher on 1.6 billion NASDAQ shares, which was sadly the best volume of the week. Opening Range Plays worked great.

Net ticks: +20 ticks.

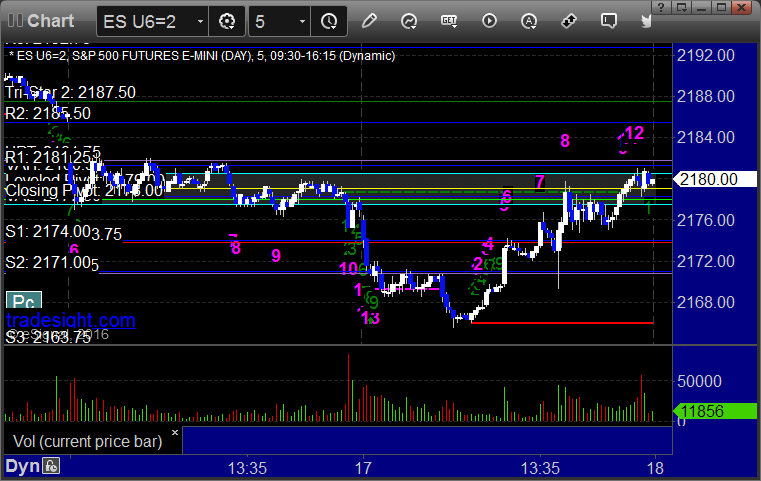

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 8/17/16

We stopped out of the second half of the prior day's GBPUSD for over 100 pips and then had a single stop out. Look at EURUSD in these doldrums, 25 pips of range. Ouch.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped:

Stock Picks Recap for 8/16/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ADSK triggered long (without market support) and didn't work:

ASNA triggered long (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered short (with market support) and worked:

His AAPL triggered short (with market support) and didn't work:

His DKS triggered short (without market support) and didn't work:

Lots more calls were made, but nothing triggered in dead action.

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Futures Calls Recap for 8/16/16

The markets gapped down and pushed lower for about 10 minutes, and that was the range for the whole session on 1.4 billion NASDAQ shares. Summer doldrums.

Net ticks: +21 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

TF:

My call triggered short at A at 1231.70, hit first target for 8 ticks, stopped second half over the entry:

Forex Calls Recap for 8/16/16

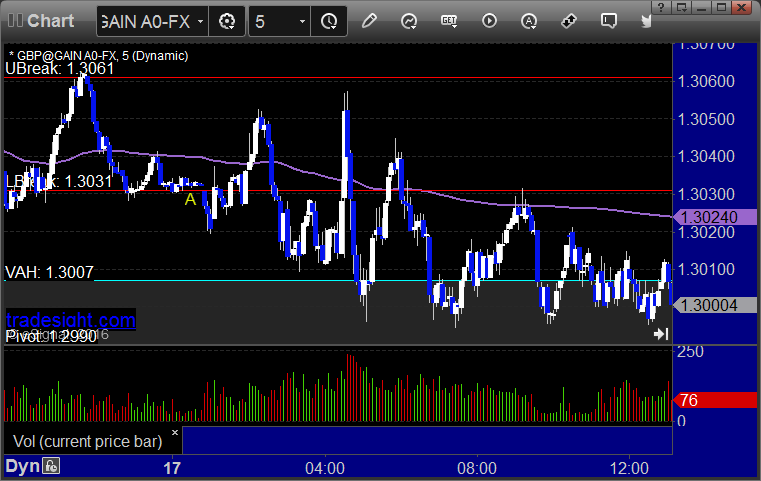

A nice winner in the GBPUSD, still going. We still remain half size, but I'll take it. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, still holding second half over 100 pips in the money with a stop under 1.3000 (yellow line) at C:

Stock Picks Recap for 8/15/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AMBA triggered long (with market support) and worked:

SYMC gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's GS triggered long (with market support) and worked:

Mark's KLAC triggered long (with market support) and worked:

GPRO triggered long (with market support) and worked:

Rich's BABA triggered short (without market support) and worked:

In total, that's 4 trades triggering with market support, all of them worked.