Forex Calls Recap for 7/29/16

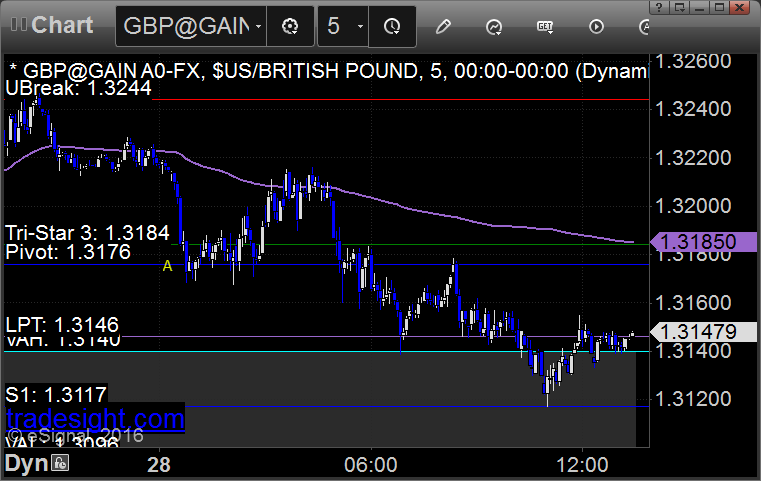

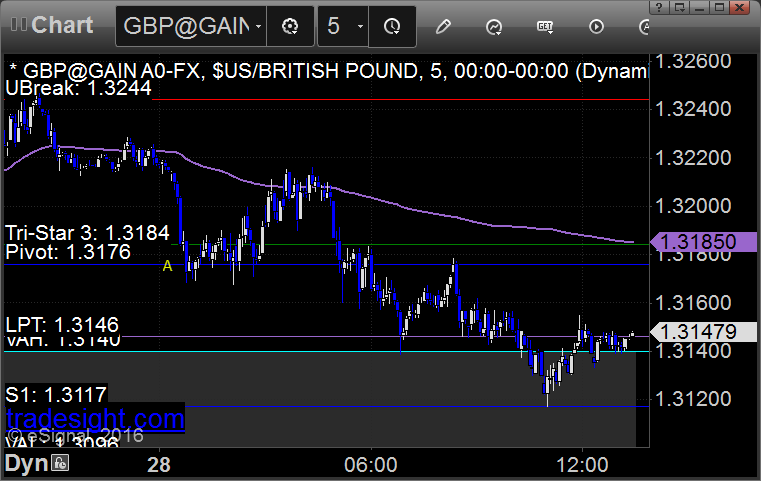

Another boring night where we were half size, made worse by the fact that our GBPUSD call triggered long right on a Comber 13 sell signal. We will remain half size in the weeks ahead as August is usually the slowest month of the year for Forex. Those who use the Seeker/Comber, this is a great time to fade signals there.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

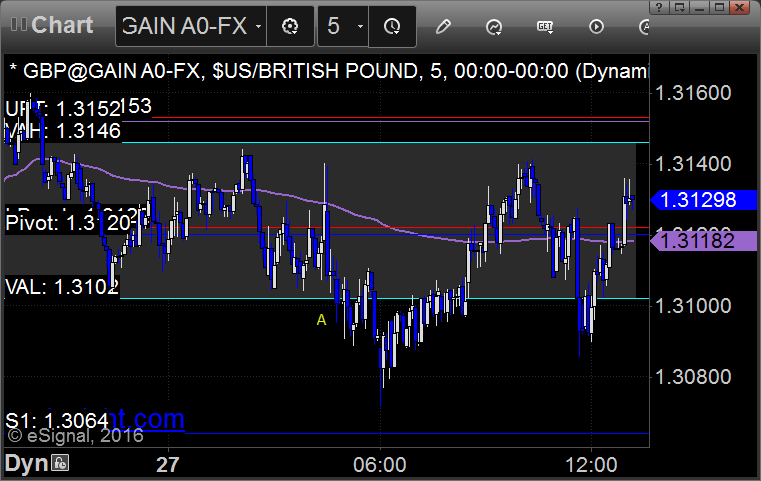

GBPUSD:

Bad timing as the long idea triggered at A right on a Comber 13 sell signal (those of you that have gone through the program should have avoided the trade if you were awake and watching):

Stock Picks Recap for 7/28/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

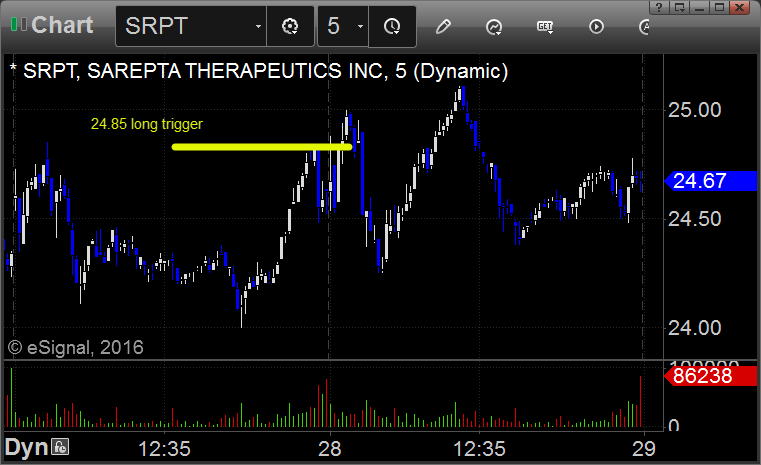

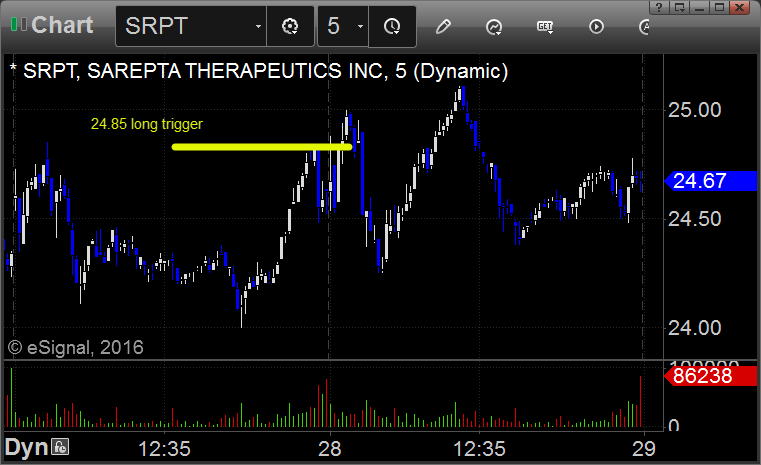

From the report, SRPT triggered long (without market support due to opening 5 minutes) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered short (with market support) and worked:

QCOM triggered long (without market support) and didn't worked:

Rich's FB triggered short (with market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked.

Futures Calls Recap for 7/28/16

The markets opened flat and didn't do much (as expected) despite a few stocks trading heavy volume from earnings. The Opening Range plays lost one direction and worked the other. NASDAQ volume was 1.8 billion shares.

Net ticks: -2 ticks.

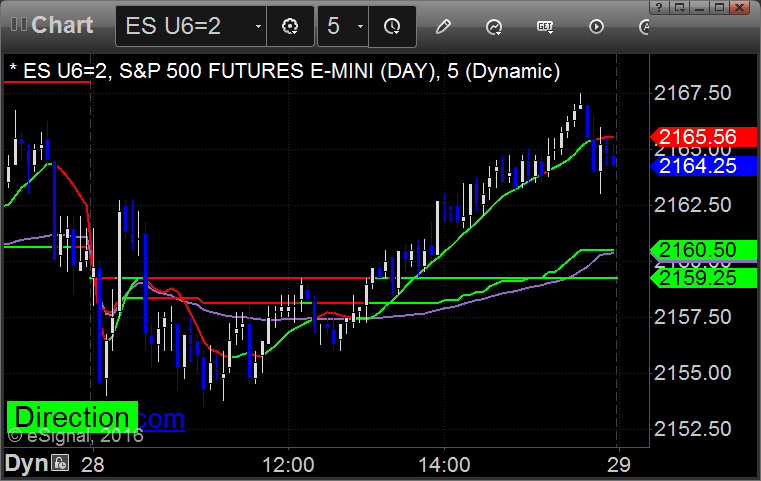

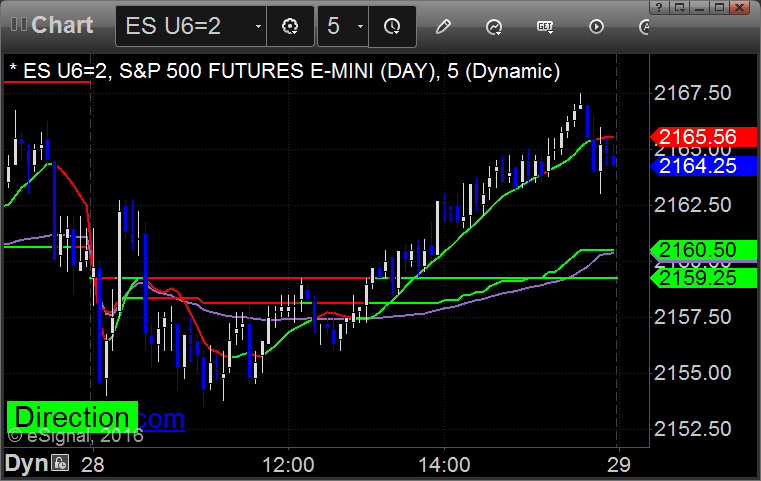

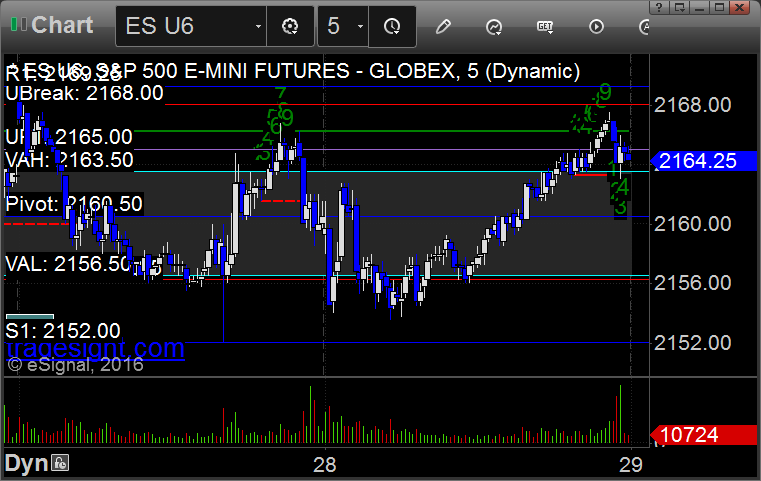

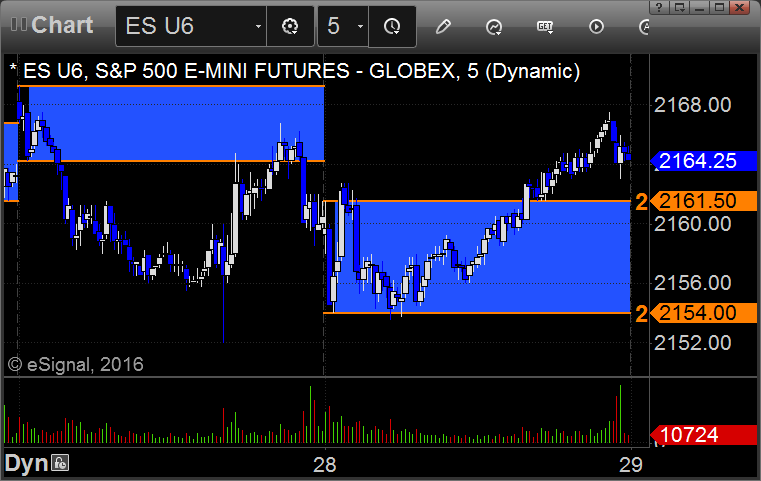

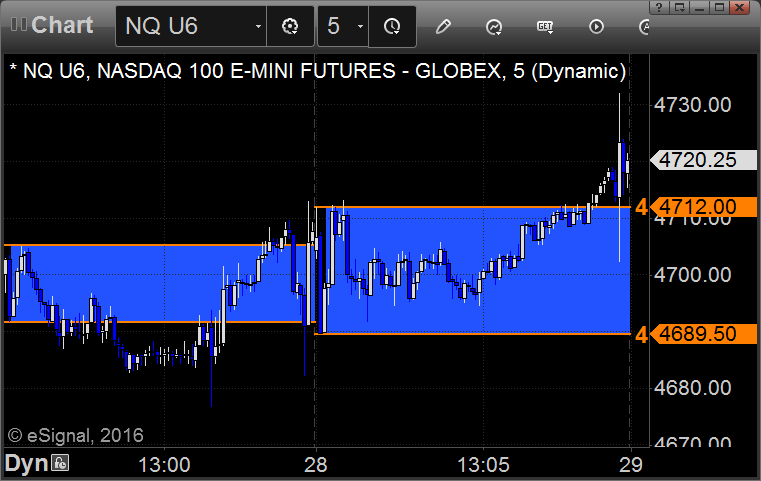

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

The markets opened flat and didn't do much (as expected) despite a few stocks trading heavy volume from earnings. The Opening Range plays lost one direction and worked the other. NASDAQ volume was 1.8 billion shares.

Net ticks: -2 ticks.

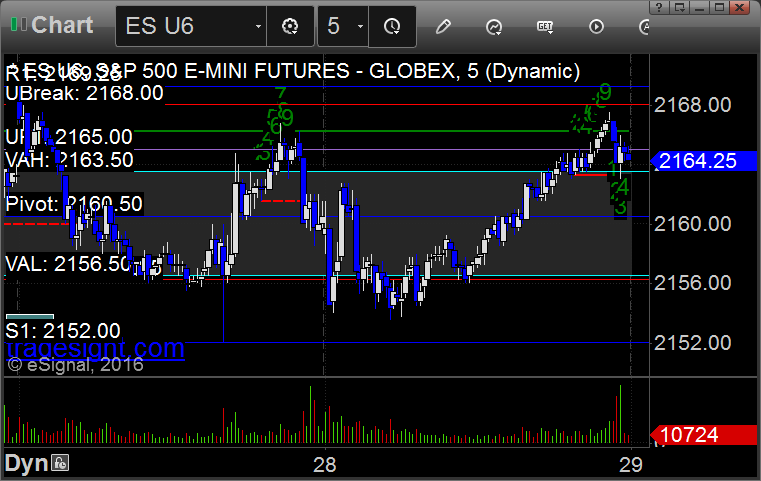

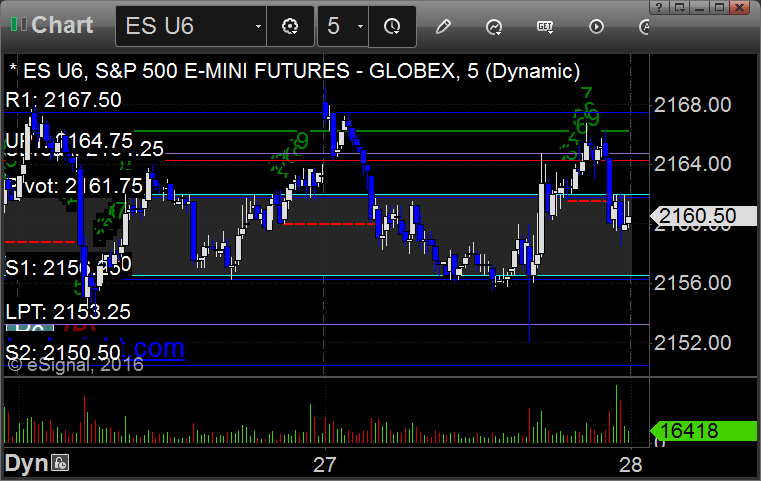

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 7/28/16

We remain half size for summer and had a stop out on the GBPUSD. See that section below.

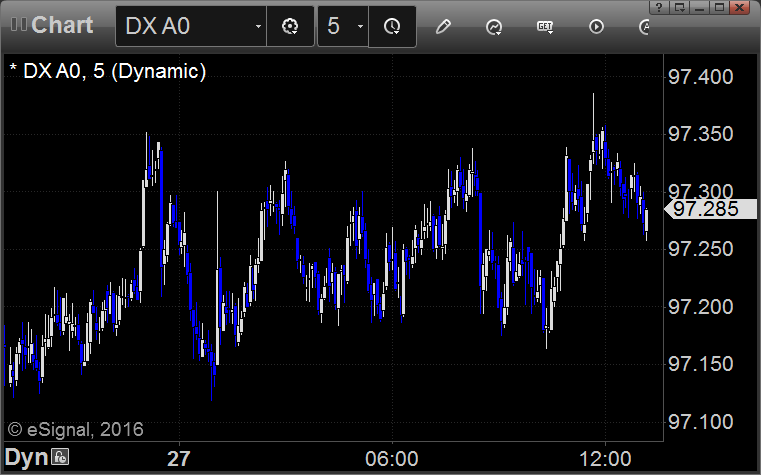

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped, would have worked if you put it back in after:

Stock Picks Recap for 7/28/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SRPT triggered long (without market support due to opening 5 minutes) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered short (with market support) and worked:

QCOM triggered long (without market support) and didn't worked:

Rich's FB triggered short (with market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked.

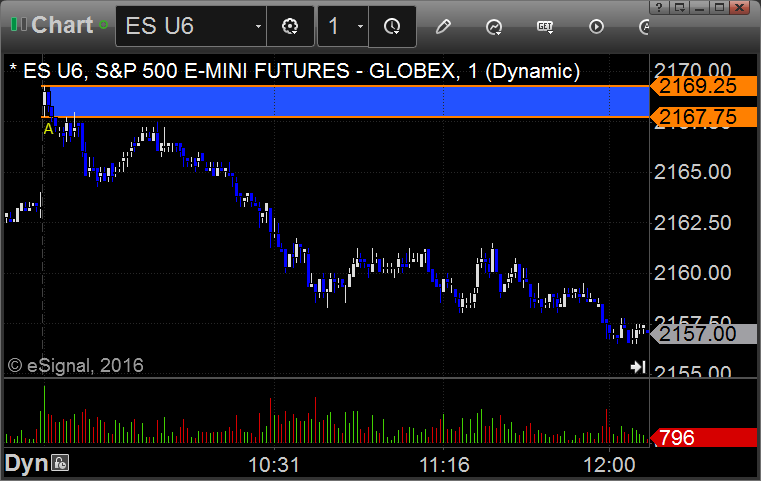

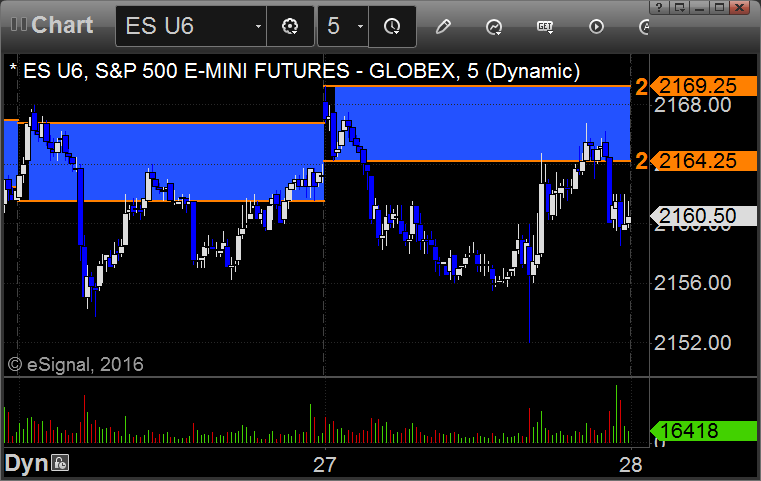

Futures Calls Recap for 7/28/16

The markets opened flat and didn't do much (as expected) despite a few stocks trading heavy volume from earnings. The Opening Range plays lost one direction and worked the other. NASDAQ volume was 1.8 billion shares.

Net ticks: -2 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

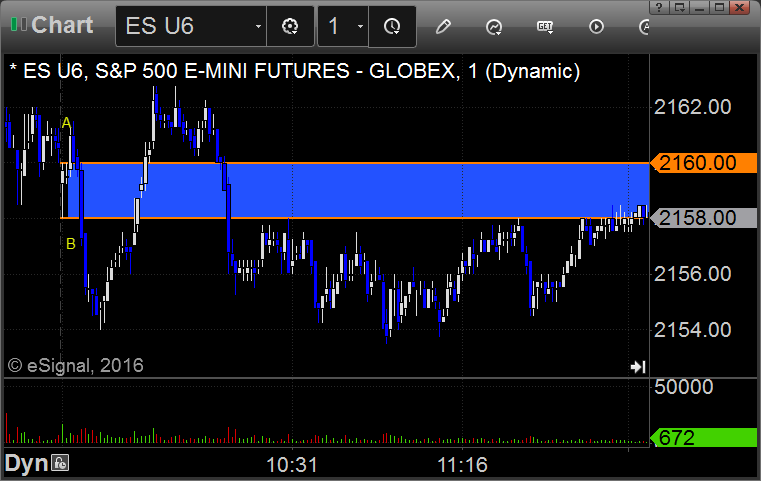

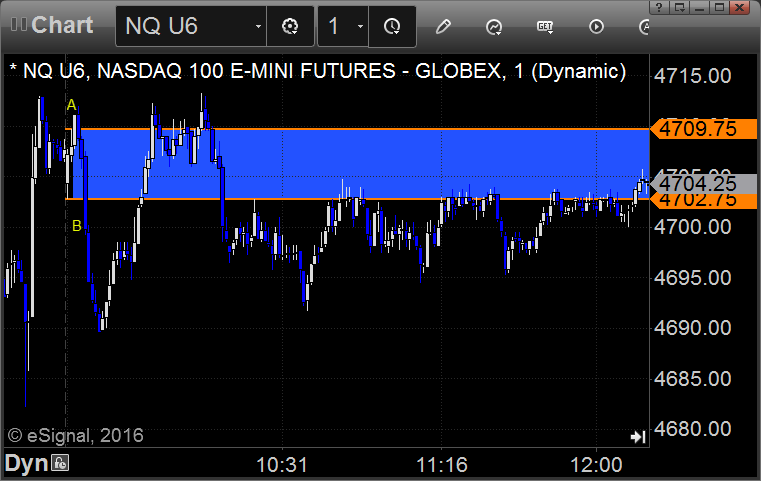

ES Opening Range Play triggered long at A and stopped, triggered short at B and worked:

NQ Opening Range Play triggered long at A and stopped, triggered short at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 7/28/16

We remain half size for summer and had a stop out on the GBPUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped, would have worked if you put it back in after:

Stock Picks Recap for 7/27/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's LOGM triggered short (with market support) and worked:

AAPL triggered short (with market support) and worked:

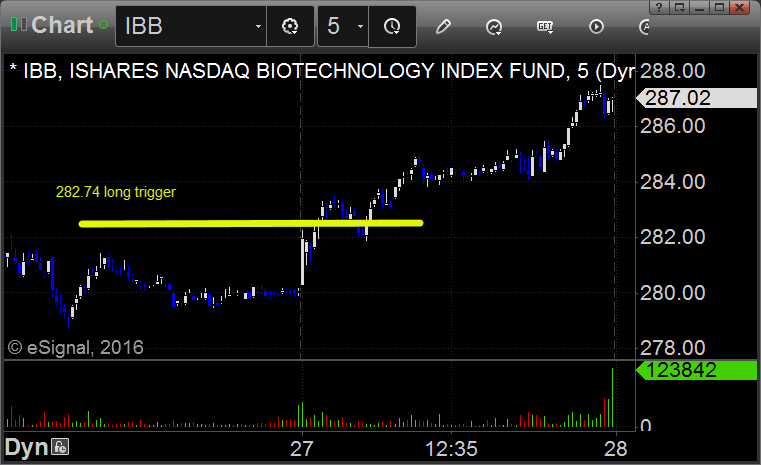

Rich's IBB triggered long (ETF, so no market support needed) and worked:

His TWTR triggered long (without market support) and didn't work:

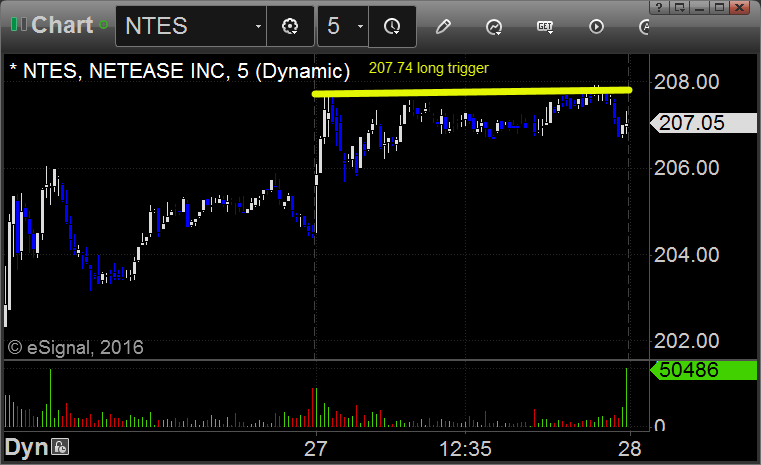

NTES triggered long (with market support) and didn't work:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 didn't.

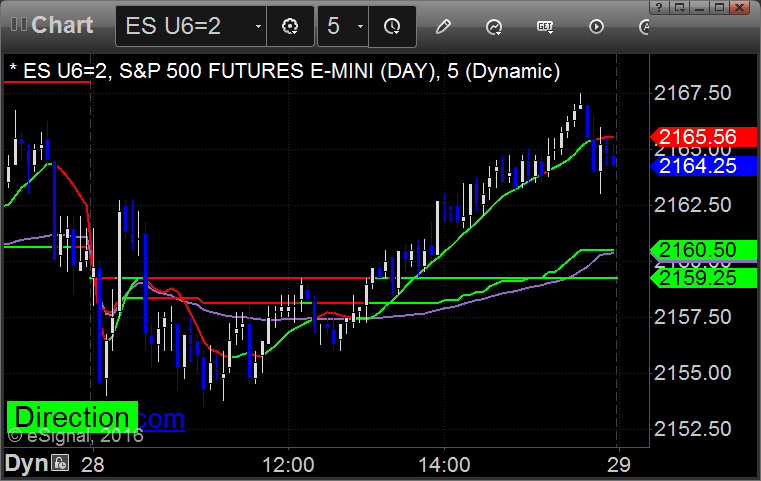

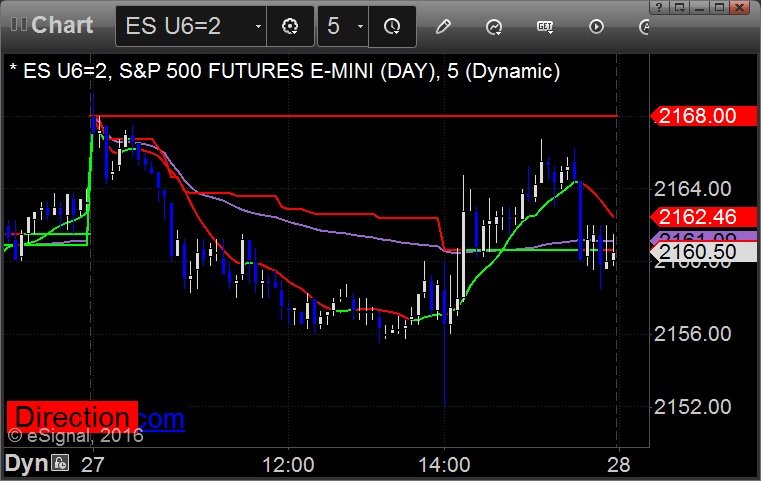

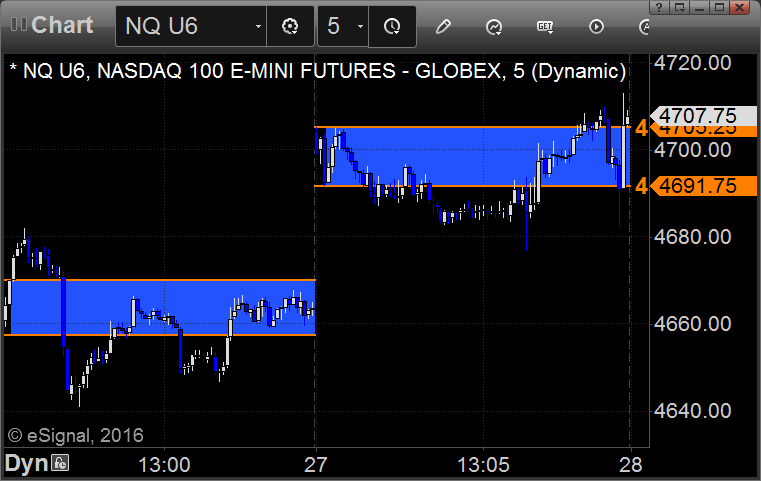

Futures Calls Recap for 7/27/16

Markets gapped up and bounced around early, then headed lower. ES gap fill, but NQ was too big with the AAPL gap. We waited for the Fed and then spiked around on 1.9 billion NASDAQ shares.

Net ticks: +11.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 7/27/16

A dull session as expected, even worse ahead of the Fed announcement (EURUSD in a 30 pip range or so). We played less than half size and got stopped on a GBPUSD trade. See that section below. These charts do not reflect the Fed announcement as they were taken before it happened.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A (for less than half size) and stopped. I did not put the orders back in ahead of the Fed: