Tradesight Recap Report for 4/7/22

Overview

Markets opened flat, drifted lower, then rallied after lunch to close slightly positive on 4.4 billion NASDAQ shares.

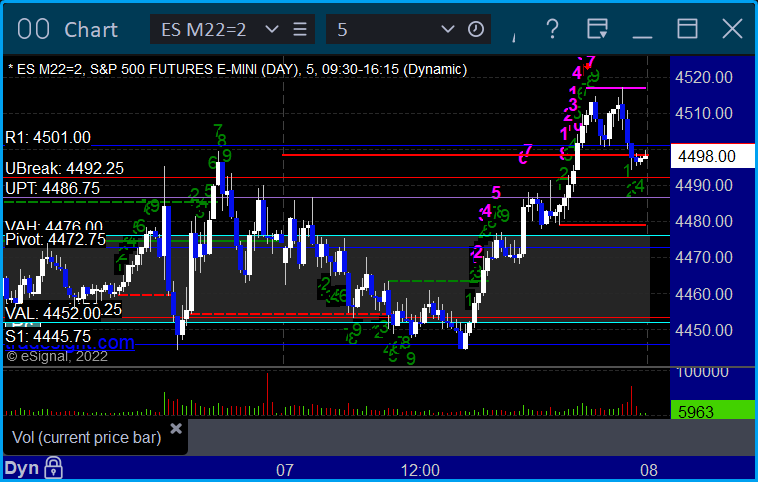

ES with Levels:

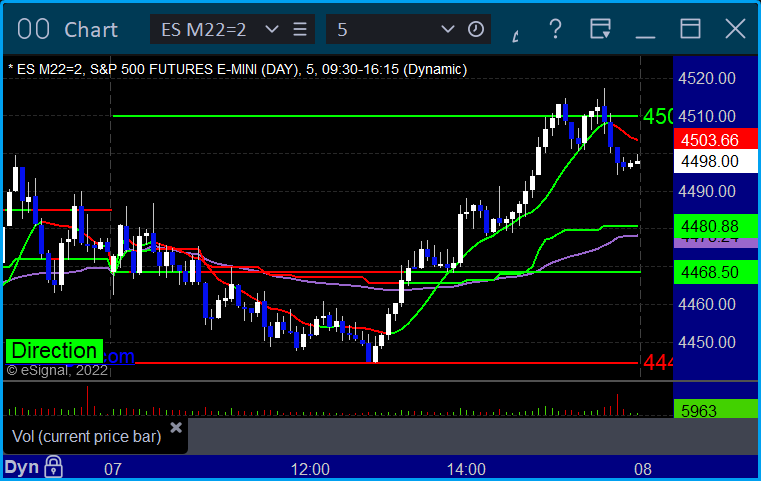

ES with Market Directional:

Futures:

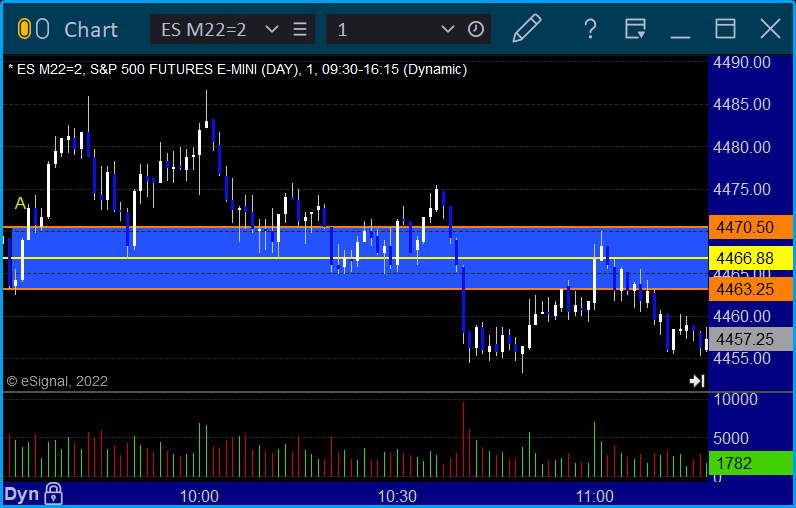

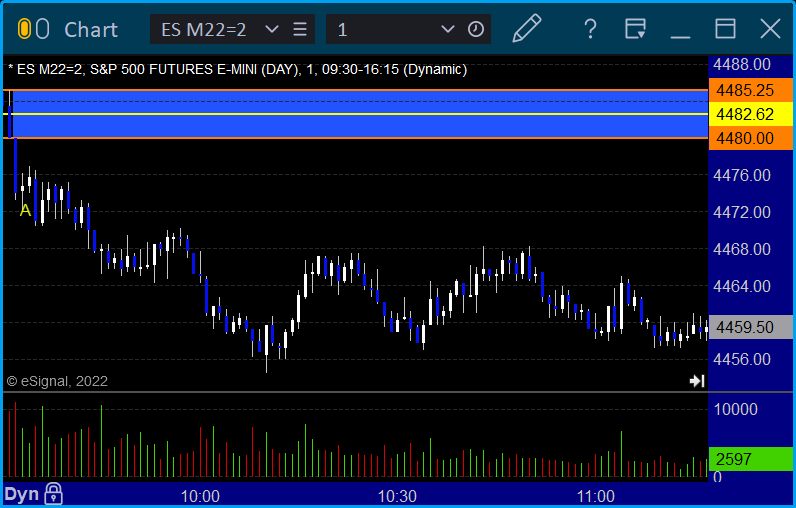

ES Opening Range Play triggered long at A but too far out of range to take:

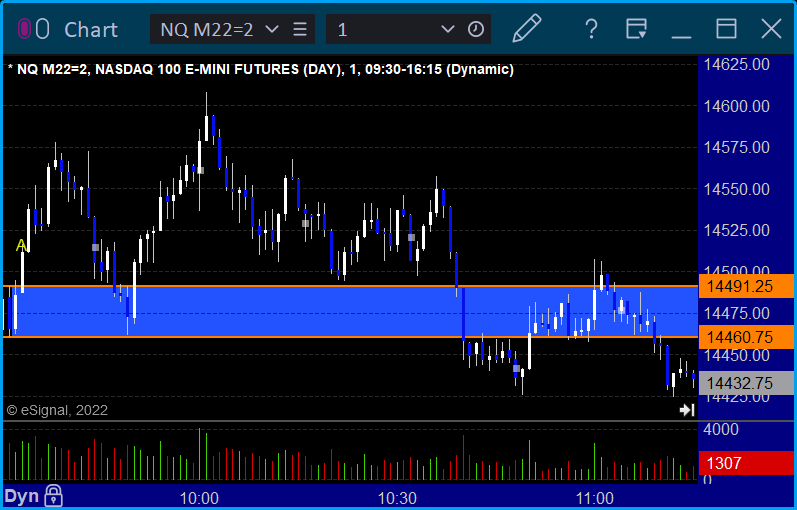

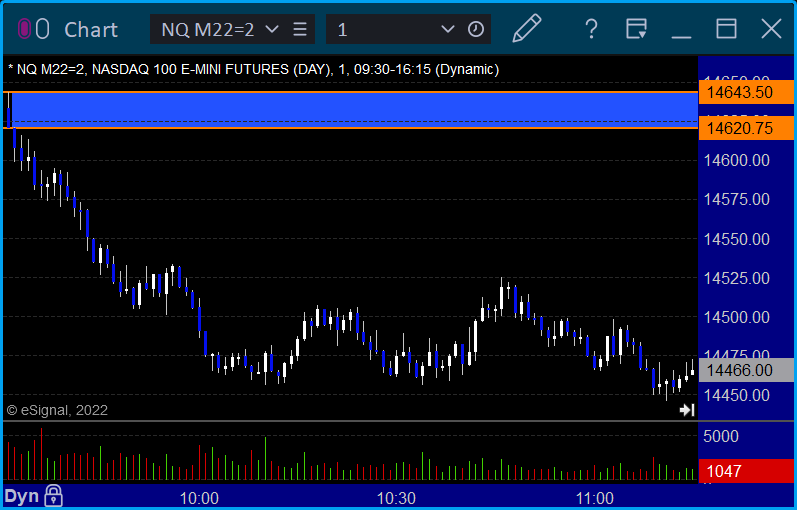

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: +0 ticks

Forex:

GBPUSD, no triggers:

Results: +0 pips

Stocks:

A little bit of green, but nothing special. Horrible market.

From the Tradesight Plus Report, no calls.

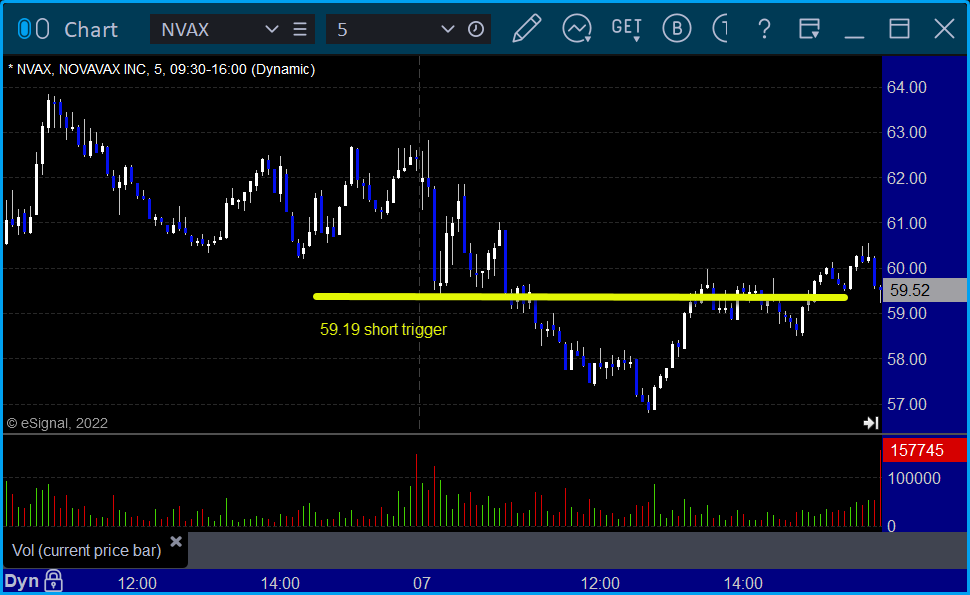

From the Tradesight Plus Twitter feed, Rich's NVAX triggered short (with market support) and worked:

His ZM triggered short (with market support) and worked enough for a partial:

LYFT triggered short (with market support) and worked enough for a partial:

That’s 3 triggers with market support, all of them worked.

Tradesight Recap Report for 4/6/22

Overview

The markets gapped down, pushed a little lower for 30 minutes, and that was pretty much it for the day on 5.3 billion NASDAQ shares.

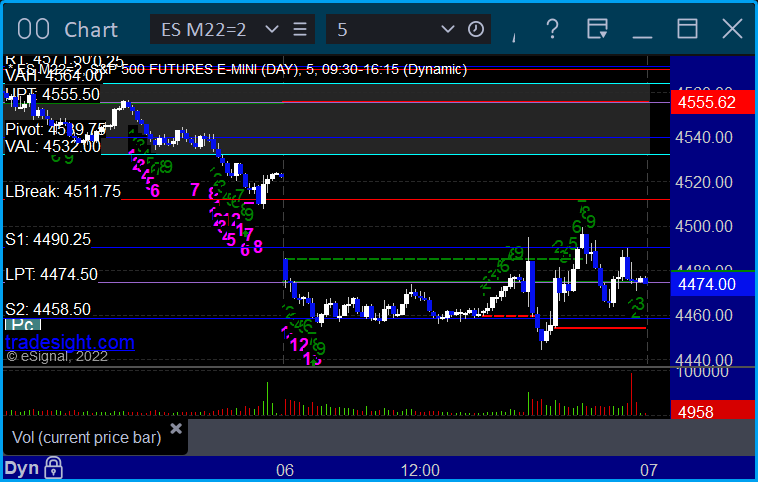

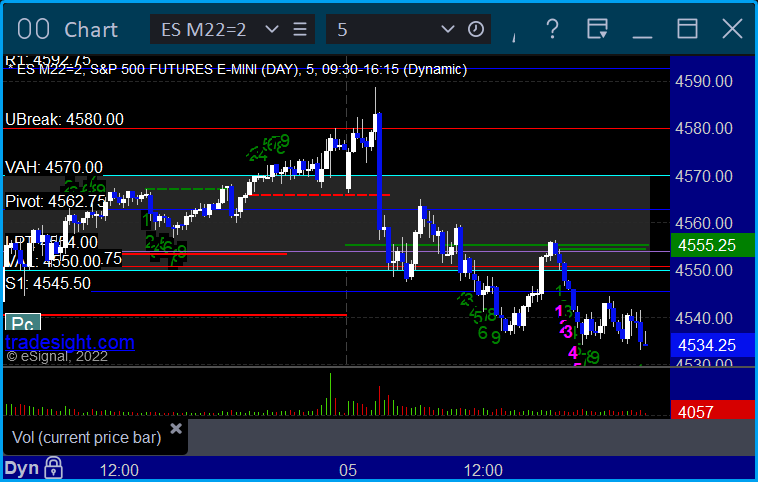

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take:

NQ Opening Range Play short trigger was too far out of range to take:

Results: +0 ticks

Forex:

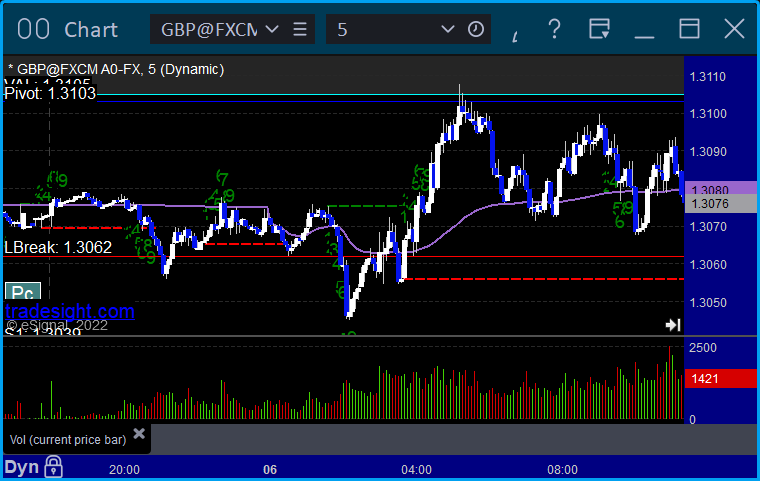

GBPUSD, no calls, no triggers, totally dead flat:

Results: +0 pips

Stocks:

A decent day in the markets despite little action after the first 30 minutes.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's TSLA triggered short (with market support) and worked:

His QCOM triggered short (with market support) and worked enough for a partial:

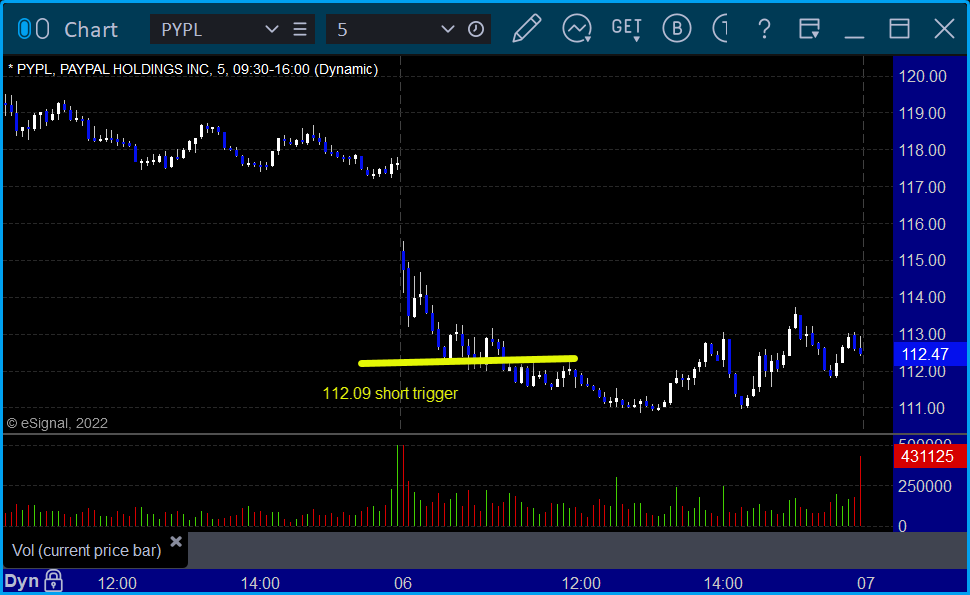

PYPL triggered short (with market support) and worked enough for a partial:

Rich's OIH triggered short (ETF, so no market support needed) and didn't work:

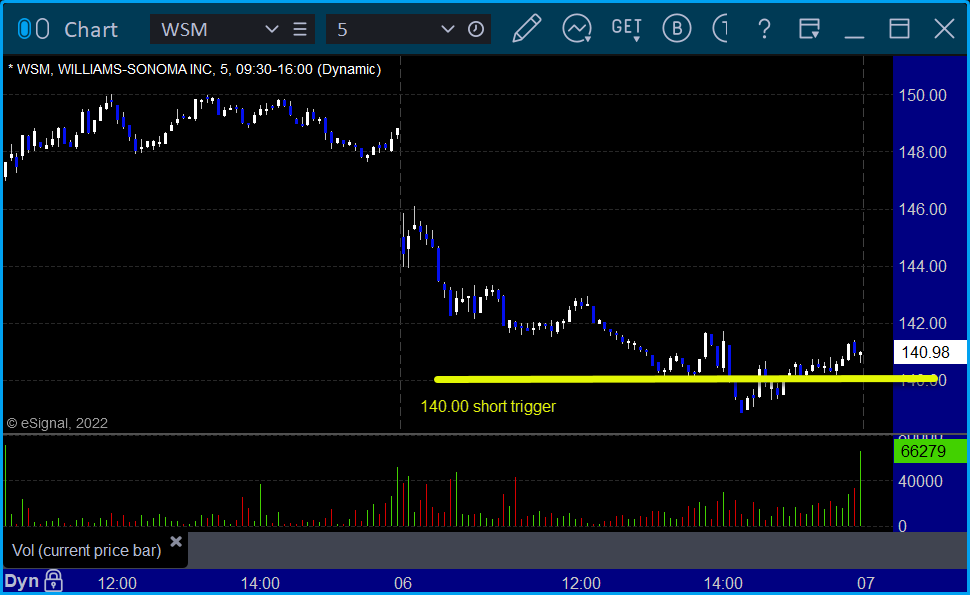

His WSM triggered short (with market support) and didn't go enough either way to count:

That’s 4 triggers with market support, 3 of them worked and 1 didn’t.

Tradesight Recap Report for 4/5/22

Overview

The markets gapped down, ES filled and went up for 30 minutes, then everything failed and closed at the lows on 4.2 billion NASDAQ shares. Big day for our futures.

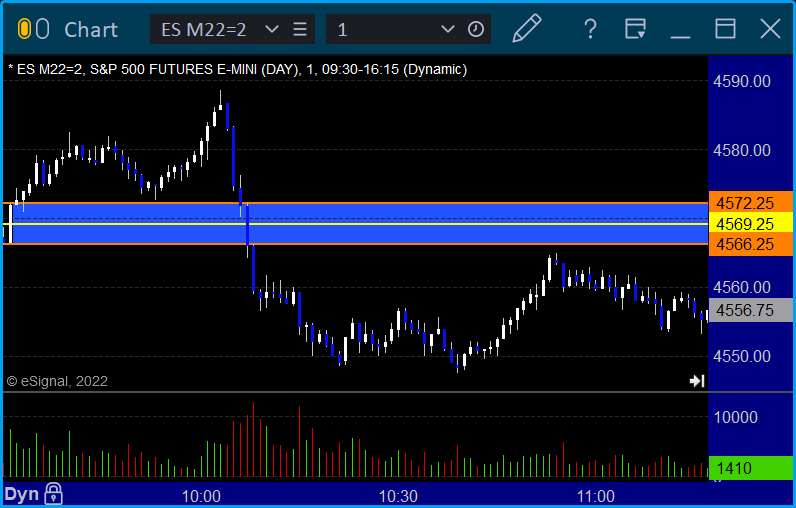

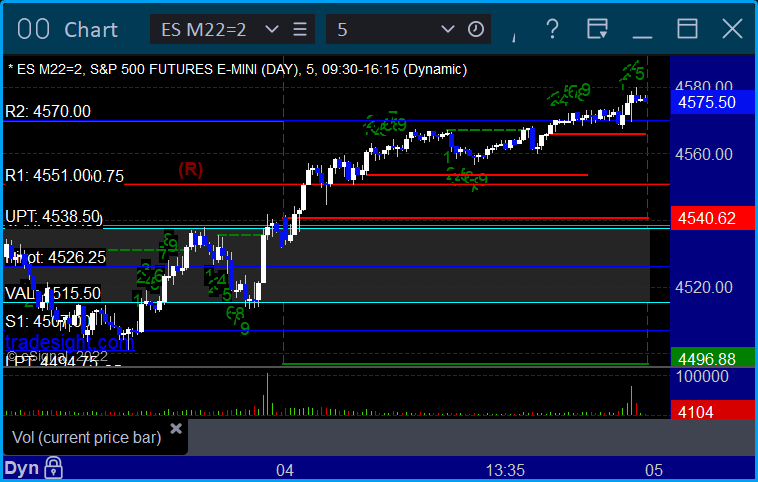

ES with Levels:

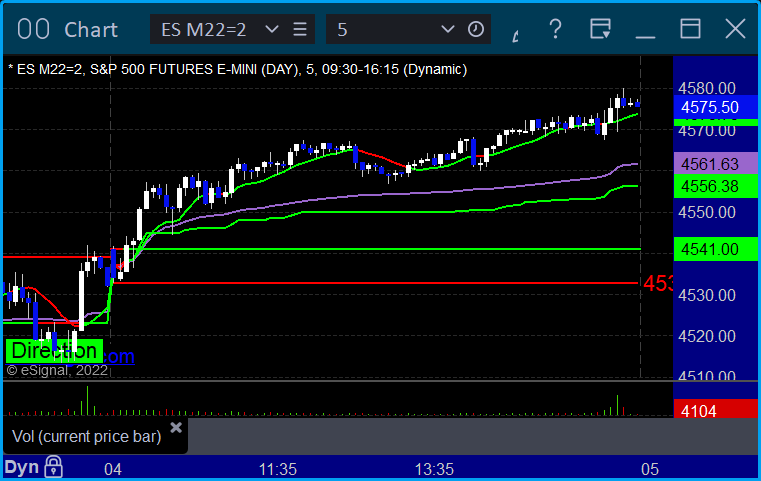

ES with Market Directional:

Futures:

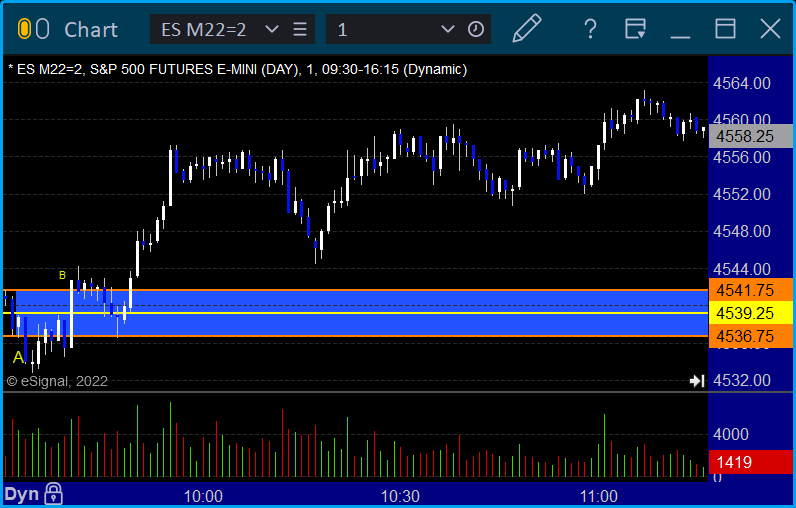

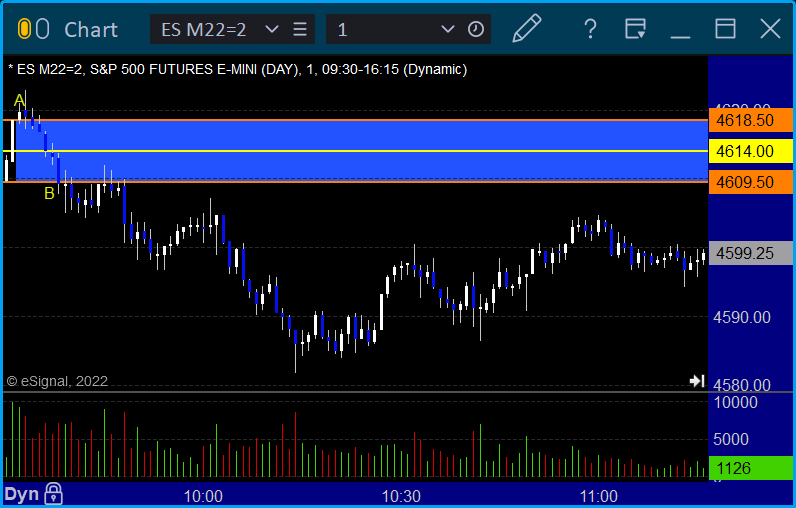

ES Opening Range Play triggered long at A and worked, triggered short at B and worked:

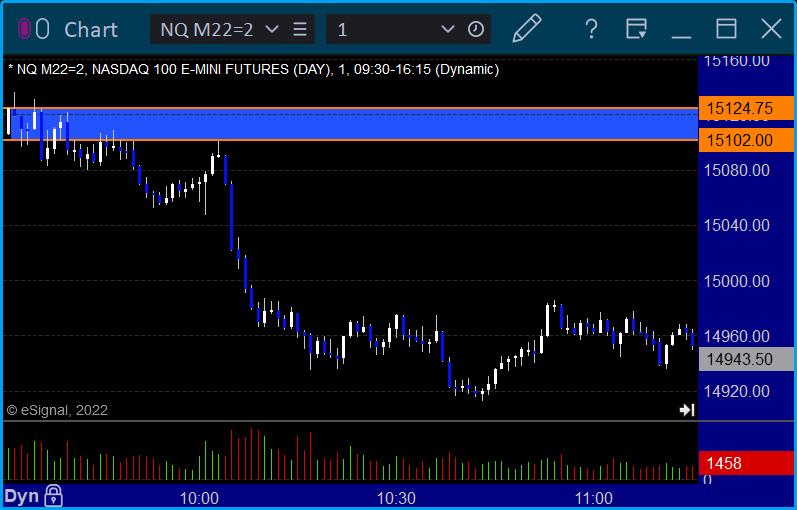

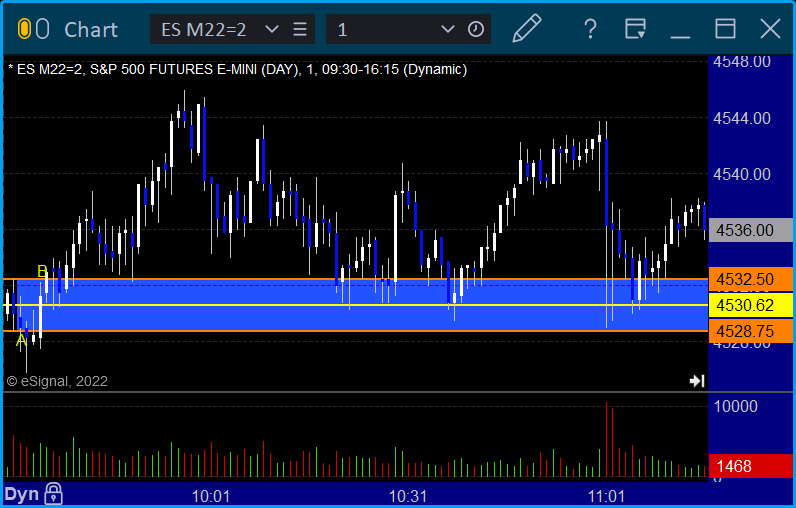

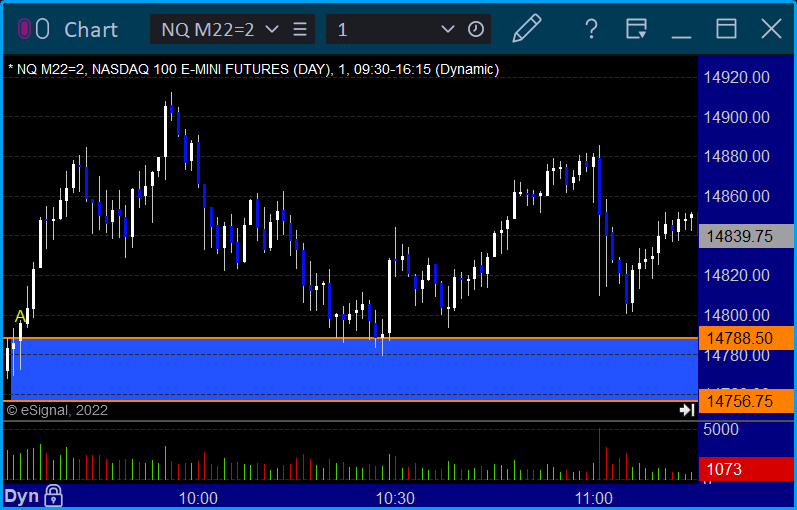

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +43 ticks

Forex:

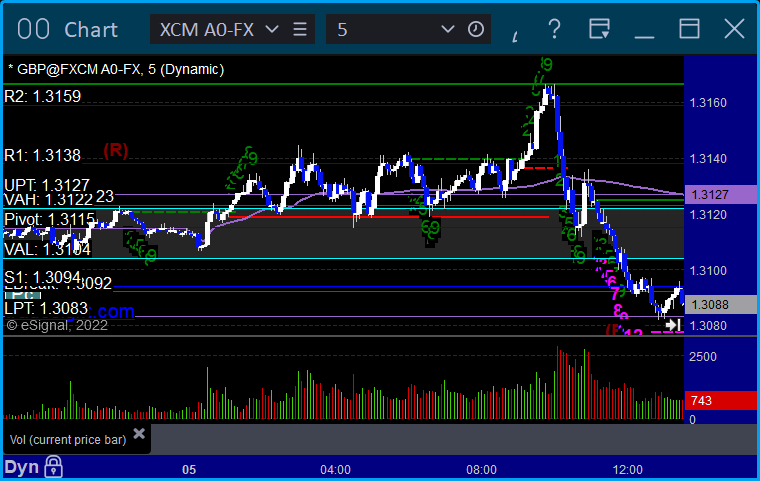

GBPUSD, no calls, Levels were too tightly spaced, no triggers:

Results: +0 pips

Stocks:

A green day at least.

From the Tradesight Plus Report, no calls.

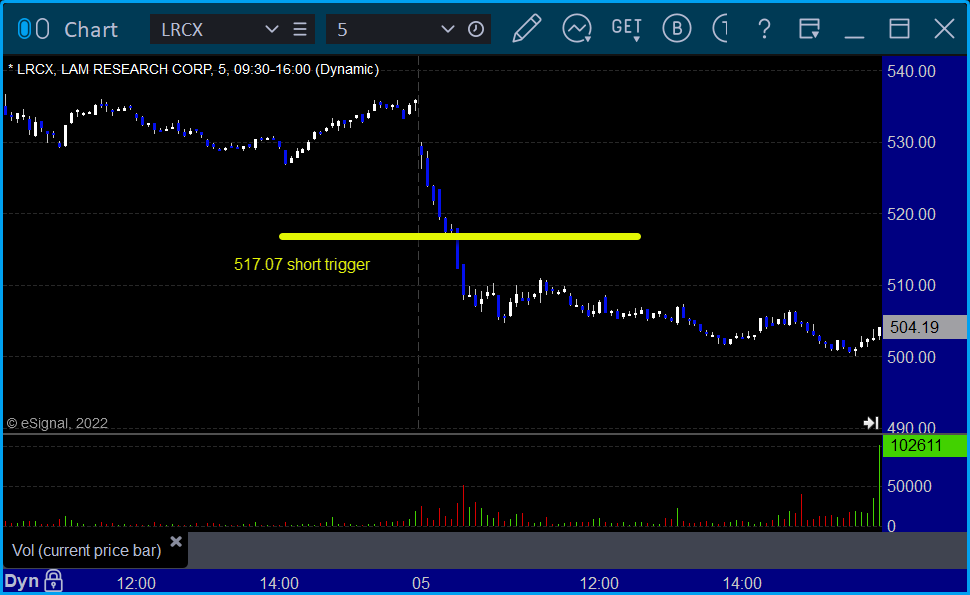

From the Tradesight Plus Twitter feed, Rich's LRCX triggered short (without market support) and worked great:

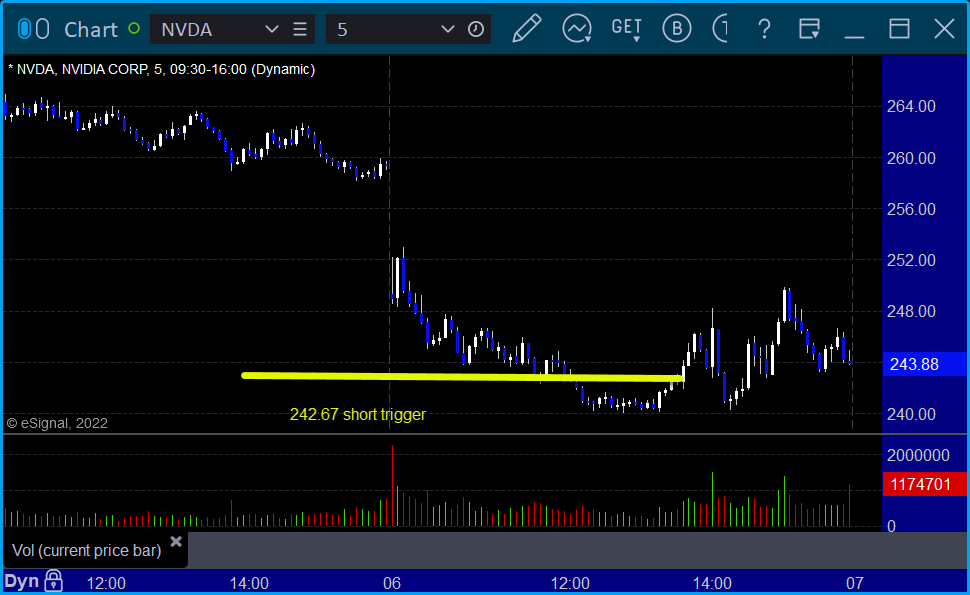

NVDA triggered short (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 4/4/22

Overview

The markets opened flat to higher and drifted up all day on a weak 4.6 billion NASDAQ shares.

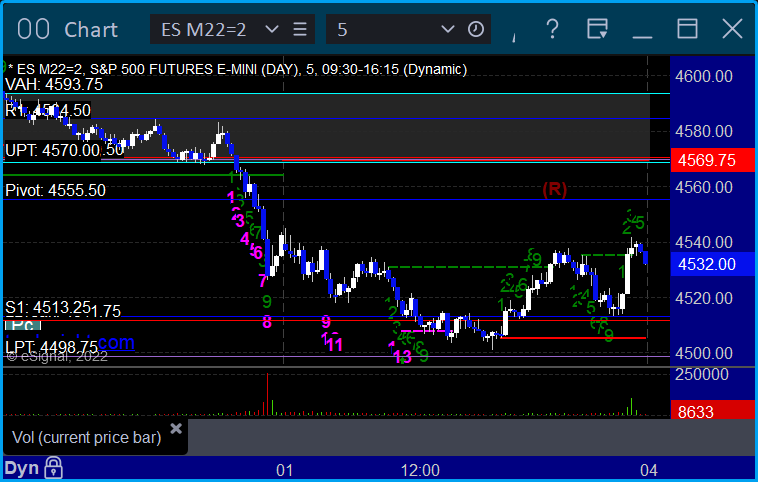

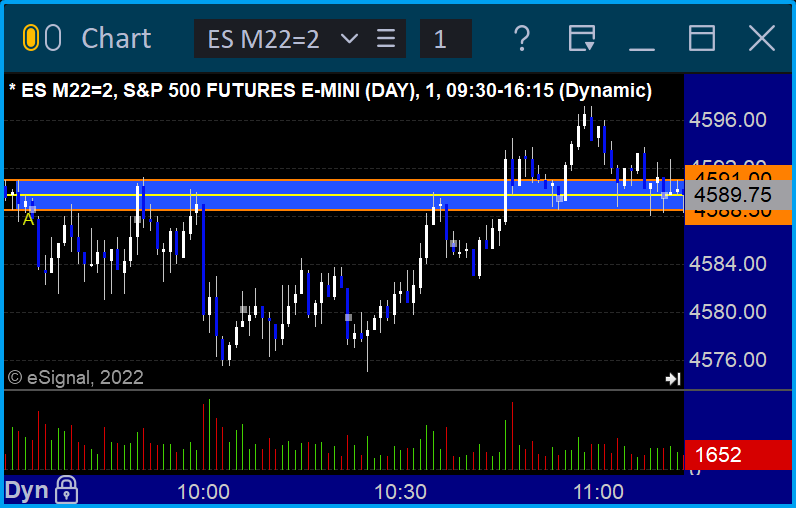

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play both triggered stopped on the midpoint:

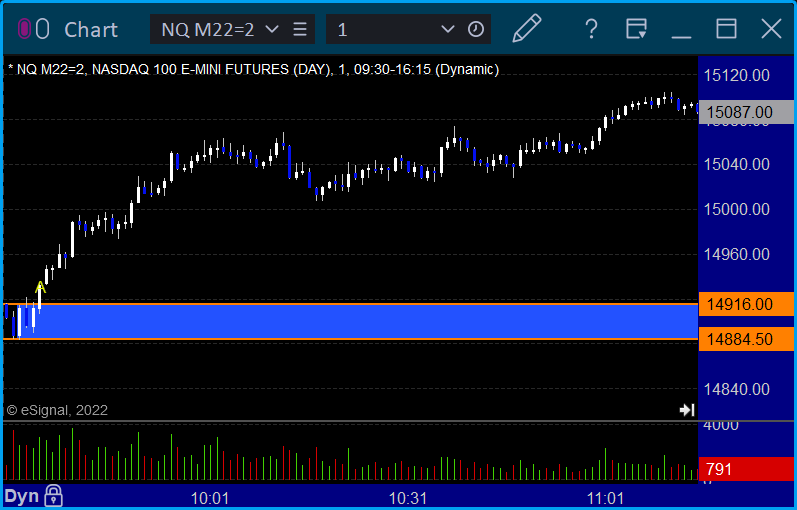

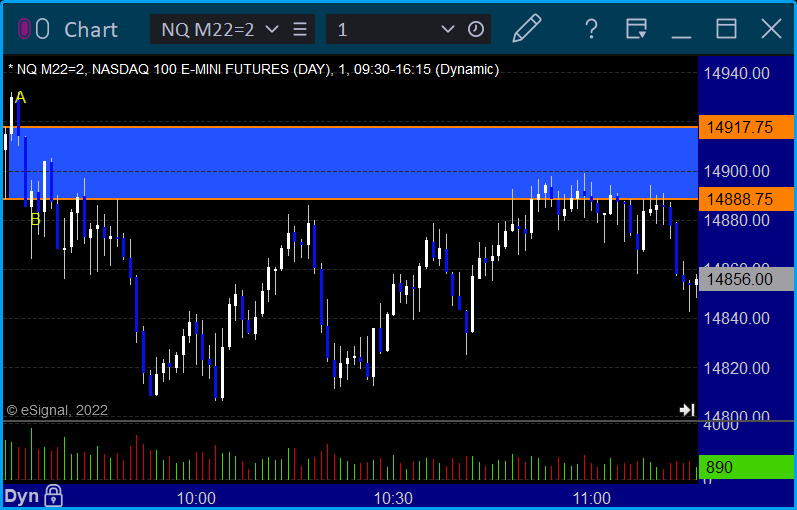

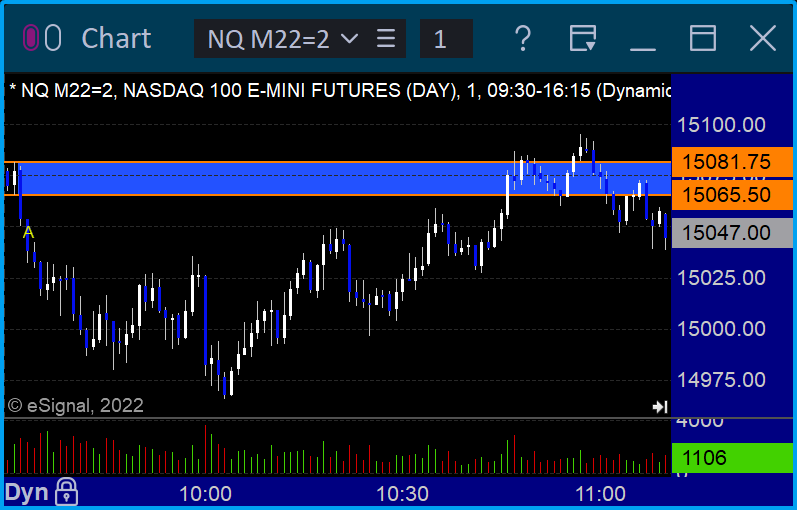

NQ Opening Range Play:

Results: -28 ticks

Forex:

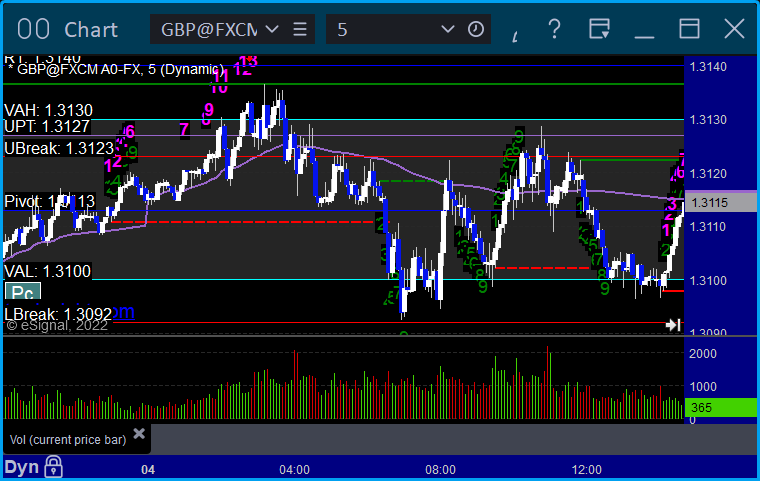

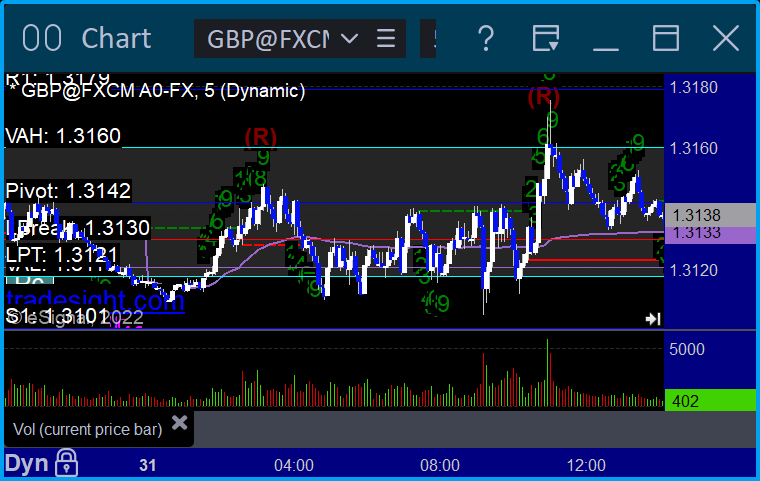

GBPUSD, nothing triggered:

Results: +0 pips

Stocks:

A nothing burger of a day.

From the Tradesight Plus Report, no calls.

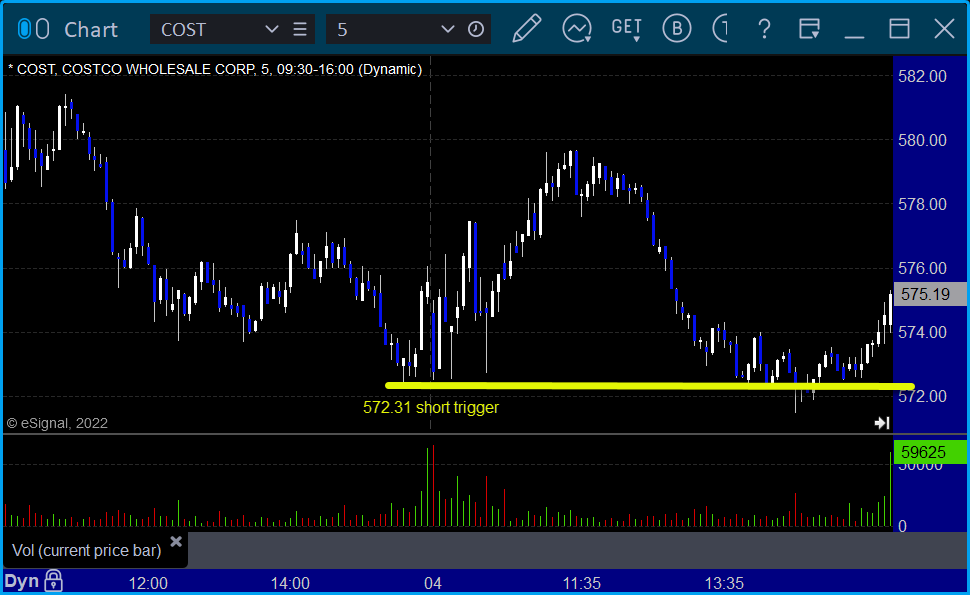

From the Tradesight Plus Twitter feed, COST triggered short (without market support) and didn't work:

That’s 0 triggers with market support.

Tradesight Recap Report for 4/1/22

Overview

The markets opened flat and closed even on 5 billion NASDAQ shares to start the quarter.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and stopped, triggered short at B and worked enough for a partial:

NQ Opening Range Play both triggers at A and B were too far out of range to take:

Results: -7 ticks

Forex:

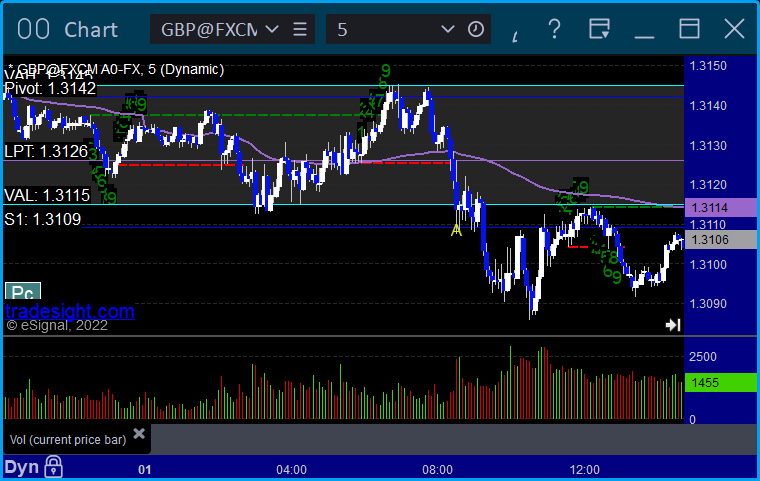

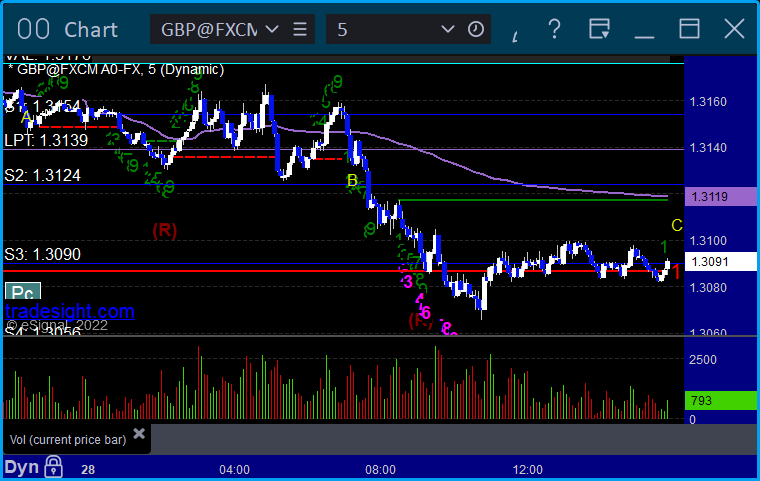

GBPUSD triggered short at A and closed slightly in the money for end of week:

Results: +10 pips

Stocks:

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's AMZN triggered short (with market support) and didn't work:

That’s 1 trigger with market support, and it didn't work.

Tradesight Recap Report for 3/31/22

Overview

The markets gapped down, almost filled, went flat for most of the day, and then sold off late on 5 billion NASDAQ shares.

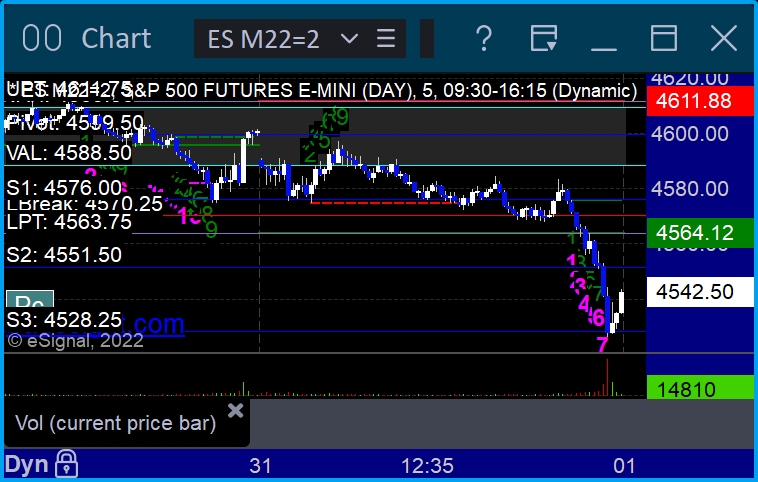

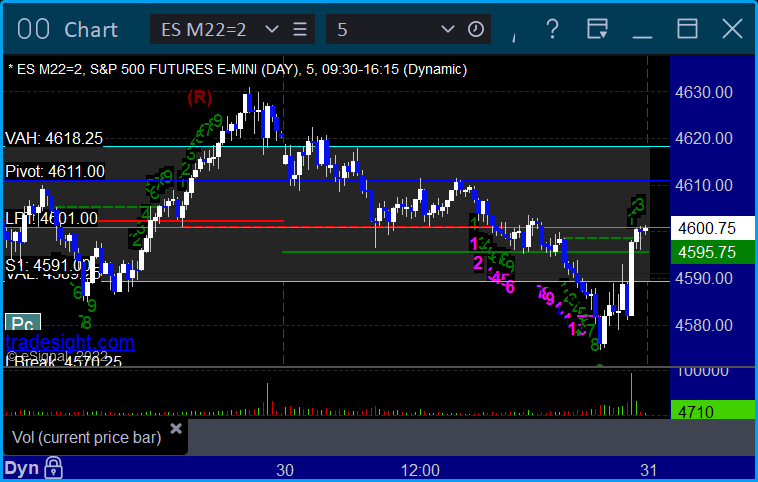

ES with Levels:

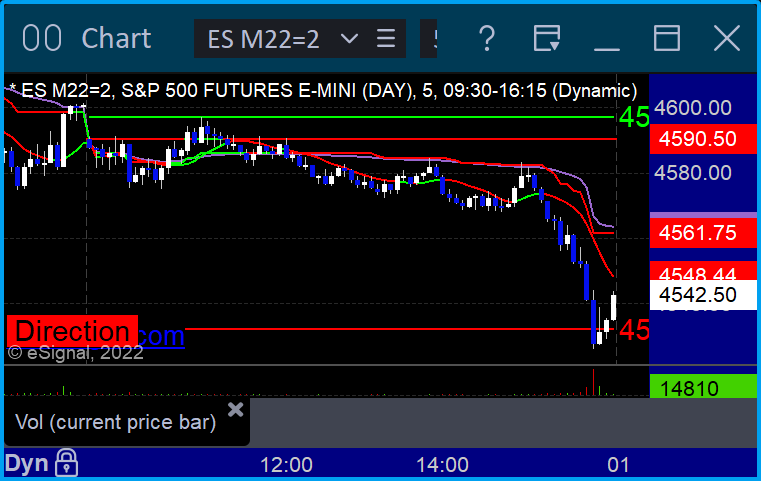

ES with Market Directional:

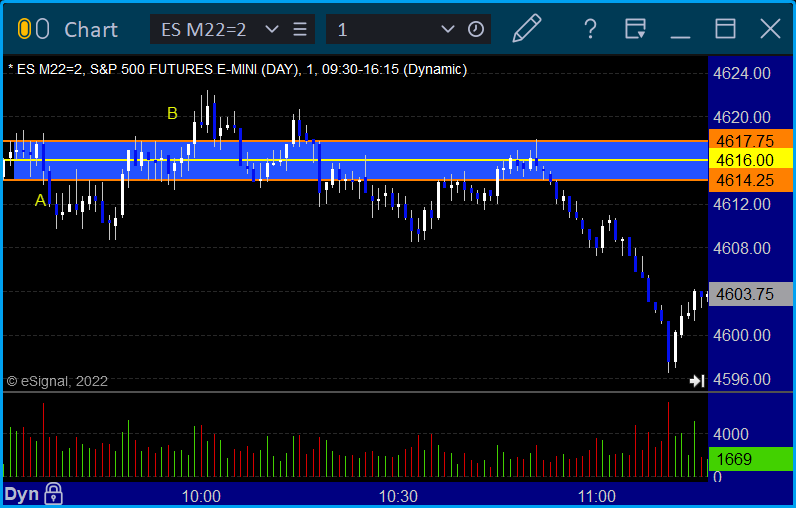

Futures:

ES Opening Range Play triggered short at A and worked:

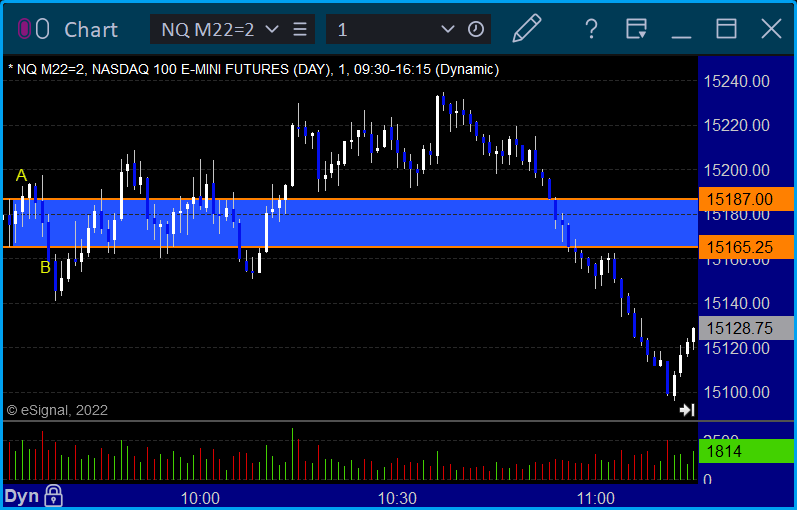

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +6.5 ticks

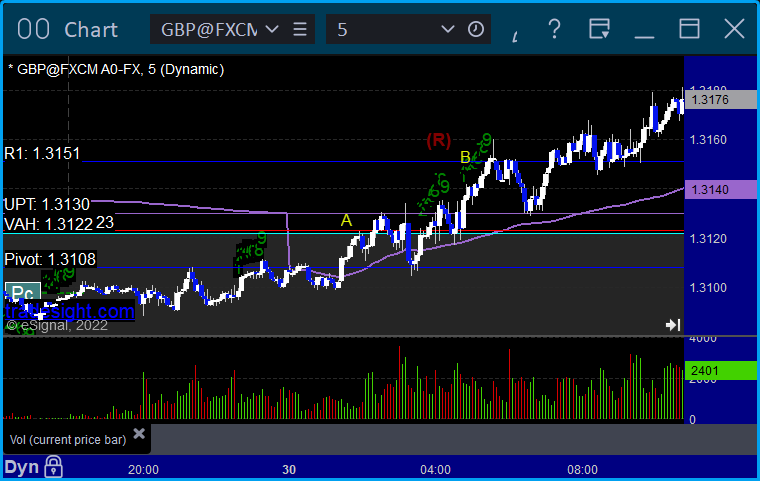

Forex, came into the day long in the money:

GBPUSD, no new triggers:

Results: +25 pips

Stocks:

Not much of a day.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, Rich's NVDA triggered short (without market support due to opening 5 minutes) and didn't work:

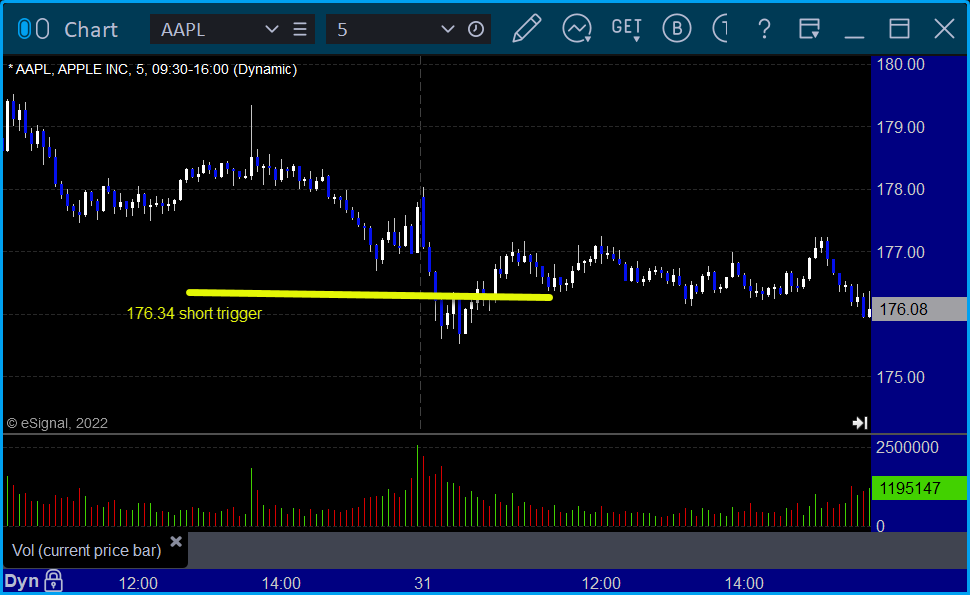

His AAPL triggered short (with market support) and didn't work:

That’s 1 trigger with market support, and it didn't work.

Tradesight Recap Report for 3/30/22

Overview

The markets gapped down, ES filled, and then we basically did nothing all day and closed on the VWAP on 5.4 billion NASDAQ shares.

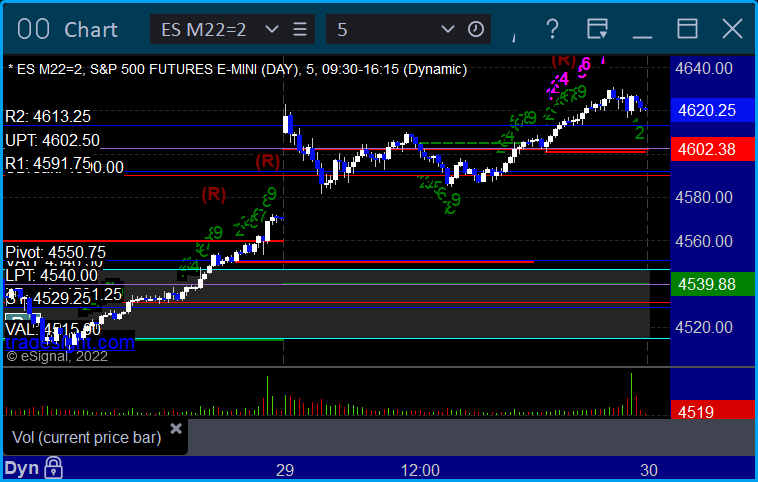

ES with Levels:

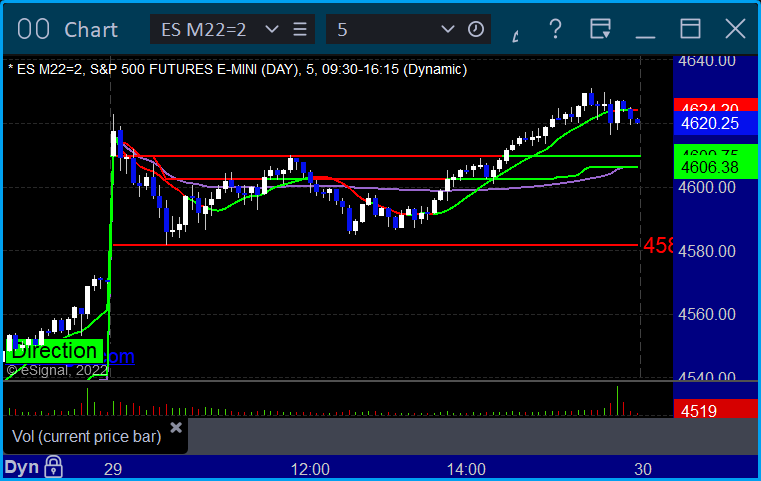

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked enough for a partial:

NQ Opening Range Play triggered long at A and short at B, both too far out of range to take:

Results: +8 ticks

Forex:

GBPUSD, triggered long at A, hit first target at B, still holding second half:

Results: None yet, trade is still going.

Stocks:

Not much here.

From the Tradesight Plus Report, COST triggered long (without market support due to opening 5 minutes) and worked:

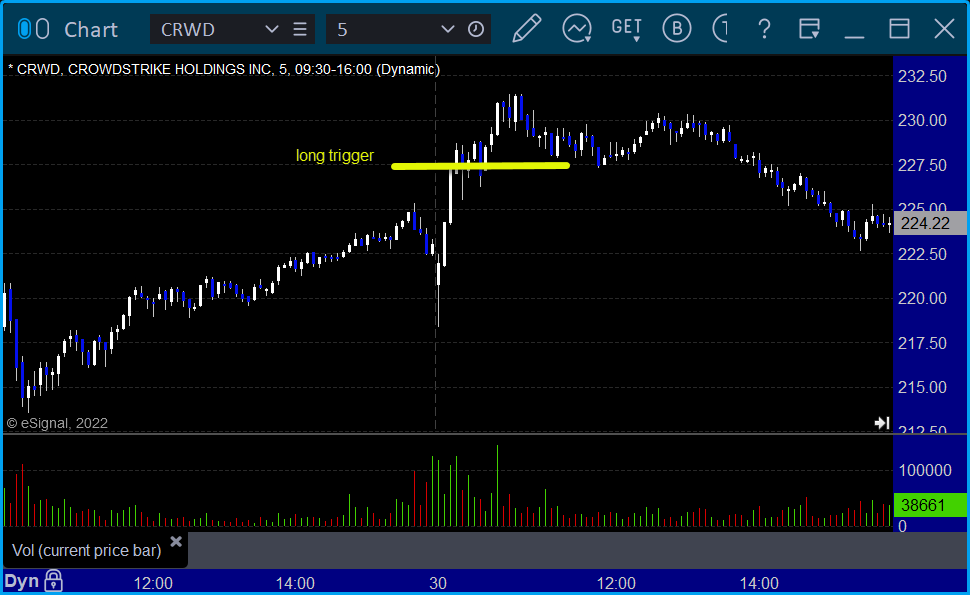

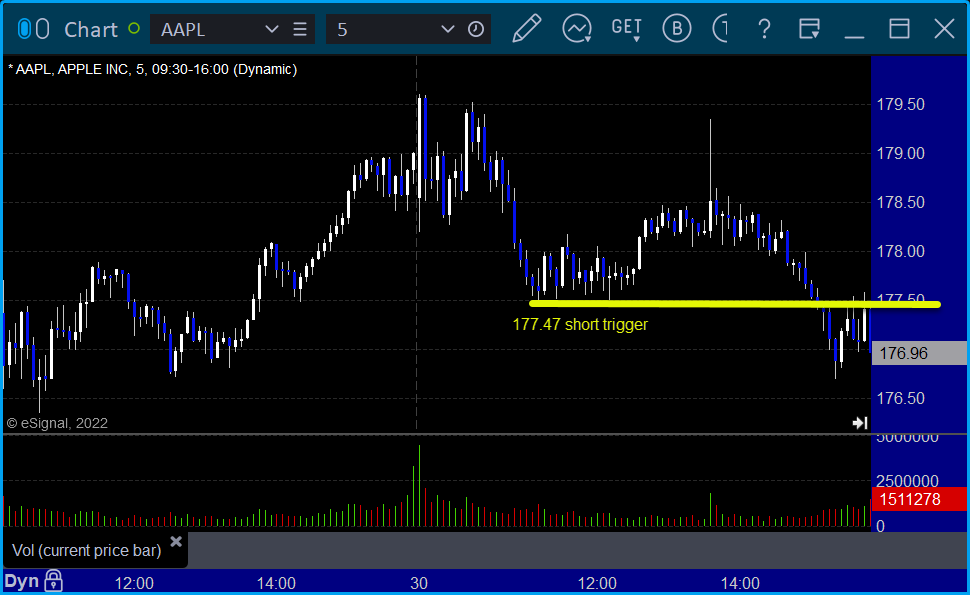

From the Tradesight Plus Twitter feed, Rich's CRWD triggered long (with market support) and worked enough for a partial:

His AAPL triggered short (with market support) and worked a little:

UBER did nothing at all.

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 3/29/22

Overview

The markets gapped up, came back a bit, went flat for hours, and tried to rally after lunch but closed near the open on 6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked enough for a partial, triggered short at B and the same:

NQ Opening Range Play, nothing here that counts:

Results: +8 ticks

Forex:

We closed out the prior day's trade in the money but nothing new triggered.

GBPUSD:

Results: +40 pips

Stocks:

Nothing happened.

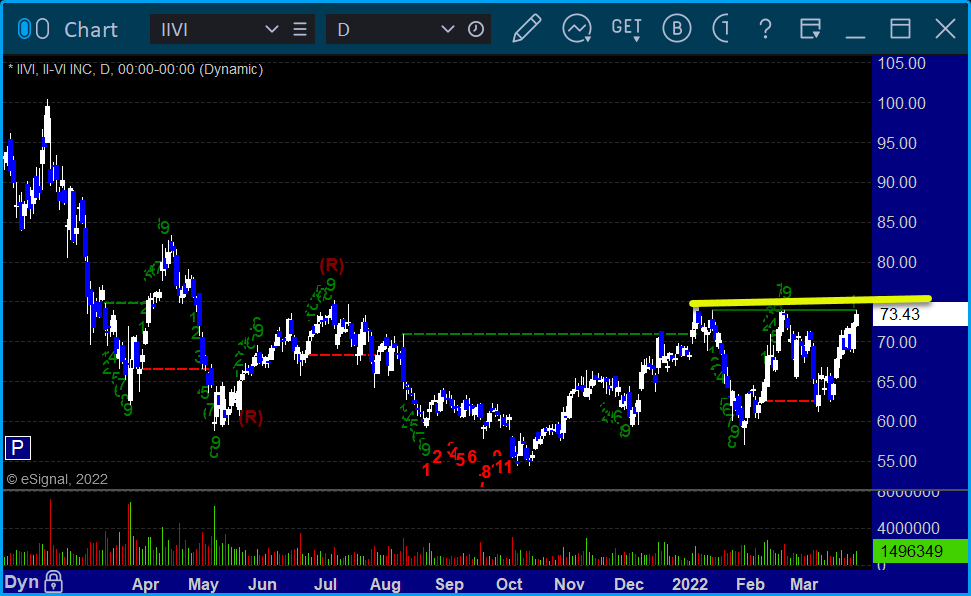

From the Tradesight Plus Report, OPCH and IIVI triggered long (without market support due to opening 5 minutes).

From the Tradesight Plus Twitter feed, Rich's TXN triggered short (with market support) and didn't work:

That’s 1 trigger with market support, and it didn't work.

Tradesight Recap Report for 3/28/22

Overview

The markets opened flat, did nothing early, dipped to lows ahead of lunch, and then rallied a bit on 5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and stopped, triggered long at B and worked:

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: -11.5 ticks

Forex:

GBPUSD:

Results: No results yet as trade is still working

Stocks:

Not much of a day.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, TWLO triggered short (without market support) and didn't work enough for a partial:

That’s 0 triggers with market support.

Tradesight Plus Report for 3-28-22

Opening comments posted to YouTube. Only a few daily chart plays found, but in case the war is becoming less of an issue, let's get back to this.

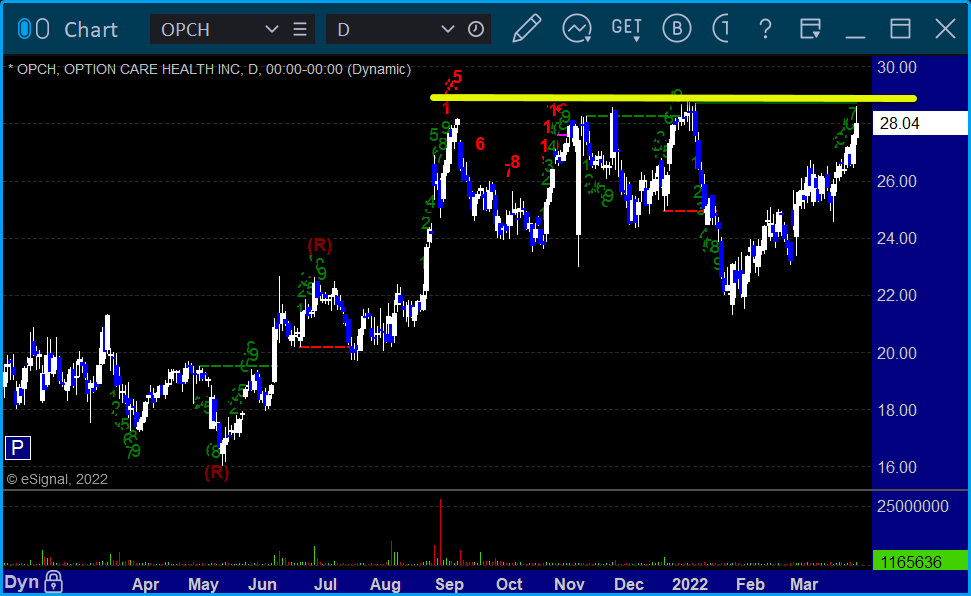

Longs first, in order of best chart construction, starting with OPCH > 28.70:

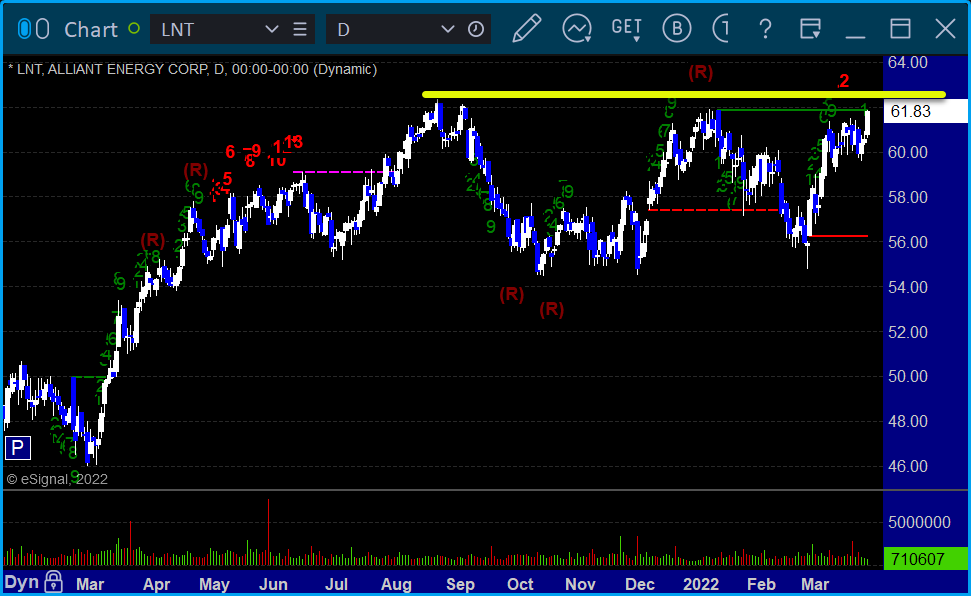

LNT > 62.35:

IIVI > 74.83:

No shorts found.

That's it.