Forex Calls Recap for 7/1/16

Boring end to the week and month and quarter, but no surprise as everyone headed out for the long weekend in the US. See GBPUSD section below.

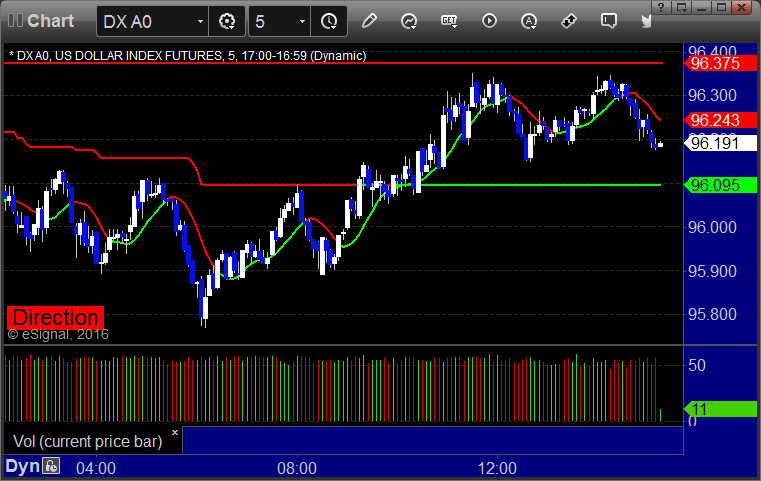

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

GBPUSD:

Triggered short at A and stopped:

Stock Picks Recap for 6/30/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, Rich's TSLA triggered short (with market support) and worked:

BABA triggered long (with market support) and worked:

Rich's CMG triggered short (with market support) and didn't work:

His ICPT triggered long (with market support) and worked:

His TSCO triggered short (without market support) and worked:

His PCLN triggered short (without market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

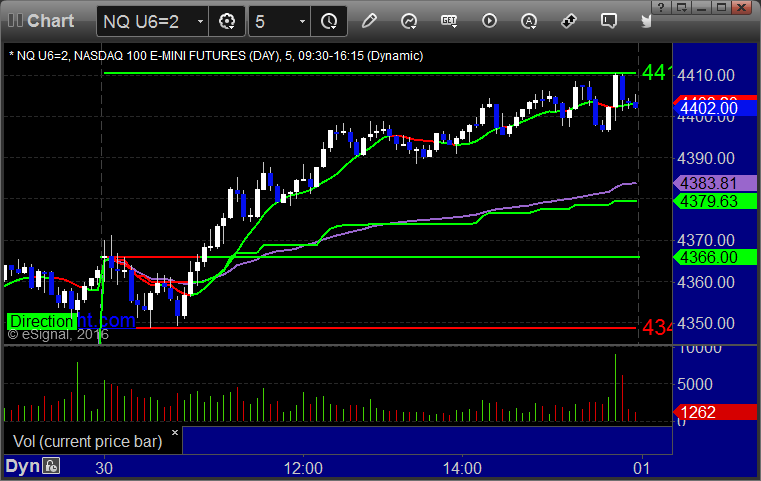

Futures Calls Recap for 6/30/16

The markets opened flat and drifted up all day on light volume until some end of day prints (for end of quarter). NASDAQ volume closed at 1.9 billion shares. We will be here Friday but not expecting much with the long weekend.

Net ticks: -2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and stopped:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

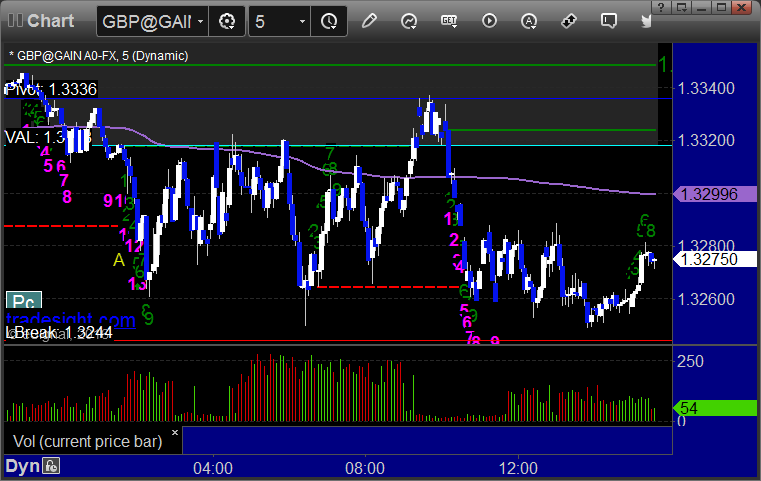

Forex Calls Recap for 6/30/16

Finally a couple of losers after a nice run. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped. Triggered long at B and stopped. Could have gone again, but we gapped down midday on news so not possible to get:

Stock Picks Recap for 6/29/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NVAX gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, TSLA triggered long (with market support) and worked huge:

GS triggered long (with market support) and worked:

PYPL triggered long (with market support) and didn't do enough either way really, but we will count it as a loser since it dipped under the VWAP:

Rich's ALXN triggered short (without market support) and worked:

His MNK triggered long (with market support) and worked enough for a partial:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 6/29/16

Another gap and go session as the ES came back to the magic 2062.50 level yet again (for the close essentially!). Volume started out strong but drifted off as we are now in "end of month/quarter/half year mode" as we have been expecting all week. We got to 1.9 billion NASDAQ shares.

Net ticks: -15 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn't work, triggered long at B and worked:

NQ Opening Range Play triggered long at A and worked enough for a partial only unfortunately:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

TF:

My call triggered long at A at 1120.20 and stopped for 8 ticks. At first, I put it back in, but when the futures faded, I canceled. It then triggered and worked:

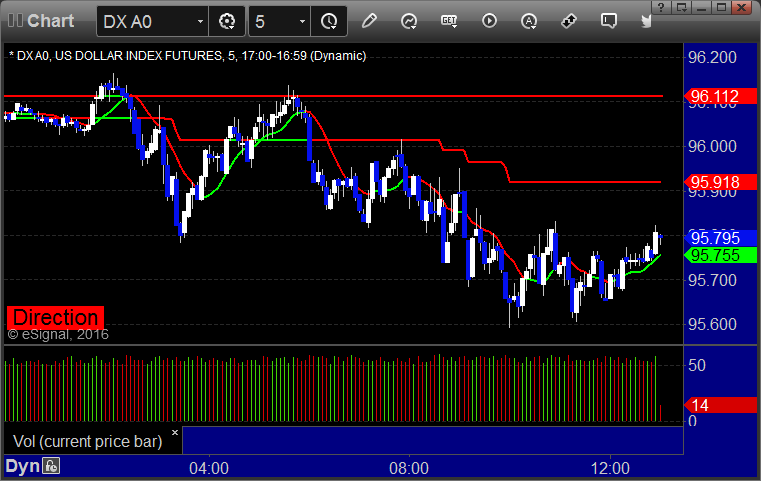

Forex Calls Recap for 6/29/16

A loser and a bigger winner for the session. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

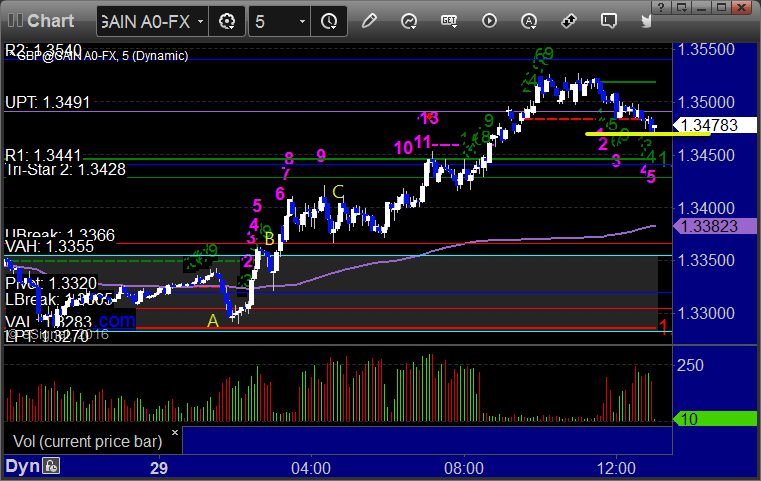

GBPUSD:

Triggered short at A and stopped. Triggered long at B, hit first target at C, and still holding second half over 100 pips in the money with a stop under the yellow line:

Stock Picks Recap for 6/28/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Mark's TWTR triggered long (with market support) and worked enough for a partial:

Mark's SPLK triggered long (with market support) and worked enough for a partial:

TEVA triggered long (without market support) and worked enough for a partial:

BIIB triggered long (with market support) and worked:

Rich's AMZN triggered long (with market support) and worked enough for a partial:

In total, that's 4 trades triggering with market support, all4 of them worked a little.

Futures Calls Recap for 6/28/16

A nice day for the Opening Range plays again even though the markets gapped up and kept going, which is never ideal. We went until the last hour without touching a single level because the ranges have spaced them out so much, so no regular calls, but we didn't need it.

Net ticks: +36.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked great:

NQ Opening Range Play triggered long at A and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 6/28/16

We made money but it could have easily been better. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, and unfortunately just barely stopped out in the money at C before running another 100 pips: