Stock Picks Recap for 6/26/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, DVAX triggered short (with market support) and worked:

FOSL triggered short (with market support) and worked:

The other four calls gapped under their short triggers, so no plays.

From the Messenger/Tradesight_st Twitter Feed, Rich's PCLN triggered short (with market support) and worked great:

His GS triggered short (with market support) and worked:

BABA triggered short (with market support) and worked:

NFLX triggered short (with market support) and didn't work, worked later:

VRSN triggered short (with market support) and worked:

PYPL triggered short (with market support) and worked:

In total, that's 8 trades triggering with market support, 7 of them worked, 1 did not.

Futures Calls Recap for 6/26/16

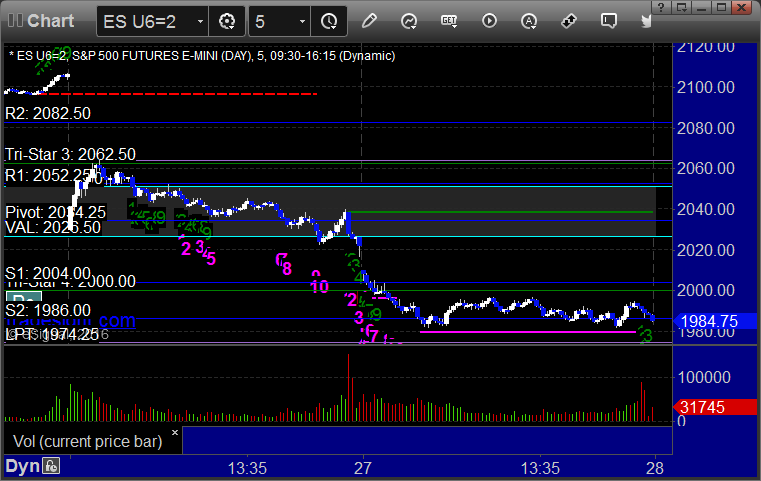

The markets gapped down again and the opening ranges were a little wider due to early volatility, so we used the midpoint for the stops. This caused the ES to barely stop but the NQ worked, basically washing the two trades. The markets proceeded lower and stayed negative all day on 2.4 billion NASDAQ shares.

Net ticks: -2 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and barely stopped by a tick or two over the midpoint:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 6/27/16

Spreads remain wide as banks have backed off the liquidity, so we will go half size for a bit to protect from that. However, the gains are definitely going to be there to be had, and we had another nice winner for the session. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, stopped second half in the money at C in the morning:

Stock Picks Recap for 6/26/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NUAN and GILD gapped under their triggers, no plays.

From the Messenger/Tradesight_st Twitter Feed, Rich's PCLN triggered short (without market support) and didn't work (worked later after market topped):

His TLT triggered short (ETF, so no market support needed) and worked:

TSLA triggered long (with market support) and worked enough for a partial:

CYBR triggered long (with market support) and worked:

His AAPL triggered long (with market support) and didn't work:

His AGN triggered short (without market support) and didn't work:

His AMZN triggered short (with market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 6/26/16

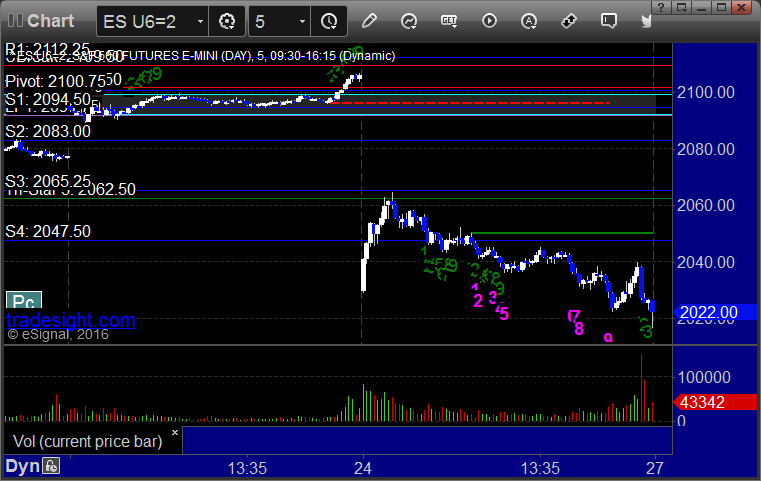

Big day for futures. The markets gapped down and shot back up quite a bit (to the ES 2062.50 level, surprise). We had stellar Opening Range plays, and then things came back to the mean over lunch and tried to dip lower in the afternoon but failed on 3.5 billion NASDAQ shares.

Net ticks: +83.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked huge:

NQ Opening Range Play triggered long at A and worked huge:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 6/24/16

Never thought I'd have to say "I missed an extra 400 pips on the second half of my winner, oh well, I'll just take 1200 pips." Friday saw the single biggest winner in Tradesight history as the GBPUSD broke under the UBreak, which was our short call, and ran about 1600 pips to the low. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

GBPUSD:

Triggered short at A, hit first target at B (looks like a blip now), and then we stopped out of the second half at C about 1200 pips in the money (spreads were wide at that point, so wherever you got out, you got out):

Stock Picks Recap for 6/23/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's AMBA triggered short (with market support) and worked:

His GOOGL triggered short (with market support) and didn't work:

His AGN triggered long (with market support) and worked:

Mark's QCOM triggered long (without market support) and worked:

Rich's SCTY triggered long (with market support) and worked enough for a partial:

His RHT triggered long (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

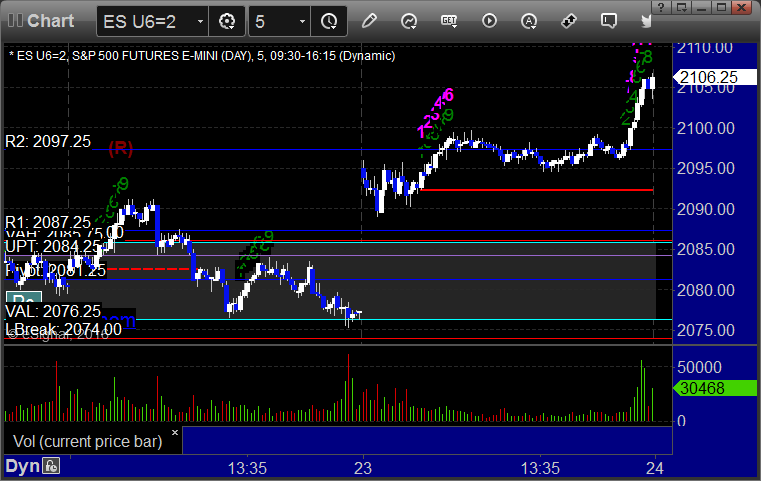

Futures Calls Recap for 6/23/16

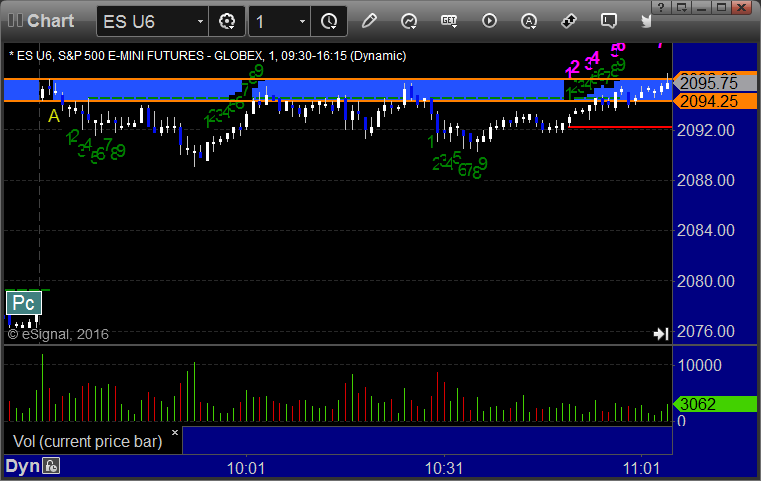

The markets gapped up and gave us nice Opening Range play winners, but the action was generally narrow again as we await the final result of Brexit. We drifted higher early in the lunch hour and that was it for the session on 1.5 billion NASDAQ shares.

Net ticks: +17 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 6/23/16

Two losers as we wait for the final results of Brexit. See EURUSD and GBPUSD sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

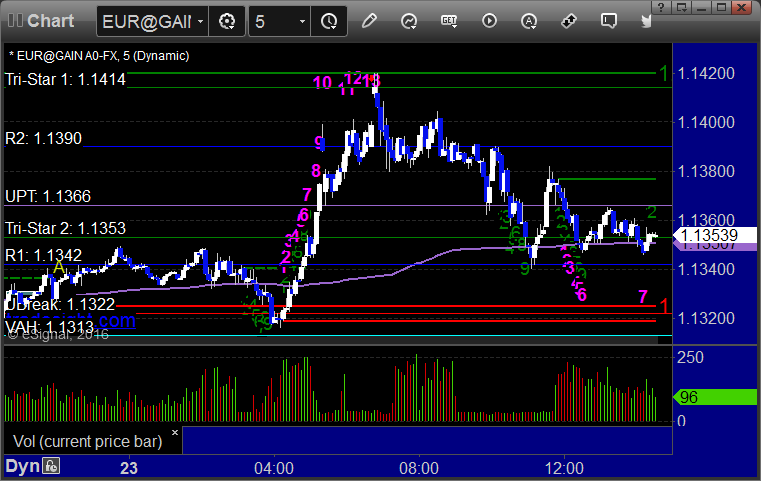

EURUSD:

Triggered long at A and stopped, worked later:

GBPUSD:

Triggered short at A and stopped:

Stock Picks Recap for 6/22/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Mark's LRCX triggered long (with market support) and worked:

In total, that's 1 trade triggering with market support, and it worked.