Futures Calls Recap for 6/22/16

Waiting for the Brexit vote continues. The market gapped up a little and did nothing for the first hour again, then pushed up a little, came back down, and we were sitting flat with an hour left and then slipped a little after lunch on 1.5 billion NASDAQ shares.

Net ticks: -8.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

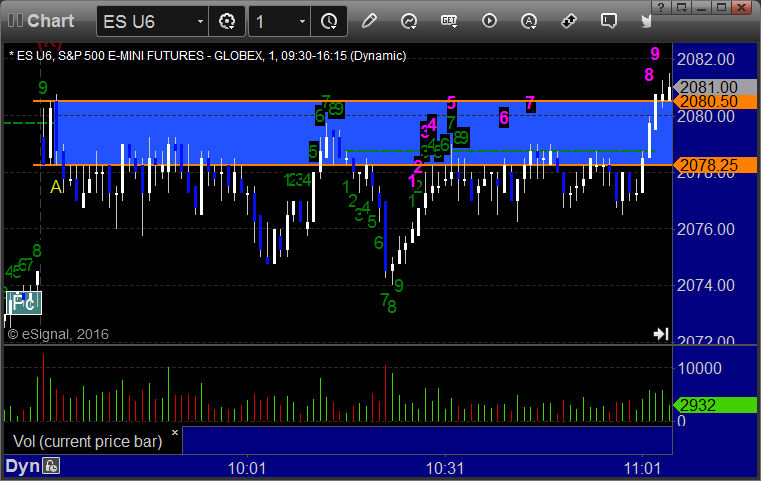

ES Opening Range Play triggered long at A and I closed it for a 4 tick loss after 30 minutes of nothing:

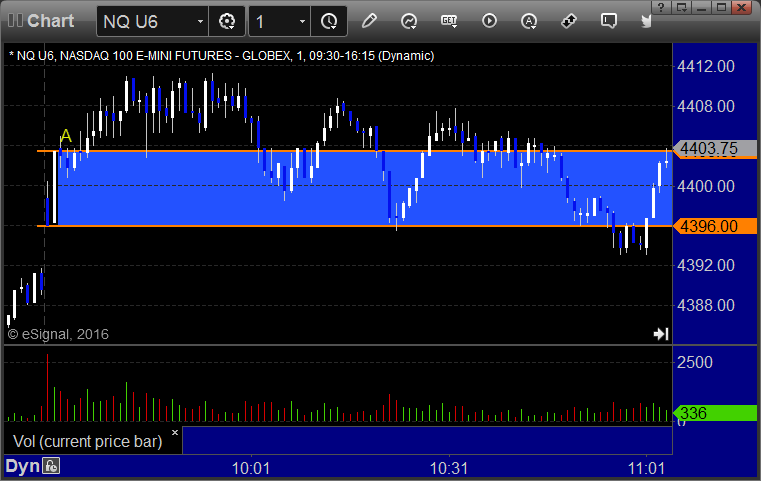

NQ Opening Range Play triggered long at A and didn't work, triggered short at B and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 6/22/16

A winner again for the session. See EURUSD section below. Here comes the Brexit vote!

Here's a look at the US Dollar Index intraday with our market directional lines:

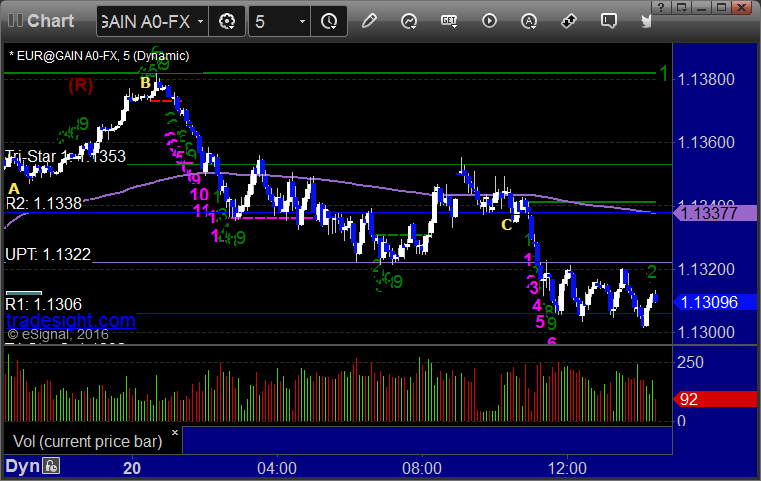

EURUSD:

Triggered long at A, hit first target at B, stopped second half in the money at C:

Stock Picks Recap for 6/21/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MTSI triggered short (without market support) and didn't work:

INFN triggered short (without market support due to opening 5 minutes) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's GS triggered long (with market support) and didn't work, although it was meant as a morning call and triggered in the last hour:

His CELG triggered short (with market support) and worked:

His ADBE triggered short (without market support) and didn't work, worked later:

His BIIB triggered short (with market support) and worked:

Mark's FAS triggered long (ETF, so no market support needed) and didn't work:

PYPL triggered short (with market support) and worked enough for a partial:

Rich's FB triggered short (without market support) and didn't work:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Futures Calls Recap for 6/21/16

Another very disappointing session in terms of movement. The markets gapped up a little this time and were just very flat for hours. The total range of the day was actually worse than Monday and NASDAQ volume closed at 1.55 billion shares. No point in making calls in this mess. The ES Opening Range play worked, see that section below.

Net ticks: +6 ticks.

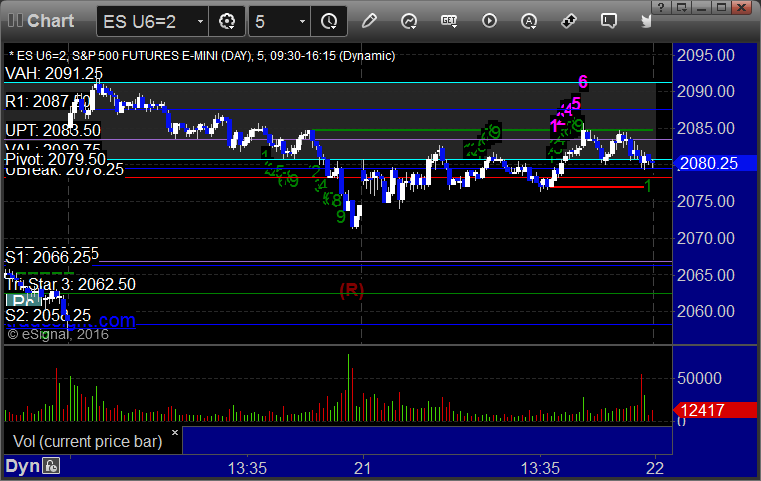

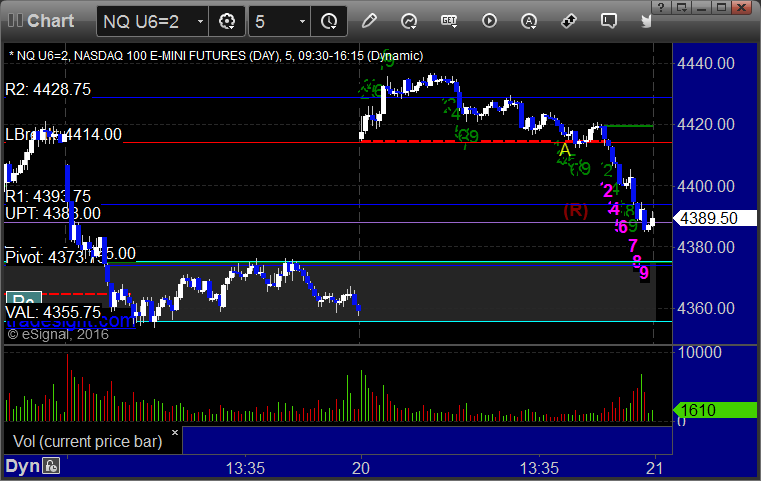

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial eventually:

NQ Opening Range Play triggered long at A but we don't take that since we are short the ES at the time and this is not into the gap (but it worked anyway):

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 6/21/16

Another winner for the week. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, stopped second half under entry at C:

Stock Picks Recap for 6/20/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered long (with market support) and worked:

NTAP triggered long (with market support) and I closed it flat (posted to Twitter feed):

TSLA triggered long (with market support) and worked great:

In total, that's 3 trades triggering with market support, all 3 of them worked.

Futures Calls Recap for 6/20/16

The markets gapped up as voting began on Brexit, but everything in the morning after that was flat as could be. NASDAQ volume closed at 1.6 billion shares.

Net ticks: -1 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked enough for a partial:

NQ Opening Range Play triggered long at A and I ended up closing 1 tick in the money after the market was flat for too long:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered short at A at 4413.50 and stopped. I did not re-enter:

Forex Calls Recap for 6/20/16

The markets gapped on the Brexit vote, putting the pairs in an awkward place against the levels, but we still pulled out a winner. See the EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A over R2 after gapping (left of the start of the chart) and then hit first target at B, stopped second half under the entry in the morning at C:

Stock Picks Recap for 6/17/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Mark's ORCL triggered long (without market support) and worked enough for a partial:

BMRN triggered short (with market support) and didn't work:

In total, that's 1 trade triggering with market support, and it didn't work.

Futures Calls Recap for 6/17/16

Pretty much as expected for triple expiration. Volume was heavy (2.3 billion NASDAQ shares) but action was poor. The markets gapped down and were flat early, then dipped, then came back.

Net ticks: +10 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial:

NQ Opening Range Play triggered short at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: