Stock Picks Recap for 6/10/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, Rich's SINA triggered short (with market support) and worked:

His AAPL triggered long (with market support) and didn't work:

His BIIB triggered long (without market support) and didn't work:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Futures Calls Recap for 6/10/16

A super-boring session as expected that gapped down and was flat all day on 1.6 billion NASDAQ shares. See the Opening Range plays.

Net ticks: +1 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and I closed it at the ORL per my post for a 3 tick loss:

NQ Opening Range Play triggered short at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 6/10/16

A slow day that finally hit the first target and we closed for end of week. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Triggered short at A, never stopped, hit first target finally at B and closed for end of week:

Stock Picks Recap for 6/9/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Mark's QCOM triggered long (with market support) and worked:

Rich's SCTY triggered short (without market support) and worked:

His AAL triggered long (with market support) and didn't go enough in either direction to count before running out of time:

In total, that's 1 trade triggering with market support, and it worked, and so did the one that triggered without.

Futures Calls Recap for 6/9/16

Pretty much as expected for contract roll. The markets were choppy and horrible and flat early. NASDAQ volume was only 1.4 billion shares at the close. The ES stuck in a horrible range for the first hour. No calls as expected, see below for results on the Opening Range plays. Tomorrow we trade the U6 contract, so the charts below will show the U6 contract with Levels, although the volume was still in the M6 more Thursday.

Net ticks: ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and stopped, triggered long at B and stopped:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 6/9/16

Another boring night, also impacted by the quarterly contract roll in all futures. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

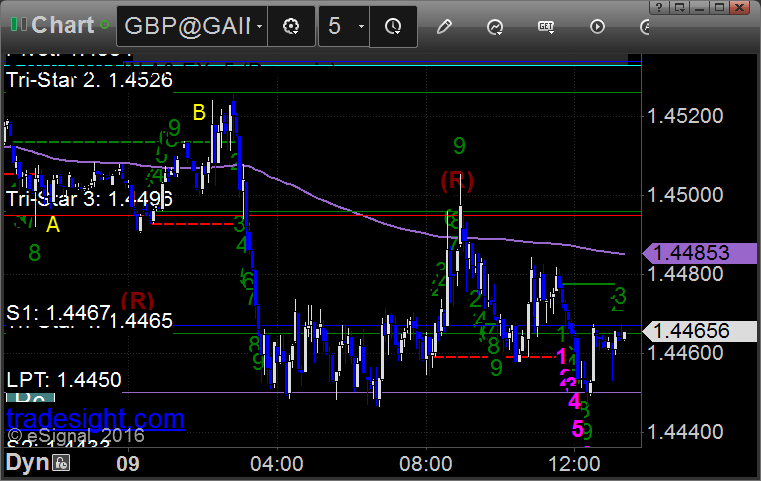

GBPUSD:

Triggered short at A and also a little later, then stopped at B before moving to work perfectly:

Stock Picks Recap for 6/8/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, WYNN triggered long (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's IBM triggered long (with market support) and didn't work:

His BABA triggered long (with market support) and didn't work:

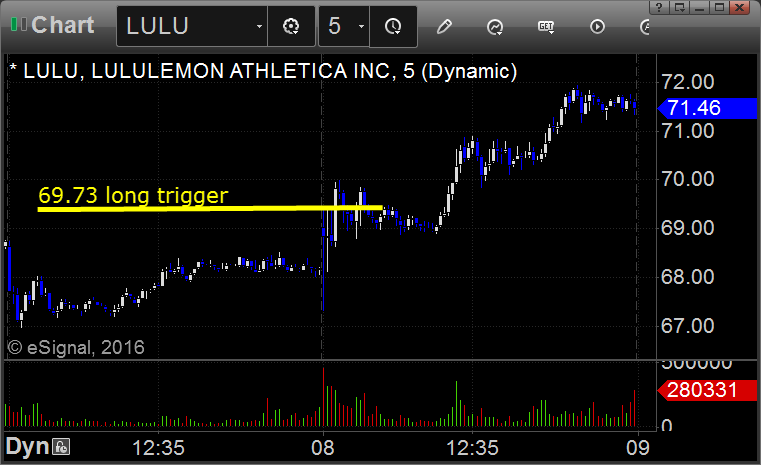

LULU triggered long (with market support) and worked enough for a partial, worked better later, this was supposed to be the real trigger on the report call:

Lots of other calls and none of them triggered.

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not, a rare day with a negative win ratio.

Futures Calls Recap for 6/8/16

A mixed bag with 2 winners and a loser on the Opening Range plays and then a stop out on another ES call for the gap fill. The markets gapped up and pushed higher initially, then came back and filled, and then came back up a bit for the second part of the session but without any excitement on 1.55 billion NASDAQ shares.

NOTE: I am on the road the rest of the week. However, the quarterly futures contract roll occurs Thursday going into Friday, which means that on Thursday we trade the M6 contracts still (and volume drops out of it) and on Friday you would trade the U6 contract (September) as the volume moves to that expiration. The Opening Range plays can still work in theory, but the Levels for Friday will be based on the U6 contract from Thursday, which doesn't have much volume, so many traders stay out of the market Friday.

Net ticks: -1 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered short at A (which is valid because it is into the gap even though we were long ES) and stopped, triggered long at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered short at A at 2111.75 and stopped, I did not re-enter:

Forex Calls Recap for 6/8/16

Two stop outs on the GBPUSD and the long worked if you were awake to put it back in. See that section below.

I will be on the road the rest of the week. Should not affect calls.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped, triggered long at B and stopped. If you were awake, the long triggered again at C and hit first target at D:

Stock Picks Recap for 6/7/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, EGHT triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's VRX triggered long (with market support) and worked:

His TSLA triggered long (with market support) and worked:

COST triggered long (with market support) and worked:

Rich's ALXN triggered short (without market support) and worked:

His FB triggered long (with market support) and worked enough for a partial:

In total, that's 4 trades triggering with market support, y of them worked, z did not.