Forex Calls Recap for 6/3/16

A big gap in the markets on the data jumped right through our trigger, so no play, which is why we use half size ahead of big numbers like that. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

The call was long over the Pivot, and that would have triggered at A but the market gapped on the Trade Balance and more importantly NFP data so unless your broker gave you a miracle fill (in which case, nice winner!), no trade for the session:

Stock Picks Recap for 6/2/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, LRCX triggered long (with market support) and worked enough for a partial:

FCEL triggered long (with market support) and worked:

DISH triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, strangely, and I don't remember the last time this happened, despite several intraday calls, nothing triggered.

In total, that's 3 trades triggering with market support, all 3 of them worked.

Futures Calls Recap for 6/2/16

The markets gapped down and were flat for 20 minutes, then finally pushed lower for a bit, bottomed about 30 minutes in, and rose to fill the gaps over lunch and then flattened out on 1.6 billion NASDAQ shares. The ES Opening Range plays unfortunately stopped both ways, offsetting a nice NQ OR play and a separate nice NQ play. See those sections below.

Net ticks: +2 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn't work, triggered long at B (valid even though we were short NQ because it is into the gap) and didn't work:

NQ Opening Range Play triggered short at A and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

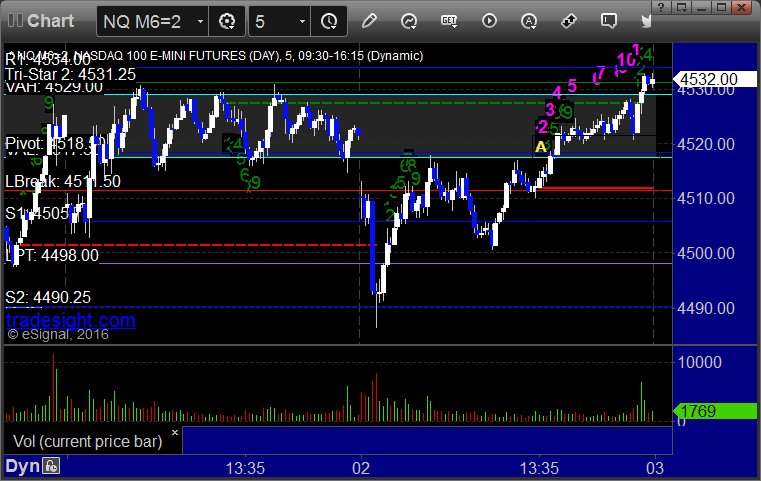

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered long at A at 4518.75, hit first target for 6 ticks, and stopped the final piece 28 ticks in the money:

Forex Calls Recap for 6/2/16

A strange night to pull out a winner in the GBPUSD, which sat in the Value Area the whole session. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

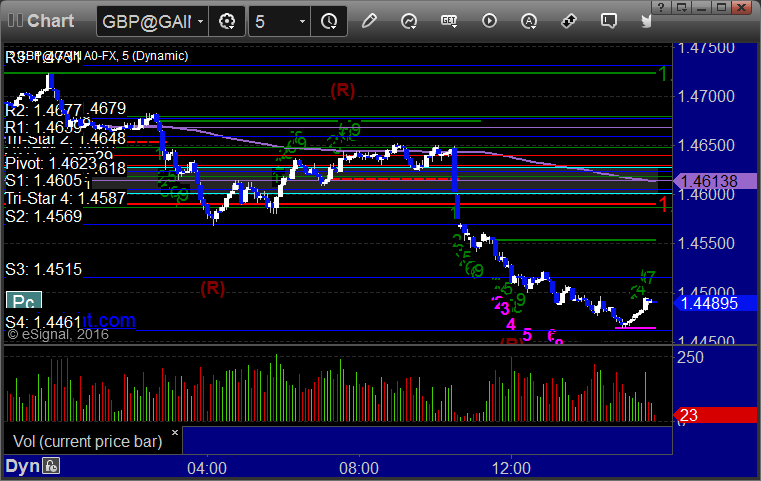

GBPUSD:

Triggered long at A, didn't stop, hit first target eventually at B, closed second half under the entry:

Stock Picks Recap for 6/1/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, LXRX triggered long (with market support) and worked enough for a partial:

IRWD triggered long (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's CBRL triggered long (with market support) and worked:

BABA triggered long (with market support) and worked enough for a partial:

Rich's VRX triggered long (with market support) and worked:

GS triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, all 5 of them worked.

Futures Calls Recap for 6/1/16

The markets gapped down and were incredibly slow again to start, then finally made a move back up into the gap and closed around flat on 1.6 billion NASDAQ shares. We had four opening range plays and 2 other calls trigger. See ES and TF sections below.

Net ticks: -26.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

First time I can recall that the ES and NQ triggered four Opening Range plays and none of them worked, but the ORs were so small that the stops were tight on each.

ES Opening Range Play triggered short at A and didn't work ultimately, triggered long at B and didn't work:

NQ Opening Range Play triggered long at A, which is still valid even though we were short the ES because this was into the gap, and didn't work, then triggered short at B, which is also valid because we were in the same direction on the ES, and didn't work:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered long at A at 2087.00, hit first target for 6 ticks, stopped second half under entry:

Forex Calls Recap for 6/1/16

A stop out in the GBPUSD (which then went on to work) and that's it. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

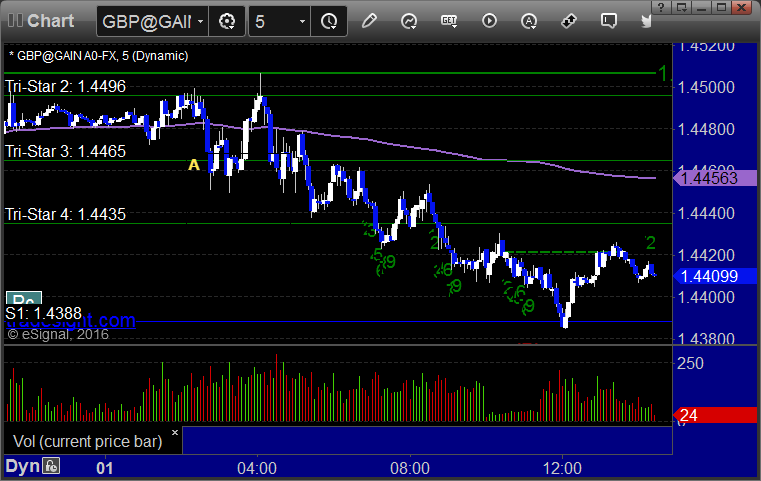

GBPUSD:

Triggered short at A and stopped. If you were awake to put it back in, the retrigger worked:

Stock Picks Recap for 5/31/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SINA triggered long (without market support due to opening 5 minutes) and worked:

OSUR triggered long (with market support) and worked a little:

From the Messenger/Tradesight_st Twitter Feed, Mark's SINA triggered long (with market support) and worked enough for a partial:

BABA triggered long (without market support) and didn't work:

VRSN triggered long (without market support) and didn't work:

Rich's FB triggered short (without market support) and worked:

His NKE triggered short (with market support) and didn't go enough in either direction to count, closed slightly in the money:

His BIDU triggered short (with market support) and didn't work, worked later:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

Futures Calls Recap for 5/31/16

A boring session as expected coming back from the long weekend and for end of month. Didn't do much. See the Opening Range plays below.

Net ticks: -1.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A but we don't take that under the rules because we were already long NQ at that point and the NQ play was into the gap:

NQ Opening Range Play triggered long at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered long at A at 4524.50 and stopped. I did not re-enter based on market volume:

Forex Calls Recap for 5/31/16

No calls for the session because the EURUSD levels were too bunched up and the GBPUSD moved up Monday afternoon all the way to R3, so nothing there, although it ended up coming back if you were looking for setups. Back to it tonight.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD: