Tradesight Recap Report for 3/25/22

Overview

The markets gapped up a little, went higher, pulled back down, sat flat all day (very confusing day) and then pushed up to close near the limited highs on 5.5 billion NASDAQ shares.

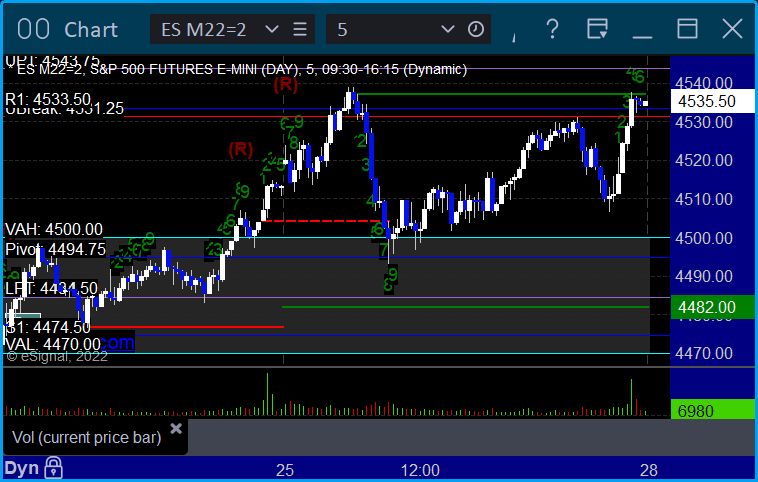

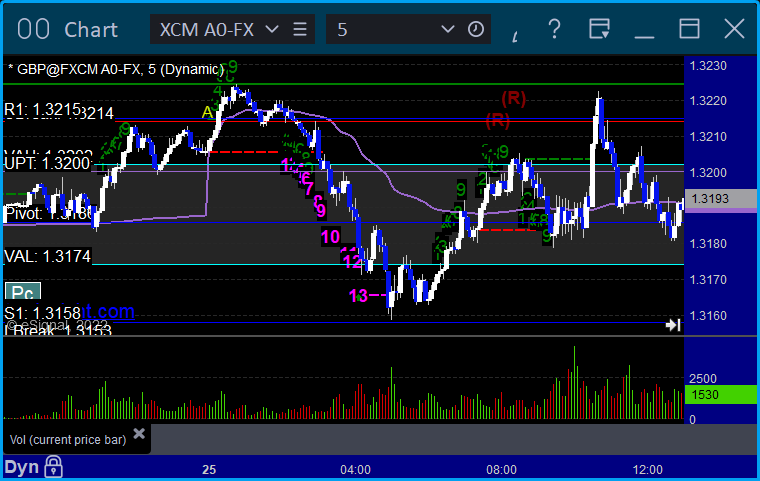

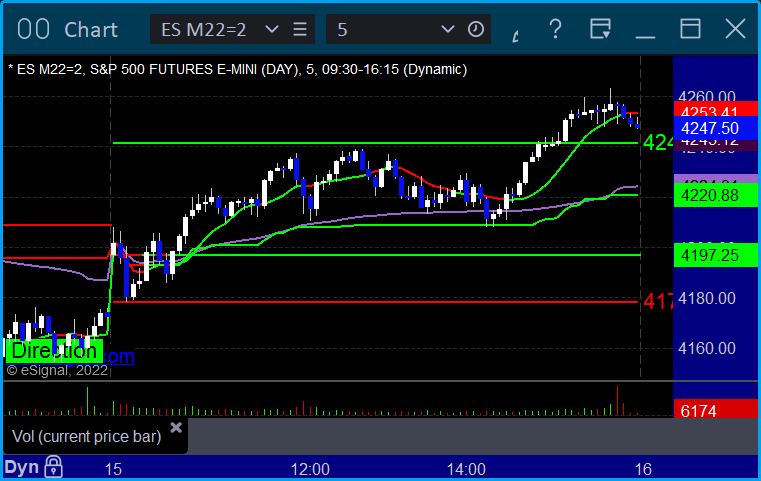

ES with Levels:

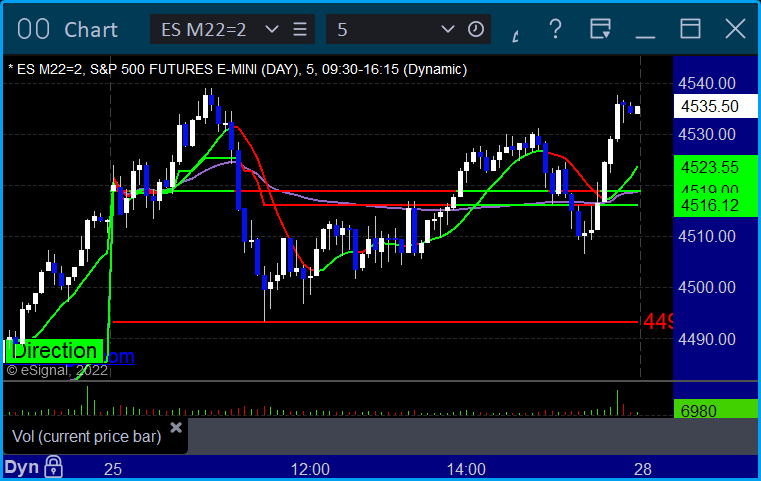

ES with Market Directional:

Futures:

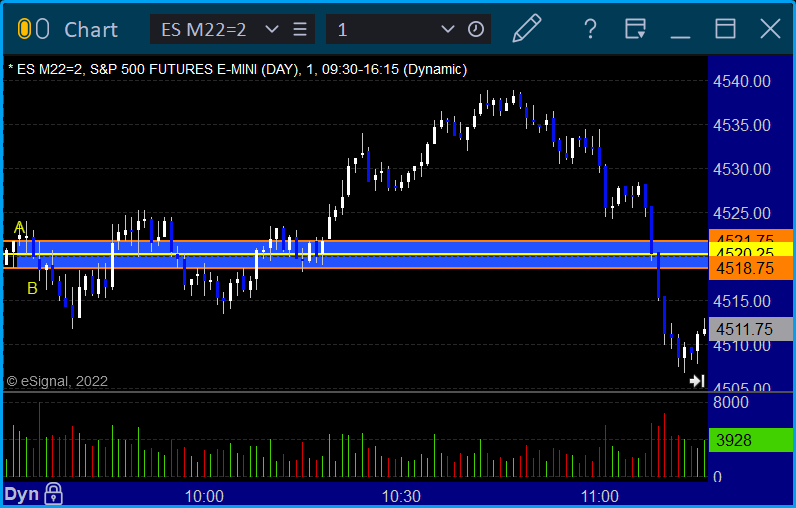

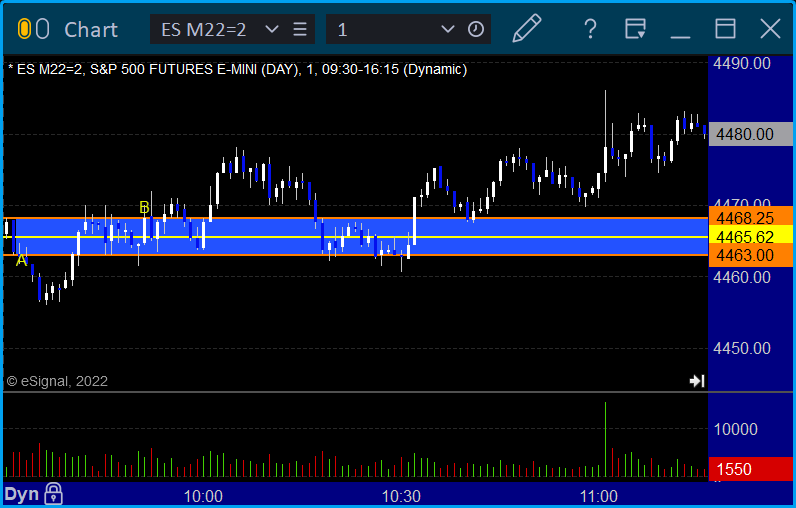

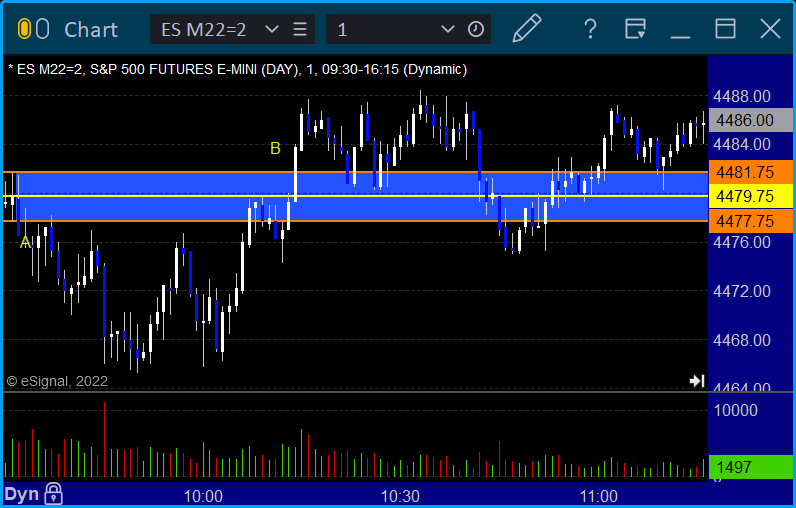

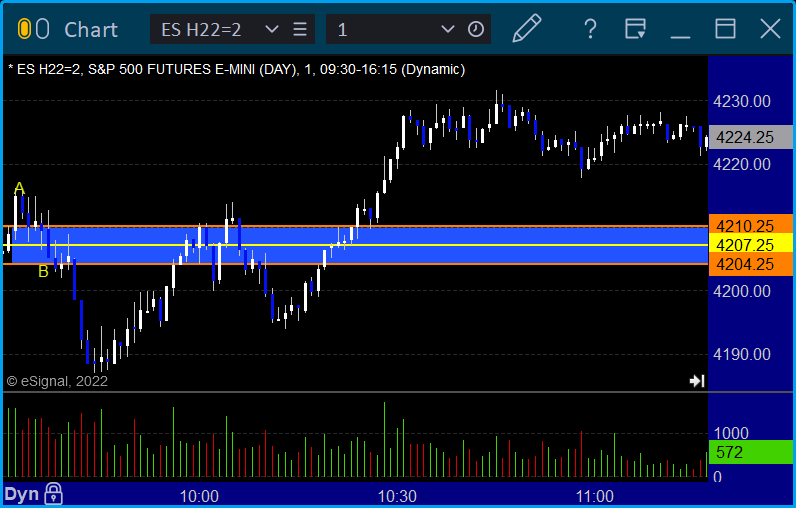

ES Opening Range Play triggered long at A and stopped, triggered short at B and worked:

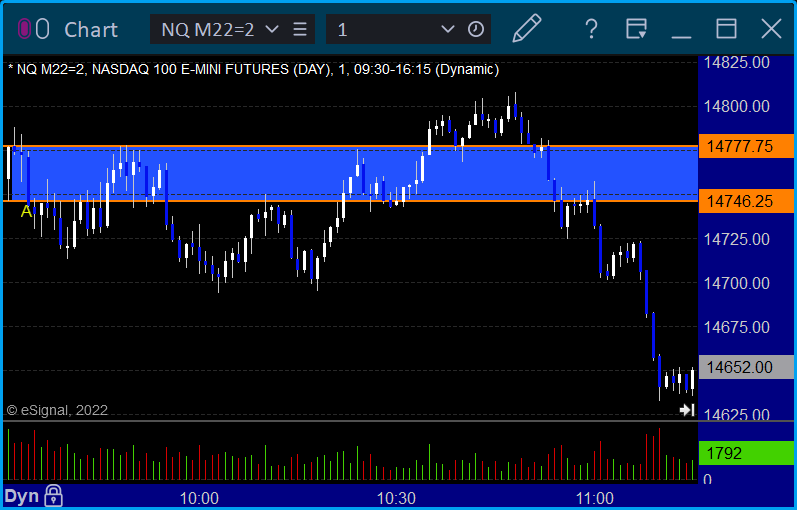

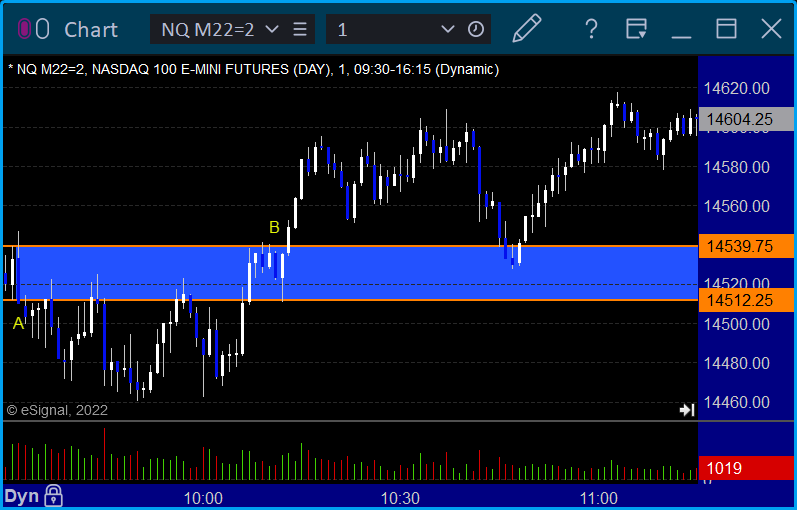

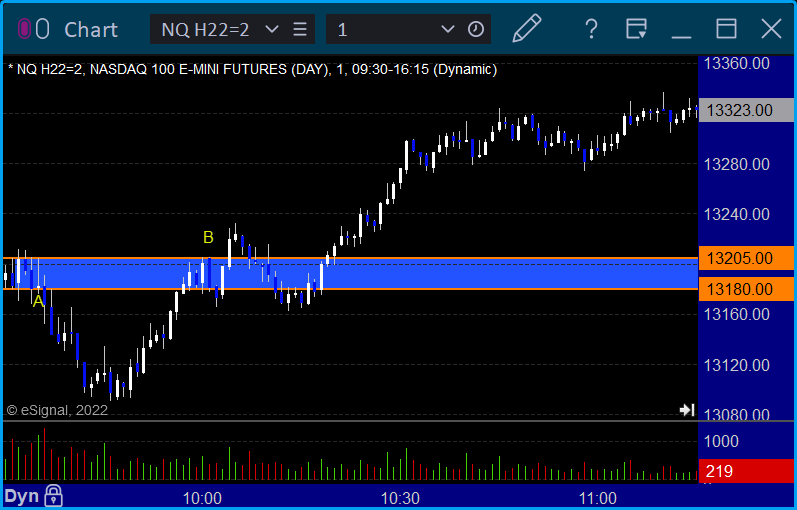

NQ Opening Range Play triggered short at A but no trade:

Results: -12 ticks

Forex:

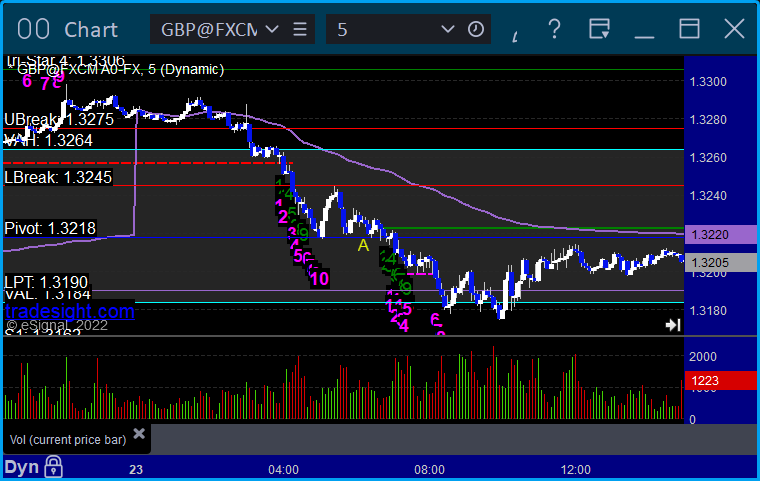

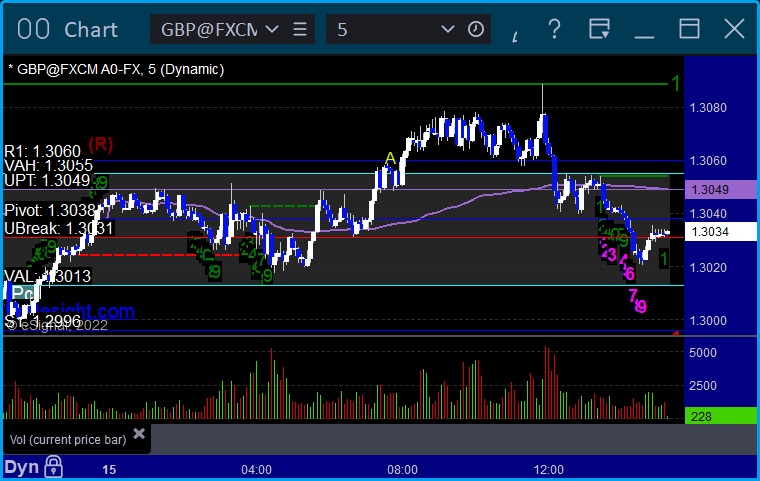

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

Not an exciting day and should have been about flat.

From the Tradesight Plus Report, no calls again due to the war situation.

From the Tradesight Plus Twitter feed, Rich's EXPE triggered long (without market support) and might have worked enough for a partial, but doesn't matter without market support:

His JNPR triggered long (without market support) and same thing:

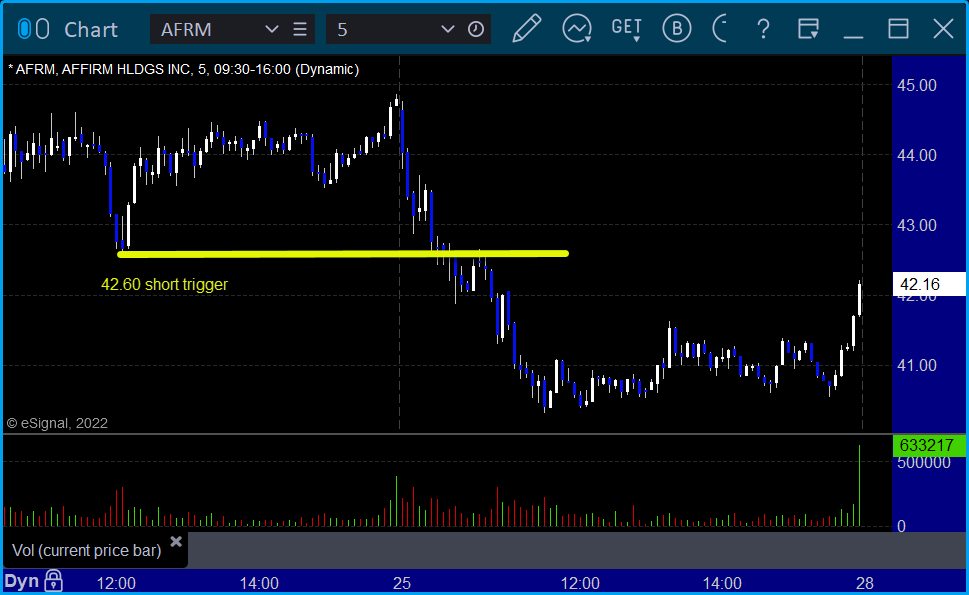

His AFRM triggered short (with market support) and worked:

His TWLO triggered short (with market support) and barely stopped out):

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Recap Report for 3/24/22

Overview

The markets gapped up and just meandered around all day, finally closed at highs, on 5 billion NASDAQ shares.

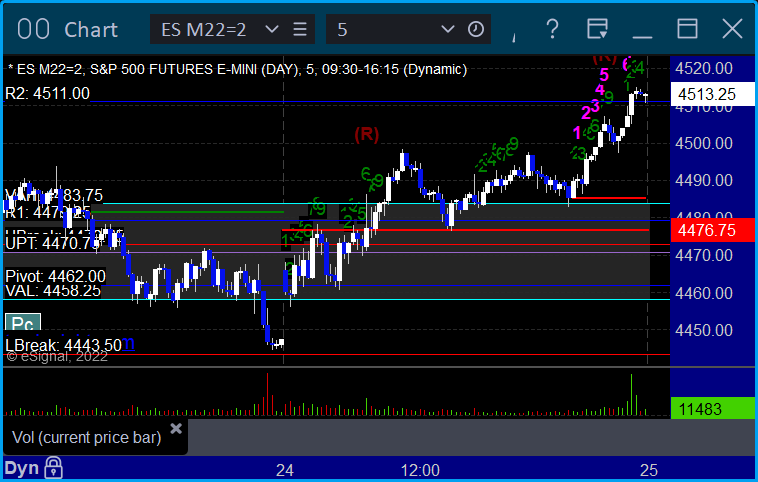

ES with Levels:

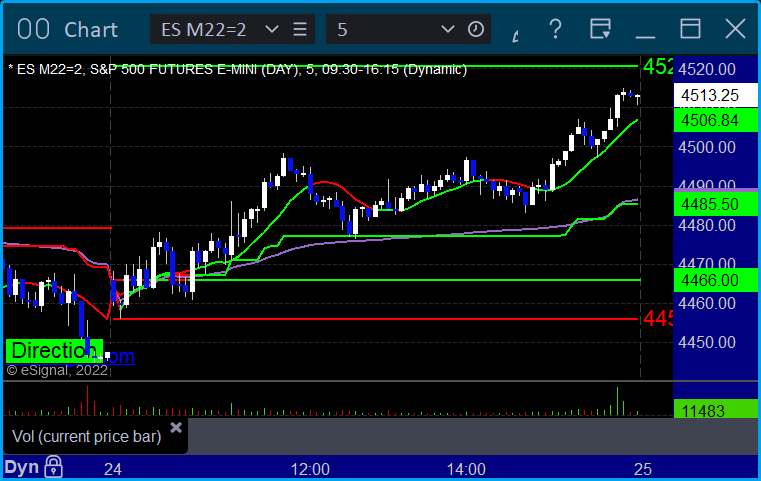

ES with Market Directional:

Futures:

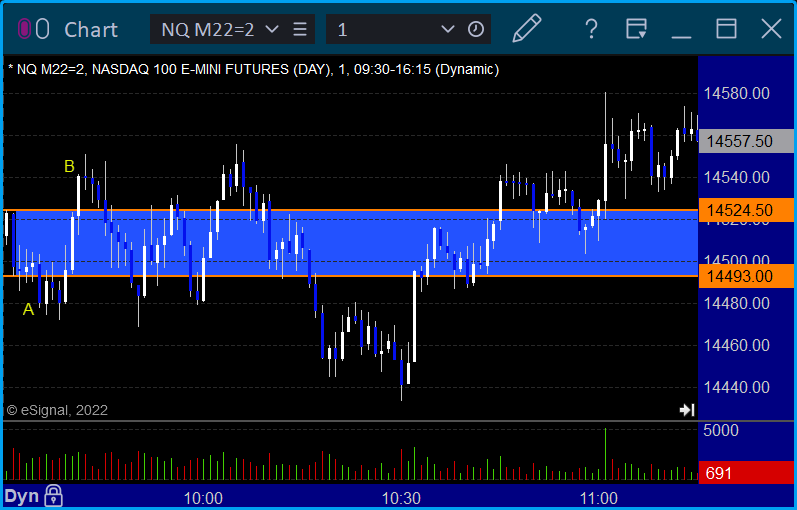

ES Opening Range Play triggered short at A and worked, triggered long at B and stopped under the midpoint:

NQ Opening Range Play both triggers were too far out of range to take:

Results: -2.5 ticks

Forex:

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

A green day, nothing special.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's NKLA triggered short (with market support) and worked:

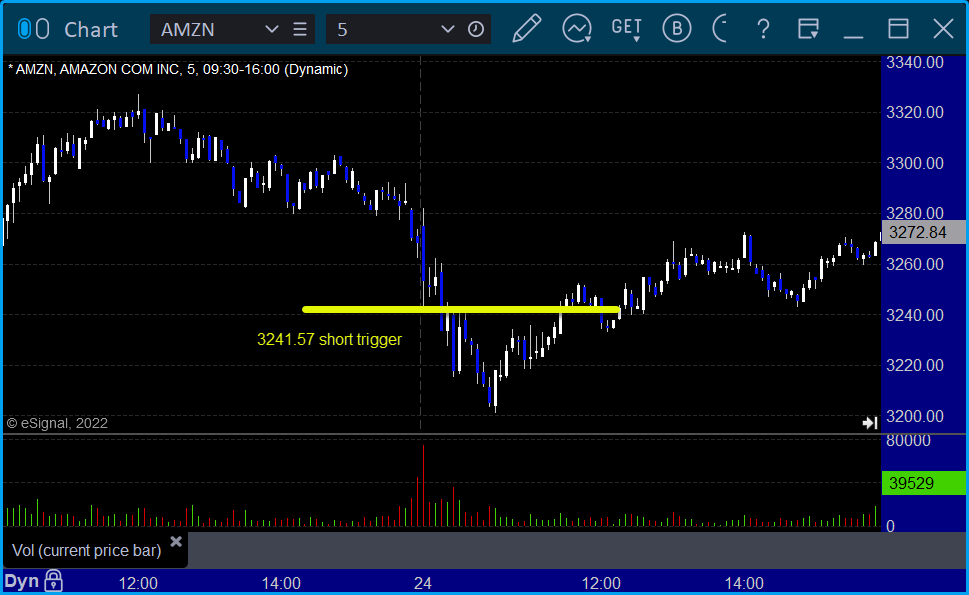

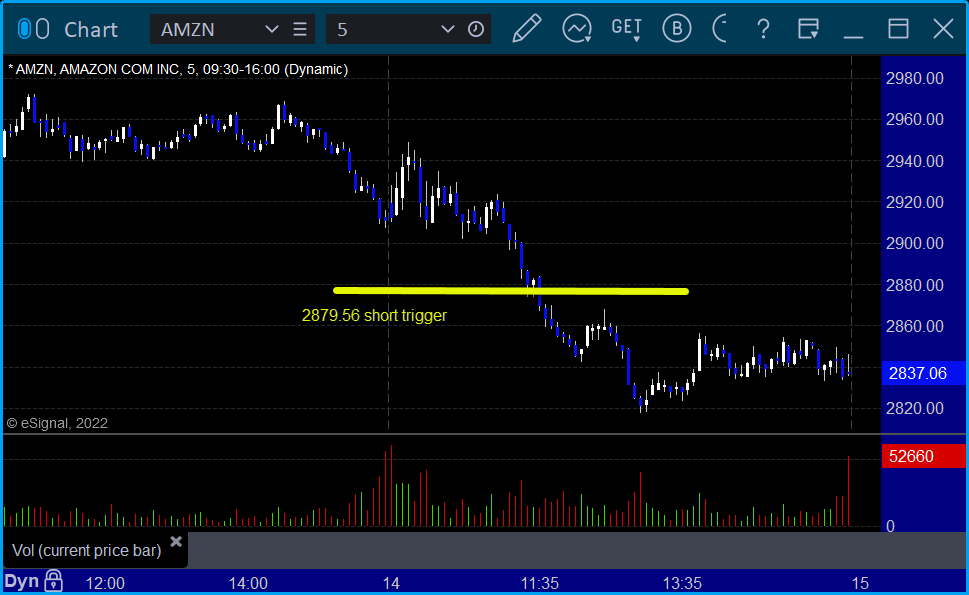

His AMZN triggered short (with market support) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 3/23/22

Overview

The markets gapped down, tried to rally and failed, and then sold off after lunch and closed at lows on 4.8 billion NASDAQ shares.

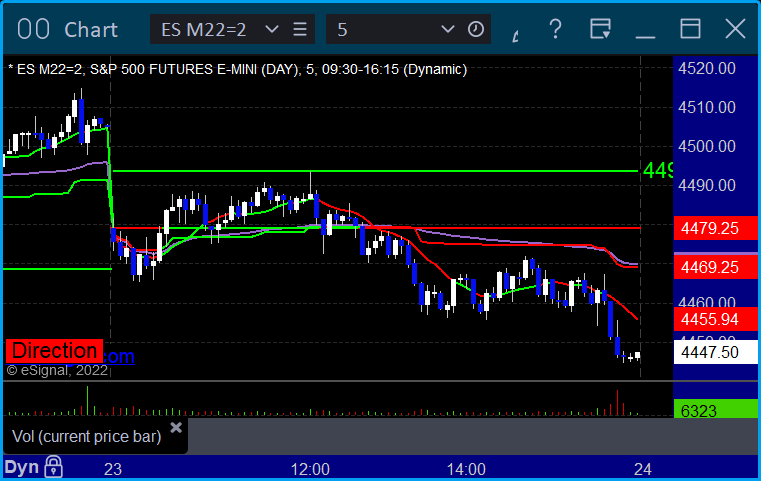

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked:

NQ Opening Range Play both triggers were too far out of range to take:

Results: +9 ticks

Forex:

Came into the day long the second half of the prior day's trade and that stopped out in the money.

GBPUSD triggered short at B and closed it slightly in the money:

Results: +40 pips

Stocks:

Not much here.

From the Tradesight Plus Report, no calls and no triggers.

From the Tradesight Plus Twitter feed, Rich's NVDA triggered short (without market support due to opening 5 minutes) and worked enough for a partial:

That’s 0 triggers with market support.

Tradesight Recap Report for 3/22/22

Overview

The markets gapped up and went higher until lunch and then went dead flat on 4.8 billion NASDAQ shares.

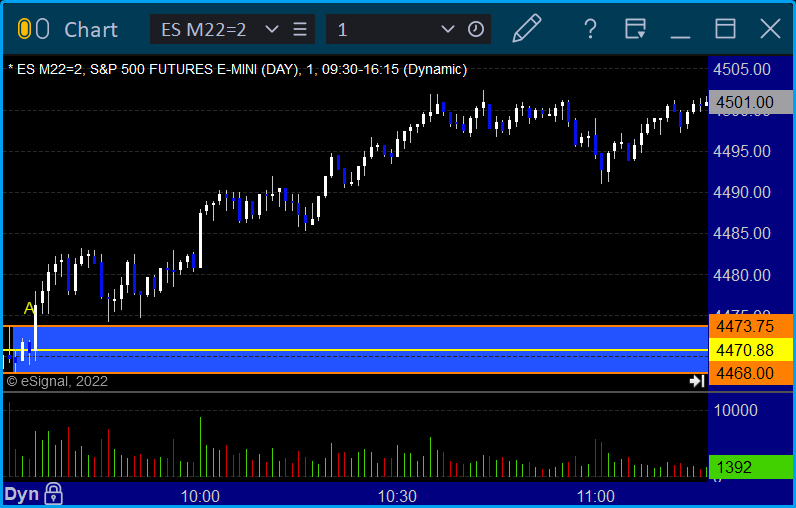

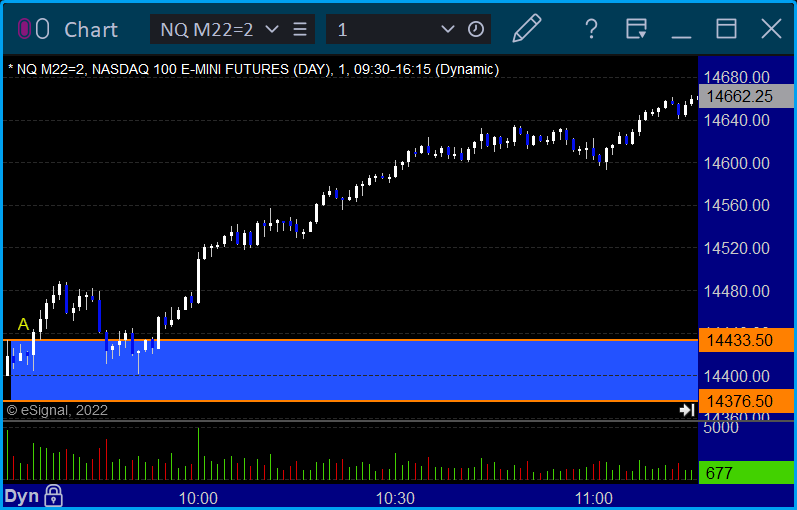

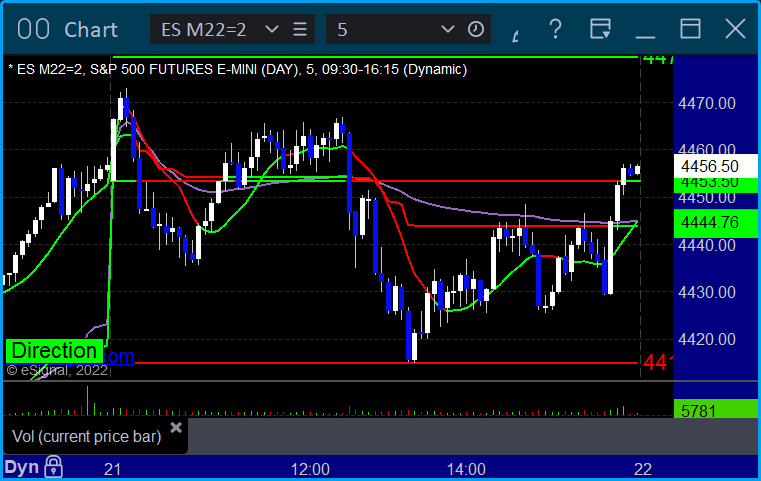

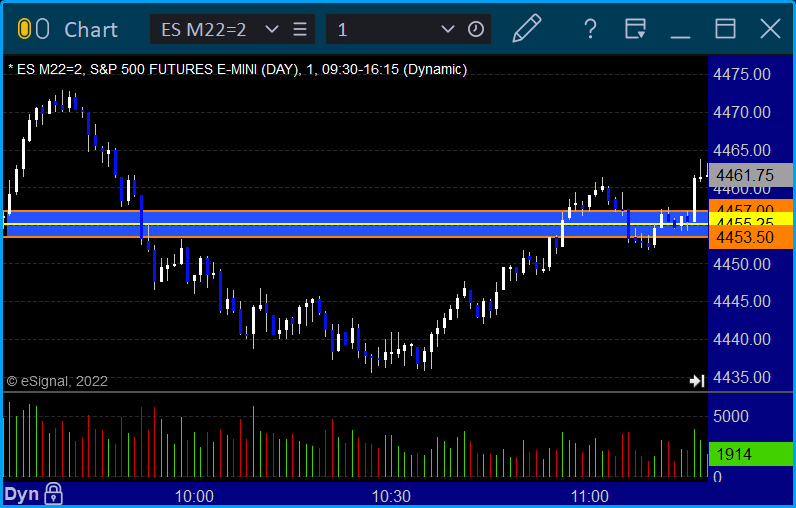

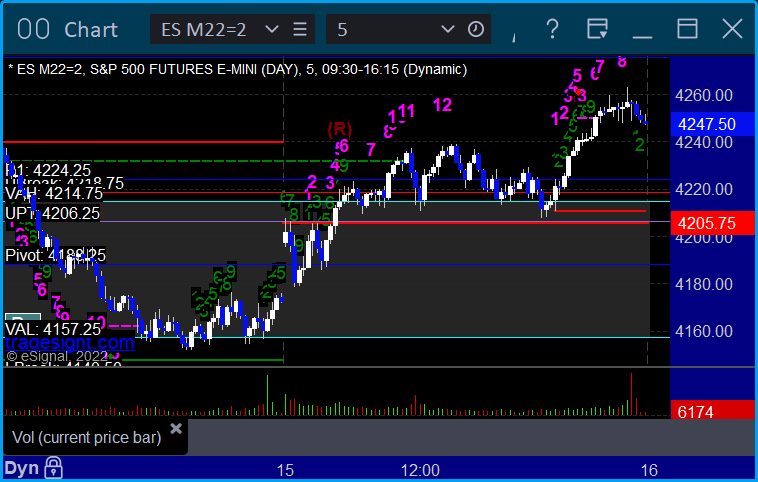

ES with Levels:

ES with Market Directional:

Futures:

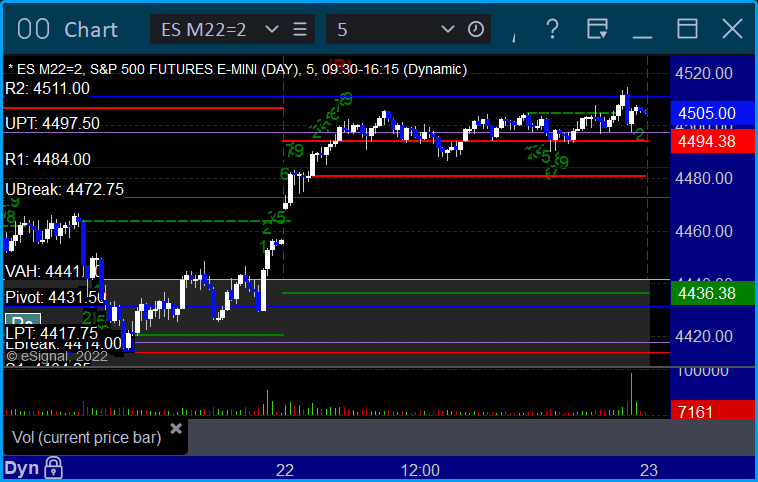

ES Opening Range Play triggered long at A but too far out of range to take under the rules by a few ticks:

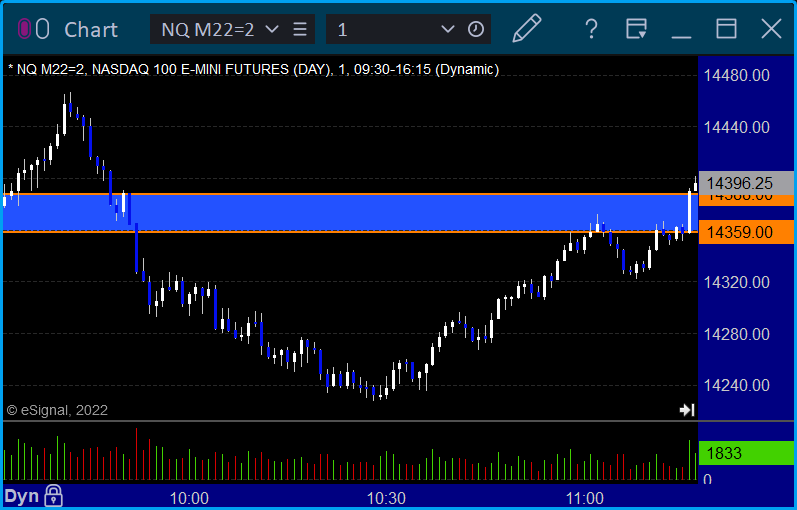

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: +0 ticks

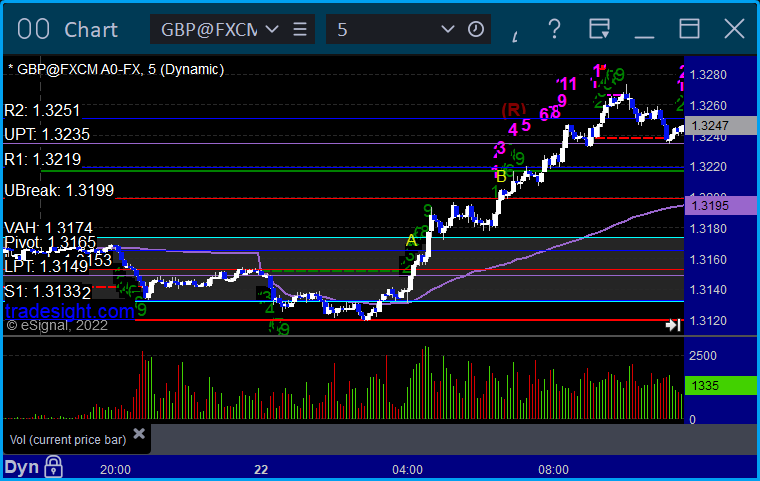

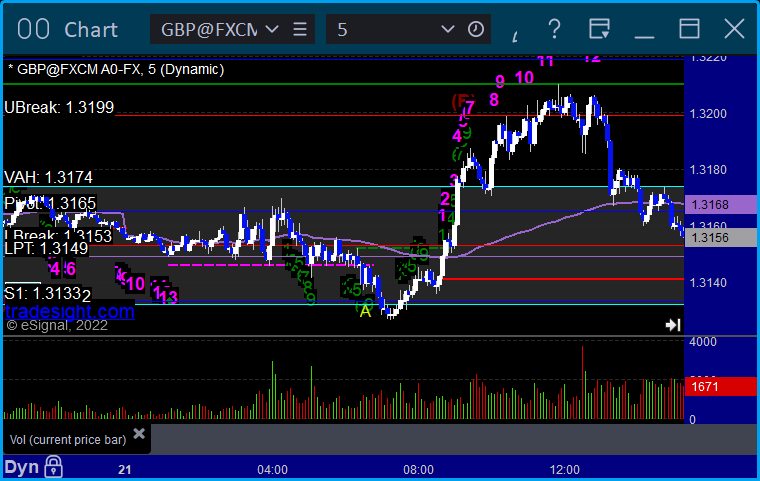

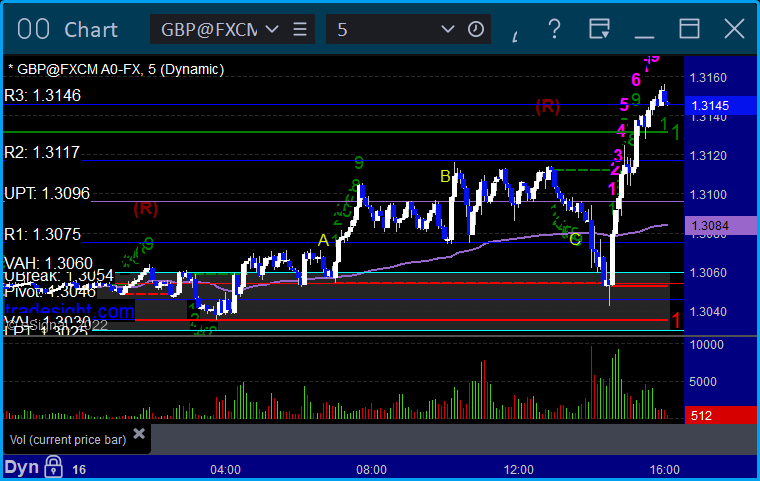

Forex:

GBPUSD triggered long at A, hit first target at B, still holding second half with a stop under R1:

Results: Trade still going

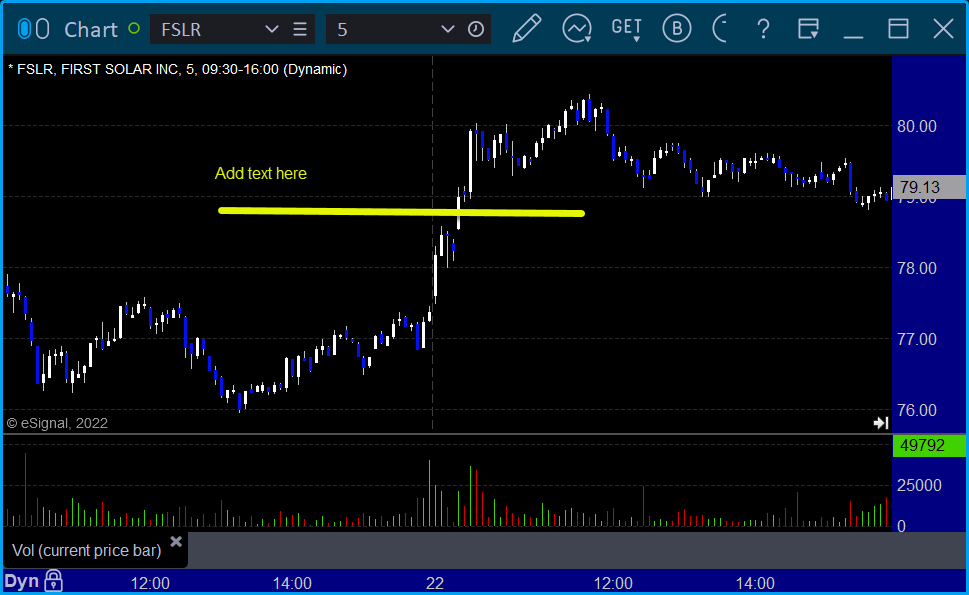

Stocks:

A great day for us.

From the Tradesight Plus Report, no calls, no triggers.

From the Tradesight Plus Twitter feed, Rich's HD triggered short (without market support due to opening 5 minutes) and worked:

His CRWD triggered long (with market support) and worked:

FB triggered long (with market support) and worked:

FSLR triggered long (with market support) and worked:

That’s 3 triggers with market support, all of them worked.

Tradesight Recap Report for 3/21/22

Overview

The markets opened flat, pushed higher, came back and went lower, sat flat over lunch, dipped once again, and then popped back up at the end of the session on 5.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked well, triggered short at B and worked:

NQ Opening Range Play, both triggers were too far out of range to take:

Results: +58 ticks

Forex:

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

Not a very interesting day.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's TWTR triggered short (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 3/18/22

Overview

The markets gapped down and drifted higher all day on 8 billion NASDAQ shares for triple expiration.

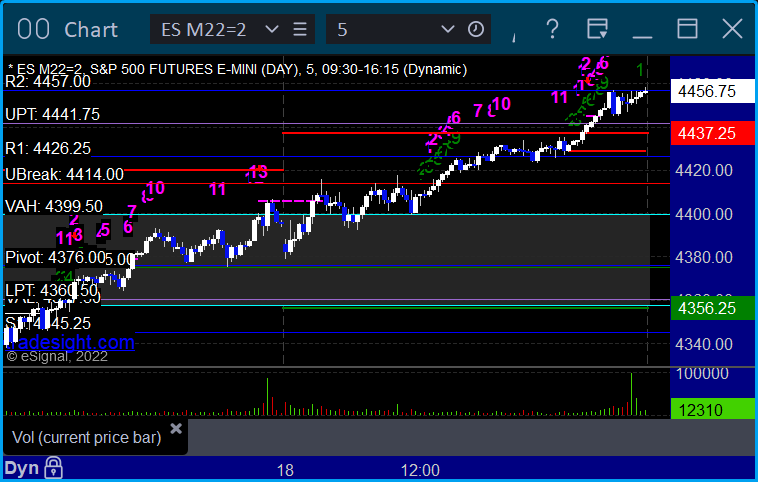

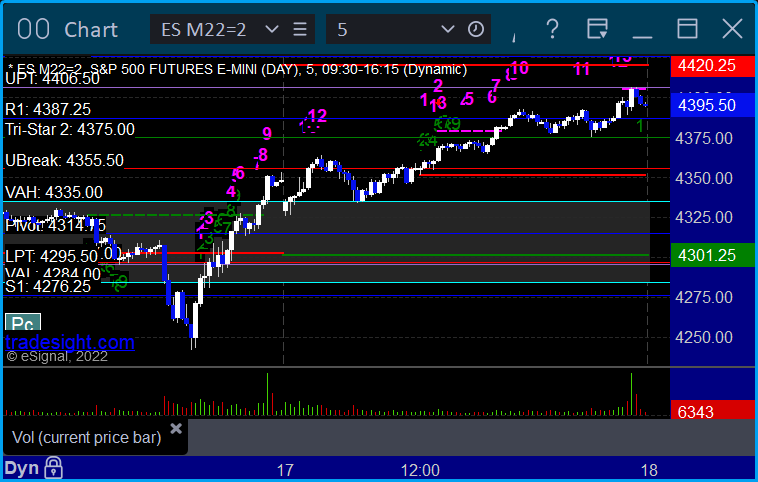

ES with Levels:

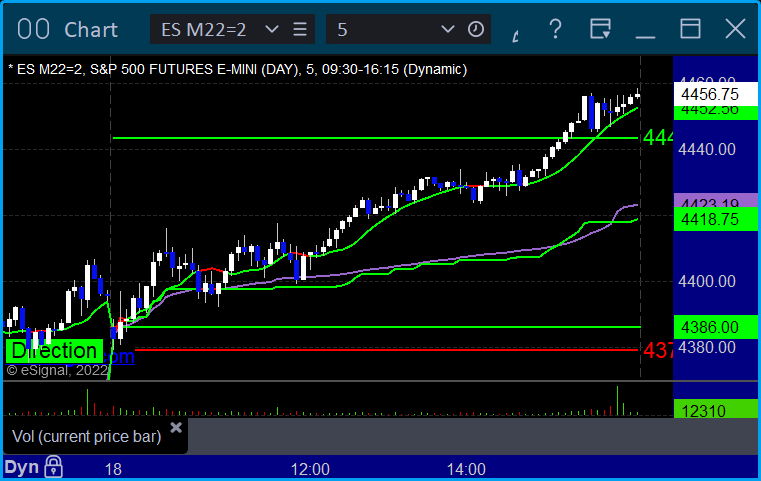

ES with Market Directional:

Futures:

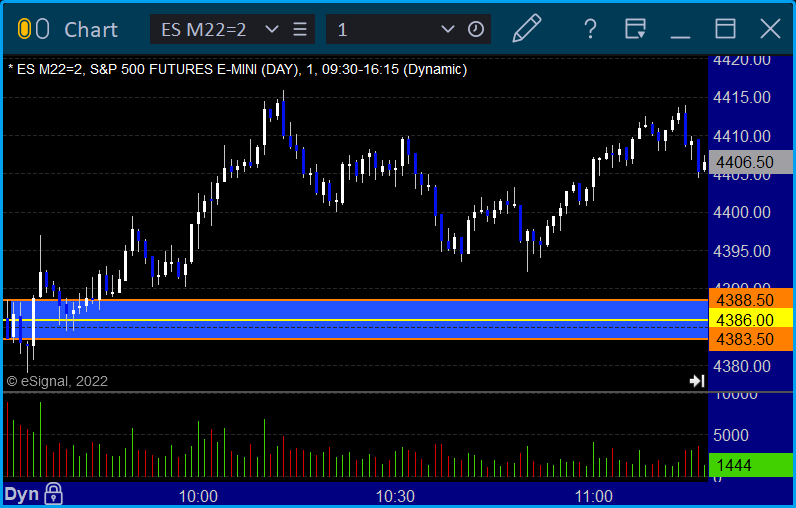

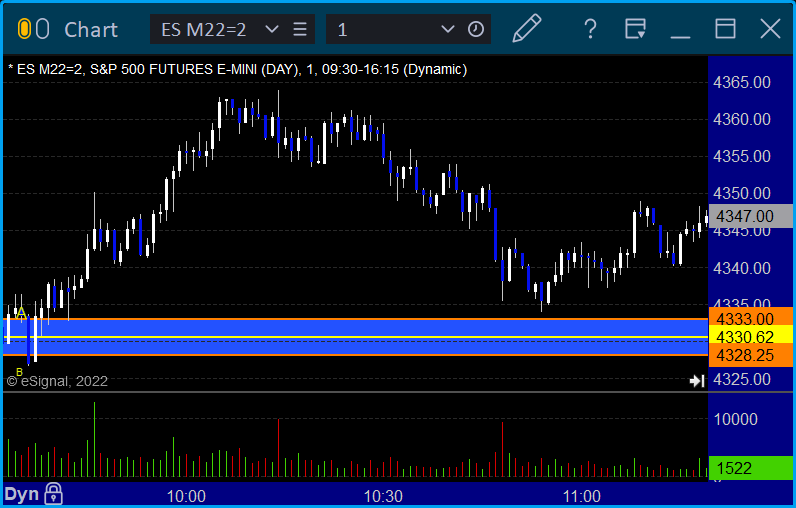

ES Opening Range Play triggered short at A and stopped over the midpoint, triggered long at B and worked enough for a partial:

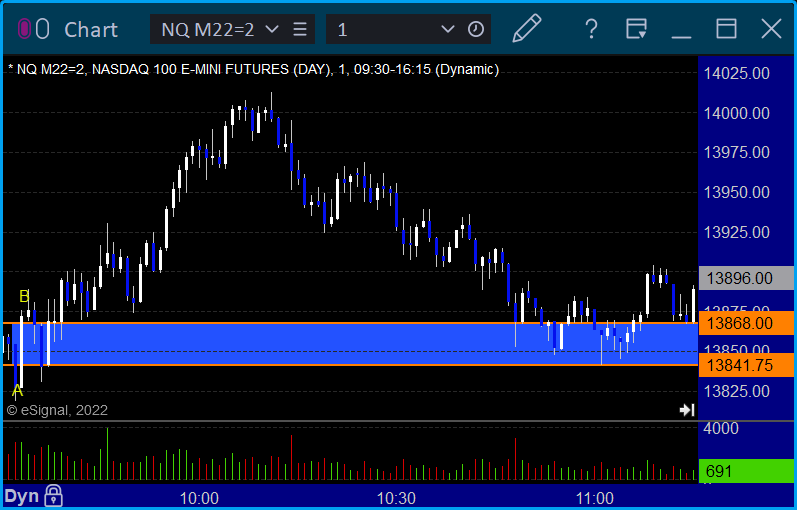

NQ Opening Range Play triggered long too far out of range to take:

Results: -9 ticks

Forex:

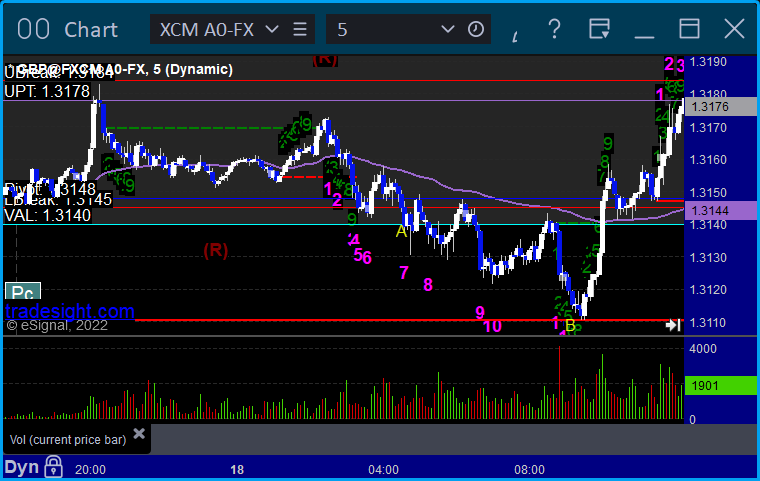

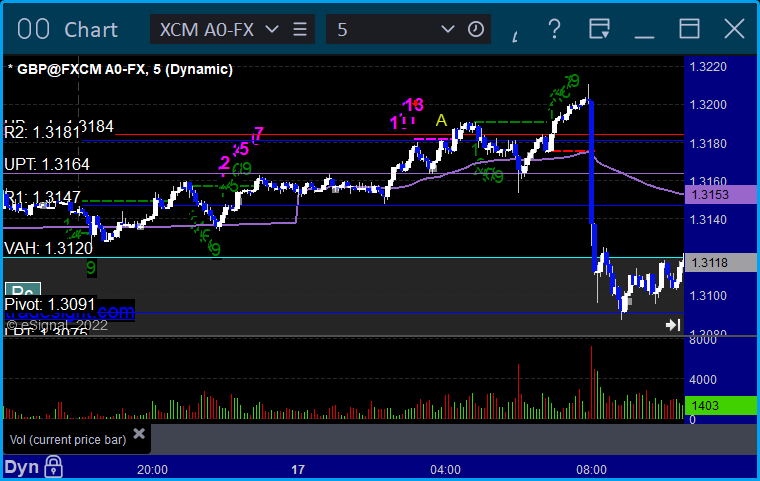

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

Another winning day.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's CRWD triggered long (with market support) and worked:

His HOOD triggered long (with market support) and didn't work:

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Recap Report for 3/17/22

Overview

The markets gapped down, filled, and did nothing most of the day, while drifting higher in the afternoon on 5.2 billion NASDAQ shares.

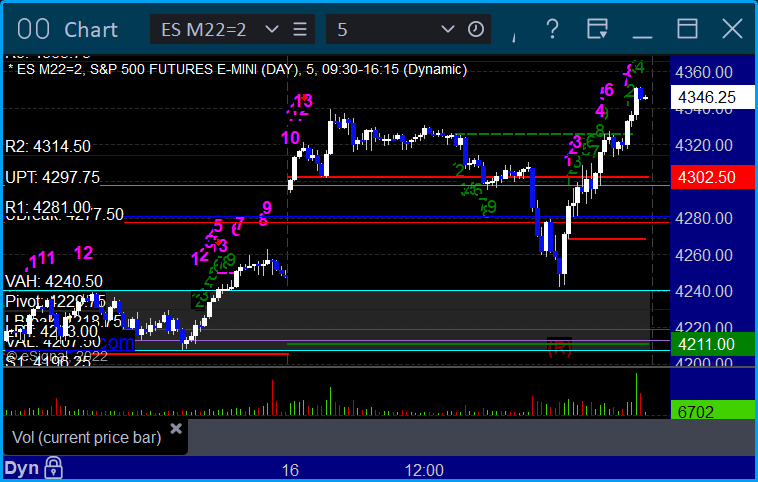

ES with Levels:

ES with Market Directional:

Futures:

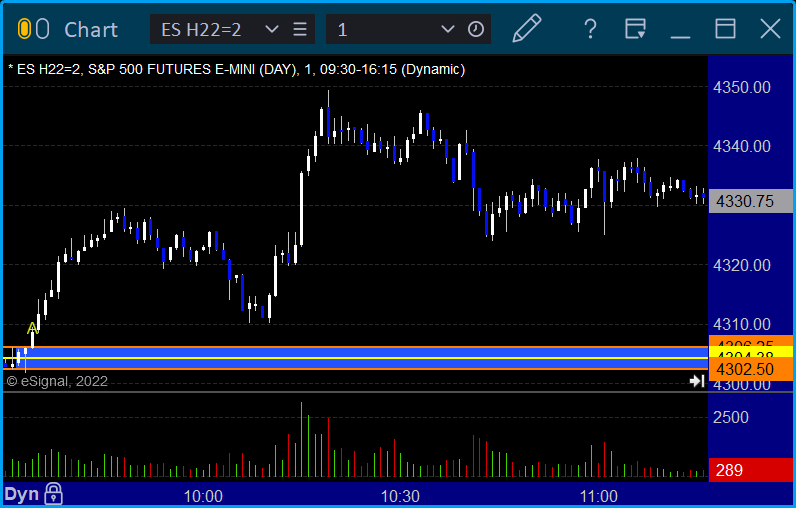

ES Opening Range Play triggered long at A and stopped:

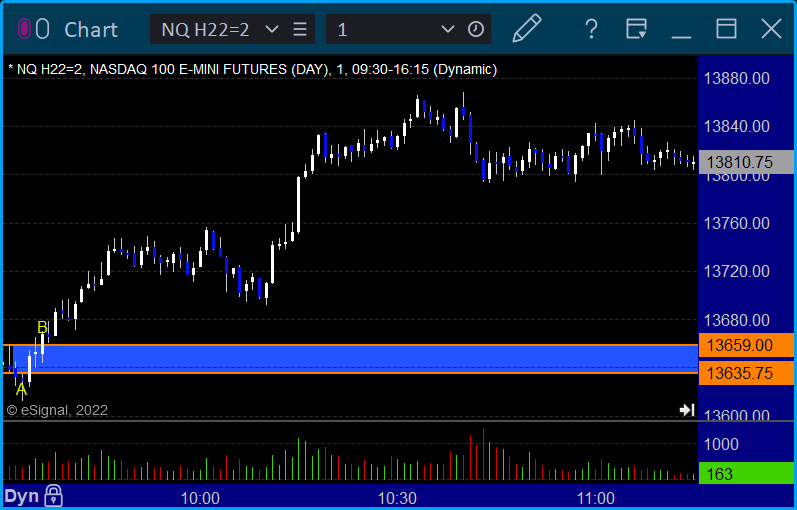

NQ Opening Range Play, both triggers were too far out of range to take:

Results: -15 ticks

Forex:

We were half size.

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

A good day.

From the Tradesight Plus Report, no calls.

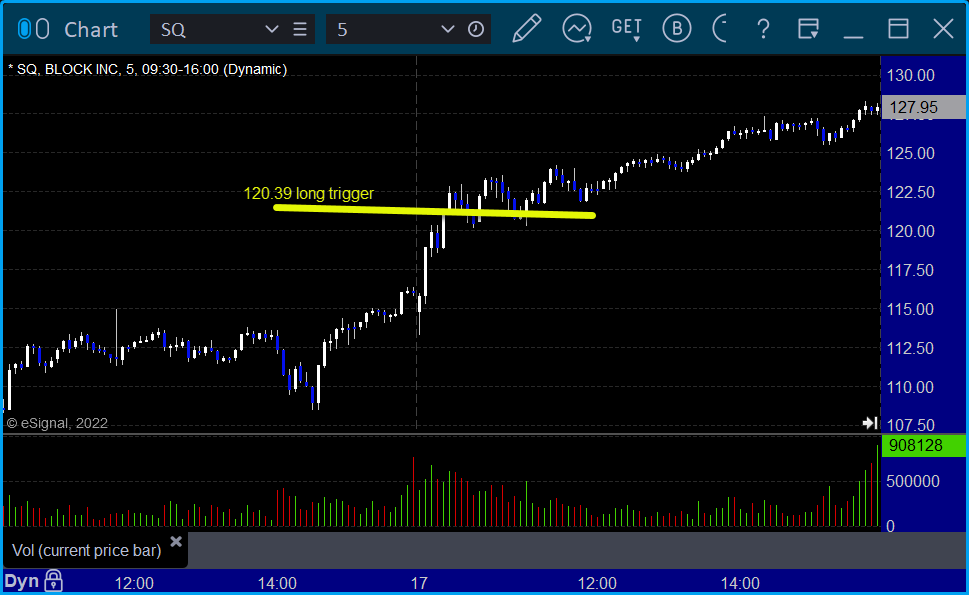

From the Tradesight Plus Twitter feed, Rich's SQ triggered long (with market support) and worked:

His NKE triggered long (with market support) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 3/16/22

Overview

The markets gapped up and didn't do much, sold off on the Fed to fill the gap, then rallied back to highs on 6.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered short at A but too far out of range to take, triggered long at B but too far out of range to take:

Results: +37.5 ticks

Forex:

GBPUSD triggered long at A, hit first target at B, stopped second half at C:

Results: +15 pips

Stocks:

A minor day.

From the Tradesight Plus Report, no calls.

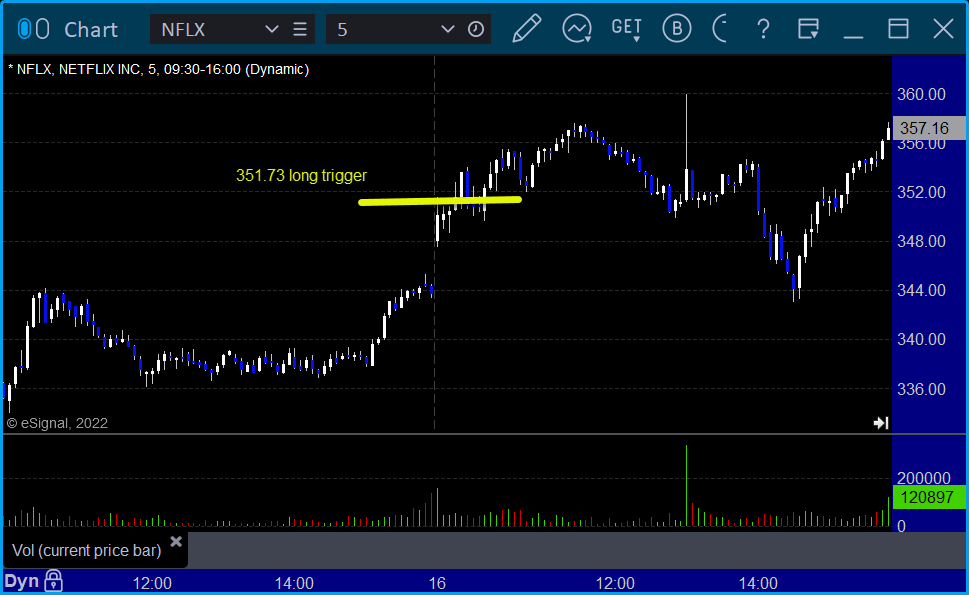

From the Tradesight Plus Twitter feed, Rich's NFLX triggered long (with market support) and worked:

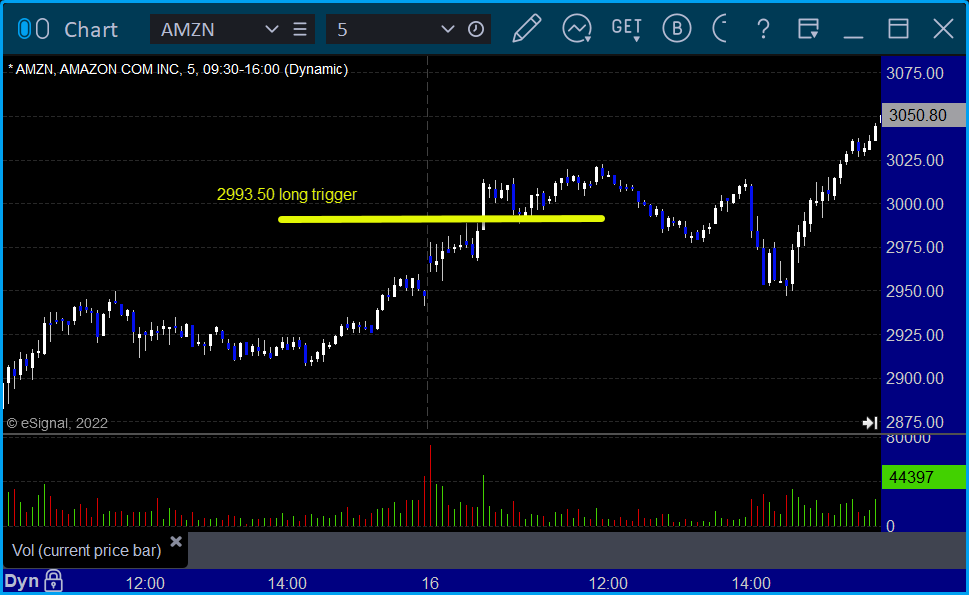

His AMZN triggered long (with market support) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 3/15/22

Overview

The market gapped up a little, almost filled, then came back up and went flat over lunch before pushing up later on 5.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A but too far out of range to take, triggered short at B and worked:

NQ Opening Range Play both triggers were too far out of range to take:

Results: +19.5 ticks

Forex:

GBPUSD triggered long over R1 and stopped:

Results: -25 pips

Stocks:

No much of a day after the last two.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, nothing triggered.

That’s 0 triggers with market support.

Tradesight Recap Report for 3/14/22

Overview

The markets opened close to flat, tried to push up, and then sold off sharply until after lunch and then went flat on 5.8 billion NASDAQ shares.

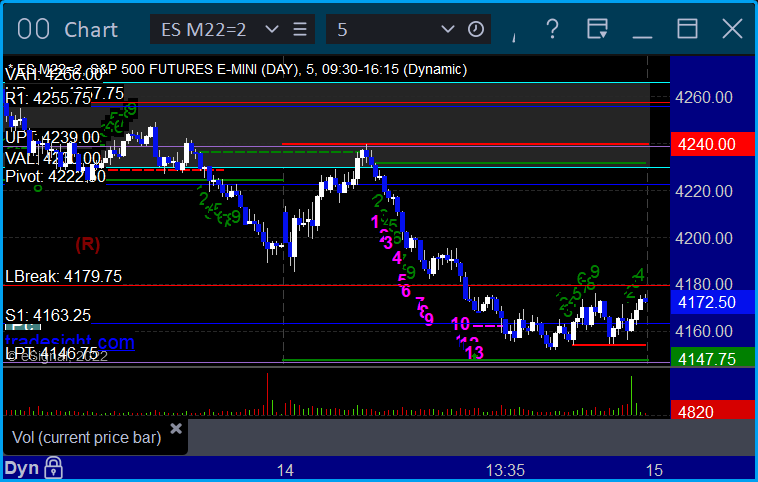

ES with Levels:

ES with Market Directional:

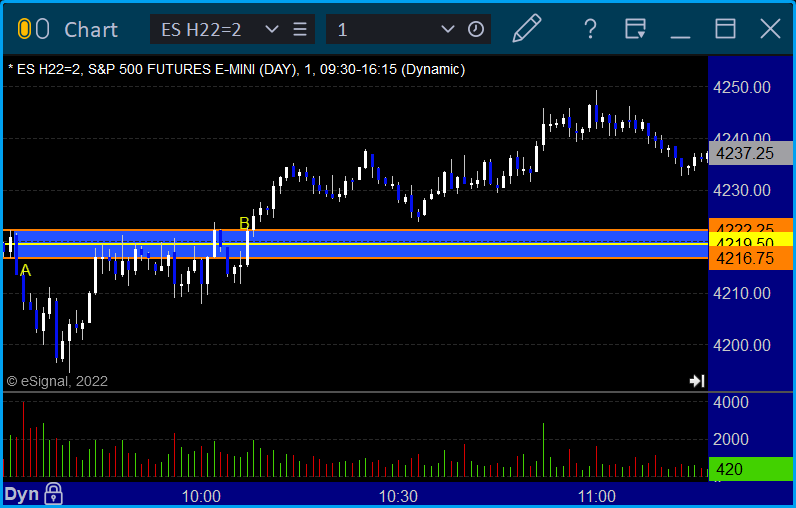

Futures:

ES Opening Range Play triggered short at A and long at B but both were just a bit too far out of range to take under the rules unless you wanted to try. Both would have worked:

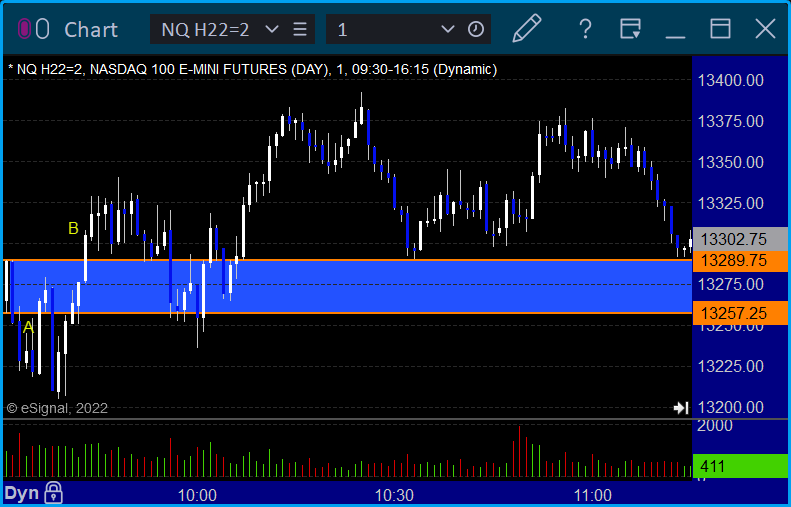

NQ Opening Range Play, triggered short at A and long at B, both were too far out of range:

Results: +0 ticks

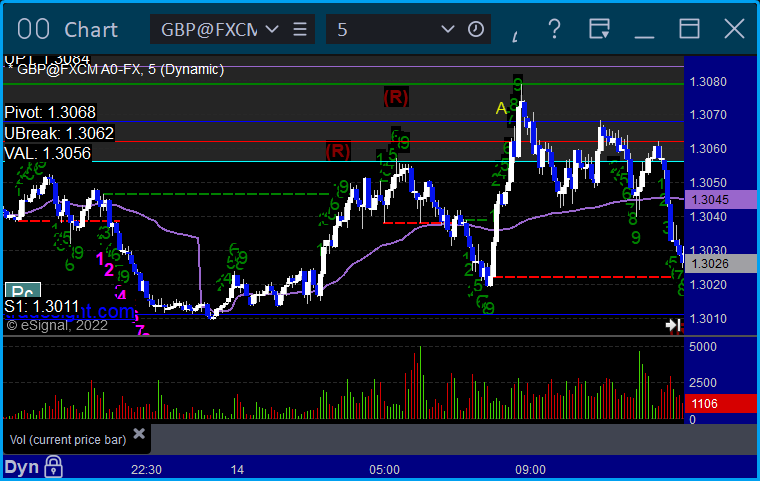

Forex:

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

A great day with three solid trades.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, INTU triggered short (with market support) and worked:

Rich's AMZN triggered short (with market support) and worked:

His WYNN triggered short (with market support) and worked:

That’s 3 triggers with market support, all of them worked.