Tradesight April 2016 Stock Results

Tradesight has been providing stock calls daily since 2002. We post the results of our of our trades, winners and losers, in our reports and Market Blog every day. Some people might find it surprising to learn that while we track our Futures and Forex formal trade call results monthly, we don’t post anything beyond the trade reviews on our Stocks calls.

There is actually a very specific reason for this. I’ve never been a fan of trying to “hype” or “promote” something. Being profitable in trading is about learning what to do and getting yourself to make the right decisions. In Futures as well as in Forex, if we publish a call in advance, just about everyone should get the same fills and be able to get in and out at almost the same numbers. That isn’t always the case in stocks. It depends on how many shares you are trading and what the liquidity in the market for that stock is at the time. For that reason, I have already been hesitant to say “These are the exact results.” I would never want to try to suggest that someone would make a certain amount of dollars trading a certain number of shares or make a certain percentage. If I take a trade and sell it for a $0.30 gain, it makes a big statistical difference if someone else had to pay $0.05 more to get in and maybe got out for $0.02 less. That’s $0.23 instead of $0.30 even though the concept of the trade was fine.

However, after many requests, in October 2015, we started posting our results. You can see these monthly here.

In our system, you can basically break trades down into four categories: Big losers, small losers, small winners, and big winners.

In order to have any chance of succeeding in the markets, you have to have a system. There is no other way around it. I’ve been trading for 20 years now, and I’ve trained over 1000 people. You don’t make money if you don’t have a technically valid system for entry and exits.

Of the four categories of trades listed above, we simply don’t allow any of the first category, which is big losers. We always have a worst-case stop and we always stick to it. There should never be a scenario where you are still in a trade that is causing a significant loss if you follow our rules.

In terms of the other three categories, generally speaking, if you have about a third of your trades fall into each category, you should be making good money. In other words, if we have about 33% of our trades as small losers and 33% of trades as small winners, those basically would offset. That leaves the other 33% of so only as bigger winners, and that’s what we are here for. In our world, we count a loser as a trade that stops out (stops in our system are based on the price-level of the stock). We count a small winner as a trade that goes enough to make a partial and then either stops the second half of the trade under the entry or stops the second half of the trade slightly in the money, but no more than the partial was or so. Then the big winners are anything that keeps going beyond the partial.

So these were the results for March, which you can view here.

Tradesight Stock Results for March 2016

Number of trade calls that triggered with market support: 102

Number (and percent of total) of small losers: 32 (28.4%)

Number (and percent of total) of small winners: 30 (29.4%)

Number (and percent of total) of big winners: 43 (42.2%)

And for April?

Tradesight Stock Results for April 2016

Number of trade calls that triggered with market support: 80

Number (and percent of total) of small losers: 18 (22.5%)

Number (and percent of total) of small winners: 28 (35%)

Number (and percent of total) of big winners: 34 (42.5%)

We had a lot less trades trigger in April than prior months, which is reflective of the drop in volume. However, by sticking to the system and waiting for the usual patterns to trigger, we got about the same results in terms of percentages. In fact, our losing ratio even dropped a bit. Nothing to complain about all things considered.

Stock Picks Recap for 5/27/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ATVI triggered long (with market support) and didn't work, this one will go back on the report Tuesday for a real trading session:

KLIC triggered long (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, no calls made as volume was just horrible.

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Futures Calls Recap for 5/27/16

The markets just drifted as expected heading into the long weekend after two boring days prior. NASDAQ volume was only 1.3 billion shares, and the futures didn't do anything. I even posted an early partial in the ES Opening Range play because it was moving so slow. See that section below.

Net ticks: +10 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A, took a 3 tick partial and a 4 tick final due to slowness:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 5/27/16

We were half size ahead of the long weekend, and for good reason. See GBPUSD section below.

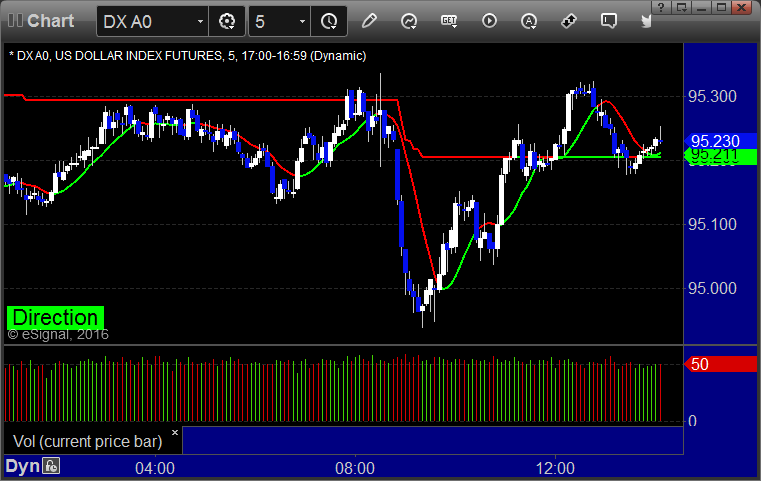

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

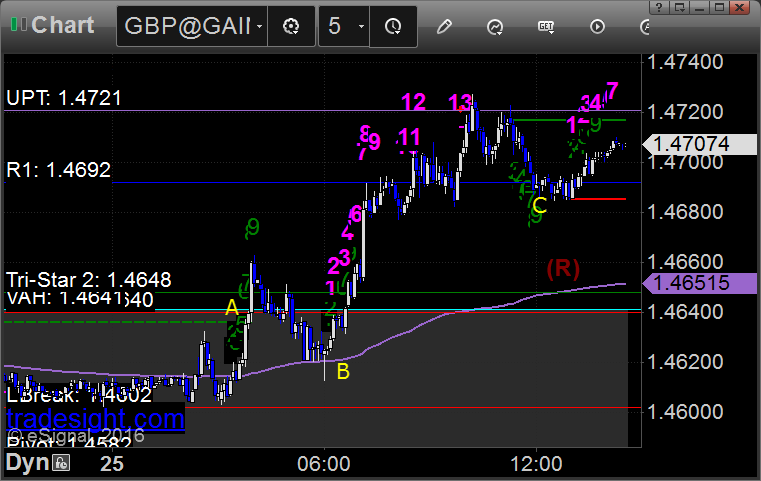

GBPUSD:

Using half size due to the Holiday, triggered long at A and stopped, triggered short at B and stopped, triggered again short at C and didn't go far, closed at D for end of week:

Stock Picks Recap for 5/26/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's ANF triggered short (with market support) and worked:

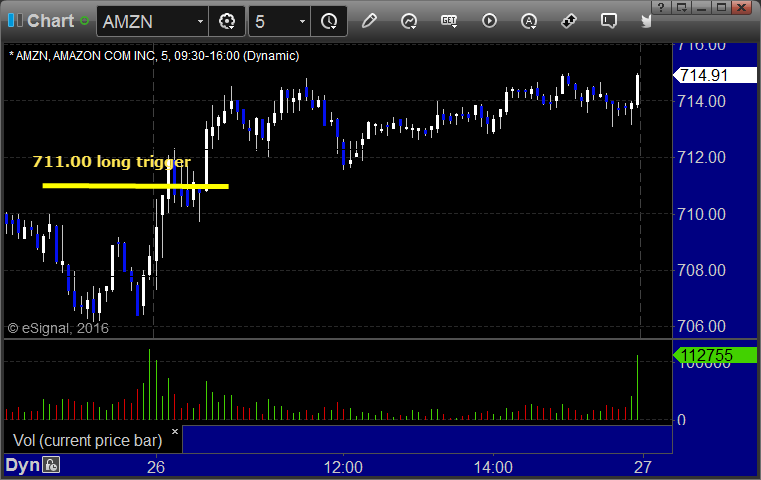

His AMZN triggered long (with market support) and worked:

Mark's MCHP triggered long (without market support) and didn't do anything by that point in the day:

Rich's AAPL triggered short (with market support) and didn't work:

His DWTI triggered long (ETF, so no market support needed) and worked:

NFLX triggered short (with market support) and didn't work, worked later:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Futures Calls Recap for 5/26/16

Pretty much a waste of a session as the markets seem to have settled into Memorial Day mode back on Wednesday about an hour in, as we've been flat since then. We opened flat and mostly did nothing. NASDAQ volume was 1.4 billion shares. No need for trade calls in that flat mess, and probably none Friday.

Net ticks: -37 ticks.

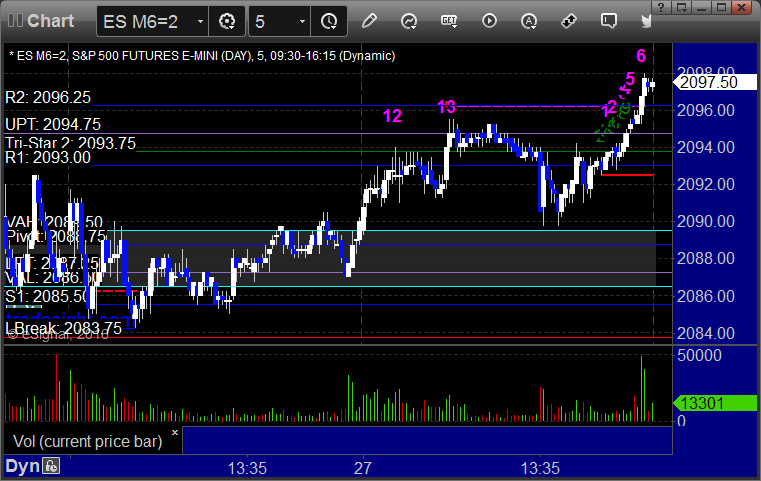

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and stopped, triggered short at B and worked:

NQ Opening Range Play triggered long at A and stopped, triggered short at B and stopped:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 5/26/16

One small winner for a boring session. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, closed at B for end of session:

Stock Picks Recap for 5/25/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, EBAY triggered long (with market support) and didn't work:

In total, that's 1 trade triggering with market support, and it didn't work. Lightest day of trading for months, but the markets were dead after the first hour and none of our other calls triggered.

Futures Calls Recap for 5/25/16

The markets gapped up and kept going again, although today was more limited than Tuesday's excellent session (not uncommon for a second "gap and go" day in a row). NASDAQ volume was only 1.6 billion shares.

Net ticks: -2 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and stopped, triggered short at B and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 5/25/16

A winner from the prior day continued, but a new trade triggered and barely stopped out. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Came into the session long the second half of the prior day's trade, which never stopped. New trade triggered long at A, barely stopped unfortunately at B, but the second half of the prior day's trade continued, and I raised the stop on that twice and stopped out under R1 at C: