Stock Picks Recap for 5/24/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

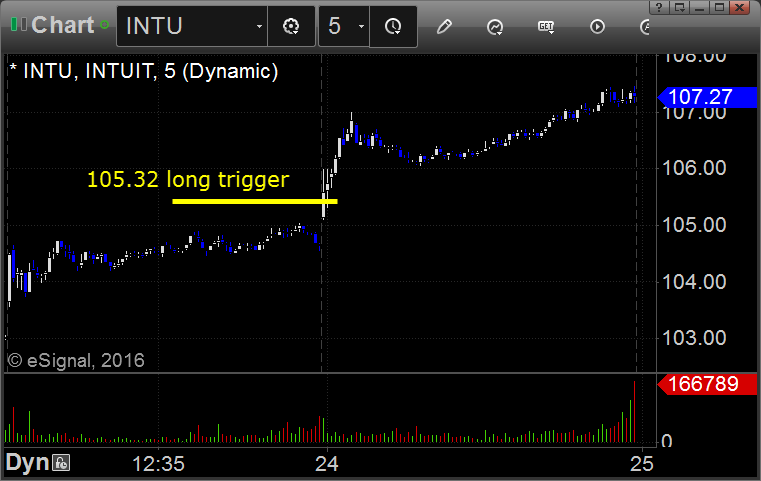

From the report, INTU triggered long (without market support due to opening 5 minutes) and worked:

OLED triggered long (with market support) and worked:

ALKS triggered long (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's QCOM triggered long (with market support) and worked:

His GLD triggered short (ETF, so no market support needed) and worked:

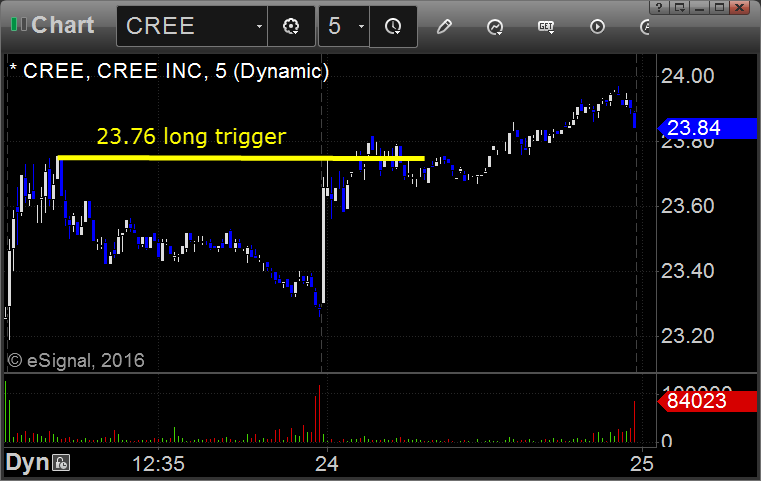

His CREE triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked, plus the two pick.

Futures Calls Recap for 5/24/16

The markets gapped up and kept running, although most of the push was in the first hour. NASDAQ volume was 1.7 billion shares.

Net ticks: +19 ticks.

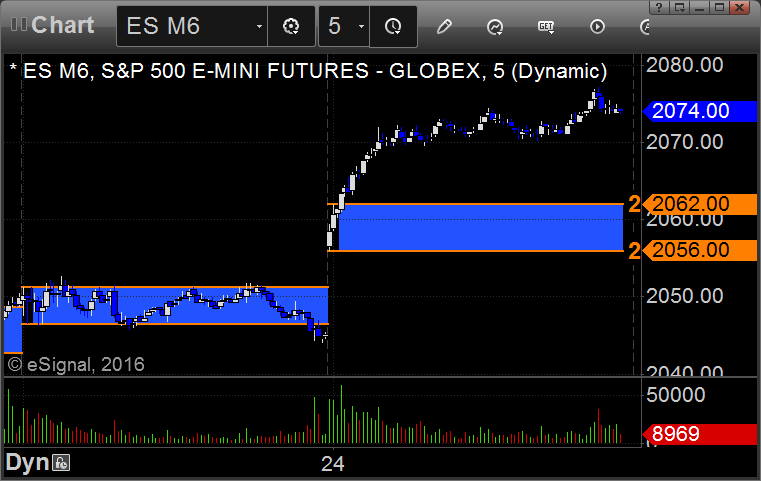

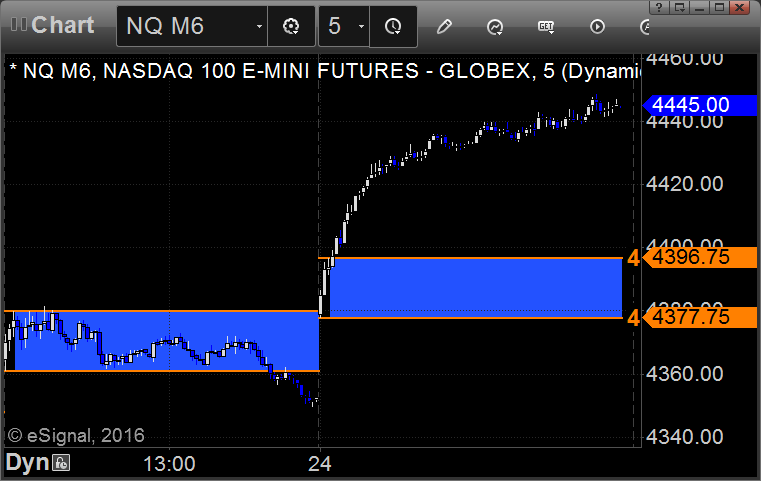

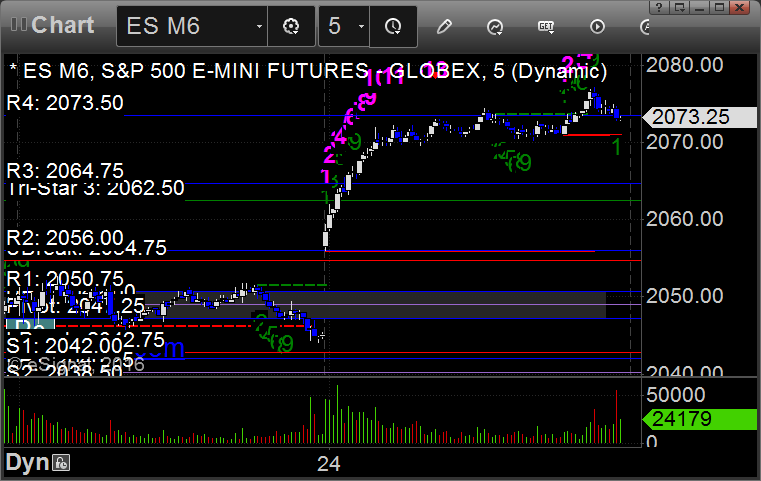

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

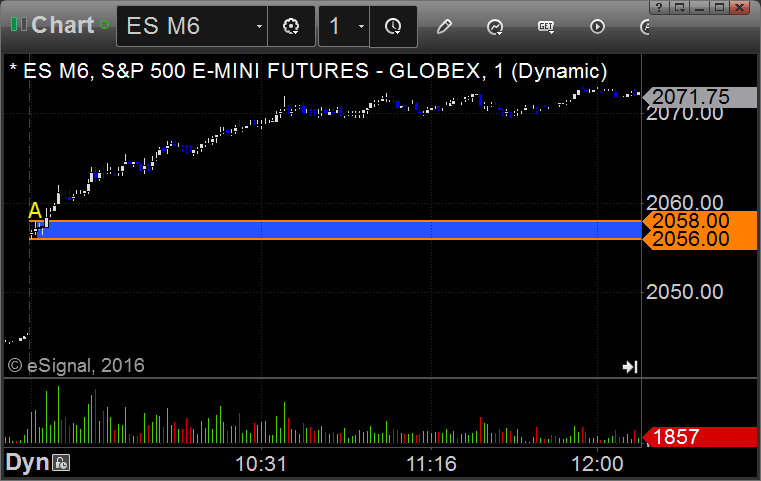

ES Opening Range Play triggered long at A and worked:

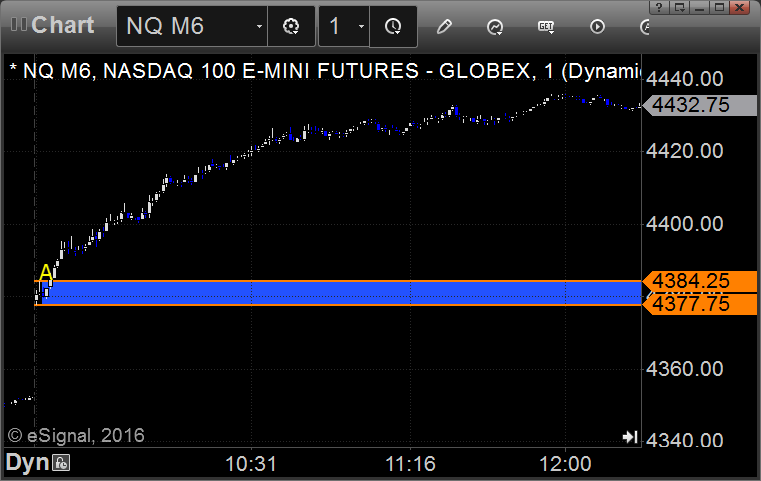

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

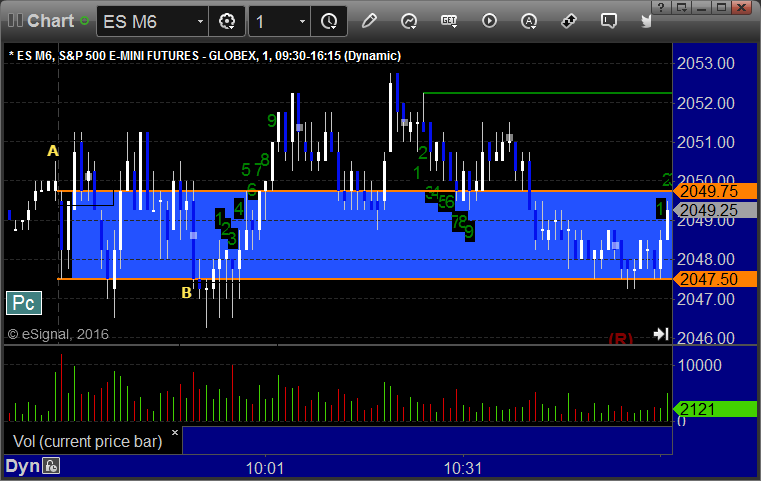

ES:

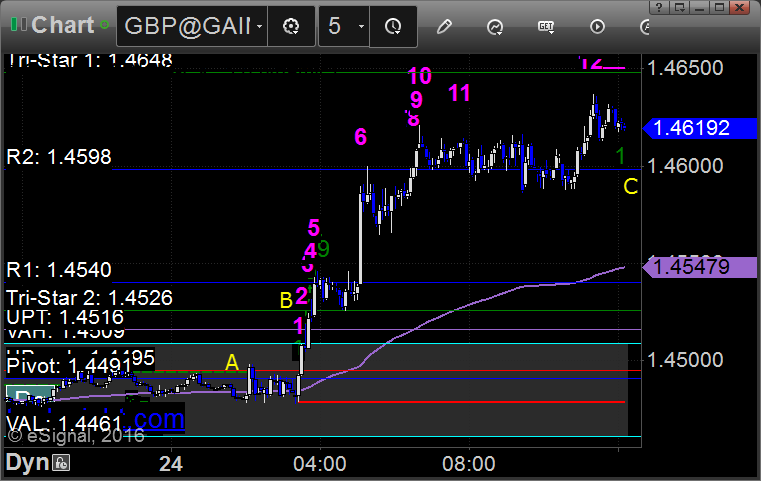

Forex Calls Recap for 5/24/16

Winner in the GBPUSD for the session still going. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

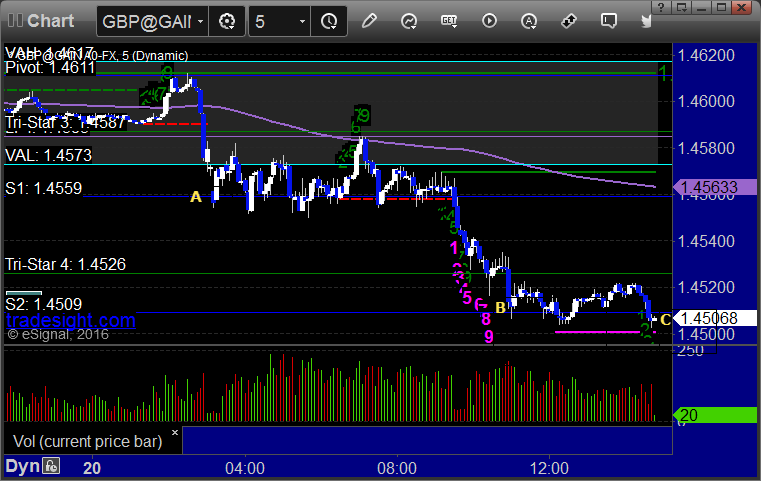

GBPUSD:

Triggered long at A, hit first target at B, still holding second half with a stop under R2 at C:

Stock Picks Recap for 5/23/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TTMI triggered long (with market support) and worked a little:

From the Messenger/Tradesight_st Twitter Feed, Rich's WDC triggered long (without market support) and worked:

BMRN triggered long (with market support) and worked enough for a partial:

Mark's COST triggered long (with market support) and didn't work:

WYNN triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 5/23/16

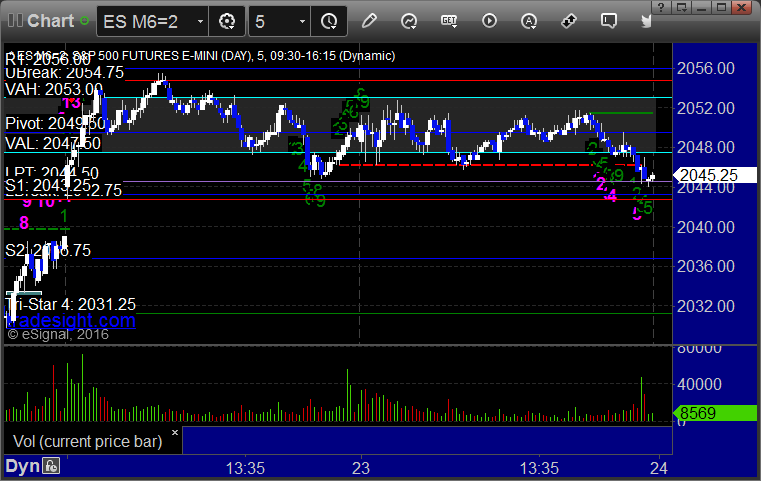

What an amazingly boring session to start the week. First day of a new options cycle, and nothing happened (not unusual but this was an extreme example). Volume even started out solid, which makes it more surprising. In the end, we basically just closed flat and barely traded over 5 points of range on the ES on 1.6 billion NASDAQ shares. No trades to call, check the Opening Range results.

Net ticks: -21 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and short at B, neither worked:

NQ Opening Range Play triggered long at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 5/23/16

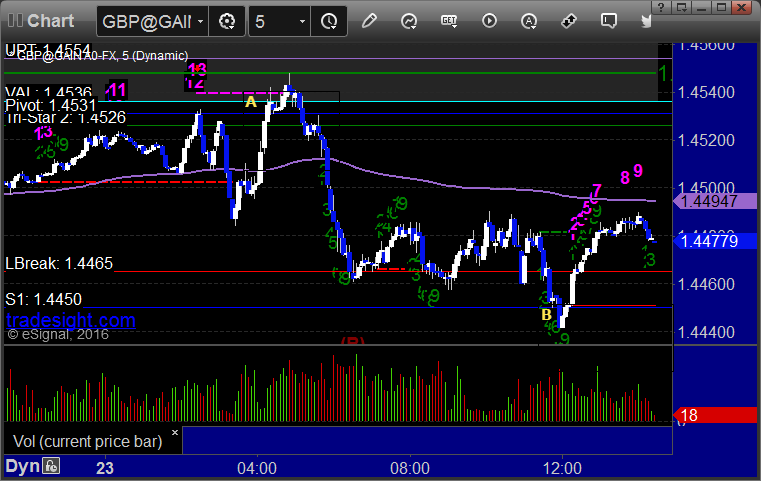

A dull session and a loser to start the week. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped. Would have triggered short at B, but noon EST is a little beyond our trading times:

Stock Picks Recap for 5/20/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FMER triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's LRCX triggered long (with market support) and worked:

LULU triggered long (with market support) and worked:

AAPL triggered long (with market support) and worked enough for the partial:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 5/20/16

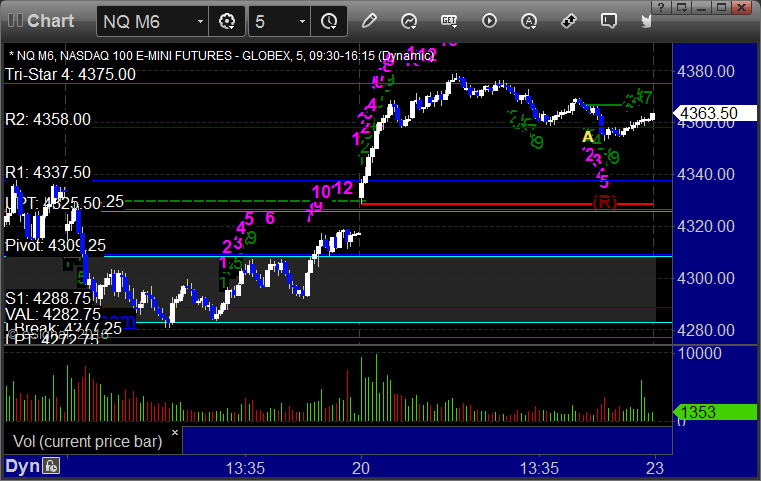

For options expiration Friday, the markets gapped up and kept going, covered most of the day's range in 40 minutes, and closed exactly on the VWAP on 1.7 billion NASDAQ shares, which is light for options expiration. We had great Opening Range plays again and another NQ trade that worked.

Net ticks: +30 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked enough for a partial, barely stopped the second half 2 ticks in the money or could have been huge:

NQ Opening Range Play triggered long at A and worked huge:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered short at A at 4357.50, hit first target for 6 ticks, stopped second half over the entry:

Forex Calls Recap for 5/20/16

A winner for the session (despite my screw-up) on the GBPUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

GBPUSD:

Triggered short at A, hit first target at B (I set my stop wrong and updated it initially wrong), closed final piece for end of week at C:

Stock Picks Recap for 5/19/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FMER triggered long (with market support, by a penny only) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's DWTI triggered long (ETF, so no market support needed) and worked:

Rich's FB triggered short (without market support just barely) and worked:

His COST triggered long (with market support) and worked:

TSLA triggered long (with market support) and worked enough for a partial:

GILD triggered short (with market support) and worked enough for a partial:

Rich's MNRO triggered long (without market support) and worked:

His VRX triggered short (without market support) and didn't work:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.