Futures Calls Recap for 5/19/16

The markets gapped down, then head-faked up for a little, then rolled again, using the LPT on the ES as general support for hours before coming back up to close above some key levels. NASDAQ volume was 1.65 billion shares. Opening Range plays were great, and we had another winner in the TF and a loser on the ES separately. See those sections below.

Net ticks: +54.5 ticks.

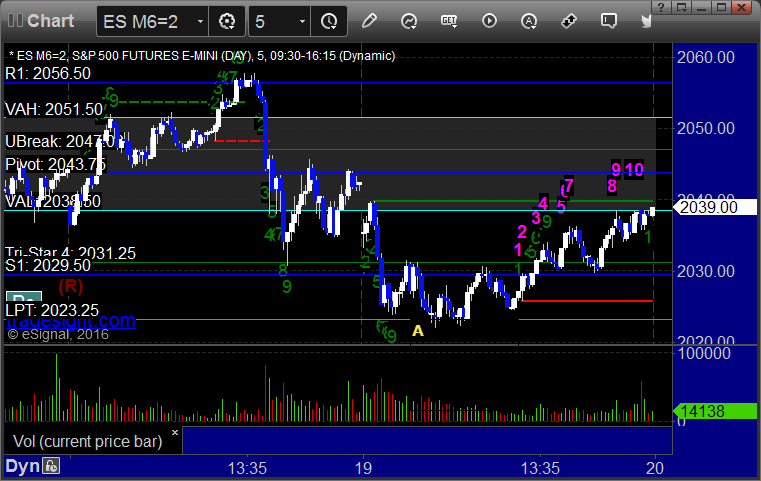

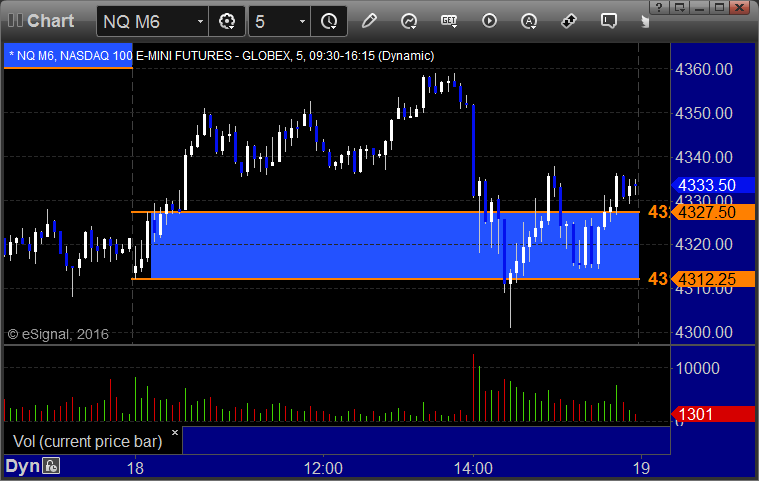

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked enough for a partial, triggered short at B and worked:

NQ Opening Range Play triggered long at A and worked enough for a partial, triggered short at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered short at A at 2023.00 and stopped for 7 ticks:

TF:

Triggered short at A at 1090.40, hit first target for 9 ticks, stopped second half 13 ticks in the money:

Forex Calls Recap for 5/19/16

The second half of the prior day's trade stopped in the money by quite a bit. A new GBPUSD trade triggered and stopped. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped:

Stock Picks Recap for 5/18/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's TSLA triggered long (with market support) and worked:

Mark's VRX triggered long (with market support) and worked enough for a partial:

AAPL triggered long (with market support) and worked enough for a partial:

Rich's VRX triggered short (with market support) and closed right where it triggered, didn't go enough in either direction to count:

His GDX triggered short (ETF, so no market support needed) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Futures Calls Recap for 5/18/16

Another nice day for the Opening Range plays. Markets gapped down and filled, tried to go higher and then reversed on the release of the Fed minutes from the last meeting. We closed in the lower half of the range on 1.8 billion NASDAQ shares.

Net ticks: +15 ticks.

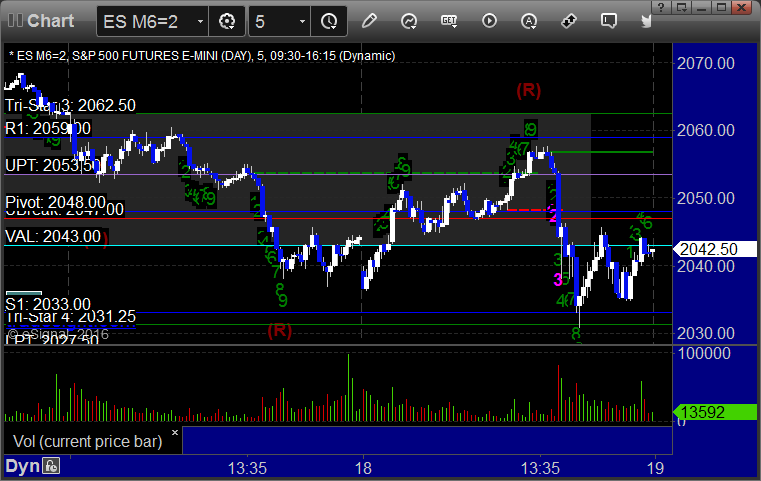

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A but we don't take that because we are already long the NQ at the time and this isn't into the gap, triggered long at B and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 5/18/16

A loser and a bigger winner (still going) for the session. See GBPUSD section below.

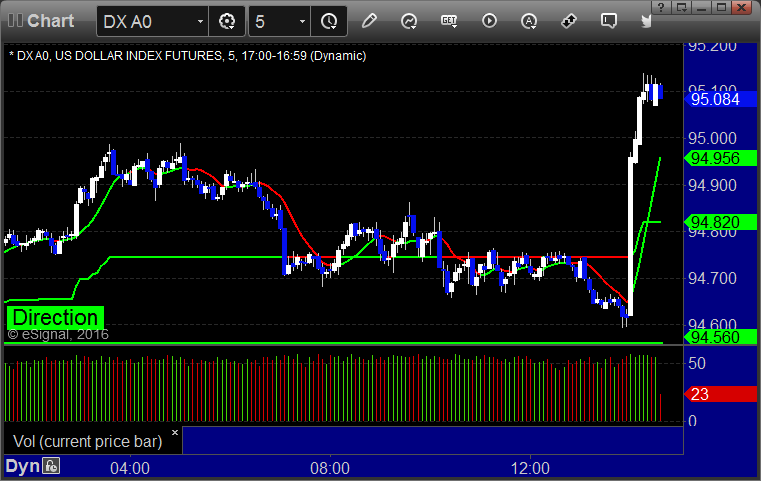

Here's a look at the US Dollar Index intraday with our market directional lines:

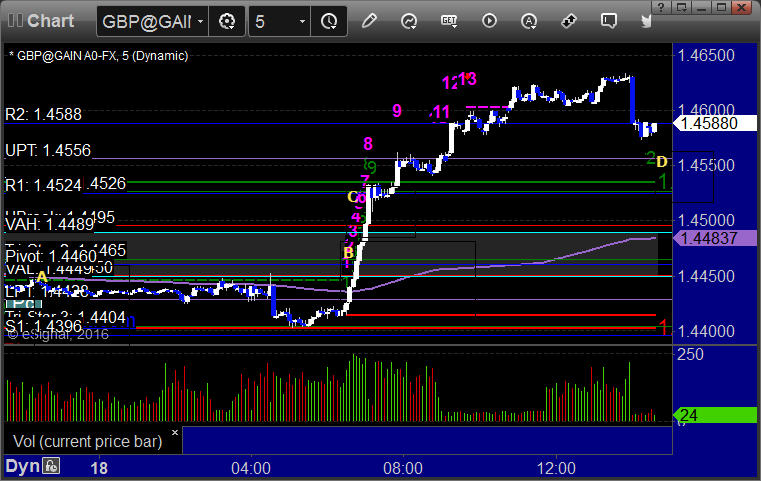

GBPUSD:

Triggered short early before A on the chart and stopped. Triggered long at B, hit first target at C, still holding second half with a stop under D:

Stock Picks Recap for 5/17/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Mark's PLCE triggered long (without market support) and didn't work:

Rich's HD triggered short (with market support) and worked:

NFLX triggered long (without market support) and worked:

Rich's VRX triggered long (with market support) and worked:

His AMGN triggered short (with market support) and didn't work, worked later:

His STMP triggered short (with market support) and worked:

His VXX triggered long (ETF, so no market support needed) and worked:

His FFIV triggered short (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Futures Calls Recap for 5/17/16

I was on the road again for a family situation (back now), so no extra calls, just the Opening Range plays and such. Markets opened basically flat and closed lower on 1.75 billion NASDAQ shares.

Net ticks: +0.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and stopped, triggered short at B and worked:

NQ Opening Range Play triggered long at A and worked enough for a partial, triggered short at B and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 5/17/16

No official calls for the session as I'm on the road for personal reasons. Back to normal tonight.

Here's a look at the US Dollar Index intraday with our market directional lines:

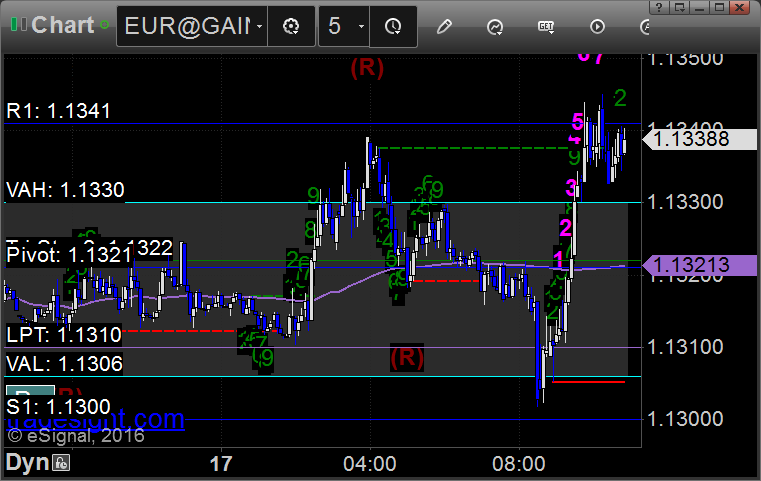

EURUSD:

Stock Picks Recap for 5/16/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CRTO triggered long (with market support) and worked:

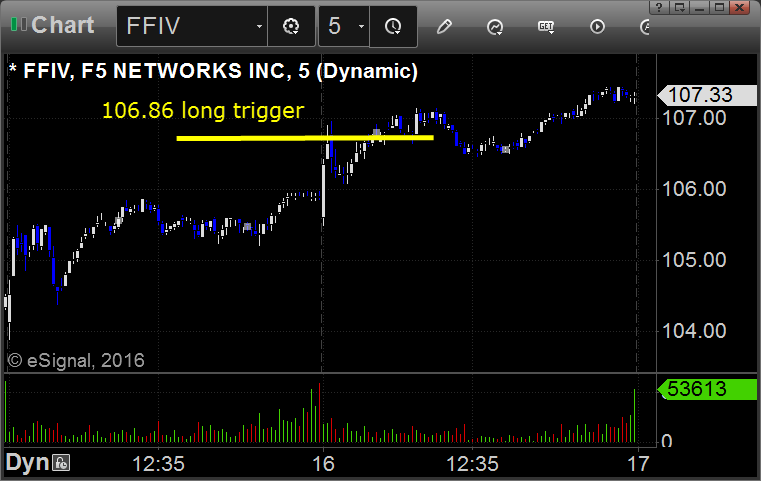

FFIV triggered long (with market support) and didn't work:

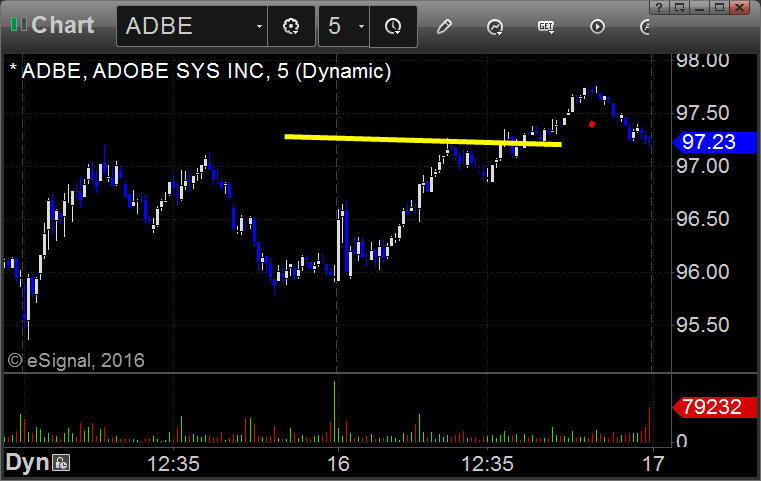

ADBE triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered short (without market support) and worked:

His FB triggered short (without market support) and worked:

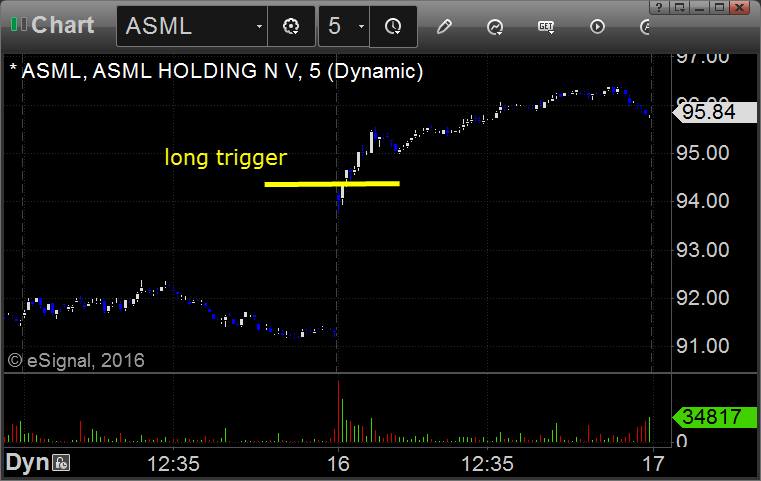

Rich's ASML triggered long (with market support) and worked:

His APA triggered long (with market support) and didn't work:

His BIDU triggered long (with market support) and worked:

Mark's NEM triggered long (with market support) and worked:

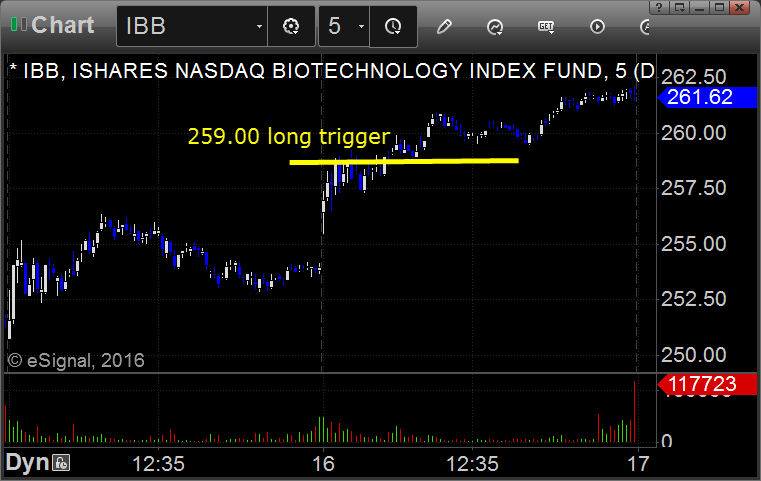

Rich's IBB triggered long (ETF, so no market support needed) and worked:

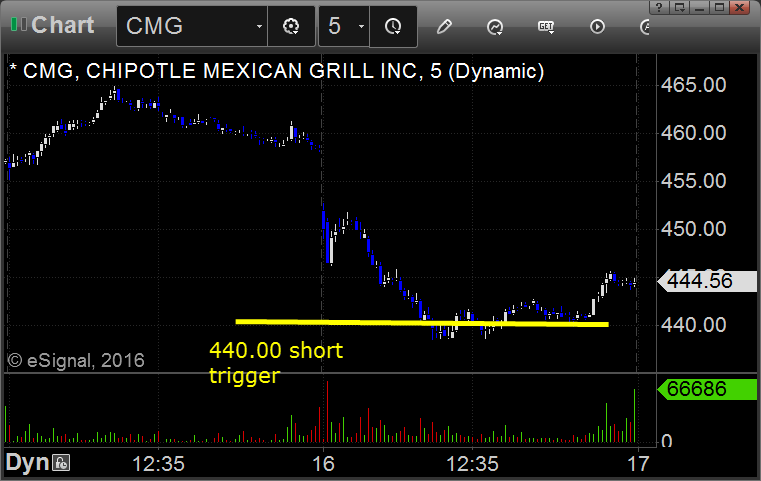

His CMG triggered short (without market support) and worked enough for a partial:

In total, that's 8 trades triggering with market support, 5 of them worked, 3 did not.

Futures Calls Recap for 5/16/16

The markets gapped up and kept going. The Opening Range plays worked. The markets closed in the top half of the day's range almost exactly at the ES 2062.50 level on 1.5 billion NASDAQ shares. See the Opening Range plays below.

Net ticks: +22 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: