Forex Calls Recap for 5/5/16

Half size for the session going into the key NFP number, and it did spike the market, so that's why we did that. One winner and one loser, see EURUSD and GBPUSD sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Triggered long at A (half size ahead of the news), hit first target at B, stopped second half:

GBPUSD:

Triggered short at A (on the news, which is why we use half size for the big numbers), and stopped:

Stock Picks Recap for 5/5/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support due to opening 5 minutes) and worked:

His NFLX triggered short (without market support) and didn't work, worked later in the day:

Mark's NTES triggered long (with market support) and worked enough for a partial:

BABA triggered short (with market support) and worked enough for a partial:

In total, that's 2 trades triggering with market support, both of them worked. Lots of other calls and nothing triggered.

Futures Calls Recap for 5/5/16

Another day that wasn't super-exciting. NASDAQ volume closed at 1.7 billion shares again, and although the ES range was a little better, not by much. We gapped up and filled, then pushed lower over lunch and then stalled for the last two hours. Opening Range plays were mixed.

Net ticks: -3.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and stopped:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 5/5/16

A nice winner (still going) for the session as we get back to full size. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, hit first target at B, still holding second half with a stop over 1.1420:

Stocks Picks Recap for 5/4/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CPHD triggered short (without market support) and worked:

AMAG triggered short (with market support) and worked:

DVAX triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered long (without market support due to opening 5 minutes) and didn't work:

His LVS triggered short (with market support) and didn't work:

His Z triggered long (with market support) and worked enough for a partial:

Mark's CELG triggered short (with market support) and didn't work:

Rich's MNK triggered short (with market support) and worked enough for a partial:

TWTR triggered long (with market support) and ended up working great (off of a Seeker buy signal on both the daily and 30 minute, which SHOULD have worked) but I gave up on it after 45 minutes of nothing happening and the market rolling:

Rich's UA triggered short (with market support) and worked enough for a partial:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not. TWTR could have been another great winner.

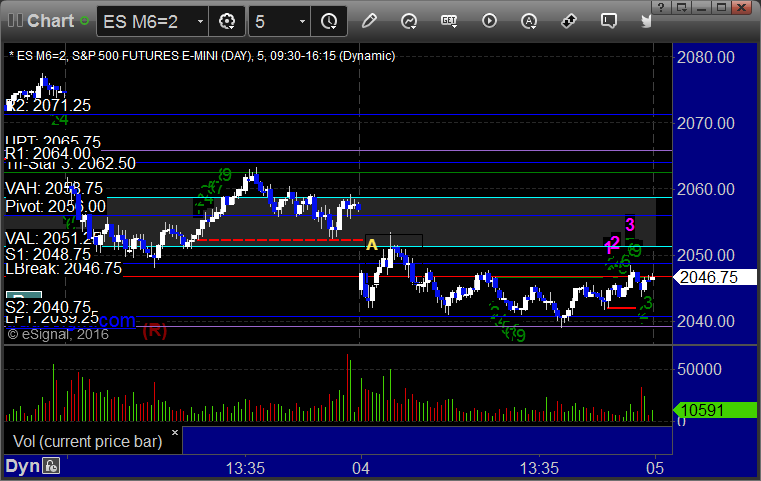

Futures Calls Recap for 5/4/16

Worst day of the year for futures trading. Market gapped down and tried to go up for a second, then went down. In the process, both the ES and NQ Opening Range plays swept both directions. An additional call on the NQ didn't work as it triggered on news (shouldn't take them on news), and then Mark had an ES winner. See those sections below. Markets closed right where they opened (again) on 1.75 billion NASDAQ shares.

Net ticks: -55.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and didn't work, triggered short at B, missed first target by a tick under the rules, and stopped:

NQ Opening Range Play triggered long at A and didn't work, triggered short at B and stopped:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Mark's called triggered long at A at 2051.50, hit first target for 6 ticks, stopped second half under entry:

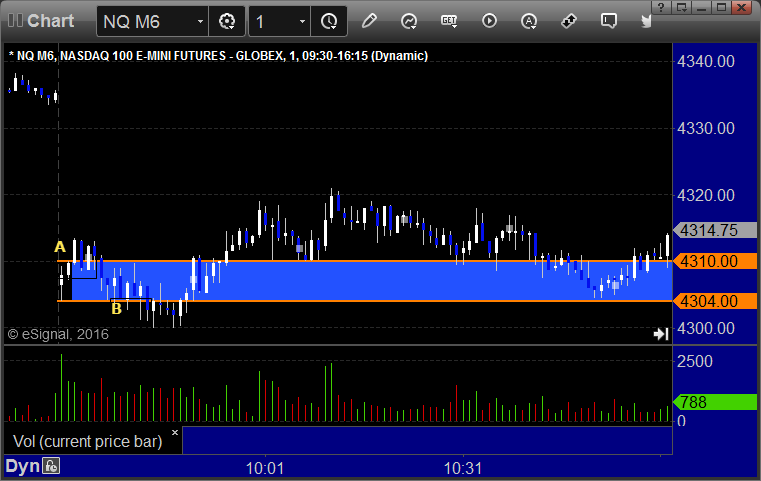

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered long at A at 4316.75 and stopped. I did not re-enter, although that would have worked:

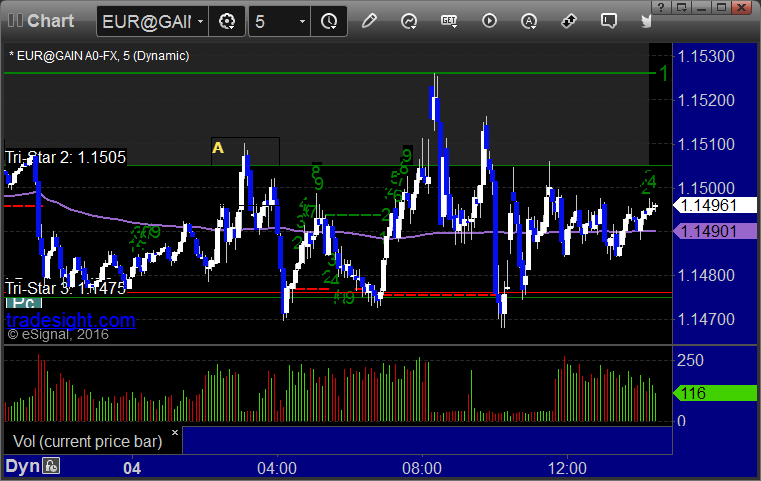

Forex Calls Recap for 5/4/16

First day in a while with a double stop out. See EURUSD and GBPUSD sections below. That's why we go half size ahead of key data like Trade Balance, so it really adds up to just 1 loser.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and didn't work:

GBPUSD:

Triggered short at A and stopped, would have triggered and worked later if you were awake to put it in:

Stock Picks Recap for 5/3/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered long (without market support) and didn't work:

Mark's ACAD triggered long (without market support) and didn't work:

His ERX triggered short (with market support) and worked:

His PXD triggered short (with market support) and worked great:

TWTR triggered short (with market support) and didn't work:

AMGN triggered short (with market support) and just hung a little in the money for hours, I eventually just closed it for lunch:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

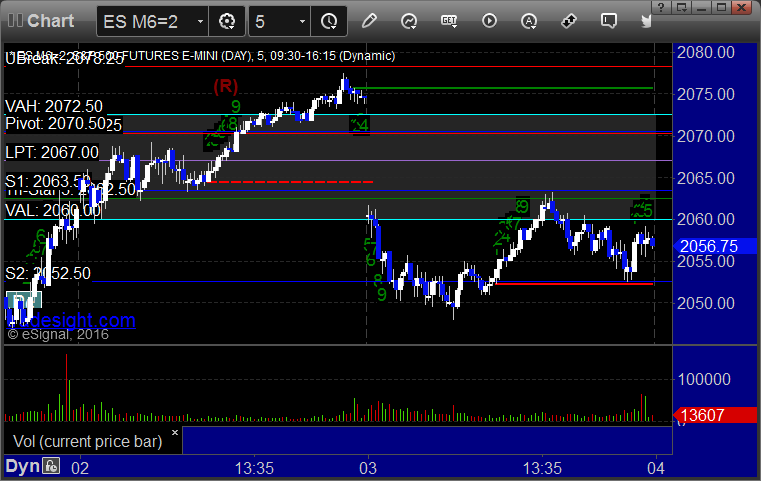

Futures Calls Recap for 5/3/16

The markets gapped down and were extremely flat early for mixed results on the Opening Range plays before finally heading down, then back to sweep the highs late in the lunch hour, and then back to the open for the close on 1.8 billion NASDAQ shares.

Net ticks: +1.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and didn't work, triggered short at B and did:

NQ Opening Range Play triggered long at A and didn't work, used the 50% OR line for the stop due to the range of the Opening Range, and then triggered short at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Mark's long call never triggered into the gap:

Forex Calls Recap for 5/3/16

We closed out the second half of the prior day's EURUSD at a nice winner and had a new one as well. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Came into the day long the second half of the prior day's trade. The new long triggered at A, hit first target at B, and we adjusted the stop on both of the trades under R1 and stopped at C: