Stock Picks Recap for 4/21/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CERS triggered long (without market support) and didn't work:

MCHP triggered long (with market support) and worked enough for a partial:

OSUR triggered long (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's WYNN triggered short (with market support) and worked:

Rich's CTXS triggered short (with market support) and worked:

His VZ triggered short (with market support) and barely didn't work:

BABA triggered short (with market support) and worked:

MDVN triggered short (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 4/21/16

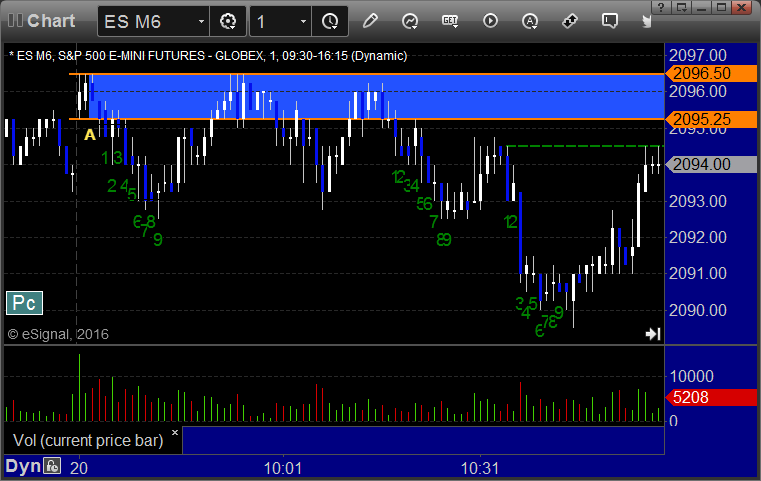

The markets opened dead flat, went lower initially, the NASDAQ side bounced, and then everything drifted back down after lunch with the ES closing near lows and the NASDAQ in the middle on 1.6 billion NASDAQ shares. Opening Range plays worked great, and I had another call on the NQ that worked a little.

Net ticks: +14 ticks.

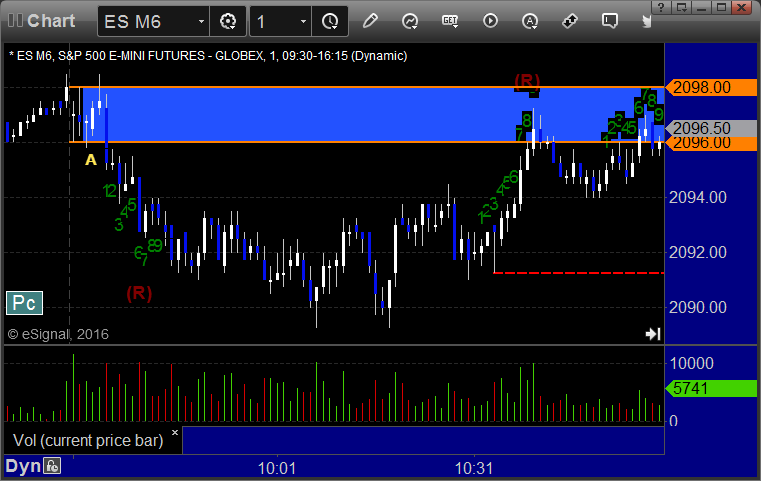

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered short at A at 4525.00, hit first target for 6 ticks, stopped second half over the entry:

Forex Calls Recap for 4/21/16

Closed out the second half of the prior session's EURUSD trade in the money and then had another EURUSD winner for the session. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, moved stop up and stopped second half at C:

Stock Picks Recap for 4/20/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TROW triggered long (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered long (without market support due to opening 5 minutes) and didn't work, worked later:

Mark's YHOO triggered long (with market support) and worked:

Rich's AAPL triggered short (with market support) and didn't work:

VRSN triggered short (with market support) and worked enough for a partial:

TLT triggered long (ETF, so no market support needed) and didn't work:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

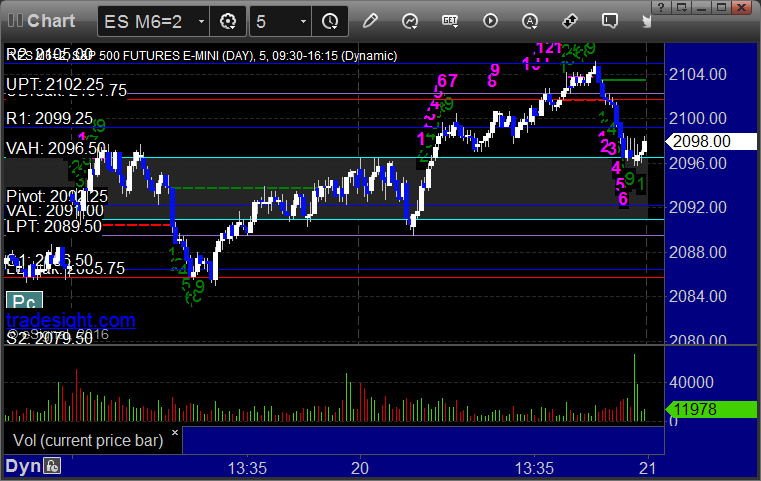

Futures Calls Recap for 4/20/16

Another nice session for Opening Range plays. The markets basically opened flat or filled the small gaps early and didn't do much for the first two hours (with another volume warning) and then drifted up over lunch and pulled back late to essentially close even on 1.5 billion NASDAQ shares.

Net ticks: +24.5 ticks.

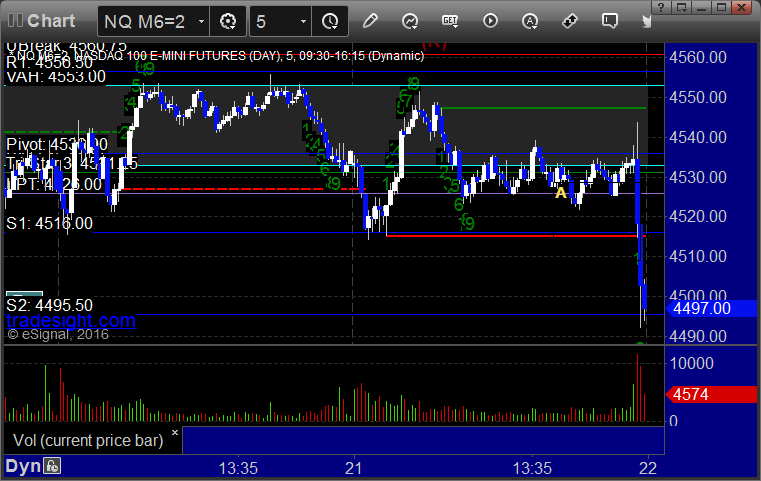

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked, triggered long at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 4/20/16

We stopped out of the second half of the prior day's GBPUSD in the money, then stopped out of a new GBPUSD trade, and then have a nice winner going in EURUSD. See those sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

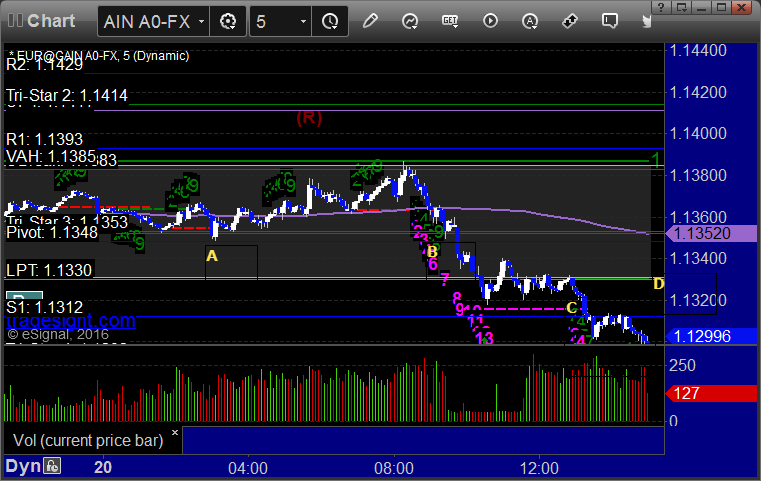

We added this trade in the morning after the EURUSD set the Pivot perfectly at A overnight, triggered at B, hit first target at C, still holding second half with a stop over levels at D:

GBPUSD:

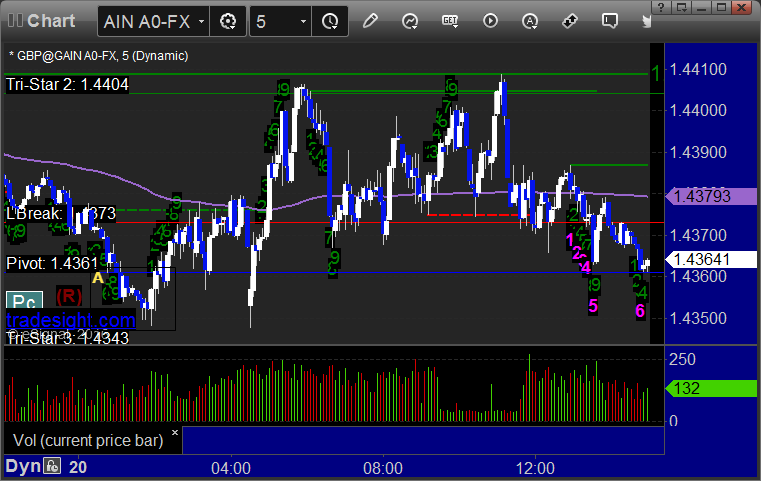

Triggered short at A and stopped:

Stock Picks Recap for 4/19/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, REGI triggered long (with market support) and stayed in a five cent range for hours so doesn't count either way:

ARIA triggered long (without market support due to opening 5 minutes) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's APC triggered long (with market support) and worked:

AMGN triggered long (with market support) and didn't work:

Mark's GILD triggered long (with market support) and worked:

Rich's AGN triggered long (with market support) and worked:

His TSLA triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 4/19/16

The markets gapped up, and the NASDAQ side immediately sold off to fill while the broad market held up. The two sides behaved completely differently until lunch, when they both dipped and then came back to the VWAP for the afternoon waiting for earnings. NASDAQ volume closed at 1.6 billion shares. Opening range plays worked.

Net ticks: +11 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn't work, triggered long at B and did:

NQ Opening Range Play triggered short at A and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 4/19/16

A nice winner for the session. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

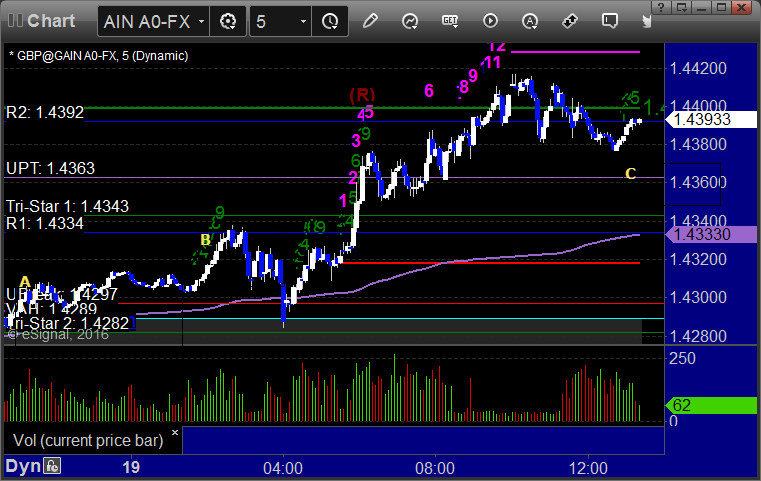

Triggered long at A, hit first target at B, still holding second half almost 100 pips in the money with a stop under C:

Stock Picks Recap for 4/18/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, KTOS triggered long (with market support) and didn't do enough to count either way:

ADBE triggered long (with market support) and worked a little (I accidentally took it this morning at 95.42 instead of 96.42...which if you look at the 65-minute chart, there was a nice pattern there as well, but I had the wrong price flagged...oh well...lol):

ELGX triggered long (with market support) and worked a little:

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered long (with market support) and didn't work but worked later:

LNKD triggered long (with market support) and didn't work:

Rich's GILD triggered long (with market support) and worked:

NTAP triggered long (with market support) and didn't work:

Rich's AAPL triggered short (without market support) and worked great:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.