Forex Calls Recap for 4/15/16

For the second time this week, staggering our orders had an impact on a trade. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

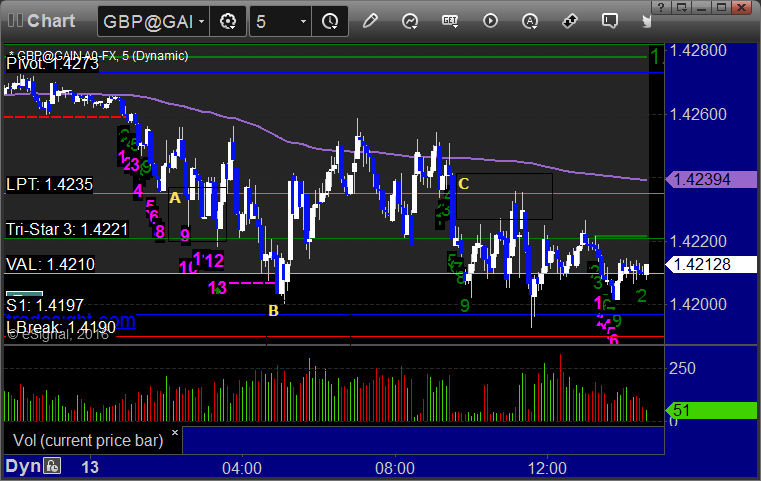

GBPUSD:

If you followed the order staggering rules, staggering the orders got us into a piece of the trade at A, which then stopped, and then the rest triggered at B (if you are awake, you put the whole trade back in), hit first target at C, and closed the rest at D for end of week:

Stock Picks Recap for 4/13/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CPRT gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's CAT triggered long (with market support) and worked:

BIDU triggered long (with market support) and worked:

LULU triggered long (with market support) and worked:

AMGN triggered long (with market support) and worked enough for a partial:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Futures Calls Recap for 4/13/16

Once again with the light volume, the Opening Range plays were a mixed bag (one stop out, two that worked). Then volume picked up later and we had a nice setup in the ES that worked. We may have gotten dual direction options unraveling, although we did not trade average range today like we did Tuesday. Volume was better at almost 1.8 billion NASDAQ shares, but that's options unraveling.

Net ticks: +2.5 ticks.

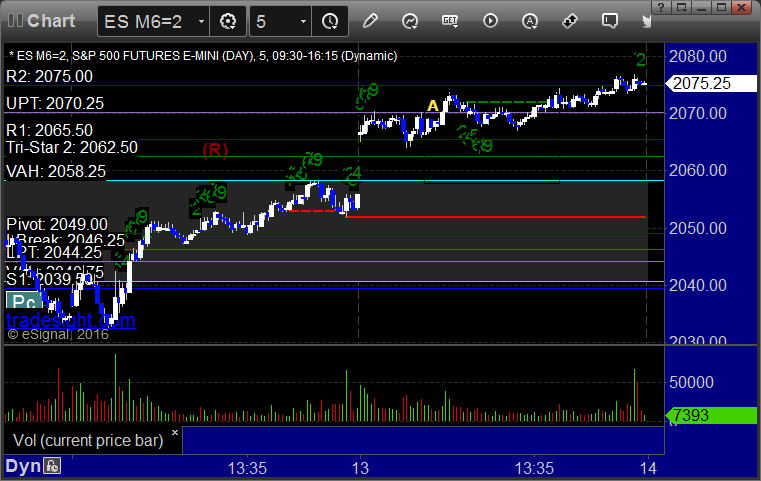

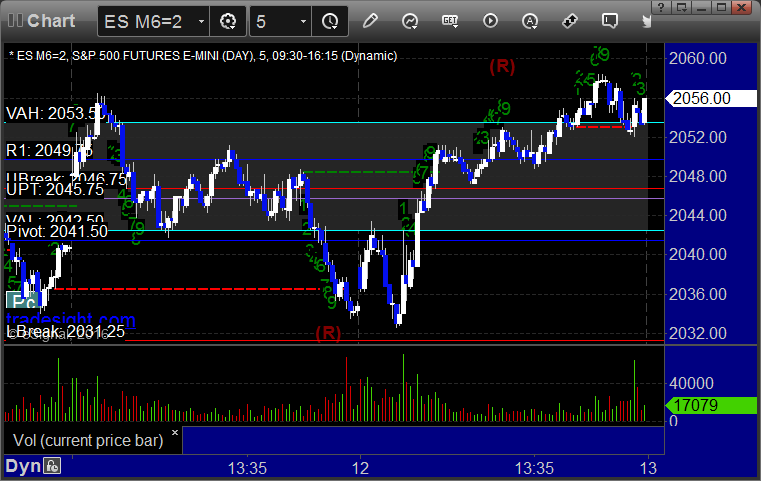

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered short at A and didn't work, triggered long at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered long at A at 2070.75, hit first target for 6 ticks, and stopped second half under the entry:

Forex Calls Recap for 4/13/16

A small winner for another dull session. See the GBPUSD section below.

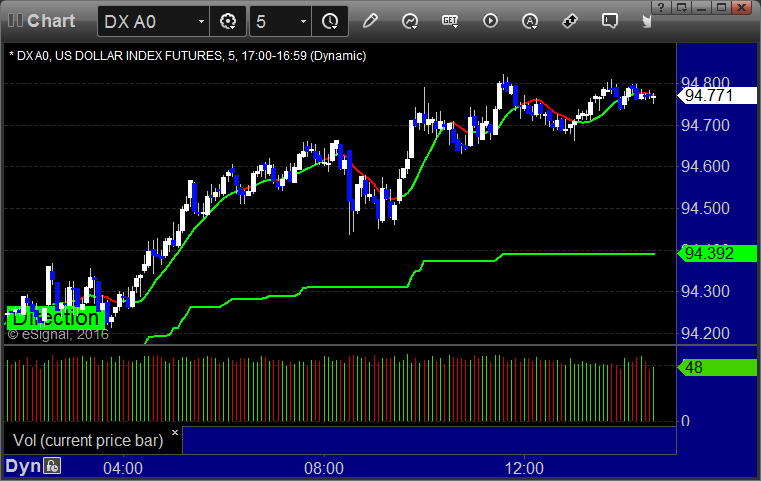

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, came within 2 pips of S1 at B so should have got you a partial, and closed the second half at C in the morning:

Stock Picks Recap for 4/12/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's GLD triggered long (ETF, no market support needed) and didn't work:

His TLT triggered short (ETF, so no market support needed) and didn't work:

His GS triggered long (with market support) and worked:

MDVN triggered short (with market support) and worked:

LNKD triggered long (with market support) and didn't work:

GILD triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not. 3 for 4 without ETFs.

Futures Calls Recap for 4/12/16

Another session (light volume) where the early action was limited and then we drifted through the day to cover average daily range and that was it. We closed closer to highs after filling the gaps and NASDAQ volume closed at 1.5 billion shares. Opening range plays were mostly a wash again, although the big winner would have been the NQ long, but it triggered more than an hour in. See the Opening Range section below.

Net ticks: -3.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

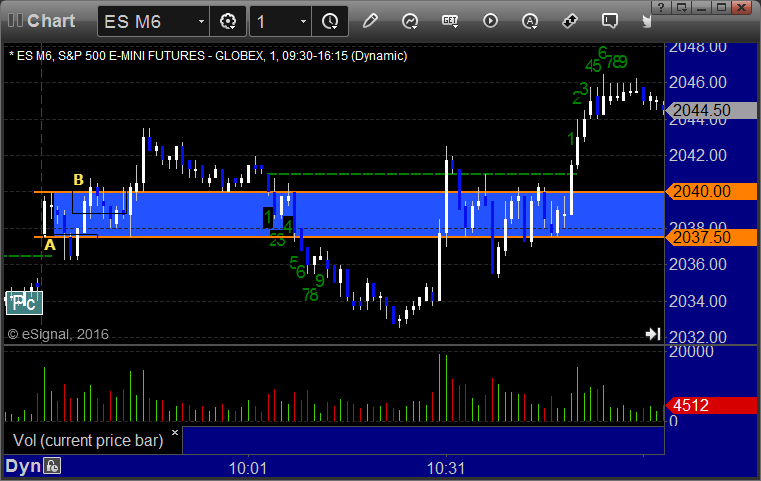

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and stopped. Triggered long at B and worked:

NQ Opening Range Play triggered short at A and worked enough for a partial. Would have triggered long later and worked but more than an hour in, which is past the point you are support to take them (not that was also the Institutional Range play though):

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 4/12/16

Another boring session in Forex (most of the markets have slowed down the last two weeks). This was a session where our order staggered helped turned a loser into a flat trade. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

If you staggered orders under our order staggering rules, part of the long trade triggered at A and stopped, then the rest triggered at B, hit first target at C, closed anything left at D in the morning. The short triggered at E and stopped:

Stock Picks Recap for 4/11/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BECN gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's DAL triggered long (with market support) and worked:

AMZN triggered long (without market support) and didn't work:

LULU triggered short (with market support) and worked great:

In total, that's x trades triggering with market support, y of them worked, z did not.

Futures Calls Recap for 4/11/16

The markets gapped up and wiggled both ways. This was the lightest non-Holiday volume day of the year at barely 1.4 billion NASDAQ shares. We did eventually fill the gaps. No point in making additional calls like that. Mixed results on the Opening Range Plays.

Net ticks: -8.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn't work, triggered long at B and did:

NQ Opening Range Play triggered short at A and didn't work and I posted to use the midpoint of the OR for the stop because the range was wide, triggered long at B and did:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 4/11/16

A light session to start the week with an intraday gap on the GBPUSD on news. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped, then gapped on news later and would have worked: