Stocks Picks Recap for 4/8/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, WB triggered long (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's GS triggered short (with market support) and worked:

His ERX triggered long (with market support) and worked enough for a partial:

His AAPL triggered short (without market support) and didn't work:

My TWTR triggered short (with market support) and worked:

In total, that's 3 trades triggering with market support, all 3 of them worked.

Futures Calls Recap for 4/8/16

The markets gapped up and ultimately filled the gaps on a weak 1.4 billion NASDAQ shares to close the week. Opening Range plays were net winners and another call worked a little on the ES.

Net ticks: +10.5 ticks.

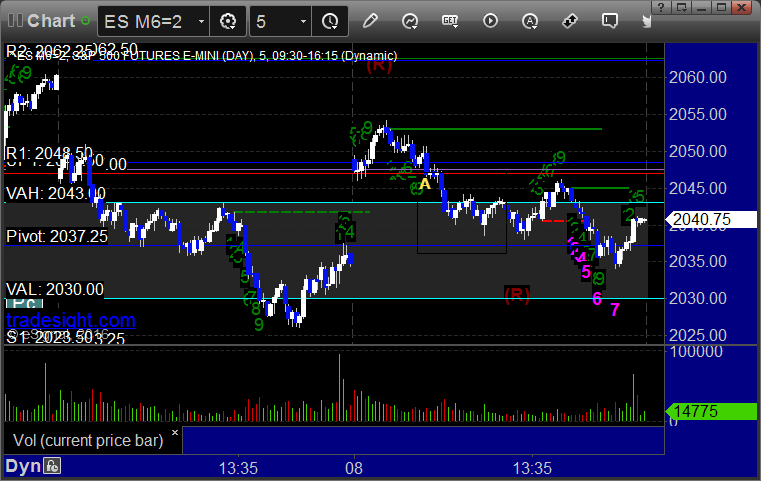

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

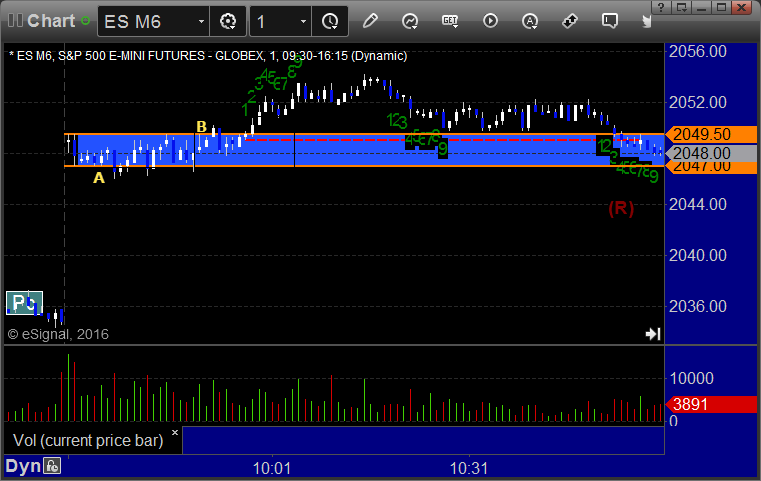

ES Opening Range Play triggered short at A and stopped, triggered long at B and worked:

NQ Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered short at A at 2044.75, hit first target for 6 ticks, stopped second half for 3 ticks:

Forex Calls Recap for 4/8/16

Slow end to a slower week with a regular stop out and a small loss to finish. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Triggered short at A and stopped. Triggered long at B and closed for 10 pip loss for end of week:

Stock Picks Recap for 4/7/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BMRN triggered long (with market support) and worked:

AFSI triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, FSLR triggered short (with market support) and didn't work:

Rich's AMZN triggered short (with market support) and worked:

TSLA triggered short (with market support) and worked:

Rich's afternoon TSLA triggered short (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Futures Calls Recap for 4/7/16

The markets gapped down and never filled. Opening Range plays worked, as did an additional NQ call. NASDAQ volume closed at 1.5 billion shares again. See those sections below.

Net ticks: +21.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked, triggered short at B and worked:

NQ Opening Range Play triggered long at A and worked. Also triggered short at B (and would have worked enough for a partial, but you aren't supposed to take this because we are still long the ES and this is not into the gap:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

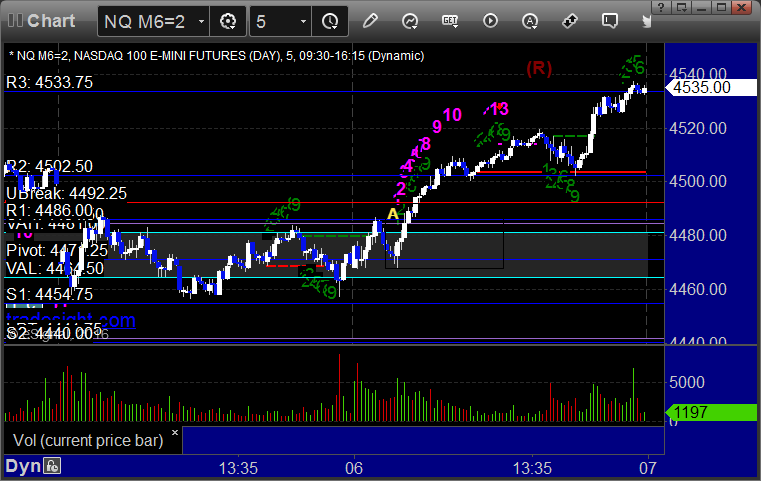

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered short at 4488.50, hit first target for 6 ticks, and stopped second half over the entry:

Forex Calls Recap for 4/7/16

A small winner for the session. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

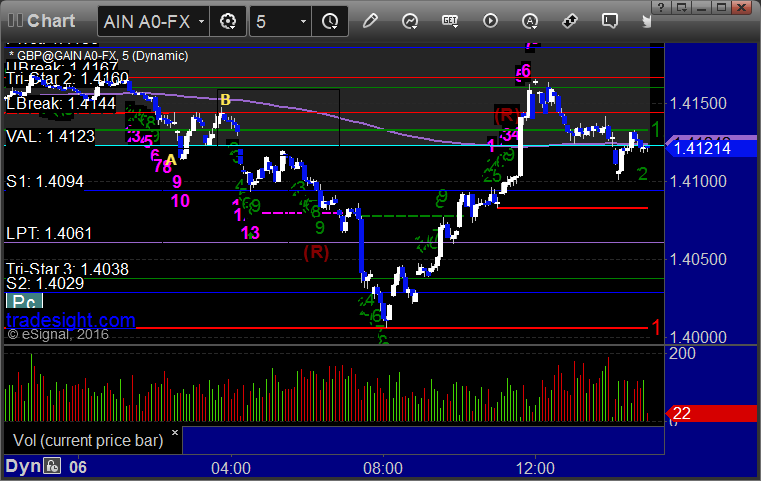

GBPUSD:

Triggered short at A, hit first target at B, second half stopped over the entry:

Stock Picks Recap for 4/6/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, LGND triggered long (with market support) and worked great:

FPRX triggered long (with market support) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's FSLR triggered short (with market support) and worked:

His TSLA triggered long (without market support due to opening 5 minutes) and worked:

SWKS triggered short (with market support) and worked:

Rich's ICPT triggered long (with market support) and worked:

His BMRN triggered long (with market support) and worked:

His VRTX triggered long (with market support) and worked a little:

In total, that's 7 trades triggering with market support, all of them worked.

Futures Calls Recap for 4/6/16

The day started out boring but then went up over lunch and beyond, almost covering average daily range. Volume started out as the worst of the week but climbed to 1.6 billion NASDAQ shares at the close. Mixed bags on the Opening Range plays, but another call worked great on the NQ. See those sections below.

Net ticks: +16.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and stopped. Triggered short at B and worked enough for a partial, but we don't count that one because we were still long NQ at the time and there was no gap in this direction, so the rules say to pass:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered long at A at 4488.00, hit first target for 6 ticks, and stopped second half after raising the stop several times at 4502.00, 28 ticks in the money:

Forex Calls Recap for 4/6/16

We stopped out of the second half of the prior day's trade well in the money and then had a new trade barely stop us out. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and might have barely stopped you at B (although if you staggered orders properly, a piece should have been left). Bummer too because it went on to work nice:

Stock Picks Recap for 4/5/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

First day in a long time with only one trigger.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Mark's ASML gapped through the trigger intraday, so no play.

Rich's IBM triggered short (with market support) and worked:

In total, that's 1 trade triggering with market support, and it worked.