Forex Calls Recap for 3/31/16

A winner on the EURUSD in a simple session. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

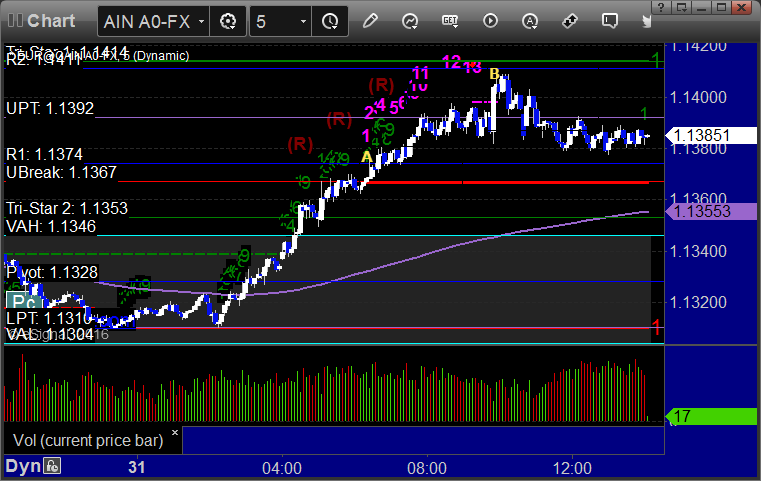

EURUSD:

Triggered long at A, hit first target at B, still holding second half with a stop under R1:

Stock Picks Recap for 3/30/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, DLTR triggered long (with market support) and didn't really work:

ORBC triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's LULU triggered long (with market support) and worked:

Rich's RH triggered long (with market support) and worked:

I put DLTR back in and it triggered long (with market support right before market support went red) and didn't work, then ran after that:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Futures Calls Recap for 3/30/16

The markets gapped up (unusual for end of quarter days) and then closed right where it opened (usual) on 1.5 billion NASDAQ shares. We are definitely in end of quarter mode. The Opening Ranges worked.

Net ticks: +14.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked but because of a conflicting sell signal, I posted a note to close for 2 ticks gain. Note that there was an adjusted candle at B that closed under the ORL but did not happen in real-time in the morning:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

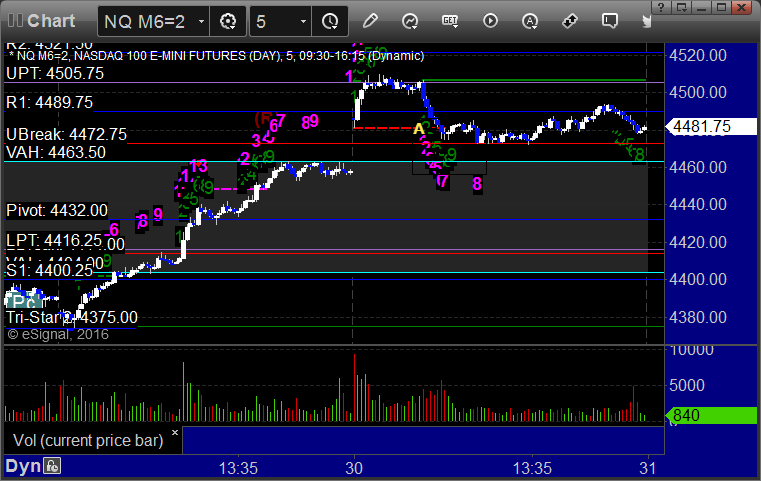

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at A at 4481.00, hit first target for 6 ticks, and stopped second half over the entry:

Forex Calls Recap for 3/30/16

A winner for the session. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

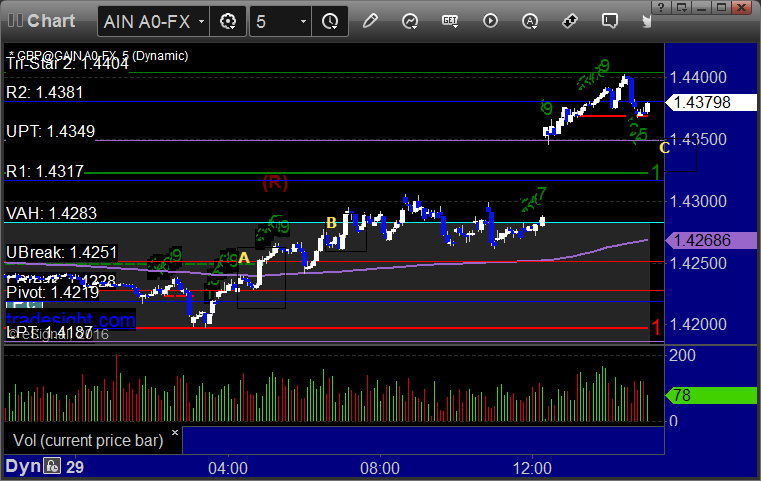

GBPUSD:

Triggered long at A, hit first target at B under the rules because it went 45 pips, but if you didn't quite get it there, hit at C:

Stock Picks Recap for 3/29/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NFLX triggered long (without market support) and didn't work:

CXRX just barely gapped past the short trigger and worked but doesn't count technically because the opening print was under the trigger:

From the Messenger/Tradesight_st Twitter Feed, BABA triggered long (with market support) and worked:

COST triggered long (with market support) and worked:

Futures Calls Recap for 3/29/16

A slow start to the session, but 3 out of 4 winners in the Opening Range plays. An additional call on the ES did not trigger. After gapping down, the markets drifted up and then popped on Yellen's comments. NASDAQ volume remained weak at 1.5 billion shares.

Net ticks: +4 ticks.

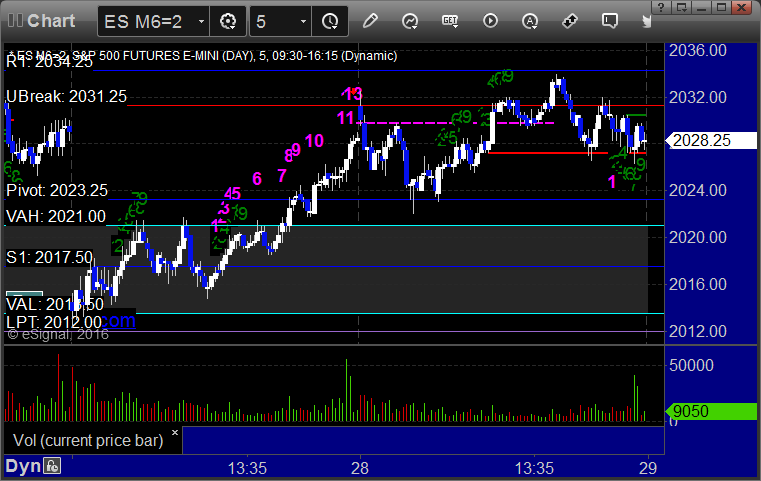

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

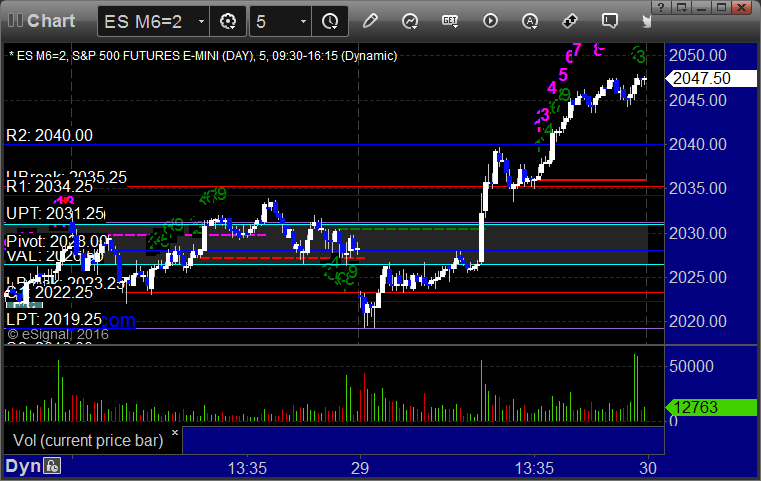

ES Opening Range Play triggered short at A and stopped. Triggered long at B and worked:

NQ Opening Range Play triggered short at A and worked enough for a partial. Triggered long at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 3/29/16

Nice session. First, we had a stop out on the GBPUSD on the short side, but then it triggered long and was holding in the money when the market spiked on Yellen's speech. We are now over 100 pips in the money. See that section below.

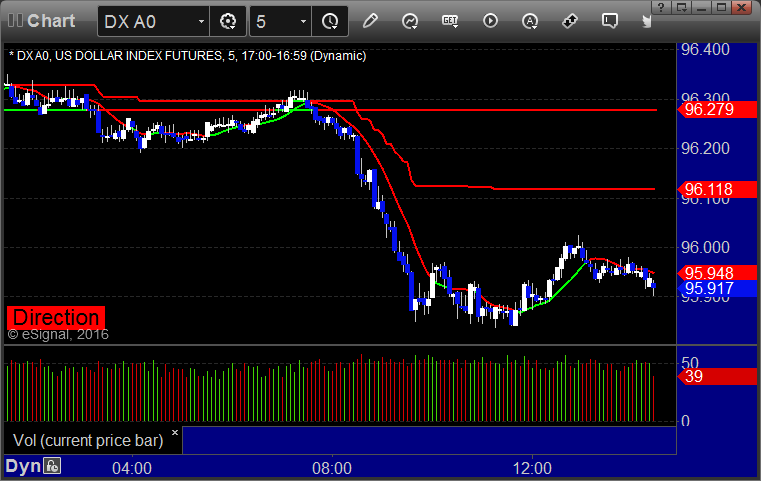

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

After triggered short earlier and stopped, triggered long at A, hit first target at B, and still holding second half with a stop under UPT at C:

Stock Picks Recap for 3/28/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FIVN triggered long (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, SINA triggered short (with market support) and didn't work:

Rich's AGN triggered short (with market support) and worked:

His NFLX triggered long (without market support) and worked enough for a partial:

His FB triggered short (with market support) and didn't really do enough to count either way, literally closed at the trigger:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not, but I made my money in the top pick, FIVN.

Futures Calls Recap for 3/28/16

The markets were dead as expected with most of the world closed for Easter holiday. NASDAQ volume was only 1.2 billion shares and things were fairly flat. No additional calls, but the Opening Range Plays worked.

Net ticks: +14 ticks.

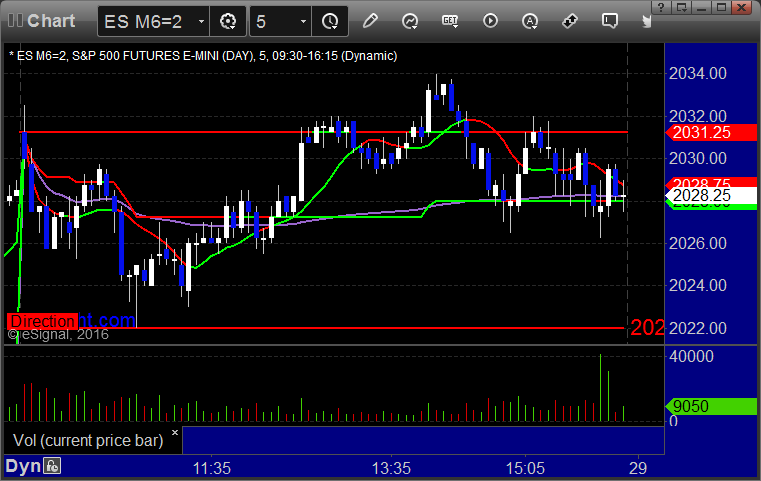

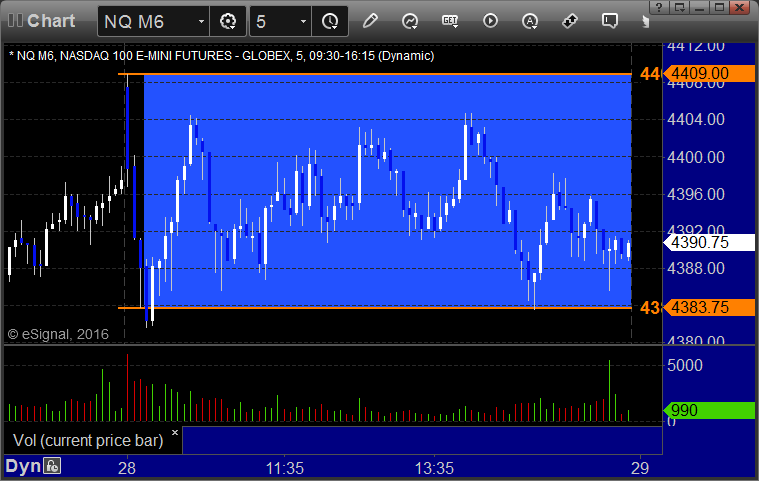

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 3/28/16

I did not post any calls Sunday due to the fact that everyone but the US was on Bank Holiday for Easter. Calls resume tonight.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD: