Futures Calls Recap for 3/16/16

The markets gapped down and gave us the lightest volume of the year in the first hour. The opening range plays worked, but things were tame beyond that until the Fed when the markets spiked up. NASDAQ volume was only 1.6 billion shares.

Net ticks: +15.5 ticks.

Markets gapped down and were flat on light volume waiting for the Fed, then rocketed upward when the Fed announced that they expected to raise rates twice this year due to strength in the economy.

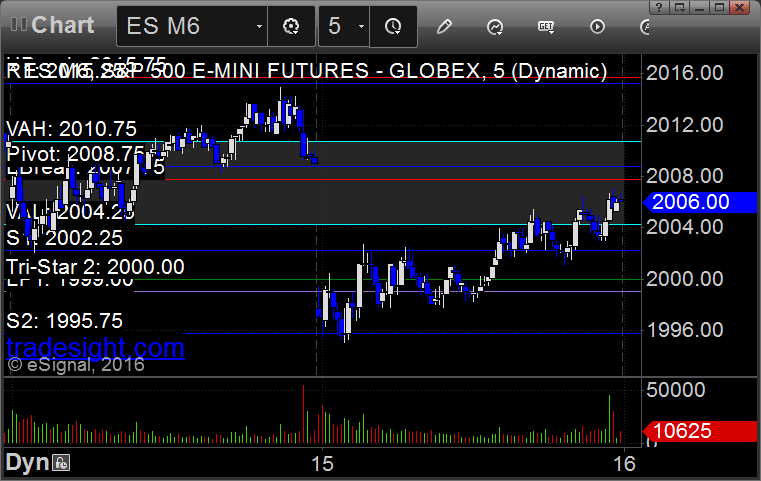

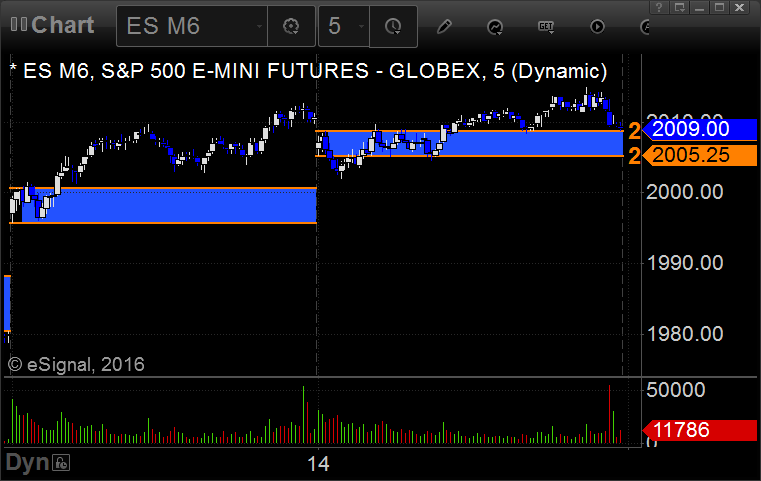

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

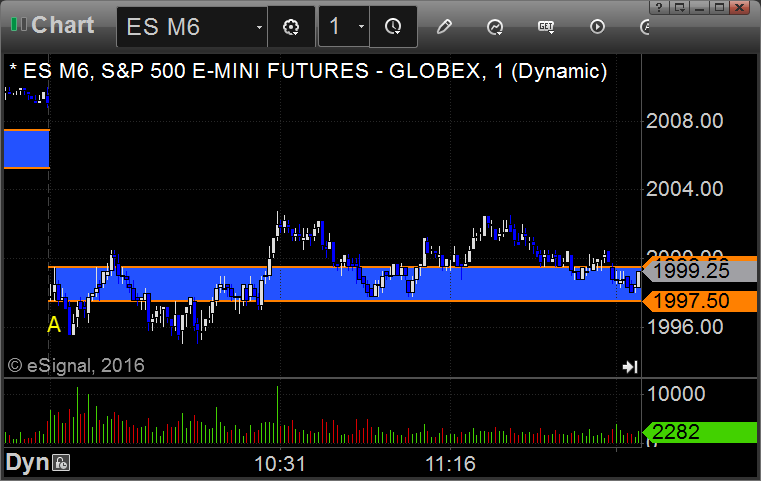

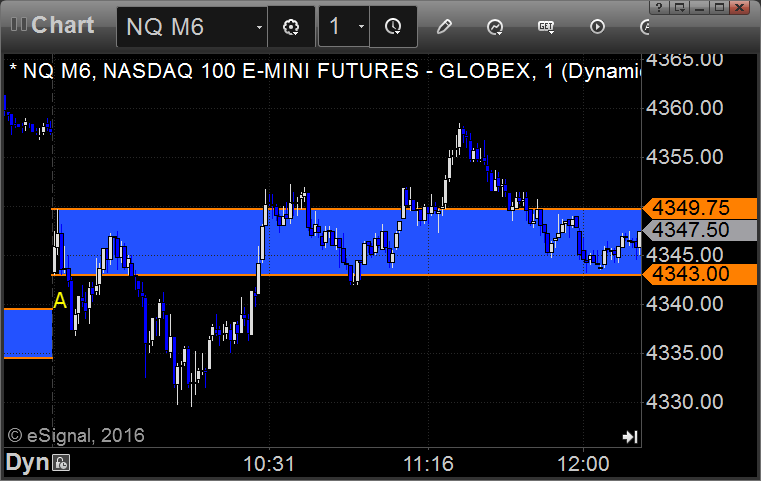

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

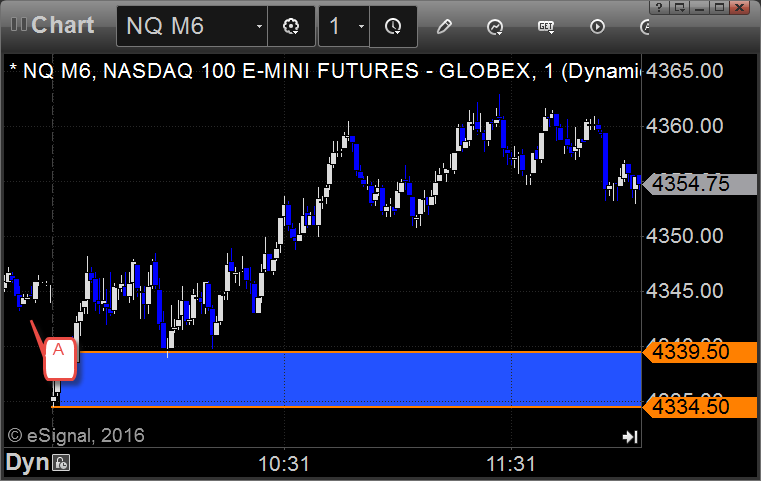

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 3/16/16

Came into the session short the GBPUSD and that ended up working out great, as did a new trade on GBPUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

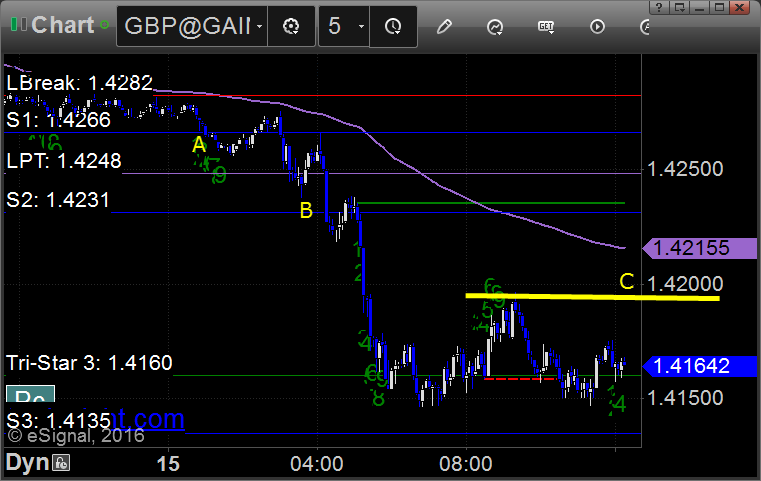

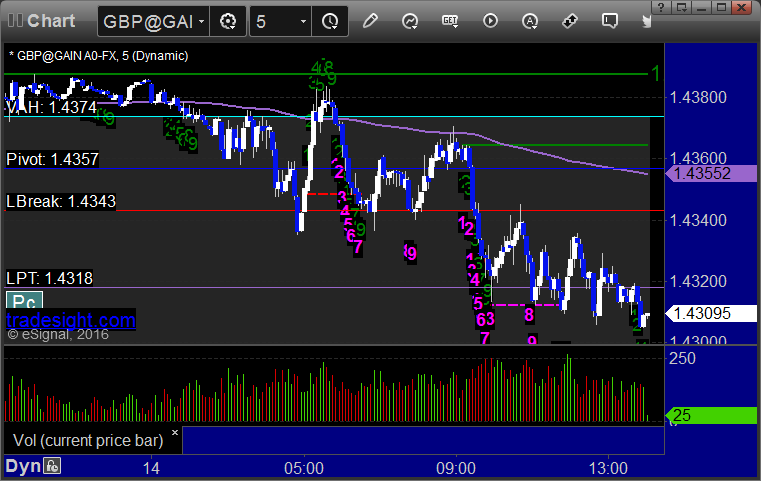

GBPUSD:

Came into the session still short the second half of the prior day's trade. New trade triggered short at A, hit firs target at B, lowered stop in the morning and stopped at C, including second half of prior day's trade which was about 175 pips in the money:

Stock Picks Recap for 3/15/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's ERX triggered short (ETF, so no market support needed) and worked enough for a partial:

His WYNN triggered short (with market support) and worked:

His TSLA triggered short (with market support) and didn't work:

Lots of other calls but nothing triggered.

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 3/15/16

We predicted this wouldn't be the most exciting week between the time change, 2-day Fed meeting, and triple expiration, and so far, we've been right. The markets gapped down and really did not much all morning in a narrow range, eventually closing on 1.4 billion NASDAQ shares. The Opening Range plays gave us a winner and a loser with early morning action so narrow.

Net ticks: -5 ticks.

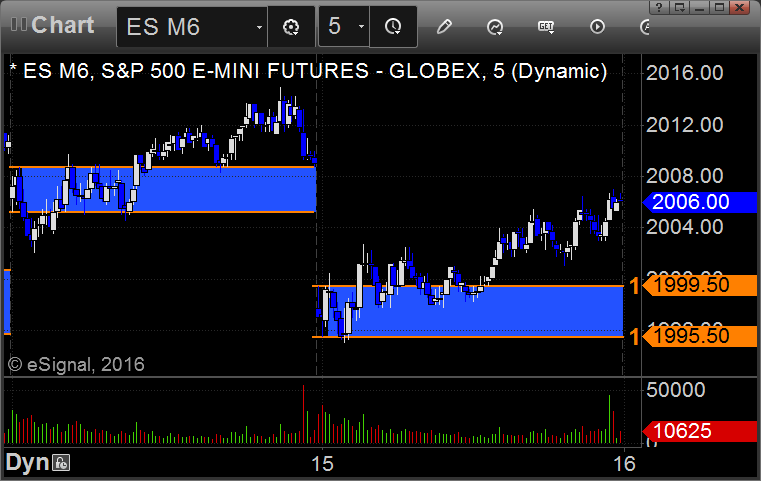

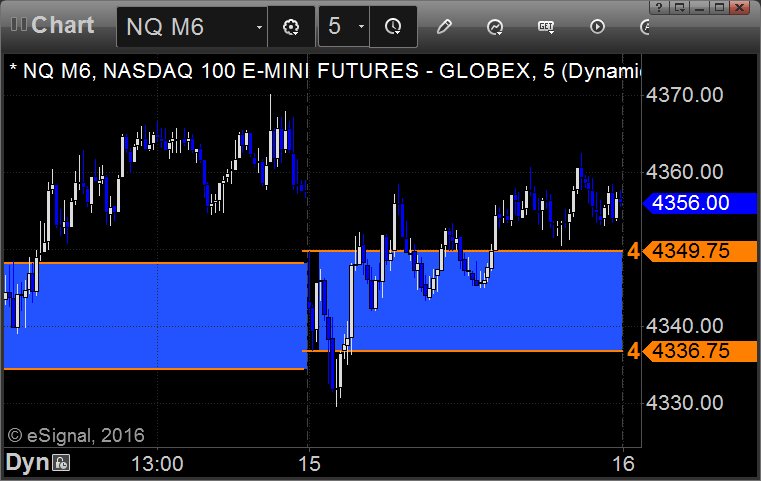

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn't work:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 3/15/16

A nice winner (still going) in the GBPUSD for the session. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, still holding second half with a stop over 1.4200 at C:

Stock Picks Recap for 3/14/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Mark's MDVN triggered long (with market support) and didn't work:

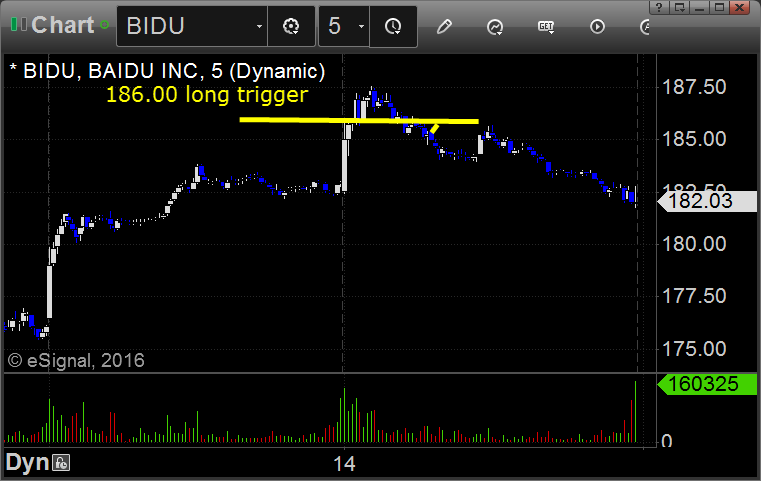

Rich's BIDU triggered long (without market support) and worked:

Rich's RGLD triggered short (without market support) and didn't work:

Lots of other calls but nothing triggered on a dead day.

In total, that's 1 trade triggering with market support (first time in months we only had 1 trade trigger with market support), and it didn't work.

Futures Calls Recap for 3/14/16

A fairly dull session coming off of the time change (not uncommon). Opening Range plays were mixed. Wasn't much to do as the market just drifted on light volume. High and low for the first half of the day was literally the VAH and VAL on the ES. NASDAQ volume closed at 1.45 billion shares.

Net ticks: +1.5 ticks.

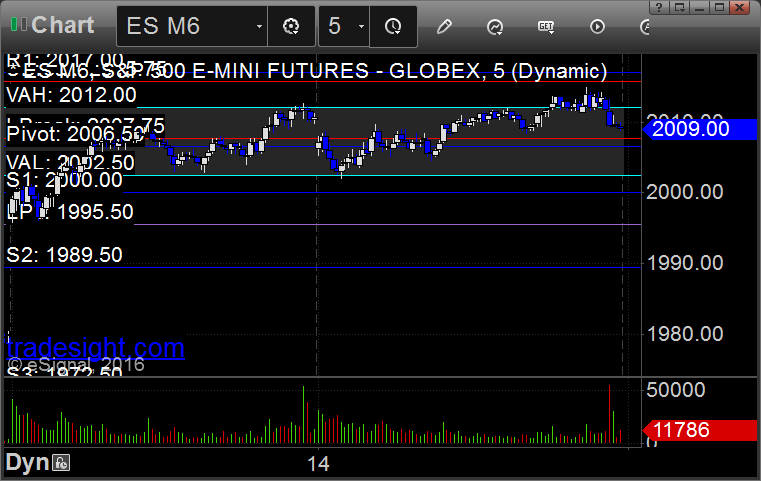

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

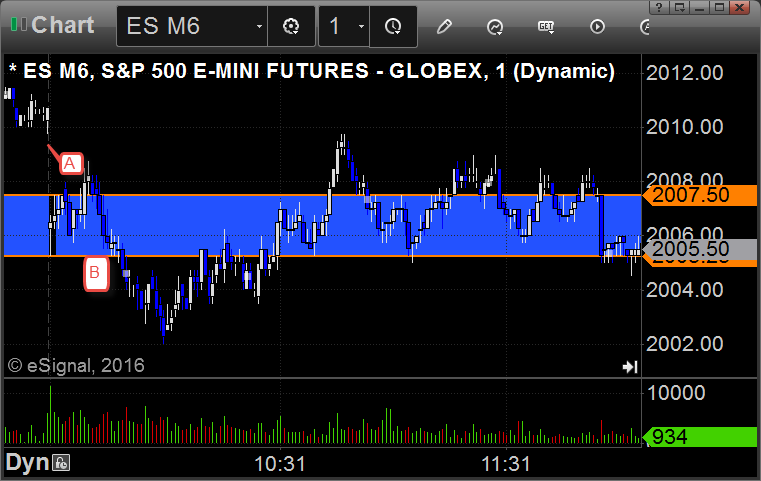

ES Opening Range Play triggered long at A and stopped. Triggered short at B and worked:

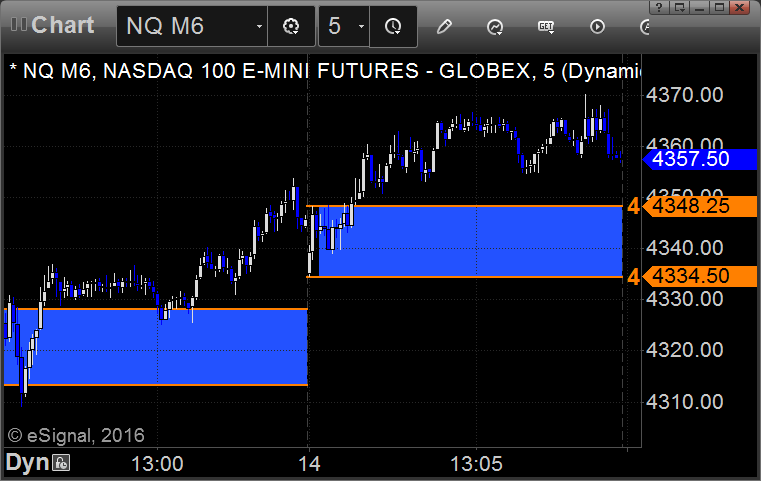

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 3/14/16

A loser and a slightly bigger winner for basically a wash. See GBPUSD section below. I'm on the road so calls might be a little late.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped. Triggered short again at B, closed about 35 pips in the money for end of session (never got to first target):

Stock Picks Recap for 3/11/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered long (with market support) and didn't work:

His PXD triggered long (with market support) and worked:

His FB triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 3/11/16

We try to make a habit of not trading futures on the Friday of quarterly contract roll. There's just not enough big players ready to go. Markets gapped up big and had a flat opening hour, then drifted a bit higher on the session on 1.6 billion NASDAQ shares. We will count the Opening Range plays that triggered first since we don't have a hard rule posted about not taking them on contract roll.

Net ticks: -26 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

Shouldn't even bother with these on contract roll, but we will count the first ones.

ES Opening Range Play triggered short at A and stopped:

NQ Opening Range Play triggered short at A and stopped:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: